Archive for February 2009

| Older Posts |

26.5-Year Mortgages for First Time Buyers |

|

First time buyers who purchase before December 1 of this year will be eligible for an $8,000 tax credit. While there are many things a first time buyer could do with that money, one idea might be to apply it directly to the principal balance of the mortgage! Assuming a $150,000 purchase price, this eliminates 3.5 years of mortgage payments off of the end of your loan! Even more exciting --- those 3.5 years of mortgage payments (that you won't pay) would have cost you a total of $33,000. There are many exciting aspects of this $8,000 tax credit to first-time buyers --- if you have any questions about it, feel free to call me (540-578-0102) or e-mail me (scott@cbfunkhouser.com). This illustration assumes a $150,000 purchase price, with 97% financing at 5.25%. Contact a qualified lender for more details! | |

The Most Popular Neighborhoods in Harrisonburg |

|

| |

The Importance of Knowing Thy Area of Expertise |

|

My main area of real estate expertise is in Harrisonburg and Rockingham County. I spend a lot of time assisting buyers and sellers in Harrisonburg and Rockingham County, and I also spend significant time analyzing the real estate market in these areas. Thus, I am very comfortable representing buyers and sellers in these areas. However, once I start venturing outside of Rockingham County, I know significantly less about market conditions, neighborhoods, available properties, etc. For that reason, if you are looking to buy or sell real estate in Augusta County, Page County, Shenandoah County, etc., etc., I will be helping to connect you to another Realtor in my company. Here's an example of the value of working with a Realtor in their area of expertise.... About a year and a half ago, my client bought a townhouse for approximately $135,000 that should have been priced around $165,000 or $170,000. The owner of the townhouse no longer lived in the area, so they didn't understand market conditions. Furthermore, the agent representing them was also located out of the area (a few counties north, if I recall correctly). Thus, the pricing was significantly off-base ($30K+ too low) --- AND the agent didn't have the property listed in our local MLS (thus, local Realtors didn't know about it). As a result, my clients were able to get a fantastic deal on the townhouse. Two funny points...

| |

Possibly the best real estate deals in Harrisonburg? |

|

Here's a reminder of the very cool "Search by Square Foot" function on my web site in the Power Search area. You can quickly find the houses that offer the most house for the dollar by inserting search criteria in the "Price / SF" field. Here, for example, are the eight single family homes in the City of Harrisonburg with asking prices that equate to $90 per square foot or less. These are quite possibly some of the best deals available in Harrisonburg right now.

| |

Urban Exchange construction update |

|

Construction is flying along at Urban Exchange (196 condos for sale and for lease in downtown Harrisonburg). Here are a few updates on the progress:

| |

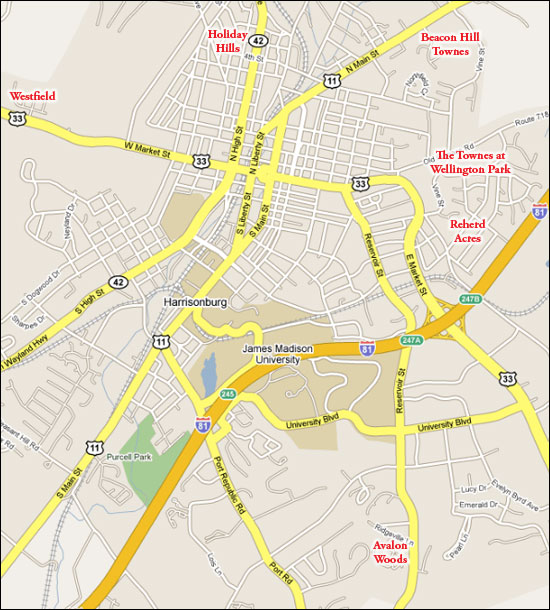

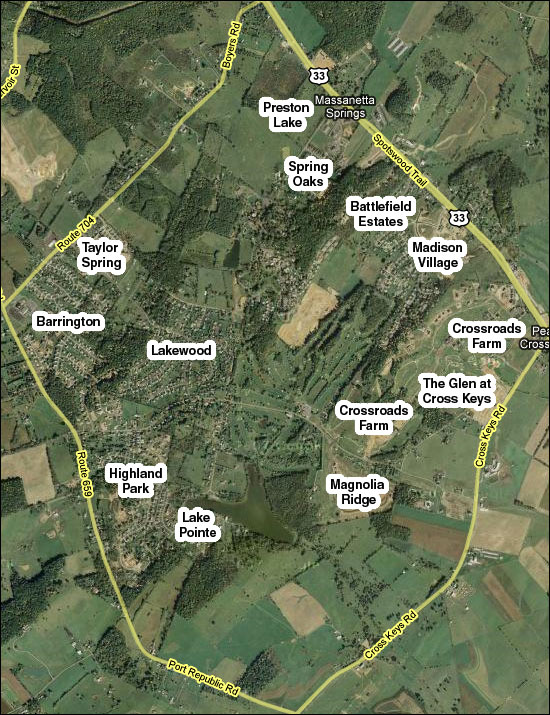

New developments in Harrisonburg, Rockingham County |

|

A gentleman from New Jersey stopped by our office today asking about the area, and trying to get a sense of where the main growth areas of the city and county are located. I explained to him, as I have explained to many people lately, that most of the growth in the County is focused just south and east of Harrisonburg in an area bound by Route 33, Port Republic Road, Boyers Road and Cross Keys Road. It's a diamond shape area (seen above), and within that are you will find many of the subdivisions that have been developed over the last 10-15 years. Click on any subdivision in the map above to jump to active listings in that neighborhood. | |

Determining an offering price in today's market |

|

In making an offer to purchase a home, there are many small and large decisions to make (closing date, home inspection, closing cost credit, etc) --- but the decision that often has a 30-year impact is the offering price. A few short years ago (2003/2004), most buyers were offering at or very close to the asking price, as homes were "flying off the shelf" they were selling so fast. These days you'll typically have a bit more time to consider your offering price, which should include thoughts and discussions about... 1. Recent Sales Perhaps the most important of all factors, at what price have comparable homes recently sold? You likely won't want to pay too much more that the price for which other buyers have recently paid for similar properties. This is often much easier thought than analyzed, as there are many homes where it is difficult to find directly comparable home sales. 2. Competing Properties For Sale It is also important to reflect on the price you would pay if you bought an alternative house that is also for sale and that is reasonably similar to the house you are actually considering purchasing. If an owner is asking $250K for their home, even if other homes have recently sold around $250K, it would be important to know if three other comparable homes are currently for sale for $205K. 3. Seller's Acquisition Cost This information is not always available, and is not always pertinent, but it can guide conversations about an offering price. If two owners are both trying to sell their homes for $250K, and one bought their home for $150K and the other bought their home for $220K, the price you might offer on one house would be quite different than the second. Again, this is not always pertinent, as most owners won't want to sell their home at a price that they perceive to be under market value just because they can based on what they paid for it originally. 4. Length of Time on the Market Again, this won't always make an impact on the price that you will have to pay to purchase a particular home, but the owner of a home on the market for a week would see an offer of 85% of the asking price very differently than the owner of a home that has been on the market for two years. 5. Your Finances Perhaps the most important factor, you must make an offer at a price that is comfortable for you when it comes to the associated monthly housing costs. Sometimes this means making an offer which you suspect will not be accepted, but some financial/budgetary rationale must be inserted into the conversation at this point. There are many other ways to look at the asking price as you determine the offering price --- and indeed, each home sale scenario is different, so beyond this quick guide, determining the offering price warrants an in depth conversation. | |

Why are fewer homes selling in Harrisonburg? |

|

As referenced in yesterday's "My hope for the 2009 local housing market" post, the quantity of home sales has fallen 44% over the past 4 years (between 2005 and 2008). At the same time, values haven't significantly fallen, and thus I tried to answer the question of why we haven't seen a big shift in home values. But one question remains --- why have we seen such a larger decline in the number of home sales!? Here are my thoughts, though I welcome your insights as well...

| |

My hope for the 2009 local housing market |

|

I am thankful that we have not seen much of a shift in home values in Harrisonburg and Rockingham County! However, the extremely slow rate of market activity that we are currently experiencing makes it very difficult for a homeowner to sell their home, and thus I hope that we will soon see market activity pick up in this area. Of note, we have seen a steady decline in overall residential sales for each of the past four years (shown above), with a 44% overall decline between 2005 and 2008. The graph and chart represent all residential sales recorded in our local MLS in Harrisonburg and Rockingham County. Each year the number of home sales has slipped further and further down, with 2008 finishing out with only 931 home sales. Thus, my hope for 2009 is that we can at least keep pace with 2008 --- with 931 home sales. I'm not hoping for a miraculous turnaround with 1,200 sales --- I'd just like to see market activity stop sliding downhill. How are we doing with this goal so far, you might ask? So far this year there have been 57 residential sales. Last year by this time, there had been 72 residential sales. We still have some catching up to do to hit the 931 mark by the end of the year, but it is indeed still early in the year --- and the stimulus package was signed into law less than 24 hours ago! | |

What is sustaining home values in our local market? |

|

Over the past few weeks I have examined shifts in home values from several perspectives:

Why!???? This is the question that many people are asking --- why aren't we seeing a downward shift in values in this area? Over coffee today, I was presented with one hypothesis (thanks Ian!) for why this may be occuring. Ian's conjecture --- we're not seeing a big shift in values because there aren't too many people in our area that absolutely MUST sell, and thus they aren't making huge price drops in order to sell. I can go along with this theory. In talking to homeowners with their homes on the market, it seems that while there are many sellers who definitely, positively want to sell, the sooner the better, there aren't a very large number who are absolutely desperate and willing to take desperate measures in order to sell. What are your thoughts? Anyone want to refute or defend this theory? | |

Meet the Developers and Architect of Urban Exchange |

|

As the development of Urban Exchange progresses, I will be continuing to post interviews on the Urban Exchange web site to provide you with a glimpse into the excitement taking place in Downtown Harrisonburg. To start off, take a few minutes to learn more about Urban Exchange via interviews with Barry Kelley (developer), Andrew Forward (developer) and Philippe Jentsch (architect). | |

A quickening pace in the local real estate market? |

|

Our company runs over 60 web sites with real estate listings --- the company site, and a web site for each agent. Over the past year there have been hundreds of thousands of property views on this set of web sites --- with each property view being a web user clicking to view the details of a given property. The graph above shows a trendline for the number of properties viewed during each of the past 12 months on all of these web sites combined. The trendline is likely not too surprising, as we see a tremendous amount of activity in March/April/May, gearing up for summer purchases, and we see a rather significant drop through the remainder of the year (August-December). January, however, showed a sharp incline --- which leads me to question --- is this simply a seasonal trend coming around again, or will we see a significantly stronger real estate market this spring? | |

An $8,000 opportunity for first time home buyers! |

|

Just a few hours ago, the long-awaited (by some) stimulus package made its way through Congress, and it will likely be signed by President Obama by the end of the weekend. The stimulus plan affects many areas of our economy, as described in this AP press release, but one section in particular should stand out for first time home buyers. Potential first time home buyers will now have an $8,000 reason to buy a house in the next nine months! Here are a few of the fine details of this new (soon-to-be-finalized) legislation:

| |

Fannie Mae empowers real estate investors! |

|

Fannie Mae's current policies don't allow an investor to finance any more than four properties backed by Fannie Mae. Thus, if you own the home you live in, you could only purchase three additional properties as an investment. This has directly affected several of my clients who have had to stand on the sidelines, or seek a commercial loan as they considered recent investment purchases. THE GOOD NEWS --- effective March 1, 2009, an investor will now be able to finance up to 10 properties through Fannie Mae! Fannie Mae does, however, put some rather significant limitations on this new policy. This summary is my interpretation of the new policy, but I encourage you to talk to read the policy yourself as well:

Thanks to Jeremy Hart, a fantastic Realtor in Blacksburg, VA for bringing this to my attention! | |

How will Urban Exchange impact Harrisonburg? |

|

Listen in as Barry Kelley, one of the developers of Urban Exchange, talks about the impact that Urban Exchange will have on Harrisonburg. | |

The Great Dis-connect: Days on Market |

|

In 2006, 1438 residential properties sold in Harrisonburg and Rockingham County, with an average of 138 "days on market". In 2007, it was 1248 properties with an average of 171 "days on market". In 2008, it was 936 properties with an average of 167 "days on market". There are currently 808 residential properties on the market with an average of 206 "days on market". Many people find it hard to believe that the average days on market decreased (ever so slightly) between 2007 and 2008. This is especially true when they talk to their friends and neighbors who are trying to sell their homes (with an average of 206 days on market). A few remarkable points:

| |

What are the chances that I will sell your home? |

|

What are the chances that your Realtor (a.k.a. "listing agent") will also represent the buyer of your home? Or, put another way, what are the chances that the agent you hire to sell your home will be the one who actually sells it (represents the buyer)? In 2008, there was a 1 in 4 chance that your listing agent would be the one to sell your home. Of the 1,371 residential properties that sold in Harrisonburg and Rockingham County in 2008, there were 342 transactions (25%) where the seller was represented by the same agent as the buyer. Statistics aside, however, this brings up the controversial issue of "dual agency" -- a practice in which the same agent represents both the buyer and seller. Dual agency is commonly practiced (as we saw above, in 1 out of 4 transactions), but it is something that I typically try to avoid. (Less than 5% of my transactions involve dual agency.) A dual agent is significantly limited in how they can represent the buyer and seller in a transaction because they are representing both parties. It would be akin, in some ways, to one attorney representing both the plaintiff and the defendant. There are plenty of times when this works out just fine, and an agent is able to fairly represent both the buyer and seller in a transaction, but there are plenty of opportunities for problems as well. Generally, the only exception that I make for practicing dual agency is when I have a pre-existing buyer client who decides they want to purchase a property where I am already representing the seller. (I'm in the midst of one of these transactions now.) Any thoughts here? Is the 25% stat (of properties being sold by the listing agent) surprising high or surprisingly low? Does dual agency seem perfectly acceptable, or remarkably absurd? | |

How to making an existing home GREEN |

|

Over the past few months I have been educating myself about green building techniques (for example: What Is An Earthcraft House?), but I have also been picking up some tips on what existing homeowners can do to make their homes more green, and energy efficient. Here are some low-cost ways to live green around your home:

I'll be posting even more information that I have learned from these Green Building courses over the next few weeks, but if you have specific questions before then, feel free to call (540-578-0102) or e-mail (scott@cbfunkhouser.com) me. | |

New Urban Exchange Photos, Office Hours |

|

Click on the photo above to view updated Urban Exchange construction photos, showing the dramatic progress that is taking place just one block from Court Square. Also, if you'd like to take a tour of Urban Exchange, please either stop by during our office hours, or also feel free to call or e-mail to make an appointment to meet on site: Condo Sales Scott Rogers 540-578-0102 scott@LiveUE.com Apartment Leasing 540-421-9341 info@LiveUE.com Are you interested in living in downtown Harrisonburg? To view the prices/rates while exploring the floor plans, click here.

| |

Rent vs Own in Harrisonburg |

|

A common question I am asked is how costs compare in buying versus renting a "starter townhouse" in Harrisonburg. This changes over time, but here's how the costs compare now, assuming that you stay in the property for three years.... Buying a townhome at $156K (example) With a 3% down payment, you'll be financing $151,320, and at current interest rates (5.00%), this will equate to a $922 monthly mortgage payment. This $922 will include the principal, interest, taxes and insurance. You will likely pay $4,000 of closing costs to buy the townhome. During your three years of ownership you will have saved approximately $5,000 on your taxes because of the mortgage interest you have paid. After three years you will have paid off approximately $7,000 of principal on your mortgage. Thus, you have a net (unrealized) gain of $8,000 ($5k tax savings + $7k principal reduction - $4k closing costs). Renting a comparable townhome To rent a comparable townhome, you will likely be paying $900 per month. You will have no up front costs, no tax savings during your time of ownership, and no financial return at the end of the three year time frame. Three Year Conclusion If you are only going to live in your townhome for three years, you will still need to carefully consider whether you should buy vs rent. Even though you will have $8,000 of savings, you will burn through much of that in the transaction cost of selling your townhome. Five Year Conclusion If you're in the townhome for five years, it becomes a much better opportunity to have purchased. In the five year analysis, you will have a net (unrealized) gain of $17,000 ($9k tax savings + $12k principal reduction - $4k closing costs). Deciding whether to buy or rent is a big decision, but it can be made wisely with some basic financial analysis. Feel free to call (540-578-0102) or e-mail me (scott@cbfunkhouser.com) if you'd like some guidance for your personal situation. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings