Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Wednesday, March 5, 2025

What are real estate investors buying in Harrisonburg and Rockingham County?

1. Some investors buy college student housing, which often has higher rental rates compared to purchase prices - though there can be greater risk of property damage or vacancies along with the higher reward of higher cash flow.

2. Some investors buy single family homes, which generally offer the lowest rental income per dollar spent on the purchase price, but which might also offer the best long term gains in increased market value.

3. Some investors buy individual townhomes and duplexes, which are often amidst neighborhoods with plenty of owner occupants as well as other investors, and can be a nice balanced approach that provides reasonable cash flow as well as reasonable appreciation over time.

4. Finally, some investors buy multifamily properties - duplexes (both sides), triplexes, quads, and even larger buildings. These offer the ability to purchase multiple properties (units, roofs) at a time which sometimes can provide a better return on investment.

So, what are investors actually paying for multifamily properties in Harrisonburg and Rockingham County? Typically the best way to look at this is by comparing the purchase price to the rental income being generated by the multifamily property.

It would be even better to calculate a "cap rate" for each sold property, but we don't always have all of the expense data available in order to calculate the net operating income (NOI) which is used in calculating a cap rate.

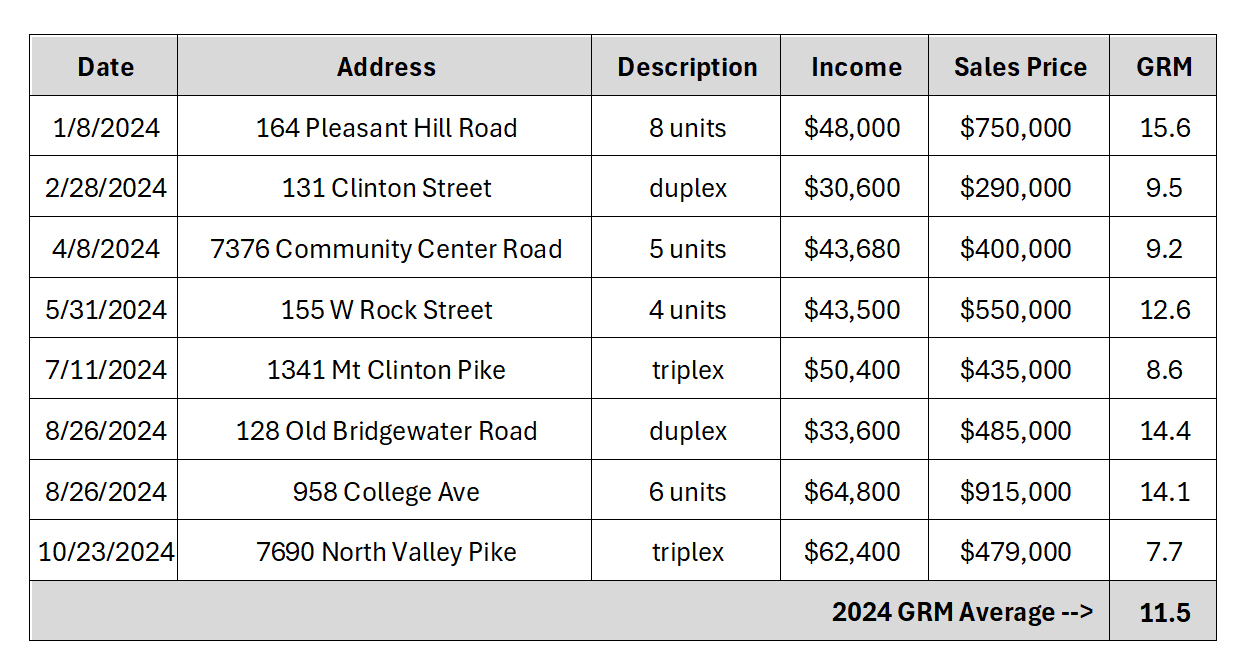

So, here's a rudimentary look at what multifamily investor buyers paid for multifamily properties in and near Harrisonburg, Virginia over the past year -- for properties where rental income data was available...

The "GRM" column is evaluating the Gross Rent Multiple... comparing the sales price to the income of the property.

As you can see above, multiple properties sold at a multiple of 12 (or higher) of their gross rental income.

For anyone who has considered a rental property purchase lately, one's ability to purchase at current market prices is often strongly correlated to how much cash you have available to put into the purchase. If you are paying cash for the property, then your cash flow will be just fine, as you don't have a loan payment. If you are financing 75% to 80% of a purchase price, you will likely have a more difficult time covering the loan payments with your rental income.

Feel free to touch base with me if you would like to learn more about investment property purchases -- or, on the other end of things, if you are an investor looking to sell some of your holdings, this could be an ideal time to do so given current market dynamics.