Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Wednesday, March 3, 2010

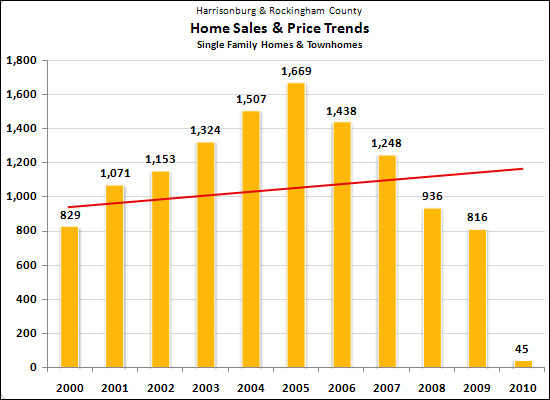

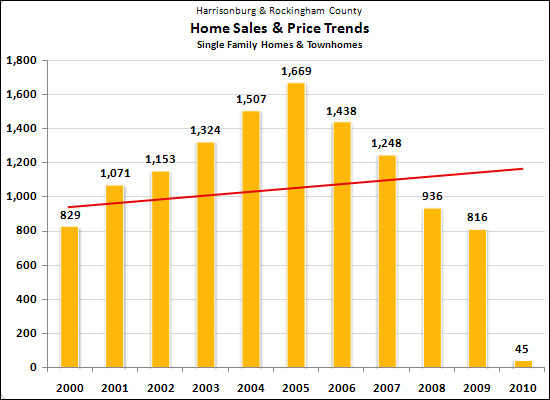

Harrisonburg has steadily grown over the past ten years, and thus I would expect that we would see a gradual, steady increase of home purchases. The recent history of home sales has not followed the slow and steady theory for the last ten years. Below I have charted a gradually increasing rate of home sales (the red line) as I might expect them to be occurring.

As you can see above, if there were approximately 900 home sales in 2000, I'd expect that we might be around 1100 home sales per year here in 2010. Let's examine why sales history strayed so far from this path....

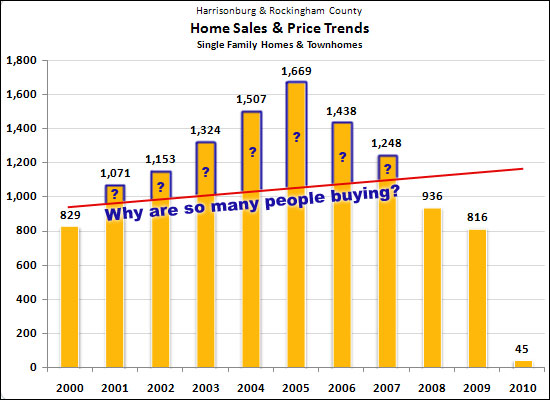

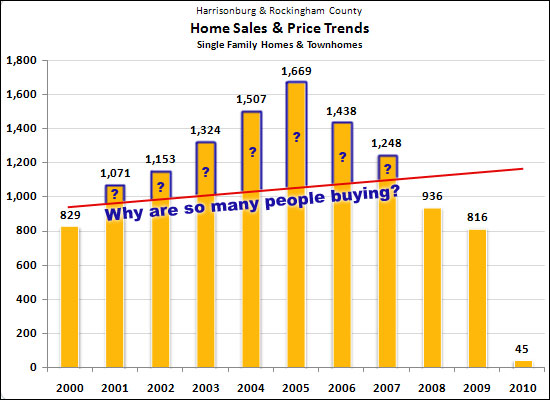

While I didn't think to ask this at the time, I now think it would have been reasonable to ask between 2001 and 2007 why there were so many people buying houses. The blue sections of the yellow bars show the unexpectedly high home sales levels (per my rough calculations). Here are my theories on why so many people were buying at that time:

But now, as seen above, there are (if my red trend line is correct) fewer buyers in the market that could be or should be expected. If we flip around the three factors listed above, we'll understand why:

As you can see above, if there were approximately 900 home sales in 2000, I'd expect that we might be around 1100 home sales per year here in 2010. Let's examine why sales history strayed so far from this path....

While I didn't think to ask this at the time, I now think it would have been reasonable to ask between 2001 and 2007 why there were so many people buying houses. The blue sections of the yellow bars show the unexpectedly high home sales levels (per my rough calculations). Here are my theories on why so many people were buying at that time:

- Financing guidelines were loose --- you didn't need much income, or assets, or creditworthiness to obtain a loan. You could even finance your closing costs! These relaxed financing guidelines pumped buyers into the market that otherwise would have rented.

- Investors were eager --- with home values escalating as quickly as they were at the time, many investors were buying properties they wouldn't have purchased in prior years when appreciation was more modest. Rapid appreciation made longstanding investors buy more properties, and created lots of new investors in the market as well.

- Appreciation was high --- you could buy a house one year, sell it a year later, and make money. This increased the number of buyers in the market considerably, since in the past if you were only going to stay put for a year or two, you would have rented.

But now, as seen above, there are (if my red trend line is correct) fewer buyers in the market that could be or should be expected. If we flip around the three factors listed above, we'll understand why:

- Financing guidelines are strict --- some would-be buyers are being turned away by lenders, as the pendulum has swung significantly past center, to where many lenders are quite hesitant to write loans unless a buyer looks perfect from credit, asset and income perspectives. This decreases the number of buyers in the market.

- Investors are hesitant --- with several years of (slight) depreciation in our market, and significant depreciation in other markets, most investors are hesitant to buy right now. I believe we have a lower than normal amount of investors buying residential properties right now.

- Appreciation is low --- with median home values dropping slightly for each of the last several years, some would-be buyers are quite hesitant to buy right now. Flat housing values at the present time mean that a buyer must stay put a bit longer in their home to have paid down their loan balance some before selling. This has decreased the number of buyers who are in the market.