Archive for May 2022

Will Home Renovations Surge In 2022 and 2023? |

|

This scenario seems to be very common right now... [1] We decided a year or two ago we wanted to sell our house and move to a bigger or nicer or different house. [2] We've been looking at houses, making offers on houses, but haven't been able to secure a contract on a house. [3] Mortgage interest rates have gone up quite a bit and we are now not sure if we want to trade in our 3.75% rate on our current mortgage (with only 20 years to go) for a new 30 year mortgage at 5.25% or higher. [4] Prices of homes we'd buy have increases significantly since we started looking to buy... and when that is combined with the higher interest rates, it really starts to affect our projected monthly payment. [5] Maybe we should stay in our current house and make some renovations or modifications to allow it to work better for us or to allow us to be more excited about staying for another 10+ years!? Staying and renovating won't be the answer for all buyers who have unsuccessfully tried to buy over the past year or two, but I think it is something more would be buyers will be considering given all of the factors outlined above. | |

Monthly Cost Of Median Priced Home Jumps Much Higher In 2022! |

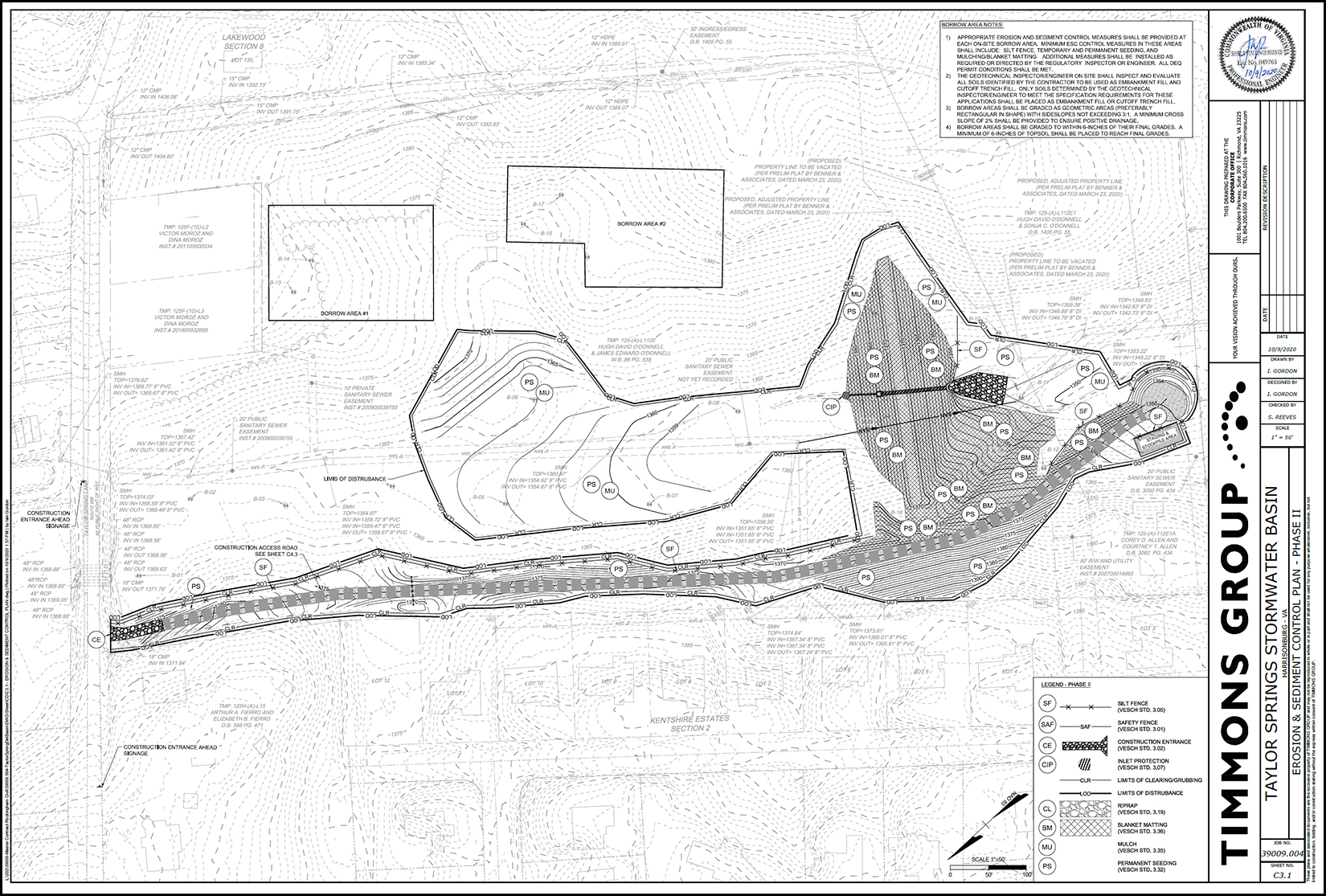

|

Wow. The monthly cost of a median priced home has jumped quite a bit in 2022! This is related to a variety of changes between 2021 and 2022... [1] The median sales price increased from $270,000 to $296,500. [2] The average mortgage interest rate increased from 2.96% to 4.27%. [3] The City real estate tax rate increased from $0.90 to $0.93. All of these factors, combined, resulted in a rather significant increase in the monthly cost of a median priced home in our local market. | |

Are We Seeing A Big Slow Down In Home Sales Activity Locally? |

|

If you read much national news you'll see plenty of headlines that say the housing market is slowing down... the housing market peaked... slower times are ahead for housing markets across the country. I'm sure that is all true, generally, nationally, and maybe in many markets. But, real estate is and has also been, local. Will the pace of home sales slow down in our local market? Maybe so. Will prices stop climbing as much as they have been in recent years? Maybe so. Are either of those things happening yet? Are we seeing a big slow down in home sales activity locally? It seems not. Properties going under contract in the past 30-ish days (April 25 - May 24) this year compared to last... Last Year = 170 contracts This Year = 162 contracts If things start changing in our local market, I'll be certain to be writing about it here... but just because you're reading it in the national news doesn't mean it is necessarily happening in Harrisonburg and Rockingham County. | |

Sales of Not New Homes Are Increasing Too |

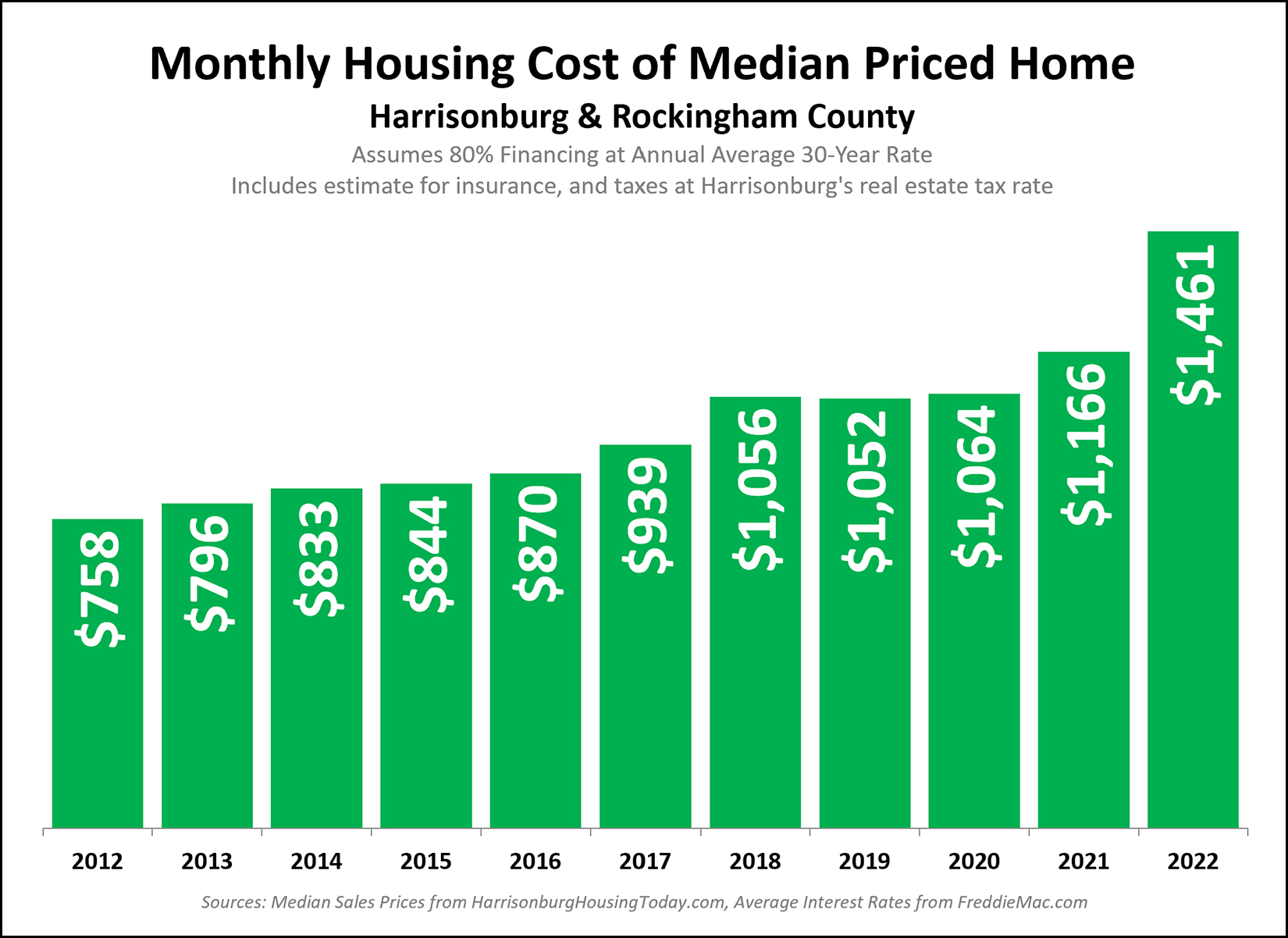

|

What do we call homes that are not new homes? Resale homes? Used homes? Existing homes? Previously owned homes? :-) Last week I pointed out that we are seeing a rapid increase in the sale of new homes in our market... a 39% increase in 2020 and a 68% increase in 2021. One might have thus wondered if ALL of the increases in our local area home sales can be attributed to new home sales. Well, the answer seems to be... no. As shown above, sales of not-new homes are increasing as well... a 10% increase in 2020 and a 5% increase in 2021. | |

New Home Construction Is Ramping Up in Harrisonburg and Rockingham County |

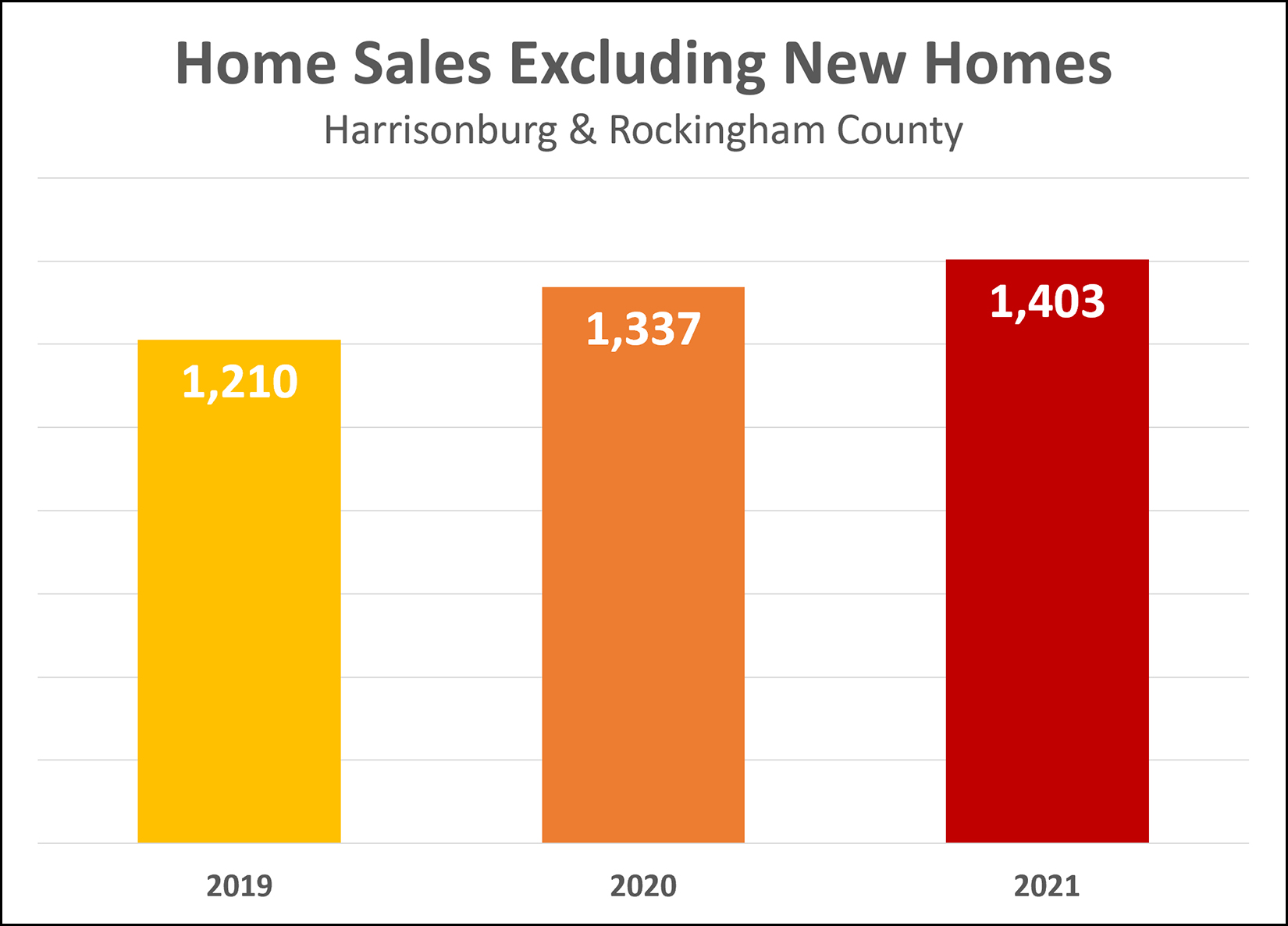

|

New home sales are on the rise in Harrisonburg and Rockingham County! After a 39% increase in new home sales in 2020, we saw an even larger 68% increase in 2021. What does 2022 have in store when it comes to new home sales? As of 5/19/2022 there have only been 77 home sales thus far this year... but there are 220 new homes under contract! Assuming all of those sell this year, we'd be at 297 new home sales for 2022, before any others that will come on the market in the coming months. New homes being built is one of the only ways we will be able to get out of this low inventory housing market. There are more people who want to live in Harrisonburg and Rockingham County than there are homes to house them. Keep on building, builders, keep on building! ;-) | |

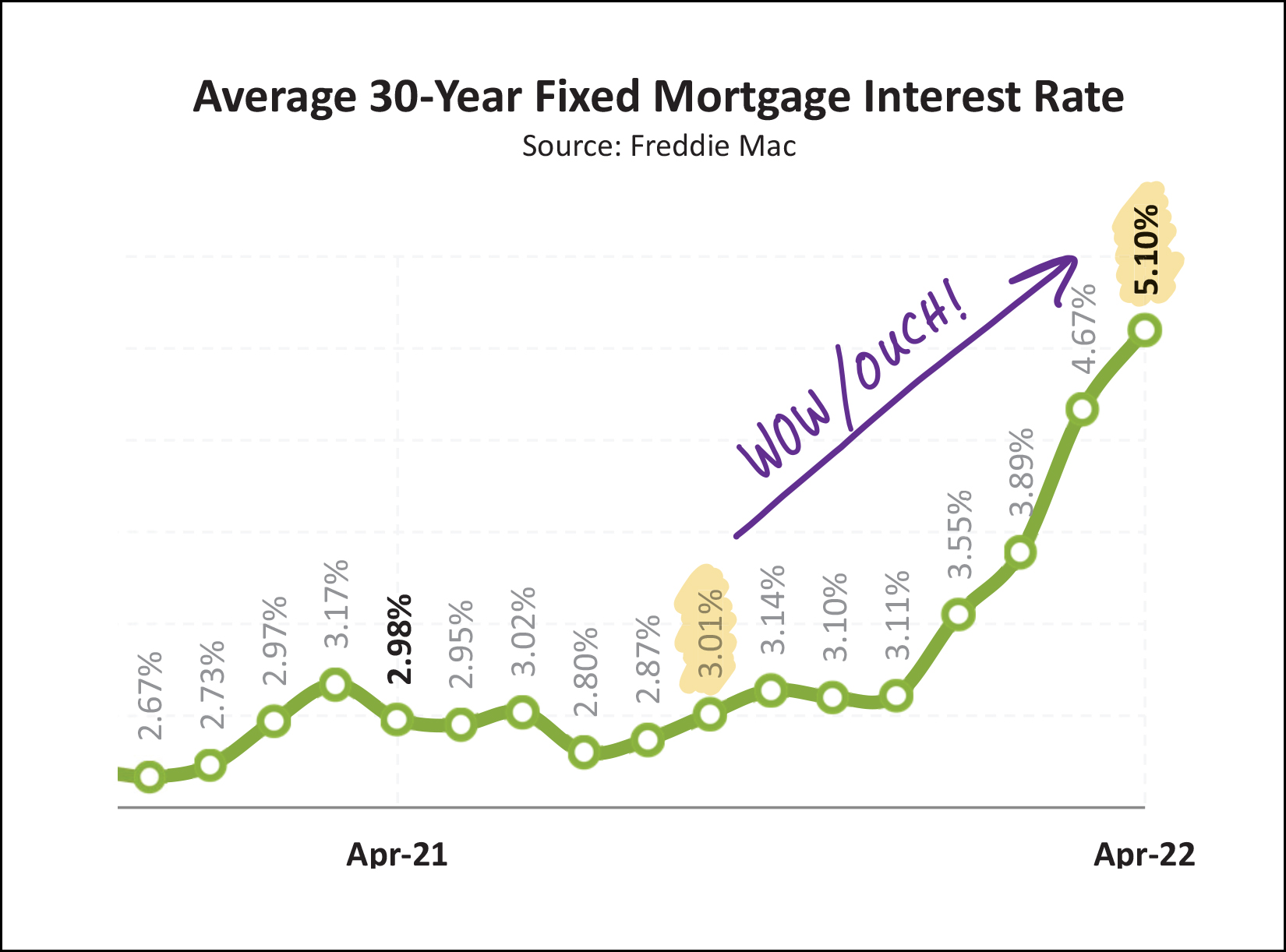

Reflecting On Large, Fast Changes In Mortgage Interest Rates |

|

For at least the past five years, I have remained convinced that mortgage interest rates would start rising... anytime. But month after month, year after year, interest rates did not rise... instead, they fell. But 2022 has been a bit different. If you had asked me anytime in the past five or ten years what would happen if mortgage interest rates increased from 3% to 5% in the course of just four months, I likely would have told you that the market would likely immediately and significantly slow down... not to a screeching halt... but certainly to a slower pace than before that enormous increase in mortgage interest rates. But, here we are, on the other side of rapidly increasing mortgage interest rates for the past four months, and the market seems to still be, doing pretty similar things to what it was doing before mortgage interest rates started rapidly climbing. Homes are still going under contract very quickly. Buyers are still often competing with multiple offers, including escalation clauses and waiving contingencies. Prices keep climbing. So, have the rising mortgage interest rates had any impact at all on our local housing market? I'd say yes. 1. Some would-be home buyers are no longer able to afford the homes they would like to buy. 2. I think some homes might be receiving two or three offers now instead of six or eight that they might have received before. 3. Some would-be sellers might not be selling after all as they see how their buying budget will be affected by higher mortgage interest rates. So, there have been changes in our local market as a result of these rapidly rising interest rates, they the higher rates have had a much narrower impact than I would have assumed in years gone by. One other point of trivia... the last time the average mortgage interest rate was 5.25% (or higher) was... way back in August 2009... almost 13 years ago! | |

Lake Shenandoah Stormwater Control Authority to Construct New Taylor Spring Detention Basin |

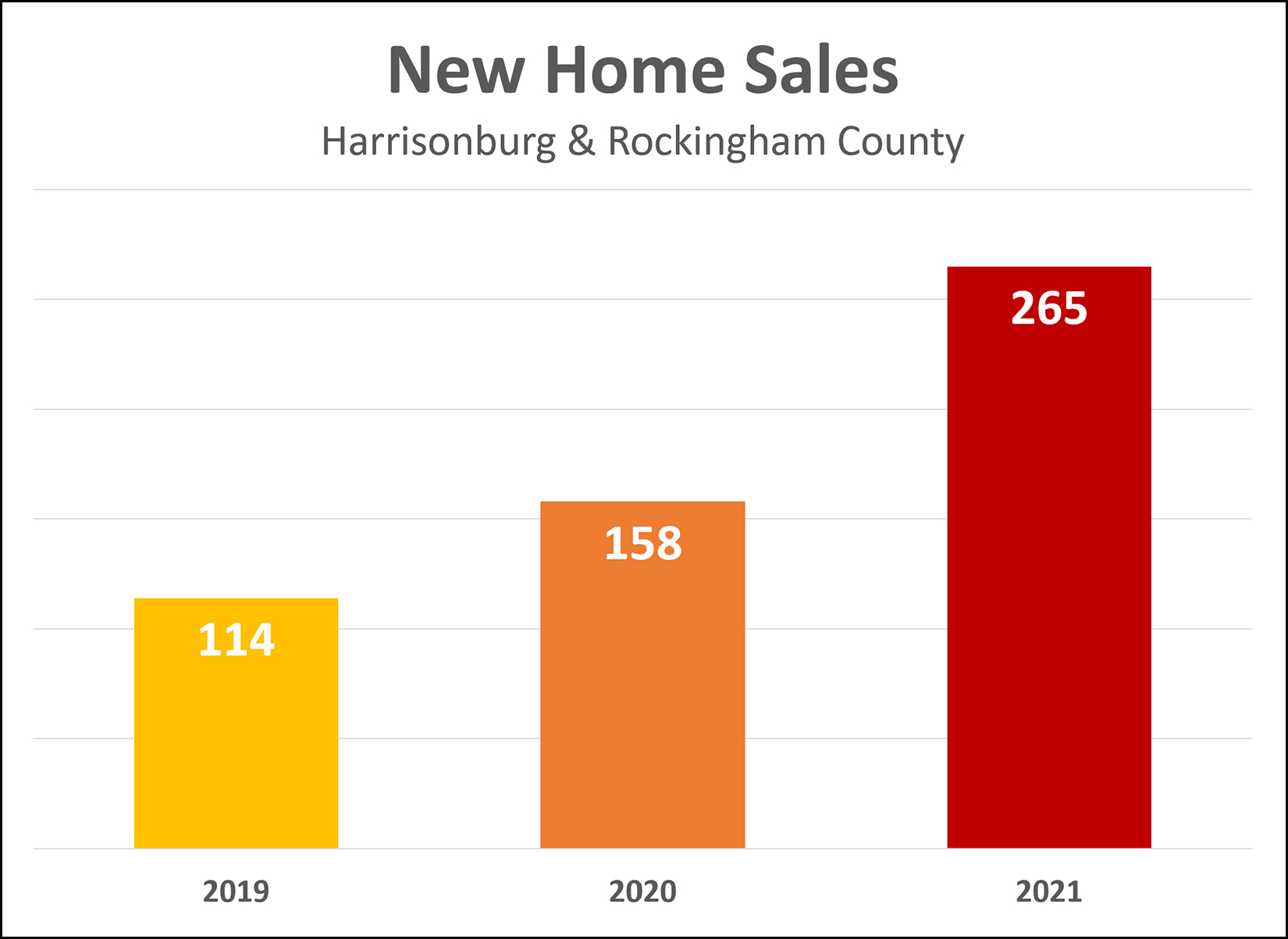

|

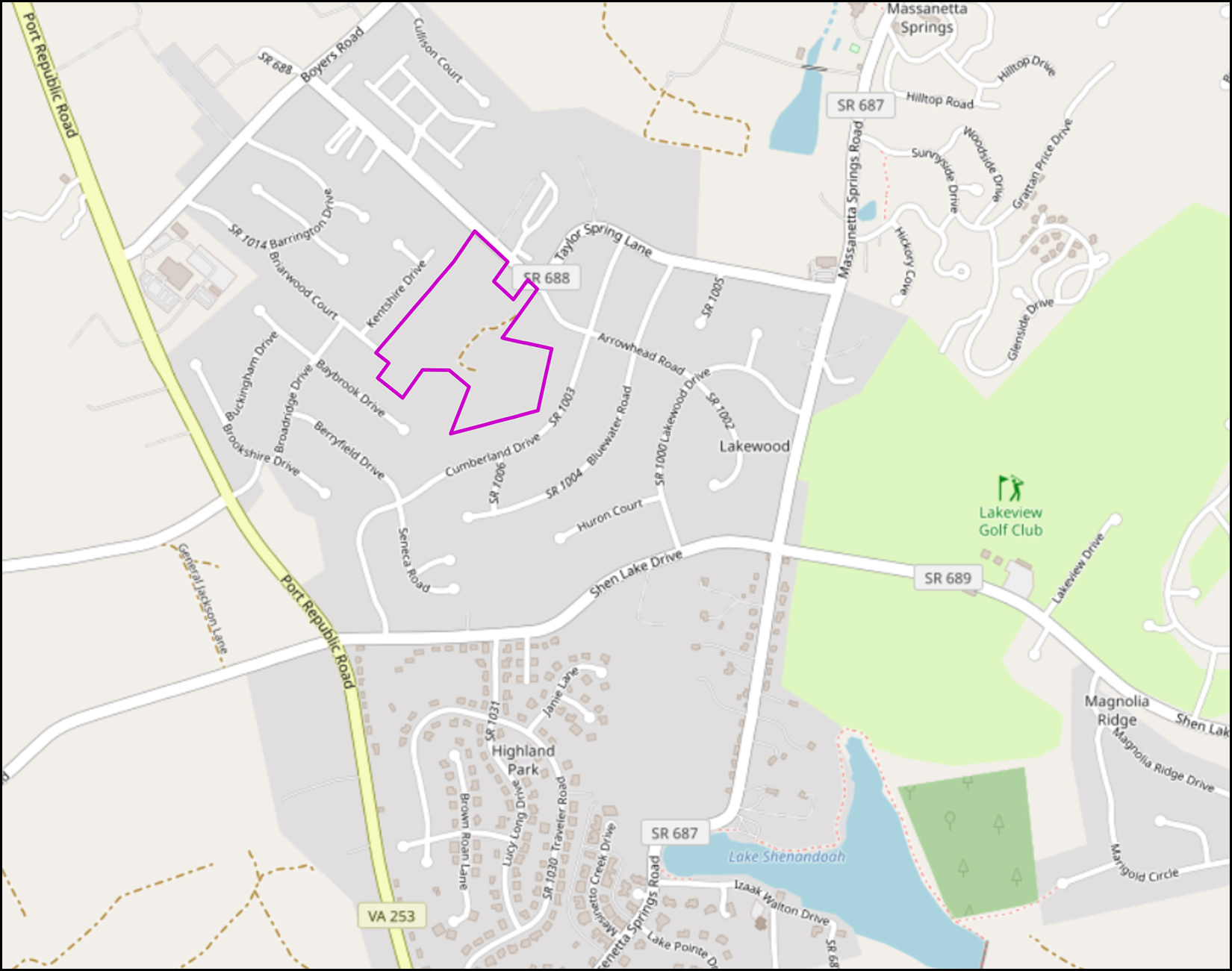

If you live in the Lake Shenandoah Drainage Area you are currently paying an additional tax alongside your real estate tax... with the new tax going to the Lake Shenandoah Stormwater Authority. The tax per property is based on $0.08 per year per square foot of rooftop area and went into effect in December 2020. Also in 2020, Rockingham County purchased a 28.878 acre property within the Lake Shenandoah Drainage Area for use as a stormwater storage area. Now, more details have emerged via an invitation to bid that closes today. Per the government documents, work is to be completed by December 1, 2022. This new stormwater facility will be located on land that is currently undeveloped between Barrington, Kentshire Estates, Lakewood, Taylor Spring and Taylor Grove subdivisions in the area outlined in pink/purple above. View engineering plans for the stormwater facility by clicking the image below... Update 5/26/2022: Rockingham County rejects single bid received | |

It Is Totally OK To Make Fast OR Slow Home Buying Decisions |

|

The housing market in Harrisonburg and Rockingham County is moving very quickly right now. The median "days on market" is only five days... which means that half of homes are going under contract in five or fewer days.

This fast moving market is largely caused by a supply and demand imbalance. There are more would-be buyers who want to buy than there are would-be sellers who are willing to sell. The fast moving market is resulting in very low housing inventory in just about every price range and location in our market. Given a quickly moving market and very low inventory levels, many would-be home buyers are thus concluding that they will likely need to make a relatively speedy decision about whether to make an offer when they see a new listing of interest. Some buyers, though, might feel like these current market dynamics (low inventory, quickly moving market) are forcing them to make rushed decisions. So, should would-be home buyers feel rushed and forced into making quick decisions? No. It is totally OK for home buyers in this market to make buying (or offering) decisions with whatever speed they would like. It is OK to move quickly in making a decision about an offer - and yes, that will likely increase your odds of being able to secure a contract on a house. It is OK to move slowly in making a decision about an offer - and yes, that will likely decrease your odds of being able to secure a contract on a house. But in the end... you get to decide how quickly you will make decisions about making an offer on a house in the current market. I won’t be rushing you to make decisions more quickly than you are comfortable... and current market dynamics shouldn’t be some external and magical force that rushes you to make a decision more quickly than you are comfortable. Let’s start exploring some houses together that you might want to buy, let’s come to understand the market as we go, and then you can make the decision about how quickly to make an offer based on your comfort level and based on how well any particular house fits your needs. It can be a stressful time to try to buy a home given current market dynamics, but it is totally OK to move at your own speed... whether that is fast or slow... or even if it starts off slow and then speeds up over time. | |

Inventory Levels Have Been Dropping For Almost An Entire Decade |

|

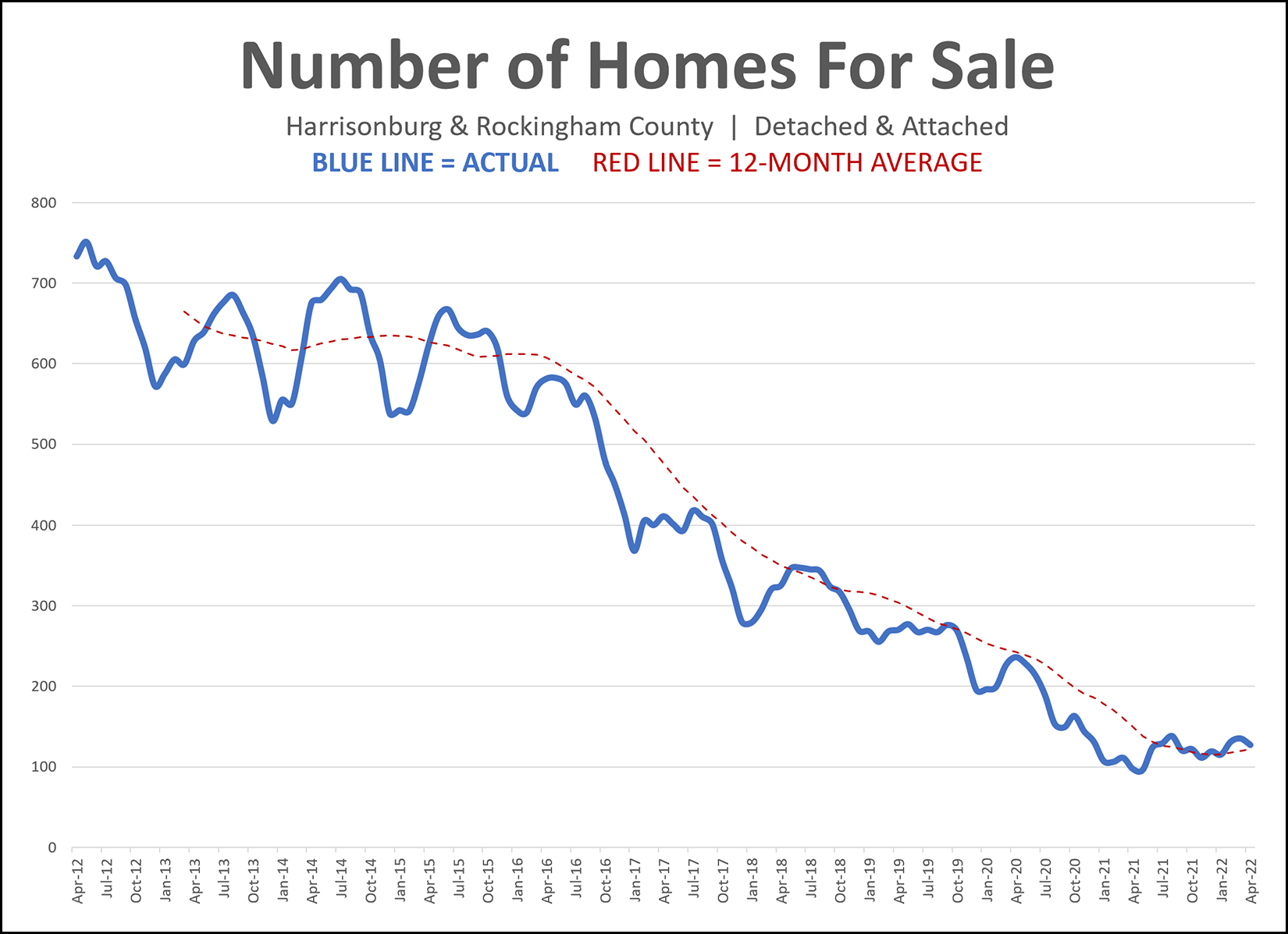

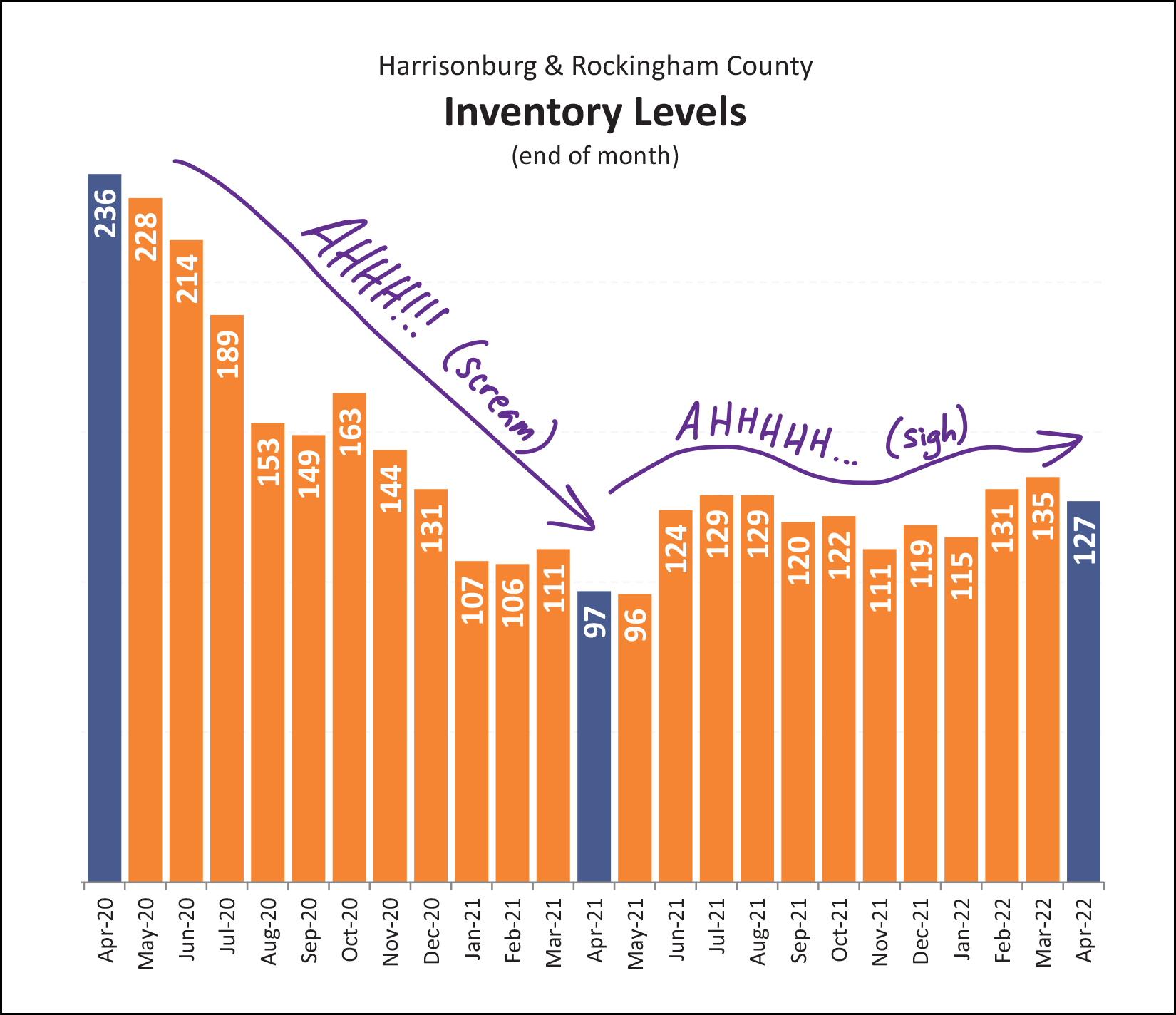

At the end of last month there were only 127 homes for sale in Harrisonburg and Rockingham County. Five years ago, at the end of April 2017, there were 411 homes for sale. Five years before that, at the end of April 2012, there were 733 homes for sale. Home buyers over the past year have had fewer options of what to buy at any given point in time than ever before in the past decade, and possibly ever before, ever. The low inventory levels don't mean fewer buyers are buying -- in fact, more buyers are buying on an annual basis than ever before. The low inventory levels are an indication that there is much more buyer demand than seller supply, so new listings get scooped up (go under contract) within a matter of days -- thus, not contributing to the inventory levels at the end of the month. | |

Home Sales Steady in 2022, Prices Still Rising Quickly! |

|

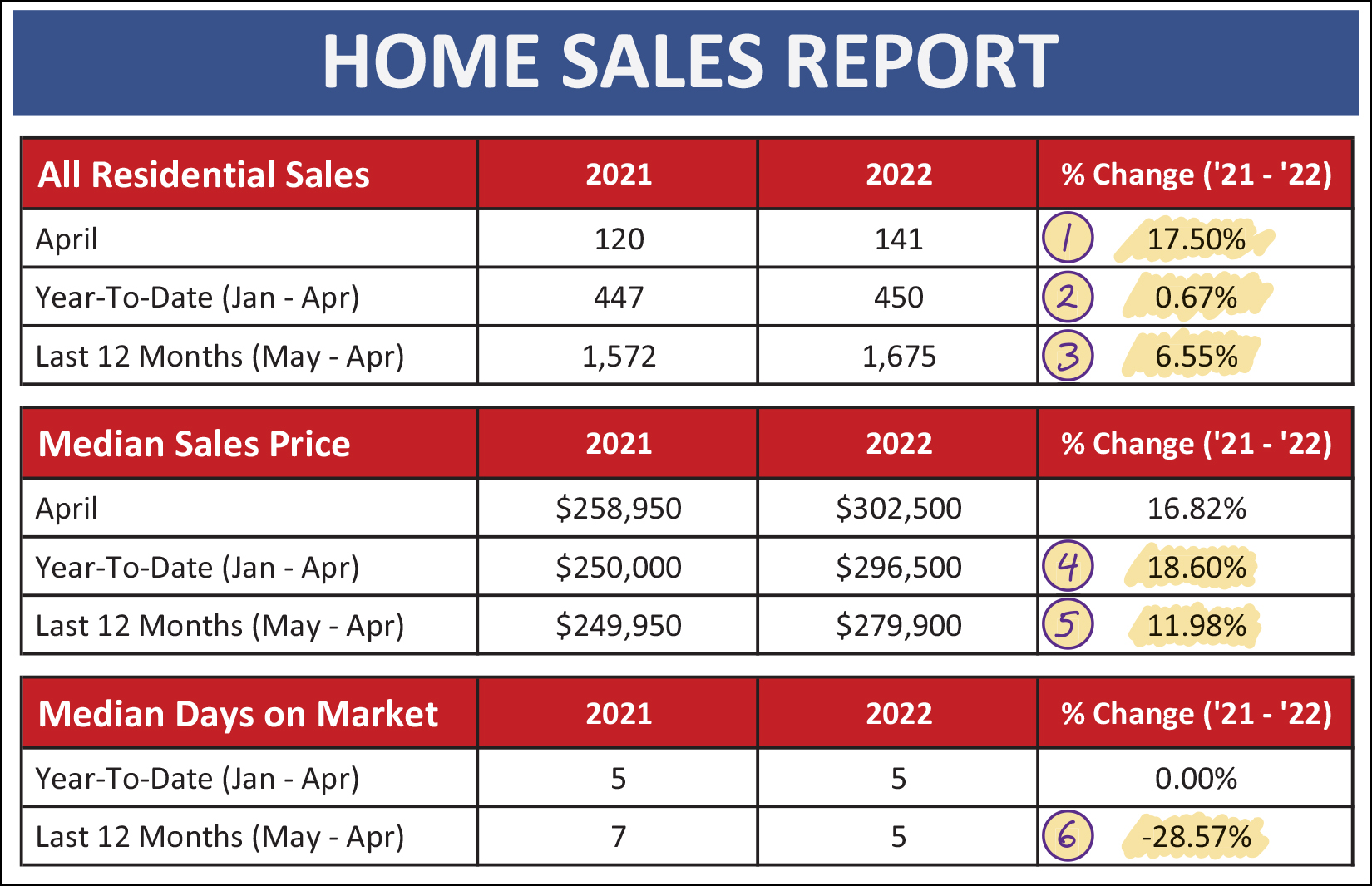

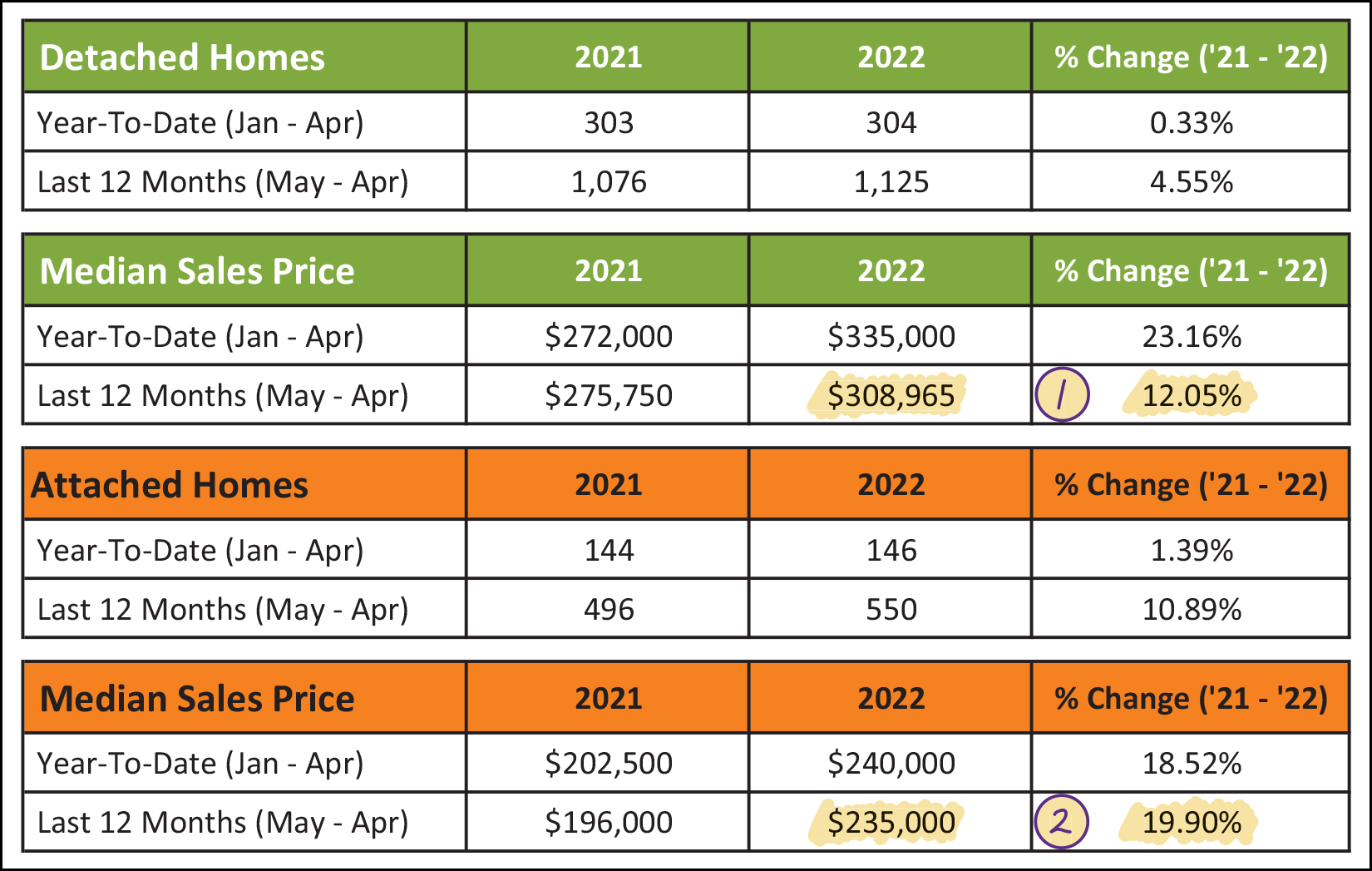

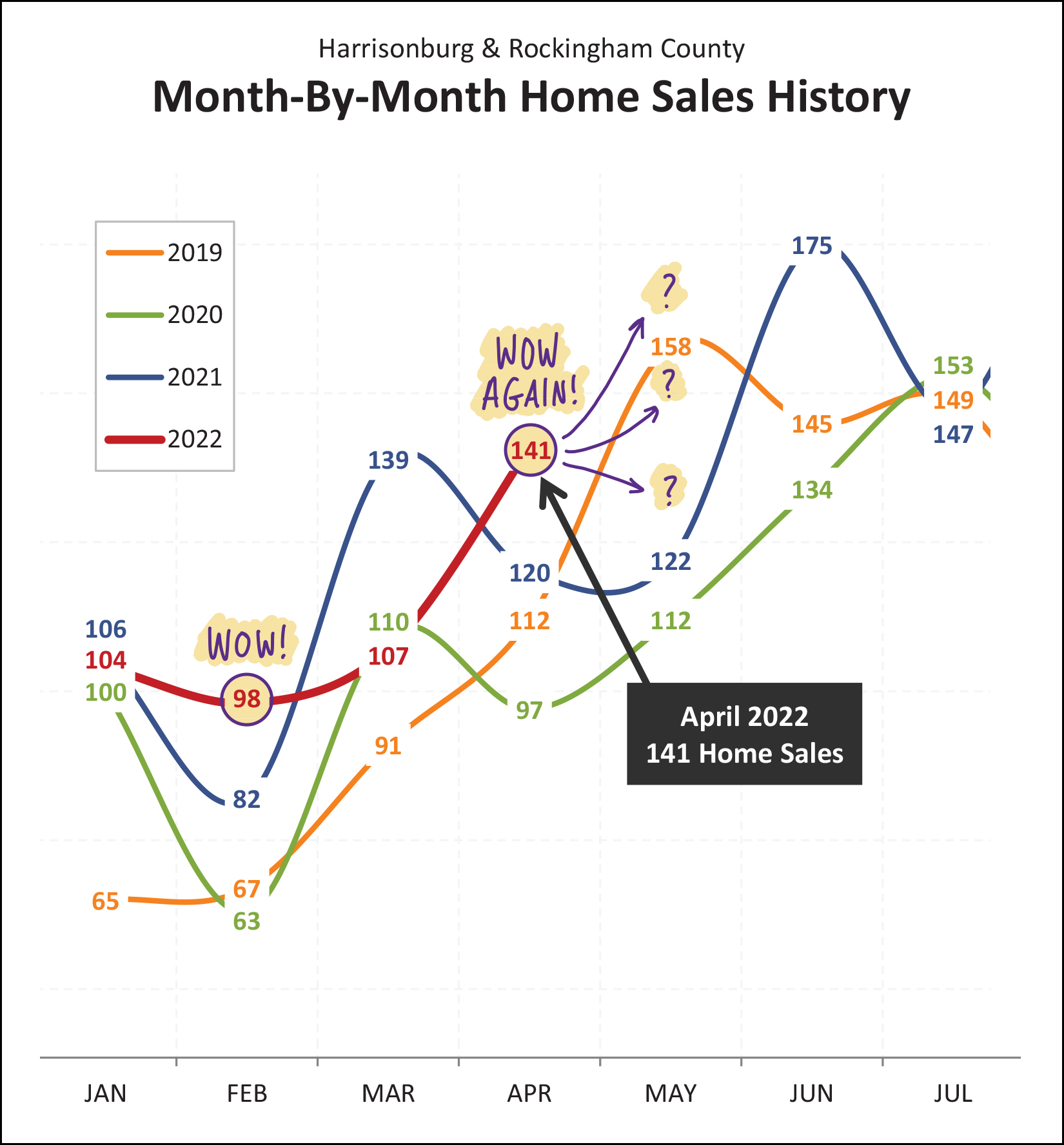

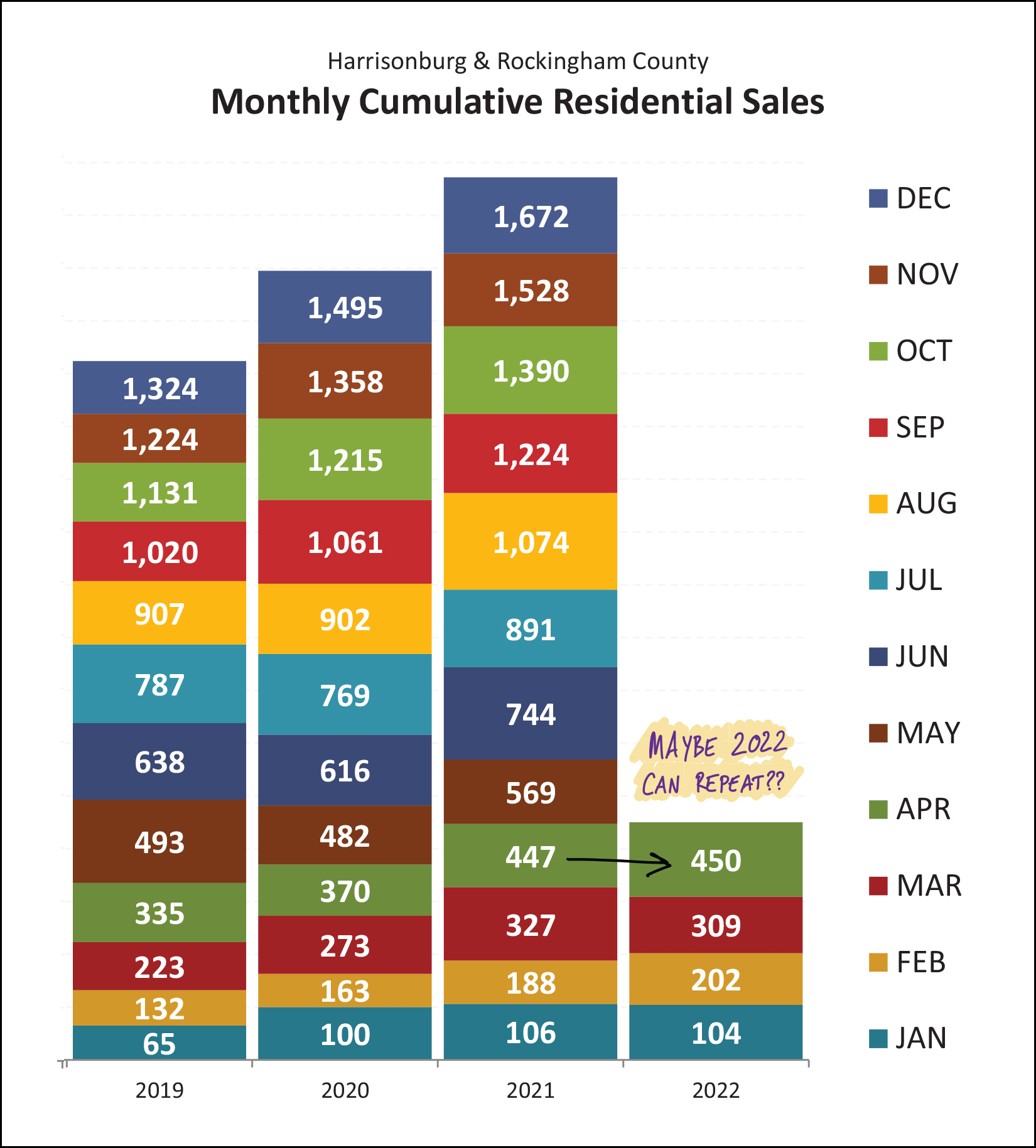

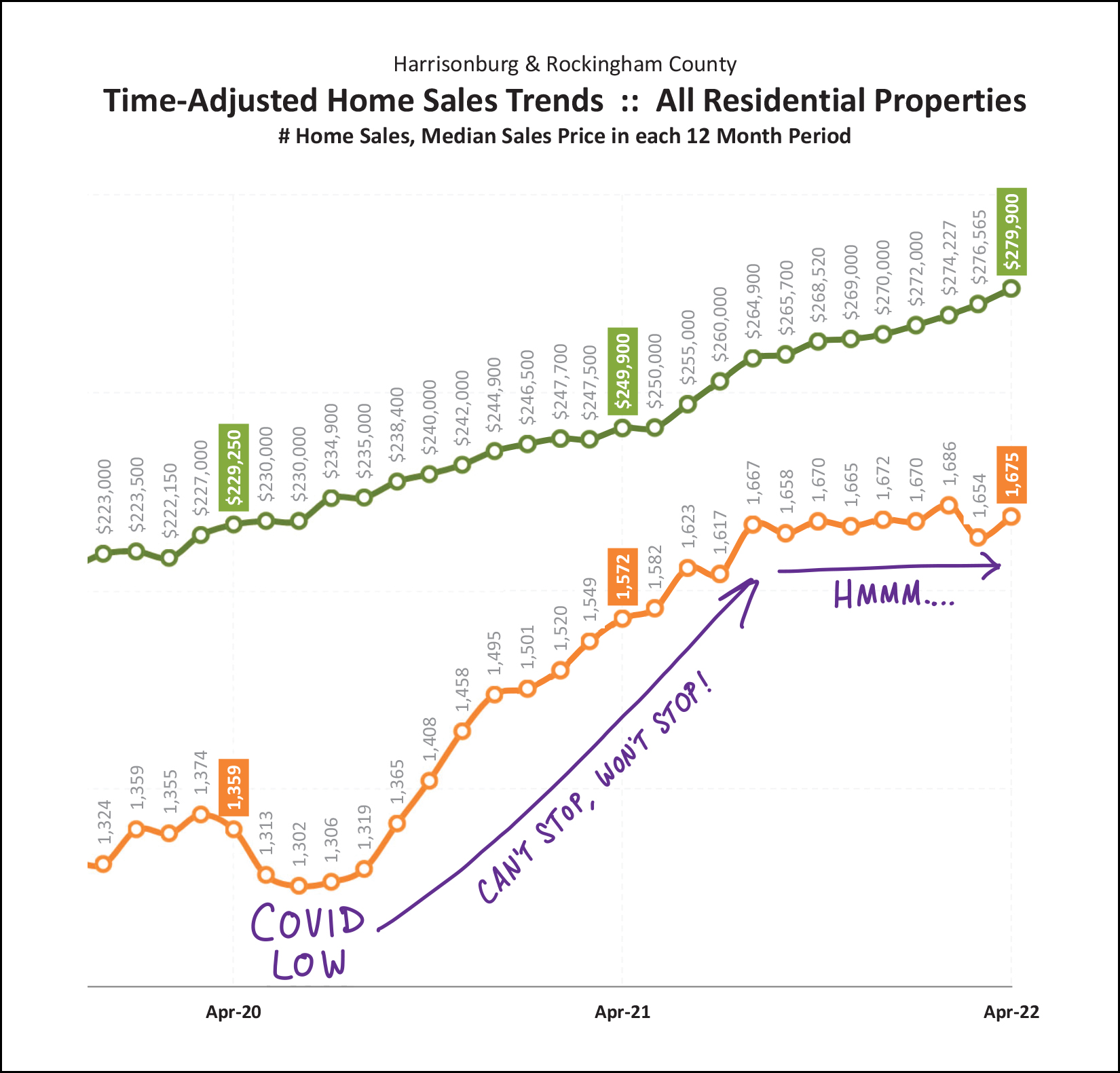

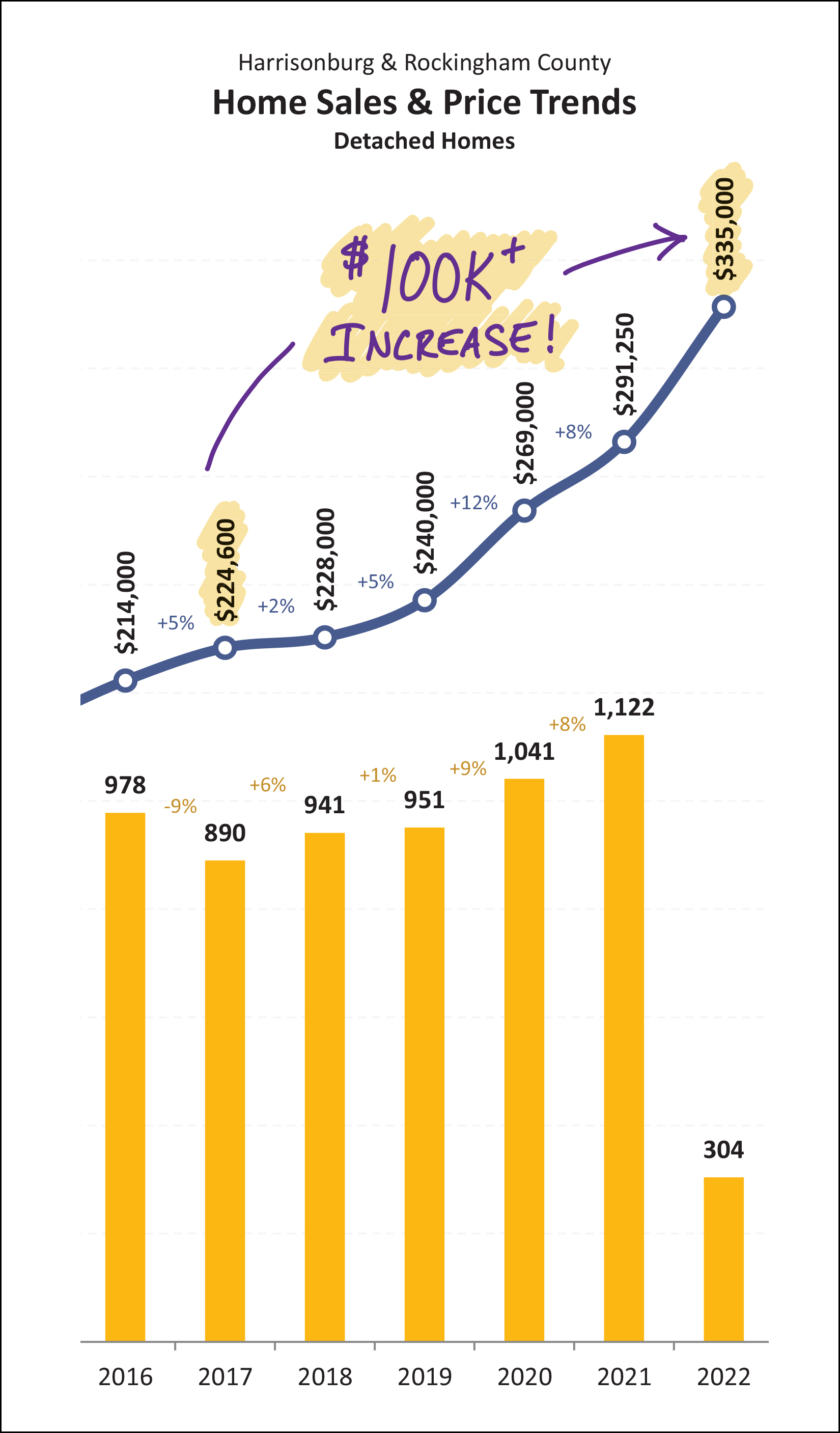

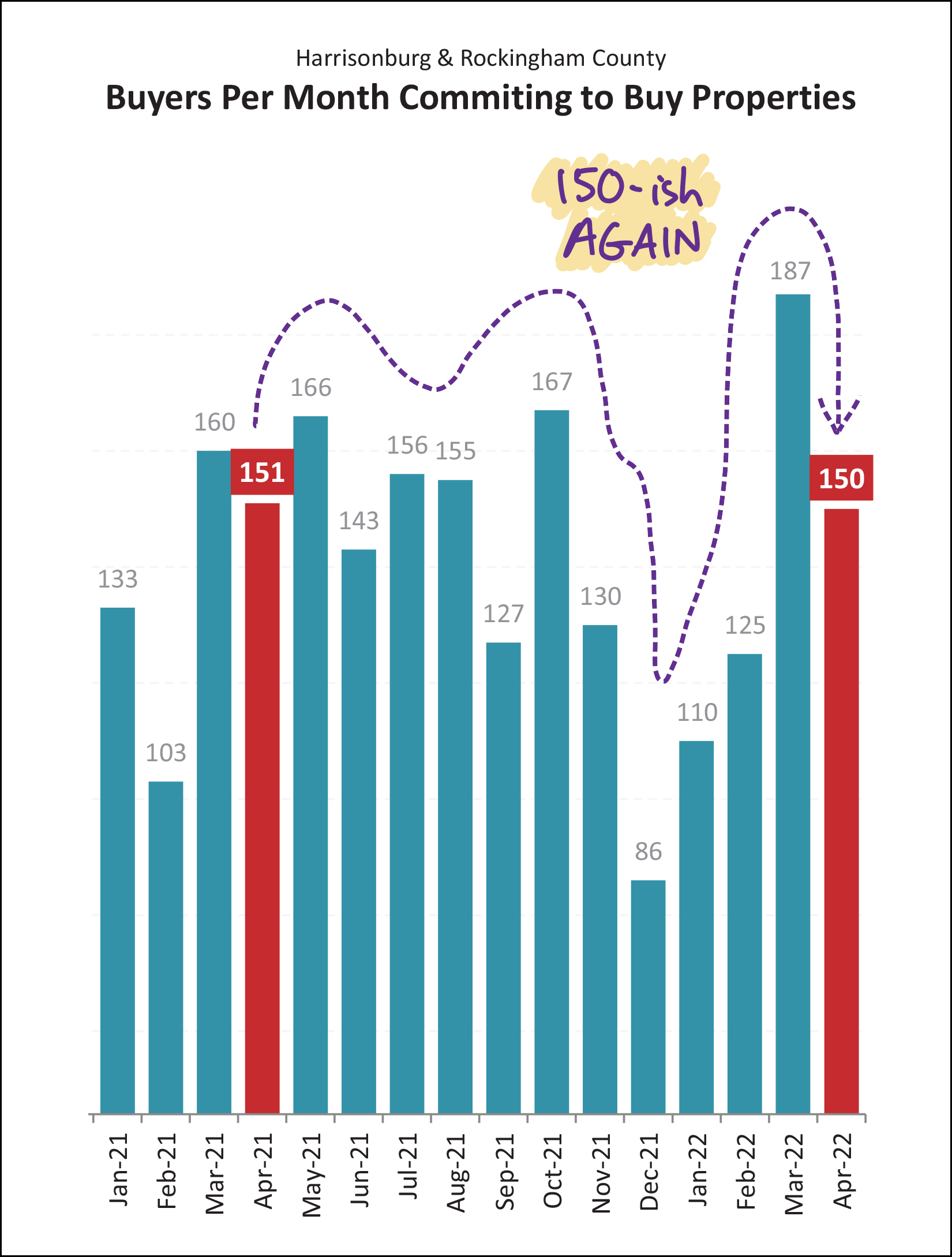

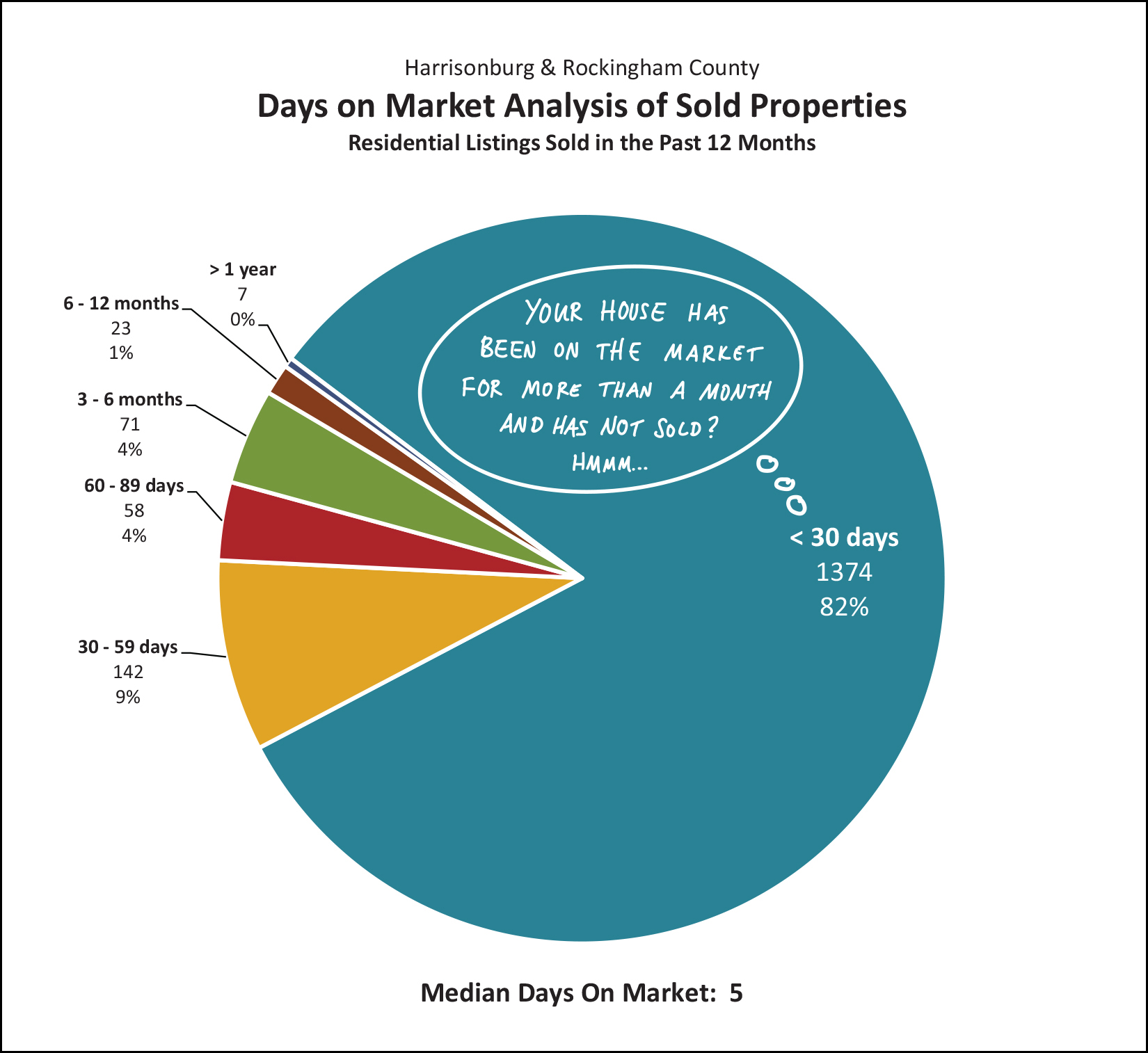

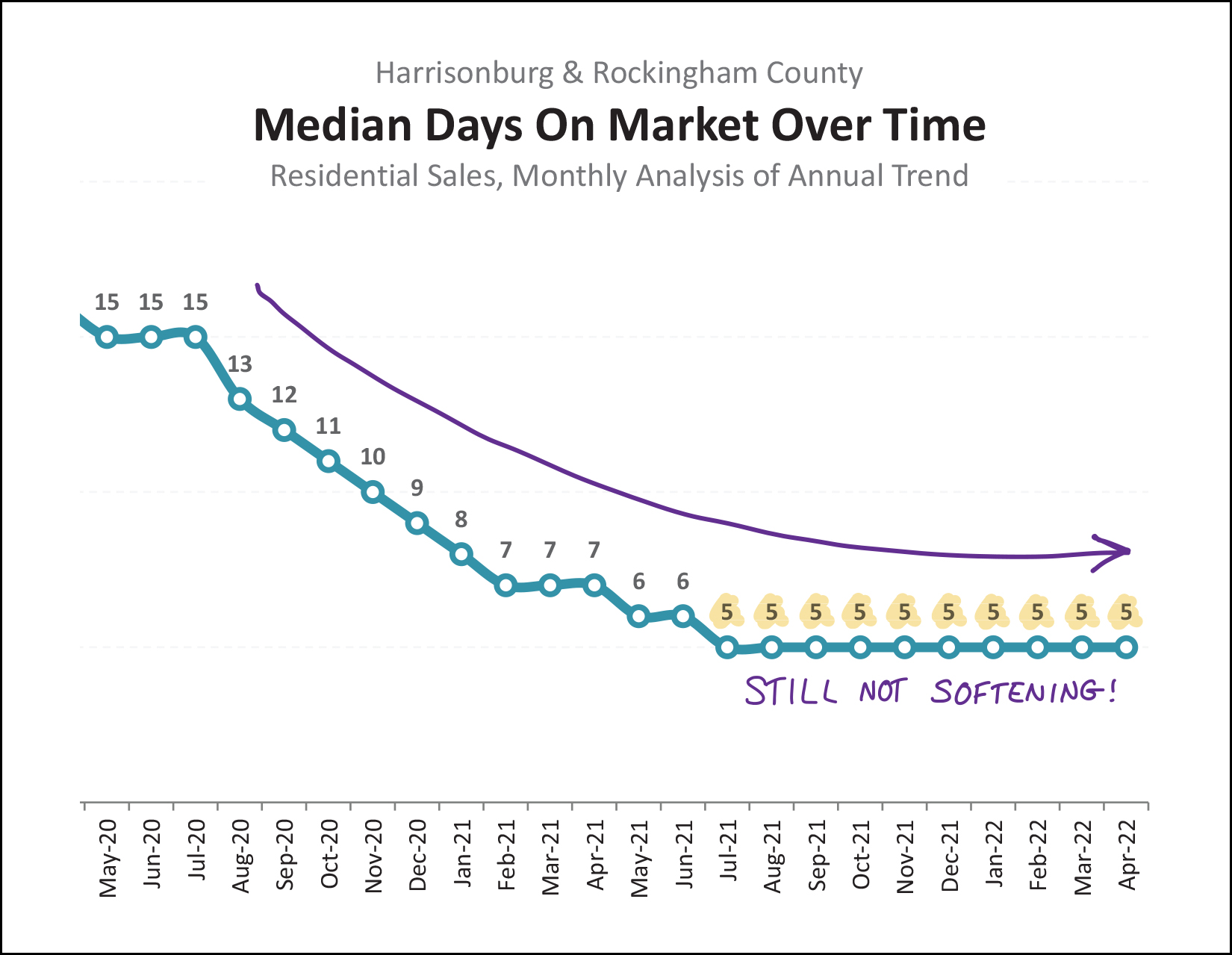

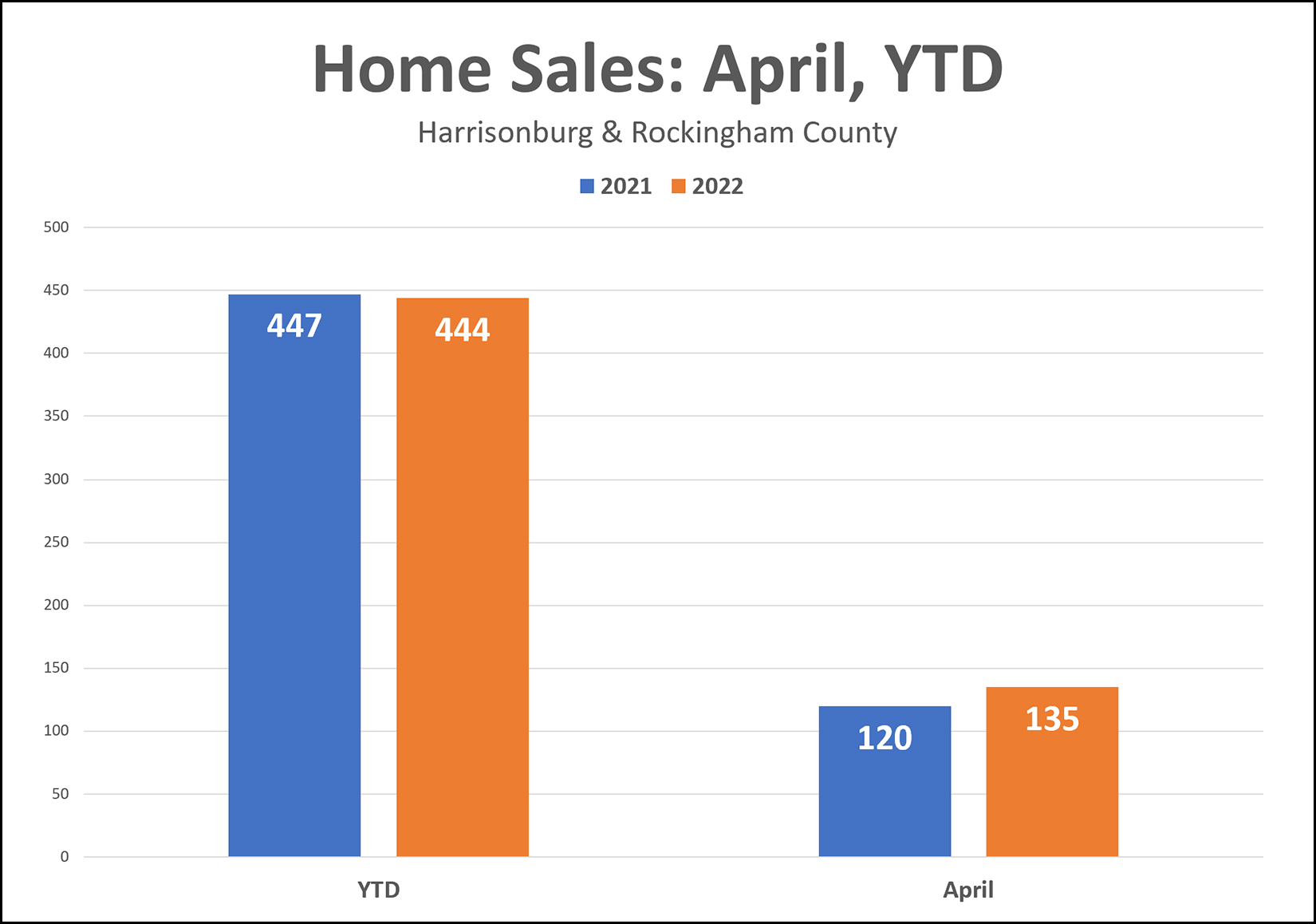

Happy Thursday morning, friends! It's definitely spring in the Valley (cool mornings, warmer afternoons, lots of rain, lots of sun) and spring is a busy time for many! Busy times in the Rogers household these days include college visits with Luke, baseball games for Luke and track meets for Emily...  Whatever has you running around this spring, I hope you are enjoying all that this season in the Shenandoah Valley has to offer and are finding opportunities to spend time outdoors (ok, or indoors!?) with family and friends. Before I get started on this month's market report, a few notes.. My Favorite Spots... Each month in this space I highlight one of my favorite spots to enjoy a meal, a cup of coffee, or as with this month, an experience. One of my favorite summer experiences is heading down to Natural Chimneys Park in Mt Solon for great music in the great outdoors at the Red Wing Roots Music Festival... a super relaxing and family friendly music festival featuring 40+ musical artists on five stages over three days, with great food, and activities for all, including camping, fun runs, bike rides, yoga, dancing and much more! Have you considered going to Red Wing but perhaps haven't been yet? Maybe this summer is the time for you to make it one of your favorite family traditions. I am looking forward to being there with my family and I'm hoping you'll join in on the fun... from June 24th through 26th. If you're interested in going to Red Wing, and haven't purchased your tickets yet, I'm giving away a pair of three-day general admission tickets. Click here to enter! I'll pick a winner in about a week. If you don't win, you still better come to Red Wing... and you can buy tickets here. Download All The Charts & Graphs... Looking for ALL the numbers and charts and graphs? Download a full PDF of my market report here. Now, then, let's take a look through some of the graphs together to see what we can learn...  Above you'll find many of the main market metrics I'm evaluating each month and there is plenty to note this month, with my notes below lining up with the numbers above... [1] We saw quite a few more sales this April than last April.. After only 120 last April, there was a 17.5% increase this April. As you may recall, March home sales were a bit slow this year, which caused some to wonder if the market was cooling off. Well, maybe it's not ready to cool off yet because April sales were hot, hot, hot! [2] Looking back at the first four months of the year there have been 450 home sales, compared to 447 sales during the same timeframe last year. Thus, home sales activity is tracking very similarly to how things looked a year ago. [3] If we broaden our view a bit more, to a 12-month window, we'll find that there have been 1,675 home sales over the past 12 months... compared to only 1,572 in the 12 months prior to that. Thus annual home sales activity has increased 6.55% over the past year. [4] The changes in sales prices over the past year is still somewhat staggering. The median price in the first four months of 2022 is 18.6% higher than it was in the first four months of 2021! [5] Again looking at a longer timeframe, the median sales price over the past 12 months has been 12% higher than during the 12 months before that. Sales prices are increasing quickly in our area! [6] Homes are selling faster, and faster, and faster yet. The median days on market over the past year has been five days, which is 29% faster than the seven day median in the 12 months before that. Wow! So, about the same number of homes are selling as last year... but at much higher prices... and more quickly! These quickly rising prices have caused to market metrics to pop over major (psychological) thresholds over the past 12 months...  [1] A year ago, the median sales price of a detached home was under $300K... at only $276K... and now it has risen above $300K to $309K. That is to say that half of detached homes that are selling in Harrisonburg and Rockingham County are priced at or over $309K. [2] A year ago, the median sales price of attached homes was under $200K... at only $196K... and now it has risen above $200K to $235K. That is to say that half of the attached homes that are selling in Harrisonburg and Rockingham County are priced at or over $235K. The times, they are a changing! Prices keep rising! Diving back into the details a bit, April was another surprisingly strong month of home sales...  The 98 home sales seen in February 2022 was a surprising jolt of energy for the early 2022 housing market, but then things cooled off a bit in March... or so it seemed. Come April, the buyers were back, and the monthly market activity was once again surprising... with 141 home sales, well above the monthly sales in April of each of the past three years. That extra burst of home sales in April caught 2022 back up with 2021...  Year-to-date home sales through the end of March 2022 (dark red bar) had fallen a bit behind where things were a year ago at the end of March 2021. But, then, enter April 2022. A strong month of home sales in 2022 pushed this year back ahead of last year when looking at the first four months of the year. Repeating the 1,672 home sales seen last year still seems like a might feat for 2022, but it is still seeming quite possible after four months of sales activity. Of interest, as it relates to home sales activity, it does seem that we have come to the end of the line of ever increasing numbers of home sales in our area...  From the start of Covid in mid-2020 to the end of 2021, we saw a rapid increase in the number of homes selling on an annual basis with that figure steadily increasing from 1,300-ish to 1,650-ish. Now, over the past nine months, we have seen the annual pace of home sales largely holding steady around 1,650 to 1,675 home sales per year. It seems unlikely that we will see another strong increase in the annual pace of sales, but it seems equally unlikely that we will see a rapid decline in the number of home sales in Harrisonburg and Rockingham County. Bouncing back to prices... which keep soaring higher and higher...  Here's a tidbit for you to share with a friend, relative or neighbor the next time you are talking about the crazy local real estate market... The median price of a single family (detached) home has increased by over $100,000 over the past... five years! That's rather astonishing. Just five years ago, the median price of a single family home was only $225K... and now it is up to $335K! Starting to look ahead now, let's examine contract activity...  Contract activity (as shown above) is a funny thing. In theory, it measures when buyers made decisions to buy homes... but in times of low inventory (as in, now) contract activity has just as much to do with when sellers are ready to put their homes on the market. Few sellers selling = few buyers buying. No sellers selling = no buyers buying. That said, a year ago (in April 2021) there were 151 contracts signed on homes in Harrisonburg and Rockingham County and in the month that just concluded (April 2022) we saw... 150 contracts signed. So, despite the monthly ups and downs that always do occur, we still seem to be pretty much on track in 2022 with how things were progressing in 2021. Looking ahead, it seems likely that we'll see around 140 to 160 contracts per month over the next four to six months. Now then, about those sellers and whether they are ready to sell...  After quite a few years of inventory levels tumbling downward, it seems that things may have finally leveled off at an equilibrium of around 130 homes for sale in Harrisonburg and Rockingham County. This is only somewhat of a relief... it's great that inventory levels aren't dropping further, but these current inventory levels still aren't doing buyers any favors. In many or most price ranges and neighborhoods there is nothing or next to nothing available for sale at any given time. For buyers to feel like things are improving, at all, we'd need to start to see a bit more inventory staying on the market at any given time. We're not there yet. Going hand in hand with very low inventory levels is the speed at which homes are going under contract...  Indeed, as noted above, if your home has been on the market for more than a month... and is still not under contract.... hmmm.... Right now, 82% of homes (that sell) are under contract within 30 days, and 91% are under contract within 60 days! The market is moving quickly, so if your house isn't moving quickly then you should have a chat with your Realtor to understand why. This next metric also looks at median days on the market, and I think it will be the first metric to start shifting if or when the market starts to soften a bit...  Over the past 12 months, the median "days on market" has been five days... and the market has been moving that quickly for almost a year now... since last July. At some point we will likely see the speed of the market start to slow down a bit... and that will be OK! If the median days on market of sold listings crept back up to seven days, or even (gasp!) ten days... the market would likely still (!!) be tipped in favor of sellers. But, despite talk of possible softening or deceleration of the market... it doesn't seem to be happening yet. And here is why some are thinking the pace of housing market activity could start to slow down a bit...  After quite a few years below 4% (and even below 3%) the average mortgage interest rate has quickly risen over the past seven months... from right at 3% to just over 5%! This can make a significant difference in the monthly payment that buyers will have to pay on their mortgage... so it has a good chance of impacting the amount of buyer interest in various houses at various price points. We haven't seen an overall market slowdown yet as a result of these rising rates, but it seems quite possible that if interest rates continue to rise we will see buyer enthusiasm dampen a bit. And with that... we reach the end of my monthly ramblings about the state of the local housing market. I hope the graphs above and my reflections herein have helped you have more clarity on the current happenings in our local housing market. Before signing off, a few reminders... [1] Make plans to attend the Red Wing Roots Music Festival this year. You won't regret it! Enter to win a free pair of three-day general admission tickets here. [2] If you are planning to sell your home, or move, or buy a home, this spring or summer, let's chat. I can swing by your house or we can start with a brief conversation by phone or email. Call or text me at 540-578-0102 or email me here. That's it! I hope the balance of your month of May goes well. Touch base anytime if I can be of any help to you or your family, friends or co-workers or colleagues... with real estate or otherwise. | |

If Your Home Has Been On The Market For More Than __ Days And Is Not Under Contract, Ask Yourself Why! |

|

Five short (long!?!) years ago -- back in 2017 -- the median days on market was 33 days. That is to say that half of homes that sold were under contract within 33 days and half took longer than 33 days to go under contract. So, back in 2017, if your house was on the market for more than 33 days, you had to start wondering why. Why was it taking that long for your house to go under contract. The same logic applies today, though the timeframe is quite a bit (!!!) shorter. The median days on market is now just five days (over the past 12 months) which means that half of homes are going under contract in five or fewer days and half are going under contract in five or more days. So... if your house is still on the market, and not under contract, a week after hitting the market (gasp!) you will probably want to ask yourself why a buyer has not contracted to buy it yet. Is the price too high? Did you not prepare the house well enough and some aspects of the condition of the house are making buyers less excited about it? Is the marketing of your house selling it short? Or, is there some aspect of your house that you cannot change that will cause it to take longer to sell? For better or for worse, within a week of having your house on the market you should have some very helpful feedback on your pricing, preparations and marketing. | |

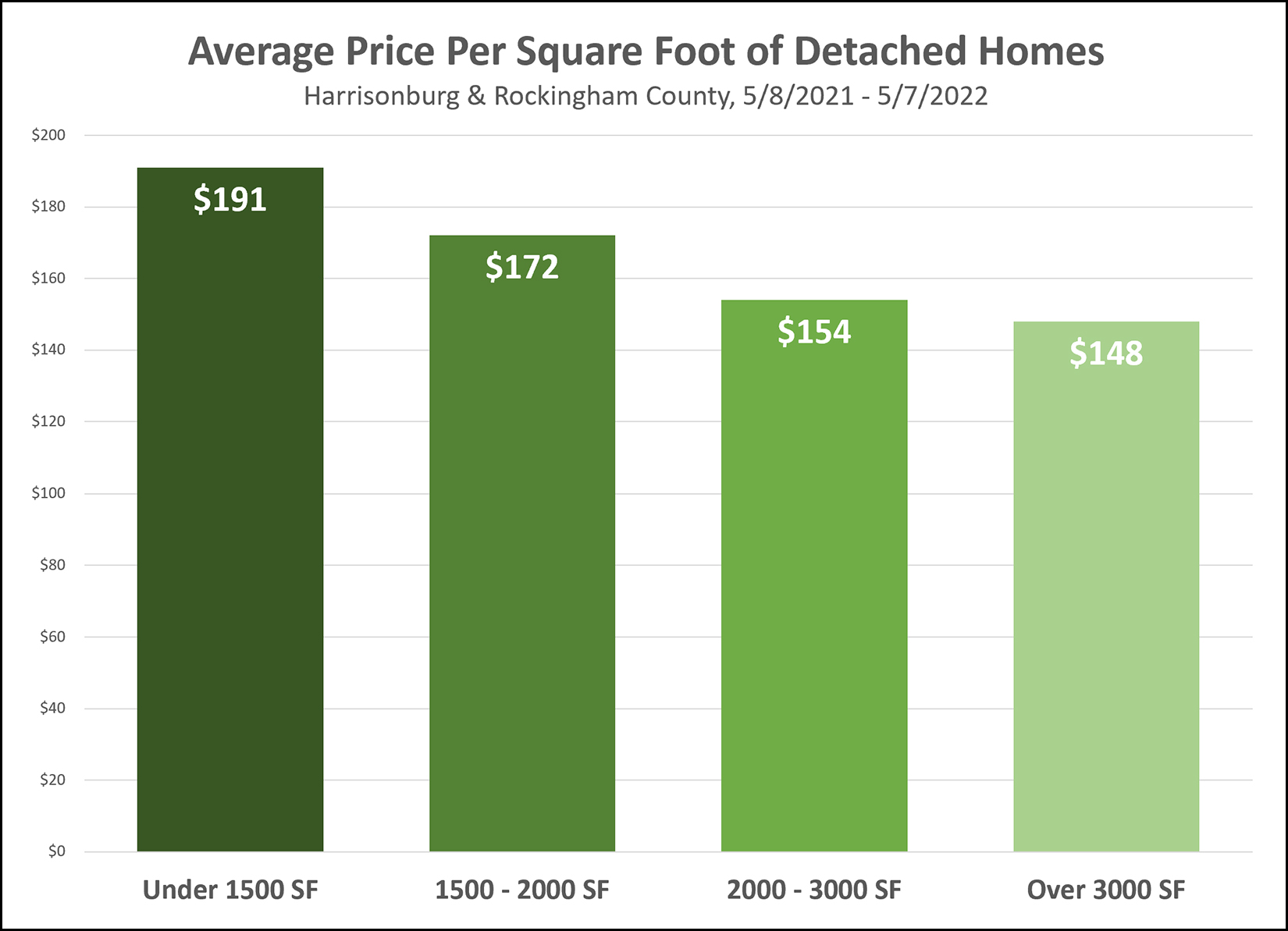

Generally Speaking, The Larger The Home, The Lower The Price Per Square Foot |

|

If all other attributes of two houses are the same or similar (age, condition, finishes, location, lot size) then we will almost always see the price per square foot being lower for the larger of the two houses if there is a decent difference in the sizes of the two houses. Stated differently, if we look at five homes that have sold in a neighborhood and we find the following... House 1 = 2,000 SF and sold for $168/SF ($336,000) House 2 = 2,050 SF and sold for $167/SF ($342,350) House 3 = 1,985 SF and sold for $168/SF ($333,480) House 4 = 2,025 SF and sold for $169/SF ($342,225) House 5 = 2,003 SF and sold for $167/SF ($334,501) ...and then if we looked at a sixth house in the neighborhood that is 3,000 SF, would it be reasonable to calculate the average price per square feet of the first five houses and then use that to calculate the value of the sixth house? Average PPSF of First Five Houses = $167.80 / SF Projected Value of Sixth House = 3,000 SF x $167.80 / SF = $503,400 So... is that reasonable? Will this sixth house sell for $503,400 while surrounded by houses that are selling for $330K to $345K? Probably not. Generally speaking, the larger the home, the lower the price per square foot. Thus, we can't reasonable use the PPSF of smaller homes to accurately predict the home value of a larger home. A seller would love to use the logic above to conclude that their home is worth $503,400 but buyers (and an appraiser) are not likely to agree. The reverse is also true... we can't use the PPSF of larger homes to predict the value of a smaller home. House 1 = 3,000 SF and sold for $152/SF ($456,000) House 2 = 3,050 SF and sold for $151/SF ($460,550) House 3 = 2,985 SF and sold for $150/SF ($447,750) House 4 = 3,025 SF and sold for $151/SF ($456,775) House 5 = 3,003 SF and sold for $151/SF ($453,453)...and then if we looked at a sixth house in the neighborhood that is 2,100 SF, would it be reasonable to calculate the average price per square feet of the first five houses and then use that to calculate the value of the sixth house? Average PPSF of First Five Houses = $151 / SF Projected Value of Sixth House = 2,100 SF x $151 / SF = $317,100 So... is that reasonable? Will this sixth house sell for $317,100 while surrounded by houses that are selling for $445K - $465K? Probably not. Generally speaking, the smaller the home, the higher the price per square foot. Thus, we can't reasonable use the PPSF of larger homes to accurately predict the home value of a smaller home. There is a place for using price per square foot for analyzing home value... but it depends on most attributes of all of the homes being very similar... location, age, lot size, finishes, and yes, square footage! | |

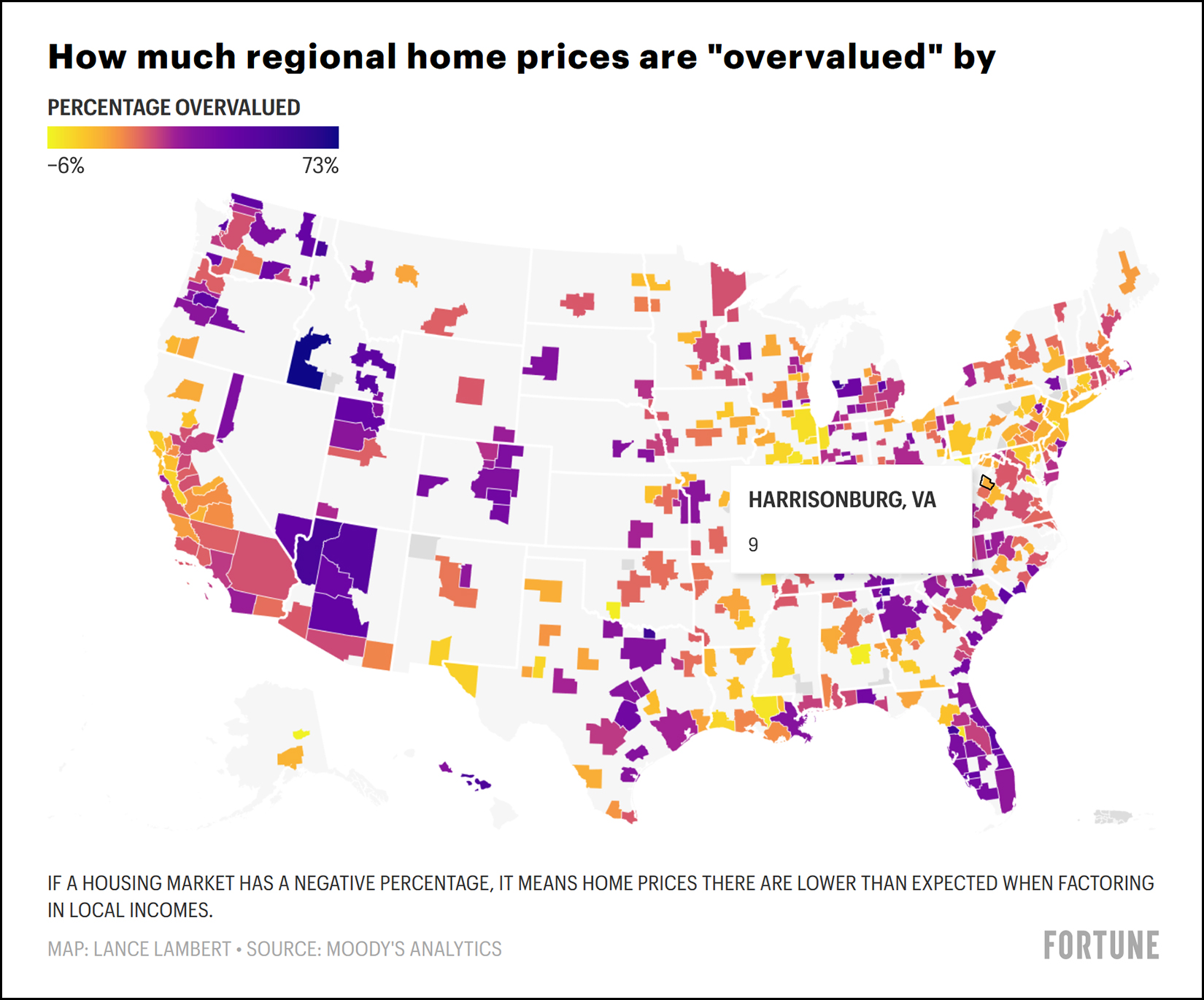

Is The Harrisonburg Housing Market Nine Percent Overvalued? |

|

There's a good article to read over at Fortune from earlier this week... In a nutshell... [1] Moody's Analytics believes the housing boom will wind down in the coming year, perhaps leading to no year-over-year home price growth a year from now. [2] Zandi, chief economist at Moody's, does not think we will see large price corrections, but some markets might. [3] Moody's ran an analysis of local housing markets within the context of local income levels to estimate which markets might be overvalued. [4] Of the 392 metropolitan statistical areas they studied, 149 markets are overvalued by at least 25%... with a high of 73% in Boise. As you can see from the map above (embedded in the article at the link above) the analysis by Moody's indicates that the Harrisonburg market may be 9% overvalued within the context of income. Read the entire article for much more commentary and further insights... | |

If Home Sales Are Going To Slow, April Did Not Show It |

|

Many wonder or suspect if home sales will slow in 2022 because of rising mortgage interest rates. That is certainly just one of the reasons why home sales could slow -- they could also slow because there aren't enough homeowners willing to sell their homes. Low supply = slow sales. Above, you'll see that we've seen just about the same number of home sales this year as last year during the first four months of the year. Furthermore, home sales this April were stronger than last April!? Finally, there are likely still some April home sales that closed this past Friday that aren't showing up in the MLS yet. So... if home sales are really going to slow down in 2022, it doesn't seem that April sales figures are showing that. Maybe things will slow down in May? Or maybe not! | |

Home Buyer Demand, While Possibly Reduced Due To Higher Interest Rates, Seems To Still Exceed Supply |

|

This is totally anecdotal at this time, so I'll see what the data seems to indicate when I compile my market later this month, but thus far.. Home Buyer Demand, While Reduced Due To Higher Interest Rates, Seems To Still Exceed Supply That is to that I suspect... [1] Buyer demand is decreasing, somewhat, due to higher mortgage interest rates. [2] The amount of buyer demand in the market is still greater than the amount of seller supply. Case in point - the anecdote - would be two very (!!) similar properties that came on the market over the past few months... The first property came on the market when the average 30-year fixed mortgage interest rate was around 4.3%. There were six offers within 72 hours. The second property came on the market when the average 30-year fixed mortgage interest rate was around 5.1%. There were three offers within 72 hours. So... yes, I think higher rates will reduce buyer demand, but that reduced demand might very well continue to exceed available supply for some time to come! | |

Take Them A Meal Launches New Mobile Friendly Website |

|

Most of the time, I'm helping folks buy and sell real estate. But... in my "spare time" I help run a website that my friend, Adina, and I created 14 years ago... TakeThemAMeal.com. What is Take Them A Meal? It's an easy (and free!) online tool for coordinating the delivery of meals to loved ones. If someone is ill, elderly, or welcoming a new baby, oftentimes family, friends, co-workers, and church members will rally around these families to take them meals. This past weekend we launched a totally new version of the website that has a fresh new design and is mobile friendly. Tomorrow, back to talking about real estate again. ;-) | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings