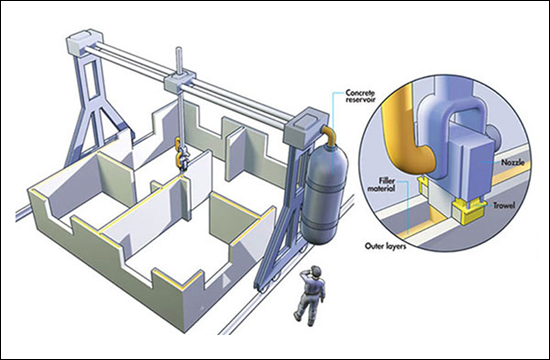

Will we be printing our houses in the future? |

|

Image: Contour Crafting Researchers are working on 3D printer that could construct a 2500 square foot home in 24 hours. Wow! Read more here: The Answer to Affordable Housing Could Lie Within a 3D Printer | |

Your Home May Be Your Largest Financial Asset |

|

Most people consider their home as a place to live, where families grow, and make memories together. But beyond simply serving as a shelter, your home may also be your largest financial asset. As such, at least from time to time, you should think of it in that light, and make decisions accordingly. First, let's examine the magnitude of your home as a financial asset. A young couple that purchases a $150,000 home at age 30 with 5% down will have paid it off by age 60, and will then have a $364,000 asset assuming 3% per year appreciation. A neighboring young couple that rented during that entire time frame would have needed to put over $600 per month (beyond their rental payment) into an investment account with a 3% return in order to match that $364,000 asset after 30 years. Thus, owning a home becomes a relatively simple way to accumulate savings that can later allow you to retire and have assets to use for your living expenses. Given this potential for a significant future value wrapped up in one's home, homeowners should spend the time, energy and money to care for and improving this asset over time. Keep ahead of the game with ongoing maintenance items such as changing furnace filters, having your HVAC system serviced, painting exterior trim, replacing interior flooring as needed, staining and sealing your deck, etc. Also, depending on how long you anticipate being in your current home, considering making some long term investments, such as planting trees and improving the overall landscaping of your home. The owning versus renting comparison doesn't even fall apart here --- the cost of these improvements are indeed above and beyond your mortgage payments, but with a fixed mortgage interest rate, your principal and interest payment will remain steady over time, as compared to a rental rate that is bound to increase over time. As you are likely to do as your life circumstances change, consider upgrading to a larger home to better suit your housing needs. Selling a home and then buying a new one involves some significant transaction costs which should not be taken lightly – but the cost of transitioning to a new home can be worthwhile if it works within your budget and works better for your family's needs. From a financial perspective, this becomes a one-time transactional cost to upgrade your investment to a larger asset. As you know, your home is much more than just a financial asset, but you must think about how your housing decisions affect your overall financial situation and the options you will (or will not) have in the future based on those housing decisions. Today's low fixed mortgage interest rates provide a unique opportunity to lock in your housing costs for years to come, and as allow for a wonderful long term investment and savings plan. Whether you own a home now, or are considering a purchase, it is worthwhile to examine your hopes, goals and dreams, as well as the financial side of the equation. | |

State of the Union |

|

Don't forget to watch the State of the Union tonight at 9PM. And let's take this opportunity to see how our local real estate market is doing as compared to where we were one year ago.

Stay tuned this evening for an update on the state of our nation, but our local housing market seems to be much improved over the past year. | |

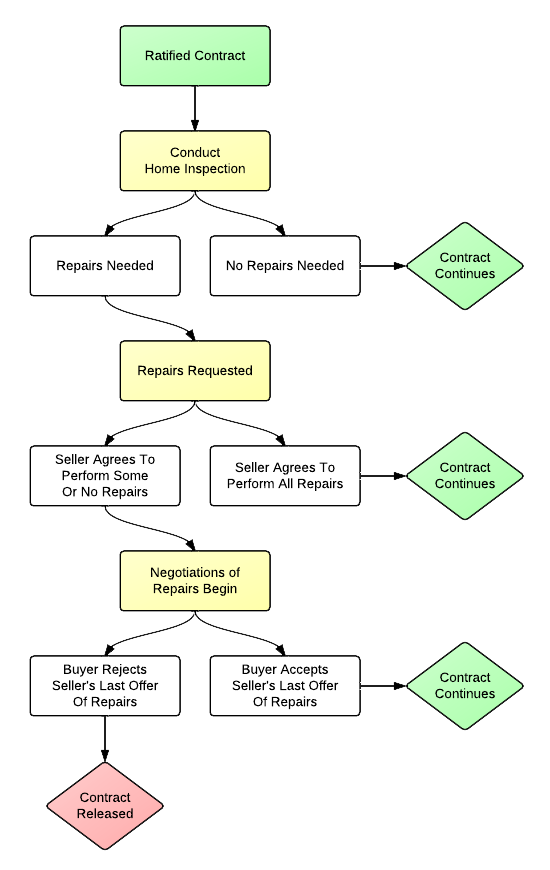

What happens after a home inspection takes place? |

|

All of this is subject to change, as the Virginia Association of Realtors just published a new version of the standard Home Inspection Addendum, but only time will tell if that form will be adopted locally. There are definitely some inherent challenges to the newly proposed form. So, until and unless things change, here's how the home inspection (and then negotiation) process works....  | |

The Home Buying Process |

|

Purchasing a home can be fun, exciting, thrilling, and fulfilling….but that very same process can also have its moments of being hard, frustrating, disappointing and overwhelming. In my role as a Buyer's Agent, I will be working with you through the entire home buying process to make it as educational and stress-free as possible. The very first step in this process is for us to discuss your needs, goals, dreams and desires. This may involve specifics such as the number of bedrooms and bathrooms, or may focus more on the layout of homes, the feel of a neighborhood, and the long term plans for your growing family. I will be focusing on listening well, and hearing what it is you are working to achieve with our home purchase – and then helping to identify the best housing options for accomplishing those goals. An important, parallel, part of starting the home buying process is to identify a target price range. This can best be determined through consultation with a reputable, local mortgage lender (just ask… I know who they are) but will involve more than just determining the highest priced home that they would allow you to purchase. It will be important to consider both your purchasing power, and your goals for how your housing costs will fit into your overall budget. You will also talk with your mortgage lender about how different loan programs might work better (or worse) for your situation. Once we have a shared understanding of what you are hoping to purchase, and we know what the price tag can and should look like, we can start to evaluate homes that are currently on the market. This will usually start online, perhaps through an exchange of emails, and saving some searches in your account on my web site. Then, you might choose to drive by some of the prospects before determining a list of homes to go view – or you may be ready to start seeing all of the homes on the list right away. As we view this first set of homes, we will learn a lot – about the opportunities in the market, and about your preferences. If we don't identify a home after looking at all of the homes on the market that seem to offer what you are looking for in a new home, we will either re-evaluate our criteria to expand our search, or we will wait to view new listings that come on the market. This extended home search process might take us weeks, or months, depending on the type of property you are hoping to purchase, and how often such a property becomes available. All along the way, I'll be following up on previous homes we have viewed to let you know if their prices have dropped, and will be letting you know of new opportunities as soon as those houses hit the market. Once we have identified the home you are hoping to purchase, we will prepare to make an offer. This will include researching similar home sales to guide our discussions of price, creating a negotiation strategy, and preparing and reviewing the pertinent contract documents. There is quite a bit of paperwork involved in making an offer on a home, and I want to make sure that you understand these contract documents and make sure that we have drafted them in a way to protect your best interests. Negotiating the final deal on the property you purchase may take a few hours, or a few days. We may go back and forth with the seller on price alone, or on many terms of the contract such as timing, contingencies, and more. Once we have a final agreement, all parties will sign and initial the final documents, and we will have a full ratified contract. Immediately following the ratification of the contract, we will need to schedule and perform a home inspection and radon inspection (assuming you are conducting both) to learn more about the property you are purchasing. If these inspections reveal new (detrimental) information about the property, we will have the opportunity to request that the seller make repairs to the property, which may result in a renegotiation on price. Typically, we are able to work through this second round of negotiations relatively quickly, so long as the seller is being realistic and rational given the new information about their property. Simultaneously with conducting these inspections, you will need to be starting the financing process to work towards obtaining full loan approval. This will start with signing your loan application and paying any applicable loan application or appraisal fees. Your lender will then be diligently working to further qualify you as a purchaser as well as the property via an appraisal. You will be providing many documents to your lender during this process as they work towards securing a loan for you to purchase the property. Within the first few weeks after your contract is in place, we will need to select service providers to coordinate the additional aspects of your home purchase. This will include a settlement agent or attorney who will conduct a title search of the property and prepare all documents for your settlement. You will also need to set up a new homeowners insurance policy on your new property, as well as schedule utility service to start in your name as of the settlement date. We'll now be just a few weeks before closing, and the final pre-settlement details will include reviewing the settlement statement (which shows all of the funds coming into and going out of the closing), conducting a final walk though of the property (to confirm the condition is as we expect it to be), and obtaining a cashier's check to bring the necessary funds to settlement. All of the details should be falling in place now, and if all goes well, we will be set for an on-time settlement. In nearly all real estate transactions (in this area) at your real estate closing you will sign all of the loan and settlement documents as well as receive the keys to your new property. The house will now be your new home, and you can take possession and starting moving in immediately after settlement. Later that day, the settlement agent will record the deed at the courthouse that officially transfers ownership of the property into your name. You are bound to have questions about the home buying process – before you begin, as we go, and even after settlement. I am here to answer all of those questions, or to guide you to the professional who can. There is plenty to learn about the home buying process, and I am here to help guide you through it and to help you make excellent decisions about your purchase of a home. | |

Updates sales trends on HarrisonburgTownhouses.com |

|

HarrisonburgTownhouses.com has been updated with sales data from 2013-Q4, and many townhouse communities are (finally) starting to see median prices increase again. So, are you wondering about property values in your townhouse community? Or considering purchasing an investment property? Whatever the reason for your interest in townhouses in Harrisonburg, you will likely find the information you need at HarrisonburgTownhouses.com, including (for each townhouse community):

The townhouse communities featured on HarrisonburgTownhouses.com include:

| |

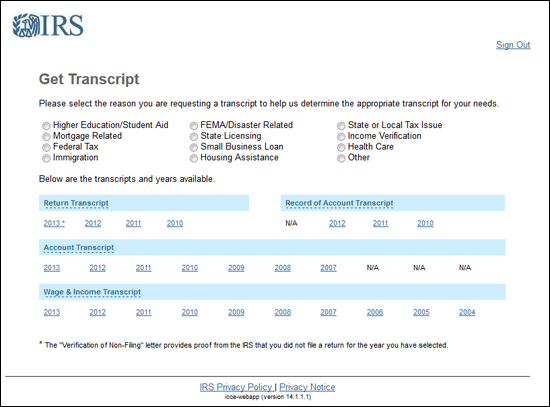

Download your tax returns from the IRS! |

|

This may be a helpful resource as you are providing documents to your lender during the home buying process. You can now download your tax returns from the IRS. I created an account and downloaded my transcripts relatively easily after dealing with some pop up windows being blocked. I found the "Record of Account Transcript" document to be the most comprehensive and helpful. It's nice to be able to download what the IRS is considering to have been your final tax filings. Check it out here: http://www.irs.gov/Individuals/Get-Transcript | |

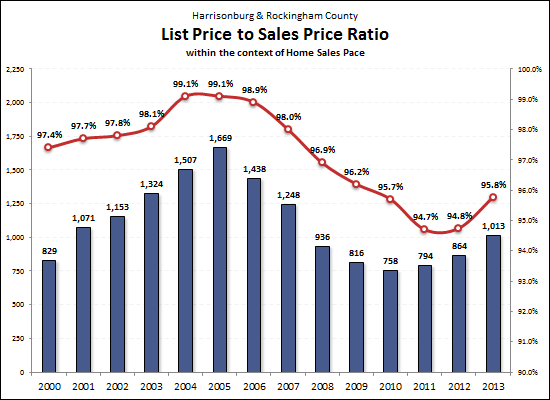

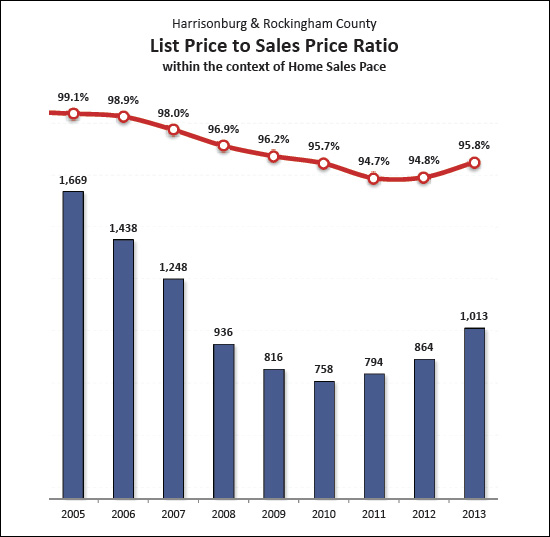

Price negotiability, pace of home sales seem highly correlated |

|

First, a disclaimer, I am not a statistician --- though I did take a fantastic stats class in grad school with Kevin Apple. That said, it sure would seem to me that there is a direct correlation between the pace of home sales, and the negotiability of home prices. Take a look at the graph above and let me know (online or offline) if you agree. Actual statisticians --- feel free to chime in. :) | |

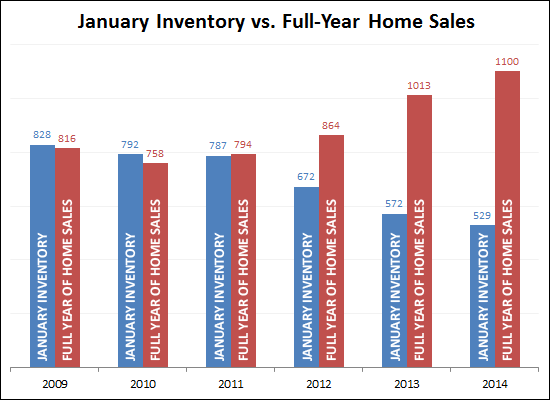

January Inventory vs. Full Year Home Sales |

|

As Todd Rhea so eloquently said in a comment on my blog post yesterday.... "This inventory analysis is a big deal for the local market. In 2009-2011 the local market entered the year with more gross inventory than homes that were sold in the following 12 months. This year for every inventory unit entering the year, there will likely be 2 sales in 2014. The impacts on price from Supply and Demand have never been repealed. With lower supply (inventory) and modestly growing demand, days on the market should continue to fall, and prices should increase in 2014."I agree wholeheartedly with Todd....

** Please note: The 2014 home sales shown in the graph above are a projection, not a promise. :) | |

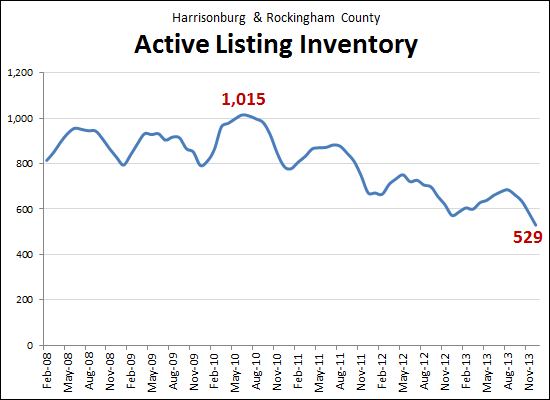

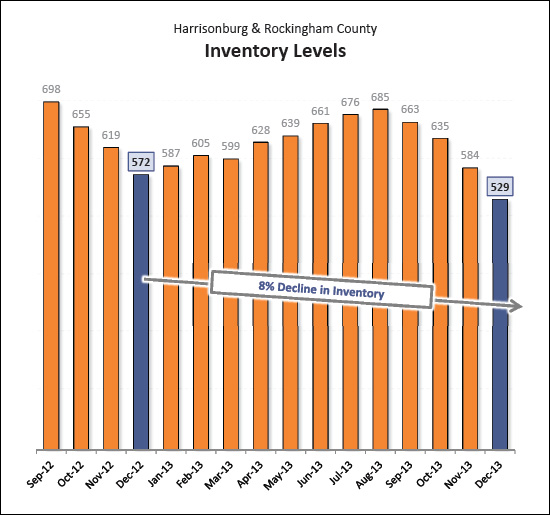

Listing inventory down 48% since 2010 peak |

|

Current active listing inventory (~529 properties for sale) in Harrisonburg and Rockingham County is at the lowest point since at least 2008 when I started tracking this data. The high point was in June 2010 when there were 1,015 homes for sale. Learn more about our local real estate market at HarrisonburgHousingMarket.com. | |

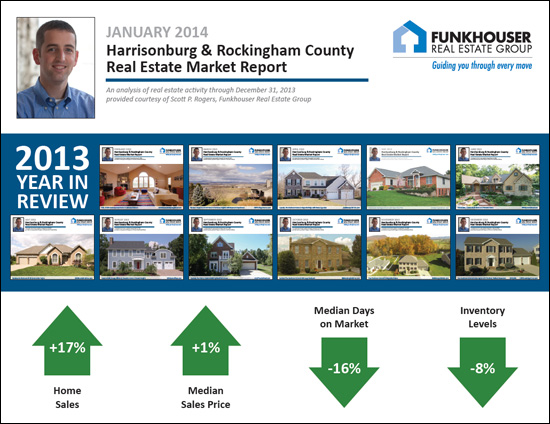

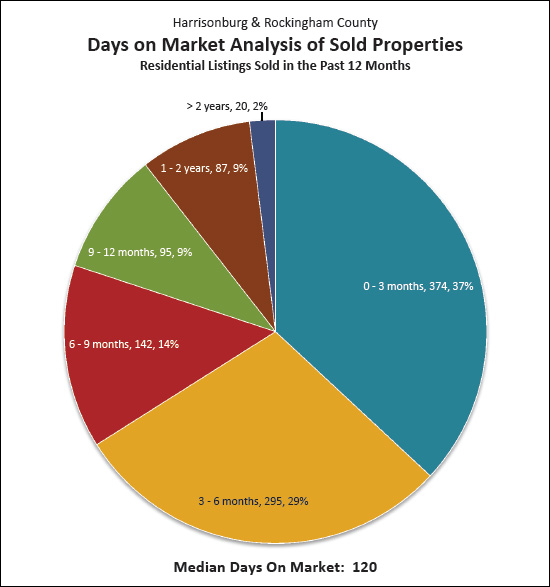

2013 Year in Review shows 17% Increase in Home Sales, 1% Increase in Sales Prices |

|

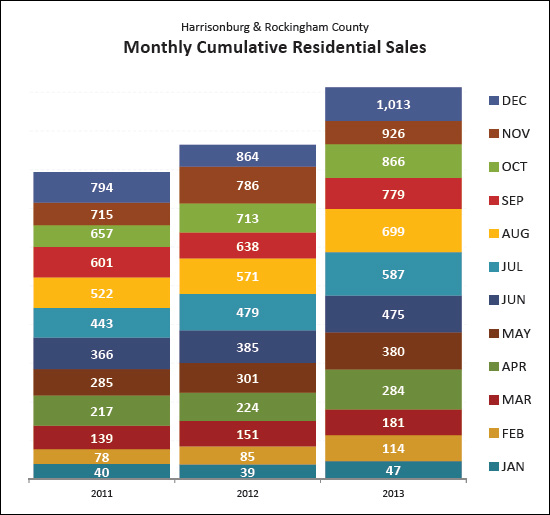

Wow! What a year! 2013 has now drawn to a close, and we witnessed some exciting milestones in our local real estate market.....

As noted above, in 2013....

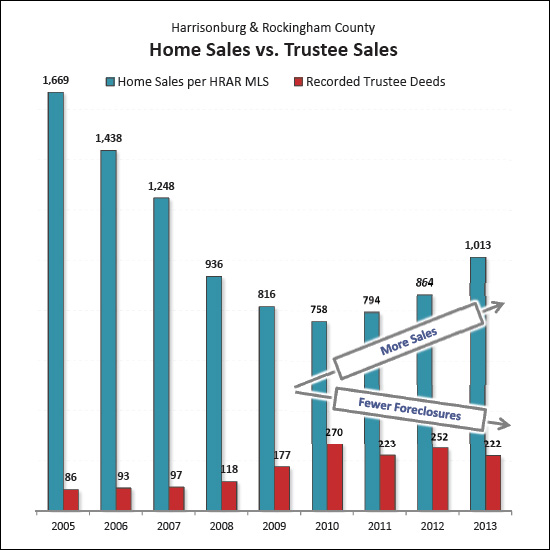

Home sales were solid through the year, finishing out (1,013) well above 2012 home sales levels (864). It seems likely that we will see somewhere between 1,050 and 1,100 home sales in 2014.  Inventory levels continue to decline, which is typical for this time of year, though we are now seeing the lowest inventory levels we have seen in over 5 years. This has several effects:

While we are still seeing more foreclosures (222 in 2013) than is historically normal for this area (50-100 per year), it is encouraging to see foreclosures starting to decline at the same time that home sales are increasing. This should result in greater market stability on into the future.  Sellers -- you ought to be encouraged that you may need to negotiate less in 2014 (depending on how your property is priced) -- buyers only negotiated an average of 4.2% off of the (final) list price of properties in 2013, as compared to 5.3% in 2011.  An astonishing 37% of homes that sold in 2013 closed within 90 days of having first been listed.....and an additional 29% sold in the following three months. This lead to an overall median of 120 days on the market for those homes that did sell in 2013 -- this does not account for homes that were listed in 2013 but did not sell. There is a LOT more the full report, so click here to download the full January 2014 Harrisonburg & Rockingham County Real Estate Market Report. An Important Caveat: Yes, our overall housing market is improving. But no, that does not apply equally to all price ranges, locations and property types. We can chat about your specific property to see whether that segment of the market is performing better or worse than the overall market. And as always, if you're interested in talking to me about buying a home in Harrisonburg or Rockingham County.....or if you are interested in selling your current home.....just drop me a line by email (scott@HarrisonburgHousingToday.com) or call me at 540-578-0102. | |

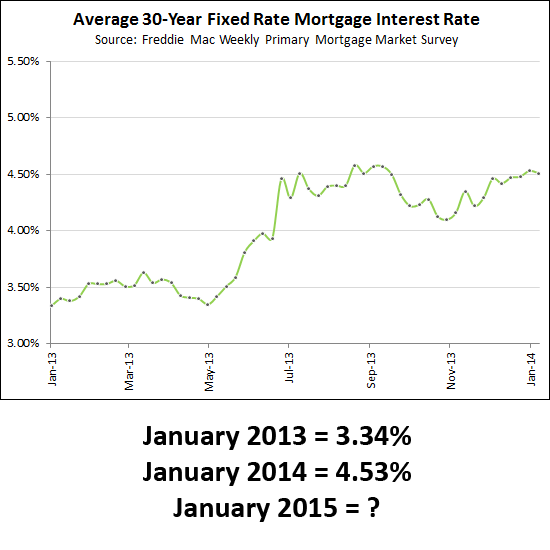

Where will interest rates go in 2014? |

|

Where will interest rates go in 2014? My guess is that we'll end this year somewhere between 4.25% and 5%. What is your forecast? | |

3 Most Expensive Home Sales in Harrisonburg, Rockingham County in 2013 |

|

Explore high end homes currently for sale in Harrisonburg and Rockingham County online at HarrisonburgLuxuryHomes.com. | |

Video Overview of new iPhone and iPad Apps |

|

Funkhouser Real Estate Group launches Mobile Apps for Real Estate in the Shenandoah Valley |

|

I am thrilled to announce that you can now download our brand new mobile apps for exploring real estate in the Shenandoah Valley. These beautiful, easy to use apps were just released, and should make your real estate searching experience even easier and more fun than ever before. Our new app is available for the iPhone, iPad, and Android devices!  Enjoy features such as.... GEO Location Search: GEO Location Search uses your phone's built in GPS device to search for properties around you. Refine your search using property or community filters to find the property you are looking for. Journey Search: Journey Search allows you to view properties within close proximity of your current location while you're on-the-go! This search will continue to update available properties as you travel. Perimeter Search: Through the Perimeter Search feature, using only your finger you can draw boundaries on the map view, showing available homes within the drawn area. Scope Search: Using the phone's built in camera and and an augmented reality engine, Scope Search displays property around you by simply pointing your phone in the direction of the property. In addition to the interactive search functionality, this app also syncs to your account with Funkhouser Real Estate Group ensuring saved data is accessible on your mobile device as well as Funkhouser Real Estate Group's website. Here are a few screenshots of the app in action on my iPad....   Have fun with our new mobile apps, and feel free to email me with any feedback or questions.  | |

Understanding Real Estate Assessments |

|

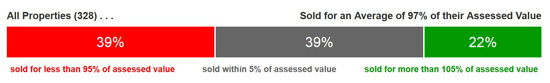

As recently published in the Shenandoah Valley Business Journal.... It's that time of year again, when homeowners (at least in the City of Harrisonburg) are receiving notices of the reassessment of their property. As you strive to understand the new (or current) assessment of your property, let's have a brief refresher course on real estate assessments. First, many people (erroneously) believe that the assessment of their property is an indication of their home's value. In actuality, the assessed value of a property is the value assigned to the property by the local assessor's office, for the purpose of determining how much you will pay in taxes. Certainly, the assessed value is intended to be the precise value of your home – but it is quite possible that there is a disparity in this assessed value and market value. The market value of your home is the price at which it would sell in the current market. Sales Prices vs. Assessed Values in the City of Harrisonburg  To better understand how assessed values relate to market value, I checked on the 2014 assessed value for each of the 328 properties that sold between January 1, 2013 and November 30, 2013. What I discovered, is that properties in the City of Harrisonburg sold, on average, for 97% of their assessed value. Looking a bit deeper, just over a third of City properties (39%) sold within 5% of their assessed value – the remaining 61% had a sales price that was more than 5% higher or lower than the assessed value. Sales Prices vs. Assessed Values in Rockingham County  Performing the same analysis in Rockingham County, we discover that County properties are selling for slightly more than their assessed value (average of 106%) as compared to City properties that are selling for a bit less than their assessed value (average of 97%). Given the great variation in assessed values and market values, homeowners should not rely on their tax assessment for an understanding of their property's value. Furthermore, home buyers should not rely on assessed values to guide them in understanding the market value of a home that they might purchase. Both buyers and sellers should strive to understand the market value of a particular piece of real estate my analyzing similar homes that have recently sold and those currently on the market in a given neighborhood or price point. The relationship between assessed values and sales prices varies based on the price, size, age and location of the home. For a more thorough analysis of the topic, visit HarrisonburgAssessments.com. | |

The Reserve at Stoneport seemingly one (significant) step closer to reality |

|

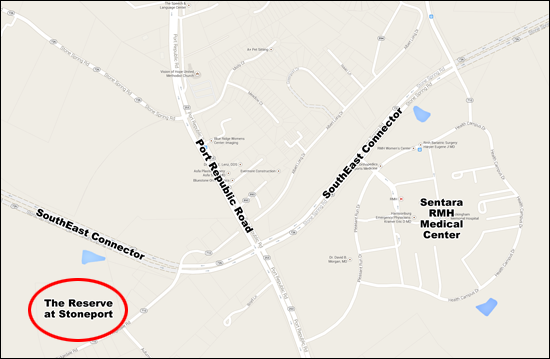

Per my prior reports, The Reserve at Stoneport may be one of the first new residential developments close to the new hospital location. Original indications were that The Reserve at Stoneport would consist of 396 apartment homes on 21.8 acres. On the last day of 2013, 11.166 of those acres transferred from the land development company (Stoneleigh Associates, LLC) to what would appear to be the developer who will build this community (The Reserve at Stone Port I, LLC). This 11.166 acre parcel sold for $1,500,000 --- or $134,336 per acre. Click here for a larger version of the map shown above. Click here for the Owners Consent that shows the specific location of these 11.166 acres. The image shown below is a rendering of The Reserve at Stoneport that was available as of October 2012. Stay tuned for updated information as it becomes available.  These were the prior details of The Reserve at Stoneport that are no longer available on the Stoneport web site, but are likely still indicative of the general direction that this development will take....

| |

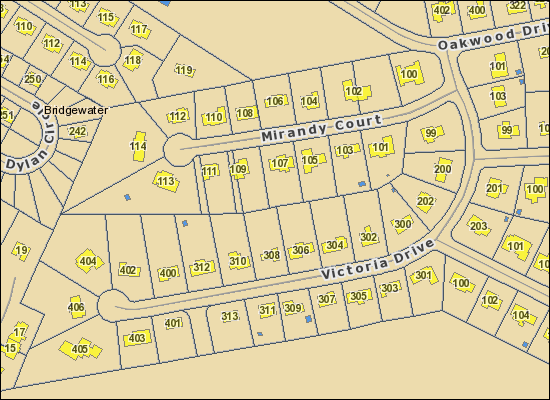

New Geographic Information System (GIS) for Rockingham County |

|

A new GIS service is available for Rockingham County -- bookmark it now -- http://rockingham.interactivegis.com. Per Rockingham County.... The increase in performance and stability along with new functionality will enhance user ability to interact and navigate inside the County map, obtaining data related to specific interests at a more efficient rate.I have explored a bit, and it does seem to be an improvement over the old GIS, and it even has a mobile site! Rockingham County GIS | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings