Archive for February 2011

Preston Lake Foreclosure Finalized: Land Transfers To Wells Fargo, Homeowners Association |

|

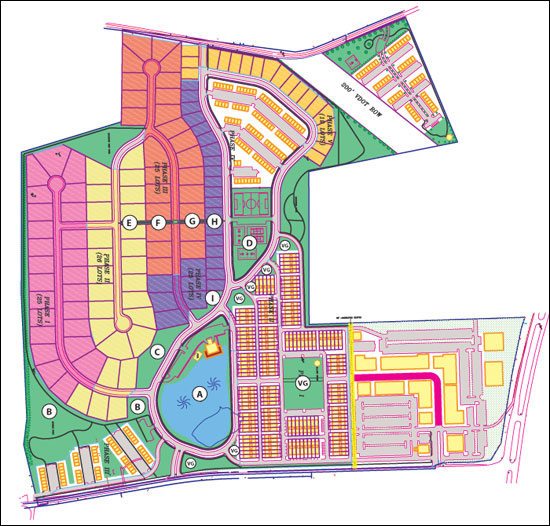

An early rendering of the intended Preston Lake community center A variety of documents were filed at the Rockingham County Circuit Court on Wednesday, February 23, 2011 finalizing the Trustee Sale of Preston Lake subdivision. In Summary: A trustee sale took place on February 3, 2011 on the steps of the Rockingham County Circuit Court, whereby Wells Fargo (as the only, and thus highest, bidder) contracted to buy back Preston Lake from its developer. Now, the deeds have been recorded transferring the bulk of the subdivision to Wells Fargo and the common areas to the Homeowners Association. The Value of 124+ Acres: The consideration paid by Wells Fargo for the 124+ acres was $3,500,000, but the trustee's deed also indicates that the appraised value is/was $4,530,000. Somewhat astonishingly, the two loans (notes) that were being foreclosed on appear to have been for a sum total of $20,500,000. The New Owner of Preston Lake: The grantee on the deed is listed as "REDUS VA HOUSING, LLC" -- an LLC registered in Deleware. The grantee's address, however, is Wells Fargo Bank out of Jacksonville, Florida. Value of the Common Areas: Per the deed transferring the common areas to the Homeowners Association, the common areas have an assessed value of $323,700.  What Conveyed To The Homeowners Association: The map above is based on an early engineering plan for Preston Lake. I have deciphered (to the best of my ability) the deed, and recorded plats for Preston Lake to mark on the map (letters in circles) the areas that conveyed the the Homeowners Association. Click on the map for a high resolution PDF, and scroll to the bottom of this post for the source files for the deed and plats. Management of the Homeowners Association: The Homeowners Association's mailing address is referenced in the deed as the same Jacksonville, Florida address for Wells Fargo. Homeowners at Preston Lake have been informed that Wells Fargo will be hiring an association management company in the very near future to handle the business of the association. What's Next: Now that the remaining land comprising Preston Lake is owned by Wells Fargo, my assumption is that:

| |

Is Homeownership Important? |

|

Buy A Home! It is the American Dream! But why, you might ask? Well, here's a bit of the historical political context for the American Dream, per the National Association of Realtors:

But despite the fact that America has prioritized homeownership for decades, and most Americans strive to own a home, it seems that structural changes might be on their way that seem likely to decrease the ability of Americans to fulfill the American Dream. As reported by WHSV earlier this week, "The Obama administration released a report to Congress last week outlining what it wants to do to reform the housing finance market. Some of the proposals include larger down payments, increased fees and possibly ending 30-year mortgages." As summaryized in the Wall Street Journal, "The Obama administration outlined on Friday its plans to begin shrinking the government's broad support of the nation's crippled mortgage market, a process that officials said could take several years and would include phasing out Fannie Mae and Freddie Mac." What would the results be? Again, confirming my hypothesis: "The cost of mortgages is probably going to go up, and homeownership is probably going to go down," said Daniel Mudd, the former chief executive of Fannie Mae who is now CEO of Fortress Investment Group. "Both of those things arguably could be a good thing." This entire train of thought leaves me with more questions than answers, but it seems that we may continue to see some significant transitions in the housing market in the next year years. Stay tuned! | |

Peer Pressure in Real Estate: If everyone else rejected this house, I probably should too, right? |

|

Yet another reason to get the list price right from the beginning --- if you start your list price too high, and languish on the market, new prospective buyers looking a a new price will still wonder why nobody has bought it to date, and will be less likely to act based on the lengthy time on the market. I can't tell you how many times (a lot) lately I have been showing a house to a buyer client and after finding out how long the house has been on the market (6 months, 8 months, 14 months, etc) they say: "so.....why hasn't this sold, given all of that time on the market?" Sometimes we can figure out why --- because the price started to high, or because they hadn't yet staged the empty house with furniture, etc., etc. That said, quite often we can't figure out any particular reason why a house hasn't sold after having been on the market for many (or many-many) months. This often leaves my buyer clients in a state of uncertainty, full of doubt and some fear. Even if they like the house (and even if they are considering pursuing it) they wonder why their home buying peers have not bought the house to date. If other reasonably intelligent home buyers have looked at the house and decided NOT to buy it, there must be a reason --- and even if my buyer client can't see that reason, they should probably follow the lead of those who had viewed the house previously --- by not buying the house --- right? Hard to say. Right now a home buyer in this state of mind can console themselves by thinking about how sellers far outnumber buyers -- thus there will always be lots of houses that haven't sold even though you REALLY think they should have. But even so, there will continue to be doubt and concern filling the room as prospective buyers realize that all of the past prospective buyers concluded that they should NOT buy the house. Again -- one good lesson to take from this as a seller is to realize that it is of utmost importance to have your home priced appropriately from the start, and to make sure your home is being marketed to the fullest extent possible --- from Day 1. | |

We won't know it's a dead end until we get there. |

|

In the past two weeks, two of my clients have apologized for taking up my time in pursuing properties that each ended up being a dead end. While I appreciated the sentiment, and I value my time, I was quick to point out that researching those possible paths was the only way to discover that they were indeed dead ends. Whether a large purchase, or a small purchase, when you are buying a home (or a building lot) it is a big decision -- financially and otherwise. Oftentimes, figuring out which house (or building lot) you want to buy requires lots of research and exploration of properties that you do not end up pursuing. It's OK! I'm happy to patiently help you explore the different options -- that's what I'm here for. Furthermore, I would much rather we spend a little bit "too much" time researching in order to make sure you are making the best possible decision than spend too little time and leave you with second thoughts after the fact. So, if you are preparing to buy a home, get ready for plenty of delightful exploration of possible properties that will only end up to be dead ends. Again it's OK --- that's the only way we'll find the perfect property for you. | |

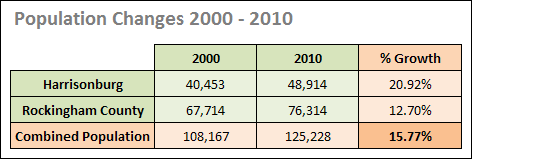

Harrisonburg and Rockingham County Population Grows 15.77% from 2000 to 2010. What does it mean for the housing market? |

|

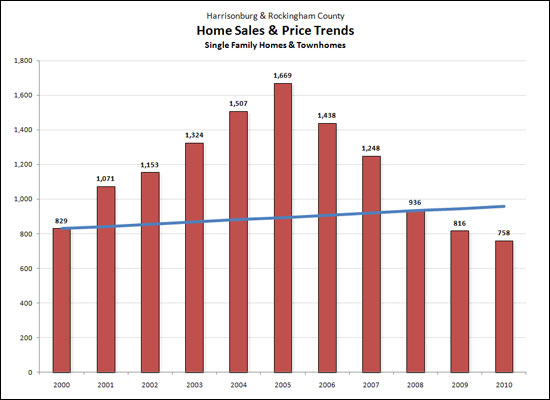

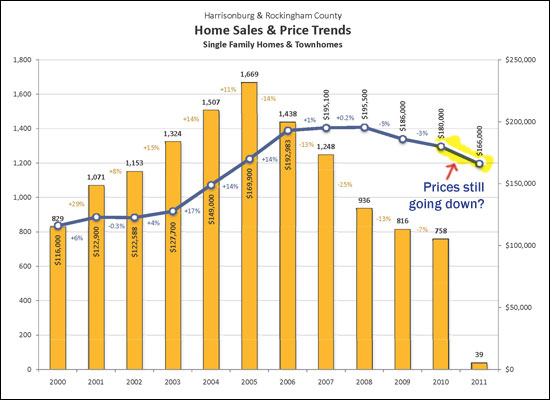

The housing market in Harrisonburg and Rockingham County was relatively normal in 2000 (as best as I understand -- since I started selling real estate in 2003). Given that the population in Harrisonburg and Rockingham County grew 15.77% between 2000 and 2010, what would have happened if real estate sales had tracked on that same path?  The red bars above show the actual pace of sales between 2000 and 2010. The blue line shows a straight line increase in sales assuming an overall sales increase of 15.77% between 2000 and 2010 to mirror the population growth. As you can see, if we assumed that the same portion of the 2000 population would buy homes in 2010, then the actual home sales last year were lower than they "should have been." My conclusion? Time will tell whether 2011 will show an equivalent (or higher) number of sales to 2010, but I believe in one to three years we will see higher total home sales in this area than we experienced last year. I don't believe the 758 home sales in 2010 should be considered the new norm. Per the 15.77% growth between 2000 and 2010, we should see, or could see, or might see, a pace of new normal home sales pace in the next few years around 960 home sales per year. | |

Sales Growth and Decline Vary Significantly By Area |

|

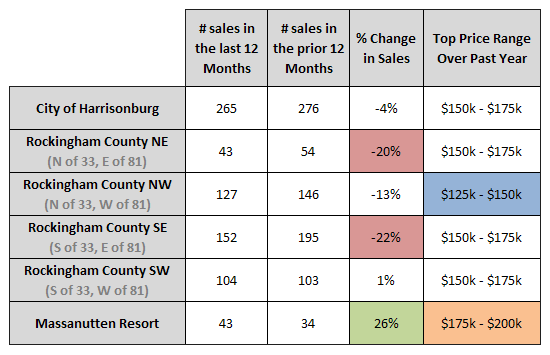

Over the past year our local real estate market has been relatively stable (only a 1% decline in single family home sales) but it turns out that the changes in market activity have varied quite significantly by location.  As you can see above, despite overall stability several areas saw continued decline in sales:

| |

Where have all the listings gone? Long time passing... |

|

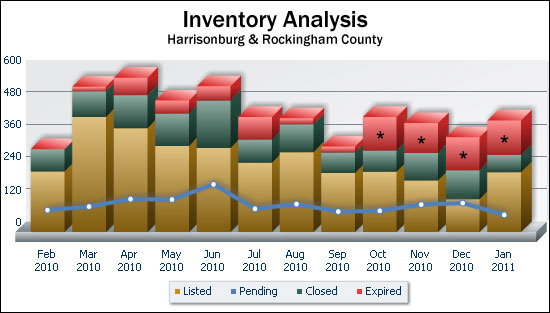

As referenced a few days ago, the inventory of listed homes in Harrisonburg and Rockingham County has dropped significantly (by 23%) over the past six months. But as Pete Seeger might ask... where have all the listings gone?  It turns out the listings expired. Take a look at the huge chunk of listings that expired during each of the past four months (Oct, Nov, Dec, Jan) -- each is a red bar with a star in it. As long as those late-2010 expired listings don't turn into early-2011 new listings, the market might stand a chance of heading towards more stability. Stay tuned! For the analytical minds amongst us, a few notes about the data:

| |

It’s Amazing How "Dumb" Smart People Can Be |

|

First --- let's be clear --- I'm not accusing smart people of sometimes being dumb. The title of this post is actually a quote from a smart person last week. She said something along the lines of "Wow, it's amazing how dumb smart people can be sometimes". I quickly translated "dumb" into "uninformed about specific topic areas" --- which she thought was a gesture of politeness, but I really think it is a fair judgment of what she was describing. Again, she's quite a bright person, but....

Bottom line -- if you only participate in something every 5 to 8 years, it's probably not reasonable to think you'll know and retain the intricacies (or even the basics) of that content area during the 5 to 8 (or more) years in between such events. If you bought a house today, you'd likely have learned during the process of doing so that you could have as little as 3.5% of the purchase price to use as a downpayment. Will you retain that information for the next 5, 8, 12 years until you buy your next home? You might, but you might also hear lots of news reports over the next three years about changing (tightening) lending requirements and then start to assume that these low downpayment programs no longer exist. If you bought a house 12 years ago and were told that you had a credit score of 800, and that it was excellent, would you remember that today (12 years later)? Or might you forget that the range is between 300 and 850? Now realizing that smart people can be dumb (uninformed) about specific topic areas, what can we conclude? Consumers should remember to not make any assumptions, and to ask questions even if they seem like they are dumb questions. Professionals (Realtors, lenders, etc.) should remember that consumers might not necessarily know the basics of what is required for a mortgage, or what good credit looks like. Have questions yourself? Don't worry, I won't think you're dumb -- I'll happily help inform you about an area of information that you probably had no need to be aware of until recently. Call anytime (540-578-0102), or send me an e-mail: scott@HarrisonburgHousingToday.com. | |

New home sales may be improving in and around Harrisonburg |

|

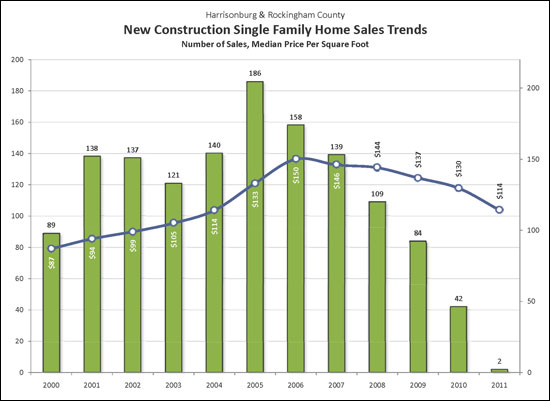

New home sales may be improving in and around Harrisonburg -- based totally on anecdotal evidence. Several of the builders I work with have seen significantly increased activity since the first of the year, and this is after several years of declining new home sales, as shown below.  It somewhat stands to reason -- as I pointed out yesterday, housing supply has been dwindling over the past six months. There was a 23% drop in listing inventory between July 2010 and January 2011, as compared to only a 5% drop during the same time period a year earlier. Fewer homes for sale leads to fewer selections for home buyers, leads some buyers to start exploring new construction homes once again. The trend over the past few years away from new homes was a matter of re-sale homes being more affordable than new homes. It was nearly impossible to build a new home at the same price that some re-sale homes were selling for in the market. Now, however, builders who have compelling products to offer, with competitive pricing, stand a chance to see a solid improvement in sales during 2011. | |

Quick, buy a house before they are all gone! |

|

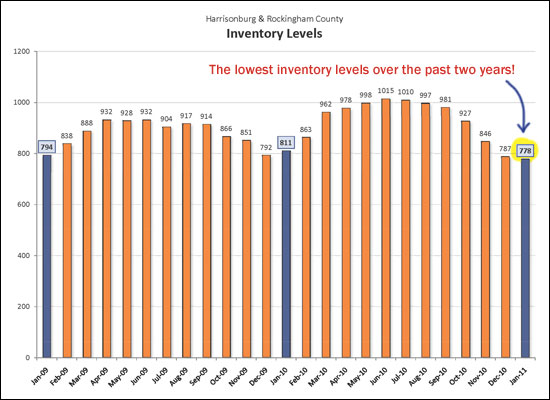

Perhaps we're not really going to run out of houses, but inventory levels are certainly dropping in Harrisonburg and Rockingham County. Two years ago (in early February 2009) there were 838 homes for sale. One year ago (in early February 2010) there were 863 homes for sale (yes, an increase). But when I published my monthly market report a week ago there were only 778 homes for sale. Furthermore, that level of 778 homes for sale is a full 23% drop in listing inventory from six months earlier (July 2010). Now wait a minute, you might object, certainly there is always a big drop between July's supply of homes and February's supply, right? Well, perhaps so, but not this significantly of a drop! If we move the clock back one year earlier, February 2010's supply of 863 homes was only 5% lower than July 2009's supply of 904 homes for sale. So what could be going on here? One prevailing theory as I talk to my clients and to other local Realtors is that have been quite a few listings over the past several years that were homeowners that wanted to sell, but didn't have to sell. Perhaps these sellers have finally given up (at least for now) as they have realized that the market isn't going to experience a dramatic turn around in the near future. Do you have other theories? Why are there fewer and fewer homes for sale? Does it seem to you that inventory levels are dropping? Are they in your neighborhood? | |

So, would it be a good time to buy a house right now? |

|

A colleague asked me this question at a meeting of the Shenandoah Valley Builders Association this evening: So, would it be a good time to buy a house right now? I responded that it would be, IF.....

But if you do meet my rough qualifiers above, now can be a fantastic time to buy, as you'll get to take advantage of:

P. S. There are plenty of other aspects of your particular scenario that could weigh your decision more or less towards buying. I'm happy to work with you to talk through that decision making process. Let me know if that would be helpful to you. You can reach me at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Mixed Signals From January Housing Market Activity in Harrisonburg and Rockingham County |

|

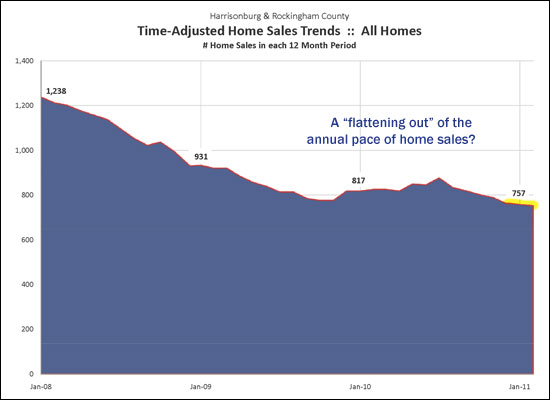

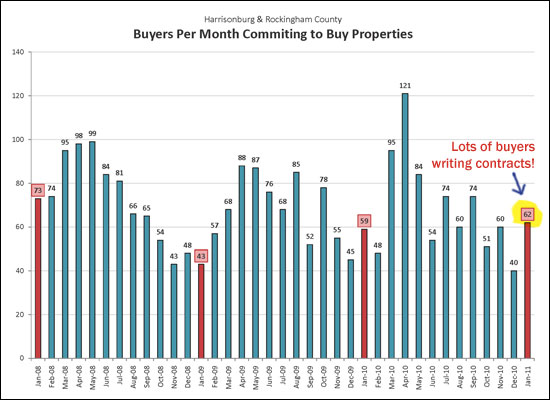

My most recent market report (excerpts below, full report here) shows a variety of mixed market indicators when examining market data through January 31, 2011:

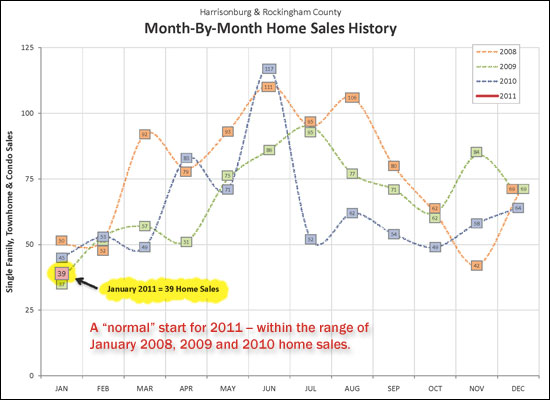

Home sales in January 2011 (39 sales) were down compared to the 45 sales in January 2010 -- but up compared to the 37 sales in January 2009. This is a relatively even start for 2011, and if the past three years are any indicator, we'll have around 50 home sales in February.  This graph shows a rolling 12 months of home sales -- and you can see that the annual pace of home sales has been declining for several years other than the temporary respite offered by the home buyer tax credit last year. The last several months, however, seem to be offering some leveling out of this indicator.  Buyers were out in full force in January 2011 -- 62 properties went under contract. This is an increase over January 2010 (59 contracts), an increase over January 2009 (43 contracts) and an increase over last month (40 contracts). This could be a strong spring market.  Perhaps due to a small sample size, the median sales price continues to decline in January 2011.  We are currently seeing the lowest inventory levels that we have seen over the past two years. This can help the market to stabilize, unless the market is flooded with listings in March and April.  Click the image above (or here) to read the full report. If you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

There must be some good deals out there -- we've seen a LOT of price reductions lately! |

|

When I log into our MLS (multiple listing service) I see a variety of early indicators about the present state of the market. I'm confronted with information about the number of new listings, the number of sold listings, the number of price changes, etc. These numbers usually don't vary too much during the course of a month --- other than on weekends, when the numbers dip, and on Mondays when they generally rise. The "price change" statistic, however, has been quite astounding of late. For example --- in the past 30 days there have been 235 price changes on properties in our local MLS (Harrisonburg-Rockingham Association of Realtors). All of these properties aren't in Harrisonburg and Rockingham County, but I think it becomes pretty evident that there are a lot of motivated sellers out there, showing that they are ready to sell by lowering their list prices. Perhaps an equally disturbing statistic that also faces me when I log in is the number of new listings versus the number of sales. In the past 30 days there have been 68 sales, and a whopping 226 new listings. This includes all areas and all property types, but regardless, that's an imbalance I don't like to see. Oh, and yes, the graphic above is illustrating an actual sales pitch I received by e-mail this past week. A currently listed property will have a $2,000 price reduction each week --- presumably until it sells! | |

To hire a custom builder, or to buy a re-sale home --- it's a tough question these days! |

|

The abundance and low prices of re-sale homes can cause great frustration for custom home builders these days. Over the past few months I have had lengthy conversations with several clients who want to build a new home.....but then they get sidetracked by re-sale homes. They start out, you see, quite focused on buying a lot, selecting and designing floor plans, hiring a builder, and building their dream home ---- but WAIT! Just before they tip the first domino, they take a look online at a few re-sale homes and they start to second guess themselves. They're about to build a $400,000 home, and they think they see comparable re-sale homes (that are only a few years old) for only $350,000. Or they're about to build a $475,000 house, and there seem to be quite a few comparable $430,000 homes that are only a few years old. My universal answer to this angst is to suggest that we spend some time viewing the re-sale homes. I suggest to them that looking at the re-sale homes will DEFINITELY give them their answer. They'll either confirm their decision to hire a custom builder --- or they'll fall in love with a re-sale home and move forward in that direction. You'd think, with the price gaps we're discussing, that these clients would often end up buying a re-sale home --- but that's not usually what happens. While there are some compelling re-sale houses for sale, they almost always determine that they'd rather pay more to have a house exactly how they want it. Sometimes this is the floor plan, sometimes the neighborhood, or the lot size or topography, or the exterior materials of the home, or the interior finishes, or the level of maintenance needed into the future, or the views.......or a combination of many of these. Sometimes this process will result in one of my clients deciding to buy a re-sale (instead of hiring a custom builder), but it almost always is a process that helps to confirm their decision to move forward with a custom build. If you're in this situation --- ready to build, but full of self-doubt when examining the re-sale market --- please be in touch. I'd be happy to help you explore the re-sale market to either confirm or derail your current plans. | |

What are your predictions for the local real estate market in 2011? |

|

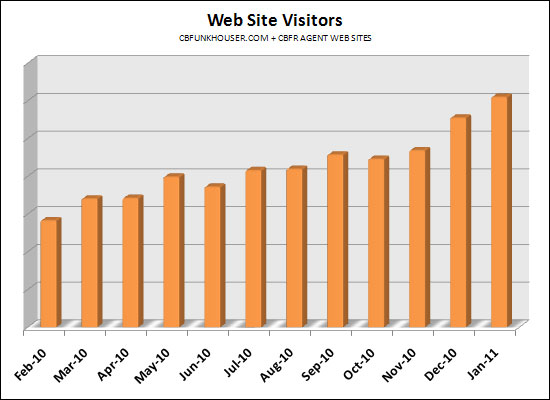

What do you think? Will the real estate market be getting better in Harrisonburg and Rockingham County during 2011? Could it get any worse? One of my predictions can be found here. One (of many) indicators that I monitor is how many people are using our company web site and agent web sites.  The meaning of this data is not immediately clear to me --- because there is a near constant increase in web site usage over the past twelve months. I expected to see much more seasonal variation in this metric. Web traffic did dip down slightly in October 2010, which would make sense if more people were looking for properties during the summer months. The big shock, however, is that buyers seem to be out (online at these web sites) in large numbers right now. Even if these interested buyers aren't all turning into active buyers, it is exciting to see that there has been so much activity in December and January. So.....what are your predictions for the local housing market in 2011? | |

Preston Lake Foreclosure Auction Results In $3.5M Sale To Wells Fargo |

|

The Preston Lake Trustee Sale took place today (February 3, 2011) at noon, and drew quite a crowd of Preston Lake homeowners, developers, attorneys, Realtors, and neighboring landowners. Here's an overview of where things stand.... Local History in the Making: It's not necessarily the good type of history, but this was the first major subdivision --- and hopefully the last --- to be foreclosed on in the Harrisonburg area. Many other areas across the country have seen multiple large subdivisions be foreclosed on, but until today, Harrisonburg had been unscathed. The timing of the development of this subdivision is likely what led us to today's events, as the development began just as the housing market began to slow dramatically. Only One Registered Bidder: Only one individual registered as a potential bidder at the sale (by showing his deposit check to the Trustee, and providing his name), though he did bid during the auction, likely because of the opening bids from Wells Fargo. Only One Actual Bidder: There was only one actual bidder....Wells Fargo. Surprise Rowhouse Auctions: In addition to the 120+ acres of land at Preston Lake that were auctioned off today, four rowhouses were also auctioned separately. This was not specifically advertised -- if it had been, I think we would have seen some actual bidding take place. Each of these rowhouses are at a different stage of completion, but each at least has the shell completed. The opening bids from Wells Fargo were as follows, and these are the prices at which they are taking back the properties:

The Common Areas: The attorney representing Wells Fargo also indicated that the common areas would be deeded to the Property Owners Association. The Association will still exist, and owners will still make payments to it to support the maintenance of the common areas and other common amenities of the neighborhood. What Happens Next: In theory, within 30 days, Wells Fargo will close on their purchase of the four individual rowhouses, and the 120+ acres of Preston Lake. The attorney representing Wells Fargo commented to me afterward that he thinks there is a 90% chance that the sale will proceed to closing and that Wells Fargo will be the new owner. After Wells Fargo owns the property, he indicated that they would sell the four rowhouses individually, and seek to sell the remaining 120+ acres to a new developer. It is unclear what price they will ask for the remainder of the subdivision (likely lower than $3.5M), and it is unclear what price they will eventually take for the remainder of the subdivision (likely lower than $3.5M). Wells Fargo's attorney also indicated that while they will attempt to sell the entire undeveloped section of Preston Lake as a whole to one developer, it is also possible that they would sell the property as individual lots or sections of lots. Wells Fargo has done this with other subdivisions around the country that they have foreclosed on, though it is not their goal. Wells Fargo is interested in money: This should come as no surprise, but Wells Fargo's goal in being the new owner of the undeveloped areas of Preston Lake are to try to recoup as much as possible of the money that they have invested in the subdivision. They won't, thus, try to unload the property for development into a mobile home park -- they will be marketing it and working to sell it for its highest and best use. This does not mean that the development plan won't or can't change -- but they will be trying to recoup as much money as possible, and thus will be trying to sell it to a developer who has the a positive (and profitable) vision for it. Those Pesky Lawsuits: The developer of Preston Lake (Richard Hine) had filed a lawsuit against Wachovia (now Wells Fargo) --- and Wachovia had responded with a countersuit. Per the attorney representing Wells Fargo, both of those lawsuits will go away once the sale closes, and the property is taken back by Wells Fargo. A Community United: If anything, the turmoil and uncertainty over the future of Preston Lake seems to have drawn its residents closer together as a community. Most of the owners were in attendance at the sale, and then went as a group to Cally's afterward to have lunch. There seems to be solidarity and general optimism (as much as is possible) amongst most (or all) of the owners. They still seem to thoroughly enjoy their homes, and each other, which is a positive sign for the future of the community. Have Questions? If you have questions about Preston Lake or the foreclosure proceedings, I'm happy to try to answer them (540-578-0102, scott@HarrisonburgHousingToday.com), or you can contact Peter Barrett of Kutak Rock, LLP, who is the attorney representing Wells Fargo. You can reach Mr. Barrett at 804-343-5237 or peter.barrett@kutackrock.com. | |

Eliminating Distractions and Objections |

|

Preparing your home to go on the market can be challenging (and tiring), and often sellers-to-be need a second (or third) set of eyes to provide suggestions about where to focus their time and energy. There are many different theories about how to best prepare your home to be on the market and viewed by buyers --- and ways of expressing those theories.

Distractions are the things that keep a prospective buyer from focusing on your house. That might be knick knacks, or family photos, or refrigerator magnets, or an overflowing pantry, or fascinating artwork, or an abundance of indoor plants, or a strange odor, or brightly colored wall hangings. Whatever it is --- if a buyer is focusing on one (or more) of these items, they're not focusing on your house. They're reading all of the Far Side comics on the fridge instead of marveling at the granite countertops, tile backsplash, recessed lighting, and stainless steel appliances. They're amazed at how you fit 234 board games into the coat closet instead of taking in the quality workmanship of the trim detail in the foyer, and the mountain views out the picture window in the family room. As you prepare your home to go on the market, close your eyes for a few moments when standing at the entrance to each main living area. Then, open your eyes, and take note of where your eyes are immediately drawn. Or, walk slowly through the space (or ask a friend to help) seeing where your eyes (and your mind) linger. Objections are those correctable physical characteristics of your home that give a buyer a reason to mark your home off their list, or to move it down a notch in their preferences. Perhaps it is that the vinyl siding needs to be power washed, or that three bi-fold closet doors need to be adjusted, or that there is poor lighting in the kitchen, or that the deck needs staining. There are oftentimes small home maintenance items that should be attended to before putting your home on the market. There are two potential dangers of having these items unresolved --- first, a buyer might become too overwhelmed by the work that they need to do to the home once they move in, and second, a buyer might extrapolate from what they can see to imagine what they cannot. A classic example of this is the dirty furnace filter that makes a buyer assume that the HVAC system has never been serviced, is in a terrible state of disrepair, and will need to be replaced immediately. As you're preparing your house to go on the market, I'm happy to provide you with another set of eyes and to give you some new perspectives on how to best prepare your home to be shown to buyers. When you're ready, just give me a call (540-578-0102) or send me an e-mail (scott@HarrisonburgHousingToday.com). Also, don't fret about having your home in perfect "show condition" before you call me --- I'm happy to give you some guidance and feedback while you're still in the process of preparing your home to go on the market. | |

Owners of Rental Property in Harrisonburg: Get ready for more IRS paperwork! |

|

Thanks to one of my clients, who pointed this new regulation out to me.... If you own rental property, you must now submit a 1099 form to the IRS and to service providers if you pay $600 or more for the provided service -- such as to a plumber, carpenter, painter, landscaper, etc. Apparently, the basis for this requirement is to make sure that contractors are not hiding their income. Requiring that this information from rental property owners will (potentially) reveal more income that should be taxed. This goes into effect for 2011 rental property income and expenses, so start keeping detailed records, if you're not already. Do you love legislation and taxation? Read more about the Small Business Jobs Act of 2010, which enacts this new requirement. | |

Will a $20,000 kitchen remodel lead to a $20,000 increase in home value? |

|

As I show my buyer clients properties, we'll often discuss improvements that they might choose to make if they buy the house we are touring. It's always a good idea to consider what projects you will undertake after purchasing a home, as the cost of those improvements (whether small or large) need to be factored in as you consider the overall financial move you are making. A common question, or area, that I explore with my clients is the potential return on dollars that they might invest in those projects. If they spend $20k on a kitchen remodel, will they increase the home's value by $20k? If they spend $8,000 adding a composite deck system, will they increase their home's value by $8k? Before starting to look into the data, I assumed that most of these projects would likely return all, or most of the cost of the investment. That is not the case. Remodeling Magazine recently released their annual report showing how the cost of these improvements affects the home's value, where the conduct extensive research to answer the questions posed above. Surprisingly (to me), nearly every project only has a partial return on the investment.

View the entire 2010-2011 Remodeling Magazine Cost vs Value Report by clicking here. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings