| Older Posts |

Slower Market Gives Buyers Time To Evaluate |

|

My column from the May issue of the Shenandoah Valley Business Journal...  Between 2003 and 2006, buyers were stumbling over themselves to buy real estate – it was a fast and furious time, and buyers didn't have time to stop to think about their purchase. Since 2007, home sales have slowed to a more normal pace (or sub-normal pace, depending on your perspective), and this has once again made room for the buying process to be a more rational, thoughtful endeavor. Between 2003 and 2006, buyers were stumbling over themselves to buy real estate – it was a fast and furious time, and buyers didn't have time to stop to think about their purchase. Since 2007, home sales have slowed to a more normal pace (or sub-normal pace, depending on your perspective), and this has once again made room for the buying process to be a more rational, thoughtful endeavor. CONSIDER THE OPTIONS – As a buyer, you can and should take the time to consider all possible properties that may fit your needs and wants. Sometimes these needs and wants become clearer as you start to look at possible homes and further understand what would work or not work for your situation or circumstances. EVALUATE SCHOOLS – Everyone has their own opinion about which schools are good, great, or the best – and these judgments are based on many criteria such as test scores, class size, etc. A great resource for evaluating or comparing schools is greatschools.net, a comprehensive web site with data on area K-12 schools. DETERMINE ZONING – Depending on whether you are buying a home in a subdivision or an open tract of land, it will be important to check the zoning for the property. Zoning can affect important aspects of how you use and enjoy your property. SEARCH FOR DEED RESTRICTIONS – It is best to know about any covenants/restrictions, easements or right-of-ways before making an offer on a property. All of these items can be found with a quick search of the recorded court documents to pull the most recent deed that conveyed the property in which you are interested. ESTIMATE LIVING COSTS – It may be worthwhile to compile information on utility costs, commuting costs, and more as you consider the purchase of a particular home, or as you compare homes in different locations or with different building characteristics. After all, it's not just the mortgage you'll be paying each month! EXAMINE NEIGHBORING USES – As they say, real estate is all about location, location, location! Thus, it is crucial to understand the properties surrounding the home you might purchase, and how the permitted uses of such properties might affect you in the future. DETERMINE CONVENIENCE – Many buyers don't conduct this step in a highly methodical manner, but it can be helpful to run down a list of common destinations to compare their location to where your potential new home is situated. Examples include: office, schools, grocery store, gas station, friends' homes, family's homes, church, recreational facilities, etc. ESTIMATE UPGRADE COSTS – Unless that home is exactly how you will want it for the next year or two, it would likely be helpful to develop a short list of anticipated upgrades or changes. Once you have priced out the materials and/or labor for the improvements, you can assess how quickly you will be able to make the changes. RESEARCH MARKET VALUE – A "Comparable Market Analysis" isn't only for a seller --- by looking at properties that have recently sold that are similar to the home you might purchase, you can better understand what a reasonable offer would be on the property. INSPECT HOME, WATER & SEWER – Once an offer has been made and accepted on the property, several formal steps may/should take place. These may include a home inspection, well/septic inspection, a radon test, a termite inspection, or more. Permission to conduct these tests and to negotiate based on their results needs to be included within the sales contract – so as you are considering a particular property, be thinking about what types of formal inspections you may want to conduct. Buying a home doesn't need to seem like an overwhelming task – but it is one that that deserves an intentional, thoughtful decision making process. | |

The Wisdom of Neighbors |

|

Are you considering purchasing a home? Do you have questions about the neighborhood? Ask the neighbors!  I showed a property this afternoon in a neighborhood where I had not shown a lot of property --- and my buyer clients were not familiar with the neighborhood either. We had a variety of questions in regards to safety, noise levels, etc. Just as we were about to leave the property, we saw one of the neighbor outside of his house, and we stopped to ask him a few questions. My clients were able to learn, firsthand, from the neighbor:

So --- as a buyer, don't hesitate to stop and chat with the neighbors --- they can be one of the most valuable sources of information about what life would be like in your potentially new neighborhood! P.S. If you're a bit bashful, let me know --- I'll be happy to start the conversation and keep it going so that we can glean some useful information! A few other thoughts on the buying process: | |

Buying A Foreclosure Property Before The Sale |

|

Can it be done? YES! Is it easy and fun? NO! Can it be done? YES! Is it easy and fun? NO!Properties in Harrisonburg and Rockingham County that are being foreclosed on are almost always advertised in the Daily News Record as an upcoming "Trustee Sale." When I see good opportunities in these notices, I post the trustee sale details on my blog. Oftentimes, information about these foreclosure sales is available several weeks before the actual sale, and thus interested buyers sometimes wonder if it is possible to short circuit the foreclosure proceedings, and buy the property before the sale. The simple answer --- yes, this is possible. However, there are typically a few obstacles: Owners in denial --- or seclusion --- or anger! Being in situation where you can't pay your mortgage any longer, and the bank is foreclosing on your home is not AT ALL a fun situation to be in. I don't at all intend to make light of the unfortunate light that some homeowners find themselves in. And thus, if you are hoping to purchased a foreclosure property prior to the trustee sale, it is important to consider the perspective of the homeowner. Many such homeowners are in denial --- thinking or hoping that they will catch up on their mortgage payments such that the sale will not take place. Others will be very difficult to reach, and it won't be possible to discuss a way to help them sell their home without being foreclosed upon. And some homeowners will be downright angry if someone contacts them about their home, and it's status as a pre-foreclosure property. The lender can't sell you the home before the trustee sale, so if you are to attempt to purchase it beforehand, you'll have to deal with the homeowner. Be careful how you broach the subject, and be sensitive to a time of difficult life circumstances! The timing will be tight! While there are often several weeks between the first notice of a foreclosure and the actual foreclosure sale, if you are financing the purchase, you will need every last day of it if you hope to purchase the property before the sale takes place. If you are purchasing the property with cash, or if you already have your financing lined up, you may not have as much of a time crunch. Sometimes the lender will postpone the foreclosure sale if they can be assured of a pending successful sale of the property that would pay off their loan. If they have doubts as to the buyer's performance, or doubts as to whether the purchase price will pay off the remaining balance of the loan, they may foreclose as planned. If you are going to attempt to buy a foreclosure property before the sale, be sure to have all of your financing details arranged ahead of time! Those second lenders don't like being in second place! Finally, it is important to recognize that there is sometimes a second mortgage or line of credit on the property being foreclosed upon. If a primary loan of $180,000 is being foreclosed on, it won't necessarily work for you to swoop in and offer the owner $181,000 because you know this will pay off their first mortgage and because you know the property is worth $200,000. If a second mortgage (of perhaps $10,000) is in place, the owner won't be able to sell the property to you unless they have other funds in place with which to satisfy the second loan. The potential existence of second mortgages doesn't mean you shouldn't pursue a foreclosure property prior to the sale, but it does mean that it will be worthwhile to do some preliminary research before making a proposal to the homeowner. It can be beneficial for multiple parties to purchase a home before it is foreclosed upon. You, the buyer, can get a good deal on the house. The seller can avoid a foreclosure scar on their credit history. The lender can avoid the hassle and cost of foreclosing on a property. But if you are going to attempt this feat of real estate acrobatics, be sure to review the factors above and consider how to adjust your proposal to make the scenario work best for all involved parties. Some additional light reading on foreclosures: - Types of Foreclosure Opportunities - How & Why To Buy Property At A Foreclosure Sale | |

What on earth is this "cap rate" you keep talking about? |

|

No --- that's not a cap rate!! Simply put, a "cap rate" is a measure of how quickly your investment is being returned to you. By your "investment" I mean the value of property that you have purchased. by "returned to you" I mean the amount of money that a property generates in a year. The cap rate formula is . . . Net Operating Income / Purchase Price So if you buy a property for $160k, rent it for $975 per month, and have $1,500 of annual expenses, you have a cap rate of 6.375%. ( ( 975 * 12 ) - 1500 ) / 160,000 = 6.375% Care to know more? Read these . . . What Is A "Cap Rate"? Harrisonburg Single-Property Cap Rates Harrisonburg Multi-Family Cap Rates Would you like help calculating the cap rate on a property you own, or are considering purchasing? Call me (540-578-0102) or e-mail me (scott@cbfunkhouser.com). | |

Harrisonburg Foreclosure: 513 Broad Street ($104k) |

|||||||||||||||||||||||||||||||||

Source: Daily News Record, May 14, 2008 Trustee: Shapiro & Burson, LLP, 757-687-8822 | |||||||||||||||||||||||||||||||||

Do Realtors Make Huge Profits On Home Sales? |

|

Josh posed the question of whether Realtors make extraordinary profits on home sales, and suggested I shed some light on the matter. I'd be happy to do so --- and I'll start with Josh's proposed example of a $100,000 home (though there aren't too many of those out there). One Quick Assumption . . . Upon the closed sale, Realtors are typically paid an amount derived from a percentage of the sale price of the property being sold. This percentage (the "real estate commission" or "brokerage fee") varies from company to company, from agent to agent, and can be negotiated. The sellers of all of the properties that I am currently marketing will pay either a 5% or 6% commission. Thus, for this example, we'll split the difference and use 5.5% as the sample brokerage fee. At First You Would Think . . . Many people would simply multiply the sales price ($100k) by the commission (5.5%) and assume that once I sell this fictional $100,000 home, I'd pocket $5,500. Could that be true?? "Sellers Agents" and "Buyers Agents" The total commission that the seller pays is actually split (typically in half) between the Realtor representing the seller and the Realtor representing the buyer. While it is legal for a Realtor to represent both buyer and seller in a transaction, and many Realtors do so quite skillfully, it is not a practice that I encourage, as it can limit the representation that each party receives. As a result, and since in 95% (plus) of my transactions I am only representing one party, we will now divide the $5,500 by 2, and have $2,750 remaining. The Company Has Costs Too The remaining $2,750 is now split (again!) between the Realtor representing the seller (or buyer) and the company for which they work. Different companies have different arrangements as far as this split --- ranging from 50% to the Realtor to as high as 90% to the Realtor. Most companies are within the 50% to 75% range, so I'll average the limits of that range, and use 62.5% for our example. This leaves $1,719 to the Realtor. However, in my case, we pay a small percentage of each commission to Coldwell Banker Corporate (since we are a part of a national franchise), which actually leaves me with $1,616. And Then There Are The Agent's Costs If we are to compare a Realtors income to anyone else's income, we must next take out my business expenses. Last year (2007) my expenses were approximately 21% of my gross income. Some of these expenses are related to a single transaction (marketing costs, for example), and some are related to my overall business (Realtor association membership, MLS membership, office expenses, education/training expenses, etc.). Thus, the figure above ($1,616) is now reduced to $1,277. Let's Extrapolate! That final "profit" on the $100,000 sale was $1,277 --- which is 1.28% of the sale price. Thus, if all of the variables remained the same, here are some additional profit points: $100,000 = $1,277 $185,700 = $2,377 (April 2008's median sales price) $300,000 = $3,840 (a very nice home) $500,000 = $6,400 (a very, very nice home) Let's Compare Again When we began, some might have made the assumption that I would have pocketed $5,500 on a $100k sale --- when in reality, I only profit $1,277. Along the same lines, someone selling a $300,000 home might think I would be pocketing $16,500 (wow!) --- when in reality, I only profit $3,840. The Question At Hand Returning to the original thought/question --- do Realtors make extraordinary profits? In my opinion, no --- in some transactions I am paid appropriately for the service, knowledge, marketing, representation, negotiation and expertise that I provided to my clients. In some transactions, I am underpaid. And in some cases, I provide such services to a buyer or seller for months, and am never compensated at all (if they do not buy or sell). I hope this has shed some light on how compensation works in the real estate world (at least in my real estate world), and I certainly welcome other thoughts, questions, and perspectives! | |

Harrisonburg Foreclosure: 1121 Rebecca Ridge Ct ($46K+) |

|||||||||||||||||||||||||||||||||

Source: Daily News Record, May 20, 2008 | |||||||||||||||||||||||||||||||||

Trends in Harrisonburg Housing Supply |

|

For some time now, I have provided monthly updates on the months of supply of housing available in four price ranges. (see May's update) Per Andy's request, I will now also graph the trends in these supply indicators.  How it works . . . Months supply is an measure of the relationship between our market's supply and demand in four price ranges. The numbers represent the months of supply of properties available in each month based on average demand per month during the past twelve months. | |

Searching For A Home Online --- Which Web Site To Use!?! |

|

In a comment on a recent blog post, Josh stated: In a comment on a recent blog post, Josh stated:"So when I was searching for my place, I rarely used realtor's websites.I stuck to hrar and realtor.com. Do most of your home buyers find your listings through your website?" I find it fascinating whenever I have the chance to learn about which web site or web sites people use to search for homes in the Harrisonburg area. Here's why I find it interesting . . . Some people (like Josh) don't want to use a particular company or agent's web site -- they will often use www.hrar.com, or www.realtor.com -- but I'm not sure exactly why. In the past, you would only find that company or agent's listings on their web site --- but now most company and agent web sites will allow you to search all homes currently on the market. Josh (and others) -- help me out here . . . 1. Would you feel an obligation to use the services of a company or agent if you used their web site? 2. Do you wonder if you are really seeing all of the listings on their web site? 3. Do you wonder if the company or agent's listings will be given preferential ranking on their web site? 4. Do you find www.hrar.com, or www.realtor.com easier or more enjoyable to use for finding properties? 5. Is there something else that I am missing? | |

How To Draw More People To An Open House (I hope) |

|

As I discussed a few weeks ago, the value of an open house is often unknown (and perhaps questionable) to home owners, and the Realtors representing them. But at the same time, open houses often get people inside of homes who may not have viewed the home otherwise --- and an important step of a successful sale is to have people view the home. So --- I'm testing out a new strategy to get potential buyers in the door at the open house . . .   I printed (front and back) 500 of these business card sized mini-flyers advertising the open house. Then, almost all of them were distributed on parked cars in an often packed parking lot near the home that is for sale. As you might imagine, I had a lot of internal conversations and questions about doing this: I printed (front and back) 500 of these business card sized mini-flyers advertising the open house. Then, almost all of them were distributed on parked cars in an often packed parking lot near the home that is for sale. As you might imagine, I had a lot of internal conversations and questions about doing this:1. Is it o.k. to put things on cars in a parking lot? According to the local police officer who I spoke to, yes, so long as a "no soliciting" sign is posted. 2. Will some car owners be annoyed by the mini-flyer on their windshield? I hope not -- I hope they say "wow, that Realtor really works hard to sell the houses he has listed" -- though I imagine some may be peeved. My apologies!!! 3. Will the owner of the parking lot be upset that some might end up in the parking lot instead of the pockets of the car owners? I hope that all of the car owners take their treasured mini-flyer home --- but I do realize that some may end up in the parking lot. As a result, I imagine that I'll either get a call to come pick them up, or a "no soliciting" notice will be installed (or both!?). 4. Will it actually work? Will I be able to generate more traffic to the open house? Will the house sell as a result? This is to-be-determined. The open house started about 19 minutes ago, so I'll have to provide another update later on. If this new strategy for getting people into open houses does work --- you know that I'll be repeating it to work to sell the other properties I have listed for sale --- if not, I'll be back to the drawing board to think of a new, creative way to market homes! | |

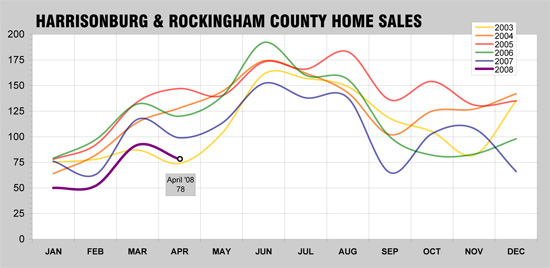

April 2008 Home Sales In A Historical Context |

|

This month's sales (April 2008) were a bit of a surprise to me. Throughout March and April I have heard about a LOT of homes that have gone under contract. I had thought we would start to see that show up in April closings, but perhaps it won't be until May or June. It is fascinating to me to see how closely most years follow the same month-to-month trend lines. The black (hollow) circle at the end of the purple line shows the 78 home sales that took place in April 2008. We saw the same April dip this year (compared to March) as we saw in 2003, 2006 and 2007. Perhaps that is because 2004 and 2005 were the years that really bucked the trends as home sales skyrocketed. Whatever the reason, home sales continue to trend as they have over the course of the past several years. Sales are happening at a slower level as compared to 2004, 2005, 2006 and 2007 --- but March and April of this year (2008) showed sales counts higher than in 2003. | |

Harrisonburg / Rockingham County Home Sales Report - May 2008 |

|

Some observations:

| |

Housing Supply & Demand - May 2008 |

|

This is an illustration of the relationship between our market's supplyand demand in four price ranges. The numbers (6, 11, 14, 25) representthe months of supply of properties currently available based on averagedemand per month during the past twelve months.  This month (May 2008) shows an increase in months supply in all except the lowest price range. The most significant increase was in the $400k+ price range where the months of supply available jumped from 21 months to 25 months. This was largely because of the increased supply of homes --- 152 homes for sale in May as opposed to only 137 in April. | |

Stalking Is NOT Acceptable, But In Real Estate . . . |

|

| |

Harrisonburg Foreclosure: 1161 Springfield Dr ($31K) |

|||||||||||||||||||||||||||||||||

Source: Daily News Record, May 7, 2008 Trustee: Shapiro & Burson, LLP, 757-687-8822 | |||||||||||||||||||||||||||||||||

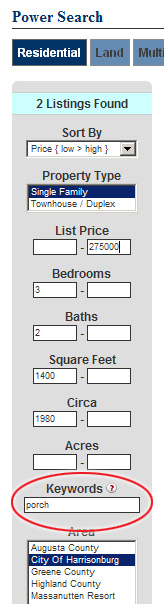

NEW --- Search for Harrisonburg Homes Using Keywords! |

|

Have you checked out the power search on this web site? You can quickly and easily search for homes based on: - single family vs. detached - list price - bedrooms - bathrooms - square footage - age of home - number of acres - geographical area - elementary school - high school But now, you can also search by keyword! | |

Harrisonburg Foreclosure: 1143 Sumter Ct ($36K) |

|||||||||||||||||||||||||||||||||

Source: Daily News Record, May 6, 2008 Trustee: Samuel I White P.C., 757-457-1460 | |||||||||||||||||||||||||||||||||

Wall Street Journal: "The Housing Crisis Is Over" |

|

"The dire headlines coming fast and furious in the financial and popular press suggest that the housing crisis is intensifying. Yet it is very likely that April 2008 will mark the bottom of the U.S. housing market. Yes, the housing market is bottoming right now." The article goes on to make some very interesting observations based on housing market data and historical comparisons. It's worth a read! | |

"The Recession That Never Was is Now Over" -- Briefing.com |

|

Thanks to a client of mine for pointing me to this great economic commentary entitled "The Recession That Never Was is Now Over" from Briefing.com. Thanks to a client of mine for pointing me to this great economic commentary entitled "The Recession That Never Was is Now Over" from Briefing.com.Some interesting thoughts from the article in regards to whether we have been or are experiencing a recession . . .

And touching on why everyone seems to think we're in a recession . . .

Again, be sure to read the full article here, from Briefing.com. | |

Harrisonburg Multi-Family Cap Rates |

|

Multi-family properties often provide different cap rates than single properties. Let's take a look at some recent multi-family sales in Harrisonburg . . . 1710 Park Road, Harrisonburg = 5.1% 1986 Brick quad Sold for $400,000 in February 2008 ( ($2030 per month x 12 months) - ( $1023 insurance + $2002 taxes + $1,000 repairs ) ) / $400,000 sale price 325 Colicello Street, Harrisonburg = 10.6% 1919 triplex Sold for $184,500 in April 2008 ( ($21600 per year) - ( $658 insurance + $678 taxes + $750 repairs ) ) / $184,500 000 sale price 331 Grace Street, Harrisonburg = 3.4% Duplex Sold for $282,000 in September 2007 ( ($1040 per month x 12 months) - ( $720 insurance + $1538 taxes + $500 repairs ) ) / $282,500 sale price As you can see, in multi-family properties, the cap rate is not as predictable as in singe family rental property. Related Posts: Harrisonburg Single-Property Cap Rates What Is A Cap Rate? | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings

I have many clients who are very knowledgeable about free resources for finding information about houses for sale. In conversation with one such client this past week, she made a joke about it being akin to "stalking" -- which we had a good chuckle over.

I have many clients who are very knowledgeable about free resources for finding information about houses for sale. In conversation with one such client this past week, she made a joke about it being akin to "stalking" -- which we had a good chuckle over.

Yesterday (May 6, 2008), the Wall Street Journal ran an opinion piece entited "

Yesterday (May 6, 2008), the Wall Street Journal ran an opinion piece entited "