Archive for December 2007

"New-Home Sales Plunge To 12-Year Low" |

|

"The housing market plunged deeper into despair last month, with sales of new homes plummeting to their lowest level in more than 12 years." "It is the one sector of the economy that doesn't show any signs of life." "It doesn't look like there is any resuscitation in store for housing over the next year..." "Sales and home prices are in a free fall." "The downturn is intensifying." Some important things to remember when reading the article:

More reading on the Harrisonburg real estate market: | |

Foreclosure: 2437 Mosby Court, Harrisonburg |

|

Property To Be Sold: 2437 Mosby Court, Harrisonburg, VA Date/Time of Sale: January 3, 2008 at 3:00 p.m. Terms of Sale: A deposit of $10,000.00, or 10% of the sales price, whichever is lower, cash or certified check, will be required at the time of sale with settlement within fifteen (15) days from the date of sale. For Information Contact: Samuel I. White, P.C. (41925-07/CONV) 209 Business Park Drive Virginia Beach, Virginia 23462 (757) 457-1460 Call between 9:00 a.m. and 11:00 a.m. Original Principal Amount of Deed of Trust: $100,400 2008 Assessment: $125,800 Comparable Properties For Sale: http://millwood_condominium.scottprogers.com Per the Daily News Record, December 29, 2007 | |

Counting JMU Students |

|

In most situations, it's o.k. if we aren't working with an exact number for JMU enrollment. However, many developers are currently spending a lot of money to build thousands of housing units in Harrisonburg --- many of which are intended to be occupied by JMU students. When you dig into the numbers, it starts looking like we will have a significant over-supply of college housing in the coming years . . . How Many Bedrooms?? Per today's Daily News Record, "more than 3,700 residential-housing units are under construction or in various stages of approval" --- of which 2,985 are apartments or townhouses. However, many of these are not 1-bedroom housing units, but 2, 3, or 4 bedroom. We'll assume for a moment that they average out at 2 bedrooms per unit. This provides us with 5,970 "beds" to fill --- and the article later states that by 2013, the city will need 2,500 additional beds for JMU students. Hmmmm.......so far that's 3,470 extra beds --- and I hope they aren't finished too quickly! What Is Headcount? The second problem (for developers spending lots of money on building these housing units) is that the figures being used for JMU enrollment can be a bit deceiving. The above-referenced article references 2013 enrollment as 21,500. The only enrollment projection I can find on SCHEV's web site close to 21,500 is the "Total Fall Headcount". This is defined by SCHEV as "A student enrolled for more than zero credit hours in courses offered for degree or certificate credit, or a student who meets the criteria for classification as a remedial student." My understanding is that this would include faculty or staff taking one (or more) class(es), students studying abroad, local residents taking one (or more) class(es), etc. All of these categories of "fall headcounts" wouldn't at all contribute to a demand for student housing. The Total Fall Headcount shows 21,542 students in 2013. For the best "living in Harrisonburg, needing student housing" enrollment figures, I am almost always pointed to the "Regular Session Full-Time Equivalent" data, which is defined by SCHEV as "A calculation of enrollment based on total credit hours taken byundergraduates and first professionals divided by 30 and added to totalgraduate credit hours divided by 24. Includes fall and spring semestersonly, does not include summer term enrollments. May be broken out by onand off-campus activity." This is a calculation to get a lot closer to the number of full time students will be attending JMU --- and these numbers show 19,333 students in 2013. Does it matter, or are we just splitting hairs? If you explore SCHEV's Enrollment Projections, you'll see that there are a lot of figures that can be used for estimating future JMU enrollment figures. My concern is that the figure that developers are using for their decisions is the highest number available -- and one that counts people who would not be seeking student housing. I can understand that the City and the Daily News Record use that highest figure in many situations, but when student housing developers use it for planning purposes, it may be a cause for concern. | |

Harrisonburg Rental Market In December |

|

Many tenants look for new rental property during the summer months --- whether because of a school transition, or otherwise. Thus, many speculate that it is, or would be, much harder to rent an investment property during the winter months. Not this week!?! Many tenants look for new rental property during the summer months --- whether because of a school transition, or otherwise. Thus, many speculate that it is, or would be, much harder to rent an investment property during the winter months. Not this week!?!One of my investor clients closed on two Harrisonburg townhouses a few weeks ago, both of which were vacant at closing. Thus, he has been in tenant acquisition mode for the past few weeks, and he and I have both been surprised at the high level of interest. In the past 48 hours, there have been 11 separate inquiries about one of the townhouses (the other has now been rented). If you currently own investment property, and have a tenant leaving mid-winter, it may not be as much of a concern as you would think! | |

Harrisonburg High-End Real Estate Market |

|||||||||||||||||||||||||||||

Each month I run the same series of calculations to determine how supply and demand relate in several price ranges --- less than $200k, $200k - $350k, and $350k and up. At the start of December, there were 20 months of supply of homes priced $350,000 and up. One of my readers posed the question of whether there might be more of a story to tell in what could be a very large price range --- $350k and up encompasses many hundreds of thousands of dollars. So, let's take a look --- please note, I updated the "Available" numbers to reflect current availability.

So --- it is somewhat interesting --- there are only 17 months of homes priced between $350k and $600k --- and a whopping 61 months of homes available priced above $600k. But to give the $600k+ homes a fair shake, let's make sure September, October and November weren't unusually low sales months. From January 2007 through November 2007 (inclusive), there were 16 sales of homes above $600k. This is 1.45 sales per month --- which would make the current inventory (43 homes) equivalent to 30 months of supply. Better than 61 months --- but this is still the most oversupplied price range by far! | |||||||||||||||||||||||||||||

Still Looking For The Perfect Gift Idea?? |

|

Consider buying your loved one a house --- with a large supply of homes in our area's upper price range ($350k +), you will have plenty of selection, and may be able to land a great price on a very valuable gift! Looking for the best deal? Some might suggest that the longer a home has been on the market, the more flexible the sellers might be on price. Here are the "best buys" in that regard . . .

| |

Negotiations: Speed vs. Enforceability |

|

Negotiating a contract can take place verbally, or in writing -- there are advantages and disadvantages of each strategy. Negotiating a contract can take place verbally, or in writing -- there are advantages and disadvantages of each strategy. Almost always, the (prospective) buyer makes the first move in negotiations -- I suggest that it takes place in written form. A buyer can certainly make a verbal offer on a property, but putting the offer in writing has several benefits:

When it comes to further negotiating the terms of a contract -- after the offer has been made -- oftentimes it can be more helpful to do so verbally. A few things to consider:

| |

Buying College Student Rental Property |

|

Lots of people consider buying investment properties -- and in Harrisonburg many people start by investigating college housing. Some don't end up buying, and here is why . . . Lots of people consider buying investment properties -- and in Harrisonburg many people start by investigating college housing. Some don't end up buying, and here is why . . .Limited Choices Most of the student housing that exists in Harrisonburg today is corporately owned --- each unit isn't owned by one or more people, the entire complex is owned by a corporation. Thus, if we look just at housing for JMU students, where individual housing units can be purchased, the choices quickly become boiled down to:

Limited Monthly Cash Flow Many investors aim to at least break even on a monthly basis -- they don't want to be losing money each month that they own an investment property. With this assumption, let's take a look at how the cash flow might work on a monthly basis for 1346-D Hunters Road, one example of a Hunters Ridge condominium for sale as of 12/20/2007. Price of $105k, 80% financed at 7.25%, self-managed Rental Income + $770 Mortgage (Principal & Interest) - $573 Condo Association Fee - $155 Real Estate Taxes - $45 Insurance - $35 Monthly Profit - $38 (a small loss) However, many potential investors call and indicate that they only want to use a 10% down payment, and that they plan to have a property management company take care of the property. Things get worse . . . Price of $105k, 90% financed at 7.25%, property management Rental Income + $770 Mortgage (Principal & Interest) - $645 Condo Association Fee - $155 Property Management - $77 Real Estate Taxes - $45 Insurance - $35 Monthly Profit - $225 (a big loss) Then Why??? With these monthly losses, you might wonder why someone would buy an investment property. There are a lot of possible reasons why someone might buy, or why the numbers might work differently for them:

| |

Driven Down Old Furnace Road Lately? |

|

Construction is booming on Old Furnace Road --- making way for "Latitude 38", a 228-unit, 800+ bedroom complex of student housing for JMU students. Some public details of the development were highlighted in the Daily News Record in August. The project is being developed by Franklin Holdings out of Charlotte, NC. Apparently they developers didn't read this, as they reference an increase of 4,000 students "over the next few years", whereas SCHEV's FTE Regular Session numbers would suggest that even all the way through 2013/2014 we'll only see a growth of 2,787 students. One thing is for sure --- students at James Madison University will certainly have a lot of housing choices in the coming years! | |

Price Corrections . . . How It Affects Us Right Here At Home |

|

A friend (thanks Randy) pointed me to an interesting article published last month by Fortune Magazine that used some interesting data analysis to come to the conclusion that home values in most markets will "fall by double digits over the next five years." A friend (thanks Randy) pointed me to an interesting article published last month by Fortune Magazine that used some interesting data analysis to come to the conclusion that home values in most markets will "fall by double digits over the next five years." Lots of questions come to mind rather quickly . . . Both Richmond and D.C. are specifically studied and referenced to have large drops in home vales --- will this have a ripple effect on the Shenandoah Valley? It certainly could --- if the changes happen that this article predicts. According to Fortune's study, Richmond home values will drop by 22.3% over the next five years, and Greater D.C. area home values will drop by 25.1% in the same time frame. This could translate into a slow down in the upper end of our market, as many buyers come from these two metro areas to relocate or retire to the Central Shenandoah Valley. (This is already a segment of the market that is over-supplied --- having fewer buyers certainly won't help!) The analysis seems a bit drastic --- is this really grounded in good math? The math is fine, but the reasoning might be a bit faulty. The basic premise of the article is that "...over time the most reliable guide to home values is rents. In most markets people won't lay out much more in monthly costs to own a house or condo than they would to rent a similar property..." I have to disagree with this assessment --- buyers pay more than they would if they rented because of: principal reduction (part of housing outlay is returned in the future), appreciation (even more financial return for having owned rather than rented), and tax savings (from mortgage interest). The root argument in the Fortune article is that a correction may have to happen in many markets because home values increased so much more quickly than rental rates. I don't think that this difference alone is going to drag home values down --- supply and demand will bring about the increase or decrease. Have home values increased faster than rental rates in Harrisonburg? Indeed they have! Here's one example --- five years ago a two-story townhome in Beacon Hill could be bought for $100k or rented for $750/month. Home prices are 11x annual rental rates. Today you can buy a similar townhome for $160k or rent it for $875/month. Home prices are 15x annual rental rates. What does this mean for our local home values? Per Fortune Magazine's math, this means we need to see, and will see over the next five years a 27% correction. Rental rates will go up some, but home values will fall quite significantly. Our home prices will drop by 27%? Really? While we may see declines in some price ranges, a drop of 27% over the next five years would be shocking. I think it is more likely that rental rates will continue to climb to get closer to where they have been proportionate to home values in the past. | |

An Icy Morning At Massanutten |

|

Does Remodeling Pay Off? |

|

Each year, Realtor Magazine partners with Remodeling Magazine to deliver a Remodeling Cost vs. Value Report which analyzes the average cost recouped for a variety of home improvement projects. The bottom line of this year's report seems to be that the best place to invest your remodeling dollars is on exterior improvements. However, the thing to notice first is that none of the projects are shown to return the total amount of money invested. As a result, I recommend that my clients carefully consider engaging in these sorts of projects for re-sale purposes. Unless you will experience some interim enjoyment from the upgrade, it is likely not worth investing the money in the project. Each year, Realtor Magazine partners with Remodeling Magazine to deliver a Remodeling Cost vs. Value Report which analyzes the average cost recouped for a variety of home improvement projects. The bottom line of this year's report seems to be that the best place to invest your remodeling dollars is on exterior improvements. However, the thing to notice first is that none of the projects are shown to return the total amount of money invested. As a result, I recommend that my clients carefully consider engaging in these sorts of projects for re-sale purposes. Unless you will experience some interim enjoyment from the upgrade, it is likely not worth investing the money in the project.Here's an overview of the top percentage returns on projects in the South-Atlantic region --- which includes Virginia:

| |

Supply and Demand --- Market Forces At Work |

|||||||||||||||||||||||||||||

Each price segment of the Harrisonburg and Rockingham County real estate market is experiencing something somewhat different. Each month I break it down into three basic price ranges . . . Homes priced under $200,000 - - - 6 months of supply available - - - no change from last month Homes priced between $200k and $350k - - - 10 months of supply available - - - supply is up, from 8 months Homes priced over $350,000 - - - 20 months of supply availble - - - supply is down, from 22 months In an ideal world (for both buyers and sellers) we'd see 6 months in all three price ranges. This is considered by many to be a healthy amount of homes on the market such that neither seller nor buyer has a significant advantage in negotiations. What follows, then, is that buyers of homes over $350,000 have the potential for quite a bit of negotiating power. For those who loves the numbers, here is the methodology. . .

This analysis is based on sales for Harrisonburg and Rockingham County, as reflected by the Harrisonburg/Rockingham Association of Realtors. | |||||||||||||||||||||||||||||

Local High Schools Honored By U.S. News & World Report |

|

Five local schools were recognized by U.S. News & World Report as being amongst "America's Best High Schools." According to the report, "A three-step process determined the best high schools. The first twosteps ensured that the schools serve all of their students well, usingstate proficiency standards as the measuring benchmarks. For thoseschools that made it past the first two steps, a third step assessedthe degree to which schools prepared students for college-level work." (read more) Five local schools were recognized by U.S. News & World Report as being amongst "America's Best High Schools." According to the report, "A three-step process determined the best high schools. The first twosteps ensured that the schools serve all of their students well, usingstate proficiency standards as the measuring benchmarks. For thoseschools that made it past the first two steps, a third step assessedthe degree to which schools prepared students for college-level work." (read more)The local schools ranked in this report were: SILVER MEDAL Ft. Defiance High School (Augusta County) - view report BRONZE MEDAL Buffalo Gap High School (Augusta County) - view report Riverheads High School (Augusta County) - view report Turner Ashby High School (Rockingham County) - view report Wilson Memorial High School (Augusta County) - view report | |

"But I Heard It On The Radio --- Aren't Home Sales Down??" |

|

Today, monthly home sales statistics were released by the Virginia Association of Realtors. As reported by WSVA today.... "sales of single family homes slumped in Harrisonburg and Rockingham County by a modest two-percent compared to the same month last year." And yet, you might remember that I reported on those same statistics (Oct '06 versus Oct '07) and indicated that sales were up 23%. What gives?? It's actually quite simple --- the Virginia Association of Realtors only tabulates single-family homes (not townhomes) --- my numbers always include both single family homes and townhomes. So...yes...the number of single family homes sales (Oct '06 versus Oct '07) decreased by 2%. But, a more meaningful analysis points out that: Oct '06 versus Oct '07 shows a 23% increase in sales of single-family homes and townhomes. (click here) AND.... Nov '06 versus Nov '07 shows a 28% increase in sales of single-family homes and townhomes. (click here) Always check the facts . . . | |

Home Sales Rise For The Second Month -- Could It Be A Trend Yet? |

|

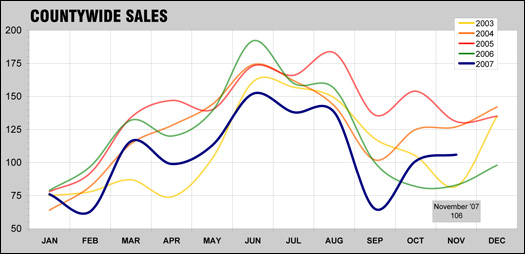

For the second straight month, Harrisonburg and Rockingham County home sales have increased over the same month in 2006.  As highlighted last month, each month from January 2007 until September 2007 showed lower home sales than the corresponding month in 2006. However, in October, this turned around --- with Oct 2007 numbers 23% higher than Oct 2006 numbers. And --- this just in --- November 2007 sales (at 106 properties) exceed November 2006 sales (at 83 properties) by a weighty 28%. As stated last month, before we declare this a trend, we'll have to wait and see what happens in December. The Details: Thegraph above shows the number of sales per month as reported by theHarrisonburg/Rockingham MLS in all of Harrisonburg and RockinghamCounty. | |

Radio Archive: WSVA Home Show: November 2007 |

|

Appealing Your (City) Property Assessment |

|

A reader posed the question of how or why might you appeal the assessed value assigned to your property by the City of Harrisonburg. Below is an overview of that subject, based mostly on information I gleaned from a conversation with Nancy Lawson at the City of Harrisonburg's Commissioner of the Revenue office. When determining new assessed values, the City of Harrisonburg always tries to get pretty close to the market value of the property --- but they are almost always under market value with their assessments. ("Market value" being defined as the amount you could obtain if you sold it.) They are often under market value because they use sales data from July 1 to June 30 --- and they release the new assessed values in November. So they are basing the new values on data that is 4 to 16 months old. However, regardless of the data being used, it is possible that the city could have assessed your property at too high of a value --- and there is an opportunity for recourse. The first step of the appeal process involves meeting with someone at the Commissioner of the Revenue's office about how they came to your assessed value --- this is called the informal review. There is a "worksheet" on file for your property showing the calculations they used to come to your assessed value. They can also share the information on comparable properties in your neighborhood, which they use to determine assessed value. If, after the informal review, you think they have assessed your property at too high of a value, you can file a formal appeal using this form. Click here for more assessment information from the City of Harrisonburg This all applies to the City of Harrisonburg. The process and details for properties in Rockingham County (or in any other city, town or county) are a bit different. If you live outside of the City of Harrisonburg and you're having trouble finding parallel information for another locality, let me know --- I'd be glad to help you research it. | |

JMU Enrollment - Funny Math! |

|

How many students attend James Madison University? How many will in the near future? Depending on who you ask, there are a lot of answers to those questions . . . How many students attend James Madison University? How many will in the near future? Depending on who you ask, there are a lot of answers to those questions . . .Current Enrollment (2007-2008)

| |

Selling In The Dark? |

|

You shouldn't have to! You shouldn't have to!When selling a home, there are things going on around you, in your segment of the real estate market, every week. But it's often difficult to discern what is taking place, and how it might affect you...

| |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings