| Newer Posts |

The Best of Lenders, The Worst of Lenders |

|

After (just about) five years in real estate, and many transactions with many lenders, I have finally discovered that with the best of lenders, and with the worst of lenders, the experience for my clients can still be fantastic, or terrible! After (just about) five years in real estate, and many transactions with many lenders, I have finally discovered that with the best of lenders, and with the worst of lenders, the experience for my clients can still be fantastic, or terrible!The root of the problem is the many variables involved with a loan, for example:

Scenario #1 --- $300k (+/-) purchase, 80% financing, loan application to closing in approximately 14 days, absolutely no issues in the entire process. Amazing! Scenario #2 --- $100k (+/-) purchase, 100% financing, down payment assistance program, loan application to closing in approximately 35 days (even though 21 was promised), an absolute nightmare with more and more, and more documentation and paperwork requested from the loan underwriter and loan closer up until the closing day. Many of my buyer clients ask for recommendations on which lender they should select in order to make it a smooth and successful purchase. I do indeed have lenders that I recommend. However --- even with one of the stellar lenders I recommend, a buyer can have a terrible financing process, as a result of the underwriter, closer, appraiser, program requirements, etc. And . . . even if you don't select one of the lenders that I recommend, you can absolutely have a fantastic financing process. | |

100% Financing (and then some) From A Local Lender |

|

A few weeks ago I was lamenting the fact that 100% finance seemed to be sailing out to sea --- never to be available again for first-time buyers (or otherwise).  However, just this past week, Debbie Huntley at SunTrust Mortgage informed me of quite a few 100% (plus) financing programs that are indeed still available . . . Lender Paid Mortgage Insurance --- 100% Financing

VHDA/FHA/PLUS --- 102.75% Financing

80/15/5 COMBO Loan

So, fear not --- even if you don't have a down payment (or even closing costs), if you have good credit and steady income, you are likely to be able to obtain 100% financing after all! | |

Buy Now, Save Big (sometimes) |

|

In two out of my most recent three closings, my buyer clients bought at a fantastic price --- below appraised value. In two out of my most recent three closings, my buyer clients bought at a fantastic price --- below appraised value. Scenario #1 --- buyers offered a quick closing, with no home sale contingency, and paid $13,000 under the appraised value. Scenario #2 --- buyers bought from a relocation company, and paid $10,000 under the appraised value. Why is it happening? In both cases, the buyers made aggressive offers --- instead of opting not to make an offer based on a higher than reasonable asking price. As I noted a few weeks ago, buyers currently seem to be hesitating to make offers, and sellers are hesitating to lower their prices. For the buyer who is willing to negotiate, this means there are opportunities to buy at great prices! | |

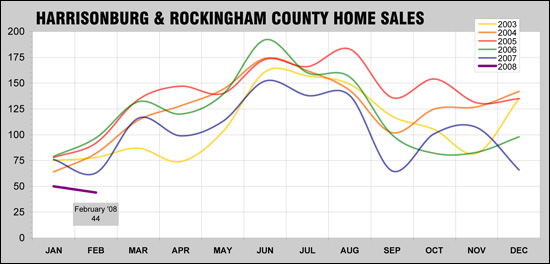

Harrisonburg / Rockingham Home Sales Report (3/7/2008) |

|

See below the report for commentary . . .  Some interesting trends this month include:

| |

Foreclosure: Mt. Hope Lane, Keezletown |

|||||||||||||||||||

| |||||||||||||||||||

Foreclosure: 730 Virginia Avenue, Harrisonburg |

|||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

Foreclosure: 1121 Rebecca Ridge Court, Harrisonburg |

|||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||

Downtown Sewer & Gas Lines |

|

Yesterday's issue of the Daily News Record included a letter to the editor from Dr. Bob Alotta commenting on the "local rock blasting" taking place at Urban Exchange -- or, as Dr. Alotta put it, "the new luxury condominiums on East Market Street." (the site of the demolition is pictured below) 1. Dr. Alotta states that "Since work began on this project, the water department had to replace three sections of sewer line in the middle of Newman Avenue..." 2. Dr. Alotta goes on to say that "A gas line was also ruptured." and that "...the city shouldn't have to absorb the cost of repairs..." that the builder should. | |

February 2008 - Sales are Down, Prices Are Up!?! |

|

February 2008 home sales are the lowest on record within the past 5 years (beginning January 2003), according to data from the Harrisonburg-Rockingham Multiple Listing Service. Only 44 properties were transferred in February, down from 50 in January 2008, and down from 63 last February (2007).  The Good News If we compare this February (2008) to last February (2007) we see two conflicting market conditions:

Advice to sellers --- be patient, as it may take longer than you expect, or would like, for your home to sell. | |

Housing Supply in Harrisonburg and Rockingham County |

|

Here is a fresh look at inventory levels for Harrisonburg and Rockingham County --- looking at all single family homes and townhomes. This is a similar analysis as I have provided in past months, with one notable exception . . . see below the graphic . . . In previous months, I had calculated the rate at which homes were selling using only the previous three months of sales figures. My logic was that if I looked back beyond those three months, it would take too long for short term trends to appear in my calculations. Today, however, a local builder suggested that short term trends (if they really are short term), could skew these numbers --- and perhaps it would be more helpful to determine the sales per month looking at a larger history than the past three months. Since I update these figures each month, I decided to make the suggested change --- thus, the data above compares available listings in March 2008 with the average sales per month for March 2007 through February 2008. The full data table is below . . .  | |

Daily News Record >> Getting Local With Real Estate |

|

I applaud Dan Wright (pictured to the right), and the Daily News Record (DNR) for running some local stories on our real estate market, such as today's "Feeling The Ripples" article on foreclosures. I applaud Dan Wright (pictured to the right), and the Daily News Record (DNR) for running some local stories on our real estate market, such as today's "Feeling The Ripples" article on foreclosures.In contrast to today's story about our local market, the DNR will often run AP stories --- which are written from a national perspective, and about markets that are usually quite different than the Shenandoah Valley. As a quick aside --- if it's not immediately apparent whether the article is local, check the "dateline" --- the city that precedes the article. And yet, despite my excitement for seeing a local article today, I can't keep from commenting on a few interesting parts of this story . . .

| |

NPR Is Right On --- The Potential Real Estate Standoff |

|

Perhaps Jonathan Clements, a personal finance columnist at The Wall Street Journal, has been reading my blog? Unlikely, however he speaks of a possible real estate standoff in a recent NPR interview, making many of the same observations as I made a few weeks ago. Perhaps Jonathan Clements, a personal finance columnist at The Wall Street Journal, has been reading my blog? Unlikely, however he speaks of a possible real estate standoff in a recent NPR interview, making many of the same observations as I made a few weeks ago.In the interview, Jonathan ponders . . . "are we going to see prices drop, which will encourage buyers to step up to the plate and purchase, or are we going to continue with the standoff, where sellers are reluctant to cut prices and buyers are reluctant to commit?" He then makes some other great observations about selling in today's market:

| |

Deed Details - - - Don't Wait Until Closing! |

|

In a typical purchasing scenario, a buyer may not see the deed that will be recorded at the courthouse to transfer ownership to them for the property that they are purchasing . . . until after the closing, after the deed has been recorded. This could have serious implications! In a typical purchasing scenario, a buyer may not see the deed that will be recorded at the courthouse to transfer ownership to them for the property that they are purchasing . . . until after the closing, after the deed has been recorded. This could have serious implications!First, to give the benefit of the doubt to local attorneys and title companies, many will briefly show the buyer the deed before having the seller sign the document --- though typically this is only to make sure that the buyers' names are spelled correctly. Again, this could have serious implications! Here are a few recent conversations I have been a part of, or heard about:

Where do we go from here? I am not a title examiner --- thus, though I will begin to pull recorded deeds for my buyer clients, I will not necessarily always be able to pinpoint all of the associated documents. A great solution, however, is to use a title company or closing attorney who will initiate the title search process as soon as the property is under contract. If deed restrictions (of any kind) exist, at least they will be discovered early on, as opposed to after the closing has taken place. | |

| Newer Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings