Archive for April 2022

Folks Who Bought Homes In 2020 or 2021 Might Stay In Their Homes Longer Than Expected |

|

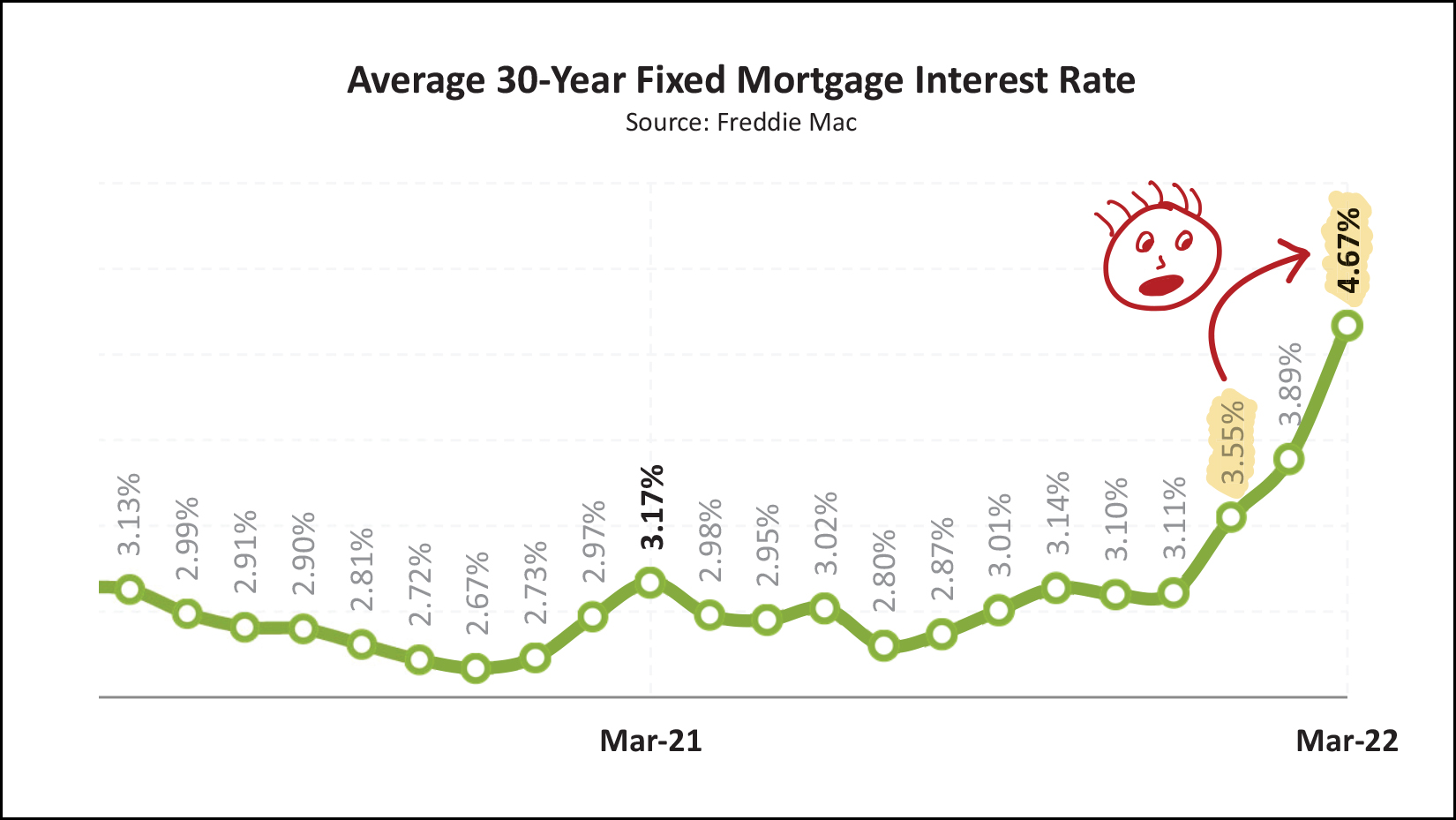

Did you buy a home in 2020 or 2021? I'm betting you might stay in that home longer than we might otherwise expect. After all, who would want to give up that fixed mortgage interest rate that is SOOOO low! For nearly all of 2020 and 2021, the average mortgage interest rate on a 30 year fixed rate mortgage was below 3.5%. That is LOW. For some months during that two year period, the rate was lower than 3%! When home buyers from 2020 or 2021 think about selling five to seven years from now, I'm guessing a part of the though process of whether to sell will relate to whether they really want to give up that super, super, super low mortgage interest rate! Mortgage interest rates are currently hovering around 5%, and perhaps they'll stay there for much of the year, and beyond... If, seven years from now, you would potentially be selling and paying off a mortgage with a 2.75% interest rate... in order to take out a new mortgage with a 5.25% interest rate... will you really want to do it? Certainly, our needs for housing (location, size, configuration, etc.) change over time... and that might supersede a desire to hold onto that fantastically low mortgage interest rate. All that said, if you were fortunate enough to buy (or refinance) in 2020 or 2021, enjoy that super low interest rate, as it doesn't seem likely that we will see them anywhere near that low in the coming months and years. | |

Can You Make a $300,000 Decision In Less Than An Hour? |

|

It's a weird time to be a home buyer... in oh, so many ways! But here's one of them... Perhaps you are going to spend $300,000 on the home that you hope to purchase this year... or $400,000... or $500,000... or even more. Given current market dynamics, this might be how you experience this home that you are going to spend hundreds of thousands of dollars purchasing... [1] See the new listing online. [2] Drive by, slowing down, looking like a stalker. [3] Frantically call or text your Realtor to set up a time to see the house. [4] Spend 30 - 45 minutes walking around and through the home with your Realtor. [5] You'll have to make an offer quickly, so no time for a second showing. [6] You're competing with several other offers, so no chance of including an inspection contingency. [7] Diligently work through the buying process with your Realtor, lender and title company. [8] Walk through your home one last time -- oh wait, for just the second time -- on the morning of your closing. [9] Attend closing and pay hundreds of thousands of dollars for the home in which you have only spent less than an hour of time thus far. [10] Move in, really get to know your home, and fall in love with it!? Hopefully!? ;-) The point is... in this fast moving, competitive market... most buyers will find themselves needing to make a decision about a very LARGE purchase very QUICKLY when that "perfect enough" house hits the market! | |

Home Price GROWTH Seems Likely To Decline In 2022 |

|

It seems likely that we will see a decline in home price GROWTH in 2022. Here are the changes in the median sales price over the past five years... 2017 = +3% 2018 = +7% 2019 = +5% 2020 = +10% 2021 = +10% While I don't think we will see the median home PRICE decline in 2022... ...I do think we will see the GROWTH in the median home price decline. Given quickly rising mortgage interest rates, it seems more likely than not that we will NOT see another 10% increase in the median sales price of homes in Harrisonburg and Rockingham County this year. I think we are likely to still see the median sales price increase, but perhaps not as quickly as it has over the past two years. | |

Buying A Home To Lock In Your Housing Costs |

|

Yes, home prices are going up... and yes, interest rates are going up. As a result, your mortgage payment (if you buy a house) will be higher now than if you had bought a home a year ago. But... since I am not able to offer time travel services to my buyer clients... home buyers need be asking whether they should buy a home now within the context of how it compares to if they had bought a home a year ago... ...instead, they need to be asking... ...whether to buy a home today in the context of how it compares to continuing to rent a house for the next few years. Options for would-be buyers would seem to be... 1. Buy now (ish) 2. Buy later 3. Rent forever Buy now... this will allow you to lock in the majority of your housing costs. Your mortgage payment will almost certainly include principal and interest (on the loan) as well as property taxes and insurance... and the taxes and insurance portion can go up over time... but buying a home now with a fixed rate mortgage will allow you to lock in your housing costs. Buy later... it seems likely prices will likely be higher with only a small chance that they will be lower... and mortgage interest rates will likely be higher with only a small chance that they will be lower... meaning your housing costs will likely be higher if you buy later rather than sooner. Rent forever... rental rates keep going up, and up, and up... so if you don't buy a home, and keep renting a home, your housing costs will likely continue to go up over time. Certainly, buying a home isn't the right choice for everyone in every situation... but buying a home does give you the benefit of locking in your housing costs when many of your other costs will otherwise continue to increase given the current inflationary climate! | |

If You Hope To Buy a Home and Have Not Talked To Your Lender Lately, Do So NOW! |

|

So, you've been planning to and trying to buy a home for the past four months... but despite having made multiple offers, nothing has worked out yet. This is not as uncommon as you might think -- there still seem to be many more buyers in the market as compared to sellers -- and thus, plenty of would be buyers haven't been able to convert themselves into actual real life buyers yet. As a conscientious and responsible buyer you likely talked to your lender before you started your home search -- four months ago -- and you became pre-approved for a loan. Good work! But... wait.... if you haven't talked to your lender since then... connect with them again ASAP! Why, you might ask? Because interest rates have increased quite a bit over the past four months! Buying a $400K house four months ago with 20% down...

Buying a $400K house today with 20% down...

As you can see, this fictional buyers would now be paying $381 a month more than anticipated because interest rates have risen quite a bit over the past four months. The buyer very likely can still afford the new mortgage payment and will still be pre-approved to buy the house of his or her dreams... but the payment will be higher than expected, and nobody likes surprises. So, if you are in the market to buy and haven't talked to your lender lately to get an updated estimate of your mortgage payment with today's rates... do so NOW! | |

Many Would Be Buyers Are Finding Zero Homes For Sale Right Now |

|

It's a strange time right now -- there are quite a few segments of the market with absolutely no options for buyers. For example, let's say you wanted to buy a resale home just east of Harrisonburg, in the Spotswood High School district, with at least 2,000 square feet, and four bedrooms... ...and you could spend up to $700,000... ...you should have plenty of options, right? Nope. There are currently... zero homes for sale (that aren't under contract) in the Spotswood High School district, under $700K, with 2000+ SF and 4+ bedrooms. So, buyers, as much as you might want to buy -- you will be at the mercy of waiting for sellers to be ready to sell. And sellers, these extraordinarily low inventory levels in many segments of the market may very well mean that you will have lots of early interest in your home... and you may very well secure a contract with very favorable terms! | |

Even Home Sellers of Newer Or Well Maintained Homes Enjoy Offers Without Inspection Contingencies |

|

So, you're getting ready to make an offer on a super popular new listing. You've heard that there have been 12 showings thus far, and there are already three offers on the table. You're going through the list of contract terms that you'll propose...

Let's arbitrarily and inexactly throw all homes into one of two categories...

Many buyers who are considering properties in the first category (older and/or poorly maintained) are hesitant - reasonably so - to skip the home inspection contingency. Here's where things get interesting, though... Some buyers who are considering properties in the second category (newer and/or well maintained) think that a seller of such a property probably doesn't mind an inspection contingency because, after all, their property is newer and/or well maintained. And yes, that is true. Those property sellers very likely don't mind a home inspection contingency all that much... ...but...

That's not to say that all buyers should be making offers without inspection contingencies as long as a property is newer and/or well maintained... ...but at some point you have to do the calculus of what offer terms are most likely to secure you a contract to actually buy a house. Even if a home sellers has nothing to be worried about in home inspection category, they still enjoy be able to consider an offer without such a contingency! | |

You Might Not Want To Think About This Aspect Of Escalation Clauses. Sorry!? |

|

Escalation clauses are all the rage right now when would-be buyers are competing against multiple other offers on popular, well prepared, well priced, thoroughly marketed new listings. An escalation clause allows you to make an offer at one price, but have that offer price automatically increase to compete against other offers. Yesterday, I pointed out that when it comes to escalation clauses... Today, I'd like to point out that sometimes, your offer with an escalation clause might escalate based on a competing offer that might make you groan when you see it after your offer escalates. Here's the imagined scenario, on a house listed for $400,000... Your Offer = $405,000 contingent on financing 75% of the purchase price, escalating to be $5,000 above any other offer up to $460,000. Offer #2 = $400,000 contingent on financing 80% of the purchase price, escalating to be $1,000 above any other offer up to $410,000. No biggie here -- your offer escalates to $415,000 and that probably seems reasonable. Offer #3 = $400,000 contingent on financing 97% of the purchase price, contingent on a home inspection, contingent on the property appraising at or above the contract price, $500 deposit, contingent on the sale of a property that has not yet been listed for sale, from buyers who have not yet been prequalified, escalating to be $1,000 above any other offer up to $460,000. Oof. Offer #3 is not likely actually an offer that would be accepted by the seller... but it caused your offer to escalate all the way up to $460,000 -- which is $55K above your original offer, and $45K above how far it would have escalated based on Offer #2. Pointing this out is not a recommendation that you make your escalation clause super complicated, as that might overwhelm or turn off the seller... but it is important to realize that competing offers that are extremely weak in almost every way except price might cause your offer to escalate just as much or more as a very strong competing offer would. I suppose, at a minimum, in the situation above, your escalation clause could have at least stated that your offer wouldn't escalate if the competing offer had a home sale contingency? | |

If Your Downpayment Is Small, Your Escalation Clause Differential Should Likely Be Large |

|

Consider these scenarios of multiple offers on a house listed for $400,000... Two offers...

In this scenario, a seller will almost always pick the first offer. Most sellers would be just fine missing out on that final $1,000 being offered by the second buyers because they would rather work with a buyer with a larger downpayment that would appear to be more financially capable, more readily able to cure any appraisal shortages, etc. Interestingly, the second buyer seemed happy to pay $435,000 for the house, but is not likely to get the house because the differential of their escalation clause was only $1,000. Now, then, here is an alternative scenario that the second buyer could have created which might have changed the thought process of the seller...

In this version of the offer situation, the second buyer will at least (likely) get the seller to slow down and give their offer some serious thought. Even if the seller doesn't like the 95% financing situation, and the possible ramifications of that high loan-to-value ratio, to ignore that second offer is potentially leaving $10,000 on the table. So... if you have a small downpayment, you may want to consider a larger differential in your escalation clause... otherwise, you shouldn't be surprised if your offer is not seriously considered by a home seller with multiple strong offers. | |

Is FOMO Fueling Rising Home Prices? |

|

The Federal Reserve Bank of Dallas indicates that there are signs of a brewing housing bubble... and FOMO (fear of missing out) might be a contributing factor. You'll find the article from the Dallas Fed and some accompanying graphs here... Some summary points from that article... [1] If lots of home buyers believe current, large, housing price increases will continue, further and stronger buying can be fueled by FOMO - the fear of missing out - which can drive prices up even further. [2] The Dallas Fed calls this phenomenon described above "expectations-driven explosive appreciation" or "exuberance" and it seems to be happening in many housing markets right now. [3] The U.S. housing market has shown signs of exuberance for more than five consecutive quarters. [4] Since the beginning of 2020 there has been a divergence between home prices and rental rates... home prices have been going up much more quickly than rental rates. [5] Much of the data the Dallas Fed analyzed shows signs of "abnormal U.S. housing market behavior" -- which probably is not a surprising descriptor for anyone who has been in the market (buying or selling) over the past few years. [6] Factors contributing to the abnormal market behavior seem to include historically low interest rates, pandemic-related fiscal stimulus programs, Covid-19-related supply-chain disruptions among other factors. So, that was most of the worrisome parts of the article, but this little paragraph towards the end is somewhat of a reassuring finale... "Based on present evidence, there is no expectation that fallout from a housing correction would be comparable to the 2007-09 Global Financial Crisis in terms of magnitude or macroeconomic gravity. Among other things, household balance sheets appear in better shape, and excessive borrowing doesn’t appear to be fueling the housing market boom." So... it's possible that there is a housing bubble (though every local market is different and will behave differently) and if there is a bubble, prices could flatten out or decline, but if they do it doesn't seem likely that it will have the same impact as the 2007-09 housing and financial crisis. Happy Monday!? ;-) P.S. Read the actual article yourself... it has some great additional commentary and context... | |

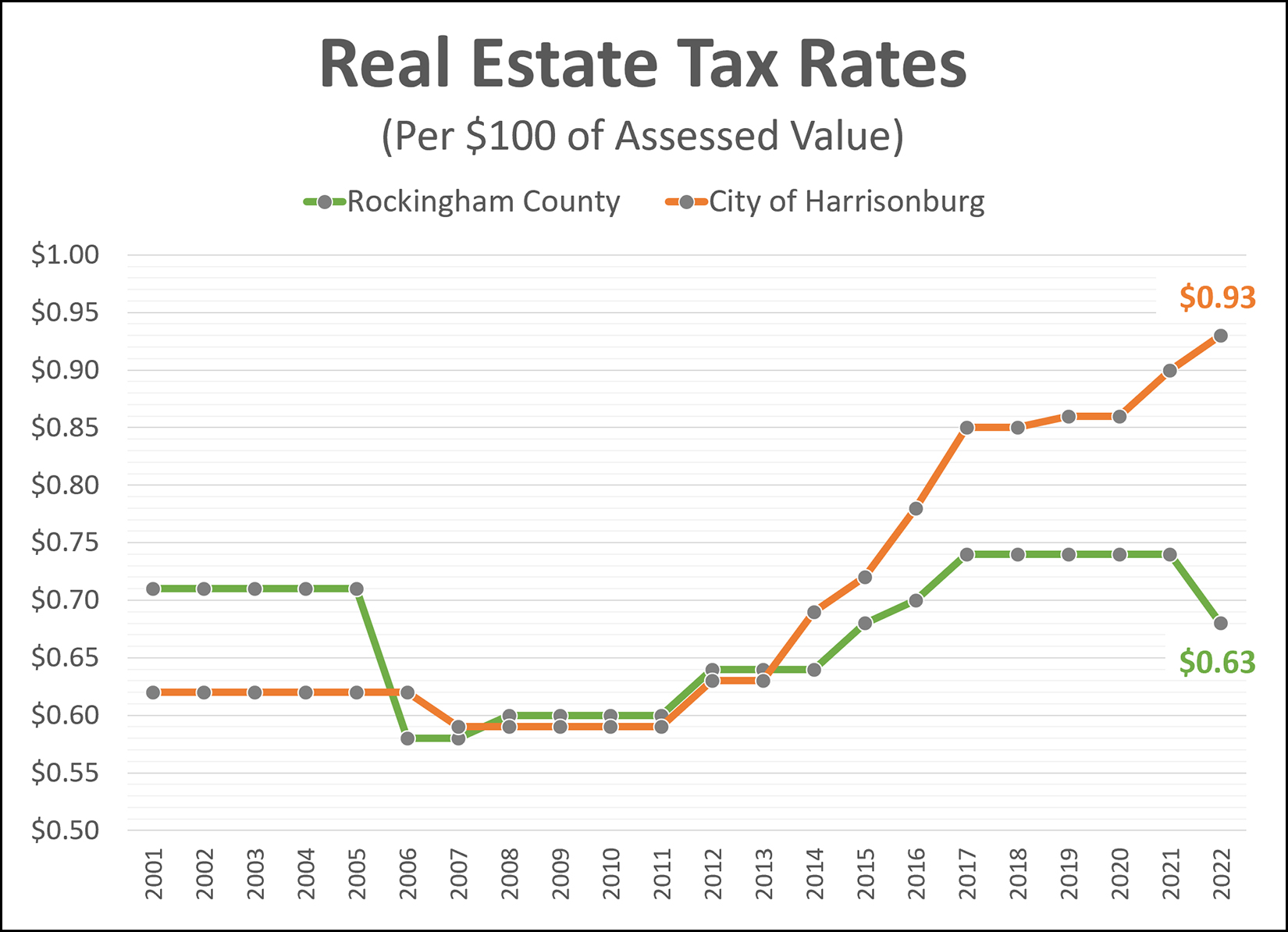

Real Estate Tax Rates Moving Up and Down |

|

Rockingham County - tax rate down 8% The Rockingham County real estate tax rate is currently $0.74 per $100 of asssessed value, but the Board of Supervisors just approved a reduction in the tax rate to $0.68 per $100 of assessed value. But... that is in the context of recently updated tax assessed value for all properties in Rockingham County, most of which increased significantly because the last reassessment took place four years ago before significant shifts in market values in this area. As a result, most Rockingham County property owners will see an increase in their tax bill despite the reduction in the tax rate. City of Harrisonburg - tax rate up 3% (pending approval) The Harrisonburg City Council will soon consider increasing the tax rate from $0.90 per $100 of assessed value to $0.93 per $100 of assessed value. The City of Harrisonburg updates their assessed values every year, so while many or most property owners recently received notice of the updated assessed value of their property, those values likely did not increase as drastically as assessed values did in Rockingham County. As a result, almost all City of Harrisonburg property owners will see an increase in their tax bill because though small increases, their assessed value and tax rate are both likely to have gone up or to go up. | |

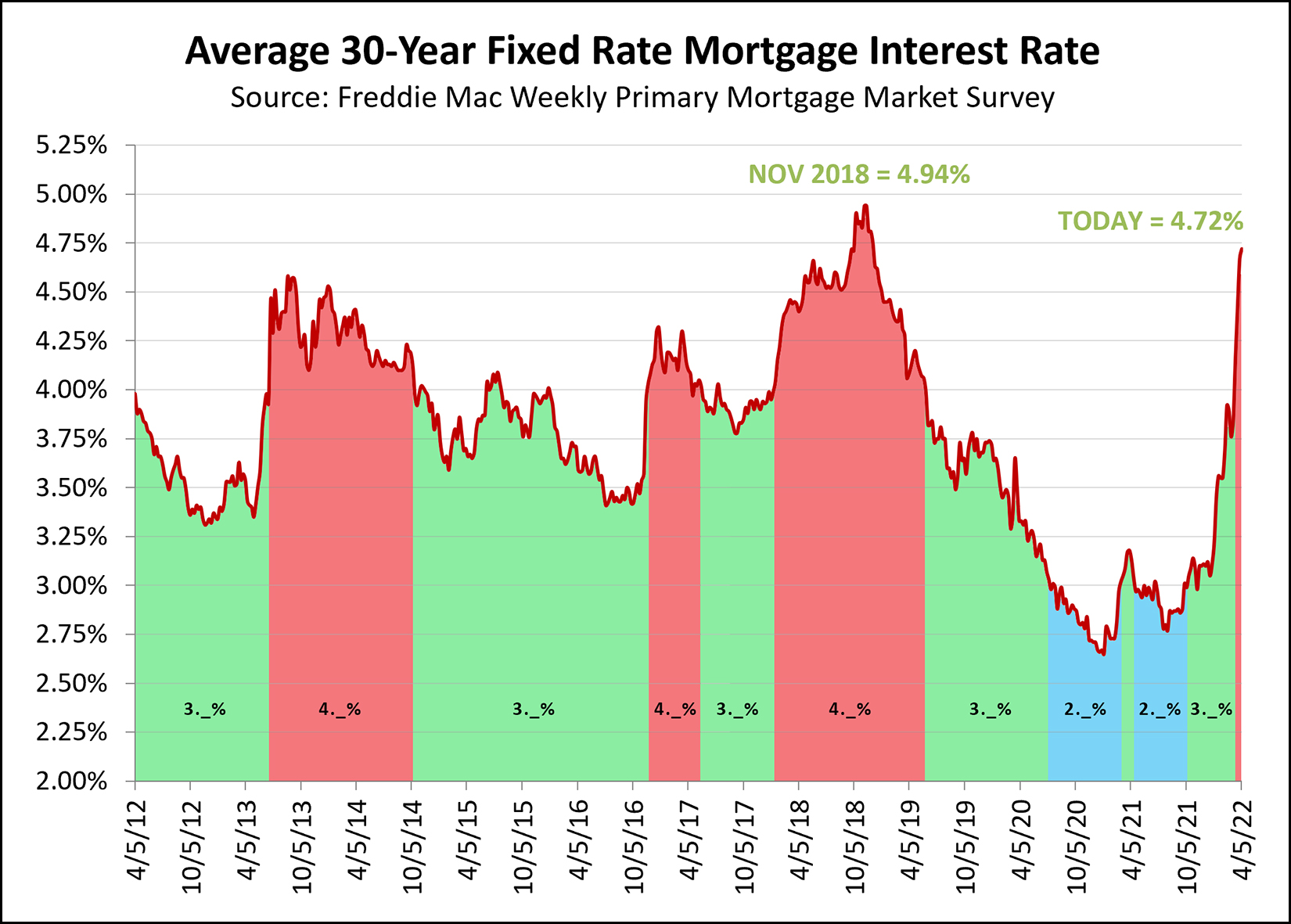

Current Mortgage Interest Rates in the Context of the Past Decade |

|

Mortgage interest rates keep on rising. The graph above shows the average mortgage interest rate over the past decade. Periods of Green = 3._% (somewhere between 3% and 4%) Periods of Red = 4._% (somewhere between 4% and 5%) Periods of Blue = 2._% (somewhere between 2% and 3%) A few resulting observations... [1] We're getting ready to pop over 4.75%, it seems, which we've seen once (for a few months) in late 2018. [2] We might be headed all the way up towards 5%, which we haven't seen at all in the past ten years. [3] While we've spent most of the past decade below 4% (green+blue) we have certainly also seen long spells above 4% (red) as well. [4] We moved pretty quickly from 2._% to 3._% to 4._% and it almost seems like 5._% could be knocking on the door. As mortgage interest rates rise, monthly mortgage payments (for new buyers) rise, which certainly creates the possibility that at some point rapidly rising home prices won't be rising quite as rapidly. | |

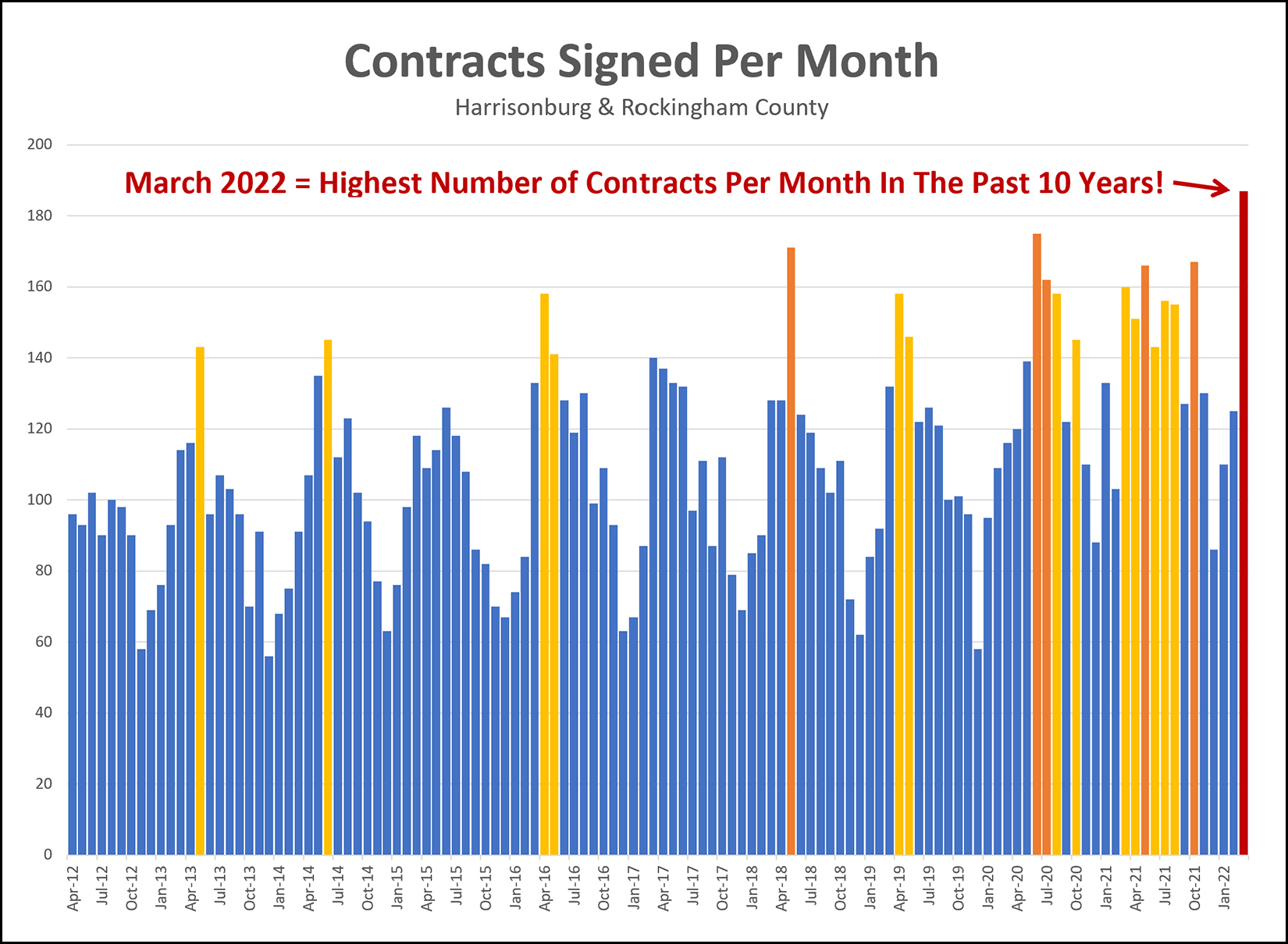

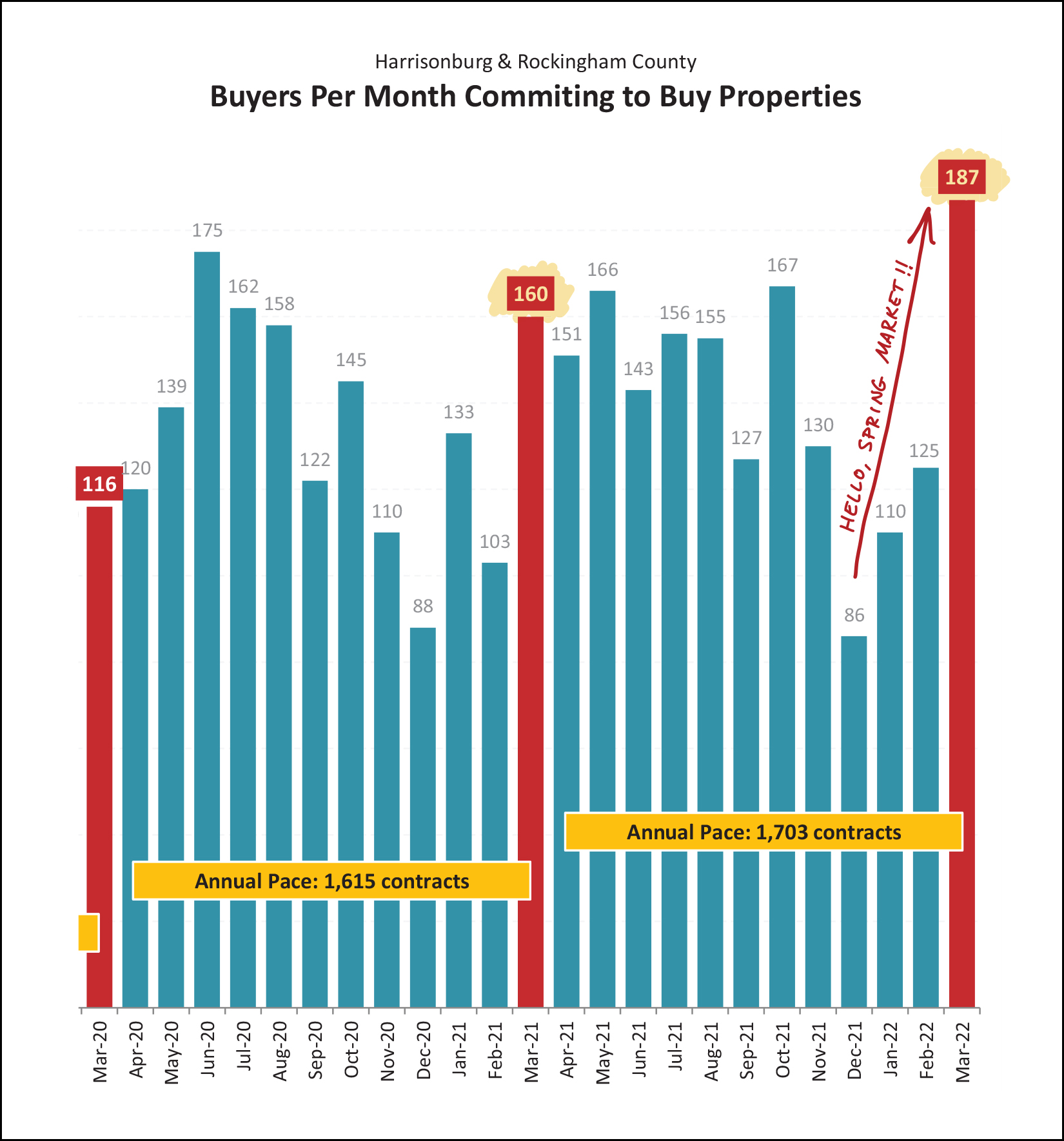

More Contracts Were Signed In March 2022 Than In Any Month In The Past Decade |

|

Wow! I knew that a lot of homes went under contract last month when I compiled my market report but I hadn't yet put it in a larger context. During March 2022, contracts were signed on a total of 186 properties in Harrisonburg and Rockingham County. Looking back an entire decade, there has never been a month when more contracts have been signed! In fact, there have only been a handful of months (five) when more than 160 contracts were signed. So, what gives? Why so much contract activity? [1] The market is strong, silly, sellers are excited to sell, buyers are excited to buy. [2] For some reason, more sellers than usual waited until March to list their homes (instead of January or February) causing an unexpected peak in March 2022. [3] Sellers are buyers are seeing interest rates rising and sellers want to go ahead and sell before rates get too high and buyers want to go ahead and buy before rates get too high. Maybe 1 and 2 and 3? ;-) Whatever the reason, there isn't any doubt that March 2022 was a record setting month for buyer and seller activity in the Harrisonburg and Rockingham County real estate market. | |

Home Sales Slow Slightly, Prices Still Climbing Quickly! |

|

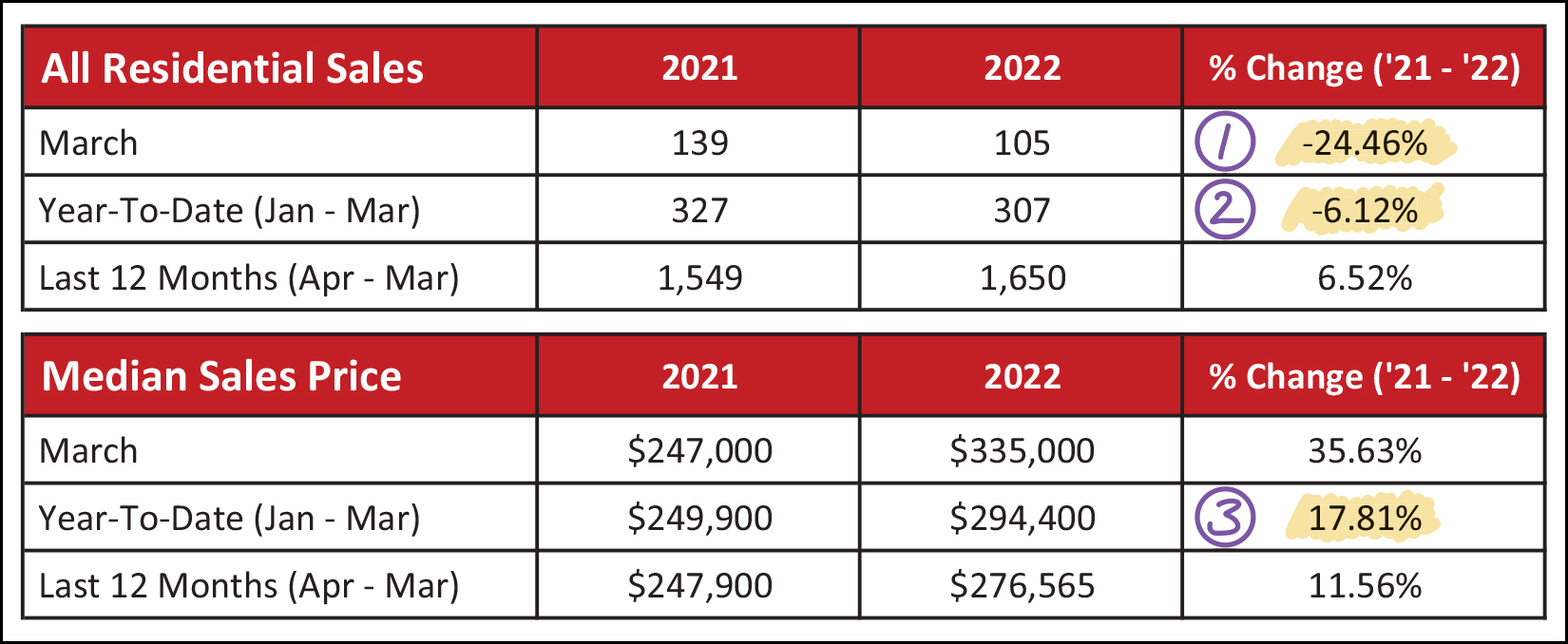

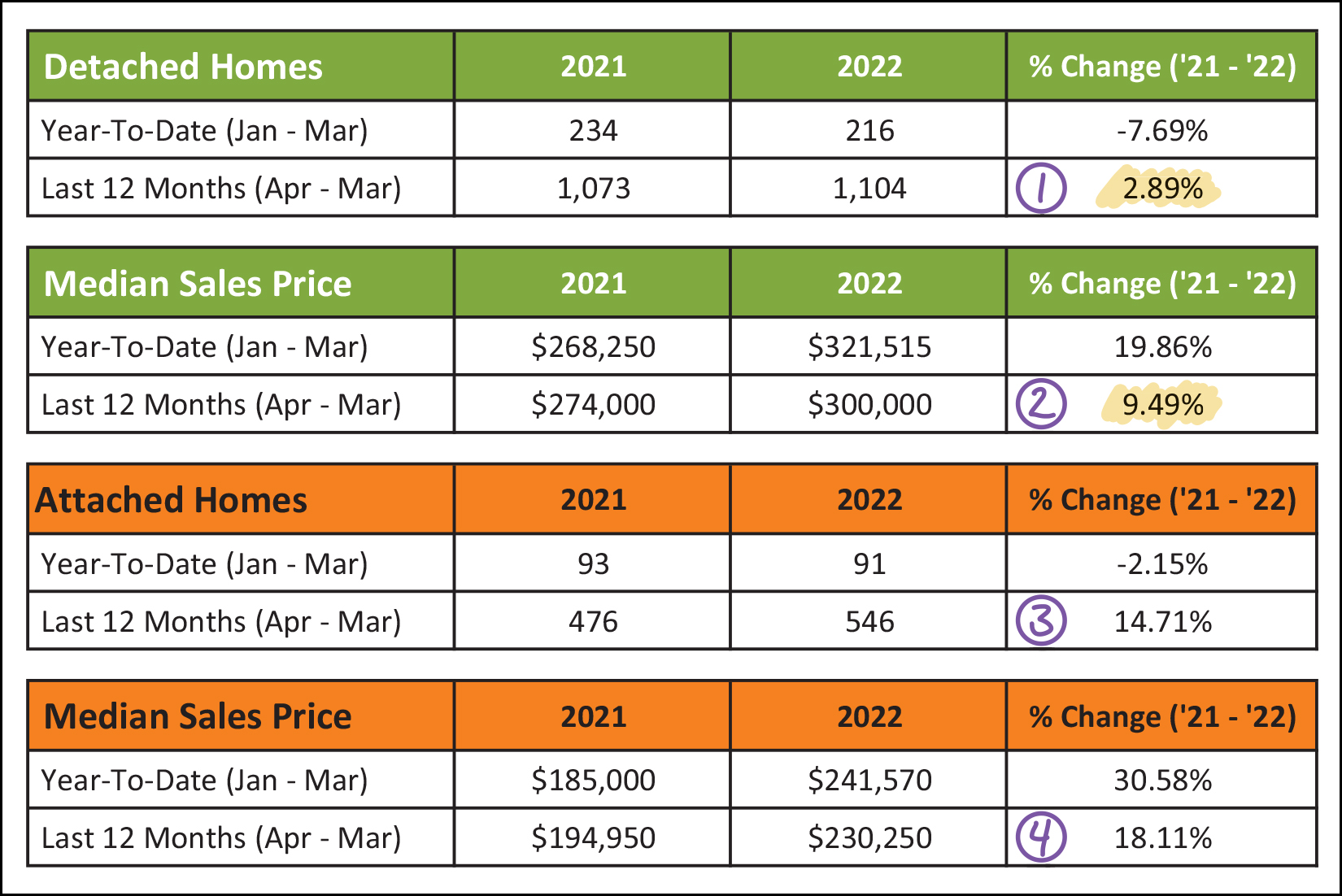

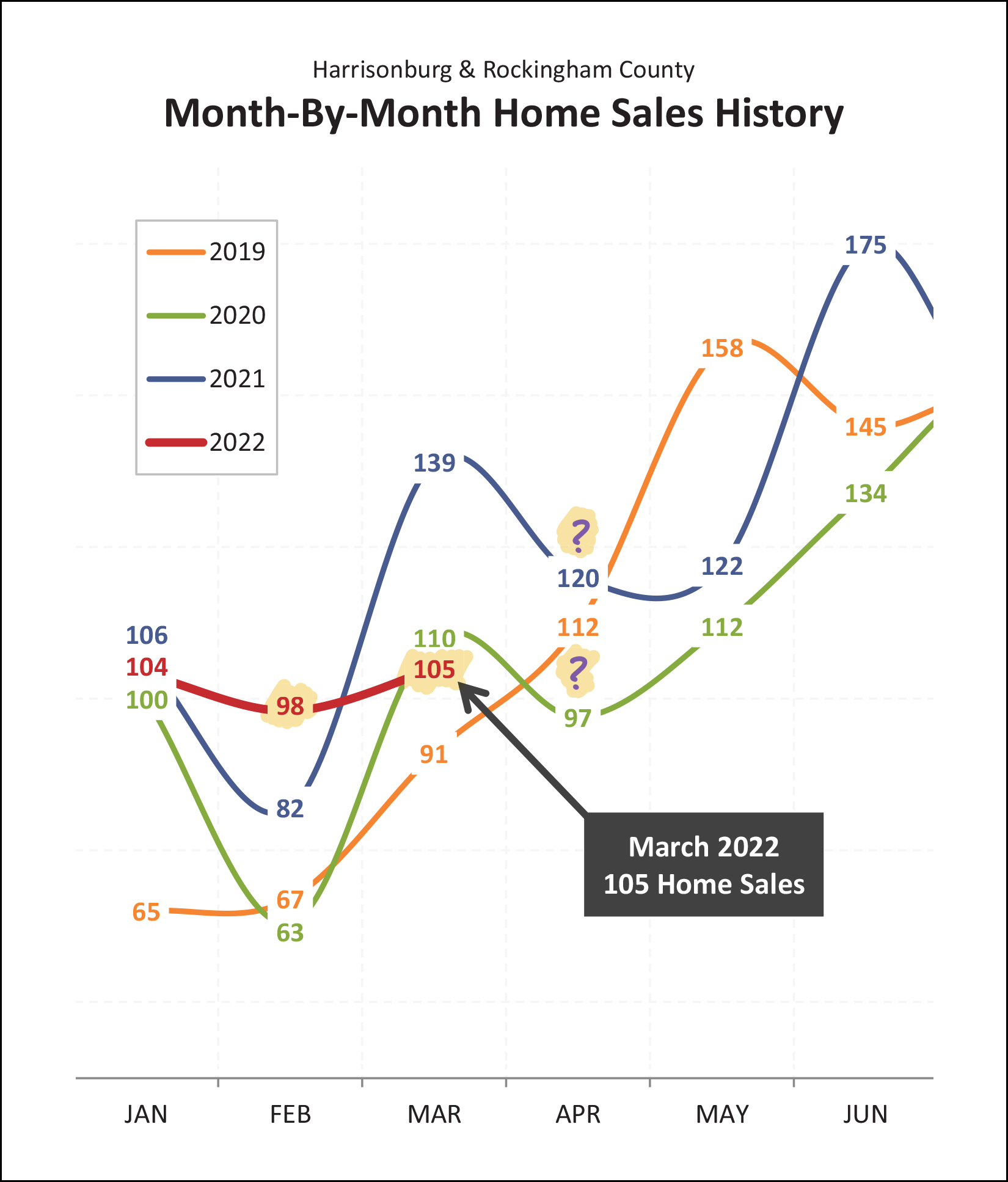

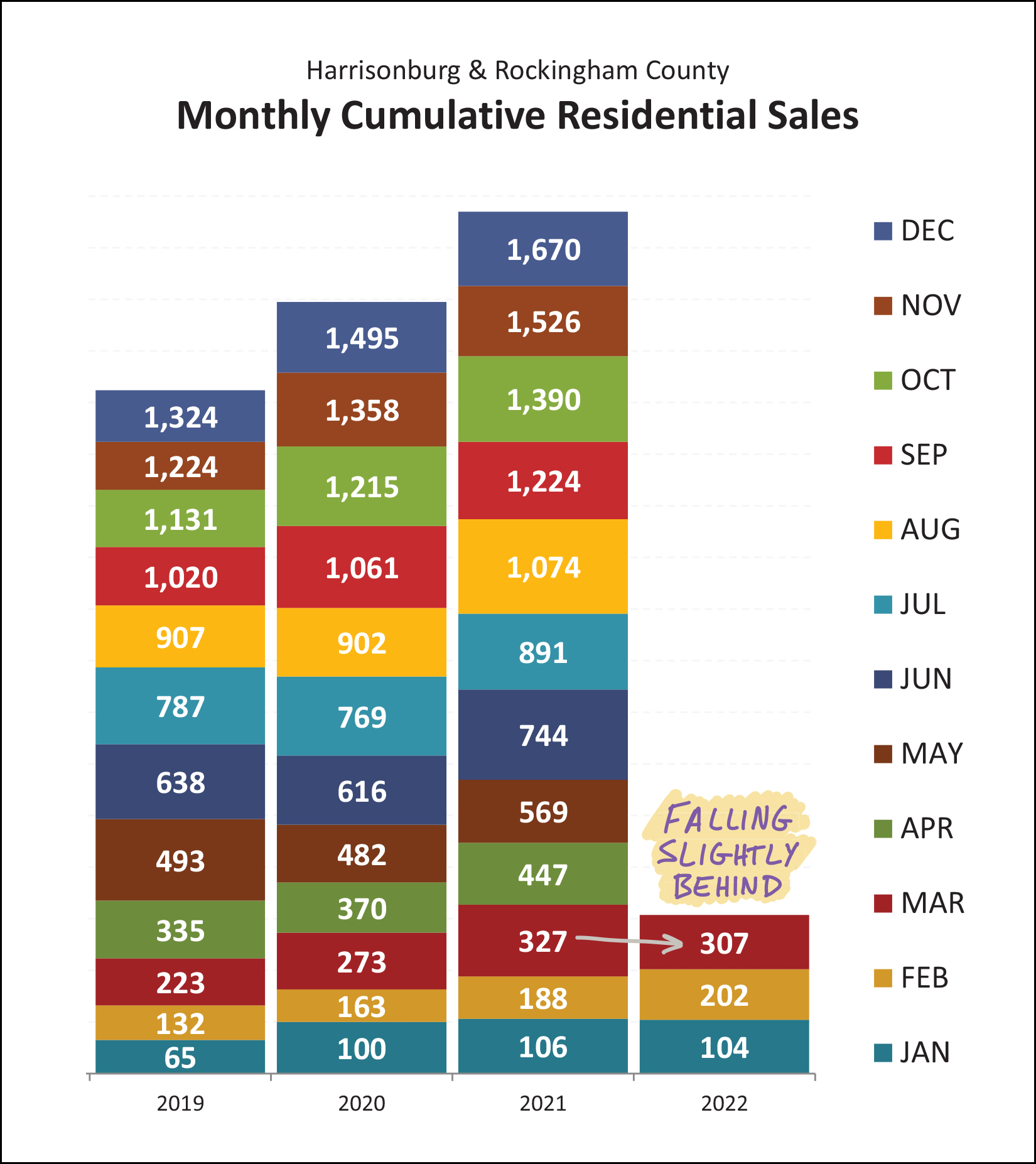

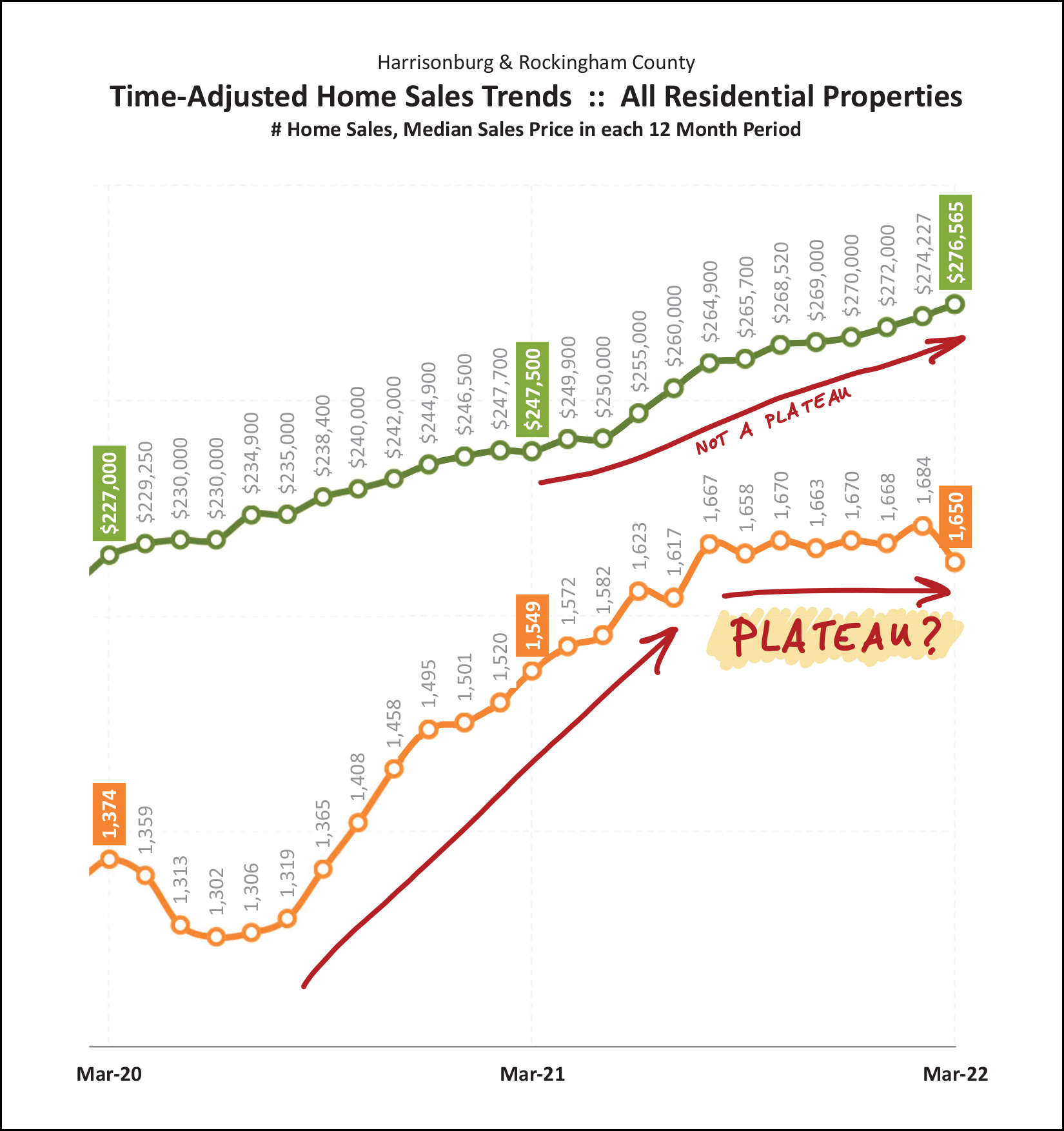

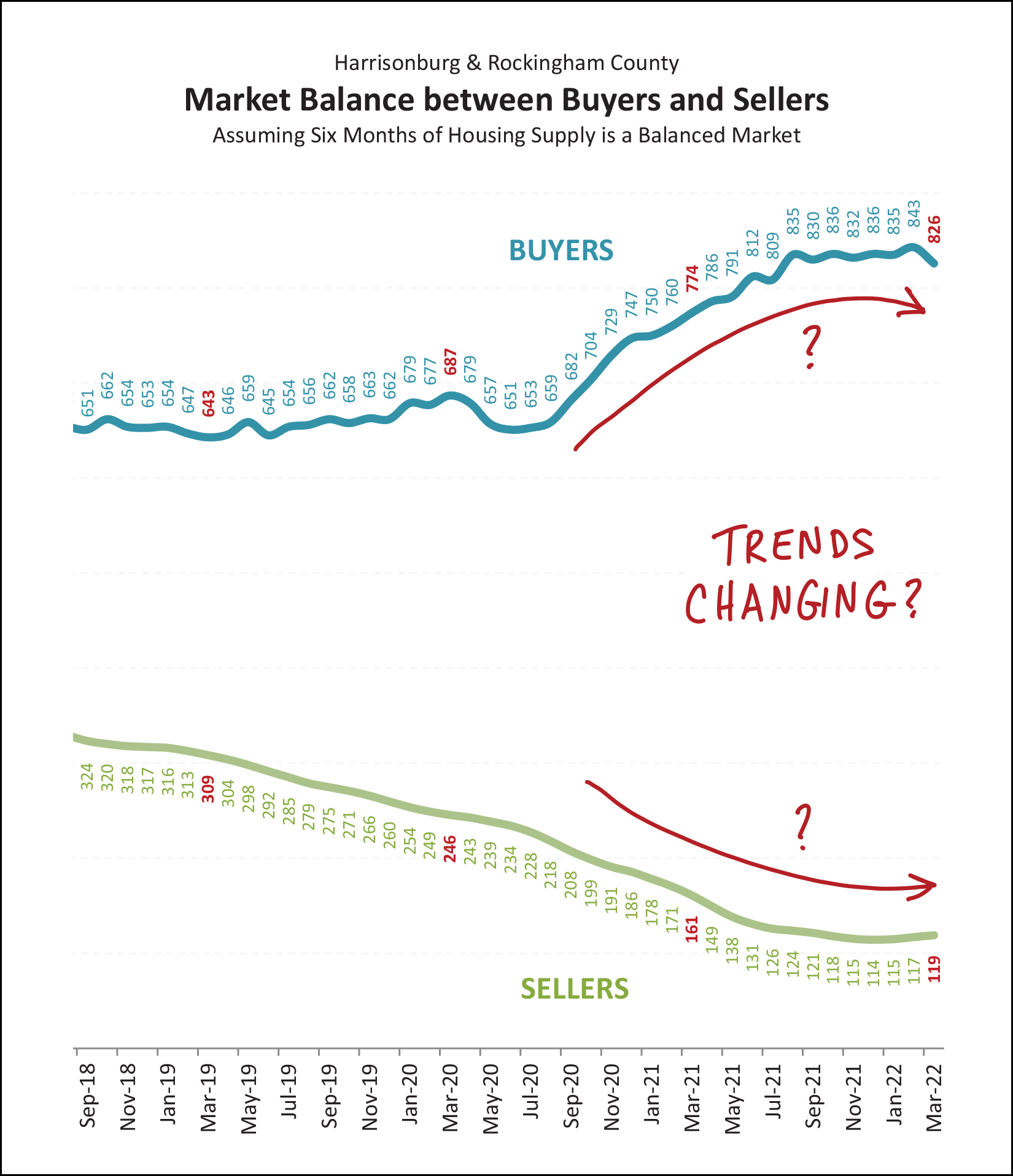

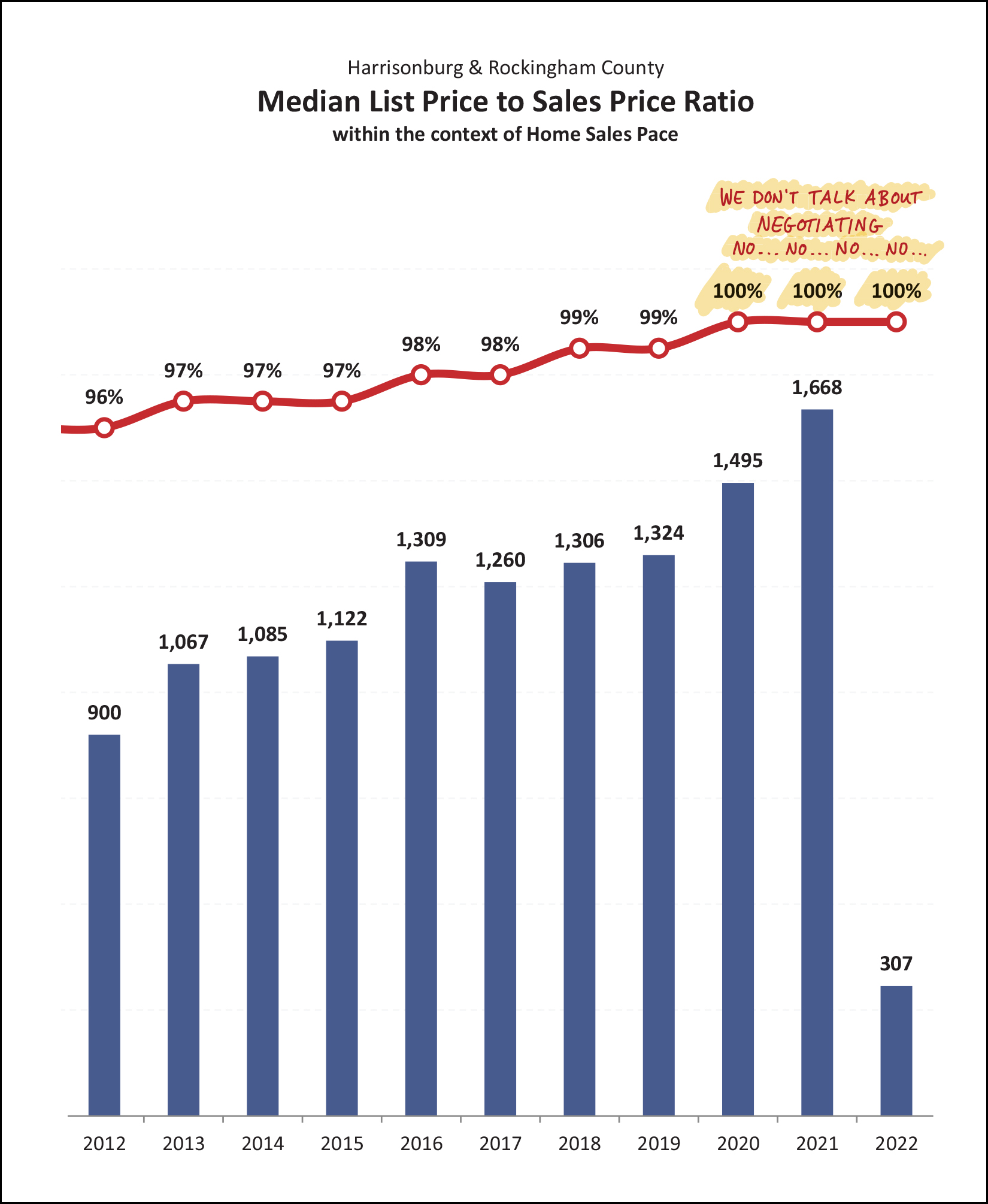

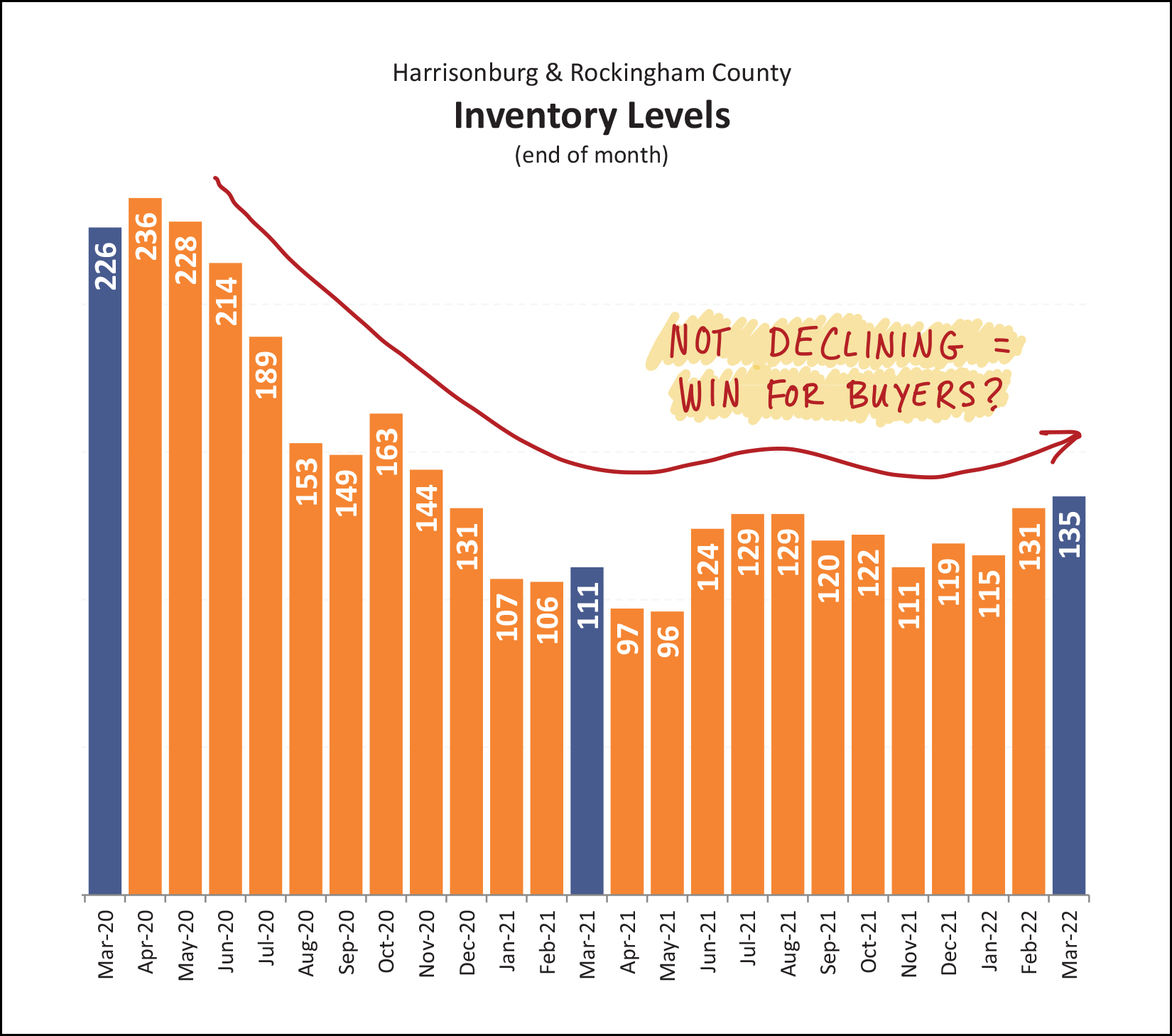

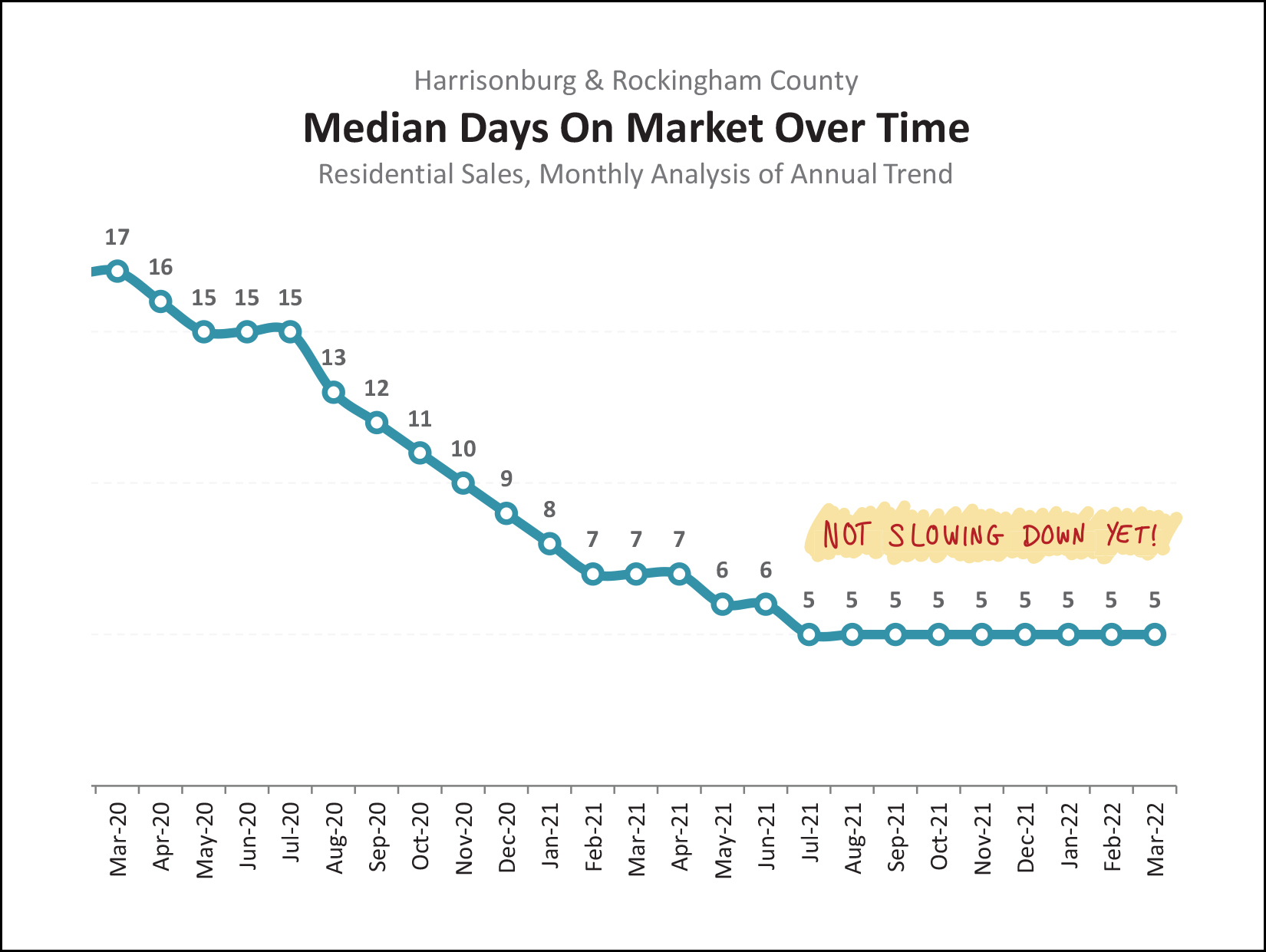

Happy Tuesday morning, friends! I hope you are enjoying the warmer weather this week, and perhaps some sporting events! We have a baseball player and a runner here in our house and the warmer weather this week is a welcome change for these outdoor sports.  Whether you're watching baseball games, track meets or soccer games these days, I hope your kids are enjoying the sport and their teammates, and you are not freezing in the stands. :-) Before I get started on this month's market report, a few quick notes... Check Out Vito's Italian Kitchen... Each month in this space I highlight one of my favorite spots to enjoy a meal, or a cup of coffee, or maybe a few other surprises in the coming months. This month, it's Vito's Italian Kitchen... a familiar and favorite restaurant on Port Republic Road in Harrisonburg. If you find me enjoying a meal at Vito's, it will likely be their calzone... or of late, I have been partaking of their delicious Coconut Chicken & Fruit salad. If you haven't visited Vito's lately, do so, this week! And... maybe next week you can go back for free! I'm giving away a $50 gift certificate to Vito's... just for fun! Enter your name and email address here and I'll pick a winner in about a week. :-) Congrats to Michael S. who won the Magpie gift card last month! Featured Property... Are you tired of bidding on house after house and not having the seller select your offer? Maybe you should build your next house instead of buying one? ;-) The photo on the cover of this month's market report is a beautiful, flat building lot in McGaheysville, currently offered for sale... and ready for you to build your next home! Find out more here. Download All The Graphs... Finally, for those of you who like to download all the graphs and examine every data point, you can grab those here. Now, then, onto your data fix for the month...  First off, yes, it's really true... after month after month of "more sales" and then "more sales" and then "more sales" -- this month there are a few indicators that are showing "fewer sales" instead. Don't panic. Read the entire market overview below for some analysis, context and commentary. In the chart above you'll note that... [1] There were 24% fewer sales this March than last March. A knee jerk reaction here might be "oh, I knew it, interest rates went up and home sales declined" but keep in mind that buyers that closed on their purchases in March likely contracted on those homes in January and February, before much of the increase in interest rates. A better indicator of whether interest rates are having an effect on buyer activity will be... buyer activity... signed contracts... and we'll get to that a bit further down in the report. The data might surprise you. ;-) [2] That 24% comparative deficit in March contributed to a first quarter of home sales in 2022 that included 6% fewer home sales than the first quarter of last year. [3] Despite a slightly (6%) slower first quarter of the year for home sales, the prices of those homes keeps on increasing. The median sales price in the first quarter of 2022 was $294,400... which is 18% higher than it was in the first quarter of last year. As I do from time to time, let's look at the trends in detached home sales (in green below) compared to attached home sales (in orange below) which includes duplexes, townhouses and condos...  As shown above... [1] We've seen 1,104 detached home sales over the past year... which is 3% more than seen in the 12 months before that. [3] Comparatively, though, the number of attached home sales has increased much more over the past year. We've seen 546 attached home sales in the past 12 months, which is 15% more than in the 12 months before that! And how about prices... [2] The median sales price of a detached home in Harrisonburg and Rockingham County has increased 9% over the past year, to a nice (or not nice, if you're buying) round $300,000. [3] Prices of attached homes has increased at an even faster rate, with an 18% increase over the past year to a median sales price of $230,250! Here's one of my favorite graphs each month, showing monthly sales in our area...  So, plenty going on in the graph above. January 2022 was what we might have expected -- right in the middle of the pack as compared to past months of January. February sales were surprisingly high, easily exceeding previous months of February. But March, hmmm, not as exciting as we might have hoped. Why weren't there more buyers in March? Some of them might have bought in February. But more likely... home buyers didn't buy (close on a purchase) in March because there weren't enough home sellers listing their homes for sale in January and February. Fewer homes available to purchase means... fewer homes will be purchased. All that said, we are certainly seeing a significant shift in mortgage interest rates right now, and that may also affect buyer (and seller) behavior moving forward. It will be helpful to see what happens over the next three to six months to better understand the overall trends in our local housing market... which is a statement that is probably always true. The next six months of data will be the best indicator of what is going on right now. :-) Next up, stack 'em up...  Here's where we'll be able to keep good track of cumulative trends as we go through the year. The first three months of home sales this year (307) is slightly lower than those same three months last year... but higher than the two years before that. Will enough home sales pile on in April to make up that deficit? One indicator that might point to a yes or no will be contract activity in March. Keep reading... Slicing and dicing the data again, we end up reviewing our basic understanding of landforms...  OK, let's see how you did at geography... before you read the captions above... the green line is or is not a plateau? And how about the orange line? Indeed, the green line is definitely not a plateau... sales prices keep on climbing, higher and higher and higher again. But the orange line... might be (?) a plateau? The number of homes selling a year in Harrisonburg and Rockingham County dipped down to around 1300/year in mid 2020 at the start of the pandemic, but then accelerated well past 1600/year by the fourth quarter of 2021. Over the past eight months, however, we have been seeing a relatively steady number of home sales per year. So, lots of home sales, but that number is no longer increasing, at least for now. So, will we see annual home sales ever (even for a month) rise to 1700 sales per year? Maybe not, given the past eight months of hanging out in the 1650 - 1690 range. And below is one more sign of a possible change in a trend in our local housing market...  As can be generally observed above, the number of buyers buying has been flattening out over the past six to nine months -- and the number of sellers selling (inventory levels) have been stabilizing (at a really, really low point) during that same time period. So, is something changing in our local real estate market? Maybe? We probably shouldn't and wouldn't conclude that the balance in the market is shifting unless we see a measurable decline in buyer activity AND a corresponding increase in availability in homes offered for sale. Which brings us right back around to needing to remember that in order for a high level of buyer activity to be sustained.... we also need to see a sustained high level of seller activity. No houses to buy... no houses will be bought. But before anyone starts thinking that the balance in the market is changing, let's take a look at how negotiations are going these days...  Indeed, buyers and sellers in today's market will tell you that there is very little negotiating happening on price... unless you consider going well above the list price as negotiating. I listed three homes for sale last week... we had three offers on one, three offers on the second, and seven offers on the third. All are selling for more than the list price. So, even if buyer activity in the overall market is declining slightly, that might be simply a result of fewer sellers selling... because the competition for each singular listing is still quite fierce. So, no, Buyer Bruno, we certainly don't talk about negotiating. Nice try, though. OK, this next graph is what I've alluded to a few times earlier...  Yowzers! Contract activity was STRONG in March 2022! After a somewhat slow start to the year as far as buyer and sellers signing contracts to buy and sell... things took off in March! There were 187 contracts signed during March 2022, which was well above the 160 seen last March! And yes, as I alluded to a few times, this probably means we're going to see a rather strong month of closed sales in April. If that, indeed, happens, the slower month of March sales will then have quickly become a distant memory. Stay tuned. Maybe more buyers are buying (in March) because more sellers were willing to sell...  After many, many months of fewer and fewer homes for sale at any given time, we're finally seeing that metric staying stable and increasing ever so slightly. Maybe this is a win for buyers... at least inventory levels didn't drop any further? Whatever we can do to encourage home buyers in this market, let's do it, because it can be a discouraging time to try to buy a home right now! Below is another picture of why it can be discouraging to try to buy right now... and I guess this one is a reverse plateau...oops, a valley!?  This chart is measuring the annual trend of how long it takes for homes to go under contract once they are listed for sale. That very last data point of "5" means that over the past 12 months the median "days on market" was five days. So, half of the homes that sold went under contract in five or fewer days. So, so fast! This makes it somewhat more difficult to be a thoughtful, intentional, deliberate home buyer, because you are going to need to make a decision quickly!! And one last graph, that even shocked my Apple Pencil as I doodled on this month's graphs for you...  Yes, you are seeing that correctly. You can gasp as well if you'd like. Over the past two months, the average mortgage interest rate has risen from 3.55% to 4.67%. That was fast!?! For years now, I have incorrectly predicted that mortgage interest rates would really start to increase soon. As we entered 2022 it became clear that the time had really could when we would see rates start to increase... but I certainly wasn't expecting it to happen this quickly. Will rates push past 5% as we continue through the year? Will they stabilize between 4.5% and 5%? Any buyers who is hoping to buy in 2022 is carefully watching these rates as it relates to their potential monthly housing costs. OK! That brings us to the end of this month's recap of our local housing market. As you can see, there is a lot going on... home sales are slowing a bit, prices keep climbing, contracts are stronger than ever, interest rates are soaring... so much to watch as we move into the hustle and bustle of the spring market! Finally, some action items for you... [1] Go enjoy a meal at Vito's Italian Kitchen and take a friend, family member, or neighbor with you! [2] Are you preparing to sell your home this spring? Let's set up a time for me to swing by your house to walk through together and talk about house preparations, the market, the process and timing. Email me or call/text me at 540-578-0102 to get that process started. [3] Ready to buy? It can be done! Let's chat about what you hope to buy, and I can connect you with a few of my favorite lenders if you need some recommendations. Signing off now... reach out anytime if you need anything... and if you have a family member, friend, colleague or neighbor that is looking to buy or sell soon, feel free to send them my way. I'd be happy to help. | |

If Higher Mortgage Interest Rates Will Cause The Market To Shift, It Does Not Seem To Be Happening Yet |

|

In theory, as mortgage interest rates increase, some buyers will be priced out of considering some homes that they would like to purchase. If enough buyers are priced out of being able to afford their preferred home, maybe we will see fewer offers on homes listed for sale. If there are fewer offers on homes offered for sale, then perhaps buyers won't keep having to pay so much over the asking price. If buyers aren't paying so much over the asking price, maybe the 10% per year increase in median sales price in our area will start to move back to a more reasonable 3% to 4% per year. But, thus far, these are all just theories and possibilities, not actualities. Despite significant increases in mortgage interest rates over the past month (and 3 - 4 months) we don't yet seem to be seeing a decline in the amount of buyer interest in many or most new listings. I'll keep wondering if we will see that shift happening... and I'll keep crunching the numbers to see if there is evidence that it is happening... but if you are holding off on buying a home right now because you are absolutely certain that a shift is coming... it might be a long wait. | |

Do Not Despair, More Homes Will Be Listed For Sale Soon! |

|

If you're hoping to buy a home in the Harrisonburg area it can seem challenging to buy a home right now. After all, you might decide you want to buy a home in the Keister Elementary School district and then be dismayed to find that there are only two houses for sale right now under $500K in that area. Well! So, as you look ahead towards the next few months should you just expect to see one or two more houses become available in the Keister Elementary School district? I'm going to say a resounding, no! Over the past year there have been (60) single family home sales in the Keister Elementary School district under $500K! That's about five houses per months... so over the next three months there may be (15) houses from which to choose... or maybe even more since a greater number of homes are listed for sale in the spring and summer than in the fall and winter. Anyhow, if you're looking to buy right now, it will be challenging, and you'll have lots of competition... but the houses you see on the market today are not the only ones you'll be able to buy over the next few months. You'll need patience in waiting and then speed in pursuing! | |

Home Buyers Who Buy Houses Without A Home Inspection Should Do One After Closing! |

|

On many, many, recent offers on properties I have listed for sale buyers have not been including home inspection contingencies. This seems, in many circumstances, to be the only way to (hopefully) make your offer competitive enough to (hopefully) win out when there are multiple other offers in this frenzied seller's market. In a more balanced market, there are two general outcomes of a buyer having hired a home inspector to conduct a home inspection... [1] First, a buyer affirms their decision to buy based on new information gleaned during a home inspection that they did not know when viewing the house prior to making an offer. If the new information causes them to see the house in a significantly different light, they may very well ask the seller to make some repairs, reduce the price or they might decide not to proceed with the purchase. [2] Second, a buyer typically learns a lot more about the house than they knew before the home inspection. Even if the new information that they learn does not cause them to decide not to buy and does not cause them to try to renegotiate contract terms with the seller, it still helps them to understand what types of future home improvement or preventative maintenance they should anticipate in coming months and years. Given this second factor, particularly, my strong recommendation to home buyers in this current, frenzied market, is to hire a home inspector to inspect your home after you close on the purchase. You are likely to gain additional information and insight into the condition and systems of your home that will serve you well throughout your ownership of the property for years to come! | |

Many Home Sellers Are Enjoying Working Through Far Fewer Contract Contingencies |

|

I used to tell home sellers that they should expect to that we'll be working through three large, major, serious contingencies between the time that their house is under contract and when it makes it to closing... 1. Home Inspection 2. Financing 3. Appraisal We had to make over each of these hurdles, through each of these gauntlets to successfully make it to settlement. But, now, sellers are enjoying often only working through only two of these contingencies, or even just one of these contingencies. I recently listed a property for sale in the $300K range and we received six offers on the property within 48 hours of being on the market. None of the six buyers included a home inspection contingency. So, many sellers are finding themselves not needing to worry about making it through the home inspection process. On another recent listing six buyers did include an appraisal contingency and two buyers specifically said that they would be willing to pay $___ over the appraised value if the appraisal came in low. So, many sellers don't have to worry about an appraisal contingency at all, or not anywhere near as much as they had in the past. Thus, many sellers are finding the period of time between contract and closing to be much less stressful... and they realize that it is much more certain that they will make it successfully to closing. Buyers, on the other hand, well, yeah... you can imagine from my comments above... they are having to decide on each offer whether to include what used to be typical contingencies (inspection, appraisal) to protect their best interests. It's a bit of a crazy time right now, with a very imbalanced market, and thus far things are not seeming to be slowing down. | |

Rising Mortgage Interest Rates Are Causing Some Would Be Home Buyers To Adjust Their Target Purchase Price |

|

Have you heard? Interest rates are on the rise. In early January, the average mortgage interest rate was 3.22% on a 30 year fixed rate mortgage. Last week, the average mortgage interest rate was 4.67% on a 30 year fixed rate mortgage. That is quite an increase!!! Here are two examples of how that might -- and might not -- affect buyers. Buyer 1 - Buying Below Budget Our first set of fictional buyers was planning in January to buy a $450,000 home in Rockingham County while putting 20% down as a downpayment. Here's how things were looking in January with a 3.22% mortgage interest rate...

Here's how things are looking now with a 4.67% mortgage interest rate...

As you can see, these buyers will have to pay $300 more each month because of the increased mortgage interest rates -- but, they were originally qualified up to $600,000 so the $300/month increase is annoying and frustrating, but does not change their plans to buy a $450,000 home. Buyer 2 - Maxing Out The Budget Our first set of fictional buyers was planning in January to buy a $350,000 home in Harrisonburg while putting 10% down as a downpayment. Here's how things were looking in January with a 3.22% mortgage interest rate...

Here's how things are looking now with a 4.67% mortgage interest rate...

As such, here's how things really look for them if they are maxing out their $1,725 per month budget given these new mortgage interest rates...

As you can see, these buyers had to reduce their budget from looking at houses priced at $350,000 down to houses priced at $305,000. That's quite an adjustment, especially when home prices are currently increasing by 10% per year. So, what does this mean for our market? All this is to say that some buyers will *definitely* be affected by these rising interest rates -- finding themselves no longer able to buy the home they hoped to buy, or needing to lower the price point of houses they will be considering. At the same time, however, some buyers will still be able to afford to buy the same houses they had planned to buy -- though their monthly housing costs for having done so will certainly be increasing. If, in our local market, most buyers were maxing out their home buying budget, and thus now have to buy less expensive homes, that could cause values to stop increasing, or even to start decreasing. What is not clear is how many buyers in our local market were maxing out their home buying budget and how many had room to increase their monthly mortgage payment if needed. | |

Will Inventory Levels (of resale homes) Increase At All This Spring? |

|

Many homeowners thinking about selling their homes this spring are considering selling sooner rather than later... because of the super low inventory levels right now. There are certainly houses on the market for sale, but many are new builds, and thus if a buyer wants to go ahead and buy and be able to move into their home, they are likely trying to do so with very few houses from which to choose. The logic of listing your home sooner rather than later is something along the lines of.... List Now = zero (or very little) competition from other sellers List Later = likely more competition from other sellers I totally agree with this logic, and listing sooner rather than later makes a lot of sense, though I also am not 100% sure we'll ever get to the point this spring or summer where you will be listing your home for sale amongst much competition from other sellers. After all, if eager buyers keep snapping up each new listing as it hits the market, the collective inventory of competing listings will never grow. So, yes, my first recommendation is to list your home sooner rather than later -- though it will probably work out just fine to list a bit later as well. P.S. Buyers -- sorry there are so few options for you!!! :-/ | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings