Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Saturday, April 14, 2012

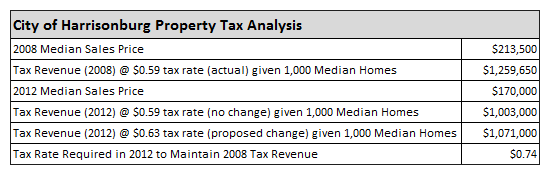

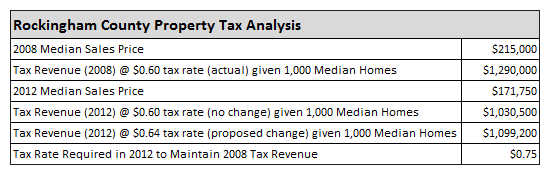

The City of Harrisonburg is considering increasing the real estate tax rate from $0.59 per $100 of assessed value to $0.63 per $100 of assessed value. Rockingham County is also considering a $0.04 increase, from its current tax rate of $0.60 per $100 of assessed value to $0.64 per $100 of assessed value.

To understand the potential rationale behind such an increase, letís examine funding levels given a few assumptions to make the math a bit easier. First, we will assume that all tax assessments are at exactly 100% of the market value of properties. Second, we will assume that both Harrisonburg and Rockingham County are comprised of 1,000 privately owned homes. Third, we will assume that all homes have market values (and assessed values) of the median sales price.

As shown in the table above, the median sales price in the City of Harrisonburg declined 20% between 2008 and 2012 from $213,500 to $170,000. If the City of Harrisonburg were comprised of 1,000 median-priced homes, the tax base and thus the tax revenue would also decline by 20% from $1.26M to $1M. Even with the proposed $0.04 proposed increase in the tax rate (from $0.59 to $0.63) the tax revenue would still decline by 15% from $1.26M to $1.07M. In fact, the tax rate would need to increase to $0.74 (a 25% increase) in order to maintain the same tax revenue as in 2008 --- assuming that assessed values have tracked precisely with median sales prices.

As shown in the table above, the median sales price in Rockingham County declined 20% between 2008 and 2012 from $215,000 to $171,750. If Rockingham County were comprised of 1,000 median-priced homes, the tax base and thus the tax revenue would also decline by 20% from $1.29M to $1.03M. Even with the proposed $0.04 proposed increase in the tax rate (from $0.60 to $0.64) the tax revenue would still decline by 15% from $1.29M to $1.1M. In fact, the tax rate would need to increase to $0.75 (a 25% increase) in order to maintain the same tax revenue as in 2008 --- assuming that assessed values have tracked precisely with median sales prices.

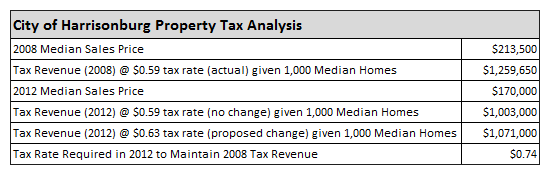

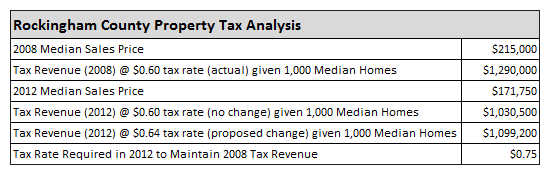

To understand the potential rationale behind such an increase, letís examine funding levels given a few assumptions to make the math a bit easier. First, we will assume that all tax assessments are at exactly 100% of the market value of properties. Second, we will assume that both Harrisonburg and Rockingham County are comprised of 1,000 privately owned homes. Third, we will assume that all homes have market values (and assessed values) of the median sales price.

As shown in the table above, the median sales price in the City of Harrisonburg declined 20% between 2008 and 2012 from $213,500 to $170,000. If the City of Harrisonburg were comprised of 1,000 median-priced homes, the tax base and thus the tax revenue would also decline by 20% from $1.26M to $1M. Even with the proposed $0.04 proposed increase in the tax rate (from $0.59 to $0.63) the tax revenue would still decline by 15% from $1.26M to $1.07M. In fact, the tax rate would need to increase to $0.74 (a 25% increase) in order to maintain the same tax revenue as in 2008 --- assuming that assessed values have tracked precisely with median sales prices.

As shown in the table above, the median sales price in Rockingham County declined 20% between 2008 and 2012 from $215,000 to $171,750. If Rockingham County were comprised of 1,000 median-priced homes, the tax base and thus the tax revenue would also decline by 20% from $1.29M to $1.03M. Even with the proposed $0.04 proposed increase in the tax rate (from $0.60 to $0.64) the tax revenue would still decline by 15% from $1.29M to $1.1M. In fact, the tax rate would need to increase to $0.75 (a 25% increase) in order to maintain the same tax revenue as in 2008 --- assuming that assessed values have tracked precisely with median sales prices.