Archive for August 2011

Unwillingly keeping your townhouse might be your best (unintentional) financial move yet! |

|

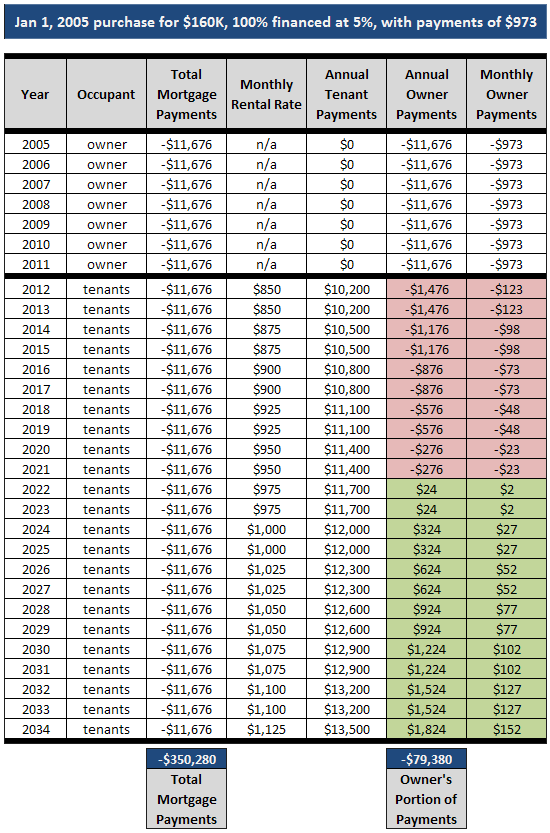

As I pointed out a few days ago, if you bought a townhouse a few years ago, you might be in a position where you can't sell it -- and thus end up being an accidental landlord. But there may be some unintended very positive consequences for keeping that townhouse. Let's examine what might happen if you kept your townhouse for the remainder of the term of your mortgage.  In the illustration above, let's imagine you bought your townhouse for $160K in January 2005 and financed 100% of the purchase price. You stay in the townhouse for seven years, and then move out of the area for a new job. Faced with a tough townhouse sales market, you feel forced to keep the townhouse. What happens next.....

As you can see, after investing $0.00 on Day 1, you end up having a cumulative $230,352 benefit after 30 years. Wow! So, can this make you a bit more optimistic about being (or feeling) forced to keep your townhouse? | |

Houses are still selling in the Shenandoah Valley |

|

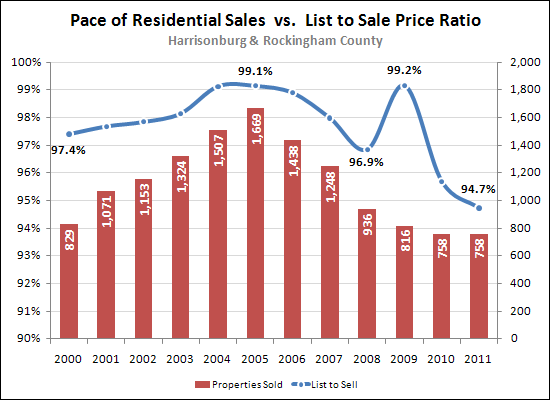

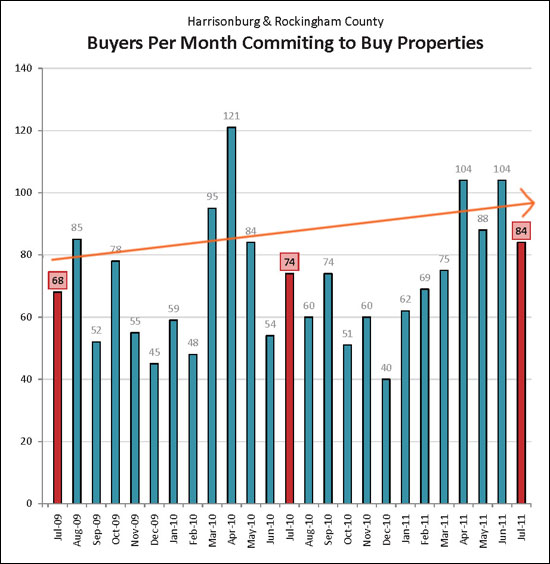

Home sales have been declining for over five years in Harrisonburg and Rockingham County and median home sales prices have been declining for three years. This causes some folks to ask – are homes even selling at all these days? Put another way – is it even worth trying to sell my home in this market? Let's examine a few facts about selling your home that might surprise you given the overall market conditions. One third of all homes that sell do so in less than three months. That is to say that of all of the homes that sold in the past six month, 34% of them were listed and then sold in less than 90 days! This is actually more remarkable than it first seems, as it often takes between 30 and 45 days to move from a contract to closing, so these homes that sold in less than three months likely sold (were under contract) in the first 45 to 60 days that they were on the market. As a seller, this should show you that you must price your home appropriately and market it aggressively from the very first day it comes on the market. Despite market adjustments, buyers still aren't negotiating a significantly amount off of the list prices of homes --- although that does occasionally happen. Back in 2000, the average list to sell ratio (sold price / final list price) was 97.4%. As it turns out, last year (2010) buyers were paying (on average) 94.7% of the list price – only a 2.7% adjustment from a decade prior. Thus as a seller you need to price your home well (as mentioned above), and you shouldn't necessarily expect to have to take 15% or 20% off of the list price during negotiations. You are much more likely to be negotiating an average of 5% off of the list price. Even if your neighbors tell you that they are having a terrible time selling their home because there are sooooo many homes on the market, just remember that inventory levels are actually quite low right now. As of early August, there were 882 homes on the market in Harrisonburg and Rockingham, which shows a 13% decline in inventory over the past 12 months. Sellers, thus, have slightly less competition as buyers have fewer homes from which to choose. While inventory levels can vary quite drastically by neighborhood and/or price range, there are many segments on the market where there are very few homes on the market right now. The past four months of contracts have been the highest in the past three years. 380 buyers committed to buy properties in Harrisonburg or Rockingham County between April and July of this year. While there have been single instances of a high number of contracts in the past, this four-consecutive-month rate of 380 contracts cannot be beat when looking at the past three years of sales (contract) history. The local housing market still has plenty of room for improvement, and isn't necessarily even in recovery mode yet, but plenty of homeowners are still finding success in selling their home. If you are going to sell your home, consult with a Realtor early, price your home well, and make sure that it will be aggressively marketed to maximize your success | |

Sellers are now landlords, and buyers are now tenants |

|

Five (or so) years ago, there were LOTS of first time buyers purchasing $150K new/newish townhomes in the City of Harrisonburg. Many of these buyers were young professionals or newly married couples. At the time, 100% mortgages were readily available, and sellers frequently paid closing costs, so a buyer could get into a house with just about no money at all. Buying a house was the cool and hip thing to do, so young people were buying houses/townhouses let and right. Fast forward to today, and we find that things are a bit different. People who would have bought five years ago are now renting because they would now need at least 3.5% of the purchase price as a down payment, and may have to pay their own closing costs. They also aren't buying because home values aren't increasing at a pace that would allow them to sell the house in the next few years without taking a loss. Thus, lots of the buyers of yesteryear are now not buyers at all --- they are deciding to rent a townhouse instead. But wait......so if there are lots of townhouse sellers, and fewer and fewer townhouse buyers, what is happening, or what will happen? In large part, many of today's would-be sellers are turning into landlords. After not being able to sell their townhouse that they bought five years ago, they decide to try to rent the property instead. This entire shift in who is (not) buying and who is (not) selling will likely take several years to sort itself out. One interest side effect is that there will be lots of 30-somethings who will unintentionally end up owning an investment property when they hadn't been aiming to do so. | |

I heard (insert this, that or the other) about foreclosures. Is that going to affect us here in Harrisonburg? |

|

If you hear something about the housing market on the news, it will likely mention the big (bad, scary) problem of foreclosures. Things you may have heard could include:

| |

July 2011 Virginia Housing Market Report Released, Harrisonburg Looks Good |

|

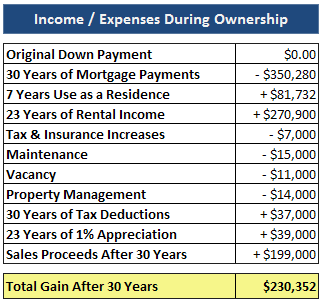

The graph above starts Harrisonburg (and Rockingham County) and Virginia on the same footing based on the number of sales in July 2010. Then, comparing the subsequent 12 months, we see that the Harrisonburg and Rockingham County housing market is (using this analysis tool) performing quite well compared to the entire state of Virginia. Our local housing market has especially performed well over the past four months, as shown above in yellow, which echos what we have seen in recently analysis of our local sales data. Click the image below to download a PDF of the entire July 2011 Virginia Housing Market Report.  | |

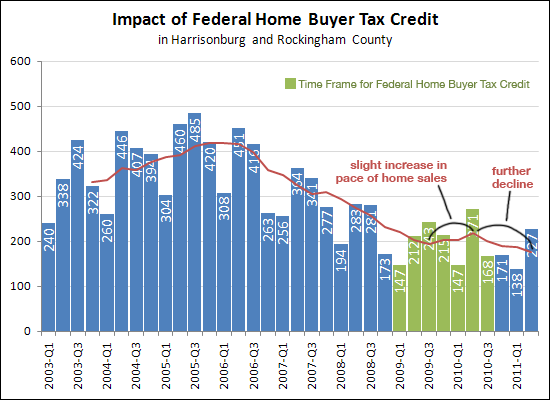

Did the federal home buyer tax credit impact the pace of home sales in Harrisonburg and Rockingham County? |

|

The federal home buyer tax credit did not seem to have a lasting, positive impact on the local housing market. While the federal home buyer tax credit (timeframe shown in green above) did cause the pace of home sales to increase, it was not lasting -- sales declined again after the tax credit expired. We're now roughly a year out from the expiration of the tax credit, so we are now getting close to being able to analyze the local housing market without a backwards reference to the (long) period of time with government intervention as an influencing external variable. It's great, thus, that the real estate market seems to finally be improving as of mid-August. | |

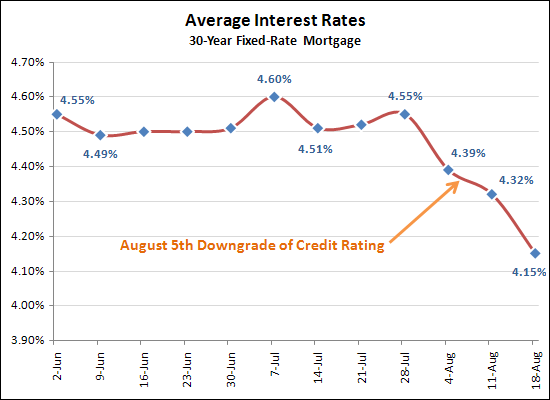

Great news for buyers! Average 30-year fixed rate mortgages at only 4.15% per Freddie Mac. |

|

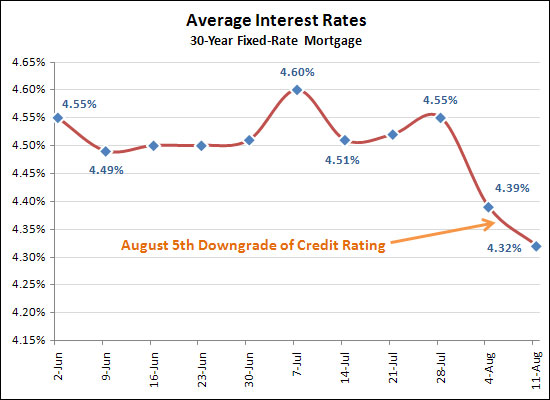

The downgrade of the United States' credit rating sure helped mortgage interest rates! Wow! The average rate on a 30 year fixed rate mortgage is now 4.15%. This is certainly a great time to lock in a rate and buy a house. You will likely be locking in your housing costs to the lowest possible point they could be for the near-term future given both low interest rates and low median home values. | |

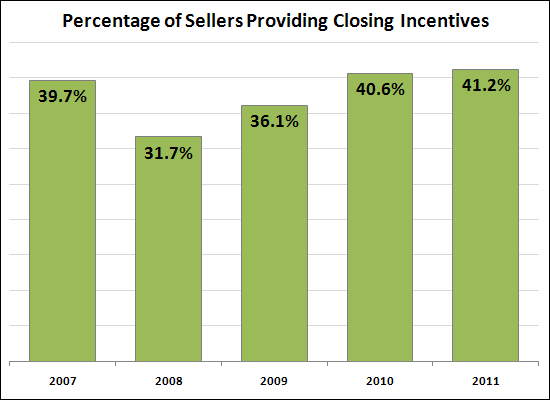

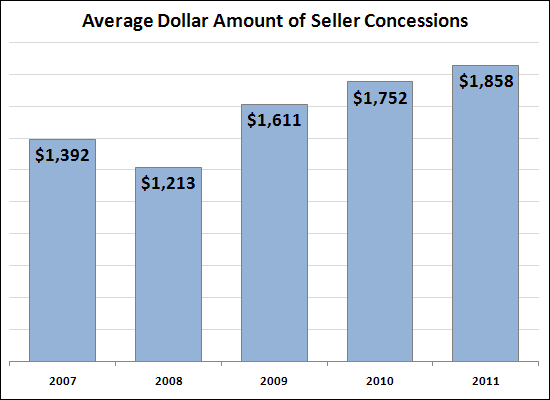

Seller concessions increase as market activity decreases |

|

Thank you, Michael, for suggesting that I analyze this....  As seen above, more sellers are giving concessions these days to close the deal. These concessions are most often a credit towards closing costs -- and thus far in 2011, 41.2% of sellers have provided such concessions at closing in Harrisonburg and Rockingham County home sales. This is a 30% increase over just three years ago.  Not only are more sellers making concessions, the average concessions are also on the rise --- from $1,213 three years ago to $1,858 thus far in 2011. This shows 53% increase, though the current average of $1,858 is less than 1% of the current average sales price of $201,364. | |

Halfway through August, and the real estate market still seems to be performing well in Harrisonburg and Rockingham County |

|

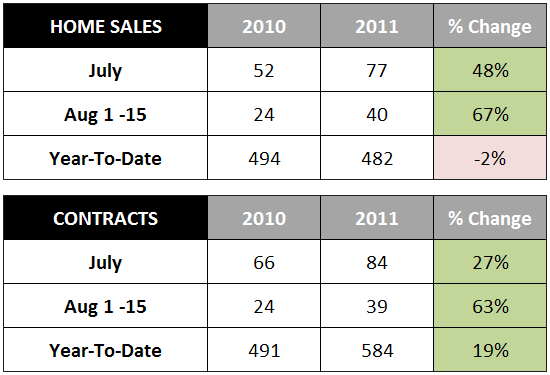

For the past five years, I've had to answer the question of "so, how's the real estate market" with responses such as "well, not so great" or "well, it could be worse." Now, the answer is a bit different, more along the lines of.... While we're not out of the wood yet, there are many positive indicators in our local housing market that seem to show a modest and slow start to market recovery. As shown above, above:

| |

Should I be worried if I am paying more than the assessed value for a house? |

|

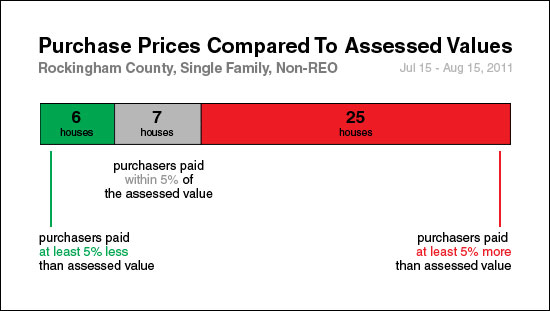

If you're buying a single family home in Rockingham County, chances are, you're paying more than assessed value for the house. Should you be concerned? No --- it just means that the assessed values aren't currently as close to market value as they are intended to be. To check in on the relationship between purchase prices and assessed values, I pulled all single family homes that sold in the past month in Rockingham County that were not bank owned sales. I then compared each sales price to the assessed value and found that most buyers paid at least 5% more than the assessed value (shown in red above). If almost all buyers were paying significantly less than assessed value, I'd be concerned about you paying more than assessed value --- but assessed values in Rockingham County are still quite low right now, leading to the data above. For your reference, in these 38 transactions, buyers paid (on average) 15% more than the assessed value of the home. | |

The list price to sale price ratio has adjusted with market, but not as much as you might have thought |

|

Back in 2000, homes sold at an average of 97.4% of the list price --- now, they sell for an average of 94.7% of the list price. That's not actually much of a shift --- only a decline of 2.7%. A few other observations....

| |

So, the downgrade of the U.S. credit rating will definitely lead to an increase in interest rates, right? |

|

While rates could still swing back upward, thus far rates have just continued to decline after the downgrade of the United States' credit rating.  Source: Freddie Mac | |

What Monday's (rather positive) local real estate market report does and does not mean for you |

|

There are lots of positive trends in the local housing market right now!

Is the future now rosy and bright? Will home value start going up, up, up again? While there are some wonderful, positive indicators in Monday's housing market report (PDF) here are some other not-as-exciting current market realities:

I would suggest cautious optimism. While we're not out of the woods yet, there are lots of indicators that would suggest that we're nearing a turning point in the market. | |

Just wait until all of these contracts turn into home sales! |

|

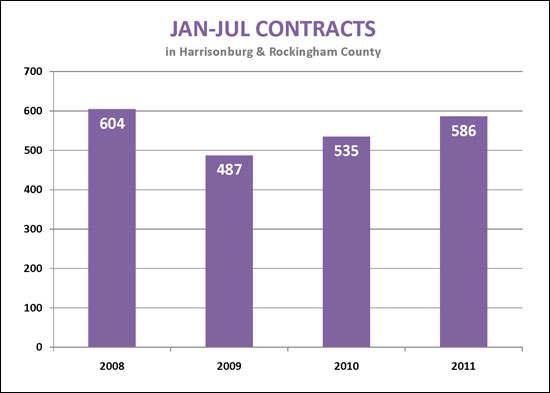

It is exciting to see how quickly contracts are coming together on homes in Harrisonburg and Rockingham County compared to the past several years. At the rate that properties are currently going under contract, 2011 should finish out a (relatively) strong year of home sales -- very likely exceeding 2010 sales. Increased contracts will eventually lead to increased sales will eventually lead to stabilized home values will eventually lead to a more balanced real estate market. Stay tuned! | |

Home Sales Increase, Prices Increase, Contracts Increase! |

|

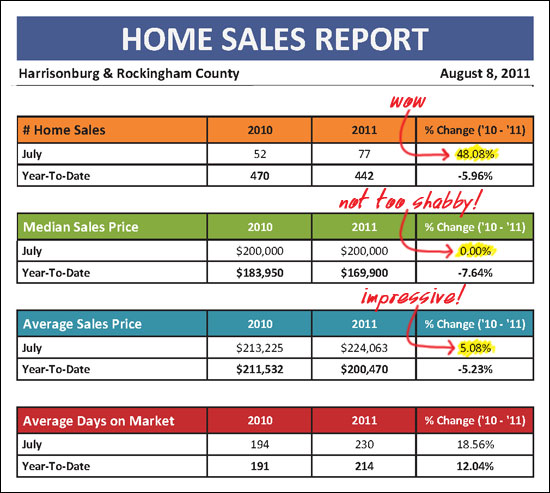

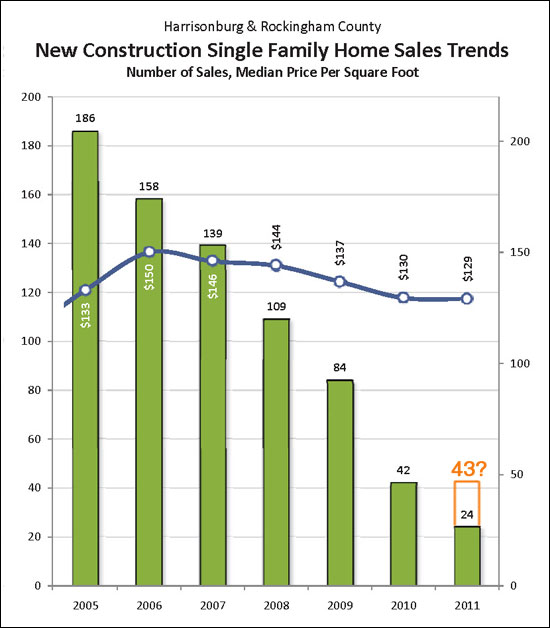

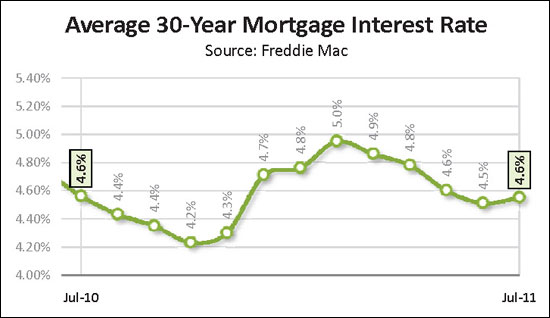

Finally, some signs of hope for the local housing market! I just completed my monthly analysis of the Harrisonburg and Rockingham County real estate market, and there are plenty of reasons to be excited. Download the full market report (PDF, 7MB) or read on for some highlights.  As seen above, July 2011 home sales shot past July 2010 by 48% --- which helped the year-to-date sales pace to come within 6% of last year's pace. Furthermore, we did not see a decline in median sales prices when comparing this July and last July....and....the average sales price INCREASED by 5% comparing July to July.  But it gets better --- the next few months should be rather exciting as well, since July 2011 buyer activity (shown above) exceeded both July 2009 and July 2010 contract levels.  Finally, some good news for local home builders, new home sales may finally be stabilizing, with both the pace and price of new homes looking to stay relatively consistent between 2010 and 2011 (as shown above).  One of the reasons (among many) that we are continuing to see improvement in the local housing market is because mortgage interest rates continue to stay below 5%. As shown above, they have started to increase a bit, but are still at an average of 4.6%.  Click on the image above to download my full Harrisonburg & Rockingham County Real Estate Market Report for further analysis of our local housing market. As always, I have included both the good news and the bad news -- my hope is that my analysis will empower you to make the best real estate decisions possible. If you have questions about the report, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

What goes into determining an asking price for a house? |

|

I was in Virginia Beach for a few days last week, and the house where we stayed (pictured above) is currently listed for sale. The price (near $1M) seemed high, but it is a almost-beachfront property, and I don't really know much about the Virginia Beach real estate market. In talking with the neighbors, however, we were told that the asking price really was too high, and that it was a result of what is owed on the property. The scenario above is not unusual -- plenty of homes on the market today are priced relative to how much the seller owes the bank, instead of based on market realities. Closer to home, in conversation two weeks ago with a buyer client, he asked "so why is that house priced so high?" I responded with "because they wanted to price it that high." Indeed, a home seller can price their home (if their Realtor is willing) however high (or low) they want to --- which means that the asking prices of homes are not always logical. Don't read too much into the asking price of a house -- it could be extraordinarily high, or the deal of the decade. Talk to your Realtor about the recent sales prices of comparable homes to ground yourself in current market realities. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings