Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Monday, September 19, 2022

Well, then.

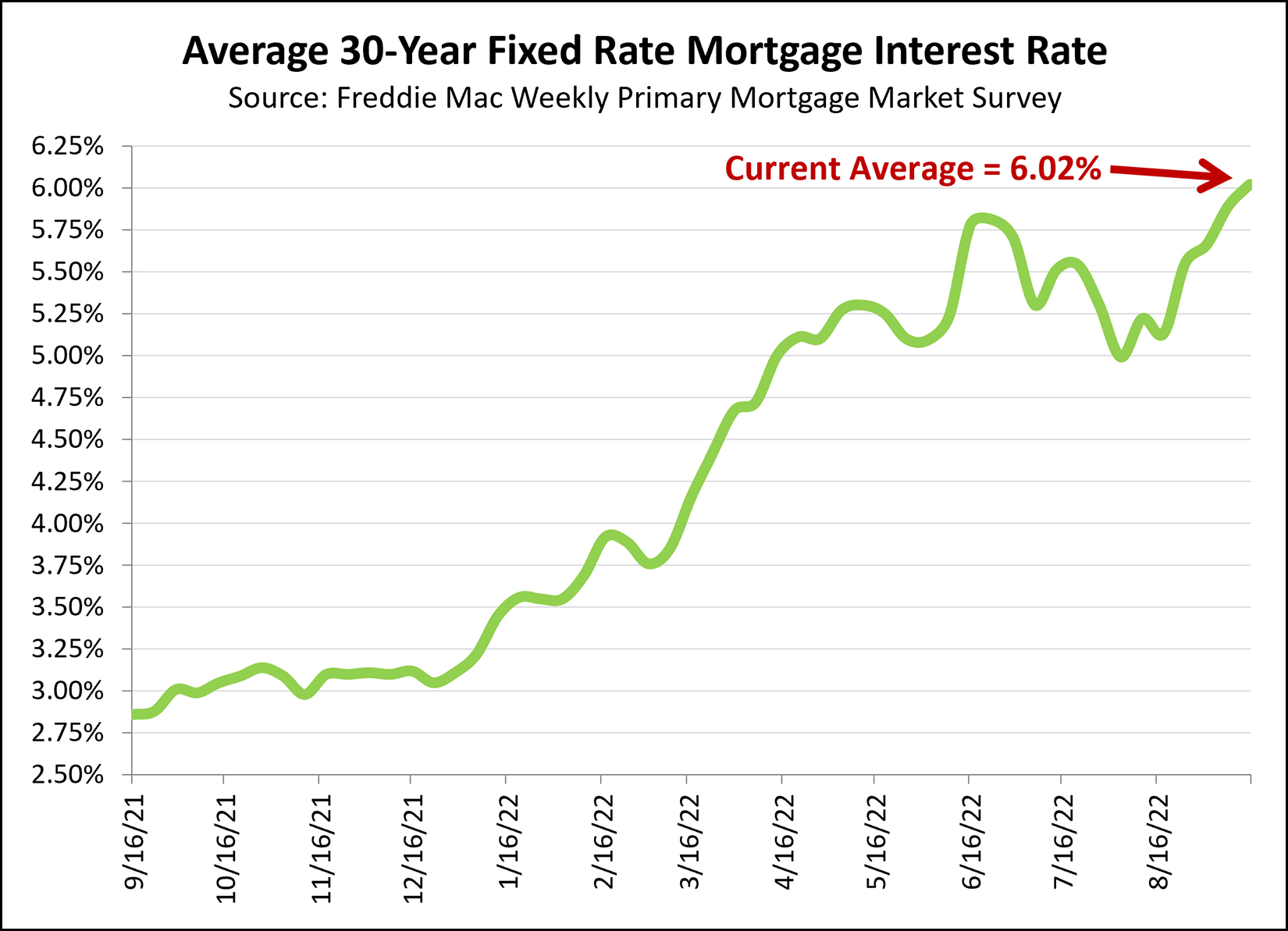

A year ago, the average 30 year fixed rate mortgage interest rate was under 3%.

Today, the average 30 year fixed rate mortgage interest rate is 6.02%.

Yikes. Clearly, this affects mortgage payments rather significantly.

Now, to create at least a bit of context...

[1] Nobody really thought 3% mortgage interest rates were normal or sustainable. They were great, of course, for home buyers... but I don't think anyone really thought they'd stick around for as long as they did.

[2] In some ways a buyer's monthly housing costs were held abnormally low by those abnormally low mortgage interest rates. So, while monthly housing costs have increased significantly over the past year given this shift in interest rates... it wasn't really from "normal" to "high" - it was more of from "low" speedily through "normal" and then to "high" today.

[3] The last time this average 30 year fixed rate mortgage rate was above six percent was back in 2008. It's been a bit.

Will mortgage interest rates continue to rise? Will they hover around six percent? Will they drop back into the five point something range? Stay tuned to find out.

In the meantime, some home buyers today are opting for an adjustable rate mortgage instead of a fixed rate mortgage. The average rate for a 5/1 ARM is currently 4.93%. This type of mortgage product will keep that 4.93% rate for five years and then can adjust once per year thereafter.