Archive for December 2008

| Older Posts |

Buy a home now while you still have options! |

|

It's December 30th, which means that we're less than 48 hours away from the largest inventory reduction that we've seen all year! OK --- perhaps I'm being a bit over-dramatic, but I predict that we will see a significant inventory drop as the calendar flips over from 2008 to 2009. Many listing agreements with hopeful home sellers were likely written with a December 31, 2008 expiration date, with a seller intending to try to sell until then end of the year and then re-evaluate. So...today, there are 778 residential properties for sale in Harrisonburg and Rockingham County. This includes single family homes, townhomes and condos. How many will still be on the market on January 1, 2009? Double check those available homes before the New Year rolls around before it's too late! :) | |

Buying and selling in this real estate market |

|

As featured in the December Shenandoah Valley Business Journal... Absent hard data on the local real estate market, we could make erroneous assumptions by listening to national news stories. Here is a quick overview of how things stand in the Harrisonburg and Rockingham County real estate market: Are property values falling? No. The median sales price of all residential properties shows a 1% increase when comparing 2008 (Jan-Nov) to 2007 (Jan-Nov). Are buyers buying? Yes. However, it is at a significantly slower pace than last year. In 2007 we saw 1,182 residential sales (Jan-Nov) and this year we have only seen 861 sales (Jan-Nov). This indicates a 27% decline in market activity. Are sellers selling? Yes. Homes are selling at approximately the same pace as last year with an average "Days on Market" of 166 this year (Jan-Nov 2008) as compared to 171 last year (Jan-Nov 2008). Hopefully this draws out the realization that while the national housing market is not doing so well, our local housing market is a different story entirely. But yet, the state of our housing market isn't good news for everyone: A Buyer's Delight Buyers currently enjoy many housing choices, as the slow pace of sales provides for high inventory levels. Inventory levels have declined since September, and will likely continue to do so through the winter, yet current levels still provide buyers with many options for their next home purchase. The current slow rate of sales can allow for significant price negotiations in some instances. Even as median home sales prices stay steady, some sellers are ready to negotiate to provide for a faster sale instead of waiting for months amidst the masses of homes for sale. Buyers are also enjoying tremendously low interest rates, now below 5% again with many lenders for a 30-year fixed rate mortgage. The most recent time we have seen interest rates this low was in 2003. A Seller's Despair Despite no significant change in the time it has taken for homes to sell, high inventory levels equates to a long wait for many sellers. This can mean month after month of keeping a home ready to be shown, or it can equate to weeks or months of discouragement from a lack of showing activity. Buyers want to negotiate on price like never before, which means that not only do sellers need to price their homes competitively to attract market attention, they also need to still have room to adjust once negotiations begin. Many sellers of late find themselves balancing money and time as they consider a buyer's offer. Where We Go Next? As 2008 comes to a close, we still find ourselves in a buyers market, and we will likely see a similar market into the first and second quarter of 2009. We could start to see an across-the-board downward shift in home values, but if we were going to see a tremendous shift, I believe we already would have seen the start of it. One of my colleagues in the financial sector recently shared a great cliche about the housing market: "Most people get in too late, and they get out too late." As he pointed out, the second mistake has already been made by most. Don't let the first happen, too. | |

Urban Exchange Construction Update |

|

Despite some rainy days in December (see above), construction is flying along at Urban Exchange --- framing for the fourth floor is being finished on the East Tower (apartments for rent), and the first floor is being framed on the West Tower (condos for sale). Click here to see the latest construction photos of this exciting project in Downtown Harrisonburg, the future home of 196 condos, and 12,000 s.f. of retail space. | |

My apologies for information overload! |

|

I use FeedBurner for my RSS feed, and every few months the FeedBurner service will hiccup, causing my RSS feed to reset. Thus, anyone reading my blog via Google Reader, or any other rss feed aggregator would have seen 20 (or more) blog posts this morning --- they weren't all written this morning, they are from the last few weeks. I suspect that those of you who subscribe by e-mail will also receive a very lengthy e-mail with 20 blog posts today. My apologies that this FeedBurner error sent WAY to much information at you, most of it for a second time! | |

Calculating the return on your home improvement investment |

|

Remodeling Magazine has released their 2008-2009 report comparing the cost of a variety of home improvement projects as compared to the added value of each renovation. The projects that they analyze include: basement remodel, bathroom addition, deck addition, master suite addition, window replacement, and many more. Drum roll please... The highest return on investment (as a national average) is a deck addition (80% return on investment), and the lowest return is on a home office remodel. Learn more... You can download a full report of the data on a city-level (the closest city to us is Richmond, VA) here. © 2008 Hanley Wood, LLC. Reproduced by permission. Complete city data from the Remodeling 2008–09 Cost vs. Value Report can be downloaded free at www.costvsvalue.com. | |

Got Lead? Here's what you need to know! |

|

If you're buying a home built before 1978, you must know that your new home may very well have paint that contains lead (lead-based paint). This type of paint can be hazardous to your health -- especially if paint chips are ingested, or if dust from lead-based paint is breathed. Lead-based paint is more dangerous for children than adults because they are more likely to put their hands in their mouths, their bodies absorb more lead, and because their brains and nervous systems are more sensitive to the damaging effects of lead. So, what's a buyer to do? I have worked with buyer clients who decided not to buy a home built before 1978 because they didn't want to live with the possibility that lead might exist in the paint. If you see this issue in that way, it's probably not worthwhile to even go look at potential homes if they are built prior to 1978. Other clients that I have worked with are comfortable buying a home built before 1978, but thoroughly educate themselves on the risks and the precautions they should take. The principal fact to remember is that if you are engaging in renovations or remodeling that will disturb the paint (chipping, scraping, sanding), then you need to take precautions to protect yourself and your family. But what about the contract? An astute home buyer will realize that the sales contract allows them to test for lead. I haven't had a buyer engage in this testing, so I'm not too familiar with the process, but if you're buying a 1950's home, it wouldn't seem to me that you'd need to do testing to determine whether lead-based paint was present in the home. Additional Resources Here are some additional resources from the EPA that may be helpful for you.

| |

National average rates at 5.17%, local rates at 4.875% |

|

As I mentioned a few days ago, low interest rates are helping people in this area cut down their monthly housing costs. And yet interest rates keep falling further --- according to MarketWatch: The benchmark 30-year fixed-rate mortgage tumbled to a national average 5.17% this week, the lowest level since Freddie Mac began its weekly rate survey in 1971. What is remarkable is that the national average rate is always somewhat higher than you can acquire from a lender locally. I reviewed a good faith estimate yesterday for a re-finance at 4.875% fixed for 30 years. If you'll definitely be buying in the next 3-6 months, now is a great time to consider doing so, given current rates. And if you aren't looking to buy / sell, but you have a rate higher than 6%, you should definitely investigate the cost savings of re-financing. | |

Search for real estate deals using NEW Price Per SF tool |

|

Several exciting upgrades to my web site have been in the works, the first a convenient mortgage calculator, and now we have added the ability to search by price per square foot via the Power Search on my web site. Think about it for moment --- you've always been able to limit the price range, or your square footage range, but now you can limit your search results to those where you are buying at a particular price relative to the size of the home. A few potential applications:

Credit where credit is due: I didn't think of this new search tool all on my own -- the idea was born in a conversation with Amar Gogia at Scripture Communities. Thanks Amar! | |

Are high priced homes selling in Harrisonburg and Rockingham County? |

|

Peruse my most recent monthly market report and you're certain to notice that our market (Harrisonburg & Rockingham County) has a very large supply of homes priced above $400,000. In fact, at the rate these homes are currently selling (54 sold so far in 2008), it would take 26 months to sell them all (117 are currently for sale). However, this doesn't necessarily mean that high priced homes are not selling, or that those sales have dropped dramatically compared to the rest of the market. The graph below shows the total number of single family home sales in Harrisonburg and Rockingham County over the past five years...  As you can see, there has been a 40% decline in single family home sales between 2004 and 2008 in Harrisonburg and Rockingham County. The graph below shows the total number of single family home sales above $400,000 in Harrisonburg and Rockingham County over the past five years...  It may come as a surprise that there has been a 32% increase between 2004 and 2008 in home sales of those single family homes priced above $400,000. The other factor at play here, however, is that homes have increased in value since 2004, so comparing these two charts isn't a perfect statistical analysis. However, this does drive home the fact that indeed high priced homes are still selling in our market. | |

Current (Incredibly low) interest rates can make a significant difference in a monthly budget! |

|

Here's an insightful article from yesterday's Daily News Record that uses a local example to show what a significant impact current interest rates can have on a family. Grefe, a teacher and coach at Harrisonburg High School, currently has an adjustable-rate mortgage that has interest rates of both 7.5 percent and 11.5 percent - but he's refinancing to a rate nearer to 5.5 percent. Depending on your financial picture, some borrowers are currently obtaining fixed-rate mortgages at or below 5.0%, and some local lenders that I have talked to expect that rates should stay at (or just below) 5.0% into the near-term future."That should save me close to $200 to $250 a month," he said. "Monthly payment-wise this will work out pretty good." (source) Even if you aren't looking to buy a home right now, this can be a great time to examine potential savings from refinancing. | |

Timing the housing market, when to buy and sell... |

|

Thanks to John for this insightful comment... "A great cliche about the housing market (and the stock market, too): Most people get in too late, and they get out too late. The second mistake has already been made by most. Don't let the first happen, too." John also suggests that "Trying to call a housing market bottom is folly." With that in mind, let's entertain ourselves by making wild guesses about December sales figures. :) November's market report will give you a context for your guess. There were only 40 residential sales in Harrisonburg and Rockingham County last month. How many will we see in December? 30? 50? 75? The closest guess will receive a small, but delightful, gift certificate to Old Dominion Coffee Company in downtown Harrisonburg. Feel free to leave your guess in the comment section below, or send me an e-mail. | |

New rules limit real estate investors to four loans |

|

One of my clients forwarded me a story from the Atlanta Journal-Constitution, which discusses new Fannie Mae and Freddie Mac rules that states that Fannie and Freddie will only back up to four real estate loans by one person. This new four-loan rule apparently replaced a previous limit of 10 loans, and was is in place to keep inexperienced or start-up real estate investors from over-investing. The four-loan limit does not allow for any exceptions for income, assets or credit scores. In checking with a local lender, I was told that if a borrower has more than 4 non-owner-occupied homes and a primary residence, no one but a commercial lender can help them on their next investment purchase. So, what is the solution?? One option is to move several existing residential investment loans into a commercial "blanket loan" thus removing residential loans from their balance sheet. Commercial loans on residential properties don't count against the four loan limit if they are in an LLC. If any lenders or investors know of any other options with this new loan limit, please let me know! | |

Is Harrisonburg a safe place to live? |

|

My brother-in-law works for the Harrisonburg City Police, which makes me feel safe, but let's check another source.... Sperling's Best Places ranks cities and towns on factors such as cost of living, schools, crime, climate, and more. In the fifth annual report, Harrisonburg ranks #8 for small towns (less than 150,000 residents)! How is this all determined? According to BestPlaces.net... "The rankings took into consideration crime statistics, extreme weather, risk of natural disasters, environmental hazards, terrorism threats, air quality, life expectancy and job loss numbers in 379 U.S. municipalities." | |

Join the JMU Nation -- Wear Purple This Thursday & Friday! |

|

Home Sales History in Rockingham County Towns |

|

After yesterday's analysis of year-to-year residential sales in Harrisonburg and Rockingham County, I thought it might be interesting to compare similar sales trends in sub-markets in Rockingham County. Here's what I found . . .         | |

Breaking Economic and Real Estate News |

|

All kinds of news over the last few days related to our local real estate market and our local economy... Bridgewater annexes 45 acres for new housing development Office Depot closes 112 stores including Harrisonburg's Site on Port Republic Road approves residential to commercial rezoning Public hearing to determine outcome of age-targeted development in Elkton | |

LIFE is the trump card of our local real estate market! |

|

In talking to a client last evening, I was asked why our local real estate market isn't doing as poorly as some others in the region or across the country. Some real estate markets have seen a 30% to 40% decline in home pricing, and we haven't seen that here. After talking for a few minutes about the strength of our local economy, I was then asked whether people are even buying homes right now in the midst of such turbulent economic times in our country. They are, although it is at a slower pace, and we began to contemplate why that might be. My conclusion is that LIFE is the trump card --- it explains why even amidst troubling economic times in our nation, people are buying houses in the Shenandoah Valley. Here are some of the reasons why....

| |

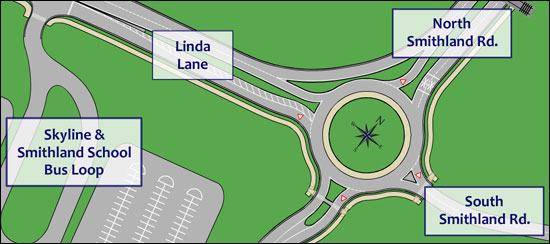

Have you driven on Harrisonburg's roundabout? If not, you might want to practice online first! |

|

My son played in the City's Shenandoah Valley United soccer program this fall, so we had plenty of opportunities to go use Harrisonburg's first roundabout -- if you haven't checked it out in person, you should --- it is a wonderful experience! But perhaps you'd like to practice online first? Driving on the roundabout is actually a bit addicting --- sometimes my son and I drove around it multiple times --- just for the thrill of it! | |

The big picture - year to year real estate sales trends |

|

Each month I conduct a thorough analysis of home sales, but most of my analysis takes a look at a monthly snapshot. Thus, at the request of one of my blog readers, I have compiled the monthly data to show a bit more clearly how the Harrisonburg and Rockingham County market has changed from year to year over the past six years.  Bear in mind that all of these charts show 2008 data through December 9, 2008 --- so there will still be a more sales before the 2008 data set is closed out. We have seen decreases from 2005 through 2008 --- who wants to guess, will 2009 be an increase over 2008, or will we have to wait for 2010 for an increase?  Single family home sales, as we might have imagined, follow a similar trend line to the first graph that showed all residential sales.  One peculiarity seen here is that there was a sharp increase between 2004 and 2005 in the number of townhouse sales. I suppose 2005 was the year of the townhouse! | |

Advice to sellers in a buyers market |

|

As I mentioned yesterday, when interviewed by WHSV, there is still somewhat of a stalemate of buyers and sellers. Some sellers are holding their prices a little higher than perhaps they should be priced, and some buyers are not wanting to try to negotiate.So, you have that gap that likely could be bridged, but it just isn't happening. I tried to encourage buyers to make that first move yesterday, and in the past I've pointed out that sellers can make offers, but here are a few perspectives that sellers should consider in our current market.

| |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings