Archive for September 2018

The Smallest House In The Neighborhood |

|

How much should you be willing to pay for the smallest house in a neighborhood? Especially if it is a good bit smaller than all the other houses in the neighborhood? Let's imagine a neighborhood in Harrisonburg or Rockingham County where homes typically sell for $350K - $400K, with an occasional sale above $400K. All of these homes, however, are 3000 SF homes. There might be a 2800 SF homes that sells from time to time, but almost all are at, above, or well above 3000 SF. So -- when a 2300 SF home comes on the market in the neighborhood, how much should you be willing to pay? A seller might say $340K. After all, you have to pay $350K+ to buy any house in this amazing neighborhood, so even if my house is smaller than most, you'll need to pay pretty close to that floor of $350K. A buyer might say $300K. After all, the 2300 SF home is markedly smaller than just about every other home in the neighborhood, so the sales price should be quite a bit lower as well. If a 3000 SF home sells for $350K, I don't want to pay more than $300K for a 2300 SF home. I might say $320K. I think there is merit in both of the perspectives above, and a blending of those two concepts gets us close to what a buyer should be willing to pay. Keep in mind -- it is also possible that a buyer will come along who just LOVES the neighborhood and doesn't need much space at all. This buyer might just be willing to pay closer to that $340K - $350K price, especially if they are a cash buyer, or moving from a more expensive market, etc. | |

Buying Decisions Are Not (Usually) Made in Garages, Closets or Unfinished Basements |

|

Most of the time -- buyers are not making their decision about whether to buy your house while they are standing in the garage, staring into a closet or hanging out in the unfinished basement. As such, when you are preparing your home to be listed for sale -- start by spending your time working on the areas where buying decisions are typically made -- main living spaces (kitchen, family room, great room, living room), bedrooms, bathrooms, rec rooms, etc. Yes, you should also work on having garages, closets and unfinished basements spick and span -- but if you don't have weeks or months to get ready to put your house on the market, that is not where you should begin. As a side note -- if you're planning to get your house on the market next month, don't feel the need to make 95% - 99% of the preparations and then have me over to walk through together to talk about market value and the final 1% - 5% of improvements to be made. Let's meet earlier in the process to talk candidly about how to best use your time in preparing your home for the market. As a side note, side note -- especially at this time of year, if you have all of the main areas of your house looking great, don't delay putting your house on the market for another month while you attend to areas (like closets) where buying decisions are not usually made. Time is valuable at this time of year! | |

Which Imperfections Can You Live With When Buying A Home? |

|

If you're looking for a resale, four bedroom home with two full bathrooms, a two-car garage, brick exterior, with a flat lot, walk out basement, privacy, views, character, charm, an open layout, defined spaces, nine foot ceilings, hardwood floors, passive solar design, a screened porch, covered porch, deck, patio and rooftop terrace -- then you'd better be ready to relocate anywhere in the US to find such a combination. :-) If you're like the other 99.9% of the home buying population, then you're going to have to make some compromises when you buy your next home -- it won't be perfect in all ways. But, the question is, which imperfections are you willing to accept? In showing a house yesterday, I had an insightful conversation with some current home buyers where we concluded it would certainly be more reasonable to buy a home that is imperfect in the size of a few rooms or the finishes of some interior features -- much more so than it would be reasonable to buy a home that is imperfect in the drainage of the lot or the condition or nature of the roof and heating system. So, when you are buying your next home, and buying an imperfect home -- give some thought to which imperfections you will accept. Imperfections that you can change later -- or that you will never be able to affect? Imperfections that are inexpensive to adjust -- or that will require a major investment? Imperfections that you can easily overlook -- or that will bug you each and every day. | |

Can You Be Out Of Your House in 35 Days? |

|

When will a buyer kick you out of your house? Probably in 35 to 90 days if you're in a popular-ish location and price range, and depending on the time of year. Here's where I get those figures...

So -- be prepared to be asked to move out 35 to 90 days after you list your property for sale. Again, this is if we can secure a buyer within 30 days. If your home is not in as popular-ish of a location or price range, or if you are being overly aggressive on price (listing a good bit higher than market value) then these norms are likely to go out the window. If you can't be out of your house for 120 days (based on the timing of a move, etc.) then you might seriously consider whether to wait a bit to list your home. What we don't want to happen is to list your home with the caveat being announced to all prospective buyers that the closing must be 120+ days into the future. Why, you might ask? Doesn't this give buyers plenty of times to plan, etc.? Yes, sort of, kind of. The main problem with this strategy (list 120+ days before you are ready to be out of your house) is that most of the buyers who are in the market to contract on a property today want to be in their home within 45 - 60 days, so we'd potentially be turning away many or most buyers who are currently in the market to buy. And then, if we have to wait 30 to 45 days for buyers who are ready to close on your delayed time frame, by that point, those buyers are wondering why your house has been on the market for 30 to 45 days without a buyer having decided to buy the home. That whole reverse peer pressure thing. So -- if you are not super flexible on the timing of being out of your house -- work the timing backwards, considering not putting the house on the market until you're in that 35-90 day window. | |

Is Overbuilding Occurring In Harrisonburg That Will Affect Buyers Of Investment Properties |

|

I am working with several real estate investors who are considering the purchase of townhouses in the $140K - $170K price range that they would intend to rent to young professionals / recent college graduates / young families, etc. A reasonable question for a thoughtful investor considering this type of purchase is whether our market is being overbuilt such that they may have difficulty renting their investment property in the future (higher vacancy) or that they may not be able to maintain their rental rate in the future. I do not believe that type of overbuilding is currently happening in our market -- though it could certainly happen in the future. But let's explore it together... Most of what one would see being built in Harrisonburg right now is either student housing or high end rentals -- and I don't believe either of these draws in the potential tenants described above -- and thus this construction would not negatively impact the investors purchasing the type of property described above. Student Housing - We continue to see more and more of this being built in our market. Young professionals are certainly not going to rent in a student housing complex -- and historically, when student housing supply has exceeded demand, the oldest and least desirable complexes have seen the biggest swings in vacancy rates (up) and rental rates (down) -- which again is not going to draw in the potential tenants we are discussing above. High End Rentals - The most obvious spot where these are being built is at The Reserve at Stone Port, though others are also planned at Preston Lake. These are apartments (instead of townhouses as discussed above) and the rental rates are much higher (for the amount of leased space) than our target tenant population would be finding in a townhouse. Again, I don't think these draw potential tenants away from the type of property that my investor clients are considering. Now -- even if the majority of what is currently being built is not likely to have a negative impact on the buyers of investment properties -- that's not to say that some other near-term construction would not have an impact. If a developer/builder started building (100) townhouses with 1400 SF, 2 or 3 bedrooms, 2 full bathrooms and intended to rent them for $950 - $1100 per month, that could impact the investment market I am describing. If a developer/building started building (100) townhouses with 1400 SF, 2 or 3 bedrooms, 2 full bathrooms and intended to sell them for $150K - $170K, that could impact the investment market I am describing. Neither of these types of developments are currently underway, though they are certainly both theoretically possible. So - given all of the above, it would seem to be a reasonable time to buy an investment property in that $140K - $160K price range, as I do not believe current inventory levels or new construction trends (for sale or for rent) are negatively impacting the buyers of these types of investment properties. | |

How Your Heat Pump Is Like Your Toenail |

|

It's time for your annual (semi-annual?) physical with your doc -- and as you review your recent health concerns with your doctor you share that you have been having some severe pain in one of your toes and one of your toenails doesn't look so great. You're not sure -- and it turns out your doctor is not sure -- if it is a drastically in-grown toenail, a fungus, an infection, or something more. Your doctor refers you to a specialist (a podiatrist) for further evaluation to see if everything is OK and what recommendations (if any) they might have. At this point, do you...

I'm going to assume most of us are going to go with the first route -- we aren't going to start hyperventilating about our possible toe removal or foot amputation -- we're going to calmly schedule an appointment with a specialist to learn more, recognizing that our general doc just simply didn't have the expert information with which to fully evaluate whether there was an issue at all and if so how much of an issue it was. So -- can't we start thinking about our heat pump (and our roof, and our deck, and our foundation walls) like toenails? If you're buying a house, and the home inspector recommends that you have your heat pump (or roof, or deck, or foundation walls) evaluated further by a specialist... It is NOT my recommendation that you...

Instead -- consult the expert! See if the _____ is really in bad shape and needs to be replaced, or if, perhaps, everything is fine (or a minor repair is needed) but that the home inspector just didn't have enough specialized expertise to come to that conclusion on their own. Again -- if you get a "hmmm -- I'm not sure about the condition of _____ -- you should consult a specialist" as a part of your home inspection, it is not necessarily an indication that all is lost. Don't cut off your toe! Schedule the follow up appointment with the specialist and keep gather information with which to make a reasonable, objective, educated decision about your potential home purchase. | |

What Is This Property Worth To You, Most People, The Theoretical Buyer |

|

If beauty is in the eye of the beholder, perhaps home value is in the eye of the buyer. While viewing a unique property yesterday, I was discussing the value with my clients. The value of that property (and perhaps any property) can seem to vary quite a bit. Let's pretend the unique property is listed for $400K. (it's not) The value to YOU -- how much a property is worth to you likely relates to how well it fulfill your needs, what your budget is for a purchase, what it would cost to make changes to the house to allow it to work well for you, etc. In this case, the house might only be worth $300K to you because it is larger than you actually need it to be, and you'd need to add a bathroom, and renovate the attic. The value to MOST PEOPLE -- how much a property would be worth to most buyers who might look at it is an important perspective for a seller to seek to understand. If ten possible buyers walked through this home and all concluded that they'd pay $350K, perhaps the house is overpriced. The value to the THEORETICAL BUYER -- in theory, if a buyer existed (now or in the future) for whom this was the absolute perfect amount of space, layout, condition, location, etc., maybe they would be head over heels in love with the house and ready to pay $375K. As a seller, you need to decide if you want to wait for that theoretical buyer -- who might not really exist -- or if you want to price your home to make its value seem reasonable to most people -- or if you want to be willing to negotiate down to a price that could work for nearly anyone. | |

Do Home Sales in Massanutten Resort Increase In The Fall |

|

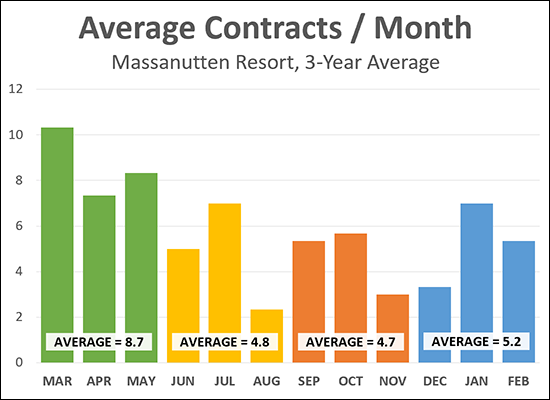

It turns out that leaves aren't the only thing falling in Massanutten in the Autumn months -- home sales are also falling -- though only slightly. The analysis above is to answer the question of one of my clients who had heard that home sales usually show a strong up tick in the Fall at Massanutten Resort. The data above is showing the average number of contracts signed per month over the past three years. Here's what I'm finding:

Every year is certainly going to be different, but it would seem that the only up tick seen in Massanutten home sales in the Fall is when comparing that contract activity to the typically slow pace of buyer activity in August. | |

Just Because Major Home Renovations Are Possible Does Not Mean They Are Advisable |

|

Sometimes you'll see a house that doesn't really work for you -- BUT -- it COULD -- with some major renovations. Maybe that's building an addition, adding a garage, tearing out some interior walls to make larger rooms, etc. Often, you'll determine that these renovations are possible -- but it is my opinion that they are not always advisable. A HOUSE JUST FOR YOU -- You should enjoy the home you live in, and make it your own, however a buyer can go overboard here. If you make major renovations to a home that makes it work ONLY for you -- then later when you try to sell, you may find it to be a challenge if your renovations made it work ideally for you -- and extraordinarily less than ideally for every other possible future owner of the home. OVER-BUILDING FOR THE NEIGHBORHOOD -- If you're buying a home in a neighborhood where homes usually sell for $250K, and you are likely to spend $230K because the house you are purchasing needs work, and then you spend $130K on fixing it up and making it work well for you -- all of a sudden you have a $360K home to try to sell in the future, surrounded by $250K homes. So -- by all means, consider making changes or improvements to the house that you purchase -- but keep in mind the big picture related to eventually selling the house as well. | |

A Middle Aged Roof Will Cause You The Least Stress When Selling Your Home |

|

And conversely -- selling a home with an old or a young roof can be frustrating! OLD ROOF -- If your home is 25 years old (circa 1993) and still has the original roof, it can be frustrating to try to sell your house -- with that old roof. Many buyers are going to be (reasonably) concerned about the near-term replacement cost of that roof. They're not going to want to pay the same price as someone just paid for your neighbor's house which has a 10 year old roof on it. NEW ROOF -- If your home is 30 years old (circa 1988) and you just replaced the roof last year, it can be frustrating to try to sell your house -- with that amazing, beautiful, recently expensive, new roof. This is not to say that buyers won't be excited to buy your home with a new roof -- they would love to do so -- they just won't want to pay $12K more than someone just paid for your neighbor's house which has a 10 year old roof -- even if you just paid $12K for the new roof. There isn't much you can do about the age of your roof -- unless it is time to replace it -- so this is more of a heads up of the potential frustrations outlined above more so than any particular recommendation. But as a best attempt at some recommendations... If you have a new roof -- be happy for the buyer of your home, but don't get caught up in trying to get the buyer to pay your total roof replacement cost above and beyond the sales price that recent comparable sales would suggest would be reasonable for your home. If you have a middle aged roof -- relax, enjoy it, sell your house without people asking many questions about the age of your roof or your plans to replace it. If you have an old roof -- you'll either need to replace it (and end up in the first category above) or sell with the old-ish roof and know that buyers will want to beat you up a bit more than normal in negotiations. | |

Preparing for Rain, Rain, Rain, Rain, Rain, Rain! |

|

We have seen record levels of rain this year that has caused unusual flooding within properties. In light of the weather forecast, here are some reminders of important actions to take prior to the storm.

Actions To Take Prior To The Storm

| |

How Much Overlap Exists In Your Home Search Criteria |

|

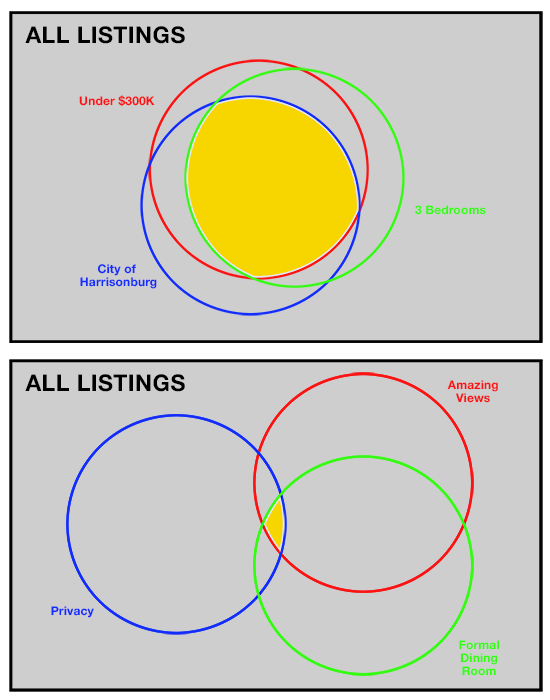

If you have three non-negotiable home search criteria, it is important to reflect on (or at least be aware of) how much overlap exists between these criteria. Above are two examples of this way of thinking about your home search.... The first set of buyers will likely have lots of options (large yellow overlap area) because many homes in the City have three bedrooms and are under $300K. The second set of buyers will likely have very few options (small yellow overlap area) because there are very few homes that somehow offer privacy AND amazing views and happen to have a formal dining room. These are fictitious illustrations -- they don't represent the actual amount of overlap that does or does not exist based on the criteria noted above -- but you should give some thought to how small of an overlap area you are creating for yourself based on what you are defining as non-negotiable in your home search. If that area is too small, you'll have very few options to consider, and eventually you may decide to flex a bit on a non-negotiable point. | |

Local Housing Market Cools, Slightly, in August 2018 |

|

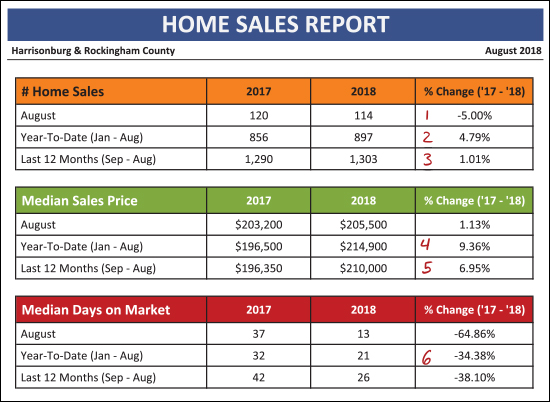

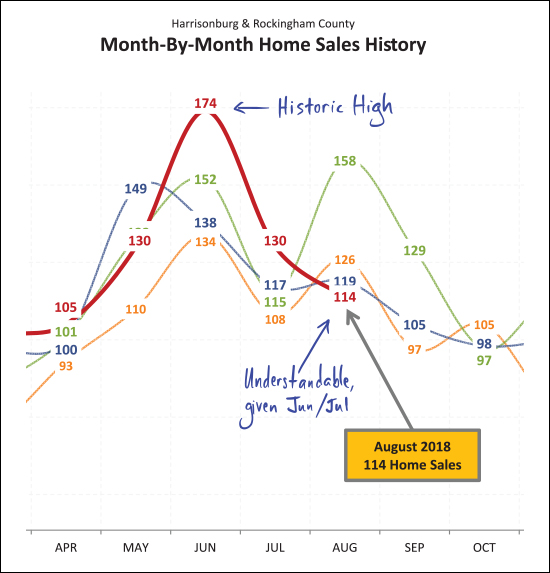

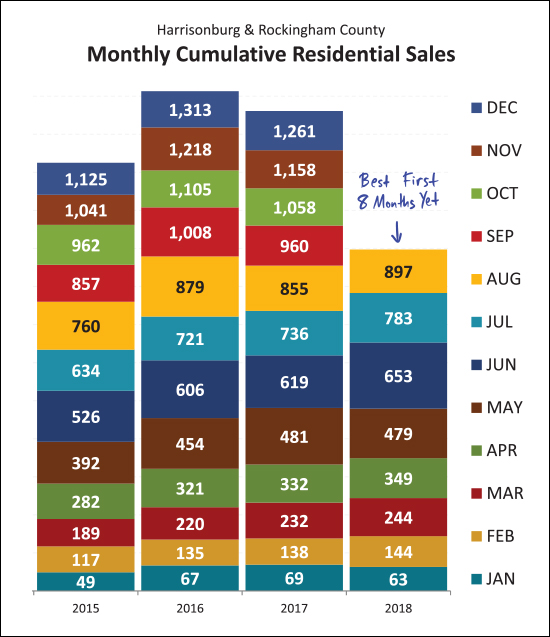

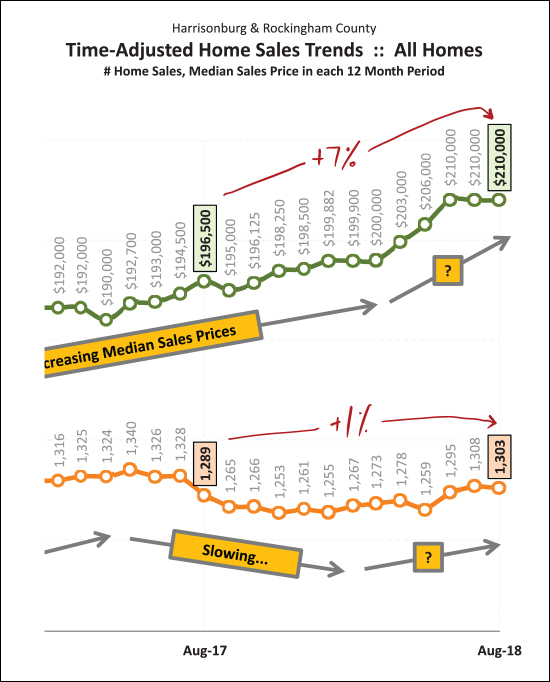

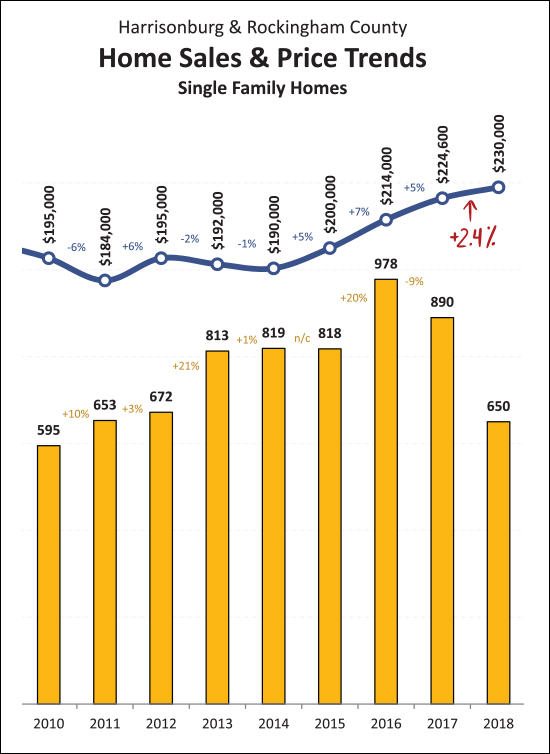

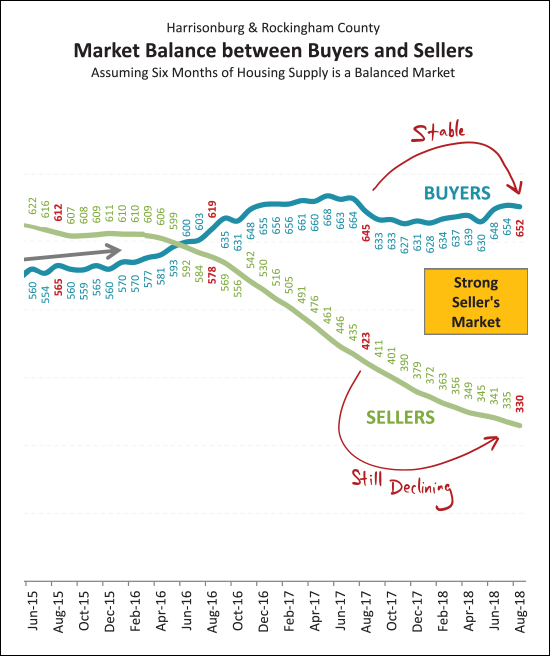

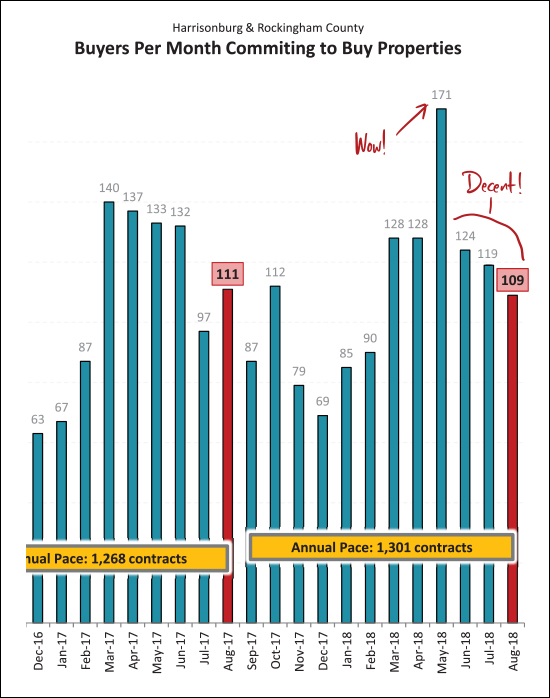

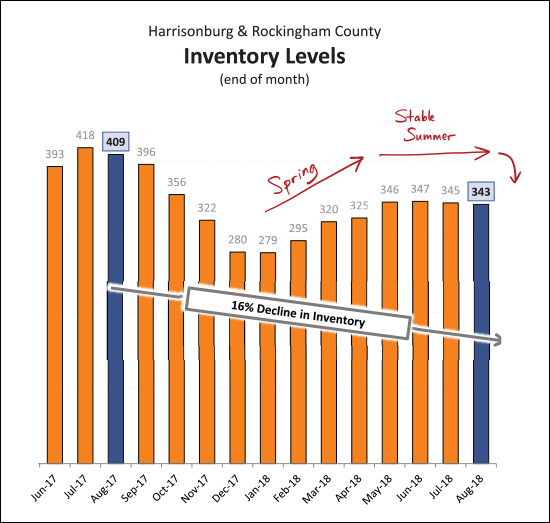

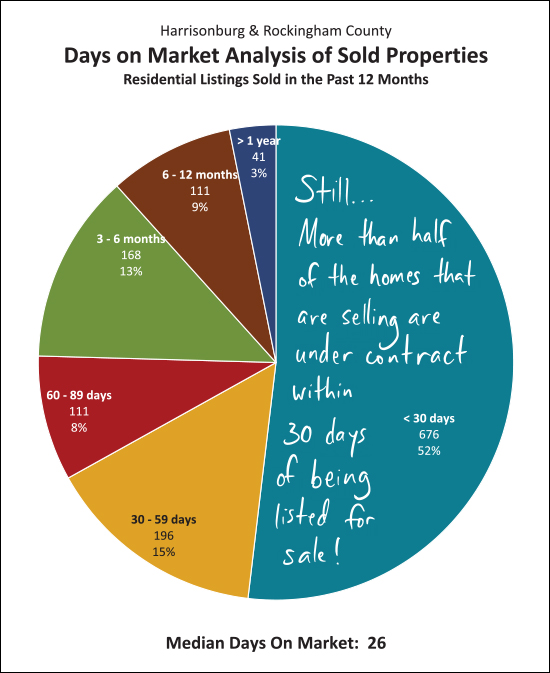

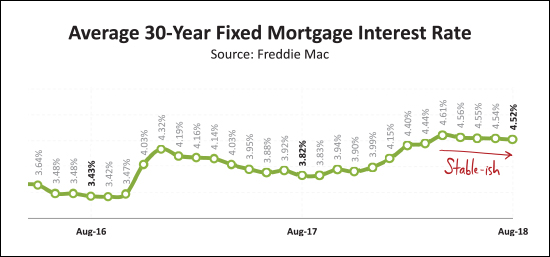

First, learn more about this new listing in Lakewood Estates by visiting 1285CumberlandDrive.com. Now, on to our local real estate market -- I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF or tune in to my monthly video overview of our local housing market... Now, let's take a look at some the trends we're currently seeing in our local housing market...  As shown above...

After an extraordinarily robust month of sales in June (174 -- third highest month ever) home sales slowed a bit in July, but remained (at 130) higher than in any recent July. It should be no surprise then that home sales cooled (even if temperatures did not) in August. Perhaps many summer buyers bought earlier in the summer this year than last. In the chart above, orange = 2015, green = 2016, blue = 2017 and red = 2018. So... Jun + Jul + Aug in 2016 = 425 summer buyers Jun + Jul + Aug in 2017 = 374 summer buyers Jun + Jul + Aug in 2018 = 418 summer buyers  We have seen 897 home sales in the first eight months of the year -- this is more home sales than we've seen in any recent first eight months of the year. At this point, we seem poised to see another 1300+ year of home sales -- which we have only seen one other time in the past decade.  Looking at a rolling 12 month data window -- we see that there has been a net 1% increase in the pace of home sales per year (up to 1303/year) and a 7% increase in the median sales price (up to $210K) over the past year. The median sales price escalated quickly from $200K to $210K this Spring but now has stayed put at $210K for the past few months.  I have never been happier to see such a modest increase in prices as I am to see the 2.4% increase in the median sales price of single family home as shown above. The 7% increase in median sales prices shown on the prior graph reflects not just increases in home values but perhaps a shift in which homes are selling. By looking at only single family homes (excluding duplexes, townhouses and condos) we can (sometimes) get a better sense of actual changes in home values. Here we see that single family home sales prices have increased only 2.4% over the past year.  The balance (or imbalance) between buyers and sellers doesn't show any signs of shifting any time soon. After multiple years of increasing buyer activity we are now seeing a relatively stable number of buyers in the market -- around 650 every six months. But at the same time, inventory levels continue to decline -- making it an even stronger seller's market -- with the usual disclaimers of "in most areas, in most price ranges, for most property types, etc."  The huge month of sales in June 2018 was foretold by the enormous month of contracts in May 2018. Since that time, we've seen relatively normal months of contract activity. The 109 contracts signed in August 2018 is pretty much in line with the 111 contracts we saw last year. Looking forward, we're likely to see a dip in contract activity in September, possibly a spike in October, before much lower contract numbers between November and February.  If you thought inventory levels have been low recently, you haven't seen anything yet. After a 16% year over year decline, we're about to head into the Fall and Winter where we inevitably see fewer homes on the market. It seems likely we'll dip below the 300 homes for sale mark again as we did last December and January. An increase in new construction is likely the only thing that can break this drought of listing inventory.  This is absolutely no consolation at all to any home seller who has had their home on the market for 2, 3, 4, 6 or 10 months -- but for sellers about to put their homes on the market, you have a decent chance of selling your home quickly -- again, depending on price point, location, features, finishes, condition, marketing, etc. But, as shown above, slightly more than half of the homes that sold in the past year were under contract within 30 days of being listed for sale.  Yes -- interest rates have risen over the past year -- by about 0.75%, which we shouldn't minimize. That said, at 4.5% -- which seems to be where we are hovering for the moment -- this doesn't seem to be drastically changing buyer behavior or housing affordability. OK -- I'll stop there for now. Again, you can download the full report as a PDF, or tune in to my monthly video overview of our local housing market And a few tips for anyone thinking of buying or selling soon -- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

Stalemates in House Negotiations |

|

Some buyers find themselves in a "repeating stalemate" situation -- where they have made offers on multiple offers and they keep coming up short, and not being able to find common ground with the home sellers. In the situation I am describing, it is not a result of the buyer being outbid by another buyer -- but rather, because they repeatedly are not willing to pay a price that the seller is willing to accept. In such a situation, a buyer can start to wonder whose thinking is askew. Are they being unreasonable as buyers, thinking that they should be able to buy one of these homes for $X? Or are the sellers being unreasonable as sellers, thinking that they should be able to sell their home for $Y? In the end, I suppose that if the seller is willing to continue to own their home (and not sell it) then it is OK for them to continue to try to sell their home for $Y if multiple buyers keep walking way from negotiations not willing to pay $Y. And likewise, if a buyer is willing to continue to not buy a home then it is OK for them to continue to walk away from negotiations when sellers won't accept $X for the house. The only way that this type of a stalemate ever ends is when one party finally decides that their long-held and previously non-negotiable position can be compromised. | |

Harrisonburg City Council Considering Regulating Short Term Rentals |

|

Do you have an opinion on whether short term rentals (such as via AirBNB) should be permitted and/or regulated in the City of Harrisonburg? If so, you should show up on Tuesday, September 11th for the public hearing on the topic. More from today's Daily News Record article...

| |

Home Construction Nearing Completion The Glen at Cross Keys |

|

The Glen at Cross Keys is a new home development just East of Harrisonburg -- on Cross Keys Road with 78 duplexes and paired homes. The final nine homes in the neighborhood are at various stages of construction -- and seven of those nine are already under contract! The final two homes to be built in The Glen at Cross Keys just came on the market. These 2100 SF homes have been popular with a retiring, down sizing demographic -- with an open layout on the first level with the kitchen, dining area, living room, master suite, laundry room, an office/den and a two-car garage all on the main level. The partial second level features two large bedrooms and a full bathroom. Buyers interested in The Glen at Cross Keys have two more opportunities to buy a new home -- and then it will be a matter of patiently waiting for a resale home to become available. Find out more about The Glen at Cross Keys here. | |

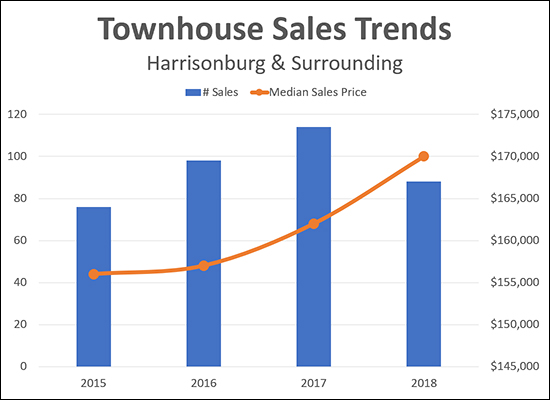

Townhouse Sales Trends in Harrisonburg and Surrounding Areas |

|

This is a somewhat limited analysis, but I think it can be helpful to understand what we're seeing in changes in demand for new-ish townhouses in the City of Harrisonburg and just surrounding. The analysis above includes the following townhouse developments of properties built since 2000:

As shown on the chart, there are an increasing number of sales happening in these developments (88 sales in 2018 is for the first eight months of the year) and the median sales price is rising -- more quickly now than a few years ago. I expect sales of this type of townhouse to continue to be strong over the next few years -- though if we see a large number of new construction townhouse developments coming online it could affect the pace of sales in resale townhouse developments. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings