Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Friday, December 23, 2016

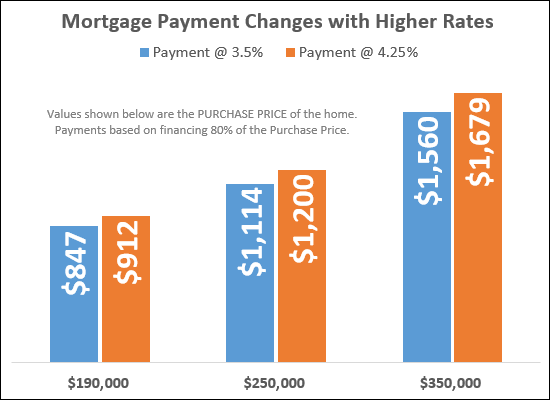

Just after the election, mortgage interest rates started rising. They started around 3.5%, and have since climbed to somewhere between 4.25% and 4.3%. It seems unlikely that they will come back own anytime soon -- if ever.

So, what do these new mortgage interest rates mean for home buyers? Well, higher mortgage payments, naturally. The graph above shows the potential change in a monthly mortgage payment for a median priced home ($190K) as well as a home priced at $250K and $350K. The payment scenarios above assume that you are financing 80% of the purchase price -- and yes, I know, plenty of folks are really financing 90% or 95% of the purchase price. If you are financing a greater portion of the purchase price, the monthly payment will be higher, and the increase in the monthly payment will be greater.

As you can see above.....

- The buyer of a $190K home would be paying $65 more per month.

- The buyer of a $250K home would be paying $86 more per month.

- The buyer of a $350K home would be paying $119 more per month.

- If you're about to buy a home, you'll be paying more per month than if you had purchased before the election. Hindsight is 20/20.

- You will still be locking in a ridiculously low (4.25% more or less) mortgage interest rate.

- It seems that mortgage interest rates will likely continue to (hopefully slowly) rise over the next year, so buying sooner rather than later may serve you well.

As always -- for actual payment scenarios, you'll need to consult a mortgage lender. Shoot me an email (scott@HarrisonburgHousingToday.com) and I can make some recommendations.