Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Wednesday, March 14, 2018

Mortgage interest rates are edging up again, as you may have heard. The average 30 year fixed rate at the end of February was 4.4% -- up from 3.9% just three months prior.

Could this (slight) rise in the cost of financing your home be affecting the pace at which buyers are signing contracts? Possibly.

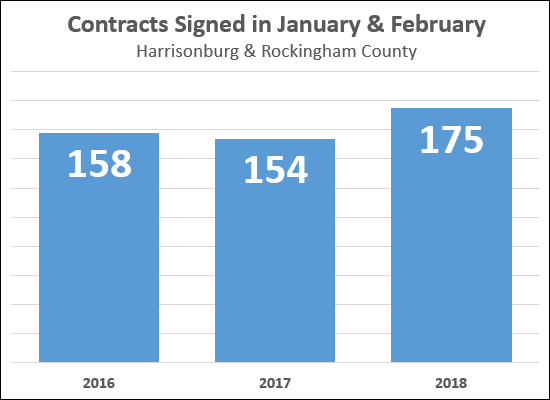

It seems that 14% more buyers signed contracts this January and February as compared to last year during the same timeframe.

This is a likely indicator that we'll see stronger months of closed sales in March and April.

Then, the questions will be....

- Will the pace of contract activity keep increasing?

- Will mortgage interest rates keep increasing?

Let's hope for yes and no, in that order.