Archive for June 2010

Buying A House In A Buyer's Market |

|

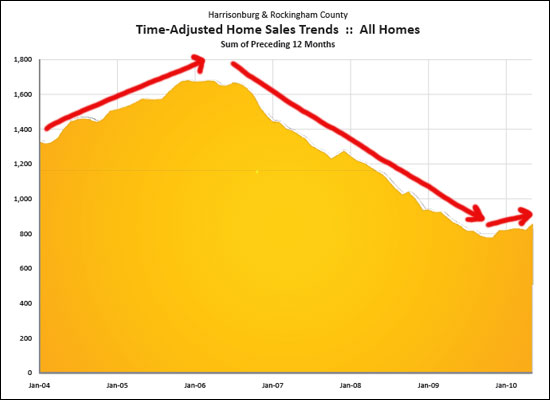

For each of the past four years, fewer and fewer home buyers have purchased homes in Harrisonburg and Rockingham County. The annual rate of home sales has declined from 1,669 in 2005 down to 816 in 2009 – a decline of more than 50%. Even though the first five months of 2010 indicate that sales activity may finally be starting to increase again, it is still a buyer's market. There are far more sellers needing, hoping or wanting to sell than there are buyers who need, hope or want to buy. In many senses, this is great news for buyers – there are fewer buyers to compete with, and more houses to choose from. Add to that the amazingly low interest rates and you'll see why today's home buyer is excited to be in the market to buy. But despite this excitement, most buyers want to make sure they are making a wise investment. In years past, just about any home would do – when the overall market was increasing by 15% to 20% per year, just about any home would see great appreciation. Now, however, prices are holding relatively stable, so it becomes more important which house a buyer chooses. As you look at which particular house you choose, one perspective to consider is how you'll do when you re-sell the house you are buying. Some homes currently for sale need updating – hardwood floors to be refinished, a roof to be replaced, wallpaper to be removed, or a driveway to be re-surfaced. These homes that are need of some updates can be a good opportunity for buyers – if the seller is pricing based on these imminent costs. An even better opportunity, however, is a home where brand new value can be added through your improvements. If you sand and stain the hardwood floors, you will have added value through improving the look and ambiance of the home – but you had hardwood floors before your work, and you still do. If you replace the roof, you will have added value through lower roof maintenance for the next buyer – but you had a roof before your work, and you still do. As you look at homes as a buyer you should not only look for updates that you might choose to or need to make, but also totally new areas where you can create space to add value. Homes with unfinished bonus rooms or unfinished basements offer lots of potential for adding brand new value. The layout of some homes invites the addition of a deck or screened porch – both of which add brand new value – or perhaps an existing porch can be converted into a sunroom. When you're just refinishing the existing spaces, you usually aren't changing the functional space offered to the next buyer – but if there is an easy way to add more functional spaces, this can offer you many options during your time of homeownership, and when you re-sell. A second perspective to consider when buying in a buyer's market is the "timeless value" or quality found in a home you are considering. Look for appropriately sized rooms, the types of rooms that you use on a daily basis, and the quality of construction and craftsmanship that means your home will still look great in 5, 10 or 15 years. In this case, it's not just about buying the biggest house, or the house with the biggest yard. Some 2,000 square foot homes have layouts that won't fit most people's lifestyles, where an 1,800 square foot home down the street might be perfectly designed for comfortable daily use. In her very well read book, The Not So Big House, Sarah Susanka encourages us to think differently about the layout of a house: "It's time for a different kind of house. A house that is more than square footage; a house that is Not So Big, where each room is used every day. A house with a floorplan inspired by our informal lifestyle instead of the way our grandparents lived. A house for the future that embraces a few well-work concepts from the past. A house that expresses our values and our personalities. It's time for the Not So Big House." Saranka points out that it's not all about quantity in a house, but about quality – quality in design and materials. Finally, it is very important to consider location and neighborhood, when buying a home in a buyer's market. A home can be beautiful, well designed, and desirable to all – but if it is located on a busy road, or in the far corner of the county, or on a street where most homes are old and poorly maintained, the future value of the home suddenly changes. Buying an older home, or one that needs work, can be a much better opportunity for you, as you have more control over the changes to the value of your home. You'll likely never reduce the traffic count on the road in front of your house, you'll never make city and employment growth stretch all the way out to your corner of the county, and you won't spend your free time fixing up the other ten houses on your block. With many more homes for sale than buyers to buy them, and with amazingly low interest rates, and with fewer buyers to compete with when negotiating a deal with a seller, it can be a very exciting time to buy a home. When you do so, it is important to consider how well the home will fit your needs, but it is also wise to consider how the home you are considering will fare when you need to sell in 5, 10 or 15 years down the road. | |

Do Harrisonburg and JMU Need More Student Housing? |

|

(The Short Answer: No!) As reported by hburgnews a developer from Glen Allen is moving forward with a developing a community for 1,500 college students. Paul Riner astutely points out (WHSV) that it might be five to ten years before enough students exist at JMU for the community to be fully utilized. Is there really too much student housing already built?

A few years ago, Harrisonburg created an incentive (with good intentions) for student housing developers to build now, now, now. Much of the land in the City that was annexed several decades ago was zoned R-3, which allowed (until recently) a property owner to build student housing (in the form of three-story apartment buildings) without asking for permission. Much of this R-3 land was adjacent to single family home neighborhoods, and thus Harrisonburg took this "use by right" out of the R-3 zoning classification. R-3 property owners were left with a three year window of time in which they could build this higher density housing (student housing) without asking for permission -- and thus the construction began! Finally, here are some fun quotes out of the Daily News Record article of July 25, 2007: "... James Madison University recently announced plans to increase enrollment by 4,100 students by 2013." Total growth will probably end up being around 1,900 students. "With the influx, we are going to need housing. We are going to need housing quickly." Well, we have that new housing now -- but it turns out we don't need much of it! | |

Mortgage Interest Rates Have Never Been Lower -- Get Out Your Calculator! |

|

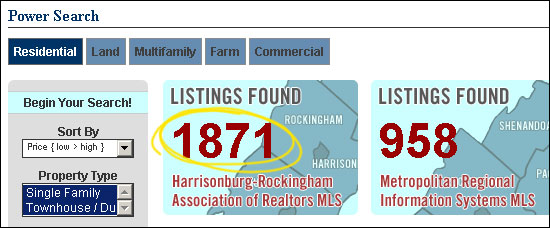

I had heard from several of my clients this week that interest rates were VERY low --- but I didn't know they were the lowest EVER! Current rates are the lowest on record, according to BankRate.com and others. I had heard from several of my clients this week that interest rates were VERY low --- but I didn't know they were the lowest EVER! Current rates are the lowest on record, according to BankRate.com and others. Of note, I two of my clients locked in this week at 4.375% and 4.5% --- wow! How do these incredibly low interest rates affect you?

Put another way --- if you were buying a new townhome this week, could it be helpful to have an extra $1,600 in your pocket? Or an extra $2,700 in your pocket? Buying now, with low rates, can save you that much (annually) as compared to your costs if rates start to increase. | |

Home Sales versus Foreclosures |

|

Data Sources: Harrisonburg/Rockingham Association of Realtors MLS, Rockingham County Circuit Court Clerk's Office (Thanks Chaz & April!) Many have asked me how foreclosures are affecting our local real estate market. Absent hard data on the number of foreclosures in Harrisonburg and Rockingham County, I have always mentioned that there aren't an overwhelming number of foreclosures --- and certainly not enough to make a huge difference in home values. Now, I have the data, thanks Chaz & April at the Clerk's Office . . .  What can be seen here is that the percentage of the home sales that are foreclosures has certainly been on the rise over the past several years. However, despite this being based on hard data, there is still a bit of fuzzy math.... The "Sales" includes all home sales as recorded in the HRAR MLS. This includes most foreclosures, because most such properties end up being bank owned properties that are then listed (and sold) by Realtors via the MLS. However, if only 127 of the 177 foreclosures ended up in the MLS as sales, then the true number of total sales for 2009 would have been 866 sales, making foreclosures 20.4% of the market as opposed to 21.7% of the market. This year (2010) and next year will be important to watch as we see how many home sales we'll have, and how many foreclosures will exist in the market. I predict that home sales will level off this year (and thus, stop declining), but that foreclosures will increase over last year. | |

The Layout of a House Often Trumps Everything Else! |

|

There are a LOT of homes on the market in the $300k - $400k price range, and I have recently been showing a lot of them to buyers. I will then have follow up calls from the Realtors representing the sellers, wondering how things went. Some of the houses are priced more competitively than others, and those sellers (and their Realtors) are often confused and frustrated when my buyer clients aren't ready to make an offer on their home. Why aren't buyers necessarily jumping at the "best-priced" house on the block? The main conclusion I have come to is that the layout of the house seems to be a significant trump card above all other factors.

The bad news is that if the layout or floor plan of your house is unpalatable to most buyers, your home may languish on the market. Back in 2002-2006, just about any home would sell (regardless of the layout) because there were very few choices in homes. Now that buyers have so many choices, they are often quite specific in wanting a layout in a home that works well for their day to day needs. | |

The first-time buyer tax credit is (mostly) over, now what? |

|

June has been a busy month in the local real estate market --- or at least on my end --- as a LOT of buyers close on their purchases of homes in and around Harrisonburg. Quite a few of these buyers are first time buyers, who will receive an $8,000 tax credit when they file their taxes early next year. But the opportunity for this $8,000 tax credit has passed now --- the deadline to have a house under contract was April 30th, and the closing deadline is June 30th (though it may be extended). So....what now? The big question that remains is whether this was either:

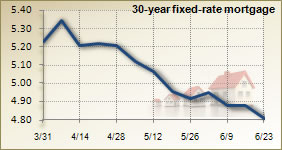

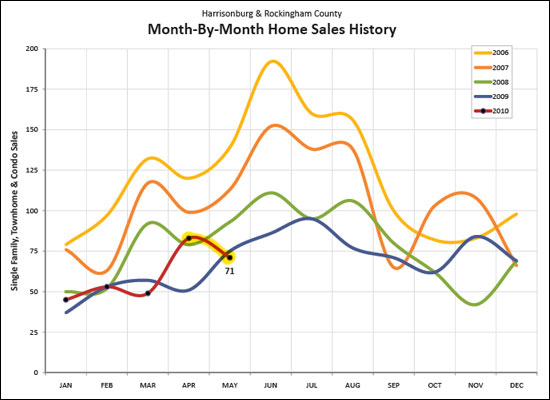

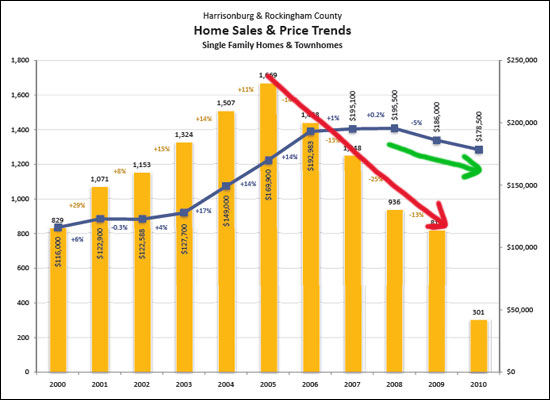

I've had this conversation with many people lately --- now that this whole tax credit has come and gone, can the real estate market stand on its own? Will things slow back down again? The big picture is this -- fewer and fewer homes have been selling for quite a few years now:

I have made lots of predictions about the real estate market over the past five years, and most of them have been wrong. I did not think we would continue to see the number of home sales fall as much as they have. In 2008, I thought for sure we'd see 2007 volume. In 2009, I thought for sure we'd see 2008 volume. So.....here I go again: I predict that we will see 800 home sales in 2010. That would show only a 2% decline since 2009 --- and would be a turn in right direction from the multiple years of double digit declines in sales volume. But, as the image above alludes to, there is somewhat of an awkward pause now, as we see what the second half of 2010 has to hold. I am thankful that the tax credit brought buyers into the market --- it helped to sell properties for many homeowners that really needed (or really wanted) to sell. I am now hopeful as we move forward, that our local real estate market will continue to recover and strengthen through the balance of 2010. | |

Local Home Sales Up 10% in 2010, Prices Down 4% |

|

Click here to view my full June 2010 Harrisonburg & Rockingham County Real Estate Market Report. Exciting Fact #1 --- May 2010 home sales declined 5% as compared to May 2009, but year-to-date sales (January through May) are up 10% over last January through May.  Exciting Fact #2 --- After three and a half years of steadily declining home sales (quantity, not prices), we have now seen stabilization or increases in home sales for over six months.  Not-So-Exciting Fact #3 --- Sales volume has declined sharply for four years now (red line), and median home values have declined gradually for two years (green line). Despite early positive indicators for the past several months, we're not out of the woods yet.  Other tidbits that you'll discover in my June 2010 Harrisonburg & Rockingham County Real Estate Market Report include:

| |

Signing Contracts in the Month of May: Harrisonburg vs. Charlottesville |

|

Intrigued by a post over at RealCentralVA exploring the number of contracts for single family homes for each of the 10 past months of May in Charlottesville and Albemarle County, I thought I'd see how Harrisonburg and Rockingham County are performing compared to our neighbors over the mountain. Reading Jim Duncan's article, you'll note that the number of buyers signing contracts for single family homes has decreased for the past several years. Here is an overlay of Harrisonburg / Rockingham data with Charlottesville / Albemarle data....  Again, the data above is showing the number of contracts that were signed in the month of May (for the past five years) on single family homes in Harrisonburg and Rockingham County as compared to Charlottesville and Albemarle County. To make it a bit clearer....  As you can see, the number of home sales (contracts in this case) has continued to decline for the past several months of May in the Charlottesville area, but those same measures have started to level off and increase here in Harrisonburg and Rockingham County. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings