Archive for December 2010

The bigger they are (houses), the harder they fall (sales)? |

|

At the current pace of the market, it would take 21 months to sell all of the housing currently on the market in Harrisonburg and Rockingham County priced over $400,000. Wow, those expensive homes certainly are suffering, aren't they? Maybe not.....  While large homes are not always expensive, and expensive homes are not always large, the trend above might be surprising given how many expensive homes are on the market. The graph above illustrates that although the pace of all home sales has fallen quite drastically over the past three years (a 38% decline), sales of large homes (3,000+ square feet) have only declined by 19%. So, it seems that the inventory statistics don't tell us the entire story. There are a relatively similar number of buyers of large homes in the marketplace as compared to three years ago......but significantly more sellers! | |

Single Family Homes Under $200,000 in Harrisonburg and Rockingham County |

|

For those looking to buy a single family home under $200,000 in Harrisonburg or Rockingham County, here's a bit of historical context for how realistic that is today. First, you'll note that there have been fewer and fewer homes purchased for less than $200,000 over the past decade, other than a slight increase this year.  What is MUCH more interesting, however, is that the percentage of the single family home market that has been under $200,000 has been steadily rising for the past four years!  We started out the decade with 88% of homes being purchased under $200,000. At the height of the housing boom, only 39% of single family homes in Harrisonburg and Rockingham County were being sold for under $200,000. However now, we have surpassed 50% again! And today, in fact, there are 206 single family homes under $200,000 for sale in Harrisonburg and Rockingham County! Click here to use the Power Search feature on my site to search for homes for sale. | |

What do we do if the real estate market stalls out? |

|

I'm not suggesting that the real estate market has stalled out in Harrisonburg and Rockingham County, but in talking to someone in another part of the country (thanks for the insight, Laura!) we came to a realization that some markets have stalled out -- and it's not clear what will get them started again. Laura and I realized that some markets are stuck in an endless loop: Buyers can't buy because comps aren't available to support appraisals......because buyers haven't bought......but buyers can't buy because comps aren't available to support appraisals............ Some would be quick to blame lenders --- why are they holding back the market? Buyer X wants to buy a house from Seller Y, and has written a contract to do so at a particular price. Why then, is the lender denying the loan on the basis of the appraisal? Well, it's actually quite reasonable for the bank to want and need to protect their interest. If they are going to invest $250k in a mortgage on a $300k purchase, they'd want to know if the house was only worth $200k. If that were the case, they would have made a poor investment, and their collateral (the house) would not sufficiently cover their investment should the borrower stop making payments. But you can likely see why this is frustrating for buyers and sellers alike. Even though it is reasonable for a lender to want to know (via an appraisal) that a house has a particular value --- if a buyer and seller have agreed to terms, and the buyer is not overpaying for the house, why must the entire process be stopped in its tracks simply because there aren't any comps available to support an appraisal. Here is a specific (though fictional) example of what this might look like, in a subdivision in Anytown, USA: 2008 sales prices: $250k, $255k, $260k, $255k, $250k, $255k, $255k, $255k 2009 sales prices: $250k, $245k, $245k, $245k 2010 sales prices: no sales! Then, when a buyer and seller agree on a sales price of $225k in early 2011, they certainly think that everything should go quite smoothly with the transaction. But if the lender can't find any comparable sold properties in the past 6 to 12 months that support , they will likely deny the loan on the basis of the appraisal. What are the buyer and seller to do? How does a market get started again after a very slow spell, given that appraisals are required for loans to move forward, and that comparable sales are required for appraisals??? | |

It is really hard (impossible?) to compete with bank owned properties |

|

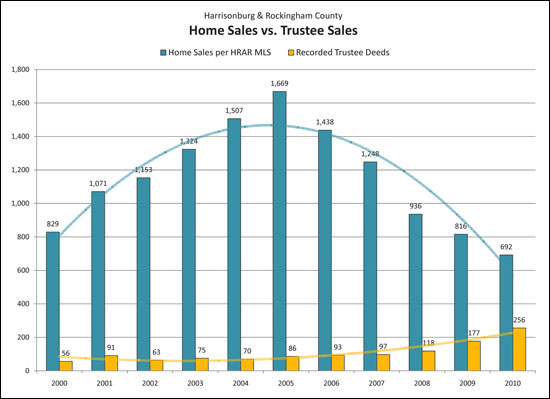

Harrisonburg and Rockingham County have seen an increasing number of trustee sales (foreclosures) over the past few years....  click the image above for a larger version of the graph The yellow bars above show the increasing number of trustee sales over the past decade, as compared to the number of sales recorded in the HRAR MLS (blue bars). I am quite thankful that we have not seen as much of a surge of foreclosures as many other areas in Virginia and across the country, but the presence of these foreclosure and then bank owned properties has had a very real impact on homeowners trying to sell in the same neighborhoods as some of these foreclosed properties. Let's take a look at an example to see the impact.... Stone Spring Village is a wonderful neighborhood of single family homes near the intersection of Port Republic Road and Peach Grove Road close to an elementary school, close to the new hospital, and close to JMU. Most homes in the neighborhood are 3 to 4 bedroom homes, most are 1,500 to 2,500 square feet, and many have basements. Until recently, home values in Stone Spring Village have been relatively stable. But three foreclosures in the past year have made the Stone Spring Village market a bit more turbulent....

Which house would you choose if the following were available?

| |

Deceived By Active Comps! |

|

Pricing a home to sell in the current market can be a challenge. Oftentimes, there aren't enough recent comparable sales with which to come to a solid conclusion about the value of a house. Another perspective from which to explore the value of a home is by putting it in the context of other homes currently listed for sale. Let's take a look at how this might work..... Comparable Home #1 - FOR SALE Priced at $235,000 / Days on Market: 45 Comparable Home #2 - FOR SALE Priced at $240,000 / Days on Market: 75 Comparable Home #3 - FOR SALE Priced at $229,000 / Days on Market: 150 Looking at the above, we might reasonably assume that we could price your home at $229,000 and be just fine with selling it in a reasonable time period. We might even get away with pricing it at $235,000. Or if we wanted a faster sale $225,000 should do the trick. But wait..........several recent experiences suggest to me that none of the conclusions stated above are reasonable assumptions....... What if we knew that none of the three homes have had any showings in the 1.5, 2.5 or 5 months that they have been on the market. Does that change things? You bet! By pricing your home in the same general range as these three comparable homes we would likely be setting ourselves up to have approximately the same number of showings that they have had............zero! Now, unfortunately, it's not always the case that we can know how many showings comparable active listings have had in the past X months. It is something, however, that we can (and should!) at least TRY to find out through conversation with the listing agents. As one additional reinforcement of this point, even if three homes had sold for $245k in the past six months, that still doesn't mean the three list prices we considered above ($225k, $229k, $235k) are reasonable. If comparably priced homes that are currently on the market are seeing absolutely no buyer interest given their pricing, then we'd be foolish to list at the same general price point and expect different results. So......how many showings do you want to see on your newly listed home? I'm assuming a few more than zero! | |

Does anyone really decide to buy a house between mid-December and mid-January? |

|

Actually, yes.... Last year, between December 15 and January 14, buyers wrote contracts on 43 homes in Harrisonburg and Rockingham County. Compare this to the past twelve months (page 6 of my most recent market report) and you'll find that seven of the twelve months didn't show too much more contract activity than was seen between last Dec 15 and Jan 14:

Thus, in the next month (+/-) we'll probably see about 1 in 20 homes go under contract. The key question here is WHICH homes it will be that sell? Perhaps those:

| |

Per CNNMoney.com, "Buying a home now is a no-brainer" |

|

The market is slow, prices have slowly declined for the past few years, and likely will for the next year --- could this still be a good time to buy? Ali Velshi from CNNMoney.com says yes. (Thanks for the tip, Sue!) Velshi's logic is that even if prices fall a bit more, that today's super low interest rates make it a terrific time to buy: "Buying a fairly priced home at today's rates may be the best deal you will ever get." I tend to agree with his logic. You see, if you're going to be in a house for the next five years, and are considering the purchase of a $250k home, you're better off to buy it today at 4.25% than to buy it a year from now at $240k with a 4.75% interest rate. Assuming a 20% down payment....

| |

Everything is worth what its purchaser will pay for it |

|

Stretch back to the 1st century BC, we find the following familiar quotes from Publilius Syrus, a Latin writer of mimes (thanks for the tip, Dave!): Stretch back to the 1st century BC, we find the following familiar quotes from Publilius Syrus, a Latin writer of mimes (thanks for the tip, Dave!):

While this may have been a prevailing theory at the time, modern day appraisal practice takes a bit of a different stance, more along the lines of "Everything is worth what someone else recently paid for something similar." For example.... if three fine homes have recently sold for $325k, $330k and $335k, we'd probably all agree that a fourth similar home is probably worth around $330k. But what if it a buyer and seller agree to a sales price of $345k? The appraisal is likely going to come back low, closer to $330k. But despite Past Buyers #1, #2 and #3 paying around $330k, if Current Buyer #4 wants to pay $345k, doesn't that mean that it some ways the house is indeed worth $345k?? | |

Is Homeownership For Everyone? |

|

Several decades ago (and earlier) home buyers would wait to purchase a home until they had at least 20% of the purchase price saved up in their bank account, and they would only buy if they were going to stay in the same home and town for many years. At the time, the percentage of homes that were owner-occupied hovered between 40% and 50% (U.S. Census Bureau). Just a few short years ago, home buyers were buying with no down payment at all (or less), even if they planned to stay in the house for only a year or two. This led to an ever increasing homeownership rate, which peaked at 69.2% of families owning their home in the early 2000's (U.S. Census Bureau). Why the sudden change of pace? And what is a buyer to do today? Many of today's first time buyers are still buying with a very small down payment, and that can be o.k. Many loan programs are available with a small down payment, such as the FHA loan program which only requires a 3.5% down payment. The risk here is that a buyer doesn't have too much built-in equity in case they need to sell sooner than they think. Purchasing a $100,000 house with a 96.5% FHA loan results in a $96,500 loan, which has only been paid down to $95,000 one year later. With such a small down payment, it can be difficult to re-sell the home in a short time frame without bringing cash to closing. As becomes evident, the down payment and the length of ownership are quite intertwined. As shown above, a small down payment with a small length of ownership can be financially difficult. A small down payment with a longer length of ownership can work just fine. Conversely, a larger down payment provides security and makes even a small length of ownership feasible. What may become clear here is that homeownership is not for everyone. Even if you're making great money when you move to Harrisonburg for a new job, if there is a strong chance you'll be leaving again in 12 months, it may not make sense to buy right away. But for those with good credit, a down payment of some sort, and a solid job that will keep you employed and in the area for the next 3, 4, 5, 6, 7 years – homeownership may be a very exciting option for you right now. With low interest rates, lots of homes on the market, and many sellers ready to negotiate, this can be a most opportune time to act. Owning a home is a passive savings account of sorts, with money accruing as you pay down the principal of your mortgage each month. Owning a home also gives you the ability to establish yourself and potentially your family in a neighborhood that may be your home for years to come. Finally, owning your home gives you the ability to invest time, energy and money into your home that will provide a future resale benefit to you – as opposed to when you paint, re-model or otherwise improve a property that you are leasing. Now being excited about buying and thus owning a home, you might look around and realize that the local real estate market isn't booming right now. Median prices have dropped a few percentages per year for the last few years. Is the local market poised for a recovery? It seems that it might be, with sales volume possibly leveling off in 2011, but no one knows for sure. Is it wise to invest in real estate when the market, and prices are down? Many think that it is wise, given that you can fix your housing costs when prices are potentially the lowest that they'll ever be, and when interest rates are potentially the lowest that they'll ever be. In many ways, your housing costs compared to what you are buying couldn't be much lower than they are right now. Buying a home isn't for everyone, but excellent housing opportunities abound for those who plan to make the Central Shenandoah Valley their home for the years to come. | |

Understanding Home Values -- When Analysis Fails Us |

|

It's easy to understand and agree upon the value of some homes, but quite difficult for some others. What is the difference? It all comes down to how easy it is to find recent comparable sales. EASY: If the home we are trying to evaluate exists within a neighborhood where all homes are relatively similar in age, square footage, architectural style, etc., it's often easy to understand the value of the home. Assuming some of these quite-similar homes have sold recently, we simply need to make minor adjustments to the sales prices of the comparable homes and we can quickly get a good feel for the value of the house. HARD: When you start to throw any unique factors into the mix, it can become quite difficult to agree upon the value of a home. For example, if the house is on a busy road, or has great views, or is on several acres, or is close to town but offers privacy -- all of these factors affect value, but it is usually difficult to find recently sold comparable homes that share all or most of these unique traits. In the HARD category above, you'll find yourself with some relatively similar comparable properties (either sold, or for sale), but with no easy way to adjust those comparable properties' values to better understand the subject property's value. In such a case, we have to do some mental not-math in our heads to come to a position on value. What I mean is this..... we can't look in a book or perform some analysis to determine the value difference between a house on two acres on Indian Trail Road versus a home on four acres on Pleasant Valley Road. Not only that, but there are likely even more unique factors in each property beyond location and lot size. Thus, we're left with consuming all of the information about all of the properties and then coming to some sort of a range of understood value for a particular property. The process I am describing above is relevant both to a seller pricing a property for sale, as well as to a buyer considering making an offer on a listed property. In both cases, there is not an obvious, clear answer to the value of a particular home. Analysis and math can only take us so far in with these unique properties! | |

How much should I be able to negotiate on price? |

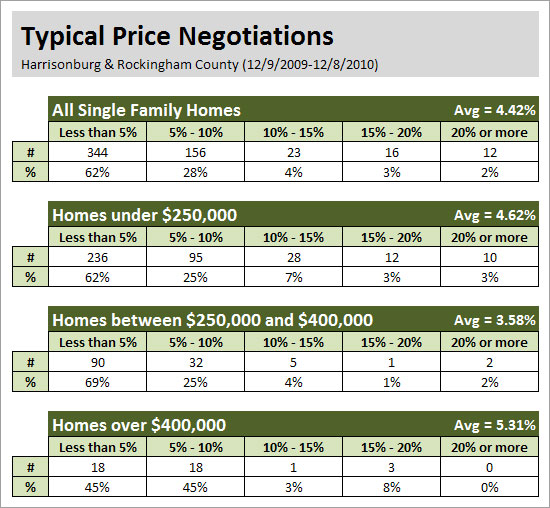

|

It is certainly a buyers market these days --- there are far more sellers in the market than buyers, so oftentimes buyers can negotiate quite effectively. Let's take a look at what the data shows us when examining all single family homes sold in Harrisonburg and Rockingham County in the past 12 months....  The first thing to point out is that sellers have (on average) accepted prices 4.42% below their asking prices. In fact, only 9% of sellers negotiated sold for 10% (or more) below their asking price. I thought the data might differ as we explored different price ranges, but the amount that sellers negotiated off of the list price didn't vary too much below $250k, between $250k and $400k versus over $400k. As helpful as this data can be, it does NOT account for several other factors:

| |

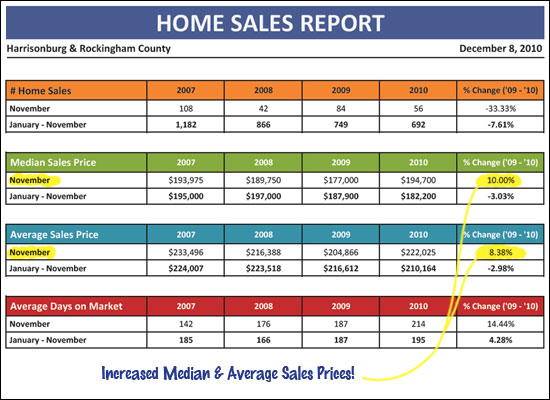

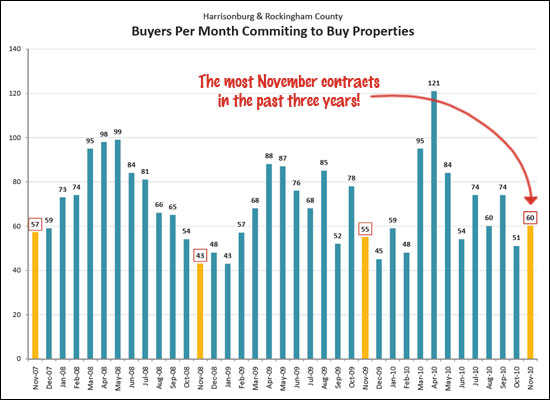

Housing Market Report: Sales Increase, Prices Increase, Contracts Increase in Harrisonburg, Rockingham County |

|

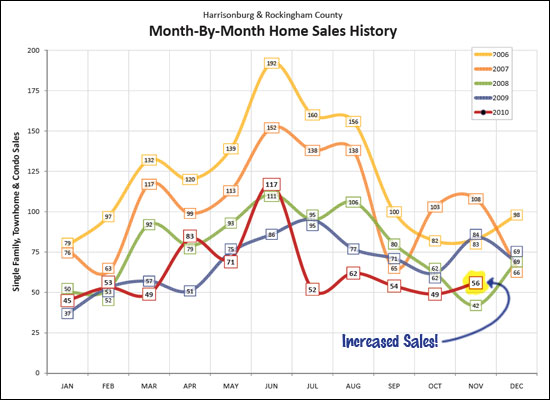

Below you will find several highlights from my December 2010 Harrisonburg and Rockingham County Real Estate Market Report, available as a PDF by clicking here. Our local real estate market still has a ways to go before recovering, but there are some positive signs this month.  First, you'll note (above) that home sales increased in November 2010 as compared to the previous month (October 2010). Sales in November were lower than in November 2009, but last November had the benefit of being the intended deadline for the home buyer tax credit -- thus lots of extra buyers closed in November.  Median sales prices and average sales prices both increased in November (10%, 8%). This, however, is likely because the median and average sales prices were much lower than normal last November as a result of so many first time buyers closing (on properties with low purchase prices) during November. Year to date figures still show a 3% year over year decline in prices.  More buyers committed to buy properties in November 2010 than we have seen in the past three Novembers! Hopefully we'll see a strong December as well.  Click the image above (or here) to review the entire December 2010 Harrisonburg and Rockingham County Real Estate Market Report. If you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

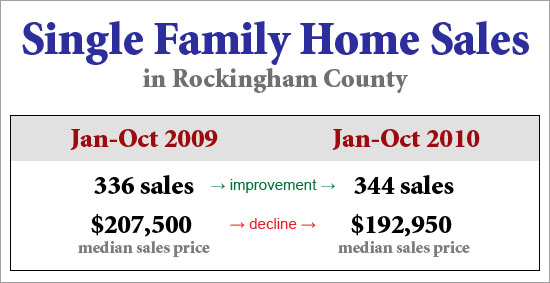

City Homes Outperform County Homes |

|

As I reported earlier this week, the single family home market in the City of Harrisonburg is improving, both in the number of homes sold, and the median price of those sold homes. There is also some good news in Rockingham County, but it's not quite as exciting.  As you'll note above, more single family homes are selling in Rockingham County this year as compared to last year. The bad news is that they are selling for less --- there has been a 7% decline in median sales prices. What does this mean if you are buying or selling a single family home in Rockingham County? SELLERS: Know they market! If prices have declined 7% over the past year, you shouldn't be basing your list price on sales prices from a year ago --- unless you are then adjusting downward. Furthermore, consider making your list price compelling today rather than potentially selling at a lower cost 6 to 12 months from now. BUYERS: Make sure that you are comfortable with what you are paying for a house --- and that you are comfortable staying in that home for several years. Median prices will likely still decline a bit further this coming year (2011) before starting to level off and increase. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings