Archive for November 2009

How Much Undeveloped Land Is Left In Harrisonburg? |

|

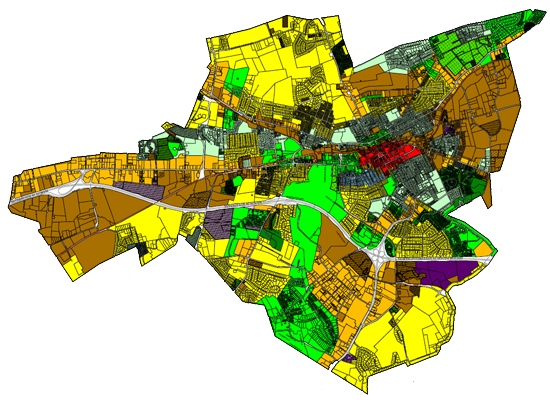

Using data provided by the City of Harrisonburg, the information below is what I am finding on vacant land in the City of Harrisonburg. Bear in mind that there is a bit more vacant land than referenced below, but I chose to exclude land owned by educational institutions, local government, religious organizations, state government. Vacant Land In Harrisonburg:

| |

Is it logical for a buyer to want 10% off of a "fair" asking price in today's economy? |

|

Keston recently commented here as follows: That is a conundrum. In the early and mid 2000s sellers believed they should ramp up their prices relative to recent comps (usually with a successful sale) - hence, the upward pricing pressures on housing. Now, the opposite situation is occurring; buyers believe they should get a better deal than current comps. Indeed, even if prices haven't come down much, buyers have progressively gotten better deals in the last two years (i.e., lower interest rates and first-time buyer incentives). In the near term buyers are either going to require a good deal now or wait for a better deal. Remember that housing increased over 10% a year in the boom times. It's not illogical for a buyer to want 10% off of a "fair" asking price in today's economy. I can follow Keston's logic --- if prices went up 10% per year (or more) as the housing market accelerated, why shouldn't prices go down 10% per year (or more) as the housing market decelerates?!! Here are my thoughts: First, I definitely agree with Keston that it is very logical for a buyer to want 10% off a fair asking price. Furthermore, I imagine those logical buyers are quite perplexed (and perhaps frustrated) that prices haven't fallen by 10% a year as the market has declined. The law of supply and demand definitely suggests that prices should have adjusted as demand so drastically declined over the past three years. But, given that prices haven't fallen in this area, let's examine what is likely happening as those logical buyers try to buy in our local market with the perspective that they ought to be able to negotiate 10% off an asking price.

| |

2010 City of Harrisonburg Real Estate Reassessment |

|

The City of Harrisonburg has reassessed all real property as they do each year, and it appears that there wasn't a significant (overall) shift in assessments. Of the 12,000 parcels of real estate, nearly 8,700 had a change in their assessed value, with 3,100 of the values decreasing and roughly 5,600 increasing. That is to say.....

If you don't believe your assessment is accurate, you can appeal the assessment starting the week of December 7th. Or you can express your frustration (or delight) in the comment section below. The bigger (MUCH BIGGER) news (or controversy) coming down the pike is the Rockingham County real estate reassessment coming in early 2010. These assessed values haven't adjusted in four years, so many people will likely see big increases in their tax bills despite feeling that they have seen no gain (or a loss) in value over the most recent few years. Stay tuned! | |

Don't Sell! If You Can Keep Your First Home As A Rental Property, Do It! |

|

If you own your first home now, and are looking to move up to your next home --- I urge you to carefully examine the potential benefits (and risks) of keeping your current home instead of selling it. Your first home is likely an ideal rental property, and you can see enormous returns if you are able to keep your current home as a rental property when you purchase your next home. That being said, I know that many people need to sell their current home to use the proceeds of that sale to use as a down payment for their purchase. Scenario #1 -- Sell After Five Years We'll imagine that your home was a townhouse bought five years ago for $110k, which is now worth $155k. In selling the property, you will clear about $42k after closing costs. (Assumptions: 100% financing at 7% fixed, five years of principal reduction, 6% gross closing costs) Net Gain After 5 Years Of Residency = $42,000 As you can see, this is a hefty payoff after just five years. Certainly, even if you didn't need the funds to roll into your next purchase, it would be tempting to "cash out" by selling your first home. Scenario #2 -- Sell After Ten Years (total) We'll again imagine that your home was a townhouse bought five years ago for $110k, which is now worth $155k. However, instead of selling the property, you rent it for $875/month, with a super conservative 1% per year increase in rental rate. We'll also assume that your insurance, property taxes, and property value go up 3% per year. If you keep the property for another five years after moving into your new home, and then you sell it, in addition to getting the roughly $42k out that you would have netted after five years, you'll also likely experience:

Scenario #3 -- Sell After Thirty Years (total) But what if you kept it all the way until the end of the 30 year fixed rate mortgage? Then things would be looking excellent! In addition to getting the roughly $42k out that you would have netted after five years, you'll also likely experience:

The Risks Certainly, as in any investment scenario, there are risks. Here are a few:

The Benefits I believe the benefits CAN outweigh the risks, depending on your own personal financial scenario. Instead of cashing out after 5 years for $42k, you can have tenants pay off the remainder of your mortgage, while you get to enjoy the monthly excesses as rental rates go up, and you eventually get to realize the appreciation of the property. After 30 years, you are likely to have received a net of $353k instead of just $42k. Wow! | |

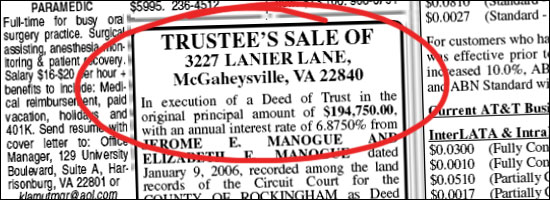

Buying A Foreclosure: Before, At, After The Trustee Sale |

|

There is often confusion about what it means to "buy a foreclosure" -- and it really all revolves around whether your potential purchase is happening before, at, or after the Trustee Sale. The Trustee Sale is the sale of the property on the courthouse steps to the highest bidder as a result of the borrower's default on their loan. BEFORE THE TRUSTEE SALE If a property is headed towards foreclosure, you may be able to buy it before it is sold on the courthouse steps. Sometimes a property headed towards foreclosure is on the market during that pre-foreclosure time period, so you could go tour the home, make an offer, and follow a traditional path towards purchasing the property. It's important to realize, however, that if a homeowner is headed towards foreclosure they are likely to be in a "short sale" scenario. A short sale is one in which the proceeds from the sale won't be sufficient to pay off the money owed against the house. If you are considering a property that would be a short sale, you may want to brush up on the typical timing of a short sale in Virginia. It's also crucial to know that there will be lots of uncertainty in trying to buy a short sale property because you'll be waiting on approval from the owner's lender, which can take weeks or months. During that time, other offers can come in, the property can be foreclosed on, etc. You'd know about these properties by reviewing notices of future Trustee Sales, or by asking your Realtor to look for properties in the MLS where a short sale is noted. AT THE TRUSTEE SALE This is where all the action is --- or not! Most trustee sales that I have attended do not have any bidders who exceed the bank's minimum bid. That is to say that the lenders typically take the properties back at or close to the amount of the outstanding loan balance. If the loan balance is a decent amount below perceived market value, then there may be bidders, but this is usually not the case. The uncertainty in buying at the Trustee Sale is that you usually will not have viewed the property (so you won't know the condition), and you won't be able to make your offer/contract contingent upon a home inspection. Thus, you're buying sight unseen, and as is. Quite a dangerous combination, which makes most potential bidders hesitant to bid too high, as they don't know what types of repairs they may have to make to the property. You'll also need to be prepared at the Trustee Sale with a cashier's check in hand, and be ready to close within just a few weeks. AFTER THE TRUSTEE SALE If you're "buying a foreclosure" after the Trustee Sale, you're really buying a bank owned property. That is to say that the lender was not able to sell the property on the courthouse steps, and thus have it back on the market after having foreclosed on the original borrower. Oftentimes, the new owner will not be the actual lender, but an asset management company. Some asset management companies will price the house quite evenly with the market, and try to sell it in a reasonable, but not overly fast time period. These properties are much like other properties on the market, except that they are owned by a bank or asset management company. Other lenders or asset management companies will list the property at a price where it is sure to sell quickly, and likely with multiple offers. A property such as this came on the market in Bridgewater this past week, and there were three offers on the property within the first few days of having been listed. Buying a bank owned property is relatively straight forward, though you may be dealing with multiple competing offers, you will definitely be dealing with lots of extra paperwork and disclosures from the bank, and you may be dealing with a slower than normal process for negotiations and closing. IN SUMMARY If you have been encouraged to "look at some of those foreclosure properties" or think that your best opportunity might be a "a foreclosure" -- maybe you should, and maybe it is. But bear in mind that the process, the risks, and the certainty of the purchase will vary quite drastically based on whether you buy before, at or after the trustee sale! | |

November Home Sales Soar In Harrisonburg, Rockingham County |

|

A few days ago I mentioned that I thought November sales would be strong, with likely around 65 home sales. I think I was wrong. I think we're going to see a big rise in home sales in November. We've already seen 49 home sales between November 1, 2009 and November 19th, 2009 --- which exceeds all of November 2008 sales. And if I extrapolate out based on how many occurred in the first 19 days of November last year, this is what we find . . . .  I'll try not to dwell on this too much . . . well, actually, maybe I will! | |

Did Our Area's Median Sales Price Increase Because Bigger Homes Were Being Built And Sold? |

|

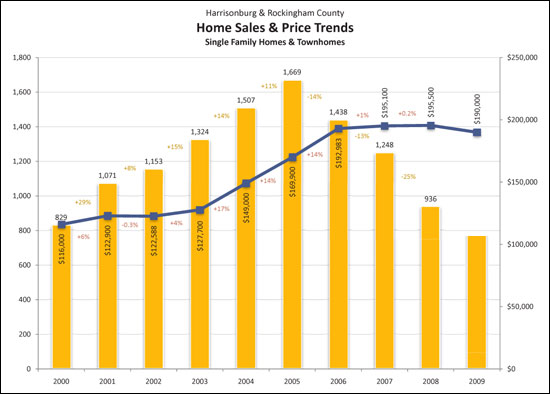

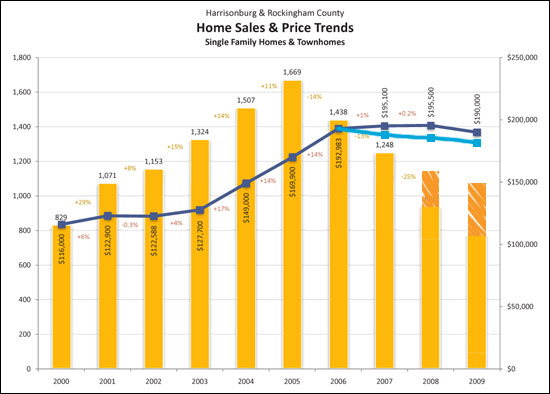

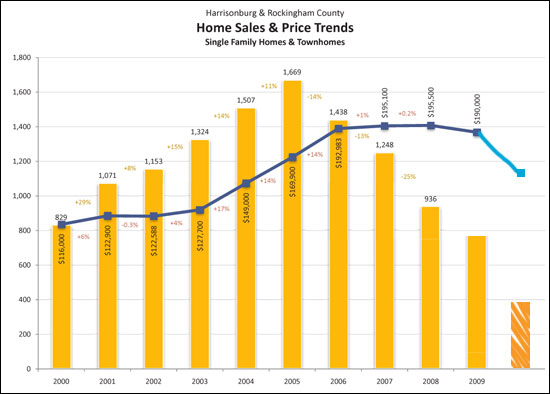

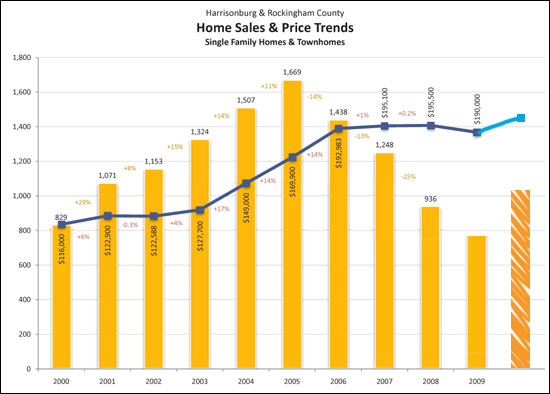

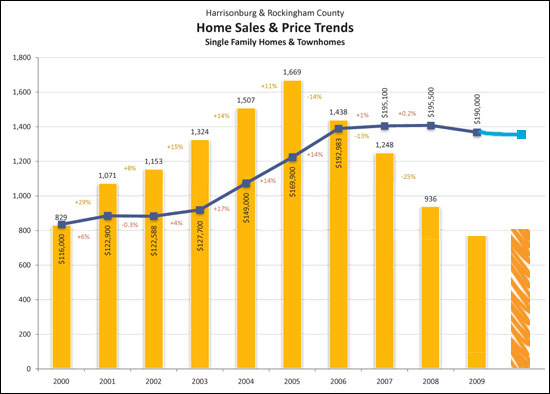

This is another great question about the Harrisonburg and Rockingham County market! The graph below shows how the median sales price has increased over the past 10 years (the blue line).  The hypothesis would be as follows:

First, check out the graph above. The median price per square foot has tracked at a relatively similar growth and decline pace as the median sales price. If the increase in price had been a result of more sales of large homes, we would have seen price per square foot stay relatively level. We do not see that. Second, if the above hypothesis were true, we would see a significant run-up in the number of large homes sold up until 2006, and then a decline. Take a look . . . This graph shows all home sales:  Next, we see that "large" homes didn't actually decline as much as the rest of the market between 2006 and 2009:  And if we create an overlay of the two graphs we'll note that despite the vast number of large homes that are for sale, that segment of the market has actually picked up pace in the recent past as compared the rest of the market:  | |

We're Seeing The Effects Of The $8,000 First Time Buyer Tax Credit In Harrisonburg, Rockingham County! |

|

I rarely make real estate sales predictions --- mainly because in the rare occasion that I do, I'm usually wrong. More on this in a few days. That being said, I believe we're seeing the specific effect of the $8,000 first time buyer tax credit (that was recently extended) here in Harrisonburg and Rockingham County. Check out how November sales figures will likely play out . . .  We've already seen 34 home sales in Harrisonburg and Rockingham County in the first 17 days of November. Compare that to how many occurred in Nov 1-17, 2008 versus Nov 18-30, 2008, and I have extrapolated a final sales count of 65 home sales this November. I will likely be wrong --- I think it will be even higher. The second version of the first time buyer tax credit was to end on November 30th, so there are quite a few purchasers already in the queue waiting to close at the end of this month. Do you want further evidence? The median sales price of the homes that have sold this month is $177,623, compared to the year to date median of $190,000. We're seeing more inexpensive (first time buyer type) homes selling this fall. Any counter prediction out there? What do you think? And what do you think we'll see in those typically stagnant months of December and January?? | |

The Puzzle (To Buyers) Of A Low List Price |

|

It can be difficult to price property as a seller, but another interesting puzzle is how a buyer should respond to a low (super-low) asking price. There are several scenarios where a list price might be quite a bit lower than expected:

The problem, of course, is that buyers are making a decision about an asking price in a vacuum! They don't know if there will be multiple offers, if any of the offers will be as high as asking price, if they will be above asking price, etc. The best solution, in my mind, is to use a relic from the recent past --- the escalation clause. This allows a buyer to make a bid that they hope will win the day, but also to provide an automatic method for increasing that offer should another outbid them. More specifically, if a house is listed at $125k that we think should sell at $225k, a serious buyer might want to:

My question, in that situation, is this --- if the above referenced property were not one with a low list price, but instead were listed at $229k, would you not be highly interested if you knew you could negotiate it down to only $185k? The issue at hand, I believe, is that it is hard to be comfortable with exceeding the asking price of a property in a buyer's market. | |

Do Townhomes in Harrisonburg Hold Their Value? |

|

This is a fascinating question, asked by a potential townhouse buyer who is concerned that townhouse values might be more volatile than single family homes because there have been so many townhouses built in the Harrisonburg area over the past several years. Here is my best attempt at evaluating how townhouses in Harrisonburg hold their value compared to single family home . . . Most of the new townhome communities in and around Harrisonburg have been built during the past six years, so I began by comparing how the median price of townhomes changed over the past six years (2003-2009) as compared to the median price of single family homes. I found that townhomes increased in value by 51% during this time period, while single family homes only increased in value by 42%.  Next, I thought it might be interesting to see how each property type has fared in the most recent three years (2006-2009) in a tough market with very little price appreciation. Comparing median price changes between 2006 and 2009, I found that townhomes increased in value by 1% during this time period, while single family homes LOST 8% in value.  Finally, just for good measure, I thought I'd stretch back even further and look at how the median prices of townhomes have changed over the past nine years (2000-2009) as compared to single family homes. I found that townhomes increased in value by 83% during this time period, while single family homes only increased in value by 70%.  Having examined value trends in a 3-year, 6-year and 9-year window, I'm quite comfortable asserting that townhomes grow in value, and maintain their value better than single family homes. Or, at least, they have in Harrisonburg and Rockingham County for the first nine years of this decade! Median price data source: October 2009 Harrisonburg & Rockingham County Real Estate Market Report | |

It's A Tough Time To Be Pricing Real Estate As A Seller |

|

You just can't win! The experience I'm having, on the ground, is this:

For our example, let's assume that the three most recent comparable sales are $220k, $225k and $230k. Certainly, this would indicate that the value is quite likely $225k based on what has recently sold. Then, if we look at what's available now, we might find something priced at $225k, $235k and $240k. Conventional wisdom would thus suggest that we price the house at either $229,900 ($230k) or $234,900 ($235k). This would allow for some negotiating room down to the perceived value of $225,000, and yet would still be appealing compared to other properties that are currently available. What I'm seeing these days is that if you're priced above the perceived value, you often will get traffic, but not offers. Thus, if the home is priced at $230k or $235k buyers will come to look at the home, but they won't make an offer because they perceive the value to be $225k, expect to thus pay $215k to $220k, and then don't make an offer because it would require $10k to $20k of negotiating. If we accept all of that to be (generally) true, the next logical step is to list the property at either $224,900 ($225k), or perhaps even $219,900 ($220k) depending on how motivated you are to move the property. But the problem here is that you'll then likely have buyers who want to pay $210k or $215k --- WAY below where you perceive the value to exist. Just to bounce back to that "value" (because some people would question it) --- if your three neighbors just sold for $220k, $225k and $230k, would you really reasonably think you'd have to sell at $210k or $215k to make the sale?? What is a seller to do? It is a tough call in any regard --- my counsel in a real live scenario differs from client to client and from property to property depending on the urgency of a homeowner's situation, the particular comparable competing properties, etc. There are ways to successfully navigate this market as a home seller, but they require careful analysis, and patience. | |

The October 2009 Harrisonburg and Rockingham County Real Estate Market Update . . . for auditory learners. |

|

Enjoy this brief video segment discussing real estate market conditions in Harrisonburg and Rockingham County as of the close of October. What do you think? Why has our market remained stable? What will we see for the balance of 2009? | |

Has The First-Time Buyer Tax Credit Pulled More Buyers Into The Market In Harrisonburg, Rockingham County? |

|

Warning: This analysis, though numerically and statistically based, is an abstract answer to a nearly impossible question.  The question, raised today by Chad, is whether the first-time buyer tax credit (that was set to end on November 30, 2009 but has now been extended) has pulled any additional buyers into the market. I say.....maybe, but.... The chart above shows how I attempted to answer that question. For each year between 2000 and 2009, I determined the percentage of home sales that were at or below 80% of the median sales price that year. We can assume that most first time buyers are going to be in that general price range (under $93k for 2000, and under $152k for 2009). The chart, thus, shows how that segment of the market has fluctuated in relative size over the decade that is coming to a close. As you'll notice, the portion of supposed first-time buyers dropped off between 2005 and 2007 --- likely because home prices were increasing (mostly between 2005 and 2006) and lending requirements were becoming more restrictive (mostly between 2006 and 2007). But....the trend then reverses starting in 2008, and then continues in that new trajectory in 2009. There are thus (perhaps) more first-time buyers in our market today because of the tax credit, then there otherwise would have been. Yes, I know --- lots of mental leaps there. The additional caveat that I offered Chad is that while I believe the first-time home buyer tax credit did and is pulling buyers into the market now who might have otherwise waited until 2010 or 2011 to purchase --- I also think there have been first-time buyers that would have purchased in 2008 and 2009 that were waiting because of the economy. Thus --- the tax credit is borrowing buyers from the future who really would have been today's buyer anyhow. Again --- all of this is largely speculative, as I can't truly tell you the number of first-time buyers in our market, but hopefully this analysis sheds a bit of light on the topic. I welcome your suggestions for additional analysis to answer this question. | |

October 2009 Harrisonburg & Rockingham County Real Estate Market Report - Sales Steady, Prices Inch Lower |

|

I just published my monthly market report on Harrisonburg and Rockingham County. Read on for a summary, or jump right into the report by reading it online or downloading the PDF. Just a year ago, I was reporting that when comparing Jan-Oct 2007 to Jan-Oct 2008:

The decline in median and average sales price is also quite troubling --- at first --- until we put that into the context of how home values have changed in other parts of Virginia and the United States. First, though, I do understand that every homeowner wants the value of their home to increase, always, every year, without exception --- and I don't fault you for that desire. That being said --- home values in our nation have declined quite significantly over the past several years, and many markets in Virignia also saw those drastic declines. Yet, somehow, the Shenandoah Valley (thus far) has remained largely unscathed. We have seen a slight, slow decline in home values (as measured by median and average sales price), but home values increased 51% between 2003 and 2006 and have only declined 1.5% between 2006 and 2009. Let me repeat that for emphasis, because it is astonishing given what has happened nearly every other housing market in the nation.... Home values in Harrisonburg and Rockingham County increased 51% between 2003 and 2006, yet have only declined 1.5% between 2006 and 2009. What does the future hold, you might ask? I showcased a few scenarios last week which you can review here. Beyond the numbers, I believe we will continue to see small declines in home values over the next 12 months, and that over the next 6 to 18 months we will see the pace of sales start to solidify and then slowly increase. To learn more about the details of our local housing market, review the entire October 2009 Harrisonburg & Rockingham County Real Estate Market Report: Read Report Online | Download PDF. If you find the information in this report to be helpful....

| |

Several More Months Of An $8,000 First Time Buyer Tax Credit PLUS A New $6,500 Tax Credit For Long Time Residents Of Same Principal Residence |

|

THE NEW TAX CREDIT IS COMING, THE NEW TAX CREDIT IS COMING! The House has passed the bill, as has the Senate, and the President may sign it as soon as tomorrow (November 6, 2009). That's right --- the tax credits for home buyers are continuing --- and now they are being applied more widely. FIRST-TIME BUYERS You now have several more months to buy your new home --- you don't have to close by Nov 30 / Dec 1. In fact, as long as you have the property under contract by April 30, 2010, you'll have until July 1, 2010 to close on the property. The tax credit is still $8,000 with several imitations on income, home price, etc. LONG TIME RESIDENTS OF SAME PRINCIPLE RESIDENCE There's something for you too! If you have owned and used the same residence as your principal residence for 5 (consecutive) years out of the last 8 years, you will likely be eligible for a $6,500 tax credit. The deadline for closing is July 1, 2010 (as long as the property is under contract by April 31, 2010.) TIMING One important note here on timing --- if you're a first-time buyer, this new bill just extends your deadlines. If you're a "long time resident of same principle residence" you'll can close on your new house (and be eligible the tax credit) as soon as the bill is signed into law. That is to say that if you're a move-up (or down) buyer ready to close tomorrow (November 6th), you might want to wait another few days for the President to sign the bill. You'll enjoy an additional $6,500 net gain --- in the form of a tax credit. INCOME LIMITS The new income limits are $125,000 for single buyers and $225,000 for couples. THE ACTUAL LEGISLATION Interested in the details of the actual bill? Click here. | |

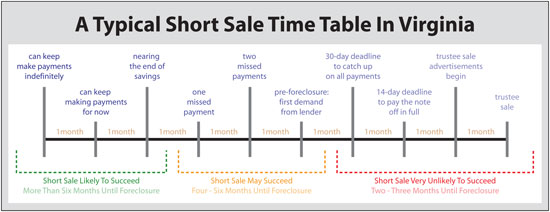

A Typical Short Sale Time Table In Virginia |

|

Earlier this week I attended an educational session put on by the Virginia Association of Realtors in regards to Short Sales which was very informative! I am currently representing a buyer who has a contract on a house that will be a short sale, and I am currently representing a seller whose listing will likely result in a short sale. Thus, in addition to being quite interesting, the top down overview prepared me to better represent my clients. First, my simplified definition of a short sale is any home sale where the proceeds will not provide the sellers with enough money to pay off the mortgage(s) in full, and where the sellers can't come up with the rest of the money themselves, and where the bank agrees to release the lien against the house anyhow, even though they aren't being paid in full. One very helpful part of our training session was an explanation of the typical foreclosure timeline (shown below) and how and when a short sale can fit in to prevent the foreclosure.  Click on the image above for a larger JPG version of the timeline, or click here for a PDF version. As you can see, above, when a homeowner knows they are headed towards foreclosure there is often still plenty of time to attempt to arrange a short sale rather than to simply wait for the foreclosure to transpire. Yet at the same time, as the foreclosure (trustee sale) looms nearer and nearer, the possibilitiy for a short sale diminishes. What else do you need to know about short sales and foreclosures? A LOT!

| |

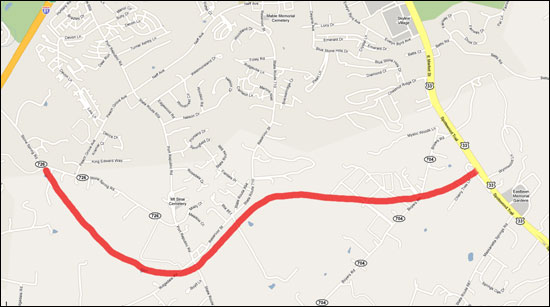

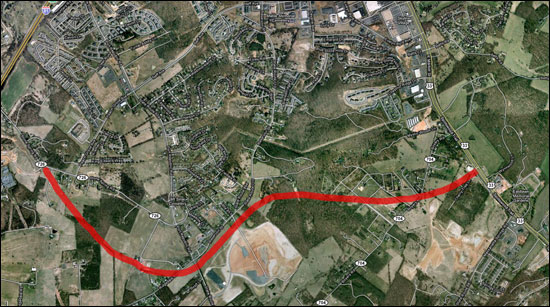

Erickson Avenue / Stone Spring Road Connector; Southeast Connector |

|

Almost a year ago I mentioned that a new road connecting Erickson Avenue to Stone Spring Road was moving forward. Construction is now moving forward, with lots of progress starting on the Erickson Avenue end of the connector. Below is a map showing where that will be situated (click on the map for a larger version) and this is a web site with more details. City Portion of Erickson Avenue / Stone Spring Road Connector:  The road shown above lies in the City, but the Connector will continue into the County, all the way to Route 33 East near Boyers Road. The map below shows an overlay of the approved map from VDOT over top of both an aerial and road view from Google Maps. Click on either for a larger view. Rockingham County Southeast Connector (1 of 2 portions)   As far as I can tell, the County portion will cut through the new campus of Rockingham Memorial Hospital, and then cross through Boyers Road before connecting with Route 33. From what I have heard, Boyers Road will become a cul-de-sac before reaching Route 33. | |

What is, isn't, and will be (or not) in the Harrisonburg and Rockingham County real estate market |

|

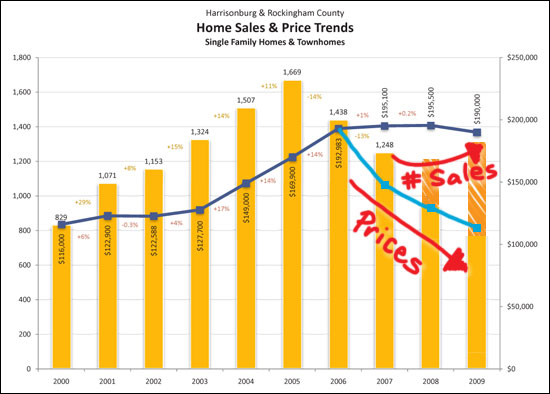

Each month I publish a real estate market report for Harrisonburg and Rockingham County, which includes this graph:  Overly simplified, you'll notice in this graph that sales are slow, but prices are steady:  Certainly better than the many markets (even in Virginia) where the pace of sales is increasing, but prices took a huge hit:  At the same time, our market could have transitioned more gracefully than it did --- perhaps if prices had dropped a bit more, sales wouldn't have slowed down so much:  The big question now, is WHAT IS NEXT for our local real estate market. I think another big drop in sales and a significant drop in prices is likely overly pessimistic:  Yet it's also probably too optimistic to think we'll see sales pace and prices rebound overnight:  My best guess? We'll see another year of negligible changes in price, but we'll see a small increase in sales pace:  But what do YOU think?? ** Of note, the 2009 bar is extrapolated from Jan-Sept 2009 sales. | |

Are Smaller Homes Faring Better Than The Overall Market In Harrisonburg and Rockingham County? |

|

My hypothesis was that smaller homes were performing better in Harrisonburg and Rockingham County than the market at large. After all, there is a significantly greater supply of homes for sale in the higher price ranges --- which would suggest that the real winners are the lower priced and smaller homes. Plus, the $7500 followed by $8000 tax credits were certain to bring lots of new buyers into this segment of the market.... The data, however, shows otherwise....  As shown above, the overall market experienced a 44% drop in home sales between 2005 and 2008. However....  As shown above, the market defined as homes with less than 1,500 square feet experienced a 47% drop in home sales during the same time period. Now, let's look at prices....  As shown above, median sales prices of all residential properties have decreased by 1.5% between 2006 and 2009. However....  As shown above, the market defined as homes with less than 1,500 square feet experienced a 4.5% drop in median sales price during the same time period. How could this be?? The best explanations for this (slightly) lower performing segment of the market (1,500 SF or less) that I can offer are....

| |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings