Archive for April 2021

How Far Above The Asking Price Are You Willing To Go? |

|

In some long forgotten distance past era I might have asked a buyer if they thought they were willing to] pay the asking price for a house that was recently listed for sale. Now, the question is a bit different. It is more often a question of how far above the asking price you are willing to go when you make an offer. When you are competing with so many other home buyers who are also planning to make an offer it quickly becomes a question of which buyer is willing to pay the highest price for a particular property. Sometimes that top price is guided by past sales prices but more often than not in the current market buyers are deciding that they are willing to pay more than other recent buyers have paid for similar properties. Escalation clauses are being used in many if not most offers these days to allow a buyer to offer one price but commit to increasing their offer to exceed the offering price from other buyers. It is okay to get excited about a list price of a new listing but keep in mind that these days you probably won't be paying that price, you will be paying some amount above that price. Thus, start thinking early about how far above the asking price you are willing to go. | |

The Morning Brew on whether the housing market will crash like it did in 2008 |

|

Do you read the Morning Brew? It's a daily email with top new stories in a format that is enjoyable to read. Subscribe here if you are interested. Here's an excerpt from today's Morning Brew that is applicable to the sort of things I usually share with you in this space...

Again, sign up for other great content from the Morning Brew here, and let me know if you agree with their editor's take on the future of the housing market. | |

Buying vs Building When Hit With Low Inventory AND High Building Costs |

|

Typically, the tension between buying vs building is one of: 1. Goals 2. Money 3. Timing If you build, you can get the house you want, but you'll pay more for it and it will take a lot of time and attention. 1. Goals = Win 2. Money = Lose 3. Timing = Lose If you buy an existing home, you won't get exactly what you want, but you will pay less for the house and the process will not be a drain on your time. 1. Goals = Lose 2. Money = Win 3. Timing = Win Don't let my oversimplification of this issue fool you -- this is something that buyers can get stuck debating for months, or even years, often while looking at resale homes to try to convince themselves to buy instead building. AND -- two current market conditions are making it an even more complicated decision...

If you are stuck in this quagmire, I'd be happy to meet with you to talk through some of the pros and cons and try to help you come to a decision you'll be pleased with in the short and long term. | |

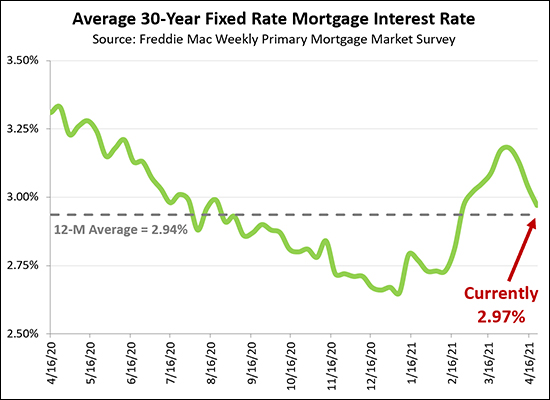

30 Year Mortgage Interest Rates Drop Below Three Percent Again |

|

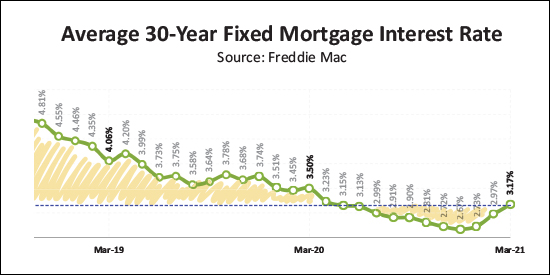

Mortgage interest rates started out at 2.65% this January and kept on rising -- all the way up to 3.18% on April 1st. But, then, they started declining again. Interest rates are now averaging at 2.97% for a 30 year fixed rate mortgage. That is well below where we were...

Today's home buyers are certainly happy to be seeing interest rates declining again, as it helps to offset the rapidly increasing prices that they find themselves paying for houses in this quickly moving and highly competitive market. | |

34 Single Family Home and Duplex Lots Planned At Highview Estates, Just North of Harrisonburg City Line |

|

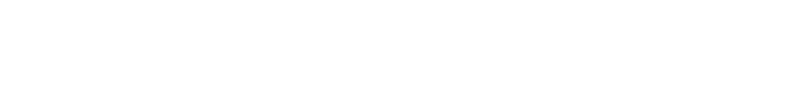

view a larger map here Per recent versions of the Rockingham County Planning Commission meeting packets, a new development is being planned for Route 42 North -- just barely outside the City of Harrisonburg, The site plan currently on file with the County is shown below, though it is likely not the final site plan. Per the County's notes it is "awaiting corrections and resubmittal." The current version of the site plan shows (18) single family home lots and (16) duplex lots -- for a total of 34 homes. view a clearer plan here This is one of the many new residential developments in Harrisonburg and Rockingham County that are under construction or in planning phases as outlined here. | |

29 More Townhouses Likely Coming To Vine Street |

|

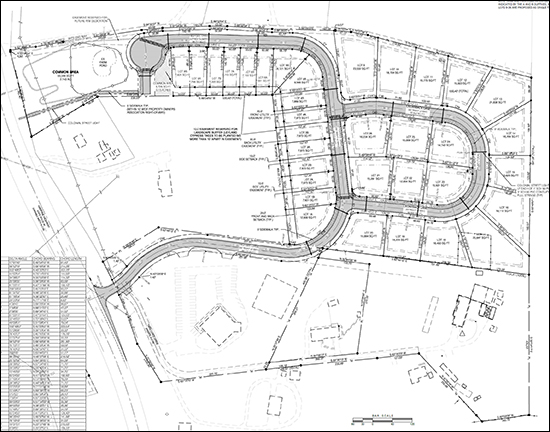

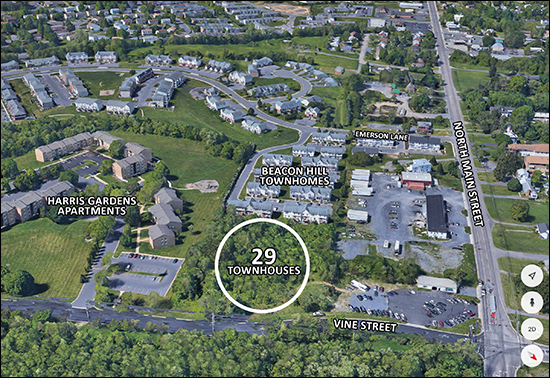

view a larger map here The Harrisonburg Planning Commission recommended the approval of the rezoning of a 2.25 acre parcel on Vine Street to allow for 29 townhouses to be built as per the proposed site plan below... view a larger site plan here This is one of the many new residential developments in Harrisonburg and Rockingham County that are under construction or in planning phases as outlined here. | |

New Residential Developments In Harrisonburg, Rockingham County |

|

As I hear about new developments being planned or proposed or approved, I'll add them to the list below. What am I missing or forgetting? CITY OF HARRISONBURG - PLANNED / PROPOSED Two41 (Blue Ridge Drive)

Stoney Ridge (South Main Street)

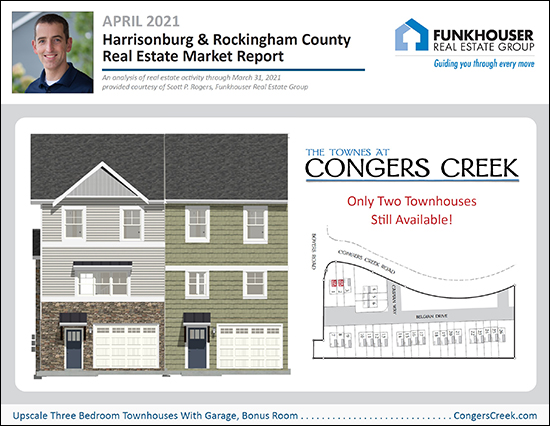

Juniper Hill Commons (Keezletown Road) ROCKINGHAM COUNTY - UNDER CONSTRUCTION Congers Creek Townhomes (Boyers Road)

Congers Creek Apartments (Boyers Road)

Crescent Ridge (Taylor Spring Lane)

Bridgewater Fields (Bridgewater)

Locust Grove Village (Boyers Road)

Preston Lake Apartments (Boyers Road)

Senior Living Facility (Boyers Road)

South Peak (McGaheysville) ROCKINGHAM COUNTY - PLANNED / PROPOSED Wingate Meadows (Pleasant Valley Road)

Boyers Crossing (Boyers Road)

Stoney Ridge (South Main Street)

Crownpoint Independent Living (Apple Valley Road)

Overbrook (McGaheysville)

The Ponds of Island Ford (McGaheysville)

Highview Estates (Harpine Highway)

| |

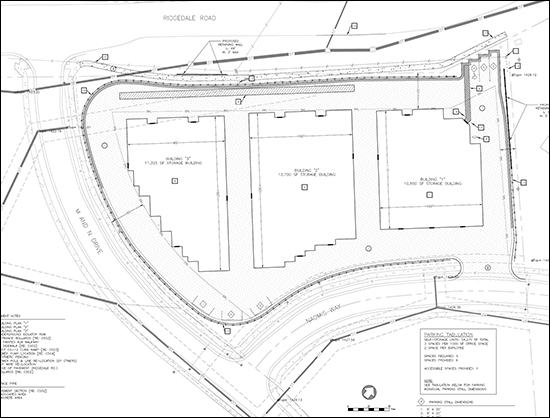

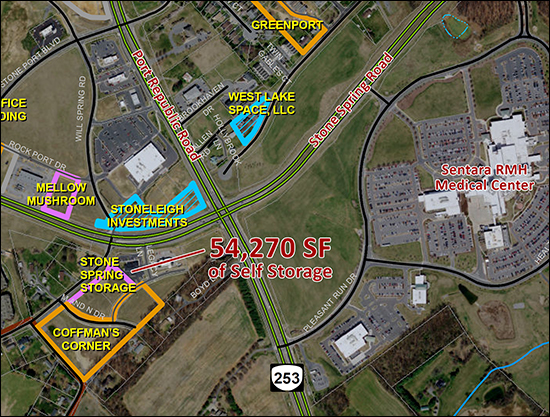

54,270 SF of Self Storage Planned For Stone Spring Road |

|

view a larger version of this map here Is there a shortage of available storage units? Later this month the Rockingham County Board of Supervisors will consider a rezoning request for a proposed development on the corner of Port Republic Road and Boyers Road that includes, among other things, 91,000 SF of storage units. But wait, there's more... The site plan is currently under review by the County for a development less than a mile from this site, off of Stone Spring Road, for 54,270 SF of self storage in three buildings... download the proposed site plan here So, there must either be an extreme need for self storage right now -- or we are potentially going to see a significant excess of available storage if both of these developments are built out. | |

Finding Gray Areas In Inspection and Appraisal Contingencies |

|

It's a crazy market right now. There are definitely many more buyers than sellers in most segments of our local housing market. As such, buyers are having to make difficult decisions about what contingencies to include in their offers. The two prime examples are the INSPECTION and APPRAISAL contingencies. INSPECTION...

APPRAISAL...

But maybe there can be a gray area between having and not having these contingencies in your offer? INSPECTION... Perhaps your offer could be contingent on a home inspection, but...

APPRAISAL... Perhaps your offer of $300K could be contingent on an appraisal, but...

These are some basic examples of how to aim for that gray area between overtly contingent and not at all contingent. If you are buying in this market, have these conversations earlier than later to know what levels of contingencies you are comfortable having in your offer to buy any particular property. | |

Home Sales Soar In First Quarter of 2021 in Harrisonburg, Rockingham County |

|

Happy not-really-tax-day, friends! (taxes are due May 17 this year) What a wild first three months of the year it has been thus far in the Harrisonburg and Rockingham County real estate market! Before starting to pick through the data to find some meaningful insights, here are a few general notes for you...

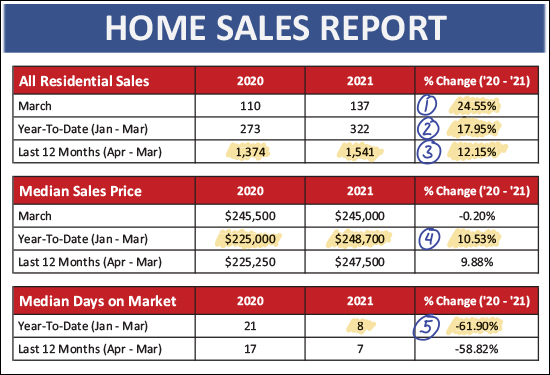

Now, let's dive right into the data and see what we can learn about our local housing market...  OK, some of these numbers (above) are just bonkers...

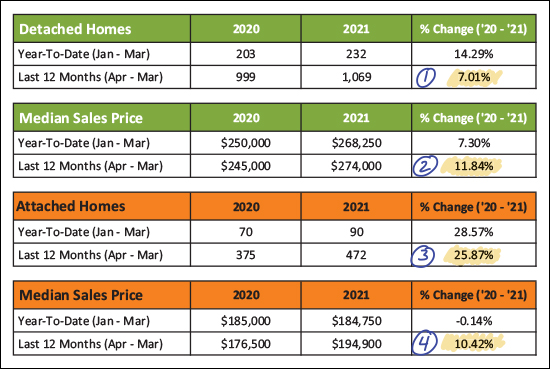

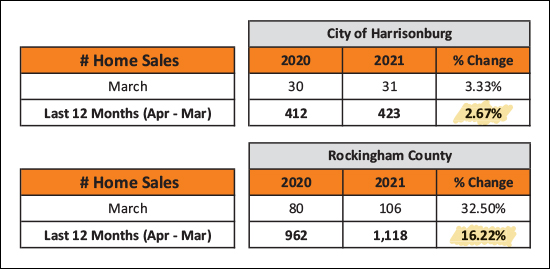

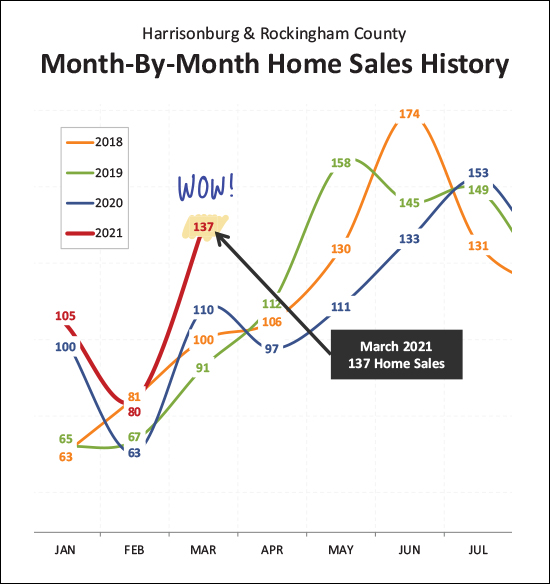

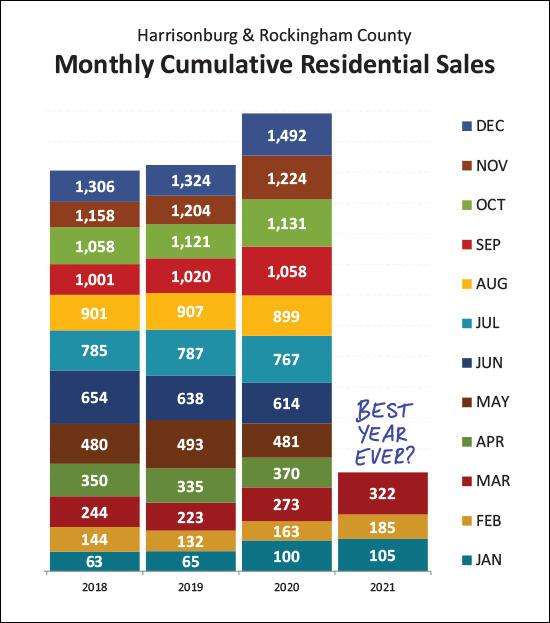

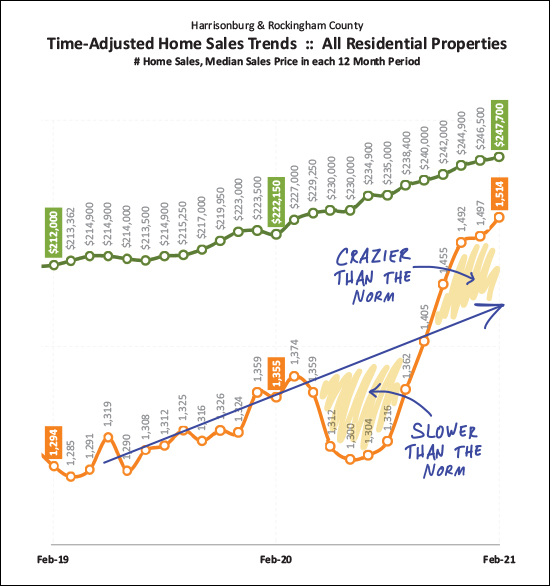

Now, then, let's take a look at a break down of detached homes (single family homes) and attached homes (duplexes, townhomes, condos)...  A few things to note when we look at this data sliced a bit differently than in the first data table... [ 1 & 3 ] While sales of detached homes increased 7% over the past year compared to the prior year, sales of attached homes increased 26% during that same timeframe. [ 2 & 4 ] The median sales price of detached homes increased 12% over the past year which is just slightly higher than the 10% increase in the median sales price of attached homes. Chopping the data up one more time by City vs. County we can note some differences as to how these two portions of our local market are performing...  The data above is just looking at where we are seeing home sales increase and by how much. Over the past year there has been a 3% increase in the number of homes selling in the City -- while there has been a 16% increase in the number of homes selling in the County. I believe this is primarily because the majority of new construction is now happening in the County -- thus those sales numbers have more of an ability to grow as compared to the City numbers where most home sales are resales. OK, next, let's visually contextualize that exciting month of March...  Indeed, March was a BUSY month of home sales in Harrisonburg and Rockingham County. While I am only showing three years of data above, the file I'm working in when I create these reports includes data all the way back to 2003 when I started in real estate. There has never, in that time, been a month of March where we have had 137 or more home sales in Harrisonburg and Rockingham County! Given contract data (we'll look at that a bit later) it seems likely that we will see another strong month of sales in April and May, which means the year is likely shaping up to be a year of a LOT of home sales. Which leads me to...  I put this graph together by stacking each month of home sales on top of the prior to see how each new year stacks up in comparison to past years. As you can see, above, this year (2021) is currently poised to be the best year ever as far as the number of properties selling in Harrisonburg and Rockingham County. So, lots of homes selling, how did we get here?  We didn't get here (1500+ home sales) without some turbulence. A year ago we had seen a slow and steady increase from 1300 sales/year up to 1350 sales/year. Then the COVID dip and then the COVID spike! Looking back, we had a five month period with far fewer home sales than we would have expected given our overall trajectory. And now, we are in the fourth month of what a much (much!) more active market than we would have expected given our overall trajectory. Now, you might find yourself saying that things have been crazy for MUCH longer than four months. Yes, you are right. The graph above is looking at a rolling 12 months of home sales, which evens out some of the peaks and valleys of home sale seasonality, but also can mean it takes longer for overall trends to appear. And yes, I know you probably didn't need a graph to tell you that a lot of homes are selling these days... but this graph made me realize that these two conflicting realities are being experienced daily in our local market...

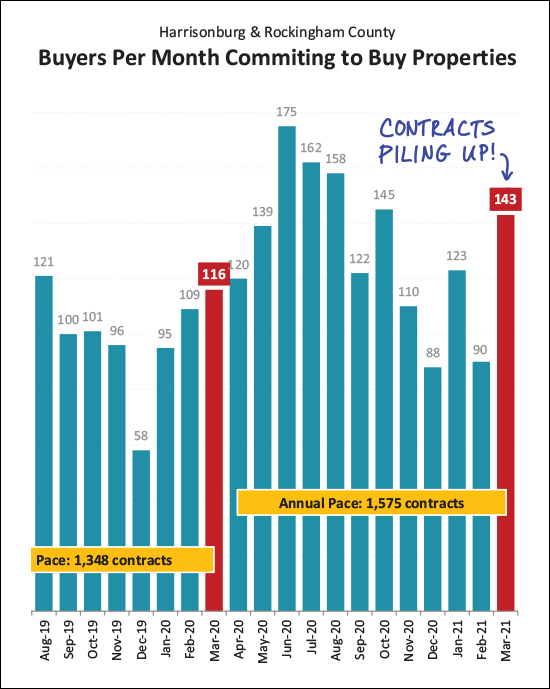

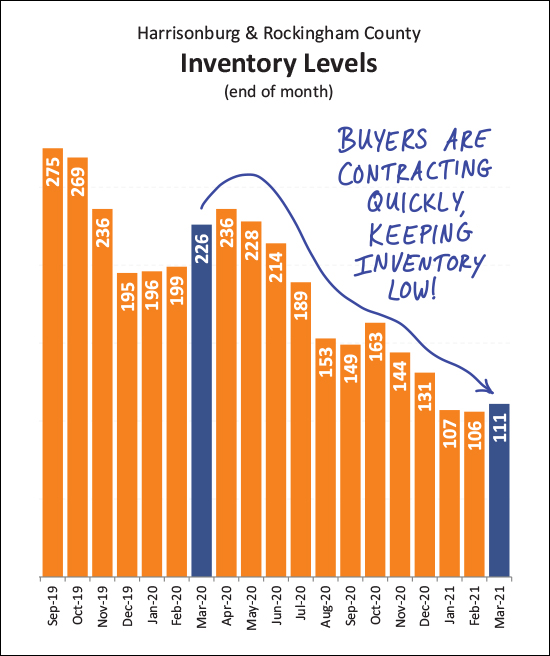

But I digress. Lots of homes have been selling. What is to come over the next few months?  Well, based on a STRONG month of contract activity in March (143 contracts) it would seem that we'll continue to have strong months of home sales in the coming month or two. Furthermore, we're entering into what is typically one of the busiest seasons for buyers to be buying homes, so I expect contracts and closed sales to continue to stay at higher levels for the next five or six months, at least! And now, I think I mentioned (or you may have heard) that there aren't many homes for sale right now...  Yes, it is true. Even though we are seeing an ever increasing number of homes selling, we are also seeing an ever declining number of available listings. As I recently commented to a client, if we start the month with low inventory and 5,000 homes are listed for sale and 5,000 homes go under contract, we will still end the month with low inventory. As such, understand low inventory fully by remembering that...

Finally, just one more graph for your perusal...  This graph shows trends in the average 30 year fixed rate mortgage interest rate and there are a few things to note here as well...

Alright, that's all I have for you at this point. You are now up to speed on the latest news and developments in our local housing market. But if you are thinking about buying or selling sometime soon, these general market trends are only part of what you want (and need to know) as you also should dig into the market in which you are hoping to buy or sell -- whether that is best defined by price range, location, property type, etc. If I can be of help to you as you make plans to list your home for sale, or to seek a home to purchase, just let me know. I'd be happy to meet with you in person, via Zoom, or to chat by phone to help you think and talk through the possibilities. You can reach me at scott@hhtdy.com or via phone/text at 540-578-0102. Until we chat, or until I write again, here a few final tips... Sellers - Even though the market is hot, you still need to prepare your home well, price it appropriately based on historical sales data and market it thoroughly and professionally. Buyers - Get prequalified for a mortgage, start stalking new listings, go see them on the first day they hit the market, and get ready to compete in a multiple offer situation. Seller / Buyers - If you need to (or want to) sell in order to buy, this will require a bit more strategery than normal. It can be done, but we need a solid plan in place from the start. | |

Home Values Might Escalate Even More Quickly If Homes Closed In Five Days Instead Of 45 Days |

|

Have you heard that home prices are on the rise? :-) It usually takes about 45 days for a contract to get to closing -- and if this time frame weren't so long, prices might be rising even faster! Here's why, with a few fictional houses as an example... March 1 -- The owners of 101 North South Drive list their home for sale for $325,000. March 3 -- The owners of 101 North South Drive sign a contract to sell their home after having received five offers, with some of the offers "over asking price" per the seller's agent. March 20 -- The owners of 105 North South Drive list their home for $335,000 given that they had heard of the high levels of buyer interest in their neighbor's recently listed house. March 22 -- The owners of 105 North South Drive sign a contract to sell their home after having received four offers, with some of the offers "over asking price" per the seller's agent. April 1 -- The owners of 109 North South Drive list their home for $339,000 given that they had heard of the high levels of buyer interest in two of their neighbors' recently listed house. April 3 -- The owners of 109 North South Drive sign a contract to sell their home after having received four offers, with some of the offers "over asking price" per the seller's agent. April 15 -- The sale finally goes to closing for 101 North Shore Drive revealing a sales price of... wait for it... $340,000. Wait a minute... The owners of 105 North South Drive and 109 North South Drive would have **certainly** chosen higher list prices for their homes if they had known that the five offers on 101 North South Drive resulted in a contract price of $340,000! And thus...

Which means that... If you are pricing your home based on recent closed sales with adjustments made for the time that has passed from when those homes sold -- and if you are taking into account the list price of homes that are under contract plus any anecdotal insight into those contract prices -- we might still be in a situation where our reasonable list price results in multiple offers over that list price. But, typically a seller in this situation isn't complaining to have multiple offers over their list price! :-) If you are ready to get your house on the market in the next month or two let's start talking now and start tracking home values -- both those that are sold and those that are listed for sale and then quickly go under contract! | |

Should You Waive An Inspection Contingency? |

|

Many buyers in many price ranges are finding it difficult to compete against SOOO many other buyers making offers on a house. They are left asking themselves how to make their offer stand out amidst multiple other competitive offers. As a buyer in this crazy market... Should You Wave An Inspection Contingency? As you might expect, it depends. Here are a variety of perspectives to consider... NO. Don't waive the inspection contingency. There could be serious issues with the house -- a failing foundation, mold in the crawlspace, a leaky roof, broken roof trusses, unsafe electrical wiring, and more! An inspection can help root out most issues with a property to give you a full and thorough understanding of the condition of the property you are purchasing. YES. Waive the inspection contingency. You'll end up spending money on your home over the first few years for maintenance or upgrades anyhow, and even if there are some surprises, you can just lump them into that cost of homeownership. YES. Waive the inspection contingency. The house is only __ years sold. What could possibly be wrong with it at this point? YES. Waive the inspection contingency. How else will I actually secure a contract on a house in such a competitive market!? In the end, I suppose it depends both on the house and you... The House: How old is it? Has it been well maintained? How old are the major systems of the house? Were you able to view the basement or crawlspace during a showing? Were there any red flags? You: Are you relatively handy with home repairs or are you overwhelmed by even the slightest need for improvements? Are you comfortable with risk? How badly do you want to buy a house. I am still recommending that my buyer clients include an inspection contingency in their offers but I am being clear about the downside of doing that as it relates to competing with other offers -- and some of my buyer clients are deciding to waive the inspection contingency after all. | |

Is The Local Real Estate Market Frothy? |

|

One of my colleagues has asked me several times in recent months if it seems like our local real estate market is getting frothy. I have said yes, but without a full understanding of what exactly is typically meant by "frothy" when referring to a real estate market. Let's take a look, based on some great information from investopedia.com. What Is Froth? "Froth refers to market conditions preceding an actual market bubble, where asset prices become detached from their underlying intrinsic values as demand for those assets drives their prices to unsustainable levels. A frothy market is one where investors begin to ignore market fundamentals and bid up an asset's price beyond what the asset is objectively worth. Froth in the marketplace is often characterized by overconfident investors and is a sign that investor behavior and investment decisions are being driven by emotions." Picking that apart a bit...

What Might Happen? "A frothy market can be the precursor to a market bubble, which may lead to a severe contraction of asset prices, also known as a crash or burst bubble. The dotcom boom and bust of 2001 and the housing crash of 2007-08 are examples of asset frothiness that eventually lead to burst bubbles. Both bubbles were marked by increased levels of investor speculation that continued until investor confidence waned and sell-offs ensued, leading to a market correction and a sharp decline in prices." I suppose the best way to think about now (2020-21) as compared to the housing crash of 2007-08 is to consider investor participation in each of those timeframes. We did see a high number of investors buying homes in 2007-08 which was temporarily driving up demand, and thus prices, and then everything came tumbling back down. While it's difficult to precisely measure, I don't think that the level of investor participation in the market is as high now as it was then. Most competition for new listings seems to be from owner occupant buyers as they are generally willing to pay more than an investor for most property types and price ranges. How to Spot Froth in Real Estate Markets Here are some of the ways to spot froth in a real estate market per investopedia...

The whole article over at investopedia.com is worth a read. Does our current real estate market seem frothy? Yes. Will it result in a real estate downturn? Maybe, but not necessarily. Should we be worried? Maybe, but not necessarily. | |

Tips For Would Be Townhouse Buyers In A SUPER Competitive Market |

|

Townhouses are selling QUICKLY in and around Harrisonburg. It is not uncommon for reasonably priced townhouses to have 5 to 10 offers within 48 hours of being listed for sale.

I suppose one critical aspect that I did not list above would be to hire a buyer's agent to represent you in finding, pursuing and purchasing your townhome. I'd suggest you select someone who is highly responsive, professional and knowledgeable about the market. Happy townhouse shopping! | |

Some Would Be Home Buyers Are Deciding NOT To Buy Given The CRAZY Housing Market |

|

Many buyers are feeling a bit overwhelmed by the prospect of trying to buy in the current CRAZY housing market. They find themselves asking...

If you're trying to buy a house right now and you are having some (or all) of these thoughts -- you are not alone. There are many reasons to persevere and to keep on pursuing that goal of buying a house -- and most buyers do seem to be doing that -- though there are also some buyers who are throwing in the towel. Here's how that might look...

It is times like these that I am thankful for all of the counseling classes I took while I was completing my graduate degree from JMU. So, if you think you want to buy, but are are nervous wreck because of the hectic housing market -- feel free to reach out. I'm happy to meet with you to chat about the process and the market. We can call it a home buying meeting or a counseling session -- whichever makes you feel more comfortable. ;-) | |

Ryan Homes May Be Starting To Help Some Housing Inventory Issues In Rockingham County |

|

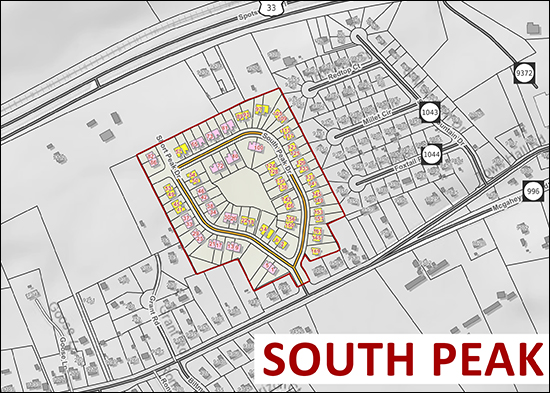

Ryan Homes, a regional builder currently building homes in 15 different states including Virginia now has two communities underway in Rockingham County and likely will be bringing more on board in the future. SOUTH PEAK is a community of single level, three bedroom (1343 - 1527 SF) duplexes in McGaheysville with current pricing seeming to be mostly between $275K and $350K. While it appears that this will be a community of 72 duplex, thus far, 35 homes have sold, 2 are under contract and one is listed for sale, at least per the MLS. SHADY CREEK is a community of three and four bedroom (1296 - 1903 SF) single family homes (so far, though I believe attached dwellings are to come) in Grottoes with current pricing seeming to be mostly between $270K and $325K. Thus far, 17 homes are under contract and 4 are listed for sale, at least per the MLS. We are definitely having some inventory issues in Harrisonburg and Rockingham County -- with more buyers wanting to buy than there are sellers willing to sell. New home construction at scale can help to address this unmet buyer demand. Thus far, these communities by Ryan Homes are only hitting two segments of our local market but I believe we will see more communities to come that will likely create inventory in other areas and price ranges in our local market. | |

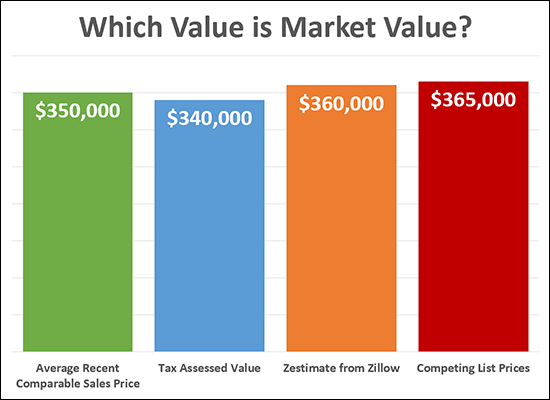

Is My Home Value The Same As The Tax Assessment Or Zestimate? |

|

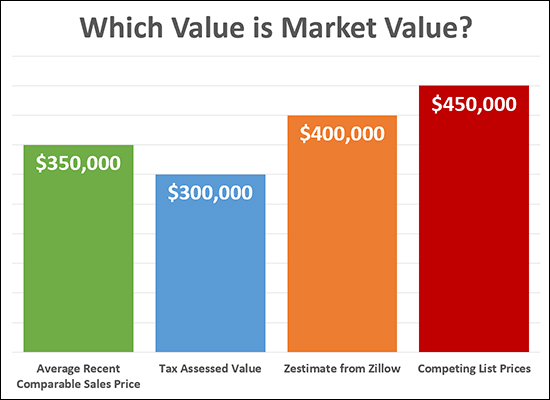

Which one of the values above is the "market value" of the imaginary home in question? The answer is -- the GREEN bar -- a home's value is most often determined by how much other buyers have recently paid for similar properties. A would-be buyer might WANT the home's value to be the "tax assessed value" -- but that might be quite a bit lower than the recent sales prices -- so a home's tax assessed value is not necessarily the home's market value. A would-be seller might WANT the home's value to be the "Zestimate" from Zillow -- but that might (often, usually) vary quite a bit from a home's market value -- so a home's Zestimate is not necessarily the home's market value. A would-be seller might REALLY WANT the home's value to be the same as the list price on competing properties currently for sale -- but those listings might sit on the market forever with unreasonably high list prices -- so the list price of competing listings is not necessarily the home's market value. Now, this scenario would be much easier...  As you can see here, there isn't too much of a difference between the different values -- so it matters a bit less which of the value perspectives we use when estimating a likely sales price and planning for a potential list price. But in the case where there is quite a bit of separation in these different value perspectives -- stay focused on what other buyers have recently paid for similar properties -- this alone is your best guide as to what you can/should expect the next buyer to be willing to pay for your house. | |

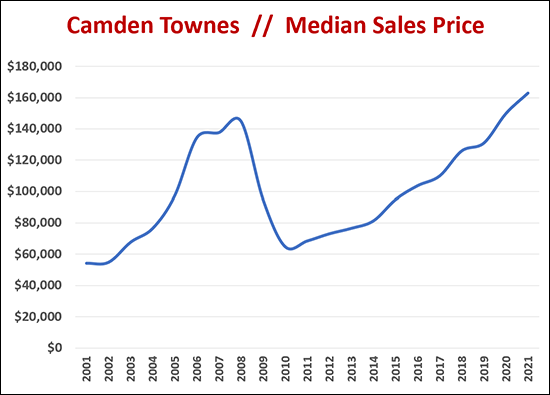

Prices Are Skyrocketing At Camden Townes |

|

Camden Townes is a rental community on Port Republic Road within walking distance to the JMU campus. This community has historically been a student housing community and my understanding is that it is still primarily, but not entirely, students living in these properties. As shown above, the values at Camden Townes have been skyrocketing over the past several years. A few benchmarks...

I suspect many factors likely affect the values in this mostly-student housing community...

As to what values will be in Camden Townes in 2022 or 2023 or 2024 -- it's hard to say based on the turbulent past of values in this community. I suppose a counter-narrative to the "who knows" perspective would be that values have mostly always gone up except during the 2006-2010 housing boom and bust? | |

Obsessing Over Real Estate Is SO Repetitive These Days |

|

One of my out of town buyer clients recently lamented the fact that he often finds himself doomscrolling on Zillow...

...as he described it, he kept going back to look for new listings and kept seeing the same listing, or saw listings that had gone under contract within hours or days. It's a tough time to be a buyer right now -- especially an out of town buyer who can only view properties virtually. Thus, yes, many buyers finding themselves endlessly scrolling through the bad news of both:

So, how does one stop doomscrolling on Zillow? Here's some advice for how to stop doomscrolling, though it was unrelated to real estate, so I reinterpreted it a bit. :-)

OK - this post started in jest, then turned more serious, and by the end, who knows... Yes, it is a tough time to be a buyer right now whether that manifests itself in doomscrolling on Zillow or otherwise. Be prepared to be patient in waiting for new listings to hit the market, go see them immediately if they might work for you, and be ready to make an offer very quickly. | |

What Could Cause Home Prices To Fall? |

|

Home prices have been on a tear (having great success over a period of time) for the past year+. Many home sellers are delighted to find out what a buyer is willing to pay for their home. Many home buyers are incredulous as to the price they have to pay for a house if they haven't been watching values adjust over the past year or two. But with all of these increases in sales prices of homes -- up 12% over the past year -- some buyers find themselves wondering if home prices will decline at some point in the future. Market fundamentals (supply and demand) seem to suggest that prices won't level out or decline anytime soon. There seem to be a nearly endless supply of buyers that are trying to buy homes (and often missing when there are multiple offers) and despite new listings starting to hit the market more frequently, inventory levels seem unwilling to meaningfully rise. So, if supply remains low and demand remains high, won't home prices stay steady or keep on rising? Yes, almost certainly. Here, though, are three reasons why home prices could fall over the next year or two -- even if none of them seem to be highly likely to occur... LARGE SCALE ECONOMIC CHANGES Certainly, if we see large scale economic changes, with the economy collapsing or unemployment skyrocketing, or a global trade war, etc., etc. then we could see a rapid decline in the number of buyers buying homes, which could cause home values to fall. But -- the economy has been through a lot in the past year+ and we didn't see that trickle down to a reduced number of buyers buying homes. So, this seems relatively unlikely. RISING MORTGAGE INTEREST RATES One of the reasons why today's home buyers often don't mind paying 12% more for a home than they would have paid last year is because of the low mortgage interest rates. Their mortgage payment often ends up being just about the same as it would have been a year ago. Rates are starting to trend upwards now, but slowly. If mortgages interest rates rose quickly, it would increase the monthly cost for a new buyer's mortgage payment, which could push some buyers out of the market, or reduce how much they could pay for a house. Thus, a large or sudden change in mortgage interest rates could cause home values to flatten out or even decline -- though it doesn't seem likely that we will see a large or sudden change in mortgage interest rates over the next year. EXCESSIVE NEW HOME CONSTRUCTION We all (hopefully) know that we have very low inventory levels in this area -- meaning that buyers have very few options of homes to buy at any given point. As I recently pointed out, new construction is perhaps the only way to meaningfully affect the available inventory. So, it's great to see some new building starting to happen in various areas of the County. If we saw a sudden, large, influx of new homes for sale, in a variety of price ranges, this could cause home values to flatten out or to decline. Of note, new construction at a large scale only in one price range might affect home values in that price range but wouldn't necessarily have a direct impact on home values above or below that price range. So -- are we likely to see home values fall over the next year or two? It doesn't seem likely -- but a combination of the factors outlined above could certainly slow down the current rapid ascent in sales prices. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings