Archive for July 2009

Virginia 2nd Quarter Market Report Shows That Yet Again, All Real Estate Is Local |

|

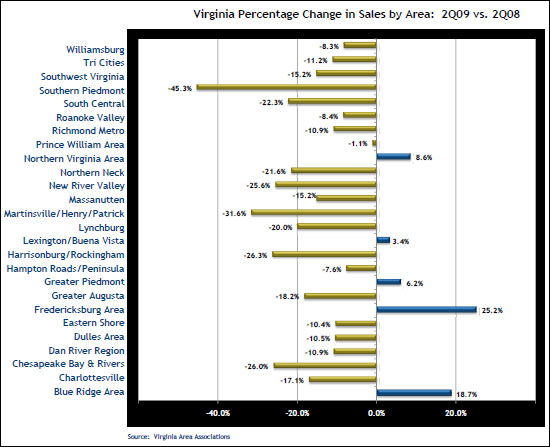

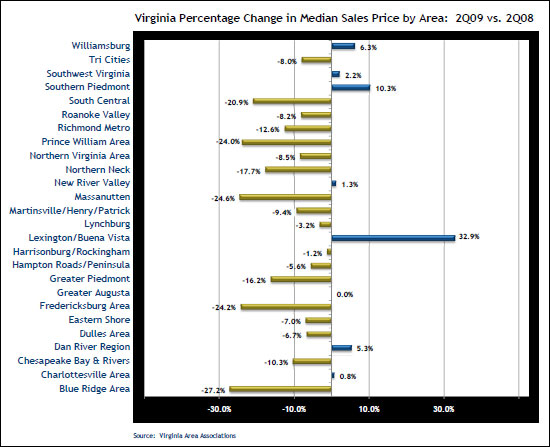

The Virginia Association of Realtors released their 2nd Quarter Home Sales Report last week, which clearly demonstrates that all real estate is local -- that is to say that all local markets perform quite differently! The graph below shows the change in number of home sales in each local market in Virginia when comparing 2nd Quarter 2008 to 2nd Quarter 2009.  Harrisonburg/Rockingham is actually one of the slowest markets in thestate, when compared to last year, with a 26.3% decline in the numberof home sales. Interestingly, there are several parts of the statewhere home sales are picking up speed again: Northern Virginia,Lexington / Buena Vista, Greater Piedmont and Fredericksburg. (clickon the graph above for a clearer, printable version) Next, below, we see that there is also a great deal of variation in median sales prices across Virginia.  Harrisonburg is in the middle of the pack as far as changes in median sales price, with a -1.2% change in the last year (2nd quarter vs. 2nd quarter). As you can see, some areas of the state have seen a 25% (or more) decline in median sales prices, and some areas have started to see median sales prices increase again. In addition to the stats, you can also review the full (16 page) home sales report, or listen to the media conference call summarizing the report (listen carefully, and you might hear my commentary on the Harrisonburg / Rockingham market). | |

History Repeats Itself: The Cyclical Nature of Student Housing in Harrisonburg |

|

Harrisonburg has a tremendous over-supply of student housing, but it's not the first time! I've been engaged in some fascinating reading (thanks JGFitzgerald!) over the past day or so --- a Citywide Housing Analysis for Harrisonburg, Virginia compiled by S. Patz & Associates, Inc in 2005. Yes, it's becoming dated, but it provides some valuable insights into the history of our local real estate market. Here are a few statements that are quite interesting within the current JMU enrollment and student housing context: "Official JMU projections of 112 additional enrollments per year by 2008 suggest a need for no more than 200 new student apartments by 2010." Wow --- and to think that in the past two years, new student housing units have been built to accommodate an additional 3,292 students!?! "In the early-2000's there was a large oversupply of apartments catering to students. Development of condominium units for students aggravated the market for rental student units. Both markets are largely distinct, and only a few of the apartment complexes that attract students also attract young professionals and/or families. Since the early-2000's, apartments catering to students have also turned to other markets, such as the emergent immigrant population who can utilize the large numbers of bedrooms in student apartments, and the oversupply of student apartments has been reduced." This is interesting --- in the early 2000's there was an oversupply, then things were back to being balanced by 2005 (date of report), and we again have a significant oversupply in 2009. This report identifies immigrants as a population that filled the vacant student housing in the early 2000's. Will we see that again? And if not, who will fill the vacancies? "In the 2000/01 school year, 1,700± beds (or 450 to 550 apartment units) for JMU students were reported by S. Patz & Assoc. to be vacant and available. This total had been reduced to 1,000± beds in 2001/02, as student enrollments increased, and as a number of mature former student apartment units were taken off the market and made available for very moderate-income poultry and construction workers who previously occupied less attractive or more crowded housing." Again --- this begs the question of who will fill the anticipated 2,470 empty "beds" this coming fall that are/were intended for college students. If you're interested, there is a lot more very interesting data in this 129-page Citywide Housing Analysis report published in 2005. I'll be taking a look at some additional sections in the days to come. | |

Is Harrisonburg Insulated From National Economic Conditions? |

|

Yes and no. I am participating in an economic survey group striving to create a true picture of the impact of the national economy on our region. In our first meeting yesterday, we discussed our local economy as it pertains to retail sales, manufacturing, farming, construction, and many other sectors. The participants included chambers of commerce, representatives from employment commissions up and down the valley, and many other perspectives on our Valley economy. After hearing some not-so-great news followed by some so-so news, followed by some plain-old-depressing news, one participant commented that it sounded like our local economy wasn't really as sheltered as some consider it to be. I quickly jumped in to clarify that (as it pertains to real estate) we are definitely affected by the national economy, but also significantly insulated from the effects that it has had in other areas. Take these two facts, for example:

| |

Is the Massanutten Home Sales Market Over or Under Performing the Harrisonburg Market? |

|

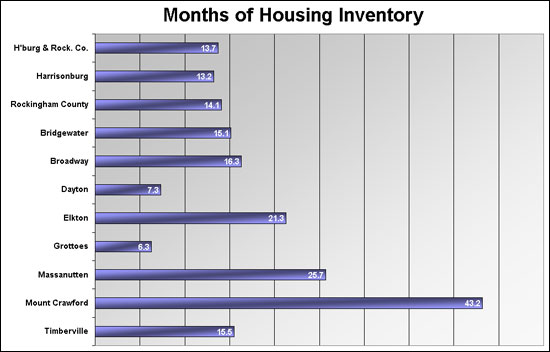

In response to my monthly home sales report, Keston asked... I'm guessing that even within Rockingham County that market conditions vary by locale. I was wondering if you have the ability to calculate the months of housing supply for Area 1 (Harrisonburg City) and Area 12 (Massanutten Resort). My hunch is Harrisonburg City is faring better than Massanutten. Let's take a look....at Massanutten, as well as other towns in Rockingham County...  Right off the bat, we see that Keston is correct. It would take 13.7 months to sell the housing inventory in Harrisonburg & Rockingham County -- but when examining Massanutten alone, it would take 25.7 months -- nearly twice as long. The other outliers are Dayton and Grottoes which are performing much better than the market as a whole, and Timberville which is performing very poorly (perhaps because of the small sample size). Click on the graph above or on the data chart below for a printable PDF of the data.  | |

VHDA DELIVERS... How to use the $8,000 home buyer tax credit for your down payment and closing costs. |

|

There has been talk for some time about using the $8,000 home buyer tax credit as a down payment or for closing costs, but the details have been few and far between. How, however, VHDA has created a specific program for this purpose, which makes it quite a bit easier... Instead of waiting until you file your taxes next year, you can receive the $8,000 tax credit at closing if you are obtaining your mortgage through the VHDA program. The $8,000 becomes a second mortgage with no interest and no payments for 12 months. Thus, the $8,000 loan costs you nothing, and stretches the loan of the money through the time when you'll get the tax credit. Providing even more flexibility, when you do get your $8,000 tax credit, you can either:

Click here for the full program flyer. | |

Buying Land in Rockingham County |

|

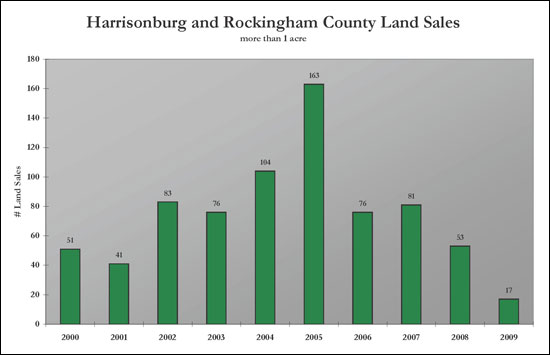

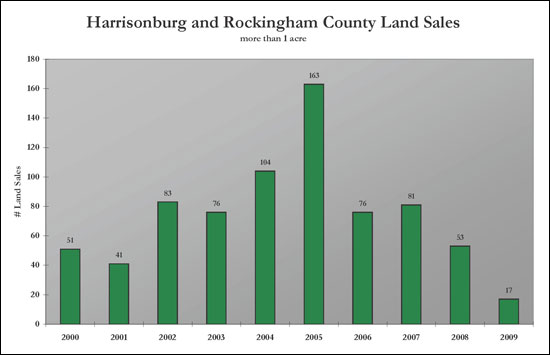

One of my readers asked an excellent question after reading my latest real estate market report: A colleague is looking for an acreage tract for a new home but is frustrated because there "isn't much listed for sale" they say. For the 2009 comparison to be more meaningful, it seems that the number of closings should be correlated to the number of listed parcels. Otherwise, one could conclude that there is either a lot of land for sale and closings are slow or one could conclude that there is not much for sale and closings are actually significant in relation to available land. Can you produce a report for your MLS system for listed parcels above one acre in size? Further can you look at that for the average number of months that parcels are on the market? As you can see in this graph below, there have indeed been very few land sales (greater than 1 acre) this year --- in fact, 17 such transactions.  So, how many such properties are even for sale these days? There are 194 properties in Rockingham County on the market for sale that are one acre or more. Of note, that is a 5.7 year supply of properties, to the extent that 17 sold in the first six months of 2009. Of those properties:

| |

Slower Home Sales, Stable Home Values per the June 2009 Harrisonburg & Rockingham County Real Estate Market Report |

|

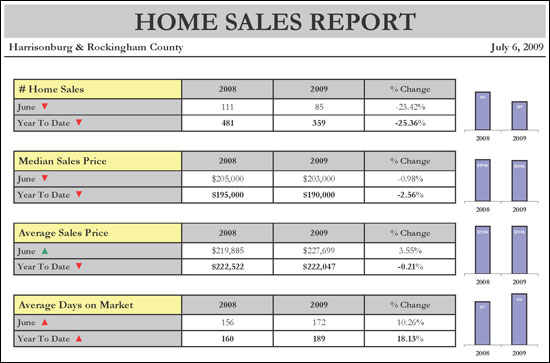

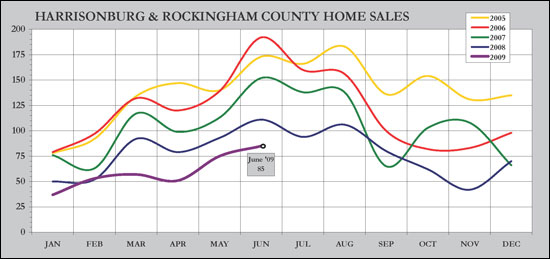

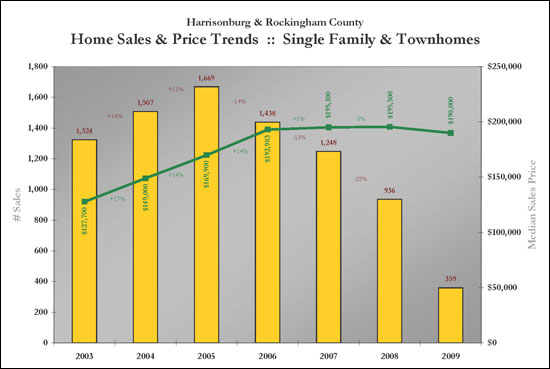

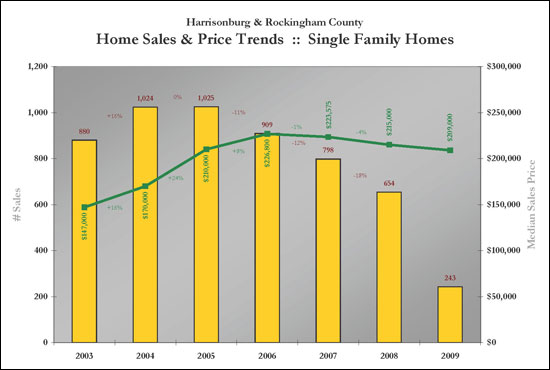

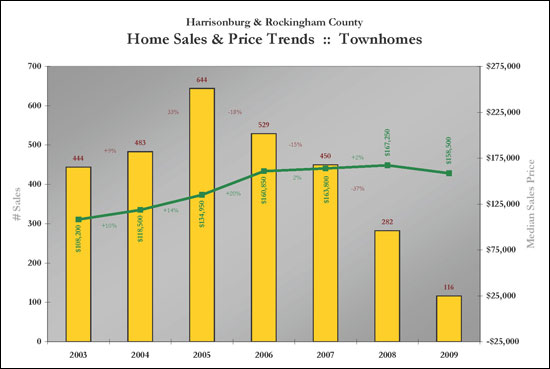

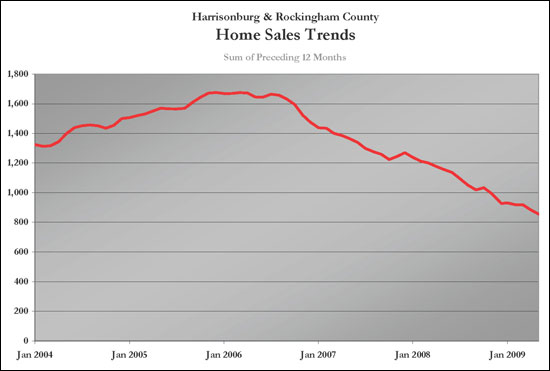

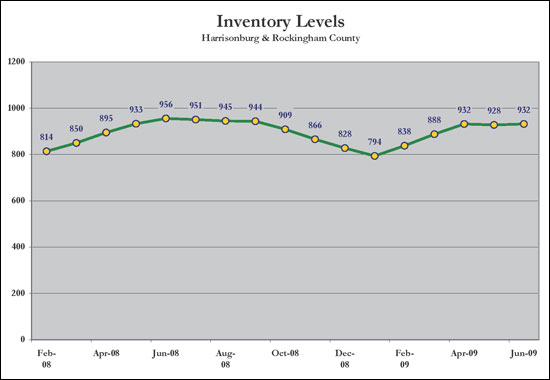

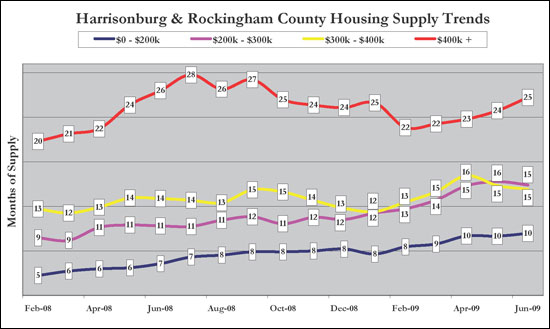

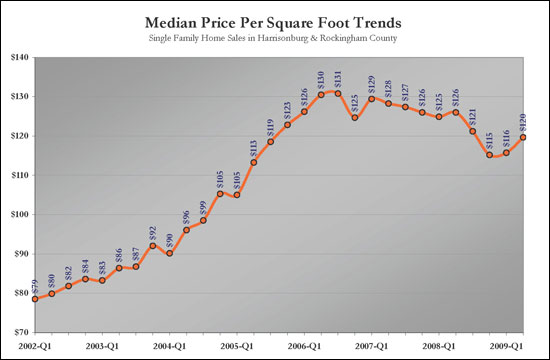

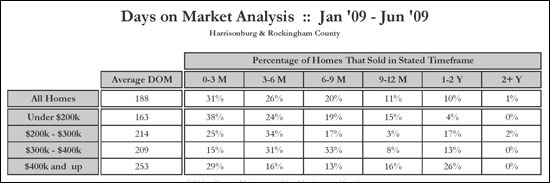

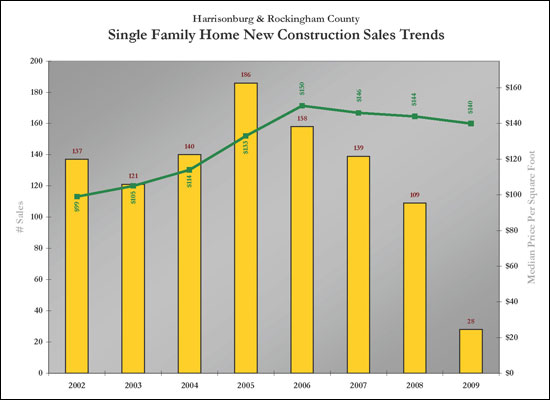

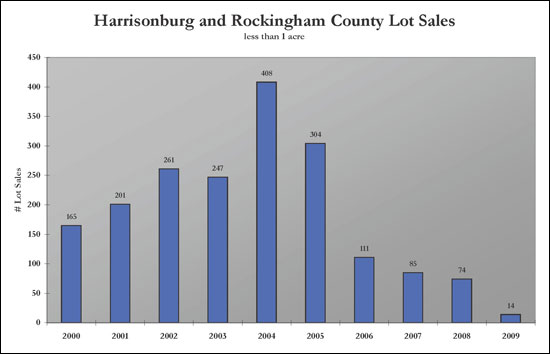

I hope you enjoy this brief overview of the June 2009 market report... Read on for a full review of the state of the Harrisonburg and Rockingham County residential real estate market. Or....download the full report: June 2009 Harrisonburg & Rockingham County Real Estate Market Report  While the pace of home sales continues to decline (25% lower in 2009 than in 2008), the median and average sales price continue to stay relatively steady in our local real estate market --- showing a 2.5% decline (median) and 0.2% decline (average) when comparing the first six months of 2008 to the first six months of 2009. Our market continues to out-perform most other markets in Virginia, evading the 20% - 40% loss in home values seen in many areas.  In this graph, we see that 2009 sales volume (purple line) is still hovering well below 2008 sales volume (blue line) --- but we are seeing the predictable seasonal increase in home sales during the summer months. The remainder of 2009 will be interesting to observe, as many first time buyers close on properties prior to December 1st to obtain the $8,000 tax credit. July always takes a slight dip, so we'll see if that holds true for 2009.  This graph captures all residential real estate activity as reflected in the Harrisonburg/Rockingham MLS. The 2009 year-to-date sales figures now include six months of sales data, and show only a slight decline in median sales prices ($195,500 to $190,000). They sales volume (yellow bars), however, continue to decline.  When examining only single family home sales in Harrisonburg and Rockingham County we see that the median sales price continues to decline at a relatively slow rate (1%, 4%, 3%) when comparing 2009 to 2008 -- the good news is that single family homes (as a whole) aren't losing value as they are in many other markets.  When examining only townhome sales in Harrisonburg and Rockingham County we note that while the sales volume has dropped dramatically since 2005 (-18%, -15%, -37%), the median sales price has gained during that time period (2005 vs. 2009) and has stayed relatively steady between 2006 and 2009.  This graph shows a normalized trend of home sales by charting the ongoing sum of the preceding 12 months' sales. We continue to see a decline in this metric, and likely will until the pace of sales stops its decline.  Inventory levels have stayed relatively level over the past three months, and have declined as compared to a year ago (932 vs. 956). Lower inventory levels will (slowly) lead to a healthier local real estate market, as a balance between buyers and sellers returns.  With inventory levels holding steady, the number of months of supply of homes in the three lower price ranges noted above has stayed relatively steady. We continue to see an increase in supply of $400k+ homes as compared to the sale pace of these homes.  After a relatively sharp decline in median price per square foot between 2008-Q2 and 2008-Q4, we have now seen an increase over the past two quarters in this metric. This may be any early indicator of the stabilization of our local market, as the price that buyers are willing to pay per livable space stabilizes.  The chart above examines time on market for homes sold in Harrisonburg and Rockingham County during the past six months. Homes with the lowest price points are selling the quickest, and homes in the upper price ranges are taking the longest time to sell. For example, overall only 11% of homes took longer than 1 year to sell, but 26% of homes selling over $400,000 took longer than a year to sell. Of note, the average days-on-market has actually declined since last month's market report. Last month's report showed an average of 193 days, compared to the new overall average of 188 days.  When examining new single family homes in our local market, we see a steady decline since 2005 in the number of homes that are selling (yellow bars) accompanied by a slow decrease in the median price per square foot since 2006 (green line). Of note, the current median price/sf is still well above the 2005 level.  The graph above depicts the number of lots (less than 1 acre) selling in Harrisonburg and Rockingham County since 2000. We continue to see only a small number of buyers in the market for building lots, with only 14 such closings having occurred during the first six months of this year.  Land sales (tracts larger than 1 acre) have also markedly decreased since 2005, but aside from the spike of activity in 2005, the pace of these land sales remained relatively constant between 2002 and 2007. Last year, and the projected figures for this year show that there are very few buyers in the market for land at this time. Download the full report here: June 2009 Harrisonburg & Rockingham County Real Estate Market Report | |

Harrisonburg Has A Tremendous Over-Supply of Student Housing for JMU Students |

|

Two years ago there was a relatively even balance between students and housing. Now, as we approach Fall 2009, there will be 822 additional students, and 3,292 additional bedrooms for students. Woah --- did you catch that? An extra 2,470 bedrooms!?! I've written about it before....

The Students Enrollment Projections Data Source: http://www.jmu.edu/instresrch/project.shtml

The following new housing projects (with the corresponding number of "beds") all make up the 3,292 new "beds" that will exist as of August 2009.

Only time will tell what the impact will be of this over supply of student housing. So far, it has translated into many lease incentives for students, and higher than expected vacancy rates for many apartment complexes. Many student housing developers say that the newest complexes in the closest proximity to a college campus will be the most successful -- so far this seems to be playing itself out here in Harrisonburg, as many new complexes are doing quite well, and some older complexes are having difficulties leasing. | |

Everything You Need To Know About Buying An Investment Property in Harrisonburg, Virginia |

|

This won't actually cover absolutely everything you need to know, but I believe it will give you a good overview. These questions were posed by a reporter from the Shenandoah Valley Business Journal, and my responses (below) were in print a month or so ago. If you missed the newsprint version, keep reading... 1. Is real estate still a good investment? What should investors know about this market? Real estate is still a good investment over the mid to long term time horizon. The days, however, of buying an investment property and selling it for a profit one year later are likely gone for good. Our local market experienced record price increases between 2003 and 2006 --- which brought a lot of new investors into our market. The perfect storm included a combination of low prices as compared to rental rates, low interest rates on investment loans, and lenders willing to finance 95% - 100% of an investment loan. In 2003 a brand new two story townhouse would sell for $100k and rent for $750/month. Three years later, in 2006, the same townhouse would sell for $160k and rent for $900/month. The 60% increase in value was accompanied by just a 29% increase in rental income. As becomes evident, the investment opportunities are not as exciting now as they were in 2003. 2. What's the difference between residential and commercial investing? Is one better than the other? A "residential investment property" is typically a single family home, townhouse or condo that will be rented to a tenant with the rental income being used to pay the monthly mortgage payment. A loan on a residential investment property will often be amortized and paid off over 30 years, similar to loan on a home being purchased as a residence. A "commercial investment property" might be a duplex building, a small or large apartment building or complex an office space, a shopping center, a farm, undeveloped land, or factory space. A loan on a commercial investment property may be amortized over 20 (or possibly 30) years, but it often will have a balloon payment after 3, 5 or 7 years --- requiring the borrower to pay off the loan or refinance it. Commercial investing is much more complex, with many factors to analyze to understand the value of any given investment opportunity. Residential investing is a much more straight forward analysis with fewer variables. Given this basic difference, those considering investing in real estate for the first time should like start with residential investing to familiarize themselves with the concept before considering the purchase of a commercial property. 3. What should potential investors look for in an investment property? Most investors start by examining cash flow --- how much cash the property will generate each month compared to the expenses that must be paid. The expenses may include: a loan payment, taxes, insurance, repairs, association dues, management expenses, utilities, advertising and supplies. Just a few years ago, positive cash flow (more income than expenses) could be achieved with 80% of even 90% financing. Today, there are many available investment properties that barely (if at all) provide positive cash flow when financed at 80%. This change is a result of property values increasing more rapidly than rental rates. After understanding the cash flow of a property, an investor should also analyze their potential one-time maintenance costs upon purchasing, or within the first few years. If a property has wonderful cash flow, but needs new flooring, paint, appliances, windows and a roof, then it is not as exciting of an opportunity as it may have first appeared. Additionally, an investor should examine other investment properties in the same neighborhood or area to evaluate whether property values and rental rates are stable, increasing, or decreasing. There are a variety of other aspects of an investment property that should be evaluated as well, including the tax consequences of buying and the potential benefit from principal reduction, tax savings and appreciation. 4. How long should investors plan to commit to their property? There are a limited number of opportunities for flipping a property in our current market. There are still, occasionally, properties that can be purchased, fixed up, and re-sold for a profit. Most investment properties, however, will need to be held/owned by the investor for at least 4 to 5 years. Residential properties in Harrisonburg and Rockingham County increased in value by an average of 15% per year between 2003 and 2006. In contrast, they decreased in value by an average of 0.67% per year between 2006 and 2009. An investor could have bought and sold in a 1 year time horizon in 2003, 2004 or 2005, but since then the time horizon would need to be much longer. While an investor won't necessarily see quick gains in appreciation if they buy an investment property now, they will have the potential for lots of negotiating room on price depending on the property being considered. That opportunity to buy below the value of other comparable properties, combined with record low interest rates, makes it a valid time for an investor to consider a purchase. 5. What tax and legal issues should investors consider before making their purchase? Consult a tax accountant and an attorney! Some of the issues that deserve consideration include: increased tax liability based on investment property income, the short and long term impact of reported property depreciation, methods for limiting legal liability, the best type of ownership structure for investment properties (personally owned, LLC, corporation, etc) 6. How does the Valley compare to the rest of the state/country in terms of investment potential? The Shenandoah Valley has not seen dramatic drops in property values that have occurred in other parts of the state and country. As a result, we may not have as many great investment opportunities in the short term, but the investor is also likely more protected from value drops in the long term. Our real estate market, and local economy have proven to be much more stable than other economies, which provides value to the investor because of a lower likelihood of losing tenants, or having difficulty leasing a property. 7. There are lots of programs designed to help first-time home buyers enter the market. Are there any incentives for investors? The government has created many incentives for first-time buyers, but there are very few incentives for investors. Investors, in fact, were a large part of the turmoil seen in real estate markets across the country. In many larger markets, investors were speculating on new construction --- signing contracts to buy 10 or more condos or other residential properties, and then selling them by the time the construction was complete to the eventual end user for 20% (plus) more than their contract price. Large scale investor speculation on new construction led to higher prices than would have been experienced otherwise, as well as a false sense of demand that led to some of the overbuilding in those markets 8. What are the best resources for potential investors? There are many concepts, calculations, measures and benefits that an investor must understand as they are considering an investment property purchase. Perhaps the most important is to understand the nature of and changes in the local real estate market -- for this, I recommend that investors review the market reports on HarrisonburgHousingToday.com. Investors interested in foreclosures can either review the printed "Trustee Sale" notices in the Daily News Record, or browse recent foreclosure notices on HarrisonburgForeclosures.com. Perhaps the most important is finding a Realtor who can assist you in evaluating individual investment properties, and comparing several investment opportunities side by side. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings