Archive for February 2008

| Older Posts |

Foreclosure: 97 Blue Stone Hills Drive, Harrisonburg |

|||||||||||||||||||||||||||||||||||||||||||

Per the Daily News Record, February 27, 2008 | |||||||||||||||||||||||||||||||||||||||||||

Foreclosure: 12173 Port Republic Road, Grottoes |

|||||||||||||||||||||||||||||||||||||

Per the Daily News Record, February 27, 2008 | |||||||||||||||||||||||||||||||||||||

Call To Action > > > Save Lake Shenandoah |

|

From today's Daily News Record, Lake Shenandoah, a.k.a. "Shen Lake," needs to be saved! Some key points of this story include: From today's Daily News Record, Lake Shenandoah, a.k.a. "Shen Lake," needs to be saved! Some key points of this story include:

Again --- read the full story here --- or contact: Steve Reeser, Fisheries Biologist Virginia Department of Game and Inland Fisheries (540) 248-9360 reesers@dgif.state.va.us | |

Cause & Effect :: Development Patterns & Traffic Problems |

|

Another key thought from last week's Smart Growth Symposium put on the Shenandoah Valley Builders Association is that . . . Another key thought from last week's Smart Growth Symposium put on the Shenandoah Valley Builders Association is that . . .Distributed neighborhoods, that are not integrated into the community, lead to more driving, and thus, more traffic. Many new residential developments in this area (think of Route 33 East) are:

| |

Foreclosure: 1182 Portland Drive, Harrisonburg |

|

Date/Time of Sale: Friday, March 5, 2008 at 3:15 p.m. Original Principal Amount of Deed of Trust: $177,882 Assessed Value: $193,000 Deposit: $15,000 or 10% of the sales price, whichever is lower For Information Contact: Samuel I. White, P.C. 5040 Corporate Woods Drive, Suite 120 Virginia Beach, VA 23462 757-457-1460 (call between 9:00am and 11:30am) ASAP# 993440 Per the Daily News Record, February 21, 2008 | |

Harrisonburg Water & Sewer Connection Fees Increase |

|

Most homeowners, or those who hope to be homeowners in the future may not have paid too much attention to the news earlier this month that Harrisonburg water and sewer connection fees will be increasing. But maybe we all should have taken note . . . Most homeowners, or those who hope to be homeowners in the future may not have paid too much attention to the news earlier this month that Harrisonburg water and sewer connection fees will be increasing. But maybe we all should have taken note . . .The Change Example #1: three-quarter-inch water meter --- in this example, the sum of the water and sewer connection fees will soon be $7,000, instead of the existing $2,000. This size would be typical for a single family residence. Example #2: a six-inch water meter --- in this example, the sum of the water and sewer connection fees will soon be $300,000, instead of the existing $17,500. This size would be typical for a large commercial project. Peruse the current fee schedule here, and the new schedule here (effective July 1, 2008). The Effect As Todd Rhea, of Clark & Bradshaw, commented at last week's Smart Growth Symposium, when builders or developers are faced with new fees, we're fooling ourselves if we think they absorb those costs. They ultimately get passed on to the buyer. With this logic, one could argue that city housing costs will increase universally by $5,000 come July. Action Item Builders and developers should note that the fees are charged at the time of obtaining the building permit --- so as long as a lot has a building permit prior to July 1, 2008, you can take advantage of the lower fee schedule. For a developer of a major residential or commercial project, this could equate to hundreds of thousands of dollars of savings. | |

Will Rockingham County Be Paved Over? |

|

I have heard some people talk about development as if in the next few years, or decades, all of Rockingham County will be developed --- with the farm land destroyed, and our history no longer preserved. Below I'll try to put that thought in the context of actual land use, but for the record --- I don't think many at today's Smart Growth Symposium thought that the above statement is true. (Lest anyone conclude that I am referring to any of the attendees).  The data above is extracted from the Rockingham County Comprehensive Plan, particularly page 18 of the section on Strategies, Policies and Actions. Here's the full list of how Rockingham County land is being used:

| |

In Theory, Construction Is Booming! |

||||||||||||||||

Are builders gearing up? (Daily News Record) Yes, and no! Read on... Building Permits Issued Per Year:

So....the number of building permits has definitely increased, BUT a large portion of the City of Harrisonburg building permits are for multi-family student housing projects. Though not having conducted a wide survey, I would guess:

| ||||||||||||||||

Smart(er) Growth For Harrisonburg and Rockingham County? |

|

Wow! Today's Smart Growth Symposium, orchestrated by the Shenandoah Valley Builders Association was a fantastic primer on growth issues and how to plan for them in the central Shenandoah Valley. Stewart Schwartz, the Executive Director of the Coalition for Smarter Growth, provided a great overview of smart growth principles and policies that provided a helpful framework for thinking about and planning for the future of our area. One key point that he made, that stuck with me, was a need to focus on developing in the right place. Those present included conservationists, builders, farmers, real estate agents, bankers, local planning staff, elected officials, engaged citizens, and more. There seemed to be a great desire for and capacity to consider working together for the best future for our valley, despite the varying perspectives each of us bring to the table. | |

The Shenandoah Valley's 2007 Real Estate Market |

|

I recently posted 2007 sales trends for Harrisonburg and Rockingham County. Here's the rest of the story . . .  OK --- that was just for visual effect --- admittedly, none of us can read the graphs above, but hopefully you can see that this market report is chock-full of usable data. The report covers the following areas:

| |

Who Pays The Closing Costs? |

|

Some buyers make offers including a condition that the seller pay all or some of the closing costs. Some buyers make offers including a condition that the seller pay all or some of the closing costs.Some sellers offer the incentive of seller-paid closing costs to try to entice buyers. What's really going on here? There are a few ways to look at it:

| |

PMI -- Is It Good, or Evil?? |

|

I am frequently asked whether PMI (private mortgage insurance) is a good thing, or something to avoid. To start with --- private mortgage insurance is an insurance policy that protects the lender in the event that a borrower stops making payments, the lender has to foreclose, and they can't recoup all of their costs. Despite the fact that the lender is the beneficiary of the insurance policy . . . you guessed it, the borrower gets to pay for the policy! PMI is required (by most lenders) for any mortgage where the loan-to-value ratio is greater than 80%. In other words --- if you have less than a 20% down payment, you will likely have to pay PMI. PMI is typically paid on a monthly basis --- with every mortgage payment. However, with most lenders, you can avoid paying PMI by paying a slightly higher interest rate. Don't be fooled --- the intent and result are essentially the same. When a borrower has to finance more than 80% of the purchase price, a lender is a bit more worried about their future ability and likelihood to repay than if they are financing 80% or less. The lender mitigates this risk by taking out an insurance policy, and having the borrower pay for it. The policy can either be paid for (by the borrower) each month, or up front. Thus the option of either paying every month, or over the life of the loan (in the form of a slightly higher interest rate). I suggest that most of my clients pay the PMI each month. Typically, the monthly payments are about the same regardless of whether you pay PMI each month (with a lower rate), or do not pay PMI (and have a higher rate). So . . .

One final note --- if you have monthly PMI costs, at some point you will want to have that part of your payment removed. Before you hire an appraiser to appraise the property and prove that your loan balance is less than 80% of the appraised value, check with your bank on their process. Many banks have a list of appraisers that are acceptable for this process, and some banks insist that they generate the appraisal request. | |

Beyond The Numbers --- What's Happening In Our Market? |

|

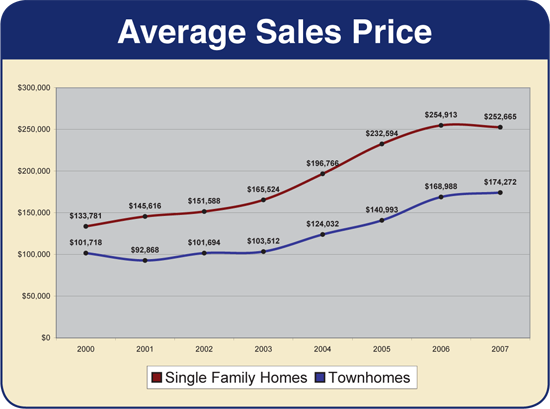

If you hadn't figured it out yet --- I love data analysis. In the world of real estate, there is a lot of data that can help buyers and sellers make intentional, intelligent decisions. Ask me a question, and I'll work to find the data that can give you a thorough and factual answer. But, there is more to the story than the numbers... Many Sellers Are Standing Firm The past year (2007) showed lower real estate activity than the several years prior, and one significant factor in that reality is sellers who stood their ground on price. It is reasonable to think that we may have seen more real estate activity if sellers had accommodated in their asking or selling prices. Average sales prices increased between 2006 and 2007 in almost all segments of our market. If sellers (collectively) had been willing to sell for a small percentage less, I suspect that sales activity would have increased accordingly. Many Buyers Are Bashful In working with buyers, and talking to possible buyers, I have come to realize that buyers in our market are (collectively) hesitant to make the "crazy offer." While there are some buyers who do indeed make those offers, many buyers do not make an offer significantly lower than asking price if they think the price is too high. This, coupled with resolute sellers, has led to a stalemate of sorts. Buyers hesitate to make the offer, and sellers hesitate to lower the price. Excitement Turned Into Trepidation Real estate values escalated rapidly between 2002 and 2006. Buyers and sellers in our market became very excited about the extraordinary gains being imagined and realized by owning real estate. It seemed like people couldn't buy enough real estate fast enough. Nobody wondered or questioned whether values would increase -- they stayed awake at night marveling at the 10%, 20%, 30% that they had or would gain by owning real estate. These days, buyers and sellers stay awake at night for a different real estate related reason. Sellers wonder if their house will ever sell. Buyers wonder if they should really be buying. We don't feel the same excitement level for buying and selling real estate. The Effect of National News We hear terrible things about plummeting home prices in other communities across the county --- or about foreclosures --- or bankruptcies. National news outlets are excitedly covering the worst of the worst situations --- which many people locally assume are happening in our local market as well. Where Do We Go From Here? It is essential that buyers and sellers have a firm understanding of their segment of our local market. Don't be distracted by other areas of the country, or other price ranges locally. It is important to make decisions based on market realities, and out of the context of your personal situation. Owning real estate is a good investment, but buying and selling decisions must be made thoughtfully. | |

Foreclosure: 111 Middlebrook Street, Harrisonburg |

|

Property To Be Sold: 111 Middlebrook Street, Harrisonburg Property To Be Sold: 111 Middlebrook Street, HarrisonburgDate/Time of Sale: Friday, February 29, 2008 at 9:30 a.m. Original Principal Amount of Deed of Trust: $260,775 Assessed Value: $260,400 Last Sale: $274,500 (April 3, 2006) Deposit: $26,000 or 10% of sales price, whichever is lower For Information Contact: Glasser and Glasser, P.L.C. Crown Center Building, Suite 600 580 East Main Street Norfolk, VA 23510 File No. 61895 757-321-6465 Per the Daily News Record, February 18, 2008 | |

Preston Lake -- Diving Into The Details |

|

I have had several clients inquire about Preston Lake, a mixed-use development underway just east of Harrisonburg. I have sent a variety of information and links to online resources to these clients, but thought I'd group all of that information together in one place. I have had several clients inquire about Preston Lake, a mixed-use development underway just east of Harrisonburg. I have sent a variety of information and links to online resources to these clients, but thought I'd group all of that information together in one place. General Information News Articles / Opinion Pieces

A few more notes and disclaimers:

| |

Buying A "For Sale By Owner" Property . . . with a Realtor |

|

Some times, when I am working with a buyer, they or I will become aware of a "for sale by owner" property of interest to them. They almost always have the same question --- how would it work if we wanted to pursue that property? Here's how I see it . . . Some times, when I am working with a buyer, they or I will become aware of a "for sale by owner" property of interest to them. They almost always have the same question --- how would it work if we wanted to pursue that property? Here's how I see it . . .In Virginia (and in most places) when a homeowner decides to sell, and work with a Realtor in doing so, they typically negotiate a percentage of the purchase price that will be paid as a "brokerage fee" at closing. This brokerage fee (call it 20% of the sales price, for the sake of absurdity, and because there is not a standard brokerage fee) is almost always split between the Realtor (and his/her company) representing the seller, and the Realtor (and his/her company) representing the buyer. So, in my absurd example, 10% to the seller's Realtor and realty company, and 10% to the buyer's Realtor and realty company. An interesting byproduct of this typical business practice is that a buyer isn't counting on "paying their Realtor." As a buyer works with their Realtor to identify, view, evaluate, negotiate and close on a property --- they aren't necessarily thinking "and in addition to buying the house, I'll be paying my Realtor 10% of the sales price." Here, some people would interject to point out that the buyer pays both Realtors, as they are the ones bringing the money to the transaction --- the seller just brings the house. And thus, the questions begin when a buyer client becomes interested in a "for sale by owner" property. As a buyer looks at the sales prices of homes listed by Realtors (for example, $200k), they don't think about having to pay a brokerage fee on top of the price --- since the seller will pay it out of the sales price. But many "for sale by owner" sellers don't plan on paying a brokerage fee to any Realtors, and thus the sales price they would negotiate doesn't accommodate for the buyer's Realtor being paid. So . . . if I have been assisting someone in looking for a home, and they decide they want to buy a "for sale by owner" property, here are the options I make available:

| |

Relocating to Harrisonburg? Set up a doctor's appointment! |

|

Like many in Harrisonburg and Rockingham County, my sister and her family had the misfortune of becoming quite sick two weeks ago --- with bronchitis. This happens --- but it became an issue --- because she moved to the area a few months ago. Like many in Harrisonburg and Rockingham County, my sister and her family had the misfortune of becoming quite sick two weeks ago --- with bronchitis. This happens --- but it became an issue --- because she moved to the area a few months ago.Almost all doctors in this area (it seems) won't see a patient unless they are a current patient of that medical practice. So, if you have recently moved to Harrisonburg or the surrounding area, you ought to schedule a "meet and greet" appointment with your physician of choice ASAP. It's actually rather humorous --- it's not too much of a problem to find a doctor that is accepting new patients, but you can't be a new patient until you have had an appointment with the doctor, completed the appropriate paperwork, etc. So --- if you are new to this area, don't wait until you are sick to think about who your doctor will be --- otherwise, you'll be headed to Rockingham Memorial Hospital, as my sister did. | |

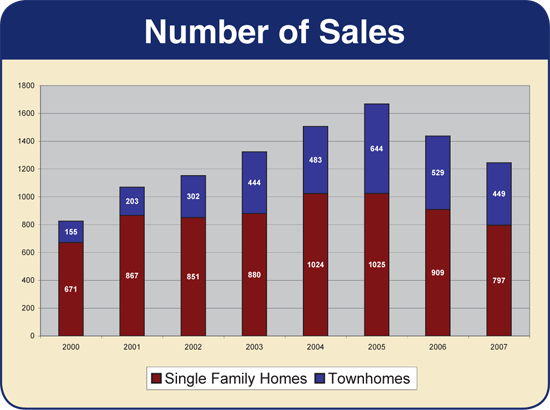

Harrisonburg & Rockingham County - Market Overview |

|

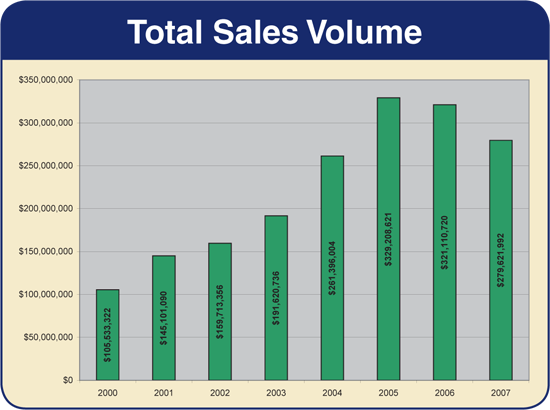

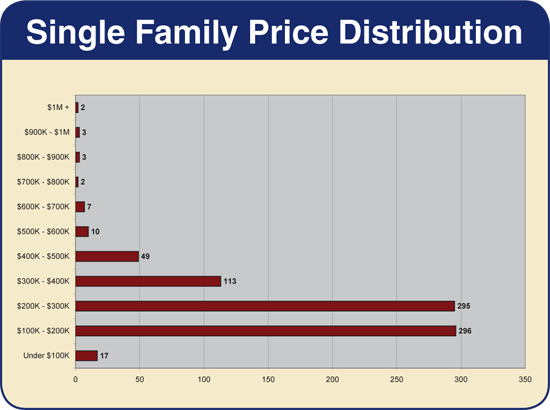

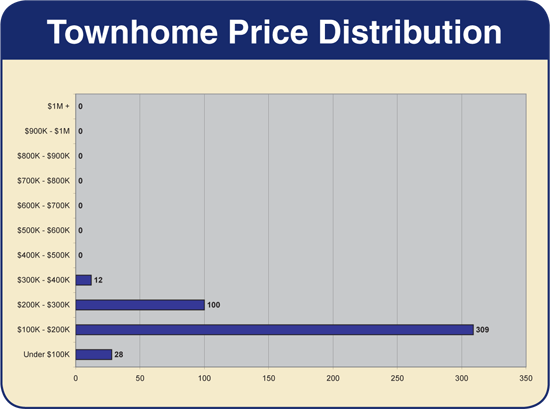

The graphs below are an excerpt from my 2008 Annual Real Estate Report on Harrisonburg and Rockingham County. These figures reflect all residential sales reported through the Harrisonburg / Rockingham Association of Realtors Multiple Listing Service. If you're interested, e-mail me for a full copy of the report, which includes a break down of Harrisonburg City, five sections of Rockingham County, and Page, Augusta and Shenandoah Counties. I will post more of this data here in coming days.      | |

Foreclosure: 80 Shotgun Spring Road, New Market |

|

Property To Be Sold: 80 Shotgun Spring Road, New Market Property To Be Sold: 80 Shotgun Spring Road, New MarketDate/Time of Sale: Friday, February 29, 2008 at 8:00 a.m. Original Principal Amount of Deed of Trust: $90,000 Assessed Value: $130,300 Last Sale: $66,500 (November 30, 2000) Deposit: 10% of sale price For Information Contact: Bierman, Geesing & Ward, LLC, attorneys for Equity Trustees, LLC 4520 East West Highway, Suite 200 Bethesda, MD 20814 (301) 961-6555 www.bgwsales.com Per the Daily News Record, February 12, 2008 | |

Hint: Avoid Loan Froad |

|

What exactly is "loan fraud," or "mortgage fraud"? What exactly is "loan fraud," or "mortgage fraud"?A few examples, per the FBI are:

The long and the short of it --- don't participate in loan fraud --- it is a criminal act. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings