Archive for December 2009

What Happens If My Neighbor Is Foreclosed Upon? |

|

Thankfully, the Harrisonburg and Rockingham County real estate market is not greatly affected by foreclosures and short sales. Many people ask why we haven't seen an overwhelming number of foreclosures in this area -- to which I offer:

So, what is the impact? In our market, with a very low number of foreclosures, this sale will not have a tremendous impact, unless the particular neighborhood where it is situated happens to have an above average number of foreclosures. Let's see why . . . .  The table above demonstrates the impact of foreclosures on a given market when 8% of the sales are foreclosures, 50% and 75%. Of note, I have informally heard from several colleagues in Winchester that earlier this year 75% of active listings in their market were foreclosures, short sales or bank owned properties. The analysis above assumes that "normal sales" range from $250k to $300k, and that the foreclosure sales are all at $200k. As you can see, with a foreclosure rate of less than 10%, the impact on median sales price is marginal. However, the market value of homes really starts to shift as there are more and more foreclosures in a market. Interestingly, this is a bit of a snowball effect. More foreclosure sales bring home values down, which puts more homeowners under water, which causes more foreclosures, which brings home values down further, etc., etc., etc. Thankfully our local market has escaped this downward cycle to date! This is a broad topic, so feel free to ask some clarifying questions or raise other thoughts or perspectives, in the comments below, by e-mail (scott@cbfunkhouser.com) or by calling me at 540-578-0102. | |

Scripture Communities Earns National Recogition in "American Builders Quarterly" Magazine |

|

Have you heard of American Builders Quarterly? The publication provides a comprehensive look at the nation's entire construction industry by profiling leading companies that consistently perform in all aspects of the building trade. Take a look at the covers of the last 15 issues (below) and you'll notice one company right here in Harrisonburg, Virginia that was recently highlighted by American Builders Quarterly: Scripture Communities.  This is rather big news, as this publication covers huge developments and developers all over the country --- but they took note (on the cover of the magazine, no less) of this local company that has been building communities in Harrisonburg and Rockingham County for several decades.  The article focused on Scripture Communities' emphasis on building lasting communities focused on market demands. For years now, Jerry Scripture has been building unique, innovative communities to meet the specific needs and desires of home buyers in many different demographics. Communities currently being developed by Scripture Communities include:

ALSO --- STOP THE PRESS! Don't forget about the Scripture Community Move Up Program, where Scripture Communities will potentially buy your house if you love one of their new communities and want to move up into a new home. | |

6,500 Reasons Why It's Great If You Have Owned And Lived In Your Home For Five Or More Years! |

|

Somehow, the $8,000 tax credit for first-time buyers is getting all of the attention, meaning that most people don't even know about the $6,500 tax credit available to you if you've lived in your home for five years. If you have owned your home for five or more years, you will (almost certainly) receive a $6,500 tax credit if you buy your next home by April 30th, 2010. To clarify -- you must have a contract on the house by April 30th and close by June 30th. Many people that I talk to who would be eligible for this $6,500 tax credit don't even know that it exists. If you're in this situation and planning to buy a new house in 2010, you really ought to consider making a move in the first four to six months of the year. Click here for more information (from the IRS) about both tax credits. Again, to try to really drive this point home: If you've owned your house (and lived in it) for more than five years, you are very likely eligible for a $6,500 tax credit if you buy a new home by the spring/summer. | |

Brand New Good Faith Estimate AND Settlement Statement (HUD-1) Coming in 2010! |

|

The U.S. Department of Housing & Urban Development approved (some time ago) two updated forms that are CENTRAL to the real estate transaction. These two new forms will go into effect on January 1, 2010:

The new Good Faith Estimate (GFE) is now a standard form across all lenders. In the past a borrower would receive a GFE with a different format from each lender that they visited --- each having a slightly different set of disclosed loan terms, or vocabulary for referencing such terms. Now, a buyer can compare two proposed mortgage scenarios from two different lenders and be able to quickly and easily compare the exact same terms from each. I see this as a huge improvement for the financing process (for buyers), as in the past there has often been much confusion about how to determine which proposed loan program is better than the other. Here is an excerpt from Page 1 of the new Good Faith Estimate, which (surprisingly?) is quite intelligible!  But there's more! Beyond a buyer's (borrower's) loan terms and closing costs being easier to comparison shop, and easier to understand . . . there is also more accountability on the lender to make sure that those terms and costs stay intact through to closing. Some of the costs CANNOT change from the Good Faith Estimate, others can only change by a certain percentage, and others that can change without limit. This is a big improvement from current HUD guidelines whereby there was no guarantee that any of the closing costs or loan terms from a Good Faith Estimate would be carried through to closing. If you're buying in 2010, or beyond, you'll have the benefit of these new lending guidelines. Feel free to ask questions as you go through the process (of me, or of your lender) -- but hopefully the process will be much clearer and easy for you to navigate! | |

Selling For A Profit All Depends On When You Bought! |

|

Thankfully, the value of homes in Harrisonburg and Rockingham County hasn't taken a nose dive like has happened in many other markets. As you can see below, modest (normal?) growth in values occurred between 2000 and 2003, unbelievable (and unsustainable) growth in values occurred between 2003 and 2006, and prices became stagnant between 2006 and 2009.  That being said, since we haven't seen consistent growth in home values since 2006, there are some homeowners who are unable to sell their house (after costs) for as much as they bought it. Conventional wisdom pre-2003 said that you should only buy a house if you knew you'd be living in it for 5 or more years. You see, with the principal balance of the mortgage declining SO SLOWLY at the start of a 30-year mortgage, it would take a full five years to have paid down the mortgage enough to cover the costs of selling. As you might imagine from the graph above (or from talking to your friends), some people bought in 2003, 2004 or 2005, and then sold a year later at a tidy profit. The market was going up so quickly that they could sell one year later with no financial detriment because of the high rate of appreciation. Let's take a look at how our market has performed over the past decade by imagining that someone has to sell three years after they buy.  As per the chart above, a homeowner buying 2000 or 2001 would have been experienced a good sized gain.  The gain is starting to be more and more unbelievable at this point. Buying in 2003 and selling in 2006 would have resulted in a whopping $53,000 gain, or roughly $18,000 per year.  While things are starting to slow down, we see here that someone could have bought as late as 2005 and been just fine, given that there was such a big jump in median home values between 2005 and 2006.  OOPS! Wait a minute! A $16,000 loss?? It's true --- if you bought in 2006 or anytime thereafter, and you want to sell your house, you'll need to prepare to do so at a loss, given the costs of selling. The big question: When will the median sales price start to stabilize? When the supply of homes for sale starts decreasing more rapidly than it has, I believe we'll start to see the median price inch upwards again --- though not at the pace it did between 2003 and 2006! | |

The Value Of Property Oddities Has Greatly Increased -- But That's Bad News! |

|

While every home is unique, there are some properties that have peculiarities that can detract from their value. Some of these oddities include:

A few years ago, when the market was hot, hot, hot (2000-2005, we'll say) these detractors didn't seem to matter too much to a buyer. Buyers often had only a few houses to choose from that would work for them, and some of those would go under contract the following day, so buyers committed to buying houses that had some peculiarities just to get a house. Now, buyers have lots and lots of houses to choose from, and thus if there are 10 houses that could work for them, and three have some of the oddities listed above, they will almost certainly only be considering the seven remaining properties. Thus, these property oddities have MUCH more impact on value now than they did just a few years ago. Put another way, a few years ago a 2400 SF home with 4 BR, 2.5 BA and a level lot would have likely sold for only a few thousand dollars more than an identical house down the street that had a very steep lot and driveway. Now, however, there might be a $10,000 - $20,000 difference in sales prices for these homes. Or . . . the home with the very steep driveway and lot might just languish on the market rather than selling. DOES IT MATTER? I had a very interesting conversation about this with a client a few days ago. Here is what we concluded:

So . . . . to re-emphasize #2 above: you can likely negotiate significantly on a home with oddities right now (in a slow market). If you do so, you'll do fine if you sell it in an equally slow market, you'll do better if you sell it in a normal market, and you'll do great if you sell it in a hot market. | |

Pondering The Future Of The Harrisonburg and Rockingham County Real Estate Market |

|

Over the last few days I have had quite a few discussions with developers, builders, buyers, sellers, and other Realtors regarding the exciting change of pace our local real estate market experienced in November 2009. To remind you of this astonishing news:

All of these are wonderful indicators, and we find yet another one at the top of this post, showing that while online property views (defined below) have been declining over the past few months, they are much higher than could be expected. In fact, there were more properties viewed online in November 2009 than in March 2009. Wow! We would typically expect that most buyers would be looking at properties online (and in person) at the start of the spring "buying season" -- but the graph above shows that there are still LOTS of buyers looking (at least online) at properties for sale. Online property views is the sum of all property views on the Coldwell Banker Funkhouser Realtors network of web sites, including our company web site, and all agent web sites. | |

The Most Frequently Used Driveway Materials in Harrisonburg and Rockingham County |

|

If you're building a home, what should you use as a driveway material? There are a lot of options!

Let's take a look at the most common types of driveways in Harrisonburg and Rockingham County. The data source for this analysis is the Harrisonburg/Rockingham Association of Realtors MLS, so it's an inexact analysis, but can still provide some helpful insights.  The chart above shows that the most common driveway material for single family homes in Harrisonburg and Rockingham County is gravel! Beyond gravel drives, which are likely found mostly in the County, the most frequently occurring driveway is an asphalt driveway. Let's take a closer look at driveways of single family homes in the City of Harrisonburg, to exclude the more "rustic" driveways found on homes further out in the County . . .  In the City of Harrisonburg, a full 1 in 5 driveways is still gravel, though asphalt driveways now lead the pack, with a full 10% greater market share than concrete driveways.  The graph above analyzes "expensive" homes --- those sold above $350k in the last year in Harrisonburg and Rockingham County. Here we find an even more overwhelming share of asphalt driveways, though we also see an increase in the percentage of exposed aggregate driveways.  Perhaps most interesting is that when examining homes sold since Jan 1 2000, we find that most have had concrete driveways. Is this perhaps the sign of a growing trend in our area, or the nation as a whole? Notes: In the last year, 570 single family homes sold in Harrisonburg and Rockingham County (per the HRAR MLS), and the analysis above is based on the 534 sales where driveway data was present and usable. | |

Are We Turning The Corner Towards More Positive Times? |

|

Take a look at home sales activity summarized by Quarter . . .  As you may notice, we've seen a steady decline in the number of residential sales in Harrisonburg and Rockingham County since 2005 . . . until the fourth quarter of 2009. Look again . . .  Please note, first, that the final fourth quarter 2009 sales figure is extrapolated based on data available as of November 30, 2009. So, my data could be wrong --- but I recently made some wild guesses about November 2009 sales (first I guessed 65, then I guessed 76) and they were both too low (the final figure was 82)! If we do see an year to year increase when comparing 2008-Q4 versus 2009-Q4, I think we can get excited about 2010 being the year when home sales finally started increasing again in Harrisonburg and Rockingham County. That being said, I will still allow for skeptics to blame it on the tax credit, or for other factors in the current market. Any skeptics out there? | |

Bold Buyers Bag Big Bargains |

|

I recently wrote a post entitled "Is it logical for a buyer to want 10% off of a "fair" asking price in today's economy?" where I concluded: There is nothing wrong with wanting to negotiate 10% off an asking price, or with making offers given such logic. But such a buyer should know that they may have to make an offer on ten or more properties before they find a seller willing to negotiate 10% or more below their asking price. Yet even given that perspective, there are deals to be had in the current real estate market --- and the buyers who are making aggressive offers are usually the ones finding the great opportunities. Here are the factors at play:

Thus, the stars must align --- a buyer must be willing to make an aggressive offer on a house that just so happens to have a seller who is ready to be overly flexible with their price. The natural question here is whether this actually ever happens. It does! But here's how --- these buyers who want to find that "great deal" often have to make offers on multiple houses before they find the one where the seller will be flexible. My advice to ALL buyers is to go ahead and make the offer that you think is reasonable, even if you are pretty sure the seller won't take it, and even if you aren't going to then skip around to house after house to find someone who will take your aggressive offer. | |

Harrisonburg & Rockingham County Home Sales Soar in November 2009! |

|

Take a look at this graph and see if you notice anything . . .  I notice a few things that are quite exciting: November 2009 home sales were 95% higher than a year ago (November 2008). Furthermore, there was a 30% increase between October 2009 and November 2009, when most other years there has been a decrease between October and November. November 2009 outperformed every other month of 2009 except for June and July. November is typically a very slow month for home sales, but this year buyers came out in droves! Read on for more good, bad, and neutral news . . .  Click here to download the PDF. If you find the information in this report to be helpful....

| |

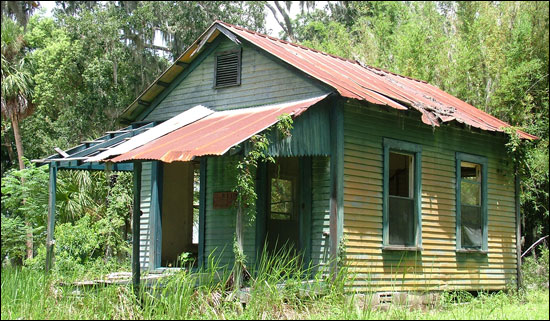

Buying a Fixer Upper in Harrisonburg? Check Out The FHA Section 203(k) Loan Program! |

|

If you're buying a fixer upper that you'll live in, you might want to consider the FHA Section 203(k) loan program! This program allows a buyer to finance their purchase and subsequent repairs into one loan. The alternative is for a fixer-upper buyer to obtain a secondary or short-term loan to finance the repairs or improvements that they will make after settlement. You can finance significantly more than the purchase price of the property in order to have cash on hand for repairs. The funds for improvements are placed into an escrow account, and the buyer (now owner) can draw on them through the rehabilitation process to pay for the repairs and improvements. There are a few basic guidelines that can quickly tell you whether this might work for your situation:

I have had clients consider this program, who didn't end up buying a fixer upper. Have you purchased a house in Harrisonburg (and surrounding) using this loan program? Or do you know someone who has? Please share! | |

Want To Buy? Have To Sell? Perhaps We Can Help! |

|

It seems that there are quite a few people in our current market who want to buy a house --- but they're at a standstill, because they have to sell their current home before they can buy. It can be a challenge to buy and sell simultaneously, as I pointed out this past September. But maybe there's another way . . . I market several neighborhoods of new homes for Scripture Communities, and just recently the builder (Jerry Scripture) has devised a move up program that has worked for him in the past, and is working again now in our current market. The concept is this: In certain circumstances, Scripture Communities will help you sell your current home, or will even commit to buying your home, if you are buying a new home in a Scripture Community. Does it sound to good to be true? It can be of tremendous help to someone who wants to buy, but most sell in order to do so. As a real, live, example --- we're in the process of building a home now (at Heritage Estates) for someone who is using the Scripture Community Move Up program. If they can't sell their current home themselves by the time their new home is complete, Scripture Communities will buy it from them at an already agreed upon price so that they can close on their new home. There are a few common sense guidelines that we're using when considering these move up scenarios:

| |

Re-visiting 2006 Real Estate Predictions for Harrisonburg and Rockingham County |

|

Much has changed in our local real estate market over the past threeyears, and yet, much has not changed at all. Let's examine today'smarket from the context of just three years ago. Back in November2006, my column in the Shenandoah Valley Business Journal includedthese excerpts: November 2006:"Today, many areas of the Shenandoah Valley are experiencing a buyer'smarket, which provides an excellent environment in which to buy a home…Today's buyers have the opportunity to aggressively negotiate on theirdream home." In today's market we find that nearly everyarea of the Shenandoah Valley, in every price range, is experiencing abuyer's market. The supply of homes far exceeds the demand, providingbuyers with plenty of choices and negotiating ability when purchasing ahome. November 2006: "The average 30-year fixed mortgage rate is currently 6.4%, more than an entire percentage point below 2000 levels." Today'srates are as low as 4.75%, with most buyer's rates hovering around 5%depending on their loan program and credit scores. It is indeedremarkable that the low interest rates from just three years ago arenow more than 1.5% lower today. November 2006: "With houses staying on the market longer, buyers have more choices than ever." Inmost cases, houses are now staying on the market even longer than theywere three years ago, providing even more choices for buyers. Thissupply has not yet shown signs of declining, though the sales pace maybe solidifying after several years of declining numbers of home sales. November 2006: "Today's buyers have the opportunity to obtain unprecedented assistance in buying their home." Thisstatement was in the context of sellers being willing to pay closingcosts, or to offer other incentives. There certainly wouldn't havebeen too many people, three years ago, who would have imagined that thefederal government would be offering an $8,000 tax credit to first timebuyers, and a $6,500 tax credit to long term owners of principalresidences. This statement from the past is true yet again, but in anew context – buyers have yet more unprecedented assistance in today'smarket! November 2006:"With so many benefits to homeownership, plus the advantages offered bypresent market conditions, anyone who was considering buying in thenext one to two years should consider doing so now. The future islikely to offer higher prices, higher interest rates, fewer choices andfewer buyer incentives." Three years later, we aren't yetseeing higher prices, or higher interest rates, or fewer choices, orfewer buyer incentives. Thus, there are still great opportunities forbuyers in today's local real estate market --- but with one significantcaveat. Over the past three years, prices haven't fallen, which iswonderful, but they also haven't increased. Today's buyers, therefore,should only consider a purchase if they will stay in their home forthree or more (or five or more) years. The days of recent past when abuyer could sell a year later for a profit are certainly no longer areality. As always, in real estate, context is of utmost importance. Over the past three years, median home prices in Harrisonburg andRockingham have fallen by 1.5%. In a vacuum, this isn't overlyexciting or depressing. Consider that most other areas in the countryhave seen value declines of 20% in the same time period, and it's a bitmore exciting. Consider that our local home values increased by 51% inthe preceding three years (2003-2006), and it's even more exciting! | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings