Archive for July 2011

New study finds correlation between local real estate market and weather conditions! |

|

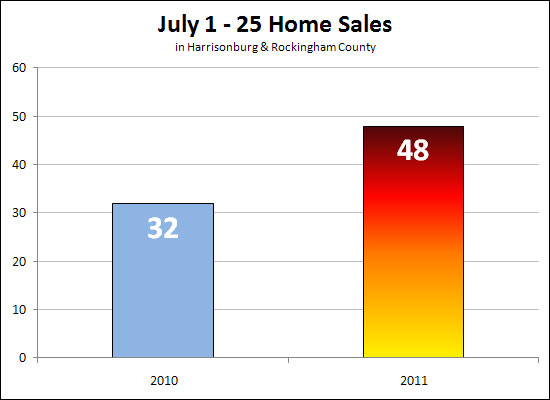

OK, so admittedly it is a bit cooler this week --- but last week was HOT, with temperatures soaring up to (and over) 100 degrees! Likewise, the local real estate market has been HOT this month....  Yes, that is a 50% increase in home sales between last July and this July!  Contracts are also up, 29% as compared to last July! My hope is that the weather cools off, but the real estate market continues to heat up! | |

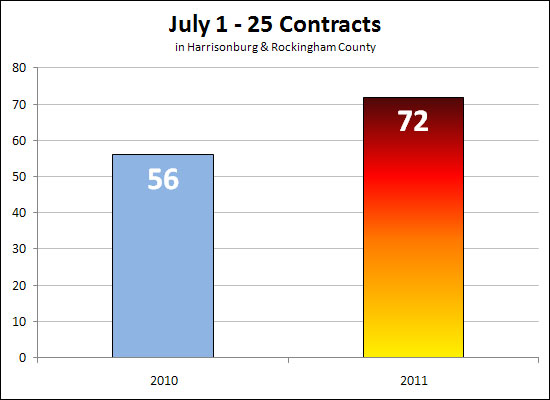

The costs of bread, gas and cars have increased, but not homeownership! |

|

The price of bread has increased 272% over the past 22 years. Likewise, the price of gas has increased dramatically (299%) -- and even the cost of cars has increased 85%. But the cost of owning a home has not increased at all --- when it comes to monthly payment. The table above shows how each item has increased in cost over time. The mere 0.5% increase in the cost of owning a home is derived using the median home price (nationally) and the average interest rate at the time. Perhaps if bread, gas and cars didn't cost so much, more people would be able to afford homes? ;) | |

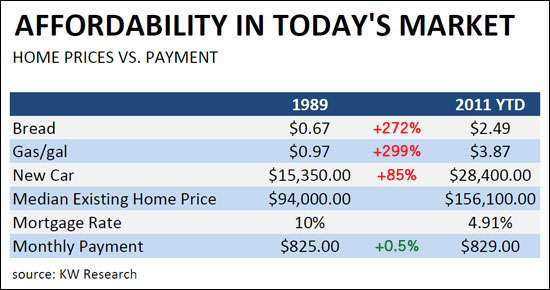

Virginia home values recovering more quickly than U.S. |

|

The Virginia Association of Realtors has released their 2nd Quarter report providing a great overview of the housing market in Virginia, including (amongst lots of other analysis) the following good news....  While median home prices have declined in both Virginia and the United States over the past two years (comparing 2010 to 2008), it seems that home values may be recovering in Virginia more quickly than in the United States as a whole. The United States median sales price stayed relatively level between 2009 and 2010 (less than 1% change) while the median sales price in Virginia increased by 3% during the same time period. Click here to read the press release from VAR, or click the image below to download the PDF of the 2011-Q2 Virginia Quarterly Home Sales Report.  | |

Way to go Virginia! A $311 million surplus! |

|

Virginia Sets Example for Cash-strapped States "Gov. Bob McDonnell announced that Virginia ended the fiscal year with a $311 million surplus yesterday. And for the second year in a row, Virginia ends the fiscal year with a revenue surplus, not a revenue shortfall. This is great news for Commonwealth residents, and it puts Virginia sharply in contrast with many other states that have seen revenues fall short of projections year after year." This is great news for Virginia and for Harrisonburg and Rockingham County. A stable economy leads to job growth, leads to a stable housing market. Read the rest of the story here, where you'll learn how Virginia was able to finish the year with a surplus! | |

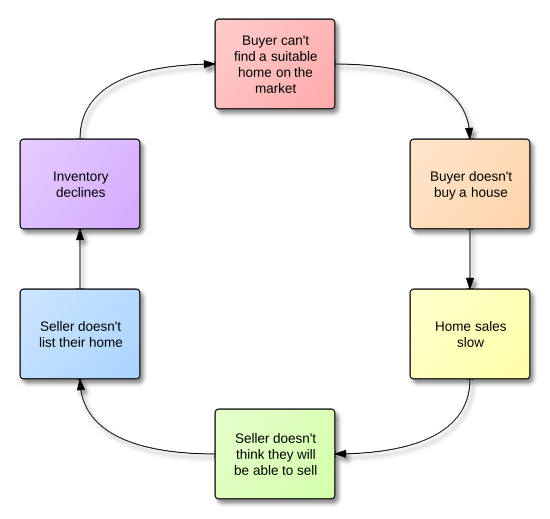

Are lower inventory levels leading to fewer home sales? |

|

After showing a house to some buyer clients yesterday, we were reflecting on the fact that there don't seem to be too many options on the market in the price range that they are considering with the characteristics that they are seeking in a home. We wondered aloud as to why it might be that we can't find them a home right now --- yet at the same time, sellers are wondering why they can't find a buyer for their home right now. Here's what I think is going on.....  If this is what is occurring (generally speaking), it begs the question of how we break out of this cycle. One suggestion is that perhaps more potential sellers ought to consider putting their homes on the market if they can offer a product and price combination that would be compelling in the current market. What are your thoughts? Does this accurately portray one dynamic of the current local real estate market? | |

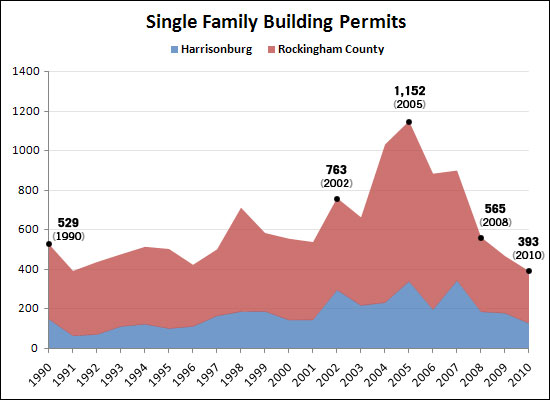

Historical Building Permit Trends in Harrisonburg and Rockingham County |

|

A 20 year history of single family home building permits in Harrisonburg and Rockingham County (shown above) reveals that much of the new home construction is market driven. The past twenty years can be summarized in four main stages:

Data Source: Weldon Cooper Center | |

Per The Atlantic: Is Now the Right Time to Buy a Home? |

|

For your daily real estate reading, consider perusing this article from The Atlantic a few weeks ago entitled "Is Now the Right Time to Buy a Home?" The author considers factors such as:

Again, enjoy the read of "Is Now the Right Time to Buy a Home?" | |

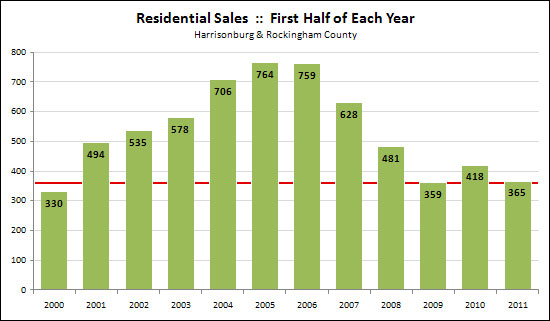

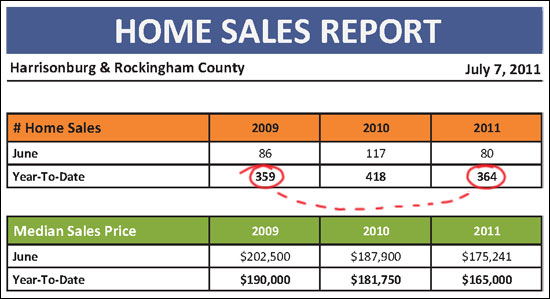

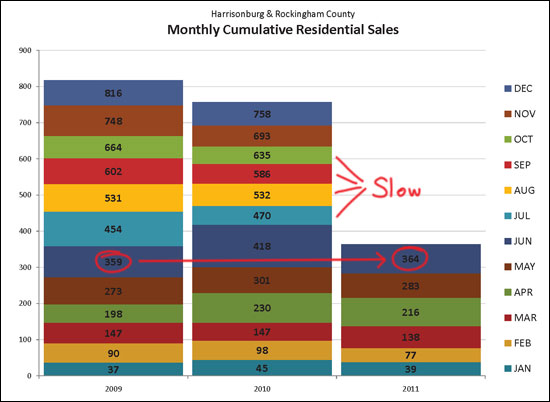

How did the first half of 2011 compare to previous years? |

|

Last year (2010) was assisted by the federal home buyer tax credit. Thus, even though 2011 shows a decline compared to 2010, it's important to note the (slight) increase as compared to 2009. The second half of the year, however, will be key. Last year's 3rd and 4th quarter were rather slow, as many (many!) buyers were enticed towards the first half of the year before the tax credit expired. Thus, this year still has plenty of opportunity to outperform last year since we don't have a tax credit affecting the timing of the market. Stay tuned! | |

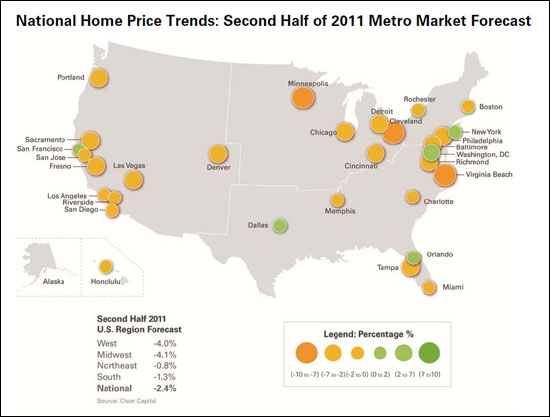

Projected strength in the Washington DC real estate market might help buoy the upper end Harrisonburg and Rockingham County market |

|

In the good old days (2000-2005) many buyers of upper end homes in Harrisonburg and Rockingham County were people retiring in major metro areas and moving to the Shenandaoh Valley. It certainly helped that they were seeing amazing increases in the values of their homes, which made upper end homes in this area seem quite affordable! Then, the DC market crashed, with prices dropping quickly --- which slowed down the influx of buyers into our market from DC, Northern Virginia, etc. But good news might be on the horizon.....  Per a recent report from Clear Capital, the Washington metro area is one of only five markets that will see positive price trends in the second half of 2011. Those improvements in home values in the metro DC area may result in more upper end buyers in our local market! | |

Real Estate: the best buying opportunity of a lifetime? |

|

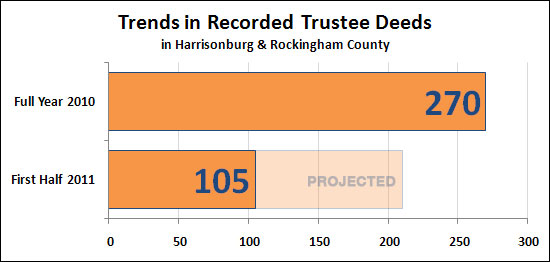

Local foreclosures slow in 2011 |

|

Great news -- the local foreclosure rate is on the decline! There were 270 recorded trustee deeds in Harrisonburg and Rockingham County during 2010. In the first half of 2011 there were only 105 recorded trustee deeds. Yet there are some interesting foreclosure sales currently scheduled:

Learn more about short sales, trustee sales and bank owned properties. | |

July 2011 Harrisonburg and Rockingham County Real Estate Market Update |

|

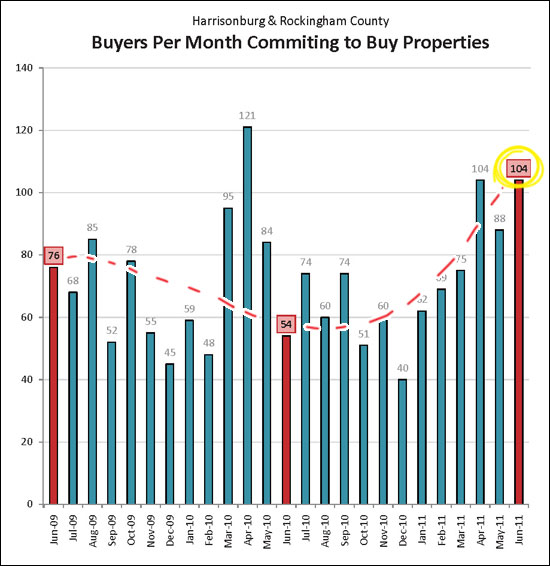

I just completed my monthly analysis of the Harrisonburg and Rockingham County real estate market. Click here for a PDF of the 25-page report or read on for some highlights. While the local housing market hasn't fully recovered yet, there is plenty to be excited about from the most recent market data below....  While year to date home sales (364) are a good bit below last year (418), we're on track with a 2009 sales pace. The thing to remember about 2010 is that many home sales were pushed into the first half of the year because of the expiration of the federal home buyer tax credit. Thus, as we continue through 2011, we stand a good chance of catching up with (or surpassing??) the pace of 2010 home sales. Median sales prices are still declining, but if the sales pace stabilizes and starts to increase, it will lead to a stabilization of sales prices and home values.  June 2011 was a FANTASTIC month of contracts -- the second month this year with over 100 contracts signed. This is a strong indicator that we will see strong home sales in July and August.  The graph above explores the number of cumulative month-by-month home sales --- you ought to note that last July, August, September and October were quite slow after the expiration of the home buyer tax credit. I believe we're poised to see some strong performance in the local real estate market over the next three to six months --- and hopefully well beyond that time!  You'll find even more exciting news in my full market report (click here for the PDF) --- and some not so exciting news to keep you well balanced. As always, if you have questions about this report, or if I can be of assistance with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

The Wall Street Journal seems to suggest that the Harrisonburg and Rockingham County housing market may be headed towards a recovery! |

|

The Wall Street Journal ran a very insightful article a week ago entitled "How to Tell if Your Housing Market Has Hit Bottom" which points out that there are some communities around the country that are actually doing OK right now in terms of their housing market. The Wall Street Journal (with the help of Zillow) identified 25 communities whose current home values are no more than 10% lower than their home value peaks. Looking at these communities may give us some perspective on how to tell when our own (Harrisonburg/Rockingham) real estate market is ready to start improving. There are three main factors that are identified, and if any or all of these are present in a real estate market, things may be ready to start improving again..... #1 - EMPLOYMENT If employment is stable or on the rise, a real estate market actually has a shot at improving. Many of the improving communities are college towns, as universities provide excellent employment stability for a community. Harrisonburg and Rockingham County continue to see very low unemployment rates -- much lower than the national average, so we're doing pretty well based on factor 1 of 3. #2 - RENTS The ratio between rental rates and home prices is an important indicator of the health of a market. If home prices soar out of control well beyond the comparable cost of renting, then fewer and fewer people will buy, as renting will be more affordable. Many rent vs. buy calculators use a factor of 15 to determine whether a market is balanced. "...if prices are more than 15 times annual rents, then a market favors renters; under 15 times, buyers." As a quick example, a two-story city townhouse might rent for $900/month and sell for $150,000. This shows that our market is (in some sectors) currently favoring buyers instead of rents. Another factor (2 of 3) in our favor. #3 - FORECLOSURES Our community (and any community) needs to see a decline in foreclosure rates before the housing market can really recover. We seem to be poised to see our first decline in the foreclosure rate this year (2011) after several years of increasing rates. This would appear to be factor 3 of 3 in our favor. The article is definitely worth reading in full (here) --- and it is some interesting food for thought that suggests that our local real estate market might see brighter days in the near future. | |

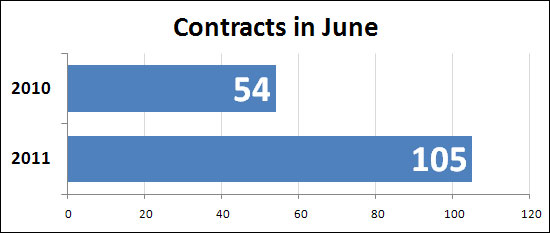

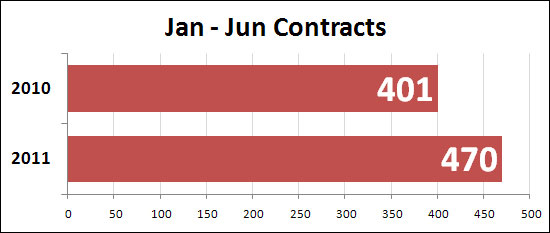

Contracts soar in June! |

|

Buyers are storming the market....look at these year over year numbers for the number of contracts signed by buyers (and sellers) this year compared to last year.....  June 2011's contracts (105) sailed past June 2010 (54) which is a whopping 94% increase!  But it's not just June.....year to date contracts are also showing a 17% increase over last year. This could be an early indicator that we'll see a recovery (in units sold) during 2011. Stay tuned.....I'll have my full report available in the next few days. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings