Archive for January 2012

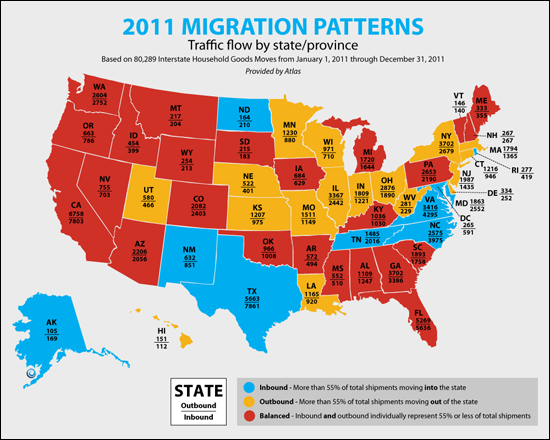

More people are moving into Virginia than out |

|

In another positive sign for Virginia's economy and thus housing market, there seem to be more people moving into Virgina than out of Virginia. Of note, Virginia is one of only 9 states where this is the case! Source: KCM Blog | |

Very cool -- drones are being used in California to market high-end properties |

|

A custom-designed drone with a camera attached is now being used to capture fantastic views of high-end properties in California. Read the article (with an embedded video) for more details. | |

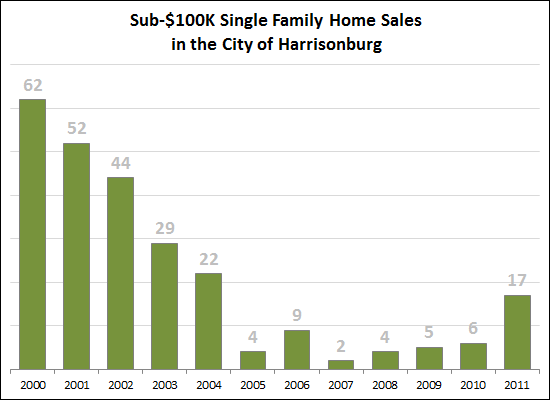

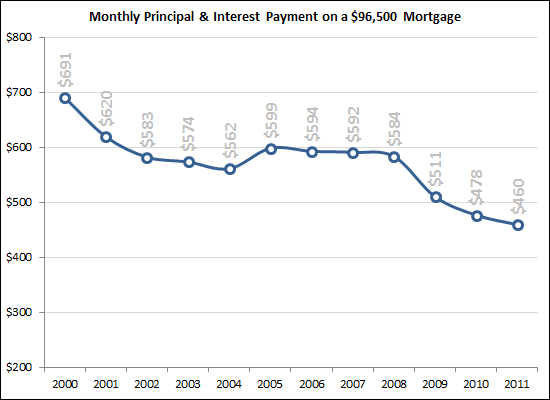

Harrisonburg Sub-$100K Single Family Homes: They're back, and more affordable than ever! |

|

As the real estate market heated up, the opportunity to buy a single family home in the City of Harrisonburg for less than $100K cooled down. Now, however, there are more opportunities to buy such homes. The even better news is that it's more affordable than ever to buy such a property.  The chart above shows the principal and interest payment on a $96,500 loan (a 96.5% FHA loan on a $100K purchase) given the interest rates over the last 11 years. This does not include taxes, insurance, and PMI. If you are looking for an affordable house --- either from a sales price perspective, or a monthly payment perspective --- don't hesitate to contact me (scott@HarrisonburgHousingToday.com or 540-578-0102). I'd be happy to help you find a home to meet your needs. | |

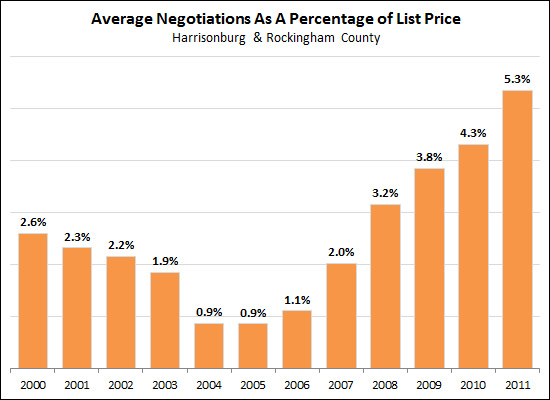

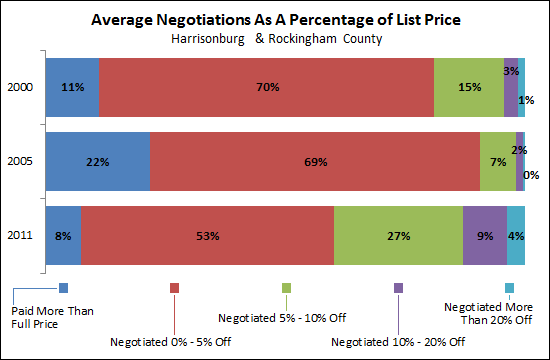

How much are buyers (and sellers) negotiating on price? |

|

More than they ever have! Pre-boom, buyers (and thus sellers) were negotiating an average of 2.6% on price -- that is to say that homes were selling for 97.4% of the list price. That went as low as an average of only 0.9% of negotiating room in 2004-2005, before rising quickly to current market conditions where the average negotiations are 5.3% of the list price.  If we look closer at the data pre-boom (c2000), mid-boom (c2005) and post-boom (c2011) we find some interesting facts:

| |

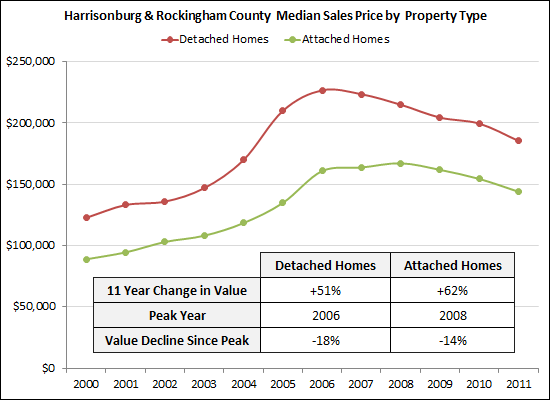

Attached vs. detached homes over the past 11 years |

|

Detached home = single family home Attached home = duplex, townhouse, condominium So, which property type has shown a stronger performance over the past 11 years in Harrisonburg and Rockingham County?

But despite all of this, I believe the detached home market will be a stronger performer over the next five years, because:

| |

Three ways to buy a foreclosure in Harrisonburg or Rockingham County, and how to find such opportunities |

|

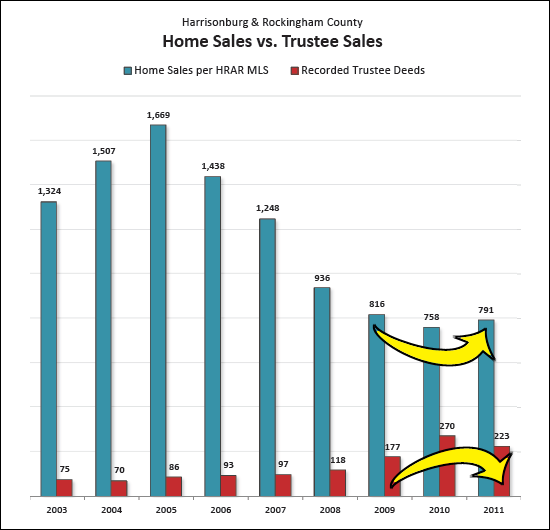

If you are in the market to buy a home, some of the properties you might be considering are foreclosures – but there are some distinctions to be aware of at different stages of the foreclosure process. It is possible to buy a home from the owner before they are foreclosed on even if they cannot pay off their mortgage – this is called a short sale. Or, you might buy a property at the courthouse steps when it is being auctioned – this is called a trustee sale. Finally, if a property does not sell at the auction, you can buy the property from the lender after they have taken ownership of the property – this is called a bank owned property or REO property. SHORT SALES: Some homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! Research potential short sales in Harrisonburg and Rockingham County online via www.HarrisonburgShortSales.com  TRUSTEE SALES: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Research upcoming trustee sales in Harrisonburg and Rockingham County online via www.HarrisonburgForeclosures.com  BANK OWNED PROPERTIES: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. Research currently available bank owned properties in Harrisonburg and Rockingham County online via www.HarrisonburgREO.com  When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. For information about purchasing a property as a short sale, or purchasing a bank owned property, please e-mail me at scott@HarrisonburgHousingToday.com or call me at 540-578-0102. | |

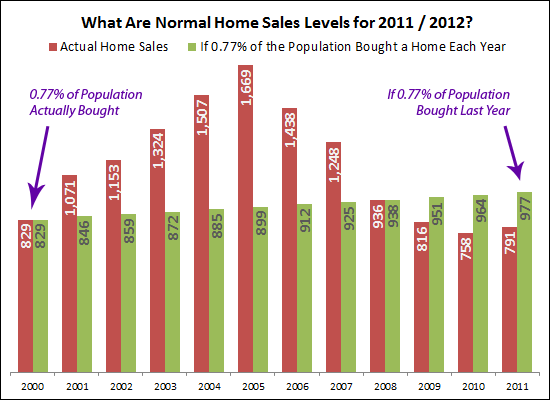

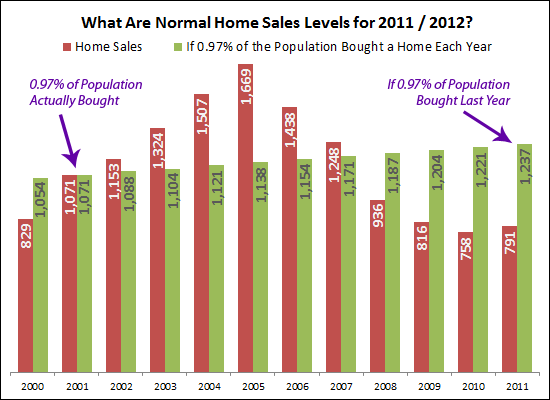

Was 2011 "the new normal" for the pace of home sales in Harrisonburg and Rockingham County? |

|

In 2000, there were 829 home sales. That zoomed up to 1,669 in 2005. This past year (2011) there were 791 home sales. Certainly, 1,669 home sales a year is not a normal pace of home sales, but is 791 home sales per year a reasonable assumption for the pace of our local housing market going forward? To explore this issue, I have created a model showing what home sales would have been if a constant percentage of our local population bought a home each year, and I have included population increases from the past decade.  Above you'll note that in 2000, a total of 0.77% of the population purchased a home (829). Then, for each following year, I have shown how many people would have bought a home if it continued to be 0.77% of the total population. Per these calculations, home sales in 2011 (though improved over 2010) are still well below where they (theoretically) should be. If 0.77% of the population bought in 2011, home sales would have been 23% higher than they were last year.  Above is a second illustration, assuming that 2011 was a normal year -- and that each year we should expect 0.97% of the population to buy a home. In this scenario, home sales should have been 56% higher last year to have 0.97% of the population buy a home. Regardless of the actual numbers, my conclusion based on the data above is that 791 home sales per year (as in 2011) is not the new normal for our market. I believe the market will improve further as to the annual pace of home sales -- at least to 1,000 sales per year. | |

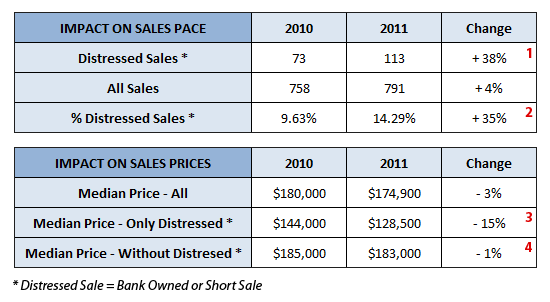

The impact of distressed sales (bank owned, short sales) on the Harrisonburg, Rockingham County housing market |

|

Housing markets across the country have been affected by an increase in distressed sales over the past few years -- both bank owned homes (that were foreclosed on) and short sales (where the sales price didn't pay off the mortgage). So, what was the impact in our local area?  A few observations based on the data above....

Again, given the decline in foreclosures in 2011, I am hopeful that we'll see a smaller number of distressed sales in 2012, leading to greater stability in our local housing market. | |

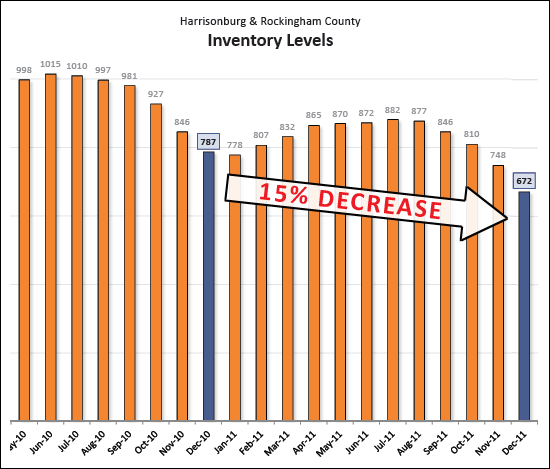

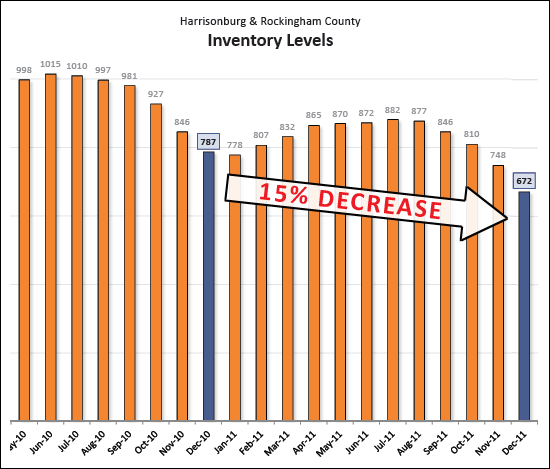

Sellers, sellers, where have you gone? |

|

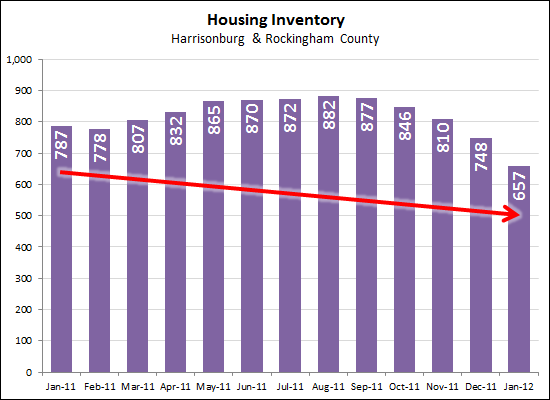

As I commented in my monthly market report earlier this week, inventory has declined significantly (15%) over the past year!  Why is inventory dropping so much??? I have a theory.... First and foremost, I believe there are quite a few homeowners who are deciding to lease their properties instead of selling them, after having had little success in the sales arena. I have seen this quite frequently over the past 6 months, and it makes sense --- leasing the property can provide a stream of income with which to pay the mortgage payment. Leasing a property also gets the homeowner down the road a bit (perhaps a year or two) after which they can try to sell again in a market this has hopefully improved. Second, I believe some sellers are either pulling their property off the market, or never putting them on the market, because they don't believe they can sell their home right now for a price that would either: a) make them happy, b) payoff their mortgage, or c) allow them to move into their next home. Finally, after six years of steady increases in foreclosures in our local market, that trend finally reversed itself in 2011. There were 17% fewer foreclosures in 2011 as compared to 2010 -- which means there are fewer bank owned homes coming on the market. We'll have to wait a few months to see, but I think it's quite possible we'll continue to see much lower inventory levels than we saw last year. | |

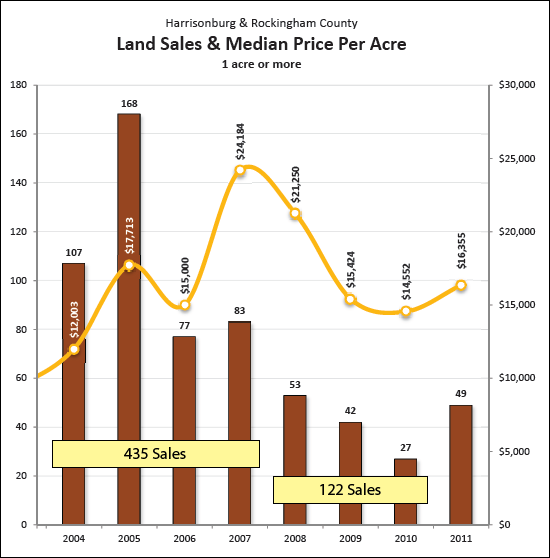

Land sales increase, in pace AND price! |

|

The housing market as a whole in Harrisonburg and Rockingham County seems to be stabilizing. As per my market report earlier this week, sales increased by 4% in 2011, even though prices declined by 3%. Land sales, however, are looking even better! There is quite a bit of information packed into the graph above, but here are the main things I think are important to note:

| |

If a resident of Rockingham County has a job and some level of job security, why wouldn't they buy a home or move into a different home? |

|

A great question from a blog reader. Any thoughts, other blog readers? | |

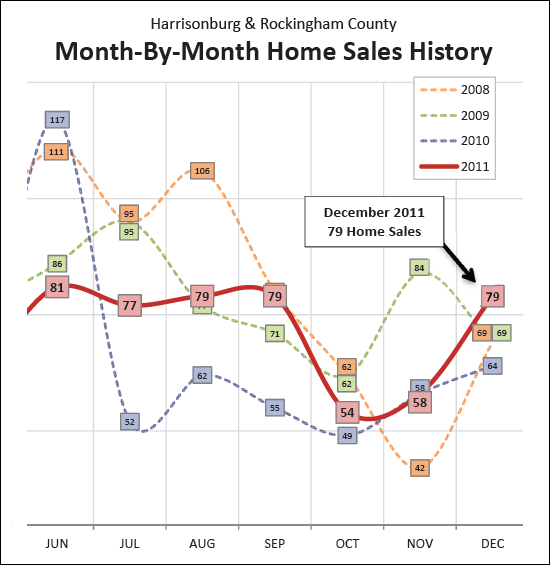

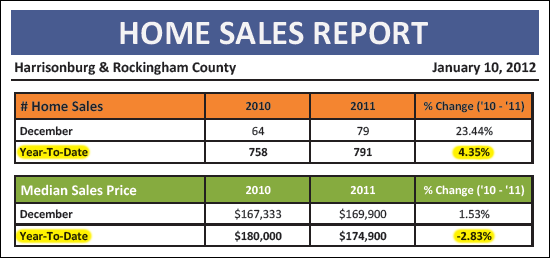

2011 Summary: Stability is returning to the Harrisonburg, Rockingham County housing market |

|

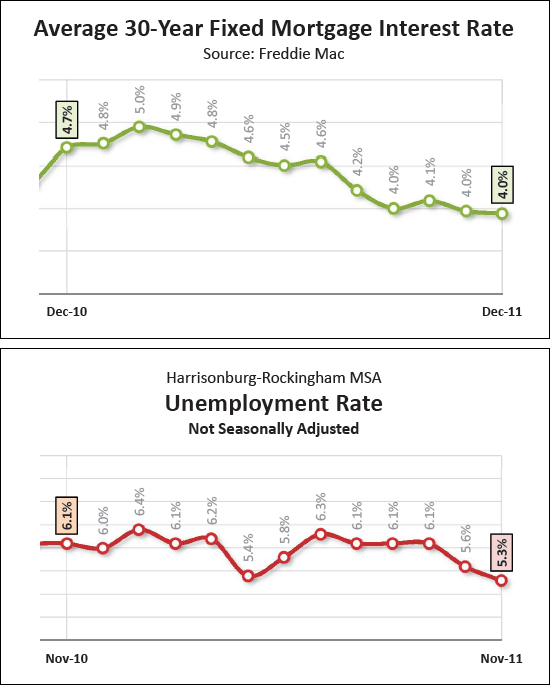

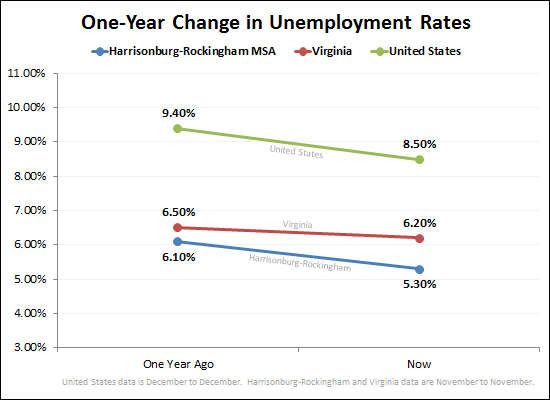

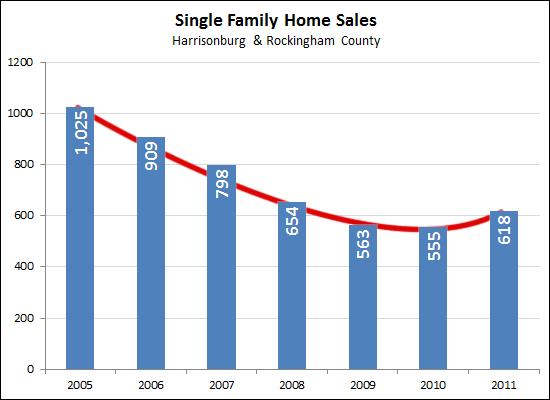

Friends and Colleagues --- Our local housing market has finally done it -- after a five year slide (and a 55% drop) in the pace of home sales, the tide has finally turned in 2011. Our local real estate market showed a 4% improvement in the pace of home sales last year, even though the median sales price declined another 3%. Jump to the PDF of my monthly market report, or keep reading for an overview. Speeding through the finish line....  The local housing market didn't slow down for the close of 2011 -- it poured on the gas to accelerate through the finish line with a strong month of 79 home sales in December. This was the strongest December in at least four years. October and November could have had us worried, with sales in the 50's, but apparently the market was holding back to create an exciting photo finish in December. The Great Reversal....  After five years of seeing fewer and fewer home sales in our local area (from 1669 in 2005 down to 758 in 2010) we finally experienced an increase in buyer activity during 2011 -- with 791 home sales. This marks a 4% improvement in the pace of home sales. The not-quite-as-exciting news, of course, is that the median sales price declined another 2.83% over the past year. But certainly, we needed to see this stability (and now growth) in sales pace before we could reasonably expect to see stability in sales prices. Hello Buyers, Good Bye Sellers....  For the past few years, there have been too many sellers in the market, and too few buyers. 2011, however, has told a different story -- one of returning stability. Not only did home sales increase 4% in 2011, but inventory levels declined 15%. While we still have a ways to go, both of these trends are headed in the direction of increased stability in our local real estate market. We Won't Miss You Mr. Foreclosure....  Foreclosures (and then bank owned homes) have dragged housing markets down across the country. Thankfully, not only did home sales increase this year in our local market (blue bars above), but foreclosures also declined (red bars above). This 17% decline in foreclosures during 2011 shows promise for fewer bank owned homes, and greater market stability in 2012. What else would help? Lower interest rates? Lower unemployment rates?  The stage is set for further stability in our local housing market during 2012 -- mortgage interest rates are at historic lows (below 4%) and our local unemployment rate is at its lowest level in over two years. Looking Forward After a 2005 peak, and a 2010 valley, 2011 brought a long awaited step towards stability in our local housing market as sales began to increase again. The pace of home sales is likely to increase even further in 2012, and we just might start to see some stability in median prices --- if not in 2012, then I would imagine we would certainly see that in 2013. For a more detailed look at the Harrisonburg and Rockingham County real estate market, download my full market report as a PDF. And -- if you have questions about the local housing market, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Unemployment rates drop in Harrisonburg-Rockingham MSA, Virginia, United States |

|

If you don't have a job, it's hard to buy a house. If you lose your job, it's often hard to keep your house. Thus, it is welcome news for the housing market to see the unemployment rates continuing to drop on the local, state and national levels. Yet another indicator that we should see a further improved local housing market in 2012. | |

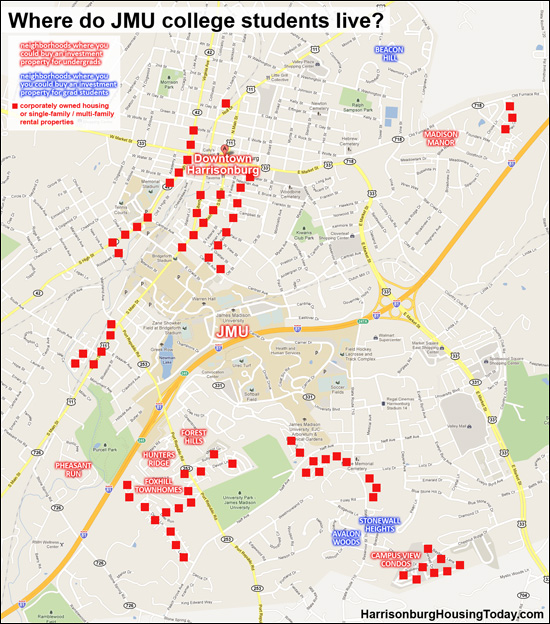

Where do JMU college students live in Harrisonburg? |

|

The competition is stiff, oh wait, no it's not! |

|

In preparing to list a home for sale, I met with my clients and we examined the competition that their home would have given its characteristics (size, location, age, price). We were surprised that there were not too many comparable homes (at all) on the market right now. If someone wants to buy this home, they won't be comparing it side by side with others that are quite similar in size, location, age and price. One reason why some homes for sale don't have as much competition is because of the overall decline in the number of homes listed for sale. Inventory levels have dropped 16.5% over the past year, and there are now only 657 homes (single family, townhomes, condos) on the market in Harrisonburg and Rockingham County. This is good, folks, especially if you are ready to put your house on the market and it is in a decent neighborhood, has been well maintained, and you are able to price it reasonably given market conditions. If you'd like to examine your competition, just call (540-578-0102) or e-mail me (scott@HarrisonburgHousingToday.com) and we can set up a time to meet. | |

Predictions for 2012 in the Harrisonburg and Rockingham County Real Estate Market |

|

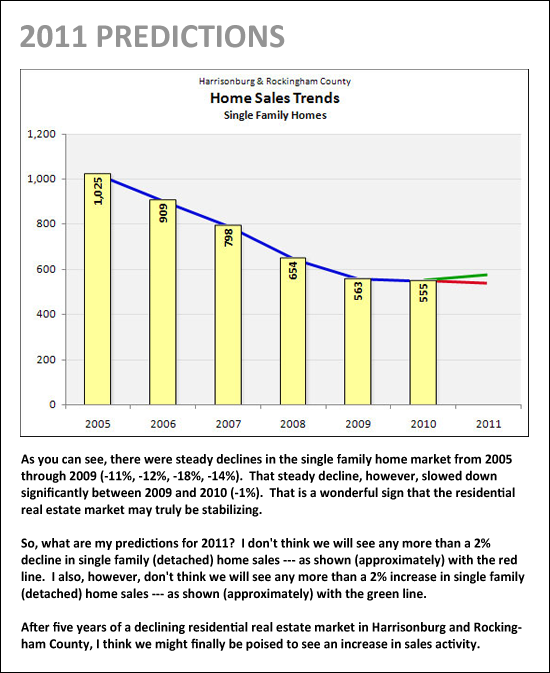

One of the best indicators in our local housing market is the pace of single family home sales. Townhouses and duplexes are sometimes bought by investors, and thus if we include those sales, we aren't getting the best picture of the pace at which homeowners are purchasing homes. Given that single family (detached) homes are a good indicator for the market, I made a prediction in January 2011 as to what would happen in our local real estate market this past year. Let's revisit those predictions for 2011....  So, how did I do? I estimated that the sales pace of single family homes would stay within 2% of the 2010 pace of home sales. Either a 2% increase in sales, a 2% decrease in sales, or somewhere in between. Drum roll, please.....After 555 single family home sales in 2010, there were......618 single family home sales in 2011 -- an 11% increase!!!! Wow, was I wrong!  Please note that the 618 sales in 2011 might actually increase a bit further -- I'll publish my full market report in another week which will include final stats. So, now for predictions for 2012. It's actually a bit more difficult this year. After an 11% increase in single family home sales during 2011 --- it's hard to be conservative in my estimates. Before seeing these figures, I would have estimated we'd see a 2% to 5% increase in single family home sales in 2012. But given that 2011 showed a whopping 11% increase in sales pace, I think I'll have to predict that we'll see a 5% to 10% increase in 2012. That would put us somewhere between 649 and 680 sales in 2012 -- which is on pace with 2008. As always, let me know if you agree or disagree. I value your input as well. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings