Archive for May 2011

What matters most to you? The national real estate market? Or the local real estate market? |

|

Here is the national news from Saturday's Daily News Record....  And here is some local news from three weeks ago....  Quite a difference in the national story and the local story. It's a shame that the top story ran in the Daily News Record, as it likely makes readers in this area assume that our local real estate market is performing terribly. | |

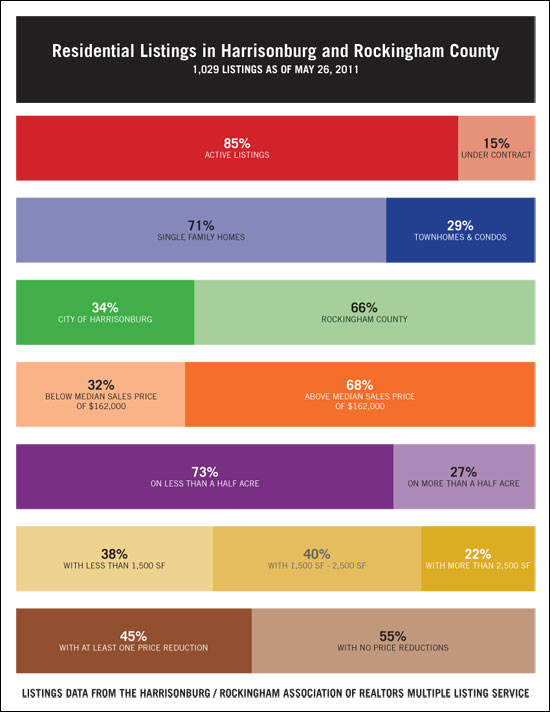

An analysis of current residential listing inventory |

|

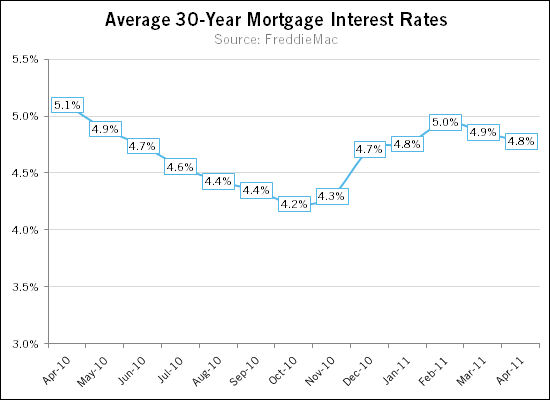

Mortgage interest rates continue to decline in April 2011 |

|

After interest rates climbed nearly a full percentage point (4.2% to 5.0%) between October 2010 and February 2011, they have started to decline again over the past several months. April 2011 marks the second straight decline down to the current average of 4.8%. Please note that you may be able to obtain an even lower interest rate than the average rates shown above depending on your credit score and other details of your finances and home purchase. Current rates offered via WellsFargo.com include:

| |

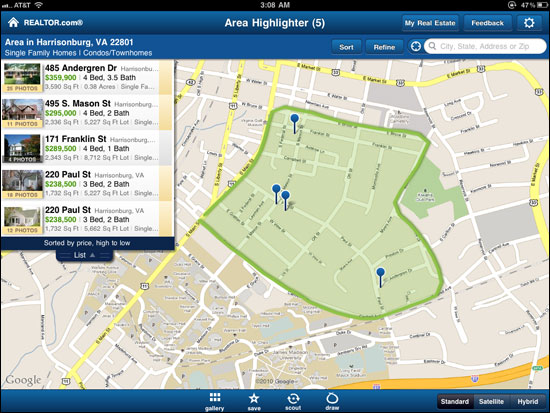

Do you have an iPad, iPhone, Android, or Windows Phone? |

|

My iPad is one of my favorite real estate tools, allowing me to pull up a tremendous amount of helpful information right when I am at a house with a client. One app that is particularly helpful to me (that might also be of interest to you) is the Realtor.com iPad app, though Realtor.com offers helpful apps on the iPad, iPhone, Android and Windows Phone. Here is a screenshot from the Realtor.com iPad app....  (click the image for a larger view) One of the brand new features of this app is that you can easily draw an search selection around an area where you are interested in buying to see homes for sale. All of this can be achieved right out in the field when driving around from neighborhood to neighborhood. If you love real estate, and love your phone, check out the apps from Realtor.com! | |

This it it folks, 2011 is (finally) going to be the year the local real estate market starts to improve! |

|

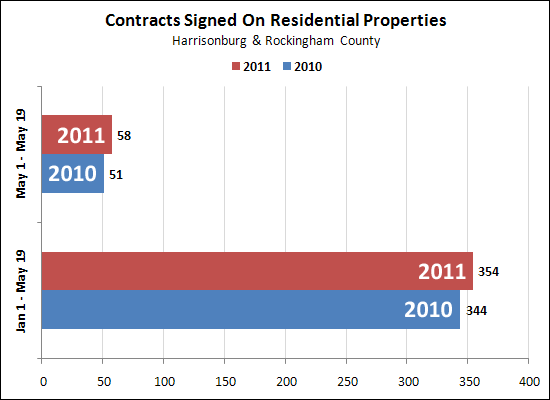

With 149 days under our belts, I'm going to go ahead and make the bold prediction.....which is (barely) supported by hard facts and market data......  Above (at the top) you're looking at the number of contracts signed during the first 19 days of May. You can see that May 2011 has been a stronger month of contracts than May 2010. The bottom half of the chart shows that overall 2011 contracts (year to date) also exceed contracts from 2010. This is despite a large number of tax credit buyers who wrote contracts in the first four months of 2010. After five years of declining numbers of buyers in the Harrisonburg and Rockingham County market, I am predicting that this (finally) will be the year when we start to see the pace of market activity (number of sales) finally start to increase again. | |

Do you own (and live in) a townhouse in the City of Harrisonburg? |

|

Do you like playing Monopoly? If you bought a townhouse between 2000 and 2005 in the City of Harrisonburg (perhaps in Liberty Square, Beacon Hill, Avalon Woods or Harmony Heights) I would encourage you to check with a lender to see if you can buy a second townhouse. I have many clients who bought two-level townhomes between 2000 and 2005 and bought them for anywhere between $100K and $125K. As a result, their mortgage payments are somewhere in the neighborhood of $700/month including principal, interest, taxes, insurance, and homeowners association dues. ($115K purchase price, 100% financing at 4.5% over 30 years) That townhouse can very likely be rented in the current market for $850/month to $900/month. There continue to be isolated opportunities to buy re-sale townhouses in these same neighborhoods for around $125K to $140K. The new mortgage payment could thus be around $800/month including principal, interest, taxes, insurance, and homeowners association dues. ($135K purchase price, 96.5% financing at 4.75% over 30 years) Monthly cash flow now: Mortgage payment (etc) = -$700 Total cost = $700/month Monthly cash flow after acquiring a second townhouse: Mortgage payment (etc) on 1st townhouse = -$700 Rental income from 1st townhouse = +$850 Mortgage payment (etc) on 2nd townhouse = -$800 Total cost = $650/month You'll actually lower your monthly costs by $50 by acquiring a second townhouse. Furthermore your tenant will be paying off your first mortgage for you, and you will own approximately $270K of real estate instead of only $135K. So, what do you say? Are you ready to invest? | |

Home values usually go up over the long term |

|

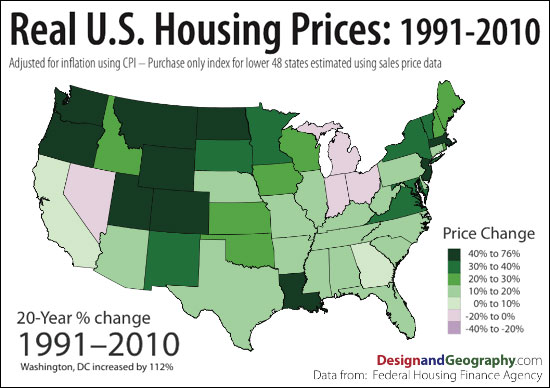

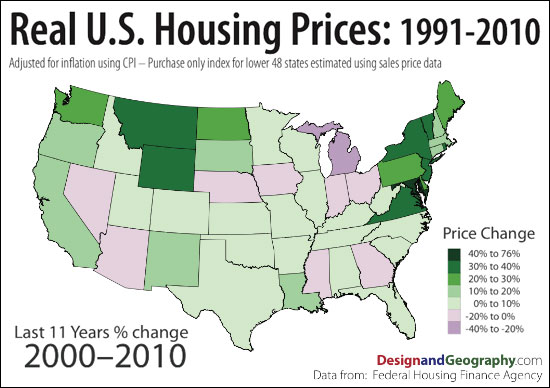

The fine folks over at Visualizing Economics have assembled another visual look at the housing market over the past two decades.  As can be seen above, nearly every state in the country witnessed an increase in home values over a twenty year horizon. Virginia fared particularly well, with a 30% - 40% increase over the twenty years.  The second map (above) shows the changes in home values over the past 11 years. Quite a few states here saw a decline (purple) in home values, but Virginia still showed a 30% - 40% increase! | |

Sales of building lots in Harrisonburg, Rockingham County appear to have stabilized |

|

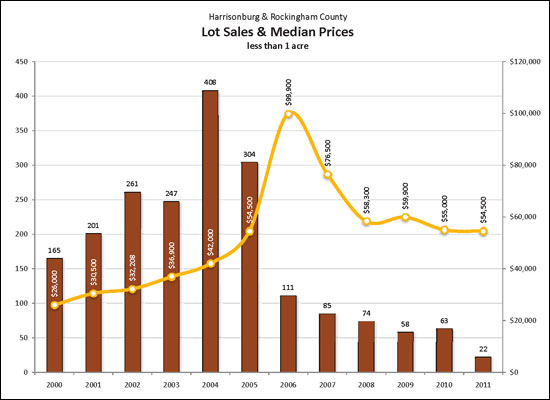

Click on the image for a larger version The median sales price of building lots (less than an acre) skyrocketed in 2005 and 2006 up to a peak of $99,900. But alas, these elevated values did not stick -- they fell just as quickly back down to $58,300 just two years later in 2008. After several years now in the mid $50K's, it seems (relatively) safe to say that the value of building lots has stabilized at a median of around $55,000. Lot sales also seem to have stabilized because the decline in the annual number of lot sales has ceased. There were more lot sales in 2010 than in 2009, and we seem to be poised to have another increase in 2011. The good news (perhaps?) is that this is still an overall increase above where values were before the rapid 2005/2006 escalation. In 2004, the median sales price of such building lots was $42,000, which makes today's median value of $55,000 a reasonable place to be given long term gradual increases in values. | |

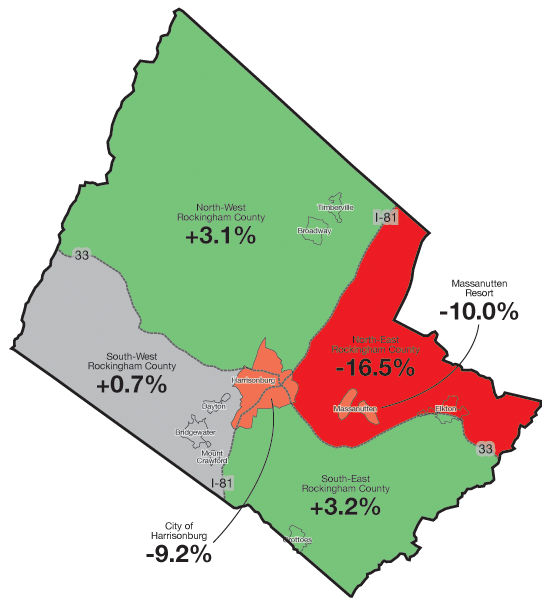

Where (in Rockingham County) are home values increasing? |

|

Each area of Rockingham County has performed a bit differently over the past year. Some areas have seen an increase in median sales price, and some have seen a decrease.  As you can see above (and below) South-East and North-West Rockingham County performed the best when comparing the median sales price from the last 12 months with the prior 12 months.  | |

Is there a correlation between selling prices and assessed values in Rockingham County? |

|||||||||||||||||||

Someone asked me this question via the chat feature on my web site a few days ago....and it's a good question: What are homes selling at in Rockingham County in comparison to tax assessed value on the property. For example if home is assessed at 200,000, what would the list price be? It's a bit difficult to answer that question specifically, because I can't easily search for properties that are assessed for (or close to) $200K and then limit it to those that have sold recently. So let's reverse it. Below are five homes that have sold in the first 4.5 months of this year between $195K and $200K in Rockingham County.

So, we can conclude several (not necessarily helpful) things from this analysis:

| |||||||||||||||||||

Founders Way Condos are APPROVED for FHA financing! |

|

Buying a condo at Founders Way couldn't be any easier!  As of this week, Founders Way Condos are approved for FHA financing. These spacious condos have wonderfully open floor plans with 2 or 3 bedrooms, and start at only $149K. Buyers at Founders Way are often attracted to:

Find out more about Founders Way:

| |

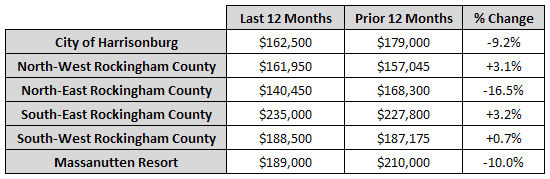

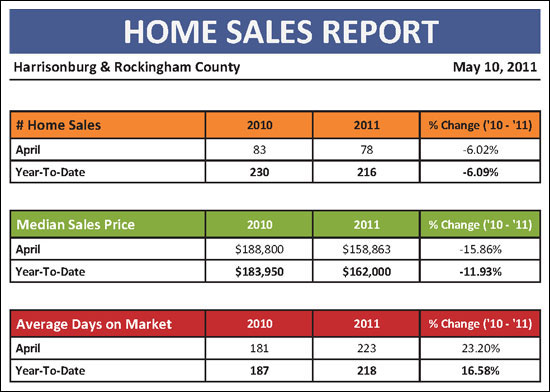

Strong Sales, Stronger Contracts, Fewer Homes For Sale |

|

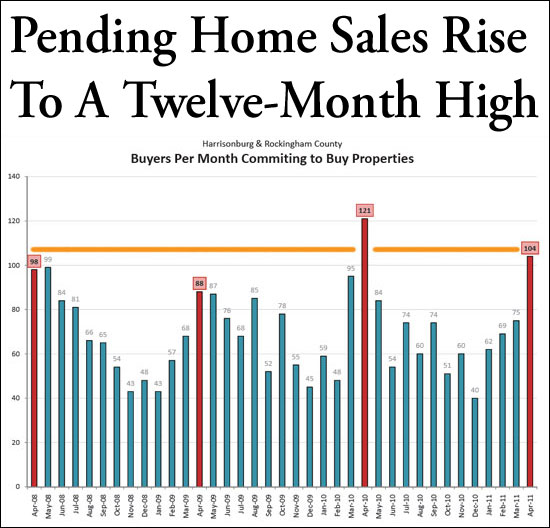

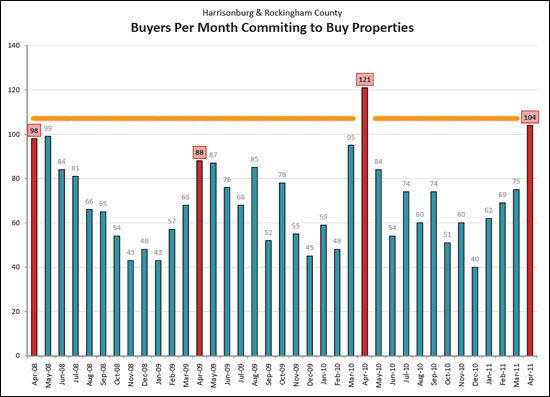

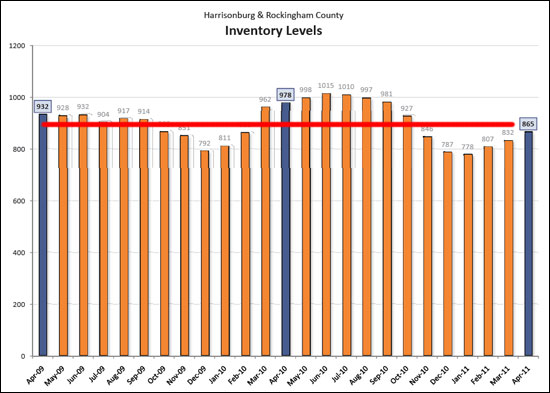

Taking a look at the first four months of 2011, there are some signs of good news in our local market.....and certainly still some indicators that are not quite as positive. Click here to download the full Harrisonburg & Rockingham County Real Estate Market Report as a PDF, or read on for some highlights....  As seen above, year-to-date sales are only down 6% -- though median prices are down 12% as compared to a year ago.  Home sales have been going strong through March and April (the red line above), after a slow start in January and February. Hopefully we will continue to see a sales trajectory that will exceed May 2010, and perhaps come close to June 2010.  Buyers were QUITE active in April 2011 --- the number of contracts written (104) was the highest month of contracts in the past three years with the exception of last April. This bodes well for strong sales numbers in May and June!  Even better news is that while buyer activity is increasing, seller activity isn't getting too out of hand. We have significantly lower numbers of listings this spring as compared to the past two springs. Our real estate market still has a long way to go before it is stable -- but April 2011 market activity seems to indicate that we are headed in that direction. For more reading, Click here to download the full Harrisonburg & Rockingham County Real Estate Market Report as a PDF. As always, if you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

How much do banks typically negotiate in selling a bank owned property? |

|

Buyers can often find great opportunities in bank owned properties, but they often wonder how much they should expect to be able to negotiate off of the list price of a bank owned property. Let's take a look.... For all residential sales in Harrisonburg and Rockingham County in the past year, we find:

I suppose the important thing to remember is that the list-to-sell ratio of any property is largely dependent on how realistic the asking price is. Both a homeowner and a bank can price a home too high when putting it on the market. Perhaps banks do that less often, and thus achieve a (slightly) higher list-to-sell ratio despite still offering great deals on properties? Additional Relevant Information:

| |

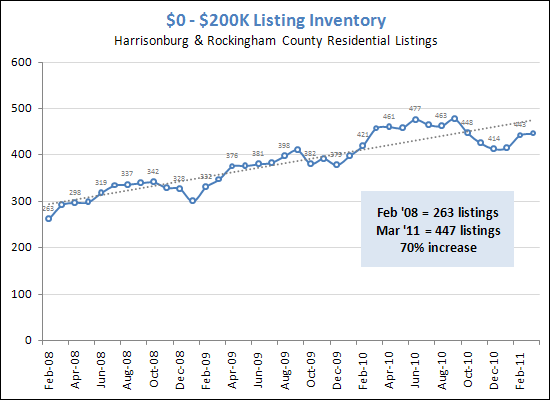

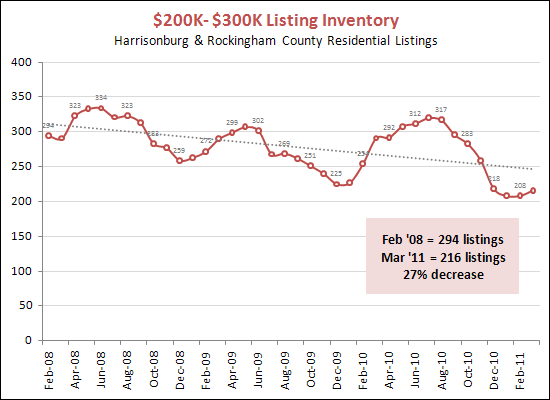

Buying options under $200K keep increasing, but otherwise, your options are vanishing |

|

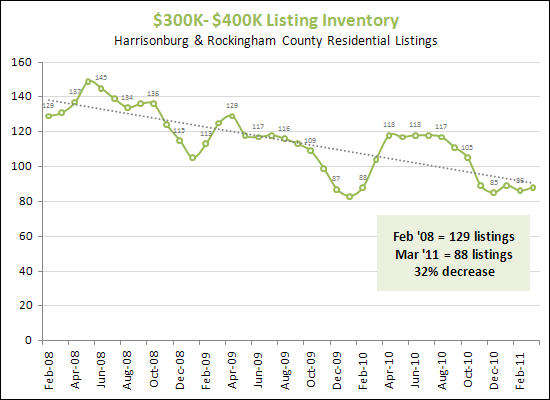

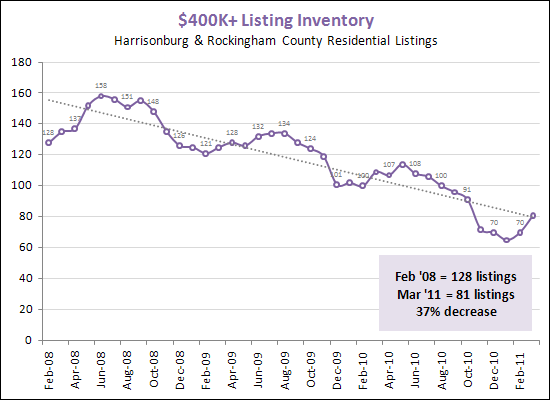

I often hear that there are too many homes for sale (sellers tell me this) and that there aren't nearly enough homes on the market (buyers tell me this). Let's examine how inventory levels have changed over the past several years.....  It may be a result of an overall decline in median sales prices (home values), but whatever the reason, the number of options under $200K keeps increasing. Three years ago, you would only have had 263 homes to choose from in Harrisonburg and Rockingham County -- but that has now ballooned to 447 listings.  Listing inventory between $200K and $300K has gradually declined over the past several years, though it did surge upwards in the spring and summer of 2010. We may again see a surge as homeowners prepare to list their homes for the summer 2011 buying season.  The decline in $300K to $400K listings has been a bit faster than in the $200K to $300K range (32% versus 27%).  Housing options over $400K have drastically declined over the past several years, with an overall 37% decline. This is likely an appropriate decline relative to the overall decline in the number of buyers in the market. Whatever the price range, we will likely start to see a surge in homes listed for sale as we continue through spring and summer of 2011. Hopefully we will not reach past seasonal peaks of 1,000+ homes as we did in mid-2010. | |

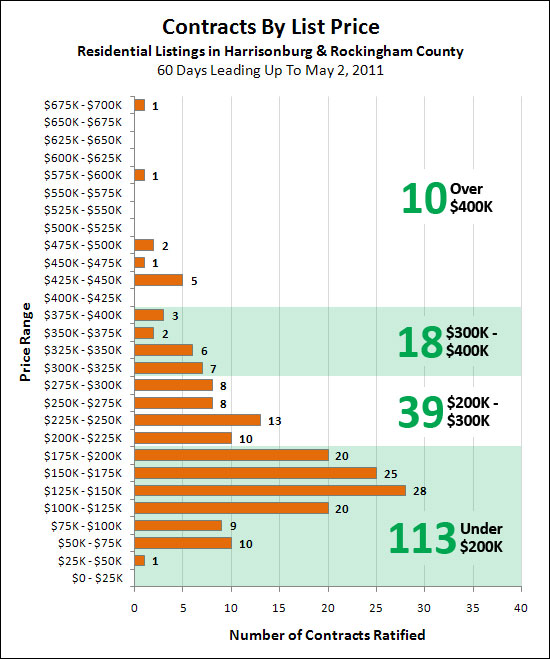

Buyers are writing offers in droves |

|

April 2011 was a busy month of contracts, with 105 contracts inked on properties in Harrisonburg and Rockingham County. Having surpassed 100 contracts, we'll call that droves of buyers....  But what, you might ask, did these buyers actually contract to buy? Let's expand our search a bit and look at the price range of homes that have gone under contract in the past 60 days....  As you can see, houses priced under $200K are still HOT! To put this in perspective.... Active listings under $200K: 435 26% of active inventory may go under contract in the next 60 days Active listings between $200K and $300K: 224 17% of active inventory may go under contract in the next 60 days Active listings between $300K and $400K: 97 19% of active inventory may go under contract in the next 60 days Active listings over $400K: 83 12% of active inventory may go under contract in the next 60 days When compared to the active listing inventory, the under $200K and $300K to $400K price ranges are performing the best at this time. | |

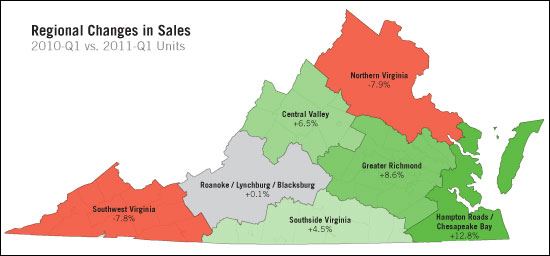

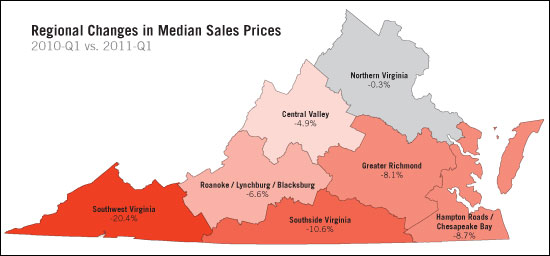

The Central Valley fares well in home sales, and better than most in home prices |

|

The Virginia Association of Realtors just published their first quarter home sales report (available here as a 6.65MB PDF). Let's take a look at how Harrisonburg and Rockingham County (encompassed in the "Central Valley" region) are doing.....  As you can see above, the Central Valley had a 6.5% increase in home sales in 2011-Q1 as compared to 2010-Q1. While we haven't yet seen such an increase in Harrisonburg and Rockingham County, it is a positive sign that our region is performing well overall.  Above you will note that the median sales price declined in every region of the state during 2011-Q1, as compared to 2010-Q1. After Northern Virginia's negligible decrease (-0.3%) the best performing region was the Central Valley, which includes Harrisonburg and Rockingham County, with only a 4.9% decline. See a few more explanations of VAR's First Quarter Home Sales Report here, or download the full PDF of the report here. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings