Should I list my home on Jan 1 or Mar 1? |

|

The annual question for those planning (or hoping) to sell their home in the spring or summer is whether to put your house on the market the first week of the year (we'll say Jan 1) or to wait until we're approaching spring (we'll say Mar 1). It's a double-edged sword --- while there will be more buyers several months from now.... there will also be more sellers, competing with you. Looking at this year (2011), between January and March:

So, while there is more competition with other sellers in March, the increase in buyers is even more significant. When comparing January to April, the change is even more extreme:

So, just when I (might) have you convinced to wait until April to put your house on the market, let me offer up this comparison:

Sure, 99 buyers per month makes your odds better than 69 buyers per month --- but it's not as if buyers are completely dormant over the next few months. Perhaps the best bet is to examine your house and your segment of the market more specifically. If you don't have much competition from other sellers right now based on the size, location, price range of your house, let's get your house on the market ASAP. If you have LOTS of competition right now with very comparable houses for sale, perhaps it makes more sense to wait for a few months. Feel free to call me (540-578-0102) or e-mail me to discuss whether it makes sense to get your house on the market now, or to wait until March or April. | |

Yes, 100% financing does still exist. |

|

If you are looking to finance 100% of the purchase price of your new home, it may still be possible. Please note that each of the loan types below have limitations and requirements that may not make you or your property eligible -- but all of them deserve research if you are interested in a 100% loan. FHA Loan + 3.5% Gift If you have access to 3.5% of the purchase price as a gift, you may be able to combine that with a 96.5% FHA loan to acquire an effective 100% loan -- even though you won't be paying back the gift. BB&T's Community Homeownership Incentive Program (CHIP) These mortgages through BB&T do not require a downpayment nor a PMI payment. Veteran's Administration (VA) Loans These loans can be up to 100% of the purchase price and are available to qualified veterans, active duty, reserves and National Guard personnel. USDA Rural Development Loans The property you are purchasing must be eligible (based on location) and you must qualify (based on income) -- you can check both of those details here. Of note, the processing of these loans can be quite slow -- after your mortgage goes through underwriting with your lender, it then must be submitted to USDA for review and approval. I am not a lender, but I'm happy to answer any general questions you might have about the process of becoming pre-approved, some professional lenders in the Harrisonburg and Rockingham County area, etc. Feel free to call me (540-578-0102) or e-mail me to discuss your financing scenario. | |

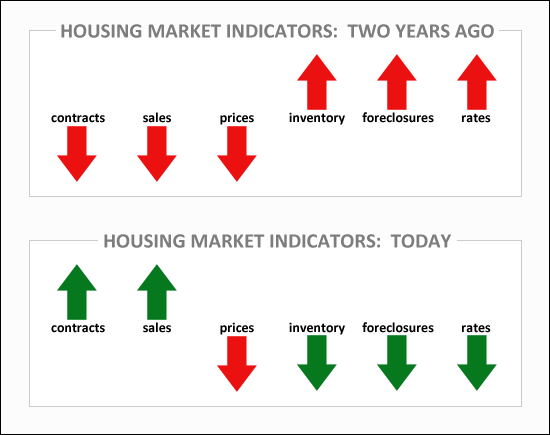

Why am I cautiously optimistic about the future of our local housing market? |

|

You don't need to tell me --- I know --- home prices are still on the decline. But here is the basis for my cautious optimism about our local housing market....  This illustrates the trends in general housing market indicators two years ago, as compared to the trends in general housing market indicators today. What do you think? Do I have some basis in reality for my cautious optimism? | |

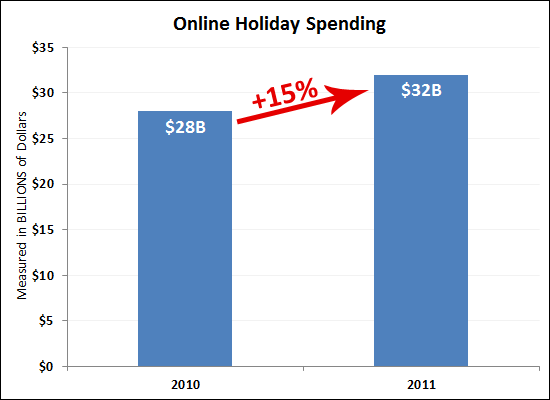

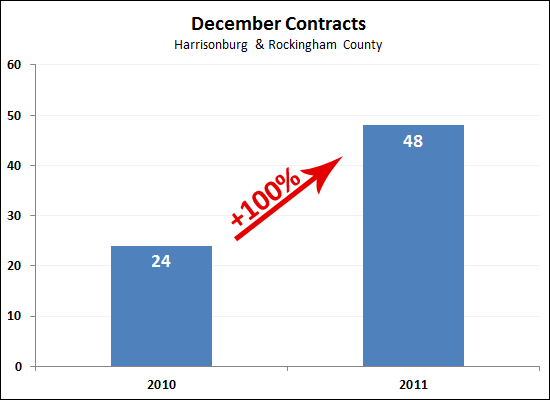

Online shopping increases 15%, but wait --- contracts on homes in our local area increase 100%! |

|

The significant increase in online holiday shopping is certainly an indicator that are economy may be finally starting to return to some form of normalcy.  But did you see what happened in our local housing market? There was a 100% increase in December contracts (Dec 1 - 25) in the Harrisonburg and Rockingham County housing market! This continues the trend of increased activity in our local real estate market. 2011 looks like it will finish out to be a strong year -- or even if a weak year, a stronger weak year than last year! | |

Massanutten Village Short-Term Rental Lawsuit Ends |

|

Daily News Record, Dec 23, 2011 By JEREMY HUNT HARRISONBURG — After being tied up more than four years in court, a lawsuit seeking to restrict short-term rental activity in a Massanutten Village enclave has been decided in favor of the defendants. In November 2007, eight fulltime Greenview Hills residents filed suit against 28 neighboring property owners — none of whom live in the subdivision — who market and rent out their houses to vacationers. The plaintiffs argue the defendants' activities violate the subdivision's restrictive covenants by operating their dwellings as a business similar to a hotel. The defendants argued the covenants don't prohibit them from renting their homes on a short-term basis. Some full-time Massanutten Village residents have complained for years about short-term rentals and the behavior of vacationers. They sought to have the Rockingham County Board of Supervisors prohibit the practice via zoning ordinance, but were unsuccessful. Since the lawsuit was filed, four plaintiffs have asked to be dismissed from the suit and eight defendants have been dismissed because they no longer own property at Massanutten. In a ruling signed Tuesday and filed in Rockingham County Circuit Court on Wednesday, Judge Jay T. Swett ruled in favor of the 20 remaining defendants. The suit centered on a phrase in paragraph two of the Greenview Hills protective covenants and restrictions in the properties' deeds. "These lots are restricted to residential use and nothing but single family, private dwellings or residences designed for occupancy by one family shall be erected thereon," it says, according to Swett's ruling. Some plaintiffs rent their properties less than 10 times a year and some more than 30 times a year, generating income ranging from under $4,000 to more than $40,000, according to Swett's ruling. Some rentals had as few as two people at a time, while others had more than 20. The plaintiffs did not want to ban renting of homes in Greenview Hills, which they acknowledge is legal, but they sought to prohibit rentals that are "continuous and recurring vacation rentals to large groups of people," effectively making commercial use of a facility intended for residential. Essentially, the case boiled down to the definition of "residential use" and "family." According to Swett's ruling, short-term rentals do fit the definition of residential use, and the term "family" should be interpreted "broadly," thereby making the defendants' rental practices legal. For example, Swett questioned in his ruling if an unmarried couple would be barred from owning or renting property in Greenview Hills. The covenants, written in 1975, are "silent with regard to any express restrictions on rental activities," Swett wrote. The plaintiffs are Kenneth and Sandra Keller and Grover and Nancy Jaeger. The defendants are: Michael Chelst; James and Elizabeth Dwight; David and Connie Vander Haeghe; John David Ross; Elliott Balaber; Peter and Ellen Burke; Martin and Carol Ischinger; Willian Davidson and Cheryl Harrison- Davison; Ryan and Barbara Nelson; Jeffrey Goering; Charles Goering Jr.; Jean-Pierre Scarfo and W. Michael and Joanna Pumphrey. Contact Jeremy Hunt at 574 6-273 or jhunt@dnronline.com | |

Nation's housing market was much worse than suspected over the past four years |

|

As Business Insider puts it, the National Association of Realtors just made the mother of all data corrections. Basically, the National Association of Realtors (NAR) retroactively adjusted its accounting of the number of home sales that took place in 2007 (down 11%), 2008 (down 16%), 2009 (down 15%) and 2010 (down 15%). Put simply, NAR had thought and had broadcasted quite widely that home sales were much stronger over the past four years than they really were -- and bear in mind, even the inaccurate, inflated numbers were quite depressing! Why did it happen?

It sort of matters retroactively -- everybody needs to go back and think that the housing market was worse than they thought before, and make their past decisions differently. Oh wait, that's somewhat difficult to do -- so the national impact is simply that we need to readjust our historical understanding of the pace of home sales from 2007-2010 and be a bit less dependent on NAR home sales estimates, as they are ultimately, just estimates. Does it matter locally? Since the national housing market (if one could be said to exist) doesn't impact us too much at all, these adjustments to national housing sales figures don't impact us that much either. Of much more importance is the pace of sales (and median price of those sales) on a local level. Could it happen locally? NAR and yours truly make different attempts as far as reporting home sales. NAR attempts to report on total home sales (MLS, by owner, by builder, etc) -- and thus there can be inaccuracies in their data. My home sales reporting is based solely on data reported through the HRAR MLS. Thus, I'm not making any guesses -- I'm just performing analysis and providing commentary on home sales reported through our local MLS. NAR's adjustments are rather significant, so let me know if you any questions or concerns beyond those addressed above. | |

With opportunities like these, we should start to see more townhouse sales soon! |

|

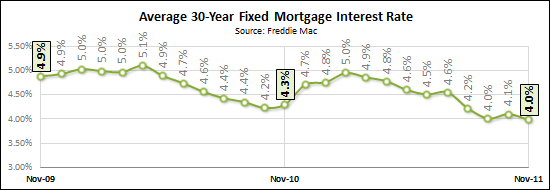

What a wild ride it has been for the townhouses market in Harrisonburg and Rockingham County. How about a brief history before looking at today's great opportunities.... Early 2000's: moderate sales (200/y) and low prices ($100K) In 2000 and 2001 there were around 200 townhouse sales per year, and the median sales price for townhouses was right around $100K. At the time, interest rates were around 7.5%, so a monthly payment on a 96.5% (FHA) loan would have been right around $745/month. Mid 2000's: escalating sales (650/y) and escalating prices ($170K) As real estate markets across the country heated up between 2003 and 2006, there were more townhouse buyers than ever in Harrisonburg and Rockingham County. The pace of sales peaked in 2005 with an amazing 644 townhouse sales, and prices peaked in 2008 with a median sales price of $167K. At the time, interest rates were around 6%, so a monthly payment on a 96.5% (FHA) loan would have been $1,085/month. Early 2010's: slow sales (150/y) and softer prices ($140K) Since the high of 644 townhouse sales in 2005, the pace has drastically dropped, down to only about 160 sales in 2011. This reduced demand for townhouses has brought prices down, and median prices are now at $143K. Interest rates are currently just under 4%, so a monthly payment on a 96.5% (FHA) loan would be right around $760/month. So, now on to some specific examples of the great opportunities in today's market:

As you can see, there are some great opportunities in the current townhouse market --- both for first time buyers, and for investors. Please let me know if you'd like some assistance in finding a property! I'd be excited to help you find a great opportunity. | |

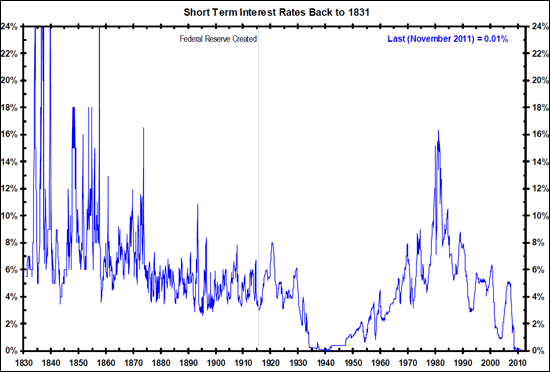

Here's one reason your mortgage interest rate is so low! |

|

Do home values go up and down with the temperature? |

|

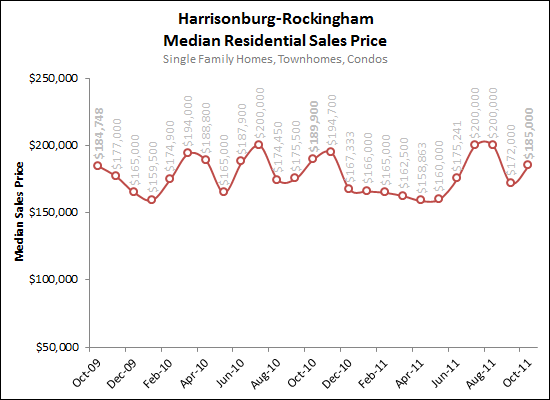

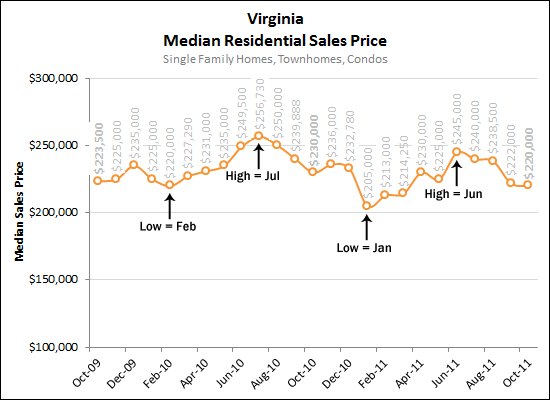

Are houses worth more in the summer and less in the winter? I have always mostly ignored that question because median home values bounce all over the place front month to month in Harrisonburg and Rockingham County.  It's certainly hard to draw any conclusions about seasonal (summer vs. winter) changes in home values based on the data above. The related question here is whether home values really jump around as much as shown above -- no, they don't -- with only 50-100 home sales per month the sample size of the data set is small enough to allow for the variation shown above. Basically, the median home value might end up adjusting quite a bit in one direction or the other in any given month because of the composition of how many smaller homes versus larger homes sold in any given month. But then when I examine the entire state of Virginia, values do seem to adjust seasonally....  So -- does anyone have any theories here? Why do Virginia home values seem to adjust so seasonally (as per median prices) but Harrisonburg and Rockingham County do not? | |

Crikey, mate! Good onya for that price! |

|

Would you advise your Aussie friends as to whether they're getting a good deal on the house they're buying in Sydney? Would you want to make sure they were gobsmacked about the price you were paying for a house here in Harrisonburg? What about New York City? If your friend was buying a condo in Queens, would you weigh in on what she should pay? And would you wait anxiously to hear back from her about how how you should price your duplex in Dayton? How about Richmond? If your mom lives in Glen Allen, will she get the final call on the price you pay for your new single family home in Harrisonburg? I'm sure you have intelligent Australian friends, well-read pals in Queens, and astute parents in other areas of Virginia -- but I challenge you to:

Again, I am sure you have very well intentioned, well informed friends and relatives all around Virginia, the United States, and perhaps the world. But at some point, we'll need to focus in on the nuances of the Harrisonburg and Rockingham County housing market and make the best decision in a local context. I am ready to spend as much time as needed with you to help you understand our local housing market and how such an understanding could and should guide your real estate decisions. Are you ready? | |

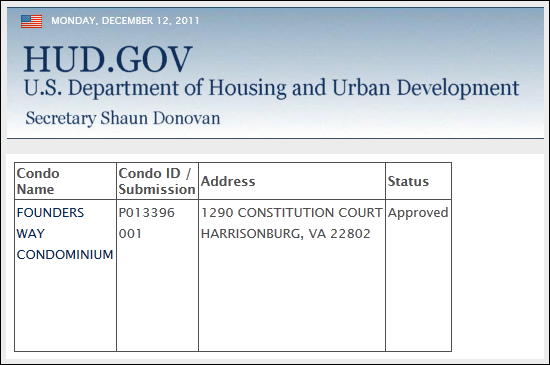

When buying a condo, make sure it's FHA approved |

|

Many condo buyers would like to purchase their condo using an FHA loan, and some condo communities are no longer approved for FHA loans. Here's the news from last month....  How might that affect you here in Harrisonburg? Well, one of the newest and most exciting condo communities in Harrisonburg is Founders Way. OK, yes, I do represent the developer and thus might be a bit biased -- but that's what we hear from the people who have bought at Founders Way too! So, if you're interested in buying at Founders Way, can you get an FHA loan?  That's right folks, you can still (quite easily) buy at Founders Way using an FHA loan. So if you're looking for an exciting new condo community in Harrisonburg, look no further than Founders Way, featuring:

To find out more about Founders Way....

| |

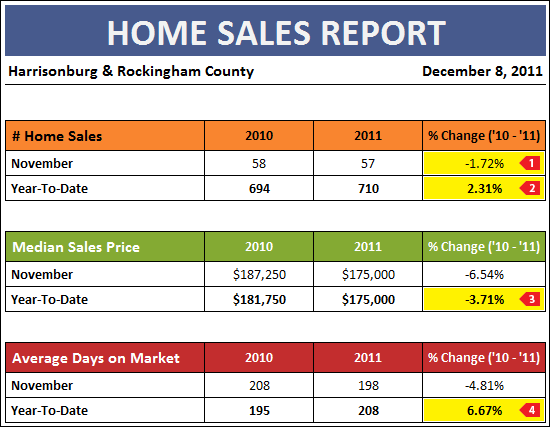

Local housing market shows continued signs of gradual recovery |

|

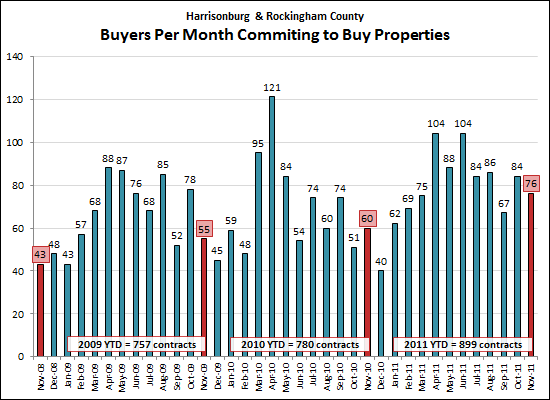

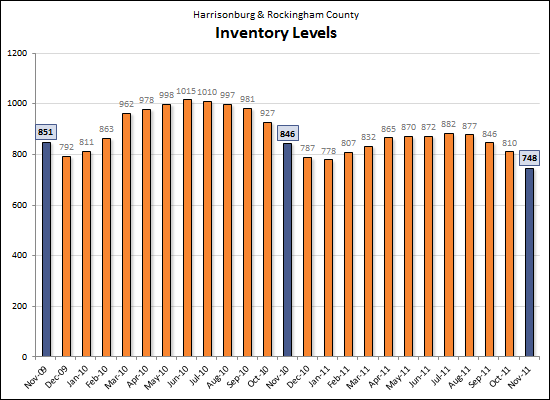

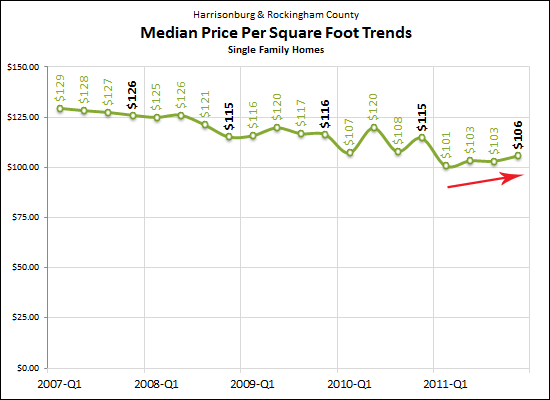

Click here to download my full market report (27 pages, 7 MB, PDF) or read on for highlights....  November was a relatively positive month for the local housing market:

A strong surge of buyers in 2011 is leading the charge towards more stability in the local housing market. As shown above, November 2011 was yet another strong month of contracts (76) showing a 27% increase over last November and a startling 77% increase over three Novembers ago.  Inventory levels continue to significantly decline, down 12% from a year ago. Lower inventory levels (fewer sellers) combined with an increase in contracts (more buyers) will eventually lead to greater balance in the local housing market.  Despite the fact that our local housing market's median price has not yet stabilized, it is interesting to note that we have seen a steady improvement in median price per square foot for single family homes over the past year. This is in sharp contrast to the steady decline seen in the four prior years.  The icing on the cake is that mortgage interest rates remain at historically low levels creating amazing opportunities for buyers. At the end of November, the average 30-Year fixed mortgage interest rate was 3.98%.  For an even more in-depth look at the Harrisonburg and Rockingham County real estate market, click the image above to download my full market report (27 pages, 7MB, PDF). If you have questions about the report, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

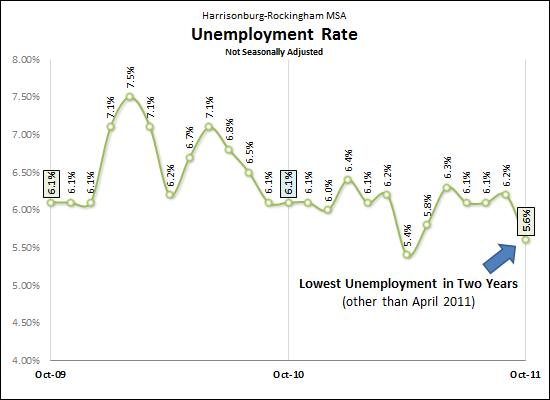

Harrisonburg, Rockingham County unemployment rate at lowest level in the past two years (other than April 2011) |

|

This is good news for the local housing market! | |

Making sense of buyer feedback |

|

As a home seller, you will face rejection left and right -- many prospective buyers will come view your house and most of them will decide not to buy it. But how, as a seller, do you make sense of that feedback? I often hear the following types of feedback after a showing:

This type of feedback (size, location, floor plan) is difficult to do much with as a seller. You likely aren't going to build an addition to your house, nor will you physically move the house, nor will you reconfigure the floor plan. Sometimes the feedback is just a mild objection to be overcome -- did you realize that the unfinished bonus room could be finished quite inexpensively (size) and that the new South East connector will make your commute quite short (location)? Oftentimes, however, if you receive feedback about size, location or floor plan there isn't much you can do about it as a seller. I also, however, will hear the following types of feedback after a showing:

This type of feedback (price, condition, marketing) is completely in your control as a seller. Many buyers will not make an offer if they think your list price is too far from reality -- adjusting your pricing may be just what you need to either generate more showings, or have a chance of the showings turning into offers. I almost included AGE as a factor outside of a seller's control, but it's much more about condition -- how well has a property been maintained, and is it in top showing shape so that buyers don't feel overwhelmed by short-term cosmetic updates and long-term maintenance needs? Finally, if a house has not been marketed thoroughly and effectively, it will likely have a much longer "days on market" than other properties, worrying buyers that perhaps they shouldn't buy the home because nobody else has in the last ten months. It is imperative to gain feedback after showings of your house -- but when processing it, try to quickly categorize it as either something you can control, or something you cannot. Of course, if the feedback is consistently something you cannot control (size, location, floor plan) the answer might be to further adjust what you can control (price, condition, marketing) to compensate for those weaknesses. | |

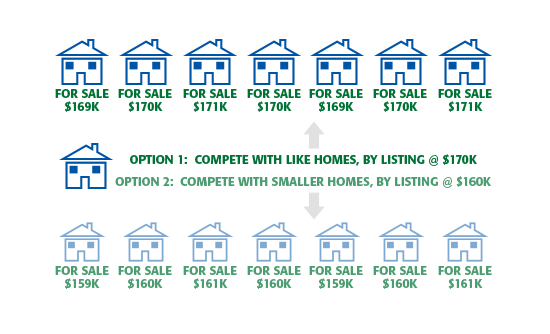

Pick a fight you can win |

|

Remember, when you list your home, you are picking your competitors....  In the above scenario....

| |

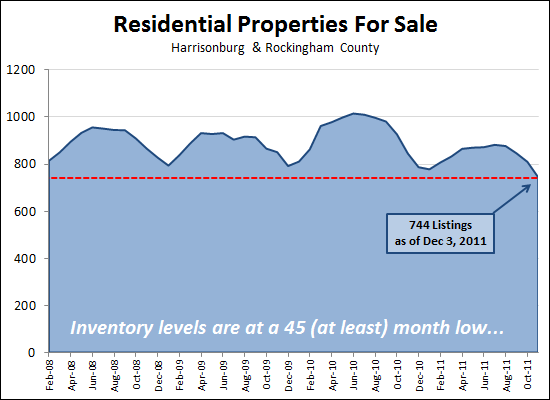

Inventory levels drop to 45 month low (at least) |

|

Each month inventory levels drop at the beginning of the month -- as quite a few listings expired on the last day of the prior month. So it's possible that today's incredibly low inventory levels (744 properties) will climb back up by a bit over the next few days. However, as things stand now, these are the lowest inventory levels we've seen in almost four years. It's actually probably quite a few more months than that, but I have only been tracking inventory levels for the past 45 months. What does this mean? Hope for further balance in the local housing market -- as the number of hopeful seller decreases, and the number of actual buyers increases, we'll return to a more balance market. | |

Let's look at this low offer as a compliment! |

|

Sellers are usually quite disheartened to receive a low offer on their house, for example, an offer of $250K on a $300K listing. But it is important to remember that even that low offer really is a complement!  If you have not yet had an offer on your house (that is listed at $300K) and you receive an offer of $250K, that doesn't necessarily mean your house is only worth $250K, nor does it necessarily mean that you should accept $250K or something close to it. It does, however, mean something quite exciting --- somebody wants to buy your house!!! Of course, negotiations won't always work out with low offers -- but recognize a low offer for what it is -- a buyer who wants to buy your house, and perhaps the first buyer who has declared as much through a written offer! If there is any way to put a deal together with those buyers, you ought to pursue it, as it's hard to know when the next buyer will work up the courage to tell you that they want to buy your house! | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings