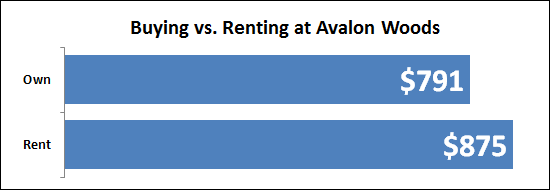

It might get to where it is more affordable to buy than rent. Oh wait, it already did. |

|

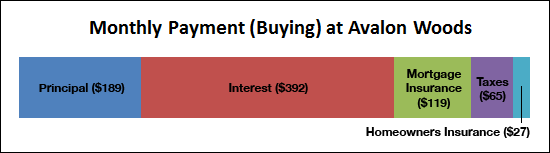

It seems likely that at least one of these active listings at Avalon Woods could be purchased for $130,000 -- and I know of several townhouses that have recently been rented for $875/month in Avalon Woods. As you can see above, this tips the scales towards owning a home being the more affordable option on a monthly basis.  Of further interest, is that of that $791 monthly payment, a full $189 goes towards the principal of your mortgage -- thus you're paying down over $2,000 of that mortgage debt in the first year alone. Certainly, there are other upfront costs (closing costs, down payment) that you will have when buying --- but it is once again an exciting time for first time buyers when you can potentially reduce your monthly housing budget through buying a home. | |

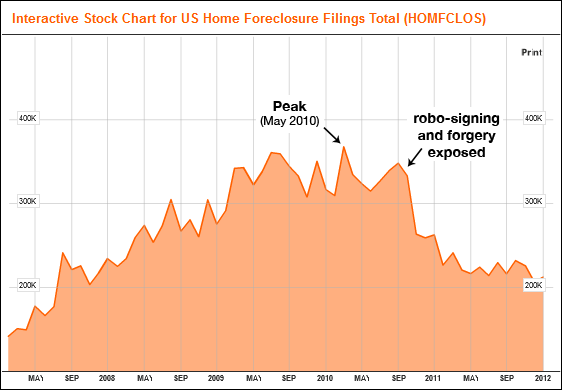

The past five years of foreclosures |

|

Bloomberg has an interactive tool that explores the number of foreclosure filings in the United States over the past five years. | |

Finding a deal on a townhouse in Harrisonburg |

|

There are some deals to be had on townhouses in Harrisonburg, based on:

Some of these are bank owned properties (post-foreclosure) and some are homeowners who are just ready to move on. I have had investors take advantage of some of these great opportunities, and I have had some first time buyers take advantage of them. Send me an e-mail (scott@HarrisonburgHousingToday.com) or call me (540-578-0102) if you are looking for a great deal on a townhouse and I'll fill you in on the details. Also, don't forget that you can find out a lot of information about townhouses communities in/around Harrisonburg by visiting HarrisonburgTownhouses.com. | |

Dick's Sporting Goods coming to Harrisonburg, VA? |

|

(photo above is a store opening in Nashville, not Harrisonburg; source) In further (potential) good news for the local economic climate, the Daily News Record reports today that Dick's Sporting Goods may be opening up a storefront at the Valley Mall in Harrisonburg as soon as this fall. Dick's would (potentially) be located in the space that Peebles vacated in 2006. This follows recent news of an Ashley Furniture store opening in the old Books-A-Million space on East Market Street. Additional tidbits on this developing story:

| |

So, I'll have 671 great homes to choose from, right? |

|

With 791 home sales during 2011, and 671 homes on the market, one might assume that there are PLENTY of homes for buyers to choose from, right? That is over 10 months of supply, you know, which means that approximately 1 out of 11 homes will go under contract each month (11 not 10, to account for new listings). But looking a little closer, perhaps there won't be 671 great options to choose from....  Now admittedly, there are plenty of homes that have been on the market for more than three months that will be interesting to buyers (and will sell), because:

| |

2011 Virginia Housing Report |

|

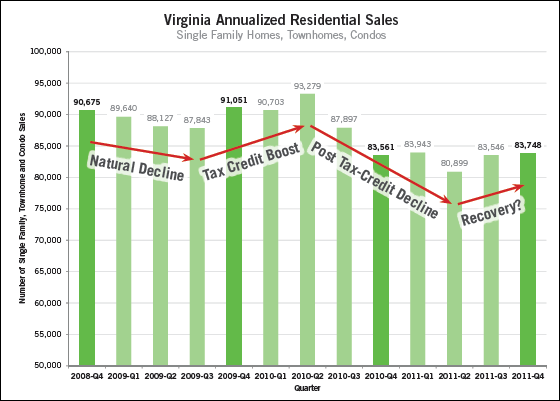

Last week, the Virginia Association of Realtors® released its 2011 Pieces of Home Housing Report including housing market data, trends, and comparisons. BIG PICTURE: Virginia homes sales in 2011 exceeded home sales levels in 2010 despite the lack of a stimulus. HOORAY FOR OUR LOCAL AREA: The Central Valley regions experienced the greatest increase in sales and the Northern Virginia region experienced the only decline. View the whole report by clicking here. | |

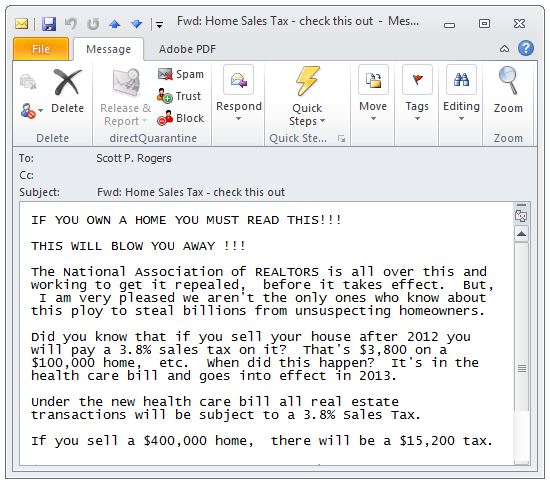

Is there really a new 3.8% Real Estate Sales Tax? |

|

I have had several people ask me about this in the past week, so I thought I'd clarify. The e-mail above is an example of what you might hear about -- a scandalous part of the health care bill that will charge everybody a sales tax of 3.8% of their home sales price starting in 2013. Is it legit? Will you pay this sales tax if you sell? Most likely not. Let's take a look.... The 3.8% tax is a tax on a very narrow band of investment income for high-wealth households (those who earn $250,000 in a joint return or $200,000 as an individual) that could come into play on the sale of a house if the sales gain is more than $500,000 for a married couple or $250,000 for an individual. Even in the unlikely event the sales gain is more than that amount, the tax would only apply based on other considerations having to do with the household's income and tax situation. The bottom line is that the tax, which was imposed to help shore up Medicare, will hit only some portion of investment income. (source here, and more here) So, here's a quick test to help you understand how wide of an affect this 3.8% tax will (or will not have):

So, back to the original e-mail --- Will the seller of a $100K home pay $3,800 per this tax? Absolutely not -- how could they have had a $250K profit if they sold their house for $100K? Will the seller of a $400K home pay $15,200 per this tax? It's possible -- if they are single, and they bought the house for only $150K, and they make over $200K/year. Hopefully you can see how far from reality the rumors are of this 3.8% real estate sales tax. Feel free to call me (540-578-0102) or send me an e-mail (scott@HarrisonburgHousingToday.com) with any questions.. | |

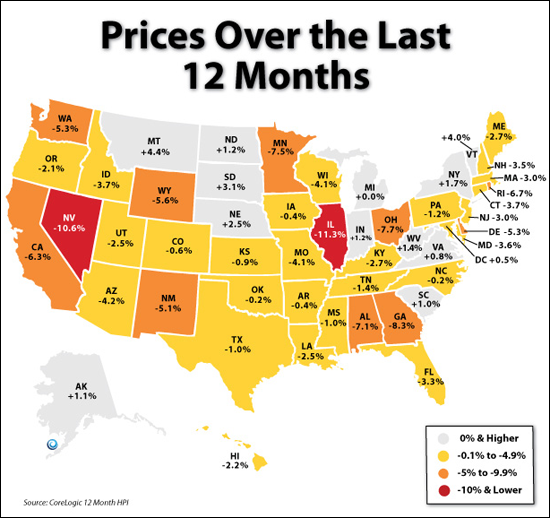

Virginia home prices continue to fare well, comparatively |

|

Source: KCM Above you will see the state-by-state change in home prices over the past 12 months. The majority of states (yellow, orange, red) have seen a decline in prices over the past 12 months --- but not Virginia. Stability in the overall housing market in Virginia is a result of overall stability in Virginia's economy and job market -- both of which positively influence our local economy and housing market as well. | |

Contracts do not always result in closings |

|

During 2010, buyers wrote 820 contracts --- and during the same year, only 758 closings took place. Why the difference? Technically, some of the 2010 closings are based on 2009 contracts....and some of the 2010 contracts will be 2011 closings. I don't suspect, however, that this timing issue significantly effected the relationship between the number of contracts and closings during 2010. Looking back, there were 47 closings during 2010 that were under contract at least twice. That closes the gap most of the way: 758 closings + 47 contracts that fell through (but then were contracted on again) = 805 closings. That leaves just 15 properties (with this rough math) that were under contract but never sold. Interestingly, 2011 was even more disproportionate....

Again, let's pretend ignore the overlap between years -- yes, I know that late 2011 contracts will close in 2012, but in theory almost all of those will be offset by late 2010 contracts that closed in 2011. So, the math gets interesting here..... There were 64 closings during 2011 that were under contract at least twice. 791 closings + 64 contracts that fell through (but then were contracted on again) = 855 closings. That leaves 100 properties (as compared to 15 in 2010) that were under contract but never sold. Again, it's rough math, here is the probability that a contract on your house would result in a closing during the past two years:

Don't get me wrong --- I like contracts, and houses going under contract -- however.....

| |

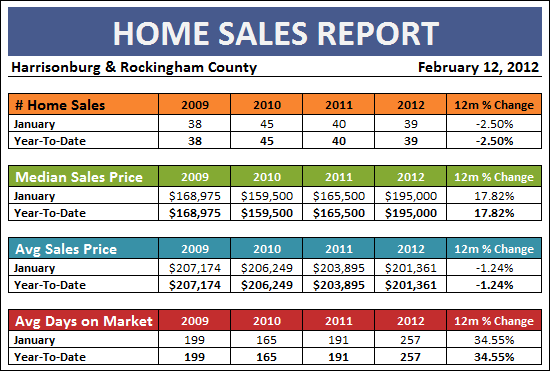

Local housing market stable in January 2012 |

|

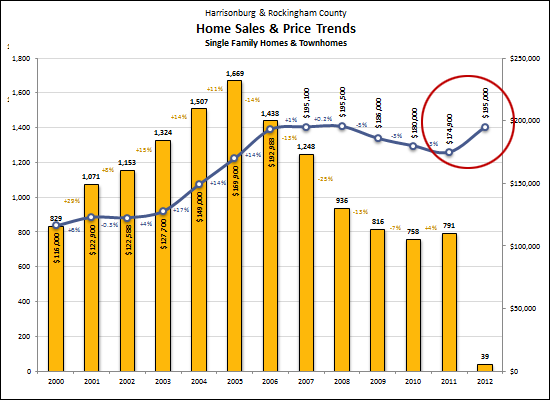

Our local housing market remained relatively stable in January 2012, showing some indicators that we will continue the new trend we saw in 2011. To remind you..... In 2011, after a five year slide (and a 55% drop) in the pace of home sales, our local real estate market showed a 4% improvement in the pace of home sales last year, even though the median sales price declined another 3%. Jump to the PDF of my monthly market report, or keep reading for an overview.  Important trends to note:

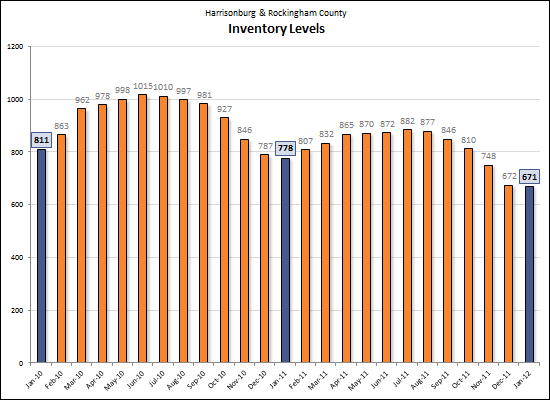

Inventory levels continue to decline (as shown above) with a 14% decline over the past year, and an overall 17% over the past two years.

Perhaps one month of data is too small of a data set to draw some conclusions --- otherwise we'd think our market has REALLY recovered, as the median sales price increased 11% when comparing 2011 to January 2012. For a more detailed look at the Harrisonburg and Rockingham County real estate market, download my full market report as a PDF. | |

The Townes at Bluestone (HarrisonburgTownhouses.com) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Here is an example of the type of information you'll find on HarrisonburgTownhouses.com.

Nestled in the woods of the Bluestone Hills neighborhood, The Townes at Bluestone is convenient to everything. Within just a one-mile radius, you will find more than 40 restaurants, major department stores, a 14 screen movie theater and a state-of-the art fitness center. The Townes at Bluestone offers an array of amenities including single and double-car garages, nine-foot ceilings, crown molding, and extensive windows. This community is still under construction and is being developed by OakCrest Builders out of Winchester, VA.    Streets in The Townes at Bluestone include: Deyerle Avenue, Blue Stone Hills Drive, Lapis Lane, Sapphire Drive and Tanzanite Drive. Properties Currently For Sale...

Below you will find details of sales in this neighborhood during the past 24 months.

Governing Documents: Supplemental Declaration Of Covenants, The Townes At BluestoneThe Townes At Bluestone, Plat Plat Of Lot Lines, BlueStone Hills | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

60 buyers will be signing contracts this month, how can we make sure one of them picks your house? |

|

Last February, 60 buyers signed contracts to buy homes in Harrisonburg and Rockingham County, and I expect about the same number to commit to properties this February. With 678 homes on the market, how do we make sure they pick your home? PRICE - First and foremost, we need to examine how your home stacks up to the competition when it comes to pricing. Are most other comparable homes priced below your list price? Very close to your list price? Perhaps we need to undercut the competition to make a buyer ready to commit based on the value and opportunity offered by your home. MARKETING - Is your property marketed broadly and effectively? Does the marketing plan for your home focus first on the primary three ways (internet, sign, Realtor) buyers find the homes they purchase? Do the property photos, brochures, and online presence accentuate your home's strong points? CONDITION - To the extent that we can generate showings through competitive pricing and appropriate and effective marketing, let's also make sure buyers are even more impressed when they view your home in person. Eliminate distractions and potential objections that buyers might perceive when walking through your home. FOLLOW UP - We'll also need to proactively and persistently follow up with buyers (or their Realtors) that have viewed your house. What are their questions, their hesitations, their objections? What additional information can we provide them, or solutions can we research for them? There are certainly some aspects of selling your house that are out of our control, but we do have the ability to affect the price, marketing and condition of your home to maximize the possibility that a February buyer picks your home! Have questions? Need help? Ready to sell? Call me at 540-578-0102 or e-mail me at scott@HarrisonburgHousingToday.com. | |

January 2012 - typical sales, strong contracts |

|

In a few day I'll be releasing my full monthly market report. Until then, you might find the following quick stats interesting..... January 2012 home sales = 39 January 2011 home sales = 40 Thus, if last year was a typical year for home sales (up 4% from the prior year) then this January came in right in line with last year's sales. Actually, one sale shy of last year's data. January 2012 contracts = 60 January 2011 contracts = 49 As a good indicator for February and March, contract numbers were quite strong during January! | |

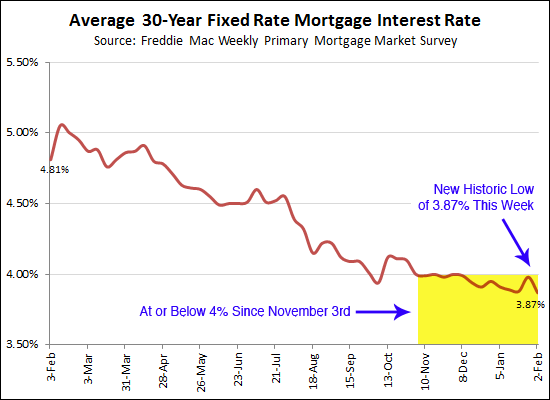

Average mortgage interest rates (3.87%) break historic low levels, again |

|

Not only have 30-year fixed mortgage interest rates been at or below 4% since November 3rd, they also hit an all-time low this past week at 3.87%. Buying a median priced home a year ago: Price: $180,000 Interest Rate: 4.81% Monthly Payment: $884 (assuming 80% LTV) Buying a median priced home now: Price: $174,900 Interest Rate: 3.87% Monthly Payment: $781 (assuming 80% LTV) | |

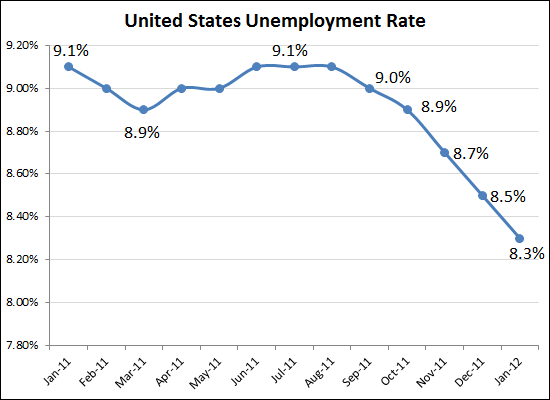

U.S. Unemployment Rate Falls Again, to 8.3% |

|

This is one economic indicator that I am happy to see heading downward. There are still lots of people who are not able to find work, but this trend is headed in a great direction. | |

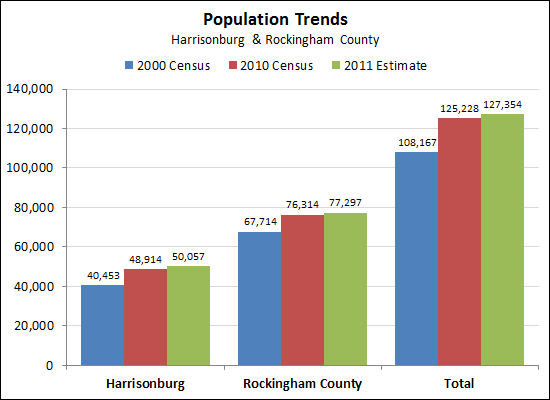

Harrisonburg Population Tops 50,000 |

|

As reported in the Daily News Record this week, the Weldon Cooper Center's population projections show that Harrisonburg has now surpassed a population of 50,000. There was a remarkable 2.3% population growth in the City over the past year -- certainly a good sign for the local economy and housing market. | |

Virginia housing market shows signs of returning stability |

|

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings