Archive for October 2011

Why it's important to focus on utility costs |

|

Let's start here, with a passionate narrative from a friend and blog reader (thanks Tony!) who recently bought a home here in Harrisonburg.... Boy do I regret not asking for utility data for the house we bought last year near Memorial Hall--ugh! What a leaky old house we bought, totally unawares. $750 for oil for just the month of January alone. Alert! Alert! Depending on the age of the home you are buying, it can be very important to ask for utility data. But it's a bigger issue, as Tony reveals.... We all are flying on the same plane at some level. We start in January and end in December. But everyone on this plane called Harrisonburg housing is paying a different utility fare. That's not too surprising -- some of us are frugal, some are not; some of us are in smaller houses, others in mansions; etc. Tony raises a great perspective for us to keep in mind -- we can think (as a home buyer) that we have all of the costs nailed down and entered into our monthly budget -- but if we forget the variability of utilities, we're in trouble. Perhaps you live in a home now that averages $150/month for heating, cooling and electricity costs. What if you purchase a new home and that jumps up to an average of $350/month. Perhaps you made your new budget based on $150/month?But I think this cost of utilities -- not just for 30 years, but forever -- is really a sleeper issue when it comes to buying a house; particularly when your utilities are based on fossil fuels. Think the price of coal-fired electricity is going to go down? I don't. Think the cost of heating oil is going to go down? I don't. Natural gas? Etc. So at first glance, it's important to ask the sellers of a house you are considering for some utility history. But wait -- that's not even entirely helpful because they might keep the house tremendously colder or warmer than you would prefer. Thus their heating, cooling and electricity costs could be much lower than you would experience once you move in. So what is the answer? Well, Tony goes even further, with a hope and goal of putting large amounts of data to work for us.... Wouldn't you like to know who got the best "fare" in your neighborhood--and how, and at what investment price? Indeed it would be nice to have this type of data. Imagine being able to take the utility costs for the home you own OR the home you might buy and compare them to other similar houses in terms of age and square footage. All of a sudden you'd be able to not only estimate your own costs, but you'd also be able to know whether the home was more efficient than most, or had significant energy efficiency challenges. Here's to hoping for a future where information about utility use is more easily available and more widely analyzed. | |

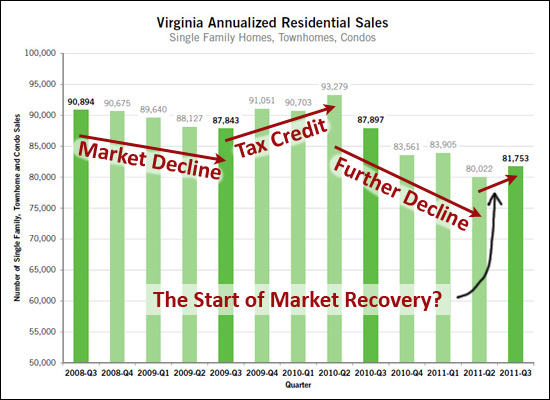

Recovery underway in overall Virginia real estate market? |

|

The Virginia Association of Realtors released their 3rd Quarter real estate market report, and one trend that stands out to me is a potential indicator that the overall Virginia housing market is starting to recover all on its own, aside from any help from a tax credit.  For a big picture look at the entire state of Virginia, definitely download their full report here.  | |

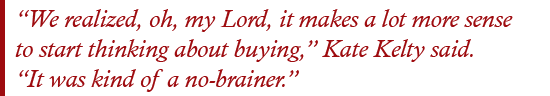

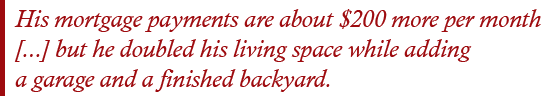

Should I buy or should I rent? |

|

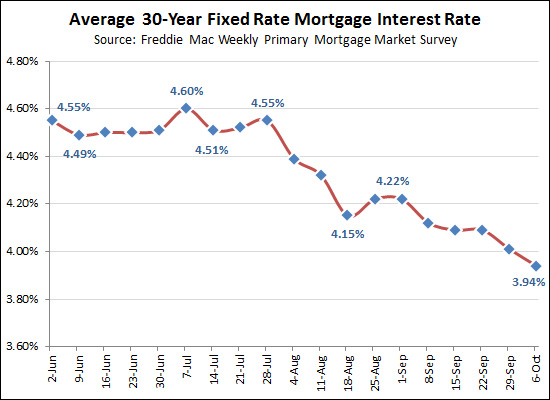

Yesterday's Daily News Record had a thorough look at buying vs. renting from a variety of perspectives. Here are a few (long-ish) excerpts....  HARRISONBURG — Chris and Kate Kelty had no plans of jumping back into the housing market a year after selling their townhouse. The couple with three young children figured they'd remain renters for a few years while building back up money for a down payment. Then they watched mortgage rates start plummeting. After a bit of number-crunching, the Keltys switched gears. "We realized, oh, my Lord, it makes a lot more sense to start thinking about buying," Kate Kelty said. "It was kind of a no-brainer." In August, the Keltys closed on a 2,500-square-foot home west of Bridgewater for $230,900. Their mortgage is $1,300 a month through a USDA Rural Development loan. Kelty, 32, said that's about how much renting a similar-sized house in the area would cost.  A good deal on a home in the county near Rockingham Memorial Hospital enticed Chris Foster, 25, to buy his first house in early October for $220,000. His mortgage payments are about $200 more per month than what Foster shelled out as a renter, but he doubled his living space while adding a garage and a finished backyard. "I had a goal all along to purchase sooner rather than later," said Foster, a pharmaceutical representative. "This was kind of a perfect storm, so to say."  Record-low mortgage rates have made buying a more attractive option for some renters. Interest rates on the average 30-year loan are hovering around 4 percent. "It would be difficult for renters to not strongly consider buying a home," said William Haithcock, chief executive officer of the Harrisonburg-Rockingham Association of Realtors. Those were just some excerpts, so be sure to read the full article online if you have a subscription. Of course, as usual, buying doesn't make sense for everybody, but it is becoming a much more compelling option for many these days. | |

Looking for a recent aerial maps? Go with Bing! |

|

I typically use Google Maps for compiling mapping data for my clients or for giving the some context for a home or neighborhood. But Bing certainly has much more updated (and thus much more helpful) satellite imagery in this area! Preston Lake on Google Maps (no homes)....  Preston Lake on Bing Maps (most/all homes)....  Bing Maps seem to be quite a bit more useful in many areas in Harrisonburg and Rockingham County. C'mon Google -- send the satellite by again! | |

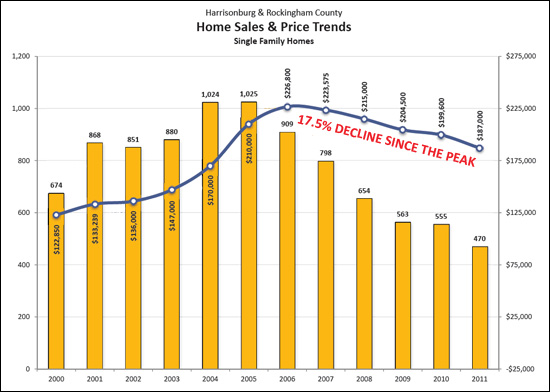

Will homes prices decline another 10% locally? |

|

Someone mentioned last week that they expect local home prices to drop another 10% or so before they stabilize. I don't think that I agree, but let's try to put it in context:  The graph above (click here for a larger version) shows the median prices for single family homes in Harrisonburg and Rockingham County since 2000. You'll note that the median sales price has fallen 17.5% from $226,800 in 2006 to the current value (in 2011) of $187,000. Will home values really drop by another 10%, down to $168,300? I don't expect that they will -- I think that as the pace of home sales stabilizes (which started in 2010) that we will see prices gradually start to stabilize. Certainly, though, if prices were to drop another 10% locally (or even 5%) that would be instructive for sellers who are holding out with aggressive list prices. | |

Will groundbreaking technology for the iPhone 5 be developed in Rockingham County? |

|

Probably not, but there is still some exciting Siri-related news for our local economy....  Known facts.... Siri is a revolutionary personal assistant application on the recently released iPhone 4S. Apple bought Siri in April 2010. Siri was developed as a project of SRI International. SRI International opened a campus in the Shenandoah Valley in 2009. So....what does it mean? OK, admittedly, SRI Shenandoah Valley might not develop a component of the next iPhone, but I think the storyline above points out the enormous upside potential of this developing research and technology company right here in Rockingham County. Per the Shenandoah Valley Partnership, SRI's Center for Advanced Drug Research (CADRE), will focus "on improving the productivity of the pharmaceutical industry, helping the nation respond to bio-threats, and developing life-saving treatments for neglected and orphan diseases." I think this is rather exciting for our local economy! | |

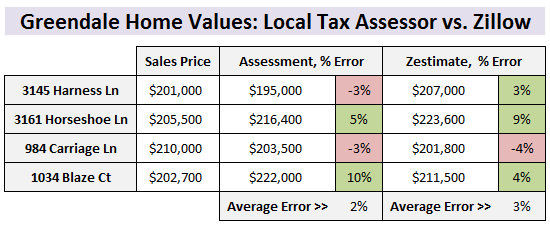

Zillow is slightly more optimistic than our tax assessor |

|

Zillow.com has been around for a few years, but only recently has offered thorough information on the Harrisonburg and Rockingham County area. On Zillow you can look up the estimated value of (just about) any house in this area. But the question, of course, is how valid are these estimates by Zillow? I performed a brief analysis for a client on the Greendale subdivison. Thus, admittedly, this is quite a small sample size. Perhaps I'll expand it further soon to see how Zillow performs in other areas when estimating the value of properties in the City of Harrisonburg.  The above analysis considers arms length sales from the past year in Greendale subdivision located in Harrisonburg, Virginia. This does not include REO sales (bank owned) or short sales. A few observations....

| |

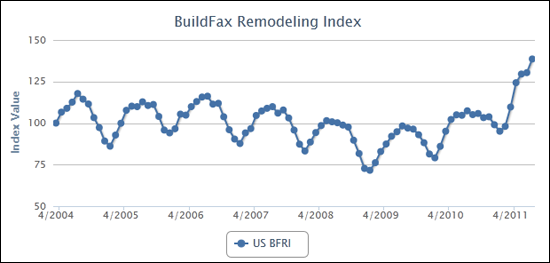

Honey, given the less than ideal housing market, perhaps we should renovate instead of selling! |

|

It seems this conversation has likely been happening quite a bit, as home improvements are on the rise!  Beyond people deciding to renovate instead of selling, it is also quite likely (as the news release points out) that homeowners are refinancing because of the current (ridiculously) low interest rates and then using equity or monthly costs savings to do home improvement projects. | |

An eternal optimist? Who? Me? Couldn't be! :) |

|

I have been accused as being an eternal optimist. :) I can understand the observation, as after all, when median prices dropped 4% last month I made sure that you knew that sales (quantity) increased by 44%. Here's how I'll spin it -- I am particularly talented at finding the smallest of silver linings in any rain cloud, regardless of the enormity of said rain cloud. :) All kidding aside, I try to present things in a relatively balanced way -- helping you to see the hope you should have based on positive market indicators, but also helping you to see the reservations you should have given negative trends. Where do I see the market today and moving forward?

| |

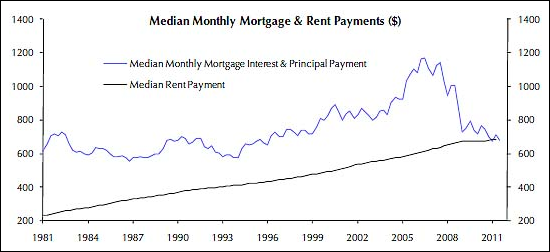

Median rental payment now equivalent to median mortgage payment |

|

There are plenty of ways to compare the opportunities of renting versus when buying. For example, a tenant in Avalon Woods recently discovered that he is paying more in rent per month than he would have to pay for a mortgage in purchasing this fantastic townhouse. This phenomenon is apparently also happening from an overall perspective as well, though, as median rental payments have now increased enough and mortgage payments have now decreased enough such that the median values are equivalent. The extraordinarily low interest rates we're seeing these days definitely help!  Source: Capital Economics, Thomson Reuters As this insightful article points out, however, the up front costs of buying (closing costs) are typically much higher than those related to renting (a refundable security deposit). Furthermore, it is quite a bit easier to decide to stop renting (provide notice to landlord) than it is to stop owning a home that you bought (sell it). | |

The Period of Maximum Buyer Opportunity |

|

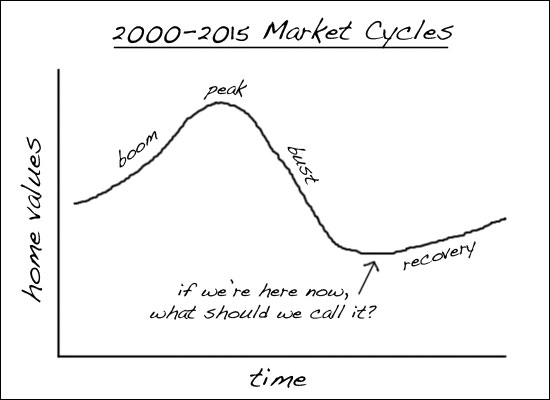

Here are some candidate titles for the time period above:

Thanks to my colleague Jay for pointing out this perspective. | |

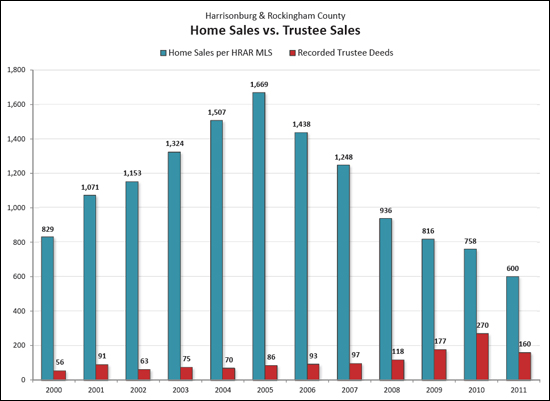

Foreclosures Decline in Harrisonburg, Rockingham County |

|

The most recent real estate news in Harrisonburg and Rockingham County isn't all good news, but there is plenty to be excited about, particularly related to foreclosures.  The numbers of foreclosures filed in Harrisonburg and Rockingham County steadily climbed between 2008 and 2010 -- but now it seems to be reversing course. In 2010, there were 270 foreclosure filings, and only 758 home sales. Thus far in 2010, there have only been 160 foreclosure filings and 600 home sales. This is a strong indicator that we'll finish out the year with fewer properties being foreclosed on, which should slowly strengthen the market. | |

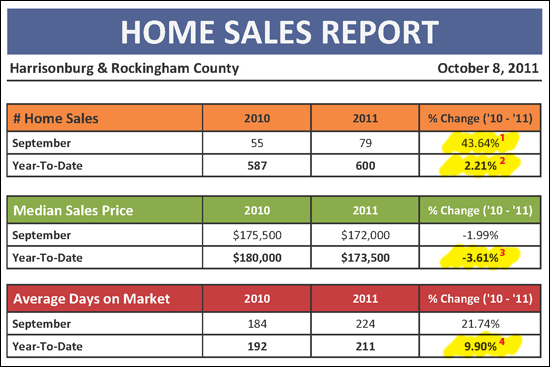

Home sales increase 44% in September |

|

Click here to download my full, 27-page report on the Harrisonburg and Rockingham County real estate market, or read on for highlights....  The housing market in Harrisonburg and Rockingham County continues to show signs of stabilization and recovery:

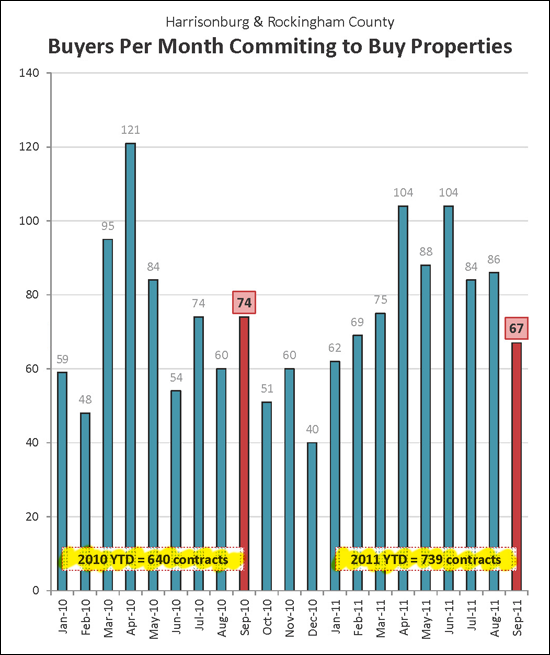

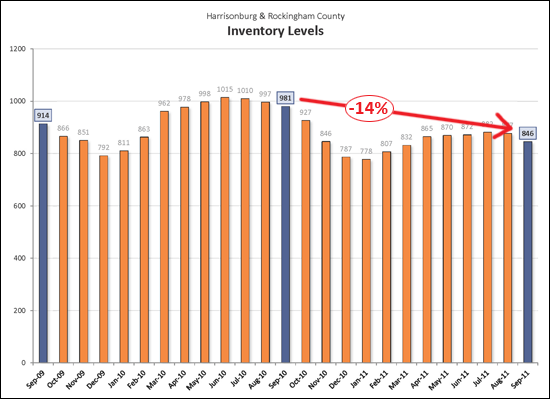

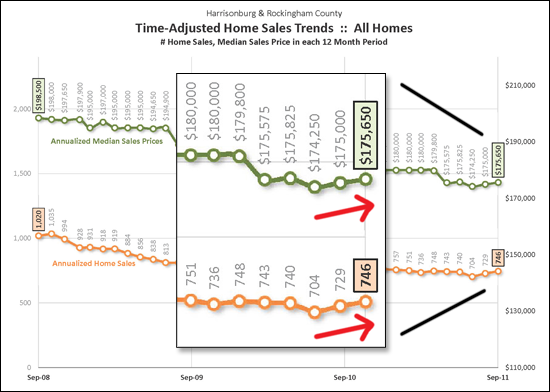

While contracts were down slightly in September (67 compared to 74 last September), contracts year-to-date are up 15%. Yes, that's right, 15% more buyers have committed to buy properties this year as compared to last year -- indicating that we should see continued strength in closed home sales over the next several months.  Helping to balance the housing market, inventory levels have declined 14% over the past year.  After three years of declining sales pace and sales prices, both metrics are now increasing when examined from an annualized basis.  If you have questions about the report, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Record low interest rates spur on buyer activity |

|

Average 30-year fixed mortgage interest rates are now below 4.0%. Wow! I have shown houses to quite a few people over the past two weeks who are seriously considering a housing transition because of the extraordinary opportunity provided by these record low interest rates. Are you considering a move? Talk to a lender (ask me if you need references), and let's start exploring your opportunities. | |

New Homes Just East of Harrisonburg, Virginia |

|

Many of the new homes built in Rockingham County over the past ten (to twenty) years have been built just east of Harrisonburg, in an area bounded by Boyers Road, Route 33, Cross Keys Road and Port Republic Road. Take a look...  These neighborhoods (shown above) offer quite a variety of housing options. Click on a link below to browse currently available homes for sale:

| |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings