How To Measure The Square Footage Of Your Home |

|

So -- are you trying to figure out the square footage of your home? Here are a few methods that are NOT necessarily going to give you the correct answer....

So, how do you really measure square footage? It starts outside the home! You'll need to measure the exterior dimensions of each level of your home -- and then subtract any open areas, such as the open space above a foyer. This measurement method, as odd as it may be, is what is used by nearly every appraiser, as it is how "gross living area" is defined by Fannie Mae, HUD, FHA, ERC and ANSI. As such, it is important that you're measuring the square footage of your home in the same way that nearly every appraiser and Realtor would be measuring it, so that you're comparing apples to apples when comparing the size (SF) of your home to another home that has sold or that is on the market for sale. And here's why I consider it to be an odd way to measure square footage....

| |

Perhaps Unsurprisingly, Most Harrisonburg Short Term Rentals Are Near EMU, Downtown or JMU |

|

Perhaps it will come as no surprise that most of the short term rentals in the City of Harrisonburg are located close to EMU, Downtown Harrisonburg or JMU. The map above shows short term rentals approved by the City of Harrisonburg as of May 1, 2020. While the City is in the process of adjusting some of their processes and guidelines for how to potentially use your property as a short term rental, the main thing to remember is that you need to get approval for doing so. Learn more about the process of establishing a short term rental in the City of Harrisonburg here. | |

Why Is This Home Being Sold In AS IS Condition? |

|

Sometimes a seller is stating this as soon as they list a property: All inspections are for informational purposes only. or This house is being sold in "as is" condition. Here are the top three innocent reasons why a seller would want a home inspection to be for informational purposes only....

| |

How To Count Bedrooms In A House |

|

You don't have to be a math major to count bedrooms, right? Well, technically, that's true -- but counting bedrooms for real estate purposes can become a bit nuanced. Now -- the National Appraiser Roster has all sorts of nuances surrounding this topic....

Wow. OK. Lots to consider there. So -- the short answer is that you can count your bedrooms based on whether they have windows and closets -- but it may require a bit more thought and analysis before we decide how many bedrooms we'll say that your home has when we put it on the market. Oh, and two final notes....

| |

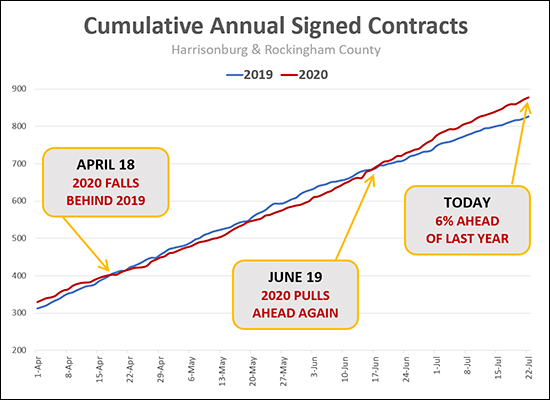

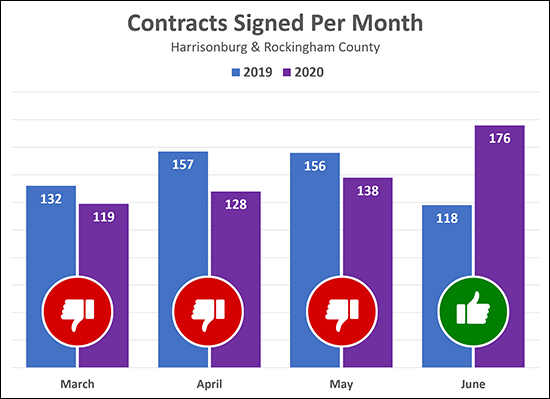

Cumulative Contract Activity Pulls Ahead In 2020 |

|

How did COVID-19 affect our local housing market? So far, this is what we're seeing...

Now, there have been 6% more contracts signed in 2020 than in 2019! There are still plenty of ways that COVID-19 could affect our local housing market, but we're not seeing any significantly harmful impacts to date. | |

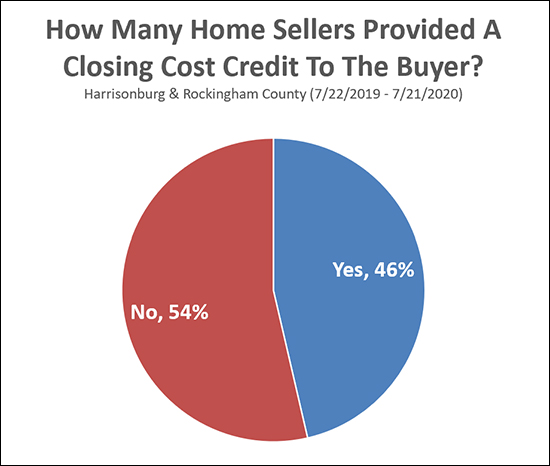

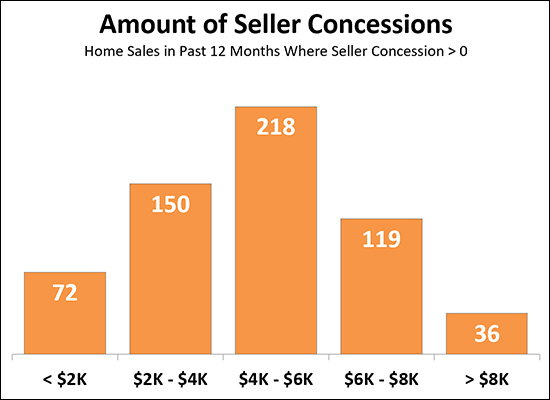

How Often Do Home Sellers Provide A Closing Cost Credit? |

|

Looking back over the past year it seems that slightly fewer than half (46%) of home sellers provided a closing cost credit to the buyer for their home. It is not altogether surprising that many buyers ask for a seller paid closing cost credit. With interest rates so low, it is not a crazy idea to incorporate some of your closing costs into the mortgage by increasing the purchase price and mortgage amount by a few thousand dollars. Here, then, is how much sellers paid in buyer closing costs over the past year in the 46% of the cases where the seller did provide such a credit...  So, if, as a seller, you are paying part of a buyer's closing costs, you are most likely to be paying between $4K and $6K --- or between $2K and $4K. And again, as a seller, if you pay part of the buyer's closing costs -- you are not alone -- 46% or so of sellers do so! | |

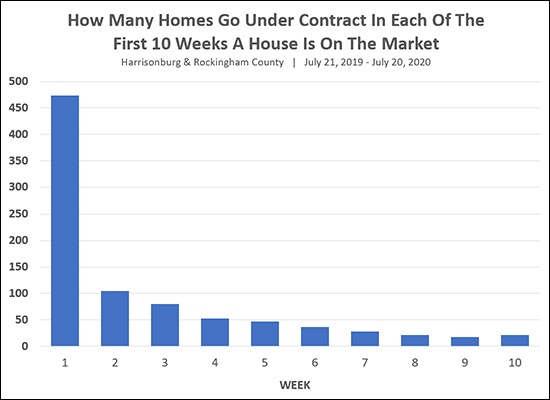

Most Homes That Sell In The First Ten Weeks On The Market... Sell In The First Week |

|

We know that homes are selling quickly. 62% of homes that sold in the past year were under contract within 30 days. 75% of homes that sold in the past year were under contract within 60 days. But was market activity spread out evenly over those first 4, 8 or 10 weeks? Not at all! As shown above, when we look at homes that went under contract within the first 10 weeks of being on the market -- a lot of them (most of them!) were under contract the very first week they were listed for sale! Perhaps this is also why we're seeing more than half of homes selling for more than their list price. | |

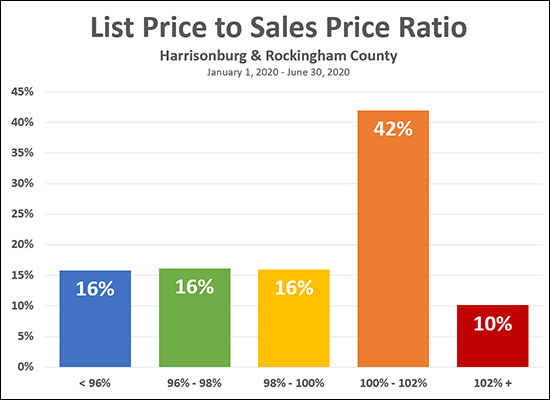

More Than Half Of Homes Are Selling For More Than Their List Price |

|

This might surprise you. It surprised me! More than half (52%) of homes that sold in the first half of 2020 sold for MORE than their list price! It is certainly true that we have seen buyers being able to negotiate less and less over the past few years as the market has become tighter in many price ranges and locations -- and this is some specific evidence that now many buyers aren't able to negotiate at all! Plenty of caveats, of course...

Anyhow, regardless of how you slice the data, the market is hot in many price ranges and buyers are often finding themselves needing to be prepared to pay the full list price or even a bit higher to secure a contract on a home! | |

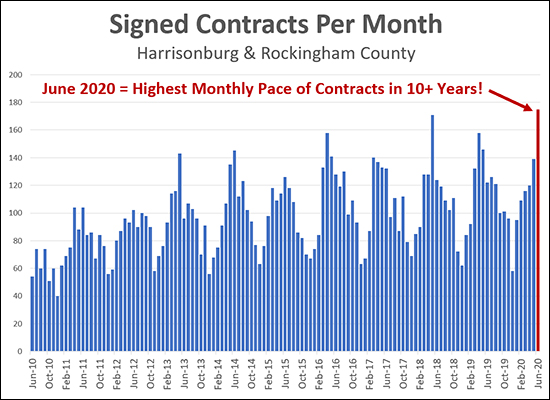

Highest Monthly Pace of Contracts in Over 10 Years |

|

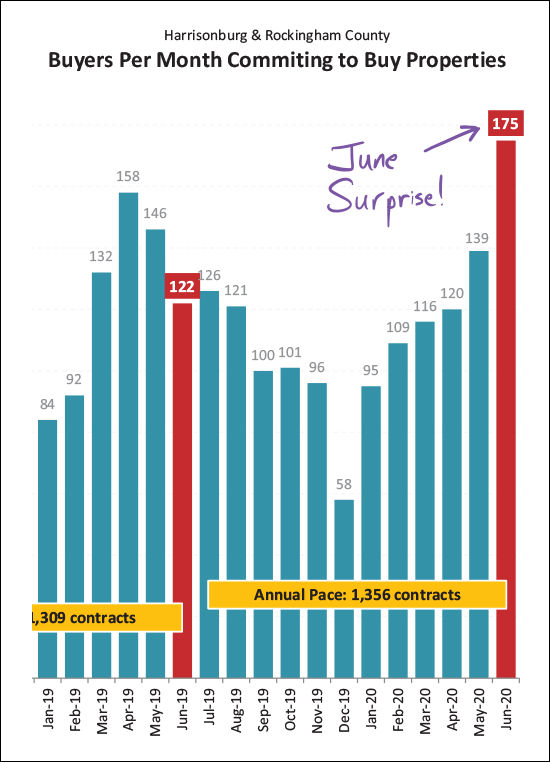

To say June 2020 was a busy month of contract activity is a bit of an understatement. A total of 175 properties went under contract in June, which was more than any other month in the past 10 years! Some of the previous high months were...

Read more about our local real estate market in my most recent monthly market report. | |

Harrisonburg Area Home Prices Up Nearly 7% in First Half of 2020 |

|

Happy Tax Day! Yes, that's right, today is the extended deadline for filing and paying income taxes. But the day is still young, so read on for an update on our local housing market before you go submit your tax filing. ;-) But first -- check out this recent listing (shown above) in Highland Park priced at $365K by visiting 4065LucyLongDrive.com. Two other notes before we get started...

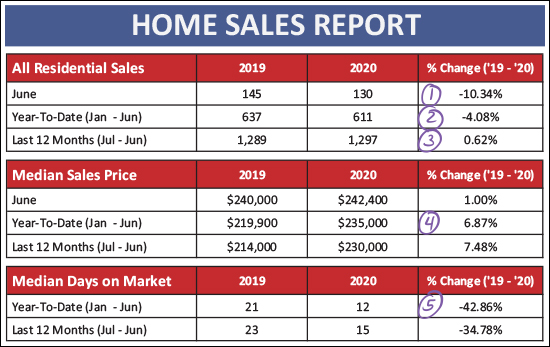

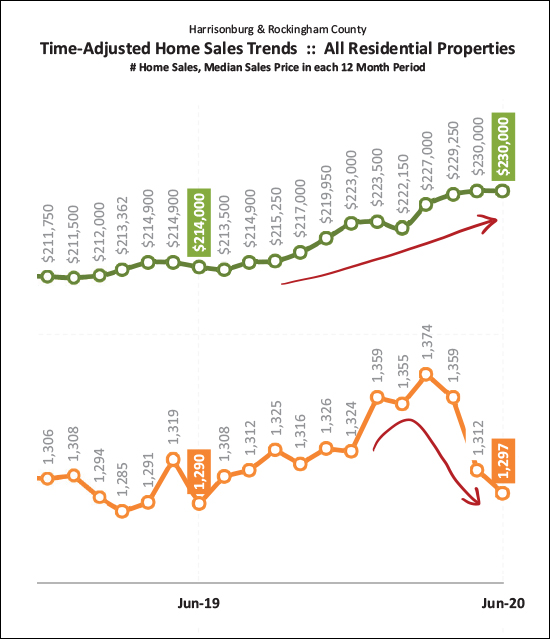

OK, now, on to the data...  We're now officially halfway through the year when looking at year-to-date sales figures and there is plenty of interesting trends to note above...

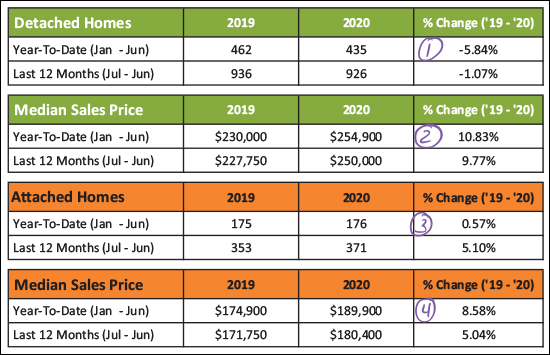

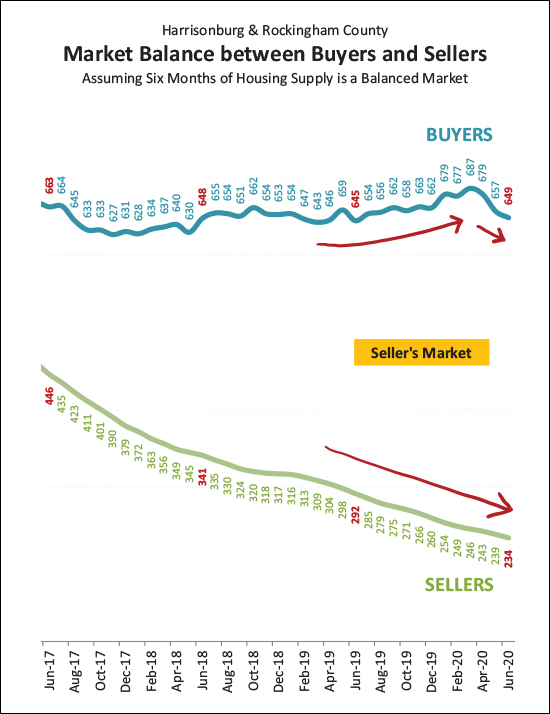

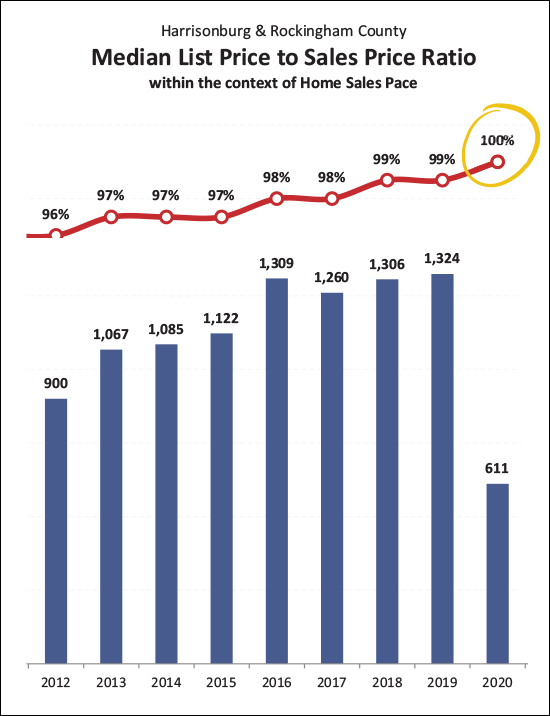

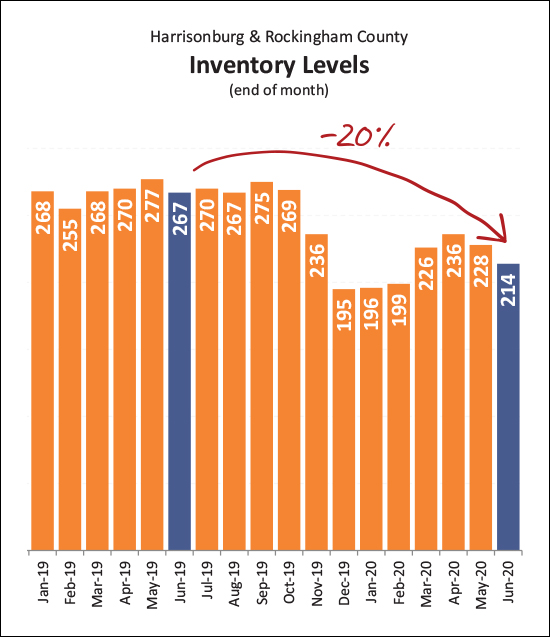

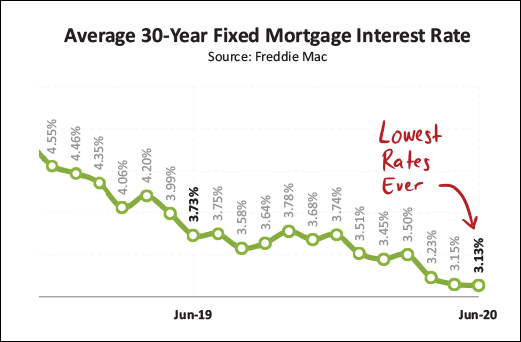

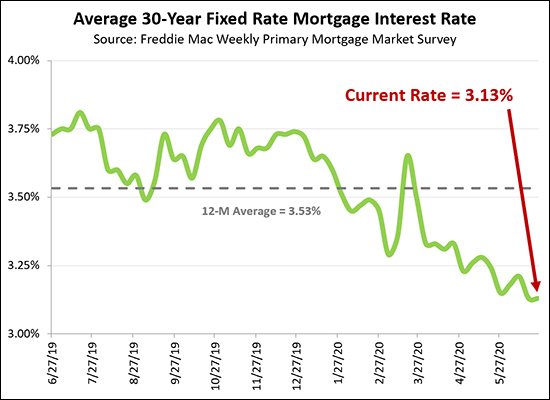

Now, let's take a brief look at detached homes compared to attached homes. Attached homes includes duplexes, townhomes and condos.  As shown above...

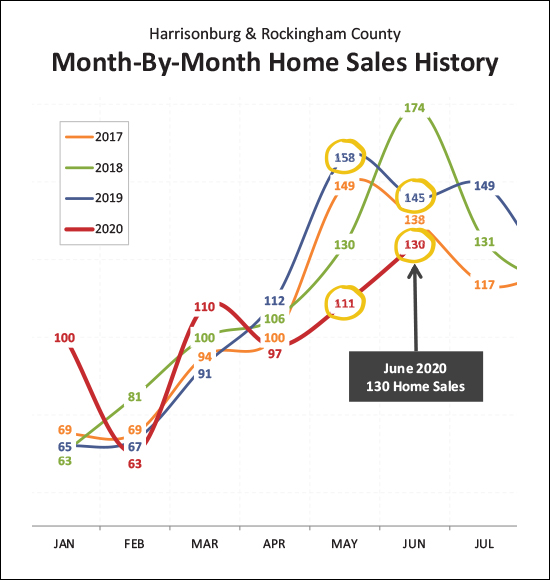

So, prices have risen quite a bit between 2019 and 2020 even without much of an increase (actually a slight decrease) in the number of homes that are selling. But perhaps the trend in the pace of home sales is shifting...  If you look at the four numbers I circled in gold above, you'll see that May 2020 home sales were drastically lower than May 2019 -- but the gap between June 2020 and June 2019 was not as severe. Perhaps we are starting to see home sales pick back up again? At least some of the (slight) decline in home sales in 2020 seemed to be a result of fewer would-be home sellers listing their homes for sale which gave would-be home buyers fewer options for buying. Now, looking at some longer term trends...  The data above looks at a moving 12-month set of data, and we're seeing divergent trends now. The median sales price (green line) keeps on steadily rising -- while the annual pace of home sales (orange line) has been drifting downward over the past three months. As noted above, fewer sales seems likely to be a result of fewer sellers being willing to sell and not fewer buyers being willing to buy -- which would at least partially explain why prices keep on rising. All of this means that is definitely still a STRONG seller's market...  As shown above, the number of buyers buying in the market has stayed rather steady over the past few years (though it has dropped off a bit over the past few months) while the number of sellers selling (inventory at any given time) continues to decline. This makes it an absolutely wonderful time to be a seller -- and probably a not very fun time at all to be a buyer. And, well, if you need to do both (sell and buy) you'll be both ecstatic and depressed! This next stat might surprise you...  I did not see this one coming! I'll dive a bit deeper into this in the coming days, but it seems that the median "list price to sales price ratio" has risen to 100% in 2020! That means that half of sellers are selling below their list price and half of sellers are selling ABOVE their list price!? I knew sellers were having to negotiate less and less on price -- but this statistic is still rather shocking. Again, I'll dive deeper into the data in coming days to see what else I can uncover here. And set your coffee cup back down, because here's another surprise for you...  Contract activity in the first five months of the year was lagging behind this year (-5%) as compared to last year. But when we factor in June contracts, not such much! Now there have been 3% more contracts in 2020 than in the same timeframe in 2019, mostly because of the astonishingly high 175 contracts signed in June 2020! Wow! Again, I'll break this down further over the next few days to try to better understand this spike in contract activity. And as is likely NO surprise, inventory levels keep on dropping...  There are currently only 214 homes for sale in Harrisonburg and Rockingham County -- which is 20% lower than where we were a year ago. I was hopeful that we'd see inventory levels pick up a bit during the spring -- which didn't really happen. Maybe we'll see some late summer, early fall increases?? Finally, on to this super low, historically low, ridiculously low interest rates...  Buyers financing their home purchases over the past few months have enjoyed some absurdly low mortgage interest rates. The current average is 3.13%, which is the lowest EVER and I've even had some buyer clients pay a point or so to get under 3% -- on a 30 year fixed rate mortgage! Wow! OK - that about wraps up my monthly run down of what is happening in our local real estate market. Stay tuned over the next few days for some deeper analysis of some of the trends as mentioned above. If you have questions about what I have discussed, or about other market trends you are observing, shoot me an email. Otherwise, until next time...

Finally... if you're thinking about buying soon, or selling soon, and are looking for a Realtor to assist you with that process - I'd be happy to connect with you at your convenience. You can reach me most easily at scott@HarrisonburgHousingToday.com or by calling/texting me at 540-578-0102. Have a great second half of the first month of the second half of the year! :-) | |

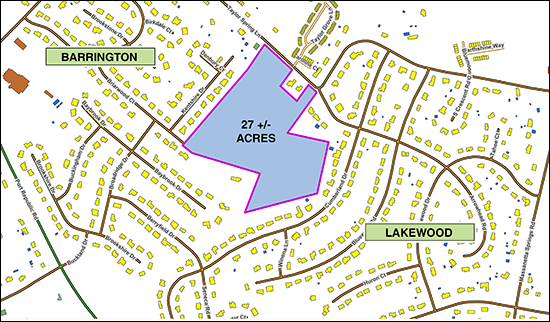

Rockingham County Considers Purchase of 27 Acres Between Barrington, Lakewood for Stormwater Management Purposes |

|

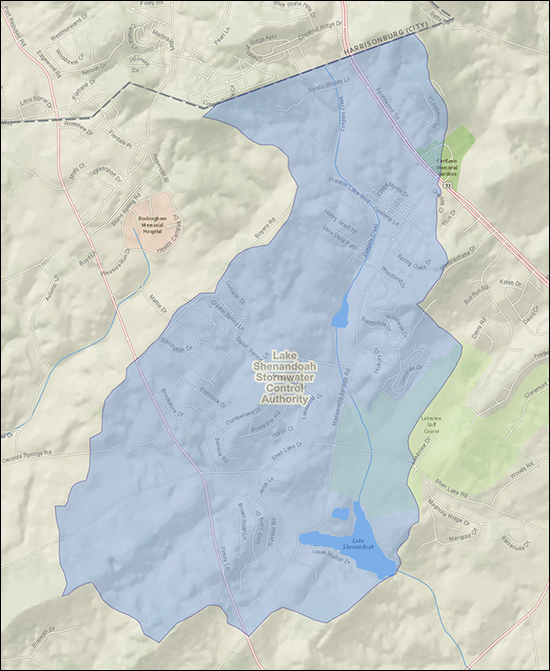

Rockingham County will likely purchase the 27-ish acre parcel on Taylor Spring Lane between Barrington and Lakewood to use for managing stormwater in the Lake Shenandoah Watershed. The purchase has not been finalized, but the County is in discussions with the land owner regarding the purchase. The County does not have a design for how the property will be used, but according to Lisa Perry, (Environmental and Land Use Manager for Rockingham County) it is safe to say that the low lying areas of the parcel will be used for stormwater storage capacity. My understanding is that only half of the property will be needed for stormwater management and that the County intends to use the other half of the land for a future County park once funding is available to build the park. Here's a reminder of some of the details of the Lake Shenandoah Stormwater Authority... If you live in (or own property in) the area shown above, you'll have a new tax to pay come December 2020 - a fee that will go towards funding upgrades in the stormwater infrastructure in the Lake Shenandoah Watershed.

These fees should bring in approximately $2.8 million over the next ten years - though the total estimated costs for the needed infrastructure improvements are between $3.15 million and $4.75 million. Also in their June meeting, the Lake Shenandoah Storm water Control Authority Board (made up of the same members as the Rockingham County Board of Supervisors)

If you live in this area, hopefully the news of this new tax isn't a surprise to you -- as it has been discussed for about a year now. The County held the first public hearing on this matter back in July 2019. | |

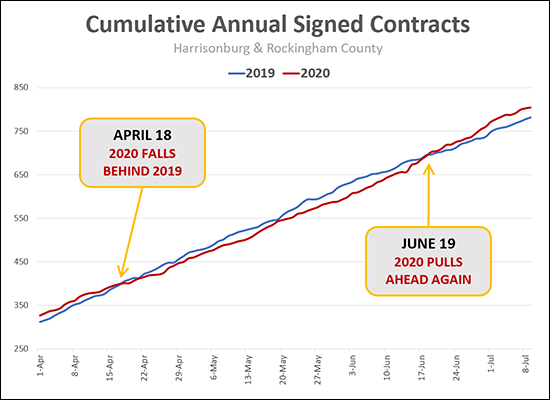

Sales Activity Was Slowing For Two Months But Has Picked Back Up Again |

|

The first few months of 2020 were strong -- stronger than 2019 and seeming to indicate that 2020 was going to be a solid year of local home sales. And then, COVID-19. Contract activity started to decline in March -- and by April 18, the number of contracts signed in 2020 had fallen behind the number signed during the same timeframe in 2019. So, it seemed that COVID-19 might at least somewhat slow down our local real estate market. But, then June! During the month of June, contract activity steadily ramped up, and by June 19th the cumulative number of contracts signed in 2020 (Jan 1 - Jun 19) had pulled back ahead of the same timeframe in 2019. So, it seems that COVID-19 might not lead to a net decline in the amount of home sales activity in Harrisonburg and Rockingham County! | |

Home Buyers In 2020 Are Locking In Ridiculously Low Mortgage Interest Rates |

|

If there is one trend line that we like to see declining -- it's mortgage interest rates! :-) The interest rates at which buyers are financing their mortgages have been lower and lower and lower as we have progressed through 2020, and are now right around 3.13%. If you are thinking about buying a home in 2020 and IF you can secure a contract on a house despite LOTS of competition from other buyers, you are likely to be financing your mortgage at one of the lowest mortgage interest rates ever seen! Perhaps that is fueling some of surge of buyers currently in the market? | |

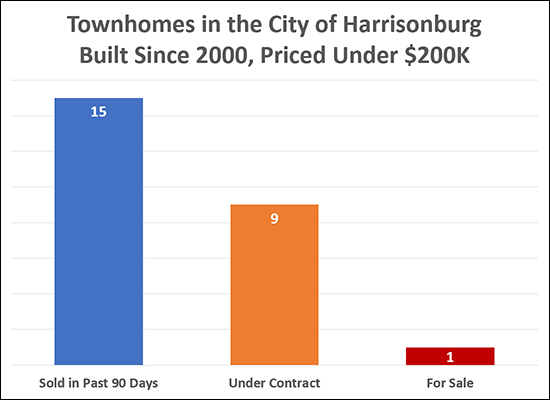

This Could Be A Good Time To Sell A Townhouse Under $200K, Built Since 2000, In The City of Harrisonburg |

|

If you have a townhouse to sell in the City of Harrisonburg, built in the past 20 years, that would be priced under $200K, this may be an excellent time to sell it. Here's why... Over the past three months, there have been (15) sales of such townhouses -- so, around (5) buyers per month are buying townhouses built in the past 20 years, priced under $200K in the City of Harrisonburg. Not surprisingly, then, there are (9) such townhouses currently under contract. But wait, what!? There is only (1) single solitary townhouse for sale in the City of Harrisonburg under $200K right now that was built in the past 20 years. So -- if you own a townhome in Avalon Woods, Beacon Hill, Harmony Heights, Liberty Square, etc. -- this might be an excellent time to sell. Email me to chat about your townhouse and its value in the current market. | |

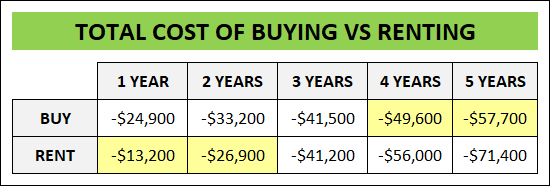

Renting or Buying A Home Within A 5 Year Time Horizon |

|

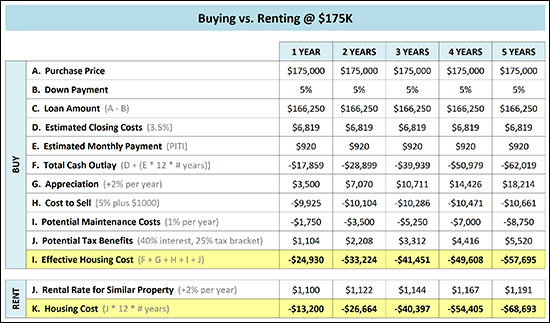

If you will only be in your next home for two (or 1, 3, 4 or 5) years -- should you buy that home? Or just rent a home instead? Let's take a look, assuming a price point in the current market of around $175K - which is likely to be a townhouse and might be what you are considering as a first time buyer...  As becomes pretty quickly, above, it doesn't necessarily make much sense to buy if you are only going to be in your home for 1 or 2 years -- and once you get to a time horizon of 4 or more years, it almost certainly makes sense to buy a home. For clarity, let's look at how I'm determining the cost of renting and buying this fictional house... The Total Cost of Renting Includes... Monthly rental rate x 12 x # years Yep, that's it The Total Cost of Buying Includes... Monthly mortgage payment x 12 x # years + closing closing costs when buying your home (3.5%) + cost of selling your home (5% + $1K) + potential maintenance costs (1% / y) - appreciation of your home's value (2% / y) - potential tax benefits of interest paid (int x 40% x 25%) Here's a visual (click for a closer look) as to how those numbers line up over a one through five year time horizon... I should also note that it is quite possible to be "just fine" from a financial perspective if you buy and only end up being in the home for a year or two if...

As you are thinking through whether you should buy or rent -- at a $175K price point or otherwise -- feel free to touch base with me and I can give you some feedback and advice based on your overall circumstances. | |

What To Expect For The Second Half Of The Year In Our Local Real Estate Market |

|

I spent some time this past weekend cleaning up my crystal ball - oh wait, no, I was cleaning my garage. My crystal ball is always ready and waiting to convincingly and accurately predict the future of our local real estate market. Or something like that... But really -- here are several of my predictions for the second half of 2020... MORE HOME SALES - The pace of contract signing (the earliest indicator of market activity) lagged behind (2020 vs. 2019) for quite a few months this year but has now broken through last year's trajectory and we're seeing more cumulative contracts signed in 2020 as compared to 2019. So, it doesn't seem that COVID-19 will end up resulting in a net decline in home sales in our local area. HIGHER SALES PRICES - Even as contract activity lagged behind in 2020, the median sales prices of those homes that were selling kept on climbing. We are not seeing any indicators on the horizon at this point that would seem to cause home prices to flatten out our decline. CONTINUED LOW MORTGAGE INTEREST RATES - I certainly didn't think we'd keep hitting new low after new low for mortgage interest rates in 2020, but indeed, that has been the case. The average 30 year fixed rate mortgage interest rate is 3.07% as of the moment I am typing this. Wow! I certainly don't expect them to be any lower than this, but I think they'll likely stay below 4% for the rest of the calendar year. SPEEDY SALES - Homes are selling faster and faster and faster. The "median" days on market has declined 37% over the past year from 24 days to 15 days. So, buyers have to be ready to jump on new listings quickly. LOW INVENTORY LEVELS - There were some times over the past few months when I thought we might start seeing inventory levels creeping up -- because sellers would unexpectedly need to sell, or because buyers weren't able to or interested in buying -- but neither of those happened. I suspect we will keep seeing very low inventory levels throughout the remainder of the year. OK - in the end - my predictions don't point to anything particularly surprising or unexpected - but perhaps that is the main take away. I don't think we are going to see anything drastically unexpected or surprising in our local housing market in the 3rd and 4th quarter of this year. | |

Contracts Shoot Skyward In June, Sort Of Like Fireworks |

|

After three months in a row (March, April, May) of slow contract activity (compared to last year) the pace of contracts being signed shot skyward in June to easily eclipse last June, as well as March, April and May of both years! This is a good indicator that we are not likely to see much of an impact on our local real estate market based on COVID, other than that it affected the timing of when these sales (contracts) were coming together. Contracts came together much later than usual this year. Happy Independence Day! | |

Which Terms Are Usually Most Important To Home Sellers When Receiving Multiple Offers? |

|

It's all about money, right? Well - not always. If you are making an offer on a house and you will be competing with other buyers who are also making offers, there is more to think about than just the price you are offering to pay. Some of these terms will be outside of your control, but keep in mind that these contract terms are ones that a seller will likely be comparing when they have multiple offers... PRICE - Certainly, if some offers are higher than others on price, they are more likely to be accepted by the seller. This can be accomplished by making a strong initial offer -- or by making an offer with an escalation that would increase your offer if other competing offers are higher than your initial offer. CLOSING COSTS - Don't ask for the seller to pay for them if you can avoid it. A $250K offer asking the seller to pay $5K is not equivalent to a $245K offer without a closing cost credit - even though they have the same net to the seller. The $250K offer requires the house to appraise for $250K, whereas the $245K offer only requires it to appraise for $245K. DOWN PAYMENT - The larger your down payment is, the more likely the seller is to consider your offer if comparing it to other offers with buyers making a smaller down payment. A larger down payment shows that you are potentially more financially capable or stable than other buyers who need to finance a greater portion of the purchase price. DEPOSIT - The amount of your deposit ($500, $1000, $2000, $5000) doesn't make a huge difference to the seller (it usually goes back to the buyer if a contract contingency doesn't work out) but a larger deposit shows greater financial capability. LENDER LETTER - This one should be obvious, but make sure to include a letter from your lender showing you are qualified to purchase the home at the price you are offering to pay. PERSONAL PROPERTY - If the seller only wants to include the kitchen appliances with the house, don't potentially miss out on buying the house because you're asking for the clothes washer, clothes dryer, lawn mower, porch swing and pet hamster. ;-) CLOSING DATE - Take a moment and ask the seller what closing date would be most convenient for them, and then work with that if you can. In the absent of that knowledge, offer a speedy closing date but verbally confirm that you can be flexible on timing. HOME INSPECTION - If you are comfortable buying without a home inspection, don't add the contingency. If you do decide to conduct a home inspection (most buyers do) then consider taking the "I did the inspection and I'm walking away from the deal without even asking for any repairs" off the table. This is one of the standard clauses in the home inspection contingency, and if you are willing to remove that clause -- basically showing a willingness to make a good faith effort to negotiate any inspection findings -- it will be noticed and appreciated by most sellers. Also, if you can go ahead and get a home inspection scheduled within 10 days, then offer a shorter inspection contingency timeframe (such as 12 day) instead of the 18 to 21 days we typically see in offers these days based on limited availability of inspectors. FRIENDLY LETTER - Consider writing a cover letter to introduce yourself to the seller and explain who you are and why you are excited to buy their particular home. If there are multiple offers with similar terms but only one buyer took the time to provide some personal context, that could go a long way towards helping the sellers gravitate towards their offer. These items above are just a few of the terms that a seller will likely be comparing when they receive multiple offers on their home. Price is certainly one of the most important factors, but oftentimes the prices of multiple offers are relatively similar -- and the seller will be looking for other ways that an individual offer stands out from the other competing offers. Best of luck, home buyers, in this fast and furious seller's market! | |

Detached Homes Under $250K In The City of Harrisonburg Are A Hot Commodity |

|

If you are selling a detached home in the City of Harrisonburg, priced under $250K, you are likely to have quite a few early showings. If your home is prepared well and priced well, it would not be uncommon to have 10+ showings on the first day that it hits the market. A few tips for such home sellers...

Happy home selling if your home is priced under $250K in the City. It will likely be a whirlwind of early activity! | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings