Median Price Per Square Foot Keeps On Rising |

|

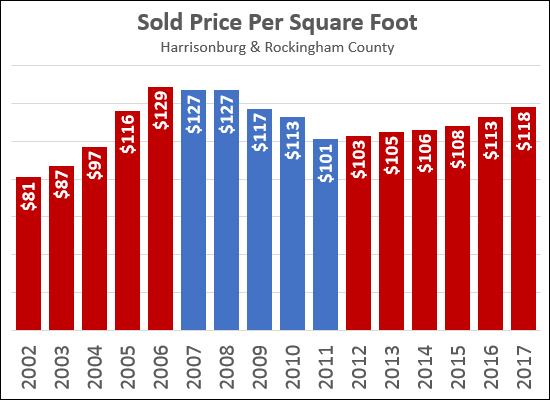

In addition to watching how the median sales price changes over time, it can be quite insightful to see how the median price per square foot of sold homes changes over time. The graph above tracks the median price per square foot of single family homes (not townhouses, duplexes or condos) in Harrisonburg and Rockingham County over the past 15 years. Price per square foot increased 59% between 2002 and 2006 during the housing boom, but then fell 22% between 2006 and 2011 as the market cooled back off. Since that time, however, we have seen a slow and steady increase in this metric -- from $101/SF in 2011 to $118/SF last year -- which marks a 17% increase over the past six years. I do not expect that we will see any drastic increases in this metric in the next few years, though an increasing number of buyers (more demand) and significantly fewer sellers (less supply) does make you wonder if we will start to see more rapid increases in sales prices, and thus in price per square foot. ALSO OF NOTE -- this metric is most helpful in understanding value trends over time -- not in calculating the value of one particular property. This median price per square foot is the mid point of many very different homes -- new homes, old homes, homes with garages, homes without garages, homes with basements, homes without basements, homes with acreage, homes on small lots, etc. A median price per square foot can be more helpful in understanding the potential value (or value range) of a single property if we pull that median value based on a smaller data set of more properties more similar to the single property. | |

The Rights Of A Home Buyer In Negotiations |

|

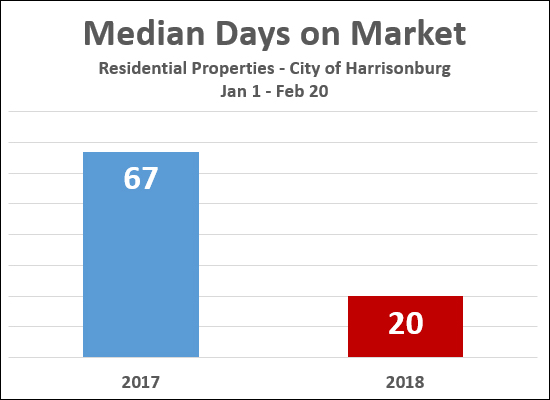

Have you heard that homes are selling rather quickly? Especially in the City of Harrisonburg? During the first two months of 2017, homes went under contract in around (median of) 67 days. In the first two months of 2018 -- it is only taking (a median of) 20 days!?! So -- if you are a buyer, entering into the fray of trying to buy a home in a fast moving, low inventory, housing market -- you must know your rights....

Revised for accuracy, you can hang these on the refrigerator....

| |

City Homes Selling Three Times Faster This Year Than Last |

|

Here is a somewhat startling statistic.... Looking at the start to last year (Jan 1 - Feb 20) the homes that sold (went under contract) in the City of Harrisonburg did so with a median "days on market" of 67 days. This year during the same timeframe (Jan 1 - Feb 20) the homes that sold (went under contract) in the City of Harrisonburg did so with a median "days on market" of 20 days. So -- homes are selling (more than!) three times faster than they were last year. Wow! And -- a few more homes are selling.... Contracts between Jan 1 and Feb 20:

Buckle up! It seems like it might be a fast paced market for much of 2018. Low inventory levels and rising interest rates certainly are contributing to this. | |

Public Hearing on Proposed Changes to Exit 245 Interchange |

|

The northbound off-ramp from Interstate 81, at Exit 245, might change in the near (?) future -- based on a proposed realignment of the exit ramp with Forest Hill Road. Do you have an opinion on this proposed change? Do you have questions? Be sure to attend the public hearing.... Design Public Hearing Wednesday, February 28, 2018 from 4:00 PM - 6:00 PM City Council Chambers (409 S Main St, H'burg) This will be an open-house style public hearing where citizens are invited to learn about, ask questions, and provide feedback on plans to realign the northbound off-ramp to intersect Port Republic Road directly across from the Forest Hill Road intersection. In the case of inclement weather, the public hearing will be rescheduled for March 8, 2018 at the same time and place. Learn more about this project on the City's website here. Here is an illustration of the proposed realignment....  | |

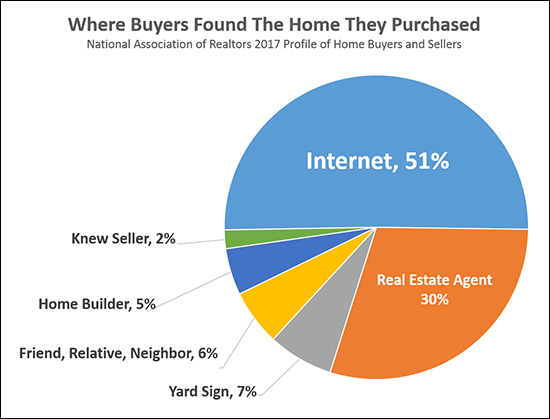

How Do Buyers Find Out About Homes For Sale? |

|

Sometimes sellers ask....

I believe the "should I" ought to guide the "will I" with these sorts of questions. If doing X, Y or Z is likely to result in buyers knowing about the home and purchasing it, then yes, I ought to do that. The research above (conducted annually by the National Association of Realtors) shows that half of buyers found out about the home they bought online. Another third of buyers found out about the home they bought from their Realtor. Let's allow the research to guide our marketing decisions, shall we? | |

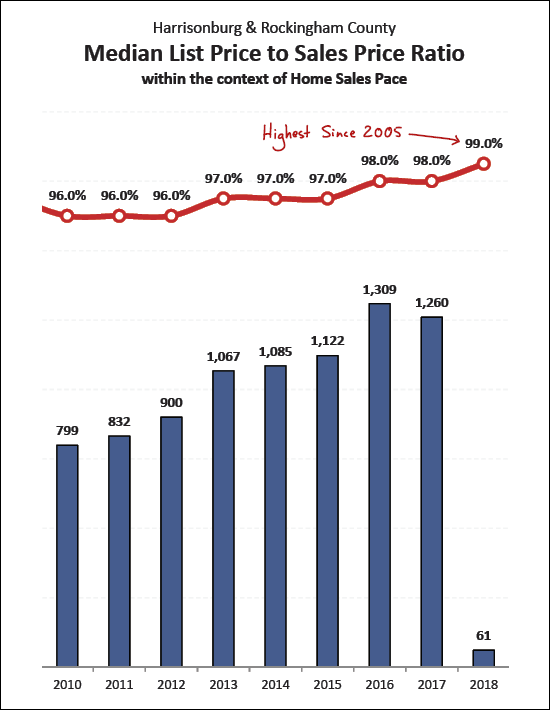

Are Sellers Negotiating Less On Price? |

|

This graph above shows the median list price to sales price ratio (red line) over the past 15 years as compared to the overall pace of home sales. At the peak of the housing boom (2004-2006) sellers were able to obtain a median of 99% of their asking price --- up from a median of 97.7% in 2001 before the pace of home sales started escalating. Then, when the pace of home sales slowed (through 2010) this metric dropped to 96%, where it stayed for three years. Sellers started selling for slightly more in 2013-2015 when they could obtain 97% of their list price. This increased to 98% in 2016, held steady in 2017, and is flirting with 99% in 2018. Of note -- the 99% figure in 2018 is based on only one month of data - January 2018. Stay tuned to see how this adjusts as we continue through 2018. | |

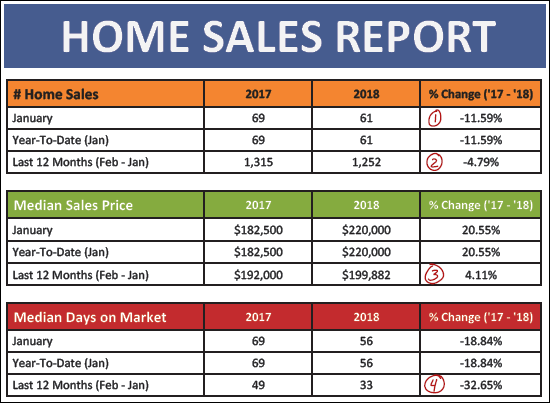

Local Home Sales Off To Slightly Slow Start In 2018 |

|

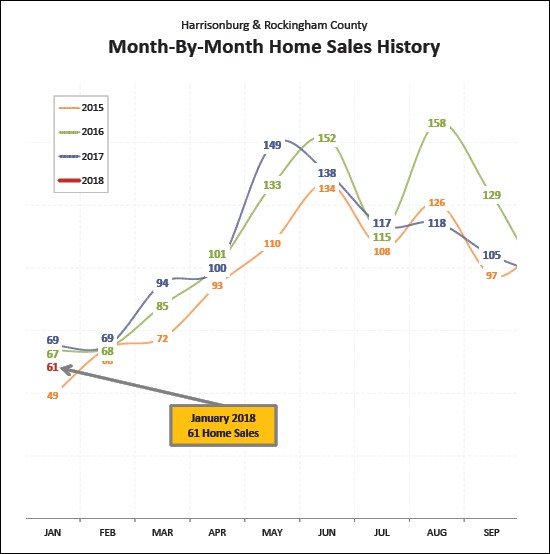

Find out more about this newly built home in Lakewood Estates at 1644CumberlandDrive.com. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market...  OK -- now, let's take a look a few of the main indicators for our local housing market....  As shown above....

As shown above, January 2018 home sales were right in the middle of the pack as contextualized by the previous three years. And in some ways, we should expect to see around 70 home sales next month -- however....

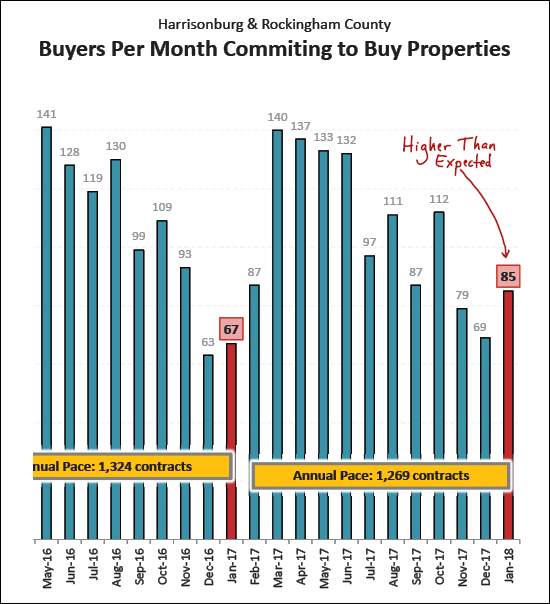

Contract activity in January 2018 was much stronger than could have been expected. Buyers (and sellers) signed 85 contracts in January -- as compared to only 67 last January. Thus, it is reasonable expect we'll probably see somewhat of a bump in home sales in February.

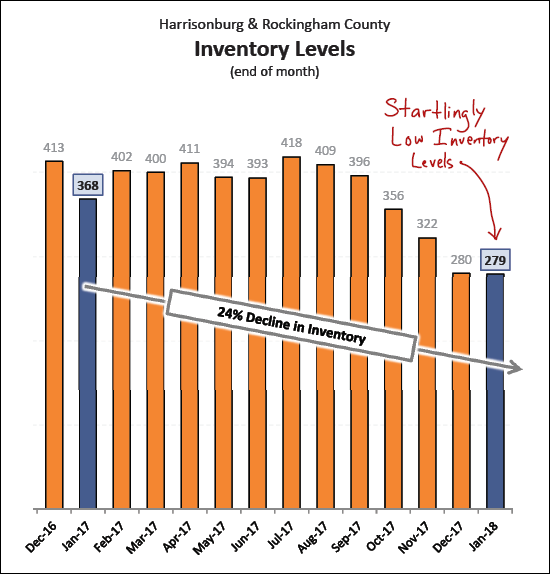

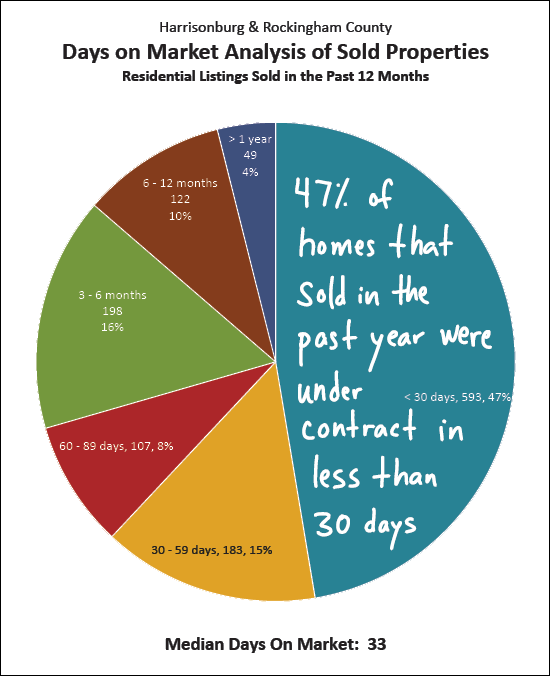

And perhaps that is why so many homes are selling so quickly. Almost half of the homes that have sold in the past year have gone under contract within 30 days of coming on the market! OK -- I'll stop there for now. Again, you can download the full report as a PDF, read the entire report with commentary online, or keep reading my blog in the coming days for further commentary. If you're thinking of buying or selling soon --- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

Sign Up For The Local Emergency Alert System |

|

Click here to sign up for the Emergency Alert System. Anyone who lives, works, or attends school in the City of Harrisonburg or Rockingham County are asked to sign up for the Harrisonburg-Rockingham Emergency Alert. The emergency alert will notify you in the event of an emergency or life-threatening weather event. This method of outreach is an additional resource for community members to be notified in the event of an emergency situation in this area. Registration is free and simple and when entering your information, be sure to list a city or county address to ensure you receive the local alerts. To receive these emergency-related messages the fastest, register your cell phone (not landline) and select to receive your alerts by text. This system was upgraded in October 2017, so everyone will need to sign up, regardless if you registered for the previous system. Click here to sign up for the Emergency Alert System. | |

Winter Is Often The Best Time For Purchasing Investment Properties |

|

Many of my savvy investor clients wait for these winter months to acquire additional rental properties. Their reasons are pretty logical....

Of note -- this advice is most applicable to townhouse properties that might be purchased by investors or owner occupants. This does not necessarily apply to multi-family properties or student housing properties. If you are looking for some advice on how to get started with real estate investing, check out HarrisonburgInvestmentProperties.com. | |

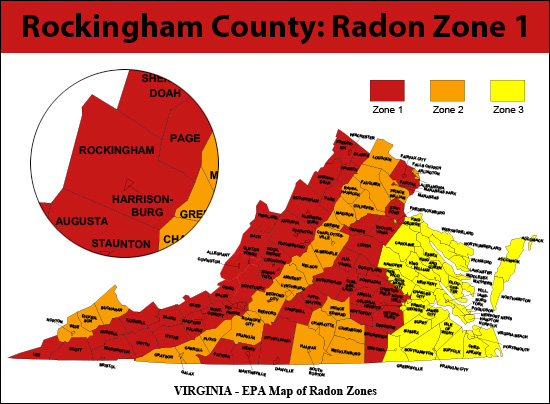

Basements in Harrisonburg, Rockingham County Should Be Tested For Radon |

|

As you can see above, Rockingham County is in Zone 1 -- which means we are in an area that is likely to have high radon levels. What is radon, and what does it mean for you? Read on, from the EPA.... Radon is a radioactive gas that comes from the natural breakdown of uranium in soil, rock and water and gets into the air you breathe. Radon typically moves up through the ground to the air above and into your home through cracks and other holes in the foundation. Radon can also enter your home through well water. Your home can trap radon inside.Learn more about radon and real estate here. | |

Selling Your Home Will Likely Require Clearing These Three Hurdles |

|

While every home sale is different -- with unique contingencies based on the needs and situations of the buyer and seller -- there are three main hurdles that most buyers and the houses they are purchasing must clear to make it to closing. So -- where is your contract in this process? Have you cleared 1, 2 or 3 of the hurdles, thus far? There will be plenty of other details to attend to, but these are the three main areas of focus. Evaluating the property condition, the property value, and the buyer's finances.... INSPECTION - This is an evaluation, by a home inspector, of the condition of the house. Clearing this hurdle typically involves requesting that the seller make some repairs to the house (or negotiate further on price) based on new information about the property condition discovered during the inspection process. APPRAISAL - This is an evaluation, by an appraiser hired by the purchaser's lender, of the value of the house. If the property appraises for the contract price (or higher), all is well -- otherwise, the buyer and seller may need to renegotiate the contract price based on the appraised value. LOAN APPROVAL - This is an evaluation, by a lender (and their underwriters) of the purchaser's financial situation. The lender must confirm that the buyer has the income to support the mortgage payment required for purchasing the home. Again - there are many other smaller hurdles (for example, a termite inspection) and larger hurdles (for example, a home sale contingency) that may need to be cleared in your purchase (or sale) of a home -- but these three main hurdles (inspection, appraisal, loan approval) are the three main mileposts during the contract-to-closing process that we'll be focused during the transaction. BUT WAIT -- THERE'S MORE.... Would you rater have three main hurdles to clear, or six?  Let's imagine that you receive two offers on your house, which is listed for $250K....

| |

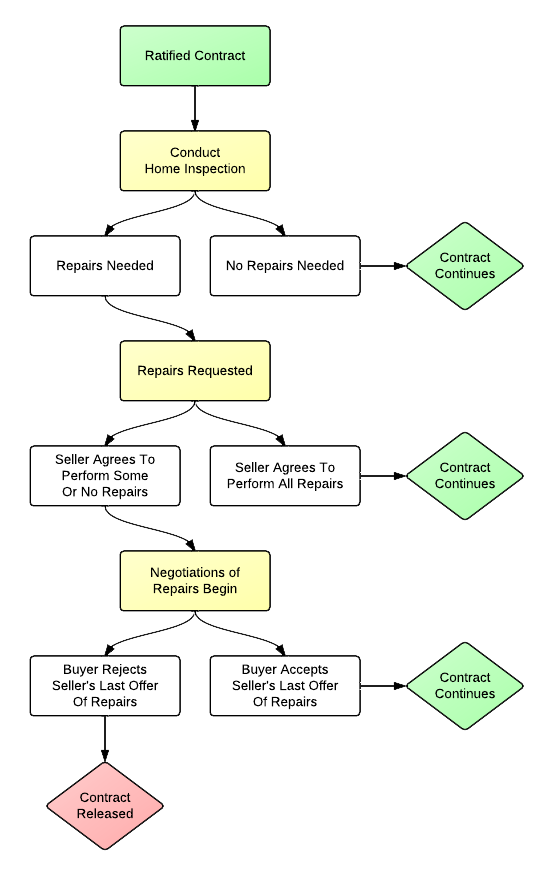

Understanding Home Inspection Negotiations |

|

A buyer agrees to pay a price for a house based on what they know about the house at that time. The home inspection process allows them to learn more about the house to confirm that it is the house that they thought. But sometimes, they discover problems with the house that they'd like the seller to address.... So, how do these home inspection negotiations usually proceed? The short (and vague) answer is -- well, it depends on the terms of your contract. But, overall, here is how the inspection process typically flows....  As you can see above, after a buyer requests repairs (based on the home inspection) the seller can choose to make some, all or none of the requested repairs. The transaction (and negotiations) can then go in a few different directions based on that response. Learn more about the home buying process at....  | |

Would You Move To The Other Side (!?!?!) of Interstate 81? |

|

If you have lived in Harrisonburg for a while (more than a few years) which side of I-81 do you live on? The East or the West? Would you consider moving to the other side of I-81? Regardless of which side you are on now, I'm guessing most of you wouldn't flip-flop to the other side. Most people stay on one side of I-81 after they buy on that side -- because they get used to the patterns of life on that side of our community. Nothing is necessarily better or worse on one side or the other -- but they are different, that's for sure. EAST: Most of the residential development over the past 15 to 20 years has been on the East side of Harrisonburg, in the general vicinity of the new hospital. This makes it an exciting place to live -- for some people. There are many newer developments where homes have recently been built, and there are newer commercial destinations (Stone Port, Martin's grocery store, Target, etc) all on the East side of town. But this also makes it a bit more hectic for getting around. Of note, there is also plenty of outbound traffic East of town, towards Massanutten, Elkton, Charlottesville, etc. WEST: There hasn't been as much residential development West of Harrisonburg over the past 15 to 20 years (other than Belmont and Monte Vista Estates) and this is just fine with most people who live on the Western side of Harrisonburg. Things are a bit calmer, without as much hustle and bustle, and in some cases with more established neighborhoods. The towns of Dayton and Bridgewater end up falling into this side of town as well for many people. I am not doing justice to all of the differences between the East side of town and the West side of town, but I believe that most people in this area are oriented towards one side of town or the other, for very specific reasons. Furthermore, most people who have spent any considerable amount of time living on one side of Harrisonburg likely wouldn't think about moving over to the other side of Harrisonburg. So -- if you're just moving to the area -- choose East or West carefully -- you might never switch to the other side! | |

How to Buy a Foreclosure in Harrisonburg, Rockingham County |

|

With some regularity, I am asked by potential purchasers how they would go about buying a foreclosure. First, here is a list of upcoming foreclosure sales, but more importantly, below is a description of a few ways to buy what you might be thinking of as a foreclosure. SHORT SALES: Some homeowners must sell their home, but market conditions won't allow them to sell it at a high enough price to be able to pay off their mortgage(s). In this example, a homeowner might have a $250,000 mortgage balance but can only sell the property for $230,000. As a prospective buyer, it is sometimes possible to purchase this type of a property through a process called a "short sale." In such an arrangement, the homeowner petitions their lender to accept less than the full payoff of the mortgage and in return to still release the deed of trust so that ownership of the property can be transferred over to you, the new owner. This can benefit the lender, as they skip the time delays and cost of the foreclosure process. This can also benefit the homeowner, as a short sale will have a slightly lesser negative impact on their credit as compared to a foreclosure. As a buyer, however, you must know that there are challenges to buying a property as a short sale. The biggest challenges of late seem to be the uncertainty of the purchase and the time table. Even if you and the homeowner agree to a price of $230,000, the homeowner's lender must still agree to accept that price – since it won't allow the homeowner to pay off their $250,000 mortgage balance in full. This process of waiting to hear back from a lender, and then complying with all of their various terms can sometimes take 60 to 120 days – or longer! TRUSTEE SALES: If a short sale does not take place, and a homeowner is behind on their payments (or not making them at all), eventually the property will be sold by the lender on the courthouse steps. Buying a property at a "trustee sale" can be exciting, and can be a great opportunity – but there are challenges as well. If a property to be sold at a trustee sale is also listed for sale with a Realtor, you can usually view the property ahead of time by calling your Realtor. Otherwise, you will likely not have the opportunity to see inside the property before the trustee sale, and thus you will not know too many details about the condition of the property. Furthermore, your purchase of the property at the trustee sale cannot be contingent upon viewing the property, or inspecting the property. In this instance, you are purchasing the property in "as is" condition, regardless of what you then find out about the property. It is also important to note that many times the lender will have an opening bid at the trustee sale that is close to (or sometimes higher than) the amount that they are still owed on the mortgage. Thus, in the example above, they might make an opening bid of $250,000. As a result of this opening bid process, many (or most) properties available for purchase at a trustee sale are not great opportunities. Occasionally, a property will be foreclosed upon that has had a mortgage in place for many years, whereby the balance of the mortgage is much lower than current market value – these are great opportunities for a buyer. Visit HarrisonburgForeclosures.com for a list of upcoming trustee sales. BANK OWNED PROPERTIES: If you don't buy the property before the auction (as a short sale), and don't buy it at the trustee sale, you'll have a third opportunity to buy it once the bank owns it. These properties are called "bank owned properties" or REO properties ("real estate owned"). Oftentimes, the prices on these properties are quite realistic, if not under market value. It would not be atypical for a house such as the one mentioned above to come on the market after the trustee sale at a price of $210,000. In such an instance, you should expect to be buying the property in "as is" condition, and you will also be buying with a slightly different contract document. Most lenders have a long standard contract or contract addendum that spell out a variety of additional contract terms designed to protect them from any future liability – and rarely will a lender agree to have these contract documents changed in any way. As you can see above, oftentimes buying the property as an REO property is where the best opportunity lies. Visit HarrisonburgREO.com for a list of bank owned properties currently on the market for sale. When a home goes into foreclosure it is often for very sad and unfortunate reasons – such as the loss of a job – and I do not wish such circumstances on any homeowner. However, if you are a buyer in today's market it is important to be familiar with different methods for buying a property when it will be, is being, or has been foreclosed upon. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings