| Older Posts |

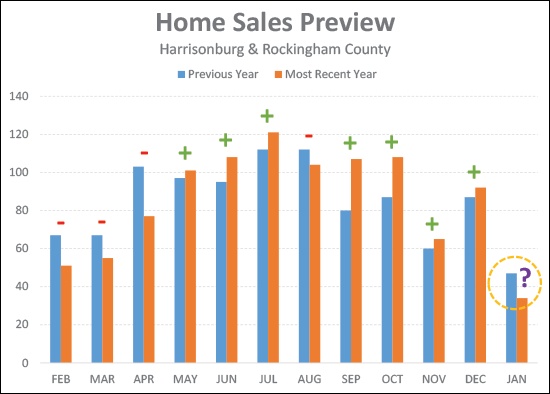

Home Sales Preview: January 2015 |

|

Looking back at sales in recent months we find that....

The current month, however, has thus far not been as exciting. We'll need to see quite a few more sales recorded in the MLS over the next few days (that closed in January) in order to come up on par with last January. Stay tuned for my monthly market report, or feel free to catch up by reviewing last month's report. | |

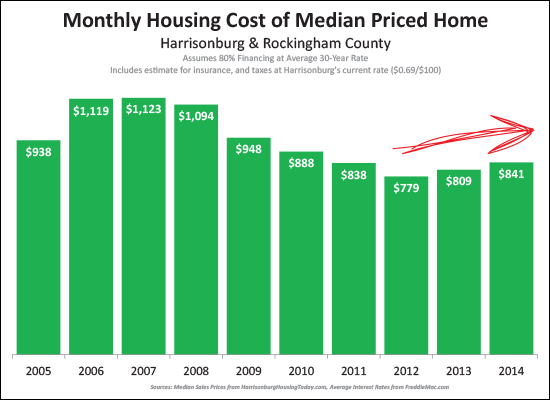

Monthly housing costs on the rise |

|

It had to happen eventually. The analysis above shows the monthly cost of financing 80% of the purchase price for a median priced home over the past ten years. A few observations....

The increases in monthly housing costs over the past two years are not surprising, because....

As a buyer, you still have a great opportunity to lock in some relatively low monthly costs of homeownership -- and there is some value in acting sooner rather than later, as these costs are likely to continue to increase over the next few years. Here's the data behind the graph....

A few notes....

| |

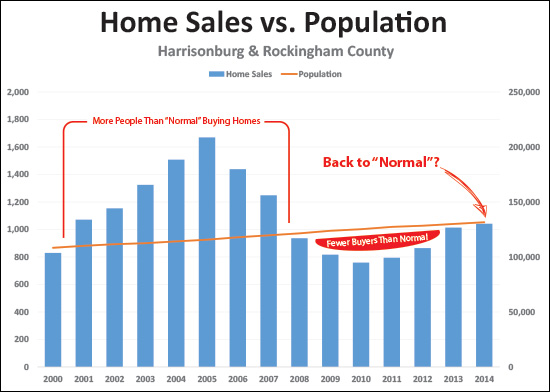

Home Sales Back In Line With Population? |

|

The Weldon Cooper Center just released their 2014 Population Estimates and Harrisonburg and Rockingham County are growing, as usual. 2014 Population Estimates:

If we take 2000 home sales as a baseline portion of the population to be buying in any given year, and then we project forward based on actual population growth, we can conclude that....

Based on the data presented above, I believe the new "normal" number of people to be buying per year may be around 1,050 - 1,100 home sales. Read today's Daily News Record article for more commentary on these new population estimates. | |

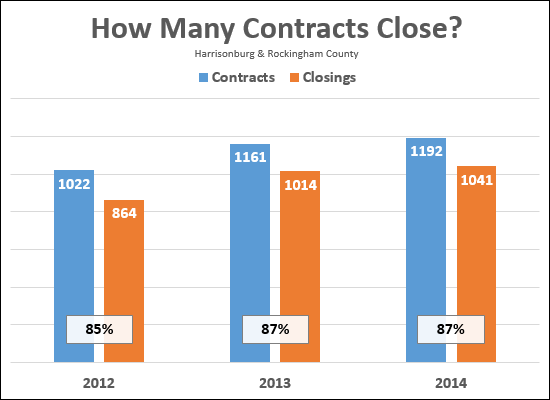

What are the odds that a contract will result in a closing? |

|

On average, six out of every seven contracts results in a closing. In some ways, that is great -- 87% seems like a pretty proportion of contracts to successfully close. However, it flipping it around, it isn't the most exciting news in the world to realize that one out of every seven contracts fails. Common reasons for a contract to fall apart include:

Whether you are buying or selling, we need to discuss and anticipate these possibilities ahead of time, and make sure we are structuring contract contingencies to best protect your interests. Of note, this analysis is not 100% precise. Technically, some of the 2014 closings are based on 2013 contracts, some of the 2013 closings are based on 2012 contracts, etc. That said, these differences usually balance themselves out from year to year. | |

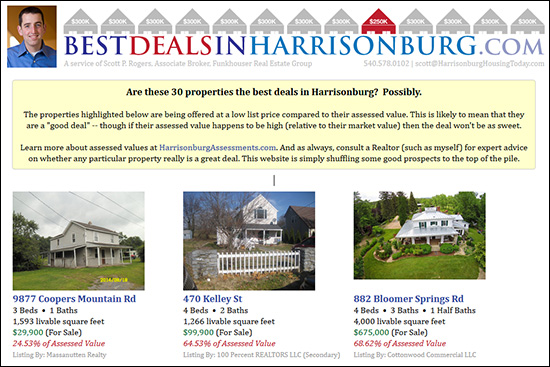

Finding the Best Deals in Harrisonburg |

|

I recently created HarrisonburgAssessments.com, which analyzes the relationship between sales prices and assessed values. And then it hit me -- what if we compared list prices to assessed values -- might we find the best buying opportunities in and around Harrisonburg? Introducing . . . . BestDealsInHarrisonburg.com! Are the 30 properties on this new website REALLY the best deals in Harrisonburg? Possibly. The properties featured on BestDealsInHarrisonburg.com are being offered at a low list price compared to their assessed value. This is likely to mean that they are a "good deal" -- though if their assessed value happens to be high (relative to their market value) then the deal won't be as sweet. As always, consult a Realtor (such as myself) for expert advice on whether any particular property really is a great deal. BestDealsInHarrisonburg.com is simply shuffling some good prospects to the top of the pile for your consideration. What are you waiting for? Go check it out at BestDealsInHarrisonburg.com. | |

Finding the Assessed Value of Your Home |

|

How, you might ask, do you find the assessed value of your home?

You can now search for your home's assessed value on HarrisonburgAssessements.com. Before you go search, however, please remember that....

| |

Homes that sell do so relatively speedily |

|

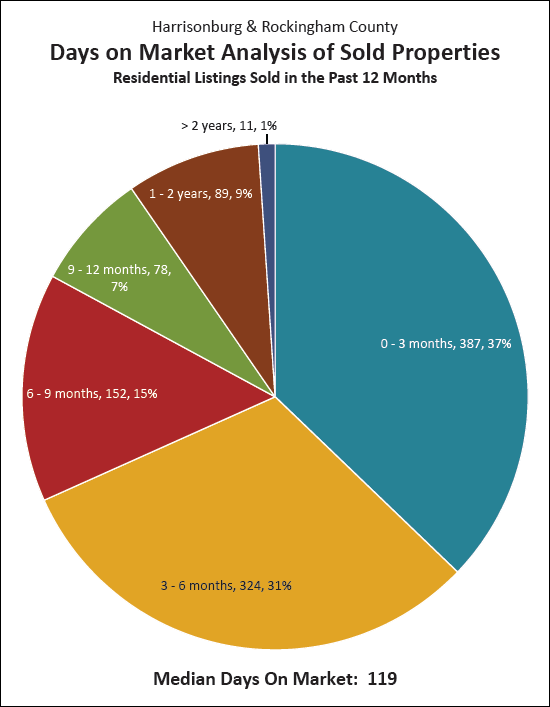

As shown above, 37% of homes that sold in 2014 closed within 90 days of being listed for sale. Homes that are prepared well for the market (repairs, improvements, staging), and priced well (know thy market) and are marketed well, will often sell relatively quickly. All that said, don't forget that there are some factors outside of your control as a seller. | |

Walk Through 655 White Oak Circle |

|

Take a few minutes to walk through this updated duplex on a cul-de-sac, located in a private, wooded, highly convenient location in close proximity to Sentara RMH Medical Center, James Madison University as well as dining, shopping and much more. Enjoy an open floor plan on the first level with a large living room, kitchen with dining area, office/sunroom and a bedroom with attached full bathroom. Upstairs you will find an additional large bedroom with full bathroom as well as a walk in unfinished attic space for additional storage. Don't miss the two back decks, gas fireplace, stainless steel appliances (gas range!), hardwood floors, fresh paint, updated light fixtures, blinds on all windows, two bay windows, ceiling fans, storage area on the back deck and hardwood treads on the stairs. Click here to walk through this home now, on your computer, phone or tablet. Or, visit this home's property website. Or, view lots of pretty photos of this home by clicking the collage below....  | |

How to buy a foreclosure in Harrisonburg |

|

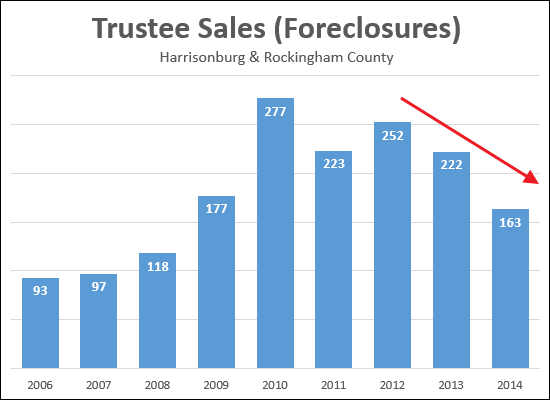

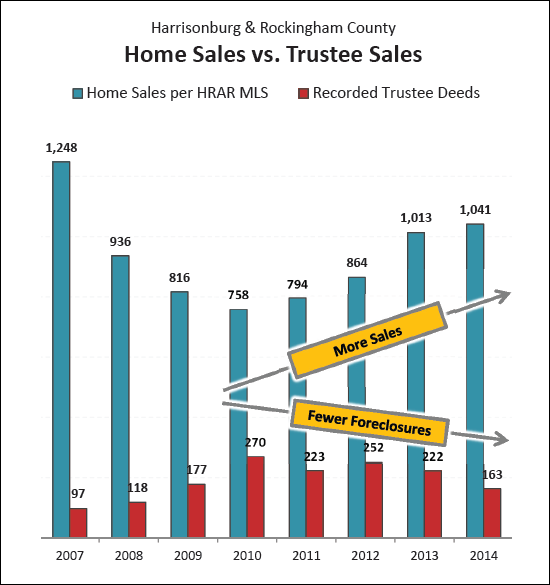

As shown above, we are starting to see fewer foreclosures in Harrisonburg and Rockingham County. With some regularity, I am asked by potential purchasers how they would go about buying a foreclosure. First, here is a list of upcoming foreclosure sales, but more importantly, below is a description of a few ways to buy what you might be thinking of as a foreclosure. If you are in the market to buy a home, some of the properties you might be considering are foreclosures – but there are some distinctions to be aware of at different stages of the foreclosure process. It is possible to buy a home from the owner before they are foreclosed on even if they cannot pay off their mortgage – this is called a short sale. Or, you might buy a property at the courthouse steps when it is being auctioned – this is called a trustee sale. Finally, if a property does not sell at the auction, you can buy the property from the lender after they have taken ownership of the property – this is called a bank owned property or REO property. SHORT SALES: Some homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! Visit HarrisonburgShortSales.com for a list of potential short sale properties currently on the market. TRUSTEE SALES: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Visit HarrisonburgForeclosures.com for a list of upcoming trustee sales. BANK OWNED PROPERTIES: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. Visit HarrisonburgREO.com for a list of bank owned properties currently on the market for sale. When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. | |

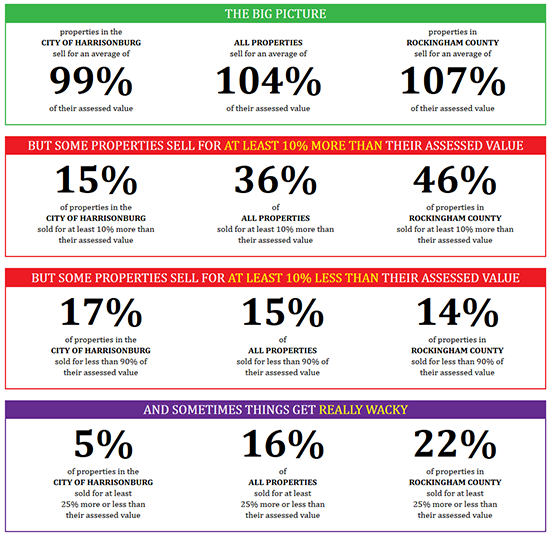

How do Assessed Values compare to Market Values? |

|

How do Assessed Values compare to Market Values? Wonder no longer! You can now find out via HarrisonburgAssessments.com. You'll want to visit this new site for full details, but here is a quick snapshot....  Find out more about the relationship between market values and assessed values at HarrisonburgAssessments.com. | |

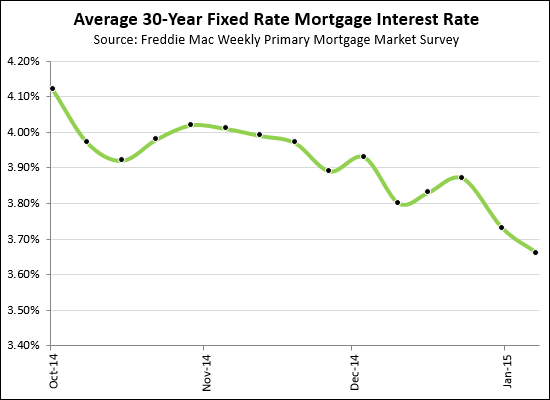

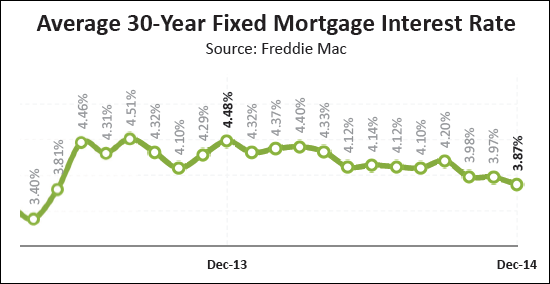

Mortgage Interest Rates Get Lower, and Lower, and Lower |

|

Here's my monthly updates on long-term mortgage interest rates and they (AGAIN!) have dropped over the past month. The average rate is now 3.66%. It is a great time to lock in your interest rate if you are buying a home! | |

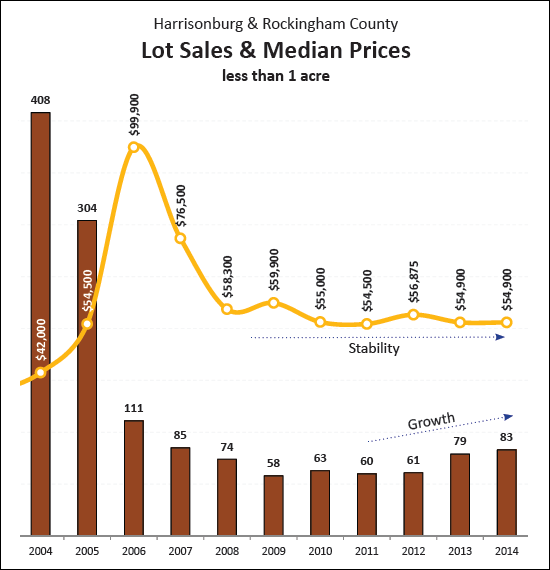

Sales of Building Lots Finally (Slowly) Improving |

|

After a huge spike in sales (408 lot sales in 2004) and in median prices ($99,900 in 2006), the sales of building lots cooled quite a bit between 2004 and 2009. The last few years, have shown slow but steady growth in this segment of our market -- 60 . . . 61 . . . 79 . . . 83 sales over the past four years. This has also resulted in stability in the median sales price, which has been right around $55,000 for the past five years. The next question is -- where (and when) will we see the next new development of single family home residential lots.... | |

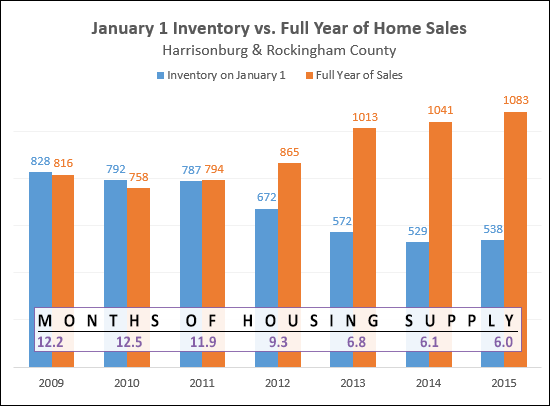

We are again starting the year with a six month supply of homes for sale, a sign of a balanced market |

|

For the second year in a row we are starting out in January with a six month supply of homes for sale, which is traditionally seen as a sign of a balanced housing market. A few years ago (2009-2011) we were consistently starting the year with enough homes on the market for every buyer that would buy in that year. That equates to 12 months of housing supply, and those were years of having a significantly oversupplied market -- which caused sales prices to decline and gave buyers the upper hand in negotiations. In 2015, we should expect that buyers and sellers will have relatively equal amounts of negotiating power, depending on the other factors affecting the sale. Important Notes: 1. The 2015 sales (1083) is an estimate of the number of sales we will see this year. Read more here. 2. The number of months of housing supply available varies by price range. See my full market report for further details. | |

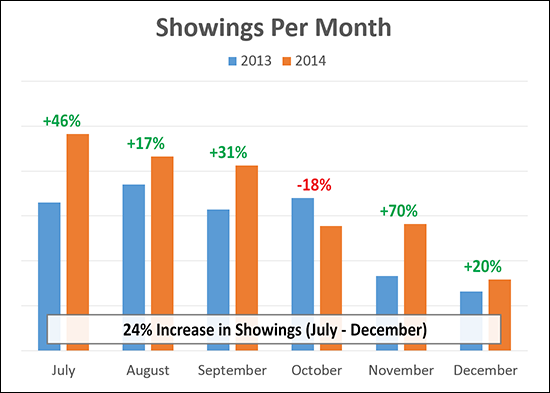

24% Increase in Showings (July through December) |

|

Showings were up again in December 2014 -- showing a 20% increase over December 2013. And looking at the second half of 2014, there was a 24% year-over-year increase over the number of showings in 2013. Exciting times! All that said, there is (clearly) quite a seasonal decline in the number of overall showings in November and December, which is likely to continue into January. | |

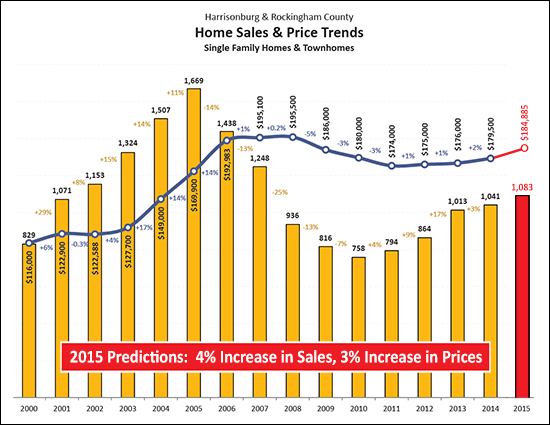

Predictions for the 2015 Real Estate Market in Harrisonburg, Rockingham County |

|

Here are my official predictions for the 2015 Harrisonburg and Rockingham County real estate market....

Who else would like to make a prediction? Click here for a larger version of my prediction graph. | |

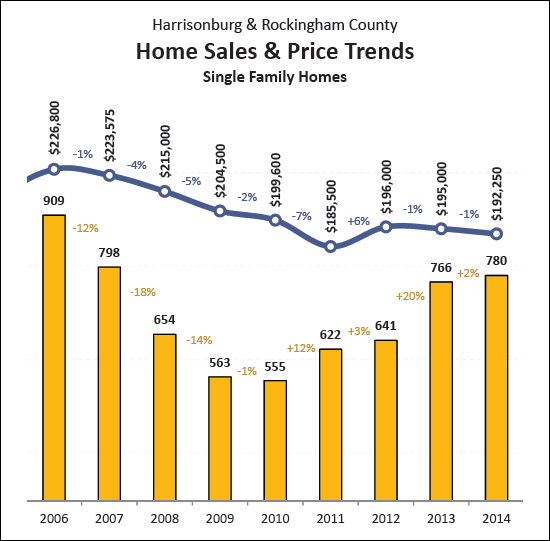

Despite overall market improvement, single family home prices shift slightly downward |

|

Despite increases in the number of single family homes selling per year over the past four years (yellow bars above), the median price of single family home sales (blue line above) has drifted downward by 1% per year over the past two years. | |

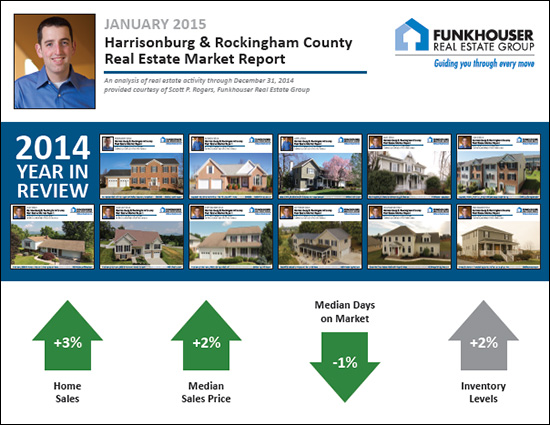

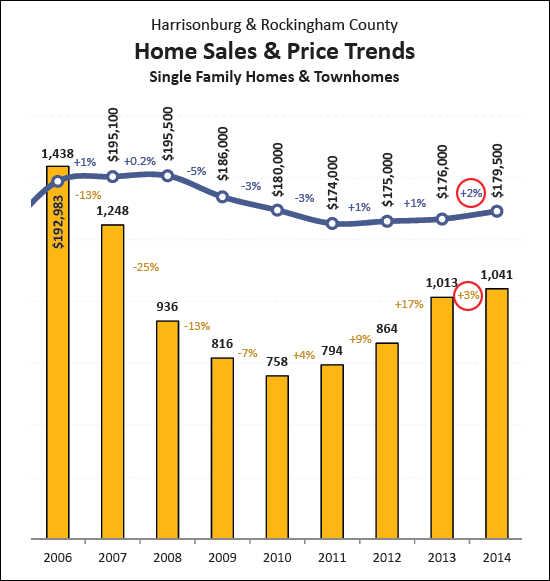

Final 2014 Report Shows 3% More Homes Sold at 2% Higher Prices |

|

I just published my monthly report on the Harrisonburg and Rockingham County real estate market. Jump to the full online market report, or download the PDF, or read on for highlights....  Here's the big news -- all of the data is in for 2014 and over the past year our market has seen....

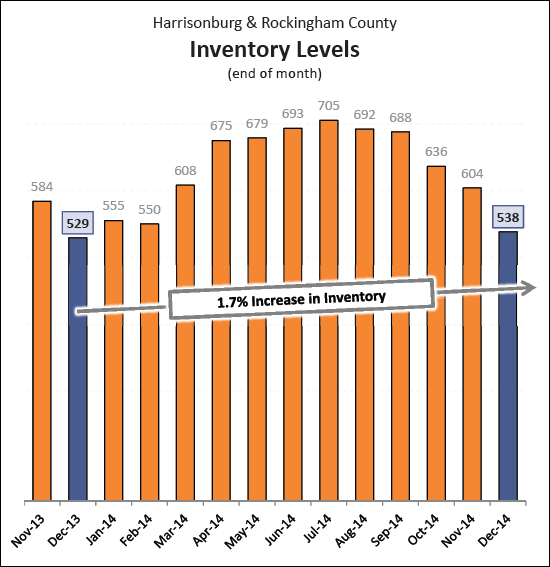

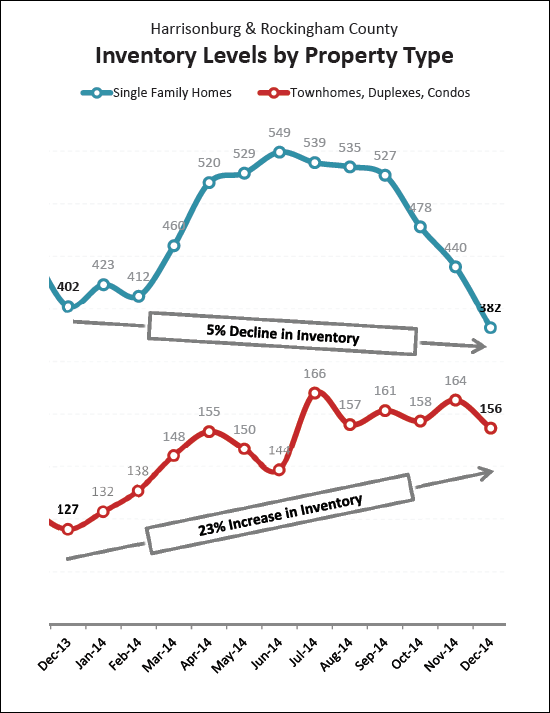

As is to be expected, there are significantly fewer homes on the market now as compared to this past summer -- buyers are choosing from 24% fewer homes today as compared to in July. Year-over-year, however, inventory levels are trending up slightly (+1.7%).  It is certainly easier to find a townhouse/duplex/condo these days than a single family home. Over the past year, inventory levels of single family homes have dropped 5%, while inventory levels of attached dwellings have increased 23%.  Foreclosures are significantly less of a problem in our local market (163 in 2014) as compared to some recent years (a peak of 270 in 2010).  Long-term mortgage interest rates continue to stay quite favorable -- currently below 4%, which has certainly contributed to plenty of buyer enthusiasm. If you are buying or selling now, or will be soon, I encourage you to become a student of the housing market. Learn what has been happening recently, what is happening now, and what is likely to happen next. Being informed will allow you to make better real estate decisions. You can continue your studies by reading the entire January 2015 market report online, or by downloading the PDF. Also, as always, if you're interested in talking to me about buying a home in Harrisonburg or Rockingham County.....or if you are interested in selling your current home.....just drop me a line by email (scott@HarrisonburgHousingToday.com) or call me at 540-578-0102. | |

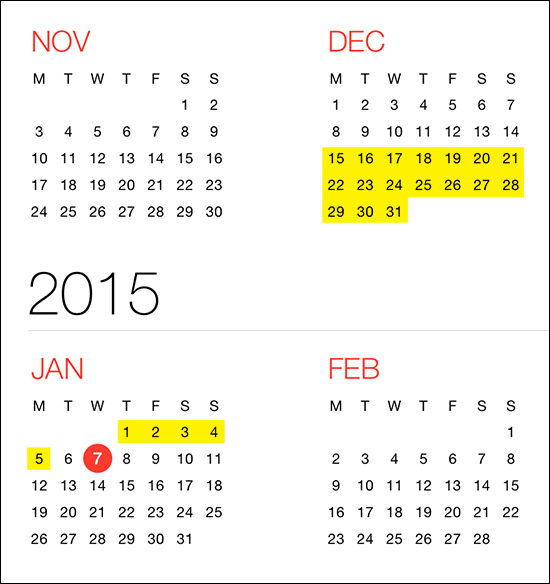

Is it worthwhile to have your home on the market over the holidays? |

|

29 sellers in Harrisonburg and Rockingham County would say YES! Many homeowners took their house off the market over the holidays, some of whom will wait until Spring to put them back on the market. And why not? There couldn't be too many people buying homes over the Christmas holiday, right? Looking back at this past holiday season, if you took your house off the market 10 days before Christmas (Dec 15) and waited until the first Monday after the New Year to put it back on the market.... You would have missed out on the 29 buyers who signed contracts to buy homes between those dates. I'll remind you before Christmas, next year, rather than pointing it out afterwards. Now we know! | |

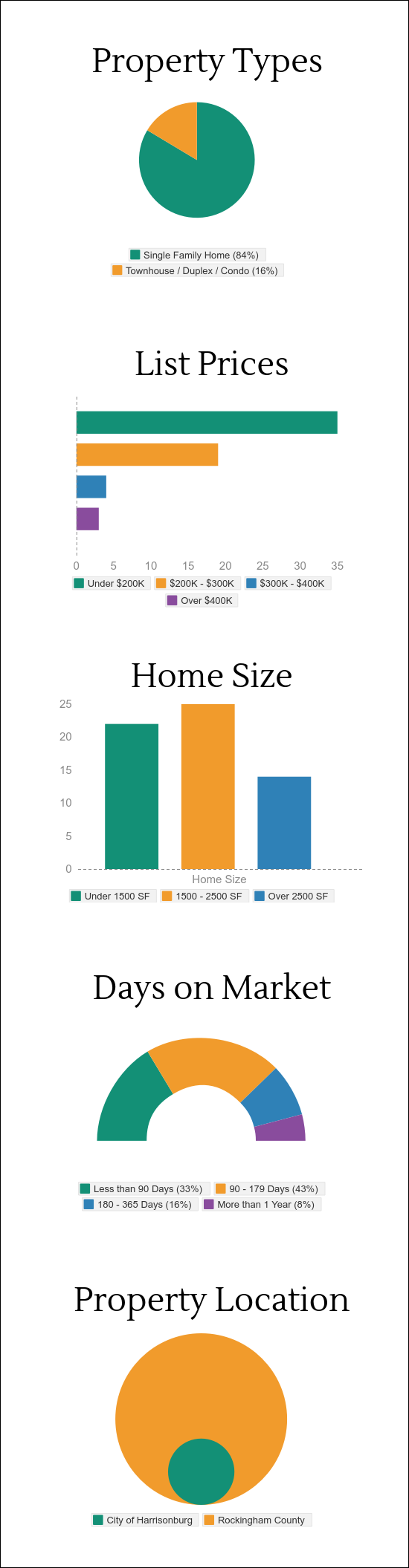

What did buyers write contracts on in December 2014? |

|

Quite a few buyers committed to buy properties last month. The graphics below show what those buyers chose to buy. And here are the lucky sellers whose homes are currently under contract.  | |

Walk Through 2195 Deyerle Avenue |

|

Take a few minutes to walk through this spacious, upgraded townhouse at The Townes at Bluestone is ready for you to move in, and is located in the Blue Stone Hills area, convenient to dining, shopping, JMU, and everywhere you want to be. Upgrades include granite countertops, hardwood floors, ceramic tile, crown moulding, tray ceiling in master suite, peninsula gas fireplace, security system, custom window treatments and much more. Enjoy two large master suites on the top level, plus a finished bonus room (with full bathroom) in the basement that could serve as a rec room, den or third bedroom. Don't miss the two car garage and deck with views. Click here to walk through this home now, on your computer, phone or tablet. Or, visit this home's property website. Or, view lots of pretty photos of this home by clicking the collage below....  | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings