| Older Posts |

Subdivision or Not --- Does it Matter? |

||||||||||||||||

Preliminary assessment -- no, not at all! A caller to the radio show yesterday mentioned that it seems to him that homes that aren't in subdivisions seem to be selling more quickly than those that are in subdivisions. As I mentioned on the air, definitely a very interesting theory --- however, the data doesn't seem to support it . . .

If we saw that there was only a 3 month (or even 6 month) supply of properties not in subdivisions (or in subdivisions), that would certainly indicate that it is currently easier and quicker to sell such a property. However, this data shows that there is very little difference in the supply/demand ratio at this time. This analysis is based on Rockingham County properties --- excluding the City of Harrisonburg, and excluding Massanutten Resort. | ||||||||||||||||

Garage Prevalence |

|||||||||||||||||||||||||

On the air yesterday, we had some questions about garages --- are most houses being built with them these days, are most buyers looking for them, etc. Here are some numbers to answer those questions . . . Garages have become a more frequent occurrence over time. Looking at sales during the past 12 months in Harrisonburg and Rockingham County, here's what we get:

Of late, the larger the home being built, the more likely it will have a garage. Looking at sales during the past 36 months, of homes built since 2000, in all of Harrisonburg and Rockingham County, here's what we get:

| |||||||||||||||||||||||||

Solar Panels, Wind Turbines and Low Flow Toilets, Oh My! |

|

What a great story --- "On 5 acres along Interstate 81 about a mile north of Harrisonburg, Zach Fettig, a 24-year-old graduate of James Madison University's College of Integrated Science and Technology, is financing and building a self-sufficient, environmentally friendly house." (Source: Daily News Record) Zach is a recent graduate, and will house several other students in the house he is building --- providing a hands-on experience for learning about and performing research on sustainable living technologies in everyday life.  Per the Daily News Record, these technologies will include: Per the Daily News Record, these technologies will include:

| |

Tune in to "The WSVA Home Show" on Wednesday (10AM - Noon) |

|

I'll be on the radio this Wednesday (Nov 28) from 11AM - Noon. Tune in, if you have the chance, on 550AM in Harrisonburg. To provide a bit more context, here are the more formal details . . . I'll be on the radio this Wednesday (Nov 28) from 11AM - Noon. Tune in, if you have the chance, on 550AM in Harrisonburg. To provide a bit more context, here are the more formal details . . .The WSVA Home Show with Ken Patterson is brought to you by Weavers Flooring America, Planters Bank, Shenandoah Paint and Coldwell Banker Funkhouser Realtors. This is the show that gives you a chance to ask the experts anything you like about home repair and remodeling, buying and selling. The show will air from 10AM to Noon. During the first hour, Ken Patterson will be joined by Rick Peters of Shenandoah Paint. During the second hour, Kemper Funkhouser and I will be on the air with Ken answering your questions. Again, don't miss The Home Show, this Wednesday, during mid-days on WSVA, 550 AM in Harrisonburg, Virginia. | |

"Just Wait . . . You'll See . . ." |

|

I received a call at the office two weeks ago that left me scratching my head. The gentleman was calling to inquire about a property priced around $80,000 --- which was a manufactured home being sold without the lot --- thus the low, low price. Since the land underneath the manufactured home was not to convey, the loans available for this product had very high interest rates, and loan terms that this gentleman wasn't too excited about. I don't blame him! I received a call at the office two weeks ago that left me scratching my head. The gentleman was calling to inquire about a property priced around $80,000 --- which was a manufactured home being sold without the lot --- thus the low, low price. Since the land underneath the manufactured home was not to convey, the loans available for this product had very high interest rates, and loan terms that this gentleman wasn't too excited about. I don't blame him!He then asked about properties in Harrisonburg around $100,000. I explained that there weren't any properties selling in that price range unless they were uninhabitable, which didn't seem to be a satisfactory answer for him. He then said "just wait . . . you'll see . . ." Puzzled, I asked him if he was trying to tell me that he thought a year from now that we would see properties in Harrisonburg selling for $100,000. He assured me that he was positive that properties would be selling at or below $100,000 within 12 months. I asked for his name and phone number, and explained that I would love to talk to him a year from now to see if he was correct. He didn't care to share his contact information --- so we continued chatting and I told him that I would be shocked beyond belief if we saw properties selling at those prices a year from now. Admittedly, over the past four years, starter townhomes have increased in price from $95,000 to $155,000 --- but to predict that in the next 12 months that these properties (for example) would plummet back down to $100,000 or even $120,000 --- that seems highly improbable. As we concluded our conversation, I realized that since perception is reality --- this caller would likely not buy any real estate in the coming year. Since he truly believes real estate values are going to fall that significantly, he would certainly not invest in any way. My predictions for twelve months from now are a bit different --- I think we will see modest increases in real estate values in most price ranges, with some possible flat-line or decreases in the $350k+ price range. I come to these conclusions (in part) by looking at how many months of supply exist in different price ranges. With such an oversupplied $350k+ price range, it is possible (or quite likely?) that some such sellers will lower their asking prices to the point at which they become the best buy in the price range --- thus affecting average real estate values. | |

Short-Term Rentals in Massanutten |

|

We've seen it in the news for almost a year and half now --- a group of homeowners in Massanutten Village are suing other such property owners because of the use of homes in their community as short-term (or vacation) rentals. This seems to most commonly understood as rental periods of less than 30 days. We've seen it in the news for almost a year and half now --- a group of homeowners in Massanutten Village are suing other such property owners because of the use of homes in their community as short-term (or vacation) rentals. This seems to most commonly understood as rental periods of less than 30 days.The latest --- instead of just suing two families for their rental transgressions, the plaintiffs are now suing 28 property owners! The entire debate on this issue seems to be over interpretation of the Massanutten Village covenants and restrictions. Those being sued point out that these covenants don't explicitly prohibit short term rentals. Those doing the suing characterize short term rentals as a business use, which is prohibited per the covenants. The blow by blow:

| |

A Great Townhouse Opportunity! |

|

The townhome to the right (1206 Wordsworth Court) is located in Beacon Hill Townes, and presents a great opportunity for investment --- depending on a few factors. Before we go any further --- I do not represent the sellers of this property, though another Realtor in my company does --- also, this property is owned by an asset management company, not an individual. The townhome to the right (1206 Wordsworth Court) is located in Beacon Hill Townes, and presents a great opportunity for investment --- depending on a few factors. Before we go any further --- I do not represent the sellers of this property, though another Realtor in my company does --- also, this property is owned by an asset management company, not an individual.In the past six months, 15 two-story townhomes have sold in Beacon Hill at an average price of $159,786. This townhome is priced at $148,000 --- thus providing a $12,000 margin. Please note, work is needed to bring this house up to a similar condition as the comparable sales. The two key factors to making this a great opportunity are: 1. Whether the buyer can do most of the work themselves. 2. The degree to which the seller will negotiate the price down below the asking price. If the eventual buyer will live in the house themselves and do most/all of the work themselves, they will only have the cost of materials for the repairs to be completed. Furthermore, if the seller can be negotiated down further, there will clearly be even more of an opportunity. Are you interested? Know of someone who is? Be in touch . . . 540-578-0102. scott@cbfunkhouser.com. | |

When To Start Marketing Your Home |

|

As mentioned last week, the amount of homes on the market varies wildly depending on the price range. On a monthly basis I compare the number of homes on the market to the number of homes selling per month to see how long it would take to sell the current inventory. The latest numbers show: As mentioned last week, the amount of homes on the market varies wildly depending on the price range. On a monthly basis I compare the number of homes on the market to the number of homes selling per month to see how long it would take to sell the current inventory. The latest numbers show:$0 - $199,999 = 6 months $200,000 - $349,999 = 8 months $350,000 and up = 22 months One of my astute clients asked the very pertinent question of how these numbers relate to when to start marketing a home. And here's the interesting part --- this shows the average time it took homes to sell in the same price ranges during the past three months $0 - $199,999 = 4.4 months $200,000 - $349,999 = 5.1 months $350,000 and up = 6.5 months As you can see, the trendline is the same (it takes longer for higher priced homes to sell), but in all three price ranges, it hasn't been taking as long as inventory would suggest to sell a home. Aside from the unique nature of any given property, my suggested time frames for when to put a home on the market are currently: $0 - $199,999 = 6 months in advance $200,000 - $349,999 = 8 months in advance $350,000 and up = 10 months in advance | |

College Student High Rise? |

|

Harrisonburg may soon see a high rise on the corner of Port Republic Road and Devon Lane. To the best of my knowledge, this would be the first seven-story (or higher) building for college students and other renters in Harrisonburg. It will have some great benefits for its tenants -- proximity to campus, a game room, a computer area, exercise area, and more. Harrisonburg may soon see a high rise on the corner of Port Republic Road and Devon Lane. To the best of my knowledge, this would be the first seven-story (or higher) building for college students and other renters in Harrisonburg. It will have some great benefits for its tenants -- proximity to campus, a game room, a computer area, exercise area, and more. According to the Daily News Record, the building will feature 274 bedrooms, and only floors two through six with have apartments, with commercial space on the first floor. | |

The Value of Title Insurance |

|

These days it seems like you can buy insurance for just about anything! Life insurance, health insurance, auto insurance, home owners insurance, and what's that --- title insurance? First off, "title" is a legal term for an owner's interest in a piece of property. When a property is sold, the Seller conveys "title" to the Buyer through the use of a recorded deed. Prior to closing, the closing attorney must conduct a "title search" to ensure the current owner can convey ownership of the property to the Buyer. So, if the title search would discover any problems with the title, why would the title need to be insured? There are a number of reasons why a buyer might purchase a property and then later discover a "title defect," including: forgery, impersonation, undisclosed or missing heirs, undisclosed (but recorded) prior mortgage or lien, fraud; erroneous or inadequate legal descriptions, lack of right of access, deed not properly recorded, etc. The possibility of these unknown title defects creates a need for title insurance, which is an insurance policy protecting the holder from loss sustained by defects in the title to the property. There are two main types of title insurance that may be involved in your transaction --- lender's title insurance and owner's title insurance. Your lender will require you to purchase a lenders title insurance policy on their behalf. This policy will be based on their interest in the property, the loan amount, and will allow them to recoup that money should the house be reclaimed by a prior owner due to an unknown title defect. The decision you will need to make at the closing table is whether to purchase an owner's title insurance policy. This policy would protect you from sustaining any future financial loss due to the discovery of a title defect. Title insurance involves a one time payment at closing, and the policy lasts as long as you own the property. While every situation is different, in almost all situations, I recommend that you buy title insurance. | |

Buyer Incentives Galore! |

|

Centex Homes is running an outstanding "Year-End Savings Event" in a variety of the areas where they are currently building new homes. Communities in Virginia include Northern Virginia, Richmond, Williamsburg and Hampton Roads. Centex Homes is running an outstanding "Year-End Savings Event" in a variety of the areas where they are currently building new homes. Communities in Virginia include Northern Virginia, Richmond, Williamsburg and Hampton Roads.Unbelievably, they are offering the following incentives:

| |

Harrisonburg Lures Downtown Development |

|

Harrisonburg is putting financial incentives in place to encourage development in downtown Harrisonburg. According to the Daily News Record (DNR) on November 14, 2007, City Council is considering extending tax break incentives to developers who are building new structures downtown. Here's the math, as I see it, per the article.... A developer invests $10M in constructing a new building to get eight year waiver of tax assessments. If the assessed value were also $10M, the total waived taxes would be $472,000 ($10M / 100 * .59 * 8). That comes out at a nearly 5% savings over 8 years --- not bad! This new proposal would be similar to the city's existing program for renovating downtown buildings. These financial incentives led to the re-development of the City Exchange building (now apartments and a restaurant). Per the DNR, "Real estate developer Barry Kelley said the historic building incentives were critical to his projects, including the renovation of the City Exchange building into apartments and a restaurant."  | |

Instant Hot Water! |

|

"Tankless hot water heaters", or "demand water heaters" have been popular in Europe for years, and in recent years have begun to appear in more new homes in the United States. In a tankless HWH, instead of storing a large quantity of water in the HWH and keeping it warm, the HWH heats the water very rapidly as it runs through the heater. Click here for more on how these systems work. "Tankless hot water heaters", or "demand water heaters" have been popular in Europe for years, and in recent years have begun to appear in more new homes in the United States. In a tankless HWH, instead of storing a large quantity of water in the HWH and keeping it warm, the HWH heats the water very rapidly as it runs through the heater. Click here for more on how these systems work.There are many benefits to a tankless HWH, including:

| |

Learning in Las Vegas |

|

In addition to being an Associate Broker with Coldwell Banker Funkhouser Realtors, I am also a member of: In addition to being an Associate Broker with Coldwell Banker Funkhouser Realtors, I am also a member of:

I'll still be accessible this week --- if you need to get in touch with me, please e-mail me or call me at 540-578-0102. | |

A Turning Point In The Market? |

|

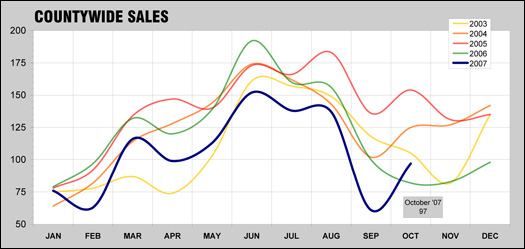

October 2007 --- mark it (retroactively) on your calendar --- the first month where sales exceeded the corresponding month in 2006.  For the past 9 months (Jan '07 - Sep '07), we saw lower sales each month than the same month in the previous year. However, that all changed in October --- and while it is certainly too early to call it a trend, it does suggest that some changes may be afoot in our local market. It is also interesting to observe that in 2004 and 2005 there was a very similar upwards tick in sales when looking at September and October. Additionally, in those two years, November and December were strong months. We will have to patiently wait to see how the next few months progress, but October sales are either an abnormality, or are an indication that a new sales trend has begun in our local market. The Details: The graph below shows the number of sales per month as reported by the Harrisonburg/Rockingham MLS in all of Harrisonburg and Rockingham County. You'll note that the blue line (2007) has been significantlybelow the green line (2006) all year until October. | |

How's the market? It depends on the price range! |

||||

Each month I examine three specific price ranges to gain insight into the balance of supply and demand in that segment of our market. Here are the most recent numbers....

In the middle example, sales data from August, September and October show an average of 43 sales closing each month. Since there are currently 357 properties for sale, that means there are approximately 8 months of homes for sale right now (357 / 43). The most disturbing figure is certainly the $350k+ range, where it would take nearly two years to sell the homes currently on the market, aside from any other properties that would come on the market during that time. This comparison of supply and demand is important to undertake when getting ready to buy or sell --- and it can be even more helpful when looking with your particular geographic or price range preferences in mind. This analysis is based on sales for Harrisonburg and Rockingham County, as reflected by the Harrisonburg/Rockingham Association of Realtors. | ||||

A Great Time For Home Improvements! |

|

As reported today in the Daily News Record, the number of building permits has dropped by roughly 16% in Rockingham County. As Jenny Jones points out, this reflects what has been going on for the past year nationally --- both with building permits and the number of homes sold. David Milstead, of Milstead Construction, also makes a great point that there are still plenty of buyers for mid-priced homes, but upper-end home buyers seem to have disappeared lately. One additional reason for this, is that many of our market's high end buyers were relocating or retiring from larger markets, selling high-priced homes in those markets, and buying high-priced homes in our market. With several of those markets slowing down, the rate of high end buyers entering our market from outside has certainly slowed in the last 12-18 months. With every economic turn (for better or for worse), there exists an opportunity. The current opportunity is for hiring a contractor to do a home improvement project. Over the past few years, this was a tough task --- with the huge demand for new construction housing, it was difficult to find someone to build an addition, or a deck, or to remodel a kitchen, etc. All that has changed --- look in the classifieds section of the Daily News Record and you'll see many contractors and builders seeking customers both to build homes or do home improvement projects. There are lots of options, and I imagine you would be able to obtain multiple, competitive bids. | |

Sales Trends In A Historical Context |

|

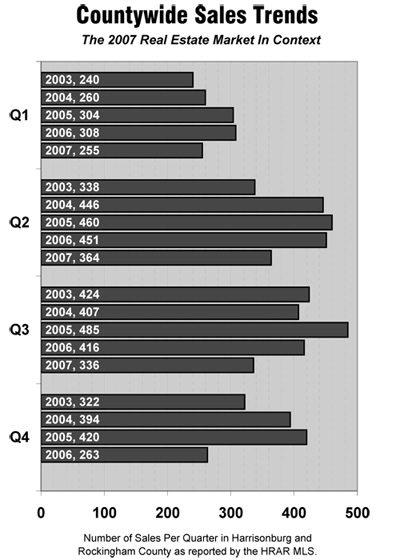

A bit more information to put our current real estate market in context....

| |

Home Sales Down 35 Percent in September?? |

|

According to the Daily News Record, "area home sales plunged 35.4 percent in September" --- wow! This might seem a bit alarming, but don't worry, it doesn't give a very accurate representation of the market. The main flaw here is relying on such a small set of data --- one month of sales. Let's look at the numbers...September 2006 - 100 October 2006 - 82 sales The above statistics are reported by the Harrisonburg/Rockingham MLS. | |

The Changing Mortgage Market |

|

80/20 mortgages with a second mortgage covering the 20% down payment . . . adjustable rate mortgages to provide lower interest rates and payments . . . interest only mortgages to lower monthly payments even further . . . step-up mortgages with lower introductory rates . . . sub-prime mortgages for poor credit or high risk borrowers. This loosening of lending standards has led to an increase in mortgage delinquencies, and as indicated by the graph above, most of this increase has been with subprime borrowers. However, these recent changes in the mortgage market affect all borrowers: fewer programs, for example the disappearance (largely) of 80/20 loans . . . increased standards such as credit scores, cash reserves, debt limits . . . increased scrutiny in the underwriting process, delaying closings . . . Understanding these trends in the mortgage market will help you to make more educated decisions about when to buy, and how to fi nance your purchase. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings