Archive for June 2021

| Older Posts |

Sometimes, Appraisals Are Reining In High Contract Prices, And That Can Keep Sales Prices From Getting Out Of Hand |

|

Let's say there's a house that comes on the market for $300K. Every Realtor and buyer that looks at it agrees that it is worth $300K because three identical houses sold the prior day for $299K, $300K and $301K. ;-) The house immediately has LOTS of interest, LOTS of showings and LOTS of offers. The house ends up going under contract for $335K. Wow! Now, a few things can happen from here...

So -- even if buyers are willing to (per their offers) pay higher and higher and higher prices for houses -- regardless of what other buyers recently paid for similar houses -- the appraisal process is still, often but not always, keeping things in check and preventing prices from skyrocketing too quickly. | |

Is The Housing Market Still Crazy? Is The Sky Still Blue On A Sunny Day? |

|

So, yes... the housing market is still crazy... and the sky is still blue on a sunny day. Speaking of sun... and heat... looks to be a scorcher this week!?! A client asked me this weekend if the market was still pretty crazy / busy / active. Indeed, it is. Will it slow down sometime? I'm not thinking it will anytime in the foreseeable future. Maybe in November? I think there is a good chance that homes will keep selling as quickly as they are right now (median of 4 days on the market thus far in June) for the rest of the summer and into the fall. Which is GREAT if you are going to be selling your home and is AWFUL if you are trying to buy a home. But yes, you can buy a home -- it will just likely take a bit longer to find a home you like (given very low inventory levels at any given time) and to secure a contract amidst a likely multiple offer scenario which we are seeing on most property prepared, priced and marketed new listings. So, yes, the market is still crazy - and I'm not predicting that to change in the near term. What about you? Do you think things will slow down at all this summer or fall? | |

Selling A Home Is A Sprint, Buying A Home Is A Marathon |

|

"How's the real estate market these days? Moving pretty fast, right?" Well, yes and no. It depends on whether you are a seller or a buyer. :-) Indeed, if you are selling your home (or will be soon) the market is moving FAST and the process will seem like a sprint...

So, yes, the market is moving pretty fast if you are selling your home. But if selling a home is a sprint, buying a home is definitely more like a marathon! Many buyers these days are finding themselves making offers on multiple houses before finally securing a contract to buy a home. One of the buyers I am currently representing recently signed a contract on a home after having made unsuccessful offers on five other properties! So, yes, the market is moving quickly -- but while a seller gets the luxury of running a quick sprint in the house market -- most buyers need to prepare for running a marathon. | |

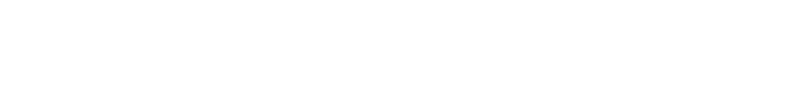

Are Lumber Prices Finally Starting To Normalize? |

|

If you haven't heard -- lumber prices skyrocketed during COVID. The graph above shows only the past 12 months. If we look a bit further back we can get a bit more context...

So, "normal" over the four years prior to COVID seemed to be a range of around $300 to $475 --- although prices did rise to $639 back in mid 2018. But then, as lumber mills shut down due to COVID and production slowed, prices skyrocketed, getting as high as $1,635 in May 2021. But over the past month, that price has fallen quite a bit...

So, a nearly 50% decline in prices over the past 45 days? That is solid progress towards getting lumber prices back to their long term normal-ish range. Hopefully this will mean we'll start to see more new construction, creating more housing inventory, and easing the inventory strained housing market... | |

All The Cool Kids Are Offering To Pay Over Appraised Value These Days |

|

Escalation clauses are so YESTERDAY!?! ;-) Not really -- many/most buyers are still using them -- but they don't matter much if an appraisal is going to rein a sales price back in... Consider these three offers on a fictional home listed for $300K...

Hooray, the house sells for $355K to buyer #3, right? Well, probably... though if it then appraises for $300K, then none of the offer prices over the list price or the escalation clauses really amounted to anything. Thus, these days, many buyers are not only asking themselves how high they are willing to go with an escalation clause -- they are also asking themselves how much above the appraised value they are willing to pay for a house. Consider, then, the following three offers on the same house listed for $300K...

Clearly, a seller would toss out the first offer. Some sellers would then immediately jump to the third offer, since it is $10K higher than the second offer -- but -- that depends on your best guess as to the appraised value of your house. If you listed your home for $300K, presumably you think it should sell for around $300K and thus might appraise for $300K. If that is the case, then the second offer above is likely a better choice for you. That offer would stay at $325K even if the appraisal came in at $300K, whereas the third offer would start off higher at $335K but would then drop to $310K if the appraised value were $300K. So, as a buyer -- consider how much above the appraised value you are willing to pay for a house when you are competing with multiple other offers -- and as a seller, consider how an appraisal will impact each offer that you might accept. | |

Home Prices Are Rising Quickly But Buyers Seem To Be Well Qualified To Buy What They Are Buying |

|

I started working in real estate way 18 years ago, way back in 2003. Between 2003 and 2006 home sales and prices shot up quickly -- and then sales slowed dramatically and prices declined slowly. Does it feel somewhat similar now? We're seeing significant increases in the number of homes that are selling -- and significant increases in our area's median sales price. But -- at least one thing is definitely different right now compared to that 2003-2006 timeframe... Today's home buyers seem to be very well qualified to buy. Back in the early 2000's when sales and prices were careening upward, some/many buyers were only marginally financially qualified to buy the homes they were buying...

These days, things are quite different...

So, yes, the market is heating up like it did in 2003-2006, but this go round, home buyers seem to be very well qualified to buy what they are buying. That would seem to be good news for the future stability of our local housing market. | |

What Is A Seller To Do When The Appraisal Comes Back Lower Than The Escalated Contract Price |

|

You're ready to sell your home. Great! We look at comparable sales and decide that your home is likely to sell for $300K in the current market. We debate pricing your home for $299K or $305K and end up going with $305K because we're optimistic about the strength of the current market. After 20 showings in 48 hours, we receive eight offers with prices ranging from $305K to $335K. We settle on the contract with a price of $330K because of some of the other terms included in the offer. Then, the buyer gets the appraisal back and your house appraised for $300K -- all the way back to what we thought it was worth before putting it on the market. The only way the buyer can pay over that $300K is if they scrape together extra cash to bring to closing. They love your house and they find a way to come up with $5K so that they can pay $305K for your house -- but they are not able to pay the $330K contract price that you and they had agreed to some weeks back. Now you, as a seller, have some options to consider... Option 1 - Sell At Or Just Above The Appraised Value Perhaps you look at the big picture and decide that you are OK selling for the price you figured your house with worth ($300K) and maybe a bit above that ($305K) despite the short-lived excitement of thinking you would be selling your house for more than you thought it was worth. It can be somewhat difficult to come to this conclusions -- after all -- a day before the appraisal report was completed you thought you were selling your house for $25K more ($330K) than you would now ($305K) be selling your house. Option 2 - Put Your House Back On The Market And Hope For A Cash Buyer The only way to get completely around an appraisal with certainty is to sell to a cash buyer. It might seem farfetched to think there would be a cash buyer for your home -- but it is definitely possible depending on the price point, property type, etc. Option 3 - Put Your House Back On The Market And Hope For A Buyer Willing To Pay Over Appraised Value If you're not selling to a cash buyer, perhaps you will be able to find a buyer who will contract to buy your home at a price above where you know it recently appraised AND that is willing and able to pay a certain amount above the appraised value. Again, this is not all that farfetched. If a buyer had made an offer of $335K, previously, and now could agree to pay $320K for your house ($15K more than the buyer you are/were under contract with) so long as they were OK with paying up to $20K above the appraised value - they might be quite excited to do so. After all, they were ready to pay $335K for the house -- only having to pay $320K (even with a $300K appraisal) might be seen as a great opportunity. As you think through all of this, you'll likely also be thinking about the value of just moving forward with the buyer who is already under contract to buy your home. Yes, it is likely going to be easier and faster to move forward with that buyer -- but you may be walking away from $10K or $15K or even more by not exploring interest that may exist from other buyers. | |

What Would Be A Reasonable Offer To Make On This House? |

|

Some clients asked me this question a few weeks ago... What Would Be A Reasonable Offer To Make On This House? ...and we had a good laugh after we started thinking and talking about it. As I told them: Reasonable offers don't buy houses in this market!? Indeed, it's that kind of market these days. It used to be that we'd look at what other buyers recently paid and then extrapolate from there as to what would be a reasonable offer to make on a house. If similar houses recently sold for $265K and $270K and $275K -- it would be reasonable to pay between $270K and $280K for that newly listed house down the street, right? Ha ha. Maybe in some long forgotten time when the market felt more normal or balanced or sane. These days... If other buyers recently paid $265K and $270K and $275K for similar houses, a seller wouldn't be surprised to receive offers with escalation clauses going up to $290K or $300K or even $310K. As such, we need to think about your offer price not only within the context of what other buyers recently paid for similar houses. Is it reasonable to pay 5% to 10% more than other recent buyers have paid for similar houses? Maybe... maybe not... But it's likely the only way you'll be able to actually secure a contract on a house! | |

Several Ways To Think About Appraisal Contingencies |

|

It used to be pretty common for real estate contracts to be contingent on the property appraising at or above the contract price. If a buyer was to be paying $350K for a house -- they wanted to make sure the appraised value was $350K or higher. These days many buyers understand that they might need to be willing (and able) to pay above the appraised value in order to actually buy a home. After all, if a house is listed for $350K and there are six offers on the house, all with escalation clauses and the winning offer is $370K -- that buyer may need to be willing to still pay $370K even if the appraised value ends up being $350K or $360K. Here, then, are a few ways that buyers are thinking about and dealing with appraisal contingencies... Contingent On Appraisal Some buyers are still making offers that are contingent on the appraised value being equal to or greater than the contract price. These offers are often going to be the ones that are least likely to be accepted in a multiple offer scenario if all other terms were the same. It is fine to include this contingency in an offer -- but it greatly reduces the likelihood that the seller will choose to move forward with your offer. An Unspoken But Implied Contingency If you are financing 90% or 95% or 97% or 100% of the purchase price -- even if you don't have an appraisal contingency explicitly included in your contract -- your offer may effectively be contingent on the property appraising at/above the contract price due to the financing contingency. When a buyer is financing 95% of a $250K purchase price -- and the appraisal comes in at $240K, their lender will likely require the buyer to bring extra cash to closing. If the buyer has extra cash -- great. If not, the buyer will not be able to move forward with the purchase as a result of the low appraisal -- even without an appraisal contingency -- because of the financing contingency. A Limited Contingency Perhaps you're offering $310K for a house and you are willing and able to move forward with the purchase so long as the property appraises at or above $300K. As such, you're willing to pay $10K above the asking price. We can make your offer contingent on the property appraising for at least $300K -- which will give the seller more peace of mind because you are willing to pay $10K over the appraised value. Not At All Contingent Maybe you love a house soooo much that you do not even care about the appraised value -- and your financing or cash situation is such that it won't change things if the appraisal comes in slightly or significantly low. In such an instance, we don't need to make the contract contingent on the property appraising at any particular price -- and we might even go so far as to say in the contract that you will proceed with the purchase regardless of the appraised value. In Summary... It's a fast moving market these days and with so many buyers making offers on properties, many buyers are often willing to pay above appraised value for a property that is a great fit for them. It is important to think about and talk about the appraisal process and strategically incorporate (or don't incorporate) whatever contract terms make the most sense given your level of interest in the property, your financing situation, your cash situation, etc. | |

I Do Not Think The Housing Market Would Collapse If Mortgage Interest Rates Rose A Bit |

|

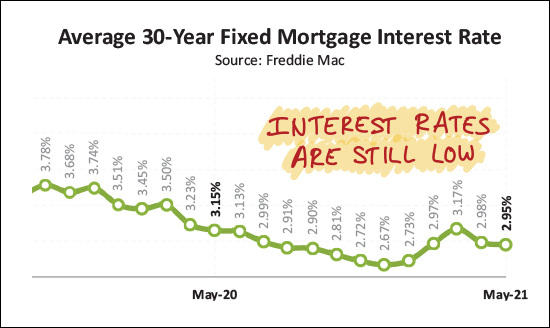

Mortgage interest rates have been very low for quite a while now. The average 30 year fixed rate fell below 4% just over two years ago -- on May 30, 2019 and has never looked back. Furthermore, this average rate has been below 3% for 36 of the past 41 weeks. So, yes, mortgage interest rates are low. Super low. Eventually, they will start to rise -- maybe above 3%, maybe to stay above 3%, maybe above 3.5%, maybe even up to 4%! When mortgage interest rates start to rise, will the housing market collapse? Will prices fall? I am thinking not -- so long as interest rates move slowly and steadily and not quickly and erratically. Right now many houses are seeing 5+ (or 10+) offers within just a few days of being on the market. Not all houses, in all price ranges, in all locations -- but many houses! What will happen if interest rates start to rise? Perhaps if they rise far enough, some of those buyers will no longer be qualified to buy -- or will no longer comfortable buying based on their mortgage payment. But what will that actually mean? Maybe instead of 5 - 10 offers on a house there will be 4 - 8? Or 3 - 7? Demand exceeds supply by sooooo much right now that if mortgage interest rates rise a bit, unwinding some of that demand -- it will almost certainly still be a very strong seller's market -- just not a very, very, very strong seller's market. So, if you start to see mortgage interest rates rising, yes it is possible that it will eventually have an overall impact on our local housing market -- but I don't think it is likely to change the overall market fundamentals. | |

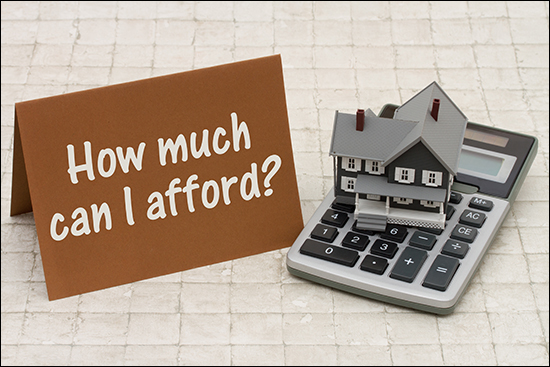

265 (More) Apartments Planned For Stone Spring Road |

|

Harman Realty and Stone Spring Holdings LLC are proposing to build 265 apartments in a development to be called EPOCH on Stone Spring Road, between The Overlook at Stone Spring and Squire Hill Apartments. These apartments would be built on the 17 acres shown above. The proposed site plan references cottages, townhouses and apartments -- but they all seem to be multiple dwelling units per building, so they might all feel like apartments? City staff recommends approval of this proposal, as does the Planning Commission. City Council will have the final say on the matter in the near future.  | |

Creative Ways To Prepare To Buy A Home In A Market That Heavily Favors Sellers |

|

My constant refrain to buyers in this market has been... Go see a house on the first day or two it hits the market, be ready to make an offer that same day, be prepared to potentially make an offer above the asking price and consider waiving contract contingencies you would normally include. Sort of overwhelming, right? Especially for first time buyers, or buyers moving into the area, or buyers who also need to sell in order to buy. If you're feeling a bit stressed about what the home buying experience is going to look like given our current market dynamics, here are a variety of ways to help you prepare for what lies ahead... [1] Talk To A Lender This one is rather obvious -- but please talk to a mortgage lender sooner rather than later. When the house of your dreams comes on the market on a Tuesday morning and we see it Tuesday lunchtime and you decide you want to make an offer, you don't want to be scrambling all Tuesday afternoon to try to get prequalified for a loan. Even if we haven't found a house for you to buy -- go ahead and talk to a lender to get prequalified, to understand the payment that will accompany a variety of prices of homes, etc. Having this information in hand will allow you to make a more informed decision about what you are willing to pay for a particular house once it comes on the market. [2] Go See Houses In a low inventory market (yes, we're in one) you might look around and find very few houses for sale that are of interest to you. Furthermore, you might not see many new listings of interest come on the market in the first few days or weeks that you're paying attention to new listings. Let's just start going to see houses. If a house comes on the market that is relatively close to what you're looking for in a new home -- even if it's not an exact match -- let's go see it. Starting to see houses, in person, will help you clarify what you want to buy and will help you better understand the market as to what prices are reasonable for what types of houses. [3] Explore Neighborhoods Of Interest Start driving around neighborhoods where you think you might want to buy a house to better familiarize yourself with those neighborhoods. Don't just explore neighborhoods where new listings are located - explore other neighborhoods too, since new listings very well may pop up there in the near future. You can explore many of our area's neighborhoods here. [4] Proactively Review Contract Documents When we have a matter of a few hours in which to make an offer, and you're really excited about the house, and you don't want to miss out on buying it, and I email you a 15 - 20 page document to review, are you going to feel like you have the time to thoughtfully review the offer documents and ask all of the questions you might have about what you are committing to in the offer? Probably not. So, let's review a fake offer on a fake house ahead of time. We can spend 30 - 60 minutes together (in person, via Zoom, etc.) reviewing the main contract documents that we will likely be using when preparing an offer on a house you want to buy. This will give you a chance to better understand the contract documents and ask questions about how the buying process and contract contingency works without feeling the stress of needing to just sign the documents to make the offer to not miss out on the house. [5] Study Sales Data These days, particularly, just watching the list prices of new listings is not enough to truly understand our local housing market. Many houses are selling above asking price with multiple offers. As such, it can be helpful to take a look at the actual sales prices of homes of interest -- or homes in neighborhoods of interest. You can follow sales prices of all homes selling through our local MLS here. It can certainly be a hurried and stressful time to buy a house -- but there are ways to prepare and plan ahead to take some of the stress out of the process! If you have questions about the buying process or if you're looking for a reputable local lender, email me (scott@hhtdy.com) or call/text me at 540-578-0102. | |

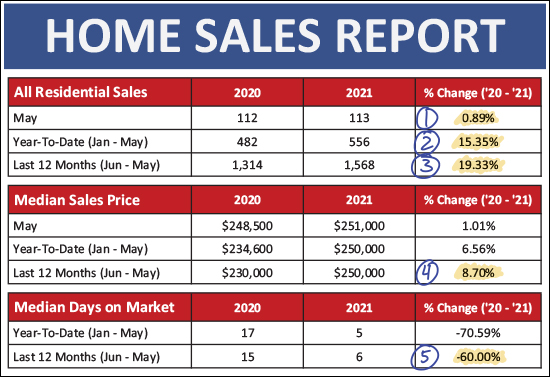

Harrisonburg Area Home Sales and Prices Rising Quickly In 2021 |

|

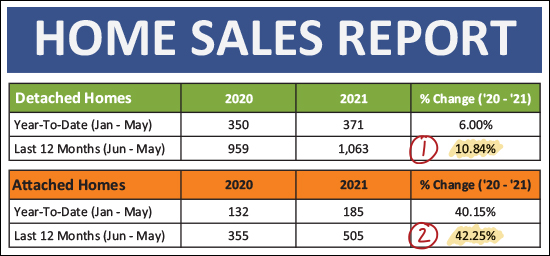

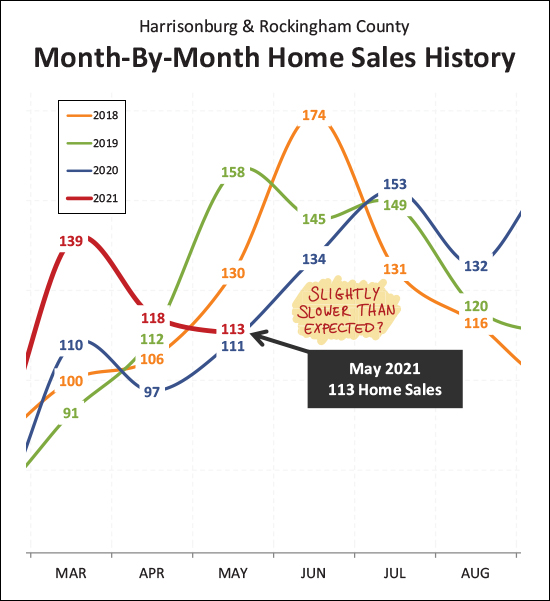

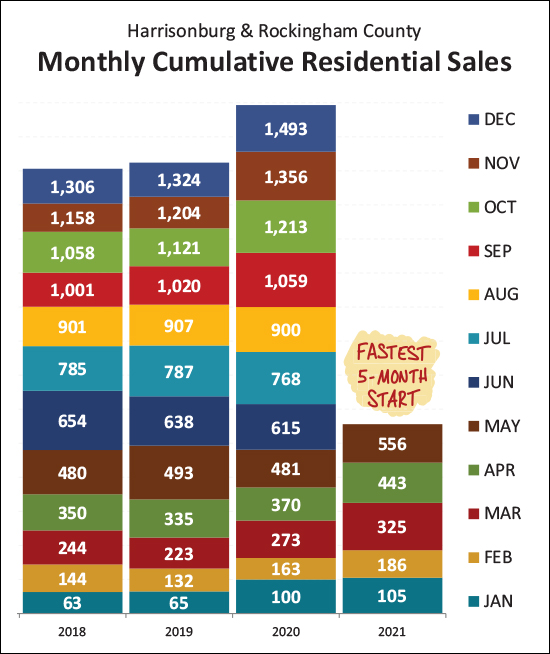

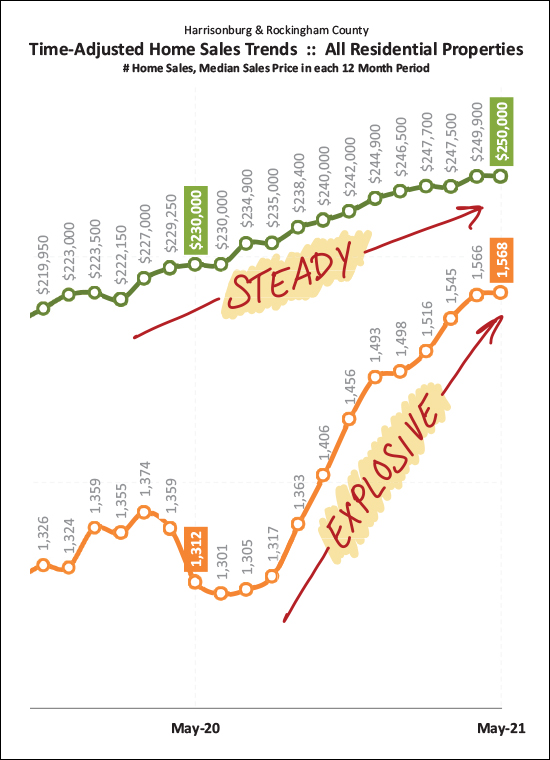

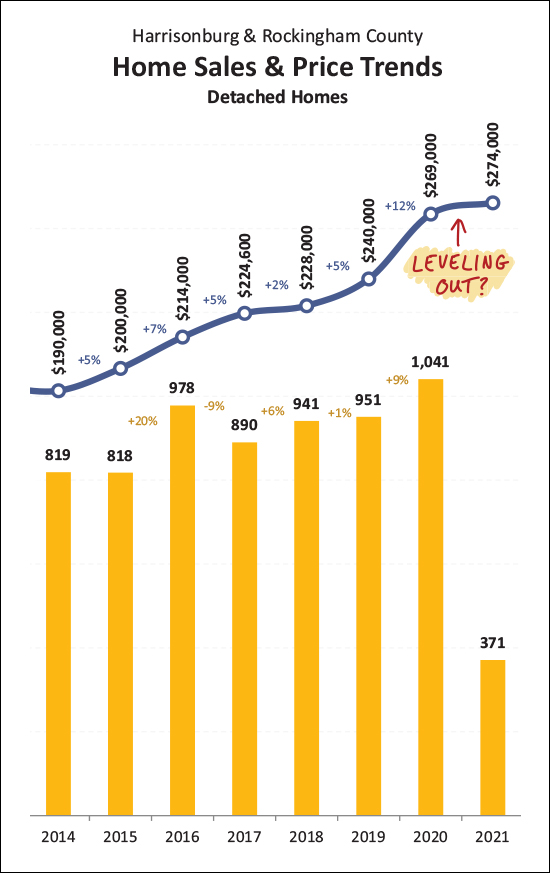

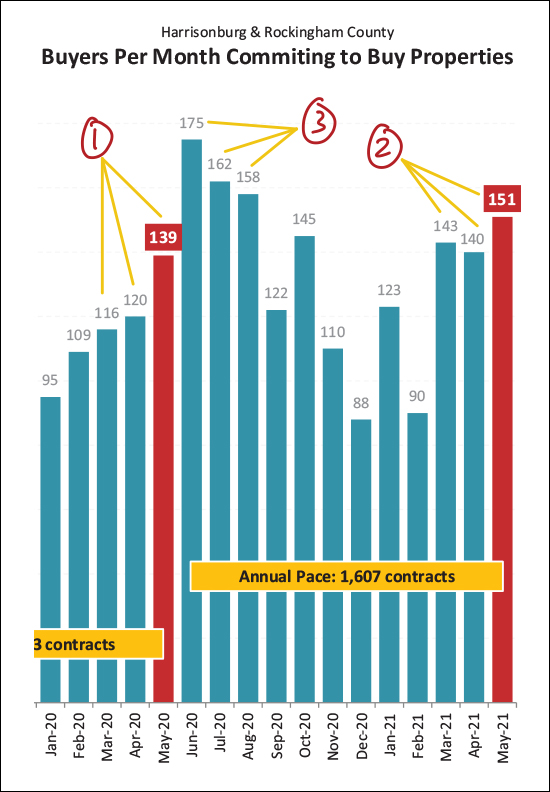

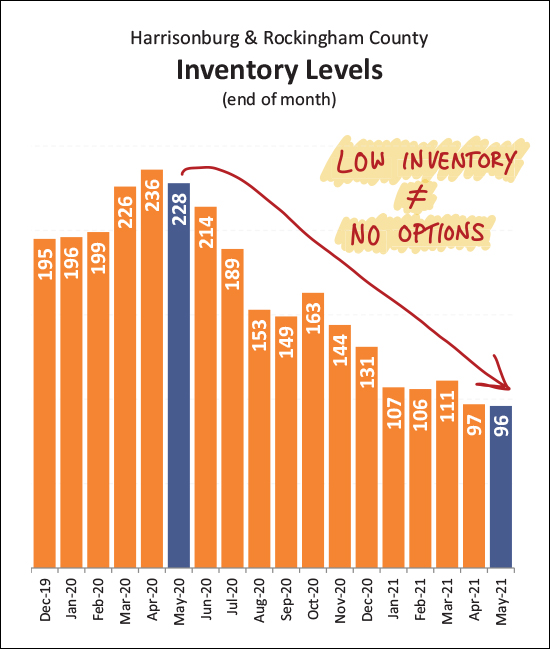

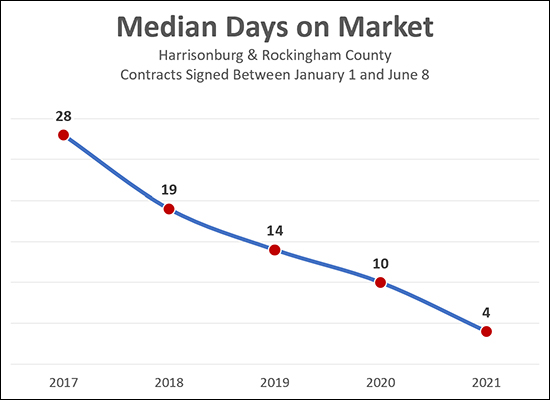

Happy Friday morning to you, friends in the Harrisonburg real estate world and beyond! It is a wild and crazy time right now in the local real estate market with many (many!) homes selling in a matter of a day or two -- often with multiple offers. It is not uncommon to have 5+ (or 10+) offers on a house within the first 48 hours of the house being listed for sale. Which means, as you might imagine, that... [1] It is a delightful time to sell! [2] It is a difficult time to buy! [3] If you need to do both, perhaps it's a wash!? Read on for some numbers and charts and graphs that can help us gain a deeper understanding of some of the current dynamics of our local real estate market -- or download my entire market report as a PDF here. First, the basic overview of how things are looking so far this year...  Several things to unpack here, actually... [1] We saw about 1% more home sales this May (the month that just ended) as compared to last May. This is actually a bit surprising. Home sales were rather sluggish last May due to Covid. As a result, I expected we'd see more home sales than we did this May. That said, the limitation on the number of home sales happening these days seems to be more in the area of how many sellers are willing to sell -- as opposed to how many buyers want to buy. So, sometimes when we see fewer homes selling -- it may simply be a result of fewer sellers being ready and willing to sell. [2] Despite only seeing a 1% increase in home sales during May, there have been 15% more home sales in the first five months of this year as compared to the first five months of last year. Thus, don't knock 2021 just yet -- we're well ahead of the pace of home sales that we saw last year. Later on I'll show you an even broader picture to see how 2021 compares to earlier years. [3] When we look at a full year of home sales there has been an impressive 19% increase in the pace of sales. There have been 1,568 home sales in the past 12 months -- compared to only 1,314 home sales in the 12 months before that! [4] Prices keep on rising! The median sales price of all homes sold in Harrisonburg and Rockingham County was $250,000 over the past 12 months -- which is a 9% increase over the median of $230,000 during the prior 12 months. [5] Homes are selling fast -- FAST! The median days on market has dropped 60% over the past year, from a median of 15 days to a median of 6 days. The median days on market is a measure of how many days it takes for a house to go under contract once it is listed for sale. OK, phew, now -- onto one slight nuance that bears noting...  The chart above is comparing detached home sales (green section) to attached home sales (orange section) over the past year. While we have seen a respectable 11% increase in the number of detached homes selling -- we have seen an astonishing 42% increase in the number of attached homes selling! These attached homes are duplexes, townhomes and condos -- and a good number of those are likely new homes. Most new dwellings currently under construction are attached homes -- which contributes to the larger increase in the sale of attached homes. Here's another visual look at what was actually a somewhat surprisingly low month of home sales in May 2021...  As stated previously -- home sales in May 2021 were lower than I thought they'd be given past months of May. During May of 2018 and 2019 we saw 130 and 158 home sales -- but that dropped down to only 111 home sales in May 2020, largely due to Covid. So, yes, I was surprised to only see 113 home sales in May 2021. I expect we'll see home sales pop back up in June -- but as also stated previously, this will largely depend on enough sellers having been willing to sell! Now, let's look at the first five months of this year compared to the same timeframe for the past three years...  As shown above, we've seen 556 home sales thus far in 2021 -- which is well ahead of the pace we saw for each of the past three years. Thus, even though 2020 ended up being a wildly active year for home sales (1,493) it would seem that 2021 might be on track to surpass that pace! Buckle your seat belts -- if we're going to get there, to perhaps 1500+ home sales -- it's going to be a wild ride for the next seven months of the year. Here's a visualization of how the annual pace of home sales has been speeding up...  As I have described it above -- [1] We have seen STEADY growth in the median sales price over the past year, plus. The current median sales price of $250,000 is 9% higher than it was a year ago. [2] We have seen EXPLOSIVE growth in the pace of home sales over the past year. The current pace of 1,568 home sales a year is 20% higher than it was a year ago! Will home prices keep rising forever? Maybe so. Will the pace at which they increase start slowing? Maybe so. Here's a brief look at that dynamic just five months into the year...  When looking just at single family homes, above, we find that... In the five years before 2020 we saw between a 2% and 7% increase per year in the median sales price. On average, the median sales price increased 4.8% per year between 2014 and 2019. But then, 2020. :-) We saw a 12% increase in the median sales price of single family homes between 2019 and 2020. So, what will happen in 2021? Well, we're only five months into 2021 thus far -- AND, if you ask most active Realtors in this area, they'd likely tell you that, anecdotally, home prices seem to be accelerating even more this year than last year -- BUT, thus far we have only seen a 2% increase in the median sales price in 2021. So, stay tuned. I'll keep monitoring this as the year continues. I don't think the median sales price is going to actually flatten out or decline -- but I also don't think we'll necessarily see another 12% increase this year. OK, this next one requires a bit of thought and explanation, but bear with me...  When it comes to contracts signed per month, as shown above, here's what I'm trying to point out... [1] Last spring (March, April, May) only 375 buyers (and sellers) signed contracts. This was likely a bit slower than normal because of Covid. [2] This spring (March, April, May) things were much more active, comparatively, with 434 contracts signed. [3] Last summer (June, July, August) was extremely active -- with 495 contracts signed. This was likely somewhat the result of the market bouncing back after a slower spring. So, what's in store for summer 2021? It's hard to say if we'll have as strong of a summer as we saw last year -- and as mentioned several times thus far, a huge impact on the pace of sales, and contracts being signed, is how many sellers are ready and willing to sell. The buyers are certainly there waiting to pounce! Now, perhaps one of the most confusing and most depressing graphs...  Lots going on here in this relatively simple graph... [1] A year ago a buyer would have found 228 homes on the market for sale in Harrisonburg and Rockingham County. That end-ish of May inventory figure has tumbled 58% over the past year to where current buyers are only finding 96 homes for sale right now!? [2] Bear in mind that low inventory does not mean no options. While buyers at this exact moment have 58% fewer choices than they did a year ago -- technically, they have had about 19% more options of what to buy over the course of the past year as compared to the prior year. After all -- the 19% increase in the number of sales in the past 12 months (compared to the prior 12 months) is a result of 19% (or more) new listings having coming on the market in the past year as compared to the prior year. [3] How can this be? How can a buyer have had 19% more options over the past year but 58% fewer options today? It's a result of the how quickly homes are going under contract. Lots of new listings have come on the market over the past year but they have been going under contract faster and faster and faster, resulting in fewer and fewer and fewer homes left on the market for buyers at any given point in time. What's one of the reasons why so many buyers are buying right now?  Low mortgage interest rates are making it a very compelling time for buyers to buy right now. Even if prices are going up, interest rates are super low -- and buying with such a low interest rate allows you to lock in the largest part of your monthly housing cost (principal and interest) at a super low payment given these super low rates. Alrighty then! If you made it through all of the charts and graphs and commentary above, hopefully you are feeling like you have a relatively good understanding of some of the market dynamics affecting our local real estate markets. Now, the "so what" of all of these market dynamics... HOME BUYERS - It's definitely possible to buy a home right now, but you're going to have more competition than ever before. You need to have a lender letter in hand, see a house within the first day (or two) of it being listed for sale, be ready to make an offer very quickly, and be willing to consider paying over the asking price and limiting your contract contingencies. It's a tough market, but well prepared, decisive, strategic buyers are winning contracts on houses. HOME SELLERS - You will likely sell your home more quickly, at a more favorable price, and with more favorable terms than you would have a year ago. That said, if you do receive multiple offers within the first week of being on the market, we'll need to make sure we're picking the offer with the most favorable terms overall, that stands the best chance of making it successfully to closing. HOME OWNERS - If you love your home, or even if you just like it pretty well, great! Settle in and enjoy owning a home during a time when home values are increasing quickly and when homes are hard for buyers to buy. Just like toilet paper, swimming pools, lumber, gasoline, and cars -- houses are in short supply and are getting more expensive. Enjoy the fact that you already own one! If you're looking to connect with me to talk about buying or selling a house, perhaps this summer, feel free to reply to this email or call/text me at 540-578-0102. Until next month, I hope you are able to find some time this June to relax and enjoy this first month of summer 2021! | |

The Ever Speedier Pace Of Our Local Real Estate Market |

|

Maybe you've heard that homes are selling quickly these days? ;-) Indeed, they are! As shown above -- for the homes that have sold thus far in 2021, that went under contract in 2021, the "median days on market" was only four days! That means that half of these homes were under contract in four or fewer days! To put that in a greater context, as per the graph above -- that median was 10 days last year, nearly 20 days three years ago, and nearly 30 days four years ago. So, yes, homes are selling QUITE speedily this year! Buyers, as a result...

It's a STRONG seller's market out there right now, and this shows itself most clearly in the speed at which homes are going under contract. Enjoy, sellers! Good luck, buyers! | |

Consider Strategically Crafting An Escalation Clause Based On Your Other Contingencies |

|

So, let's consider this scenario... Offer #1 = $255K Offer #2 = $250K with an escalation clause to increase $1K above all other offers up to $270K Based on this information, buyer #2 wins, right? Their offer is effectively $256K and the first offer is $255K, so the seller would definitely pick offer #2, right? Well -- maybe. What if we had these additional details... Offer #1 = $255K, contingent on the buyer financing 80% of the purchase price, and no home inspection Offer #2 = $250K with an escalation clause to increase $1K above all other offers up to $270K, contingent on the buyer financing 97% of the purchase price and contingent on a home inspection and contingent on the property appraising at/above the contract price I suspect you may see where I'm going with this. In this situation, why would a seller pick offer #2, just for a sales price that is $1K higher, to then voluntarily be subjecting themselves to possible further negotiations related to the home inspection, the appraised value, and with a buyer who would appear to be less financially qualified (3% down payment instead of 20% down payment) than the first buyer? Most sellers would likely pick Offer #1 in this more nuanced scenario. So -- extrapolating from this specific "what if" -- if your offer will include contingencies or terms that are bound to be less favorable to the seller, you may want to consider being willing to pay a higher price compared to other offers. Here's how that might look... Offer #1 = $255K, contingent on the buyer financing 80% of the purchase price, and no home inspection Offer #2 = $250K with an escalation clause to increase $5K above all other offers up to $270K, contingent on the buyer financing 97% of the purchase price and contingent on a home inspection and contingent on the property appraising at/above the contract price Now, the seller has an offer of $255K and an offer of $260K. The higher offer still has more contingencies to work through -- but perhaps they are more willing to do so given that the sales price would be $5K higher in this scenario instead of just $1K higher. So, as you consider that "differential" that you put in your escalation clause -- consider the other terms and contingencies you are including and how they might compare to other competing offers -- and consider adjust that differential accordingly. P.S. No, I'm not an attorney. I'm not offering legal advise. I'm just a Realtor pondering negotiating strategies aloud. Consult with your Realtor about how to draft the most competitive offer on a property based on your situation and that individual property. :-) | |

Why Was MY Offer On The House Not The Winning Offer? Again!? |

|

If you're trying to buy a house in 2021, it is not uncommon to make an offer on a house -- only to have it NOT be accepted. After all, many new listings are seeing 3, 5, 10, 15 offers within a few days of being listed for sale -- and clearly, the seller can only accept one of those offers. As a result, many would-be buyers are finding themselves wondering WHY didn't the seller accept MY offer!?!?! Was it all about price? Did I not offer them enough money? Well, yes, there is a good chance that your offer was not accepted because someone else was willing to pay a higher price for the house -- but there are quite a few other reasons why your offer might not have been accepted. Here are some of them...

Those are but a few of the reasons why your very strong offer may not have been accepted by a property seller. It can, after all, be pretty surprising when you make a very strong offer and then are told that you didn't win. As a side note, we usually won't know why exactly your offer was not selected -- but we can always ask to see what the seller's agent can share. That feedback, if provided, can help guide your decisions when you make an offer on the next exciting new listing to hit the market. | |

What Could I Discover In A Home Inspection That Would Make Me NOT Want To Buy This House? |

|

The conversations about home inspections (and whether to do them as a part of a home purchase process) are playing out a bit differently these days. I used to always recommend that a buyer conduct a home inspection as a part of their home purchase process. I still do recommend that - but I now much more clearly point out the potential ramifications of including a home sale contingency in an offer in the current market. When there are five or more offers on a home (as there often are these days) there seems to be a relatively good chance that at least one of the buyers will not include a home inspection contingency in an attempt to be the buyer whose offer is selected by the seller. Most sellers, after all, would much rather not have to deal with a home inspection -- even if they wonderfully maintain their home and do not know of any property condition issues. Thus, many buyers are now asking themselves... What Could I Discover In A Home Inspection That Would Make Me NOT Want To Buy This House? If you asked most buyers that question three years ago they would probably say "plenty of things!" - and most buyers would then include a home inspection contingency. These days, more and more buyers are saying "well, probably not much, right?" - and those buyers are deciding not to include a home inspection contingency. So - if you're buying a home (or hoping to buy a home) in the crazy seller's market of 2021 - should you include a home inspection contingency? It probably depends on...

We can talk further about this decision as we consider each particular property during your home search. | |

Why Are These Buyers Offering So Much Money For My House? |

|

In this craaaaaazzzy seller's market, some sellers find themselves asking... Why Are These Buyers Offering So Much Money For My House? It's a fair question. And sort of a funny one. :-)

Wait!? What?? Could this really be so? This is just an example, conceptually, of how things might feel when pricing your home in the current market. It seems that buyers are willing to pay ever, ever, ever increasing prices for houses in this area. So again... why!? Well, I think it stems from a few general things going on right now...

So, in the end, are buyers paying more than they should? Are buyers paying more than your home is worth? The answer is somewhere between probably and definitely - but today's buyers seem to be aware of it and comfortable with it. Thus, as a seller, enjoy being on the winning side of the housing market -- and hopefully you won't have to turn right back around and buy in this lopsided, one-sided market! P.S. I still haven't decided. Are we imagining the people in the picture I put at the top of this post to be the buyers or the sellers in this scenario? Imagine them as you will. :-)

| |

Welcome To The Ebb and Flow of the Summer Real Estate Market |

|

Week 1 - Lots of new listings Week 2 - A few new listings Week 3 - No new listings Week 4 - Lots of new listings Scramble and repeat. Welcome to summertime! This spring was rather busy in our local real estate market with lots of new listings -- most of which promptly went under contract, many with multiple offers, many over the asking price. But now, summertime. During the summer months we typically see a slow down for a few weeks as school ends and then a very sporadic flow of new listings through June, July and August. This is mainly a result of people planning to leave for vacation, being on vacation, and recovering from vacation. So - there will certainly be plenty of new listings to consider this summer, but the timing of when those listings come on the market may very well seem irregular and random. If you haven't developed patience thus far as a buyer through a tumultuous and competitive spring market, the ebb and flow of new listings this summer should help you get to a zen-like level of patience. ;-) | |

Does An Increase In The Real Estate Tax Rate Directly and Significantly Affect Housing Affordability? |

|

The City of Harrisonburg recently increased the real estate tax rate from $0.86 per $100 of assessed value to $0.90 per $100 of assessed value. Does this affect housing affordability for home buyers and homeowners? I tried to say "yes and no" for this question -- but it's somewhat difficult to say that the increase in the real estate tax rate (alone) has a meaningful increase on housing affordability. Technically, yes, the increased tax rate does increase the cost of owning a home -- but not by much... For a property assessed at $250,000...

So, for the house assessed for $250,000 -- the monthly payment would increase by $9 per month based on this change in tax rates. So, certainly an increase in monthly housing costs, but not much of one. To put this change in monthly housing cost in context... If a homeowner had financed 90% of their purchase price of $250K at 3.5%, their mortgage payment would likely be right around $1,243 before the change in tax rate -- and right around $1,251 after the increase in real estate taxes. So, this change in tax rates increases their monthly payment by less than 1%. Am I saying that the City of Harrisonburg can just keep on raising the real estate tax rate forever without any impact on housing affordability? No. But it's hard to argue that this increase in the real estate tax rate, on its own, dramatically changes the financial picture for many or most homeowners. Now, I'll pivot a bit to a few other common talking points related to real estate taxes... Increased Tax Rates + Increased Assessed Values If we look at both at the increase in property values AND the increase in the real estate tax rate, then yes, the change in one's real estate tax bill is more significant. That said, the assessed values of real estate do not (at least right now) seem to be increasing as quickly as sales prices are in the current real estate market. While the median sales price has increased by about 10% over the past year, this year's property value assessments increased a net of 2.9%. As such, we shouldn't hastily calculate the increase in a tax bill using the increase in our local median sales price to show a large increase in real estate taxes, because market values are currently escalating much more quickly than tax assessed values. Tax Rate Increases + Income Changes A somewhat common refrain is to say "real estate tax rates increased by __% over such and such timeframe -- but my income didn't increase by that much during that timeframe!" This argument doesn't make a lot of sense to me. Let's make it as extreme of a point to point comparison as possible. The real estate tax rate was $0.59 ten years ago and is now $0.90. That is a 53% increase over a ten year period. So, per the argument above, I'd need a 53% increase in my income during the same time period in order to afford those higher real estate taxes, right? Well, probably not. :-) I'm going to use very rough, inaccurate numbers here, but let's pretend Fred owned a home assessed for $150K ten years ago and today it is assessed at $250K. His annual tax bill would have been $885 a decade ago at that $0.59 tax rate and that would have increased to an annual tax bill of $2,250. That's quite an increase! In fact, it's a $1,400 increase in annual real estate taxes over ten years. So, per the prior argument, he probably needs to have seen a 53% increase in his income because the real estate tax rate increased 53% over a decade, right? Well, maybe not. If Fred was earning $35,000 a decade ago, a 53% increase over the past ten years would mean that he would be earning $53,000 today. If you made it through all of my ramblings, thanks for reading and engaging on this topic. Do I think higher taxes are OK or good or great? No. I would love for everybody to pay the same or lower taxes forever and ever. Do increases in the local real estate tax rate directly and significantly affect housing affordability? In the short term it's very hard to say "yes" to this ($9/year) based on the information above. Over the mid to long term, certainly, this does have a cumulative impact - but I believe we should be precise with our language. Do you agree or disagree or have another counterpoint? Email me at scott@hhtdy.com. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings