Archive for August 2010

Harrisonburg / Rockingham MLS Changes Days On Market Accounting Practices |

|

Here's how it started, or so they tell me.... In some other city or town in Virginia, a relocating buyer swept into town looking to buy a house. He found a great house, discovered that it had only been on the market for a few weeks, and made a offer on the house relatively close to asking price given the short length of time on the market. After moving in, he was talking to a neighbor, and commented on how glad he was that he was able to secure the house even though it was such a new listing. The neighbor laughed, saying "What are you talking about? They had been trying to sell that house for three years!" How was it possible there? Was it happening here? The buyer's confusion, it seems, was based on the "Days on Market' field in the local MLS. The information that the buyer reviewed showed a very low number for "Days on Market" and he understood that to mean (as most people would) that it was a very recent listing. But in that area (and yes, in Harrisonburg and Rockingham County -- until recently) this "Days on Market' field could be conveniently reset by re-listing a property with a new company. Indeed, even around here, if a seller became worried about buyers' perceptions of an ever increasing "Days of Market' value, that seller could list their home with a new real estate company, and start over at ZERO! But now, things have changed around here.... Our local association of Realtors (HRAR) MLS changed in the past two weeks, introducing a new "Cumulative Days on Market" field. This field will now track the total length of time that a property has been on the market, even if it is listed by multiple companies. Thus, if Brokerage A has a property listed for 300 days, and after the listing agreement expires, the property owner hires Brokerage B, the "Days on Market" slate will no longer be wiped completely clean. "Days on Market" will indeed return to ZERO, showing the length of time on the market with the new listing broker, but "Cumulative Days on Market" will continue to increase, to 301, 302, etc. Does "Cumulative Days on Market" EVER reset?? If a property has been off the market (not listed) for 120 days (4 months), then both the "Days on Market" and "Cumulative Days on Market" will reset to ZERO when the property is re-listed. How does this affect buyers, or sellers? As a buyer, it will now be easier than ever for your Realtor to quickly discover how long a seller has truly been attempting to sell their home. As a seller, it will no longer be able to present your home as a NEW LISTING all over again just by switching real estate companies. So, good or bad? I'm glad the change has been made --- it makes it more difficult for a seller to be deceptive (which is reasonable) and it makes it easier for a buyer to have a clearer understanding of the status of the property. But what do you think? | |

Local Home Sales Versus National Home Sales |

|

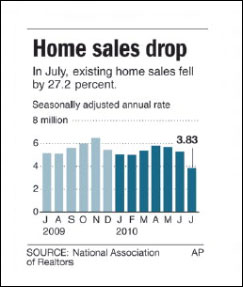

You may haven noticed the depressing news in the Daily News Record today -- on the front page -- home sales dropped 27% in July! You may haven noticed the depressing news in the Daily News Record today -- on the front page -- home sales dropped 27% in July! But wait -- those are national numbers, and may not have much to do with what's going on in Harrisonburg and Rockingham County. The chart to the right is from the DNR, showing the 27% decline in July. The chart below shows essentially the same data for Harrisonburg and Rockingham County. The only difference is that the national figures only include existing home sales (it excludes new homes) and the local numbers are both new and existing homes. Here is the local data:  Despite a 27% decline nationally, local home sales only showed a 5% annualized decline! | |

Is My House Overpriced? |

|

This is a question that many home sellers are wondering these days in and around Harrisonburg -- and perhaps all across the nation. Let's see why.... A real estate market is considered to be balanced (between buyers and sellers) if there are six months of supply available. Depending on the price range, there is quite a bit of excess supply in the Harrisonburg and Rockingham County housing market:

It was said by some, at one point, that if your house hadn't sold in 60 days, lower the price, and repeat. Thus, if you started at $300k, and you hadn't sold it within 60 days, you might lower it to $290k, and wait another 60 days and lower it again, etc. Eventually, you'd reach the point where the market (buyers) would respond to your price, and you'd sell the house. That logic might work in a balanced market, but when the market is so flooded with sellers, and so void of buyers, the logic doesn't work as well. Homes now sometimes sit on the market for months priced well below comparable homes, and don't sell. Will they sell if the price is lowered? Maybe, but maybe not! Time on the market is quite unpredictable at this point, and price is no longer the trump card. In many markets, if a price was lowered to a certain place, a house would definitely sell. If it appraised at $300k, and you lowered it to $280k, it would more than likely sell. Now, you could lower it to $260k, and it might sell, but it might not. You could then lower it to $240k, and it might sell, but it might not. Thus, as you can hopefully see, the answer to the aforementioned question (Is My House Overpriced?) is very difficult to answer. I suppose the answer is that if it has been properly marketed, and it hasn't sold, then it is probably overpriced, but even if the price is lowered, it still may not sell. One last illustration to explore this dilemma... Three comparable houses on your street sell for $245k, $250k and $255k. You assume your house is worth $250k, and put it on the market for $245k to be aggressive. It doesn't sell after four months, so we assume it is overpriced -- even though recent sales would not suggest that. After another four months at $235k, it still hasn't sold. Is it overpriced? I suppose the market would say yes, even though recent comparable sales still do not agree. If, after another four months at $215k it has still not sold, do we STILL say it is overpriced??? | |

What Do You Mean I Did Well? I Brought Thousands Of Dollars To Closing! |

|

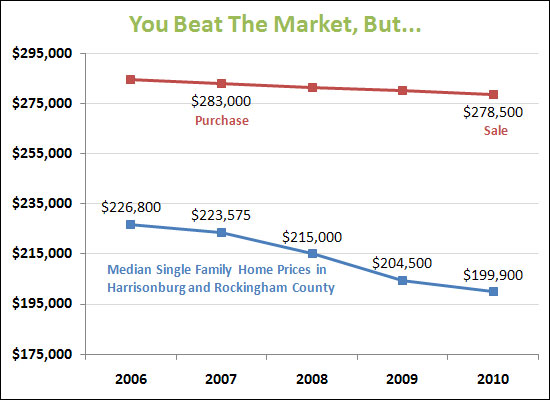

In these crazy times, it's possible to "beat the market" and yet still be hurting financially...  The blue line above shows the trend in single family home prices over the past five years in Harrisonburg and Rockingham County. As you can see, prices have declined, though only a total of 12% over the past five years. The red line shows the purchase and sale of a single home in Harrisonburg, as experienced by some of my clients. You'll note that while the red line declines, it's not by anywhere near as much as the blue line. Thus, my client's home outperformed the market --- they beat the market, and experienced a smaller decline that perhaps they should have. How exciting, right?? But no, actually, it wasn't too exciting. The heroic act of selling the house at a higher price than the market suggested would be possible was still painful. My clients had financed most of their home purchase in 2007, so they actually had to bring thousands of dollars to closing in 2010 in order for the sale to proceed. You see, it's not as simple as the purchase price minus the sales price --- you also have to factor in the closing costs on the buying side (2007) and the closing costs on the selling side (2010). So....when the market is declining, even if it is declining slowly, it can be difficult to purchase and then sell within a short time period. Thus, buyers and sellers should note that:

| |

Owner Financing In Harrisonburg & Rockingham County |

|

Can't obtain traditional financing? Perhaps the owner of the house you are purchasing can finance the purchase for you! Actually...there don't seem to be too many owner financing opportunities available. Searching our local MLS, I'm finding five properties in Harrisonburg and Rockingham County that are advertised as having owner financing opportunities....   (1) 3318 Friedens Church Road - 3 BR, 3 BA, 2700 SF, $326k (2) 216 Emerald Drive - 3 BR, 3.5 BA, 2581 SF, $199k (3) 150 Inglewood Court - 3 BR, 2 BA, 1408 SF, $178k (4) 1380 J Hunters Road - 2 BR, 2 BA, 953 SF, $57k (5) 1372 J Hunters Road - 2 BR, 1 BA, 837 SF, $47k In many (not all) cases, an owner that can provide owner financing either owns the property outright (no mortgage remains), or has a low balance on their mortgage that they can pay it off entirely. Then, with no mortgage in place, they'll expect some portion of the purchase price from you as a down payment, and the rest will be repaid over a term and on a schedule negotiated between you and the owner. Most owner financing scenarios are not 30 year arrangements, but may involve owner financing for 5 or 7 years, with a balloon payment at the end. To be more specific --- a $200k purchase might involve a $20k down payment, and then the $180k balance amortized over 30 years at 6% interest, but with a 5 year balloon. This would mean that you'd pay a monthly payment of principal and interest as if the $180k loan were stretched out over 30 years, but after 5 years you would have to pay off the entire remaining balance of the loan. Typically the balloon payoff is accomplished by refinancing the property with a traditional lender at some point prior to when the balloon payment is due. If you own a property, and are trying to sell it, and could offer owner financing --- do it! There aren't too many properties with this option readily available, so you might entice additional buyers if you can offer to finance their purchase. If you're a buyer looking for owner financing, you'll probably need to approach owners (in addition to the five above) who aren't offering owner financing, to see if they can or would consider it. | |

Types of Investment Properties In Harrisonburg |

|

Below are several general categories of investment properties in Harrisonburg that you might consider purchasing. Each has its own pros and cons. College Rentals - There are many more bedrooms than college students in Harrisonburg right now, so this is not necessarily a great choice, but it can work well given the current pricing of these properties. Hunters Ridge Condos, Hunters Ridge Townhomes and Madison Manor are your main choices in this area, and with a decent down payment, the cash flow can actually work well now that prices have dropped considerably over the past few months. New-ish Townhomes - Here you'll be aiming for graduate students or young professionals as tenants. I suggest buying a townhouse with two full bathrooms, and either two bedrooms or three bedrooms can work well. Your main choices are: Liberty Square, Liberty Square II, Beacon Hill, Avalon Woods, Harmony Heights, Wellington Park and Blakely Park, though there are some other areas to consider as well. Being new or new-ish townhomes, these are usually in good condition and relatively easy to rent. Old-ish Single-Family / Multi-Family Homes - If you don't mind tackling some maintenance on a home that is 40 to 70 years old, you might find some good opportunities in and around the downtown area where you can buy a home that could be fixed up and rented to college students, graduate students, young professionals or a family. These properties range from 2 bedroom homes that may currently be owner occupied to 5+ bedroom homes that have been rented to college students for years. Depending on your goals as an investor, each of these categories of investment properties can make more or less sense. Feel free to call (540-578-0102) or e-mail (scott@HarrisonburgHousingToday.com) if you'd like to discuss your goals, and which properties would work best for you. Read more about the numbers of investing here. | |

Harrisonburg and Rockingham County Home Sales Fall Dramatically In July 2010, But The Future Still Looks Bright (Really!) |

|

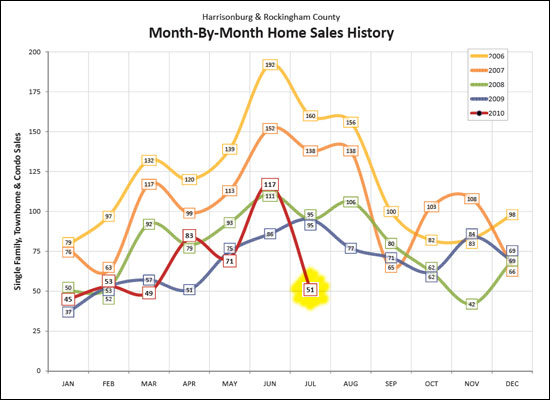

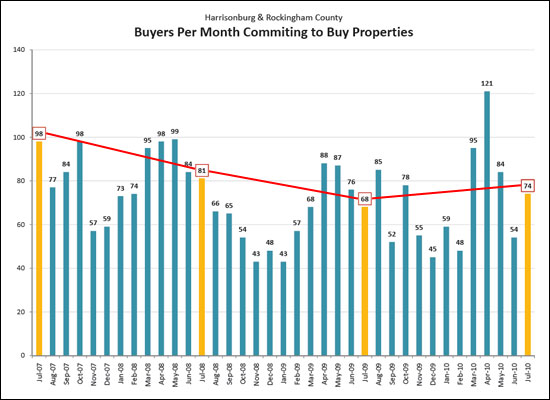

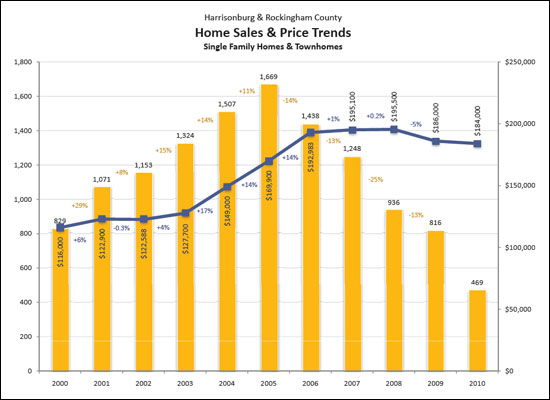

Click here for the full August 2010 Harrisonburg & Rockingham County Real Estate Market Report. If we only looked at July 2010 home sales (and ignored several other key indicators, and the bigger picture) we might get a little worried about our local housing market.  As can be seen above, there were very few home sales in July 2010. This is likely because of the original June 30th deadline for closing under the home buyer tax credit (the deadline has now been extended to September 30th). But after a very slow July, we'll probably start to see things pick back up, since contracts looked healthy in July 2010.  As can be seen above, there weren't too many buyers committing to buy properties last month, but there was a return to the contract-signing-table in July 2010. This month's buyer commitments actually exceeded last July's data, showing a reversal of the downward trend of the last several years. For another reversal, read on.  The yellow bars above show the number of home sales over the past ten years -- it is very likely that after four years of declining home sales, we might finally see an increase in 2010. Year to date, 2010 shows a 3% improvement over 2009 to date. The blue line above shows the change in median sales price over the past ten years. The median sales price declined by 5% between 2008 and 2009, but the decline appears to be much smaller this year. Learn even more about what's going on in the Harrisonburg and Rockingham County real estate market by reading the full report.  Do you have questions about this report, or about the Harrisonburg and Rockingham County real estate market? Or about your house? Or about a house you might buy? Be in touch . . . Scott Rogers | 540-578-0102 | scott@HarrisonburgHousingToday.com | |

The Five Best Deals In The Last Ten Days |

|

Over the past few weeks I have received (on behalf of my seller clients) quite a few offers that I considered to be quite low:

First, do note that of the 27 homes sold in Harrisonburg and Rockingham County over the last 10 days, on average, 5.4% was negotiated off of the list price. Now, for the houses where the buyers negotiated the highest percentage off of the list price....  4377 Hilltop Road (Massanetta Spring) - sold for 22% less than the list price  160 Wildwood Drive (Bridgewater) - sold for 15% less than the list price  253 S Sunset Drive (Broadeway) - sold for 11% less than the list price  2965 Pin Oak Drive (Belmont Estates) - sold for 10% less than the list price  545 Tabb Court (Preston Heights) - sold for 10% less than the list price So, with average negotiations of 5.4%, what do you think? Where the four offers of 10%, 15%, 16% and 20% below asking price reasonable? Perhaps negotiations have to start somewhere! | |

So, you're not having an showings on your house? What could the problem be? |

|

I talked to a local Realtor yesterday who has three listings that have been on the market for two months now, and have yet to be shown. By yet to be shown, I mean that not a single buyer has come to view the house. What is going on here? Have all of the buyers left town? There were some people who thought that after the home buyer tax credit ended, that the local real estate market would slow down to a crawl. That didn't exactly happen, as we'll see in a few days in my monthly report. So, given that properties are still selling in Harrisonburg and Rockingham County, why are some listings not seeing any showing activity at all? PRICE: It is possible that the price of the home is simply too high to motivate any buyers to come view the property. Some sellers figure "well, they can make an offer, so it's o.k. if my house is priced $10k, $20k, $40k higher than what I'd really accept." This logic doesn't work well in today's market, as buyers will often not even go to view a house if they think the asking price is too high. As a tangible example, I was talking to an agent in my office last week who had a house listed for around $225k. After a month of very few showings, they lowered it to $215k. After another month of very few showings, they lowered it to $205k. Within two weeks they had roughly 10 showings, and an offer that was successfully negotiated. (These prices have been changed slightly to keep things anonymous around here). As you can see, once the property was at a price that made sense to the buying public, they were willing to come and see the house, in droves! NO/FEW BUYERS: It is (quite) possible that there are not very many buyers in your home's price range or "product range". It is certainly obvious that if you have a house priced at $5,000,000 that there would be very few buyers, thus very few showings, thus very few offers. It is also quite possible that there are (for example) very few buyers in the $250k - $300k range who would be satisfied with only having three bedrooms and two bathrooms. If everyone looking in that price range wants four bedrooms, then you can lower your list price from $300k to $290k to $280k to $270k, etc., and you might still see very few showings and market activity. POOR MARKETING: Your property must be presented well and widely (primarily online, as that is where nearly all home buyers start their search) so that you can maximize the number of people who are even considering coming to view your home. If the photos of your home are dark, or if there are very few photos, or if the square footage calculations are inaccurate, then you probably can't expect too many showings, or offers. The good news here is that you (and/or your Realtor) can affect/fix any instances of poor marketing. You can also fix a pricing problem --- to some extent, depending on how much you owe on the house and many other aspects of your personal financial situation. The bad news is that you can't do anything to fix the problem if it is a result of very few buyers looking for what you happen to be selling. A house can be marketed wonderfully, priced very well, and may still have very few showings. Again --- if there isn't anyone looking for what you are selling, then you still won't have showings. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings