Archive for March 2023

Home Sellers Often Sell Homes Perfect For First Time Buyers... To Investors |

|

Over the past few years, townhouses in or near the City of Harrisonburg between $175K and $250K have been a hot commodity! This type of property is perfect for first time home buyers... ...but... ...this type of property has also been quite attractive to investors. And, what is a seller to do when receiving the following three offers on their townhouse... [1] An offer from an intended owner occupant contingent on the buyer financing 95% of the purchase price. [2] An offer from an investor contingent on the buyer financing 75% of the purchase price. [3] A cash offer from an investor. If all other terms (price, contingencies) were equal, most sellers would find the third offer to be most preferable, followed by the second offer. The first offer would be the least favorable to most sellers. For many or most sellers, the amount of a buyer's downpayment (5%, 25%, 100%, etc.) is often a proxy for certainty of successfully making it to closing. If a buyer already has the cash to buy the property - wonderful! If a buyer has 25% of the purchase price as a downpayment - still pretty good! If a buyer only has 5% of the purchase price as a downpayment - not as ideal. And as you can imagine from the information outlined above, so long as there are investors making offers on properties that would be perfect for first time buyers.... the investors will probably be the ones securing the contract to buy said property. So what? For Sellers - This is not a problem at all. Having a variety of offers from which to choose is... ideal! For Investor Buyers - This is great. It's nice having a leg up over some of the other competing buyers. For First Time Buyers - This stinks. I'm renting a townhouse now... and you're telling me I can't manage to buy a townhouse because I'm competing against investor buyers who are going to buy townhouses and then rent them out to people such as myself? Ugh. How do we break the cycle? Indeed... if there were a desire to make this dynamic / situation "work better" for first time buyers... how would it be done? [1] Individual sellers could certainly opt to sell their townhouse to first time buyers with less favorable (less certain) financing. [2] Investors could (maybe?) eventually decide to stop buying as many properties as rental properties if prices (or interest rates) are or become too high to make that type of an investment feasible. [3] The City could provide a financial incentive to sellers of properties under $250K (for example) if they sold them to first time buyers. ;-) It's hard to imagine this one happening but it could be an interesting strategy for the City to utilize to attempt to increase home buying opportunities for first time buyers. | |

Why Are Housing Inventory Levels So Low In Harrisonburg And Rockingham County? |

|

First, Harrisonburg is a popular place to live. Beyond everyone who is living here now, we continue to see new folks planning to make Harrisonburg their home, including but not limited to...

So, lots of people want to make Harrisonburg their home. Second, I think that more people are moving to Harrisonburg than new housing units are being built. If over a five year period, 5000 new people decided to make Harrisonburg their home, we wouldn't see a change in availability of housing if we also saw 5000 new housing units built. I think that the amount of new moving to (or attempting to move to) Harriosnburg over the past 5 to 10 years has exceeded the number of new housing units built during that same timeframe. Third, I think there is an imperfect match between what home buyers want to buy and new housing units that are being built. First of all, plenty of the new housing units that have been built over the past ten years have been rentals - apartments or otherwise - which hasn't helped provide housing for would be home buyers at all. Furthermore, the "for sale" housing that is being built in this area certainly meets the needs of some buyers, but probably not most or all buyers. If you're hoping to buy a home that is within the location, size parameters and price parameters of one of our area's new home communities -- great, you'll be in good shape! If what you are hoping to buy is not the type / size / price of new homes being built in our area, then the new housing units being built don't help you out at all. As such... the popularity of Harrisonburg and the rate at which new housing units are being built, and the type of housing units being built all contribute to a shortage of housing inventory for many price ranges and property types. | |

Higher Mortgage Interest Rates Might Be Resulting In More Buyer Competition In Moderate Price Ranges |

|

Clearly, the Harrisonburg and Rockingham housing market is still quite competitive right now, especially for homes under $400K. One reason for this might be related to current mortgage interest rates! Higher mortgage interest rates result in higher monthly costs. If some home buyers were looking in the $400K - $500K range when mortgage interest rates were around 3%, they may very well now be looking in the $300K - $400K range now that mortgage interest rates are above 6%. After all, if you're financing 80%... $450K purchase at 3.25% mortgage interest rate = $2,011 per month $350K purchase at 6.25% mortgage interest rate = $2,070 per month Yikes! So, if $300K - $400K purchasers were previously only competing with eachother, they might now find themselves competing with buyers who were previously planning to spend up to $500K! That said, it is of course also true that some $300K - $400K purchasers might also have had to reduce the target price for their home purchase as well. | |

64 Townhouses Coming (Soon?) To Crossroads Farm |

|

Since Crossroads Farm was first proposed in 1999, there has been a section of the neighborhood where townhouses were intended to be built, as shown above. Thus, this new rezoning request is simply regarding some details of those townhouses... and is not related to whether townhouses are allowed in this area. The rezoning request is to allow for taller townhouses. The applicant would like 16 (of the 64) townhouses to be able to be up to 42 feet tall to allow for a garage on the main level and two living levels above that. The two buildings labeled "TH-3" above are intended to be three stories... on the front of the building... though when viewed from the back they would appear to be two stories as the first level would be below grade at the back of the townhouse. This more detailed rezoning request may mean that these 64 townhouses will be built sooner rather than later. Click here to view more details in the rezoning application packet. | |

One Of The Best Market Indicators Right Now Is How Quickly Houses Similar To Your Home Are Going Under Contract |

|

Are you getting ready to list your home for sale this spring? Are you trying to figure out how to price your home? Step one - as usual - is to look backwards, at past sales, to see how much buyers have paid for houses similar to your home over the past six (or more) months. But another market indicator that we shouldn't overlook is... ...how quickly houses similar to your home are going under contract. FOR EXAMPLE... If we look around at past sales and we find that buyers have recently paid $410K, $415K and $420K for houses similar to your home... ...we might plan to list your home for $415K or $419K or $425K. Let's say we're super optimistic and we're planning to list your home for $425K. But, then, if you're not putting your home on the market for a few weeks, we should carefully monitor similar houses coming on the market for sale. If we see... [1] Three similar houses come on the market for $420K, $425K and $429K, each of which go under contract in a matter of days... then we should be encouraged to stick with our plan of pricing your home at $425K. [2] Three similar houses come on the market for $410K, $412K and $415K, all each of which are still available for sale after being on the market for two weeks... then we might want to consider a list price of $415K or $419K instead of $425K. So, with pricing these days, we need to look backwards at past sales, but we also need to see how quickly buyers are contracting to buy houses similar to your home. Let me know if you're ready to start thinking through potential pricing (and timing) for selling your home this spring. | |

Buyers Should Choose Their Words Carefully When Talking About A House While Walking Through It |

|

As a buyer, when you are walking through a home, keep in mind that the seller might be listening. These days, there are plenty of ways that a seller could be monitoring their home, with a security camera, or other recording device that could allow them to hear every word you are saying while you are in their house. So..... [1] Don't insult their house. It won't help during negotiations. [2] Don't discuss negotiations. You might be revealing your strategy. By the way, sellers, you'll need to disclose if there is a recording device in your home. There is a field in our local MLS specifically for this disclosure. | |

Nationwide Median Sales Price Declines For First Time In More Than 10 Years... But, What About Locally? |

|

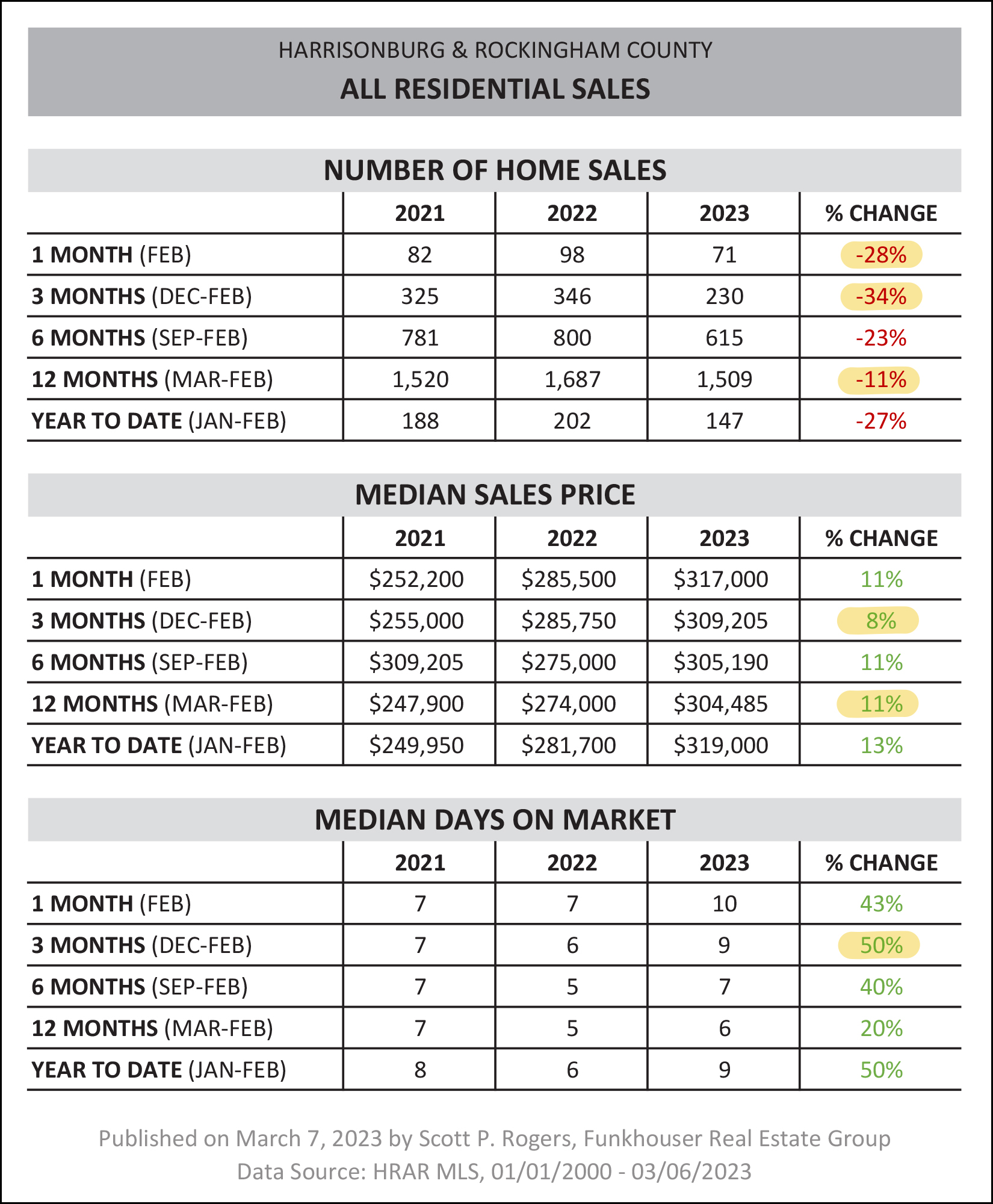

I saw the headline over at CNN yesterday... home prices are falling (nationwide, barely) for the first time in over a decade. The median sales price of a home in the United States was $363,000 in February 2023... ...marking a (tiny) 0.2% decline from a year ago. How do those numbers compare to Harrisonburg and Rockingham County? February 2022 - February 2023

February 2023

So, as usual, we're just doing our own thing over here in Harrisonburg and Rockingham County. Will we see home prices decline in Harrisonburg and Rockingham County? Before that happen, we'd need to see them level out (stop going up) which isn't happening at this point. So, read the national news (if you must) but as usual, it's much more important to keep tabs on the local trends. | |

Buyer Demand Exceeds Supply In Varying Degrees By Price Range |

|

As one might expect, there are more buyers able to and interested in buying a home for $200K than for $300K... and more buyers able to and interested in buying a home for $300K than for $400K. You get the picture. As such, we currently find buyer demand exceeding supply in varying degrees by price range. These numbers are completely made up, but are likely not too far off base given recent listings or transactions I have been a party to or have heard about in our local market... SHOWINGS IN WEEK ONE, BY PRICE RANGE:

If you're seeing more showings than outlined above, your house may be slightly more popular than the average house based on its location and condition - or you might have priced it "just right" for the current market. If you're seeing fewer showings than outlined above, your house maybe slightly less popular than the average house based on it's location and condition - or you might have priced it "a bit too high" for the current market. Again, the data above is completely fictional (not based on actual showing data) but is included to paint a general picture of the differing amounts of buyer demand in different price ranges in the current market. | |

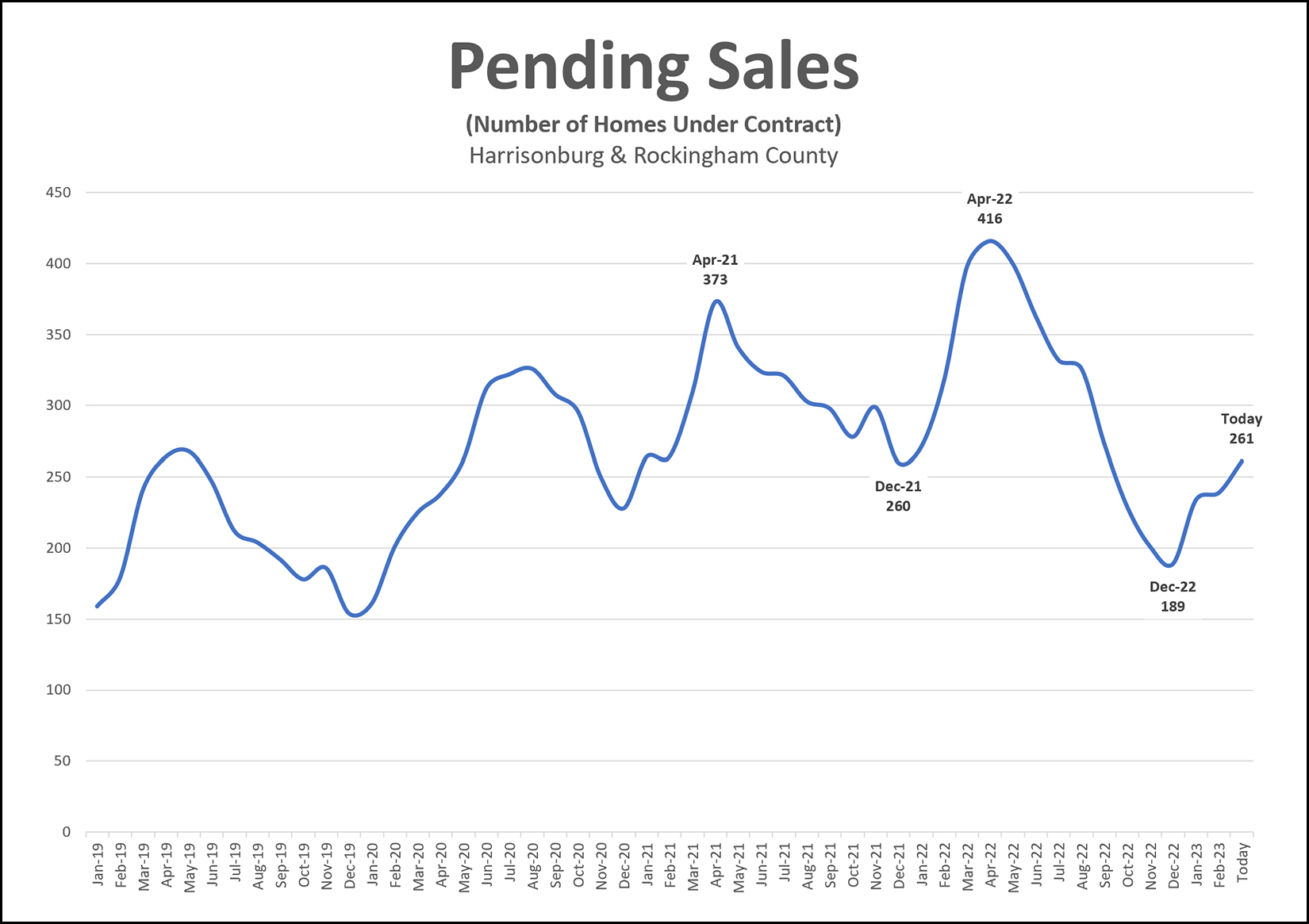

Pending Home Sales Data Points To Slower Months Of Home Sales Ahead |

|

Pending home sales is the most timely indicator of what we should expect in the very near future for closed home sales. A pending home sale is a house that is under contract. Two springs ago (2021) the number of pending sales peaked at 373. Last spring (2022) the number of pending sales peaked at 416. There are currently only 261 pending home sales. As such, it seems likely that we'll see fewer closed home sales over the next few months. But, interestingly, this lower level of pending home sales does not necessarily seem to be a result of an insufficient number of buyers wanting to buy -- but rather, an insufficient number of sellers willing to sell. This seems to be a supply side issue inventory levels (the number of homes on the market for sale) remain stubbornly low. If we were seeing fewer pending home sales, and inventory levels climbing, this would be an indication that buyer demand is declining. That is not what we're seeing. So long as fewer sellers are willing to sell, we are likely going to continue to see lower numbers of pending home sales, and lower numbers of closed home sales unless new construction options increase to provide additional housing options for home buyers. | |

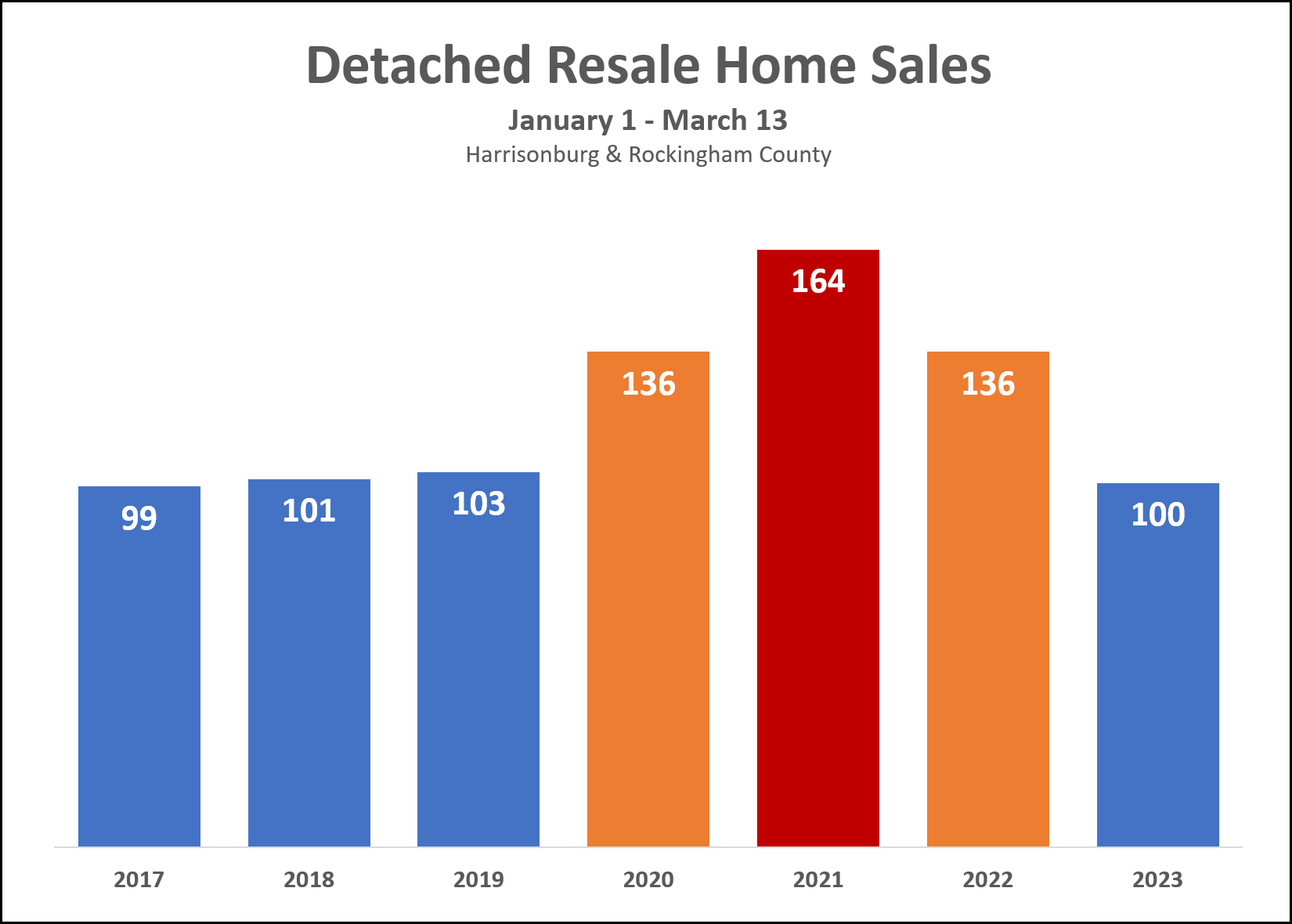

Detached Resale Home Sales Decline 39% In Two Years, Down To... Pre Covid Norm |

|

First, a definition... Detached Resale Home Sales = not townhouses, not duplexes, not condos, not new homes Now, then, an observation... Detached Resale Home Sales have declined 39% over the past two years when looking at first 2.5 (ish) months of the year. Oops, wait, another observation... Detached Resale Home Sales have dropped all the way down to... pre covid norms. In the three years leading up to Covid (2017, 2018, 2019) we saw home sales between January 1 and March 13 totaling 99, 101 and 103 home sales for each of the above referenced years. But then, the three most recent years showed a very different pace of sales... Jan 1 - Mar 13 of 2020 = 136 sales! Jan 1 - Mar 13 of 2021 = 164 sales! Jan 1 - Mar 13 of 2022 = 136 sales! But, then, back to what seems to have been the pre-Covid norm... Jan 1 - Mar 13 of 2023 = wait for it... 100 sales So, two things seem to be true right now... There are significantly (!!!) fewer detached, resale homes selling right now compared to how many we saw during the same timeframe over the past three years. But, yet, the number of detached, resale homes selling right now is quite normal per the historical trends before Covid started messing with the housing market. Prospective home buyers in 2023 should thus realize that... [1] There will likely be a historically normal number of homes that you could buy this year... if we ignore the three most recent years. [2] There will be far fewer options of homes to buy this year compared to last year and the year before. [3] There may very well be more competition from other buyers for that smaller number of homes that will be available for purchase. As you can see through all of this -- the decline in home sales is very much due to a restrained supply (only so many sellers willing to sell) rather than a restrained demand (only so many buyers wanting to buy). | |

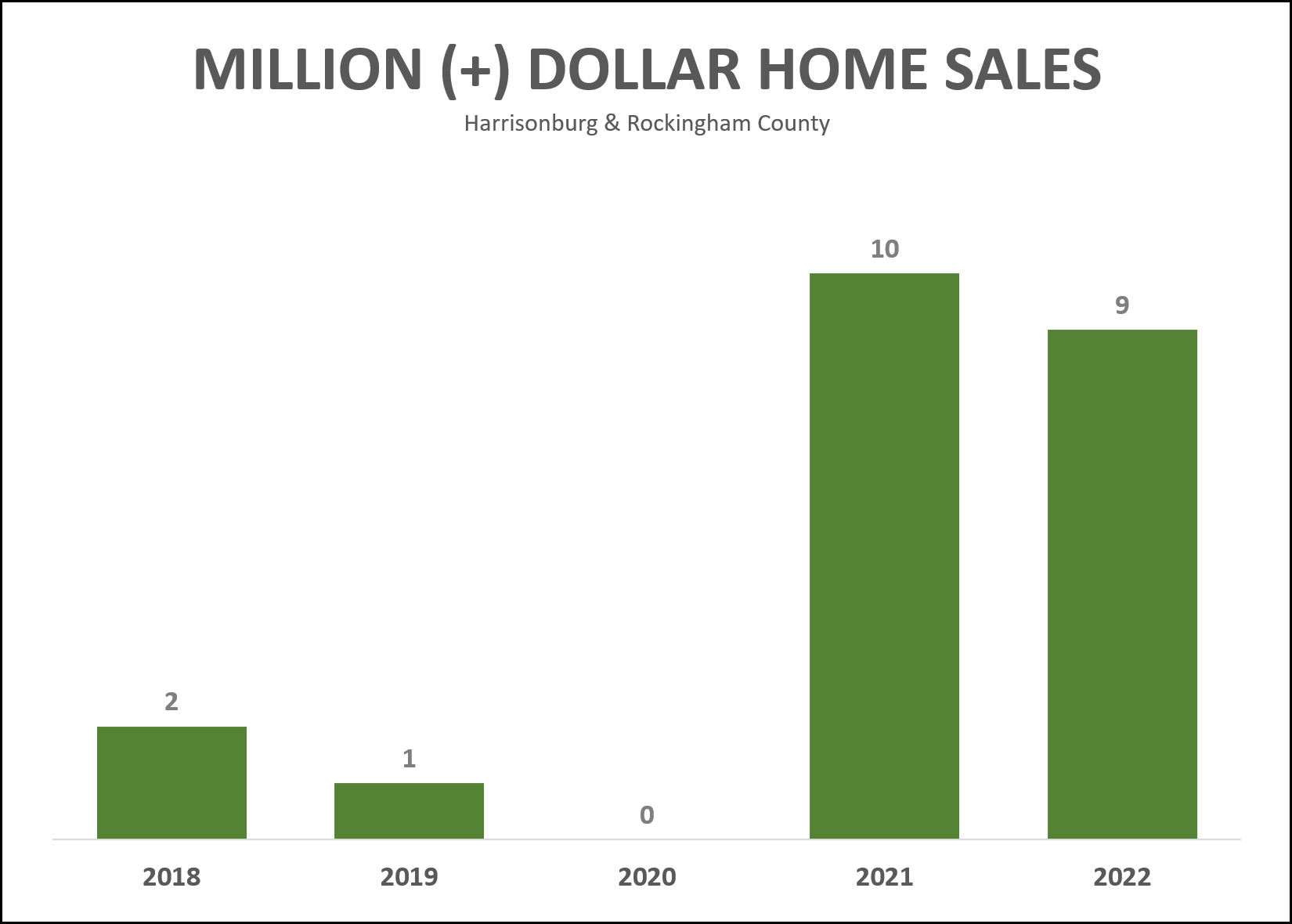

What A Great Time To Sell Your Million Dollar Home |

|

It's been a good time to sell a million (+) dollar home lately. After only three million dollar sales over three years (2018-2020) we have seen 19 million dollar sales over the past two years. Wow! Check out what people have been paying $1,000,000 for lately here. If you're ready to sell your home for one million dollars... let me know. ;-) | |

Home Buyers Who Bought Homes Two Years Ago Thought They Were Paying Crazy High Prices For Their Homes |

|

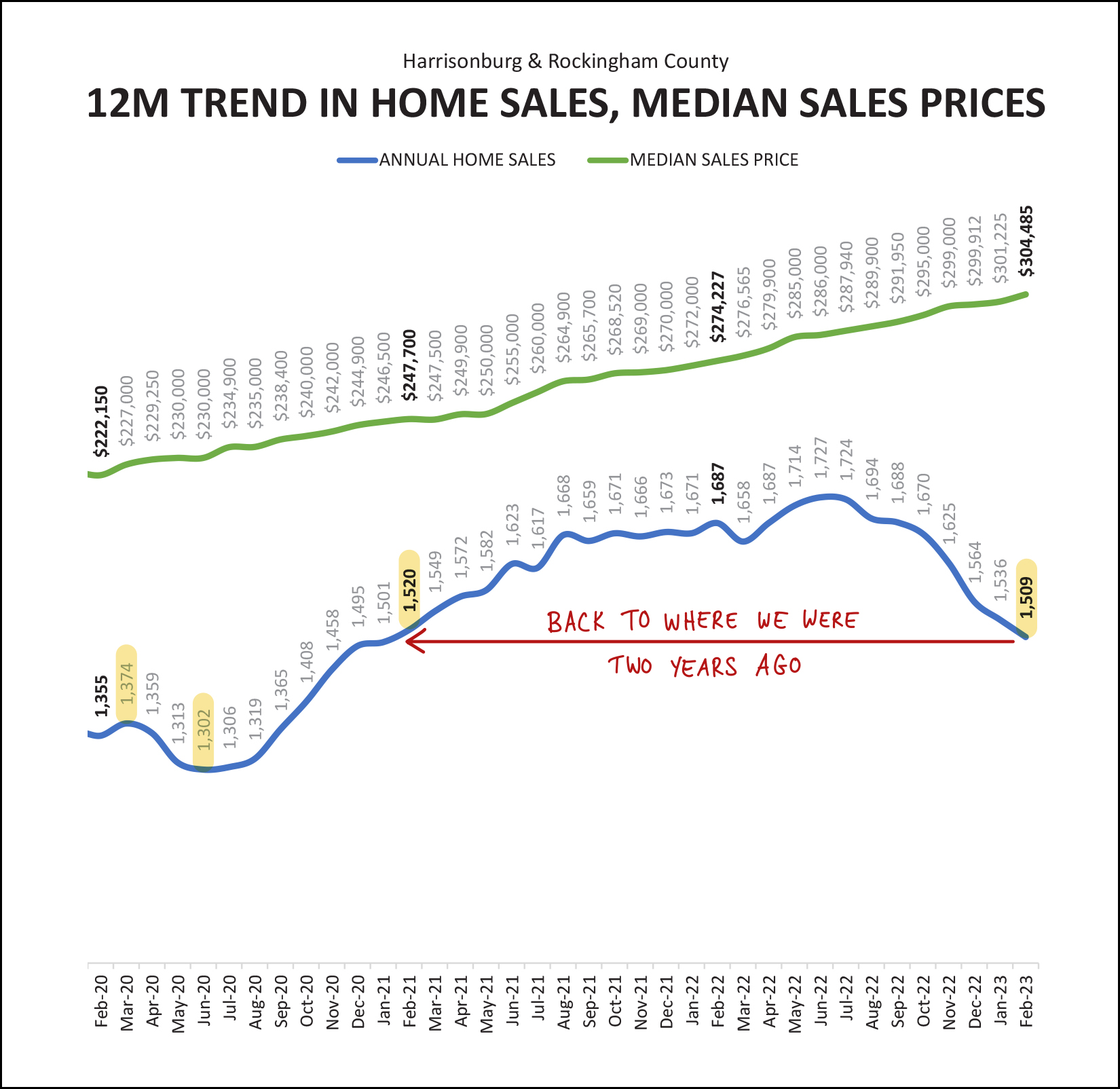

I think those home buyers look at things a bit differently now. Three years ago the median sales price in Harrisonburg and Rockingham County was $222,150. One year later it had risen 11.5% to $247,700. Home buyers who were paying $247,700 thought they were paying WAY TOO MUCH for their homes. Why in the world did they need to pay 11.5% more than a similar buyer one year earlier!? My how those numbers look different today. Now, just two short years later, the median sales price has risen 22.9% (in two years) to $304,485. So, do you think those same home buyers who reluctantly paid $247,700 two years ago are upset for having paid 11.5% more than buyers were paying the previous year? Nope, not at all. They're delighted to have paid 22.9% less than buyers are paying today. Yes, this is an unusual time. I don't think we're going to see several more years of double digit annual increases in median sales prices. That said, I also don't think we're going to see home prices decline. So, while it can seem like today's home prices are high compared to home prices in the past -- your perspective might change a bit over the next few years when you're looking backwards at today's home prices. | |

How Likely Is It That We Will Find A House That Fits You Better Than This One In The Next 90 Days? |

|

We will try to find you the perfect house to buy... that checks off all of the boxes on your list of needs and wants. If we happen upon a nearly perfect house... we should probably be asking ourselves... How Likely Is It That We Will Find A House That Fits You Better Than This One In The Next 90 Days? These days, with relatively low inventory levels in many price ranges and for many property types... ...and with quite a bit of buyer interest in most of those price ranges... ...we may very well conclude that we are NOT likely to find a house that is a better fit for you in the next 90 days. The moral to the story, I suppose, is that in a low inventory (few sellers) competitive (many buyers) market... you might need to settle for a nearly perfect house instead of a perfect house. That way, you might actually end up with... a house! | |

Fewer Home Sellers, Thus Fewer Home Buyers, But Ever Higher Sales Prices In Early 2023 |

|

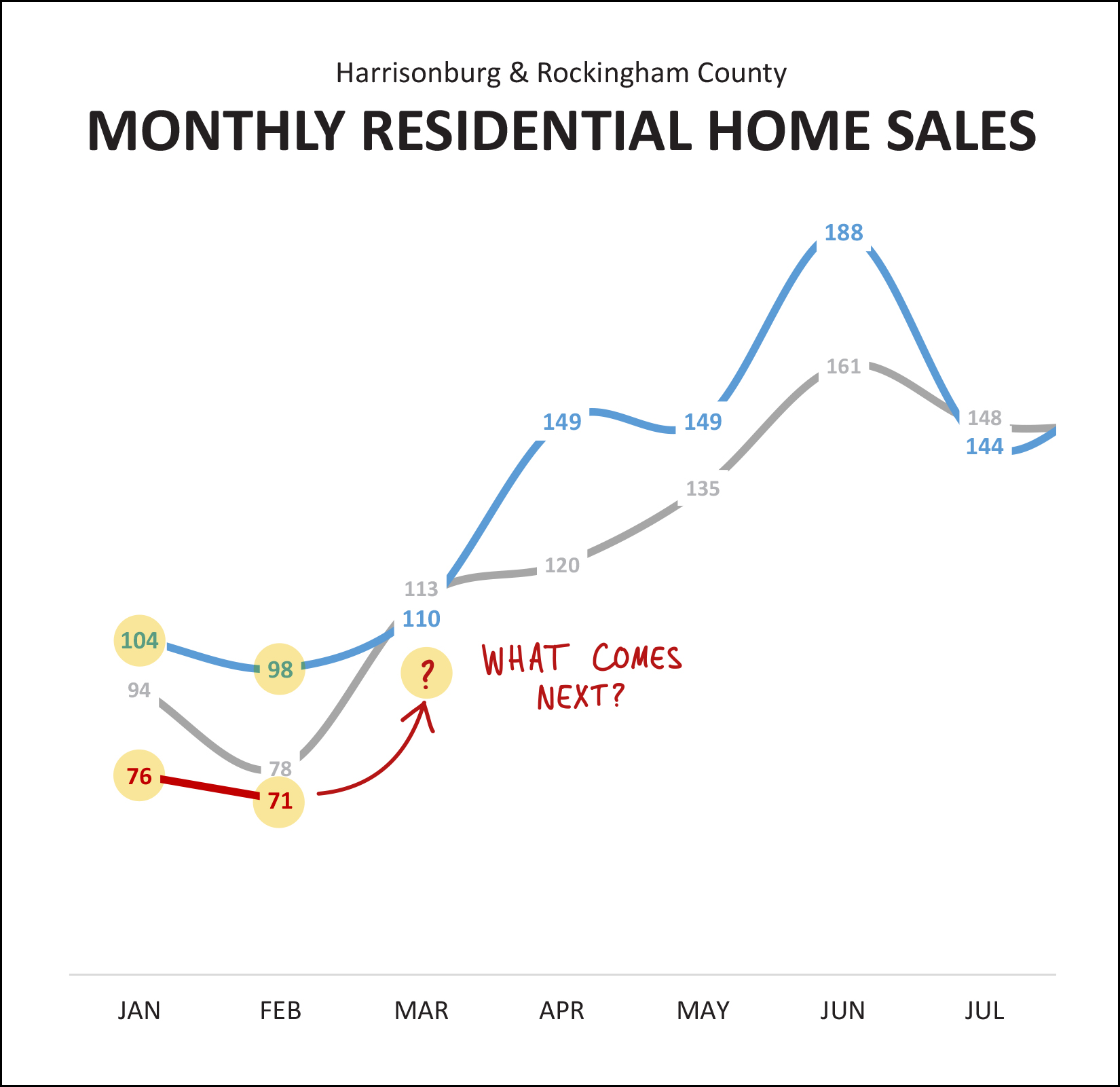

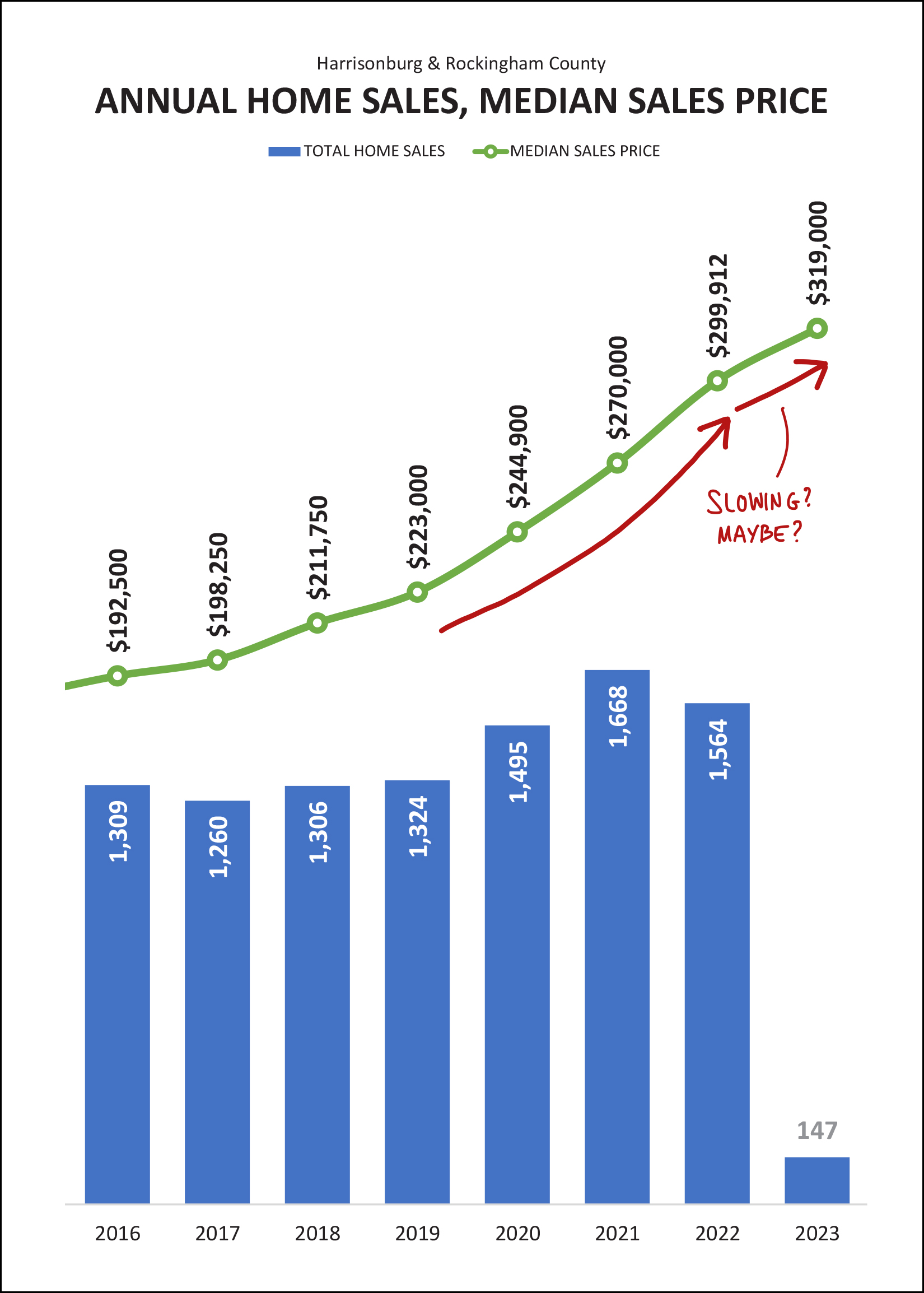

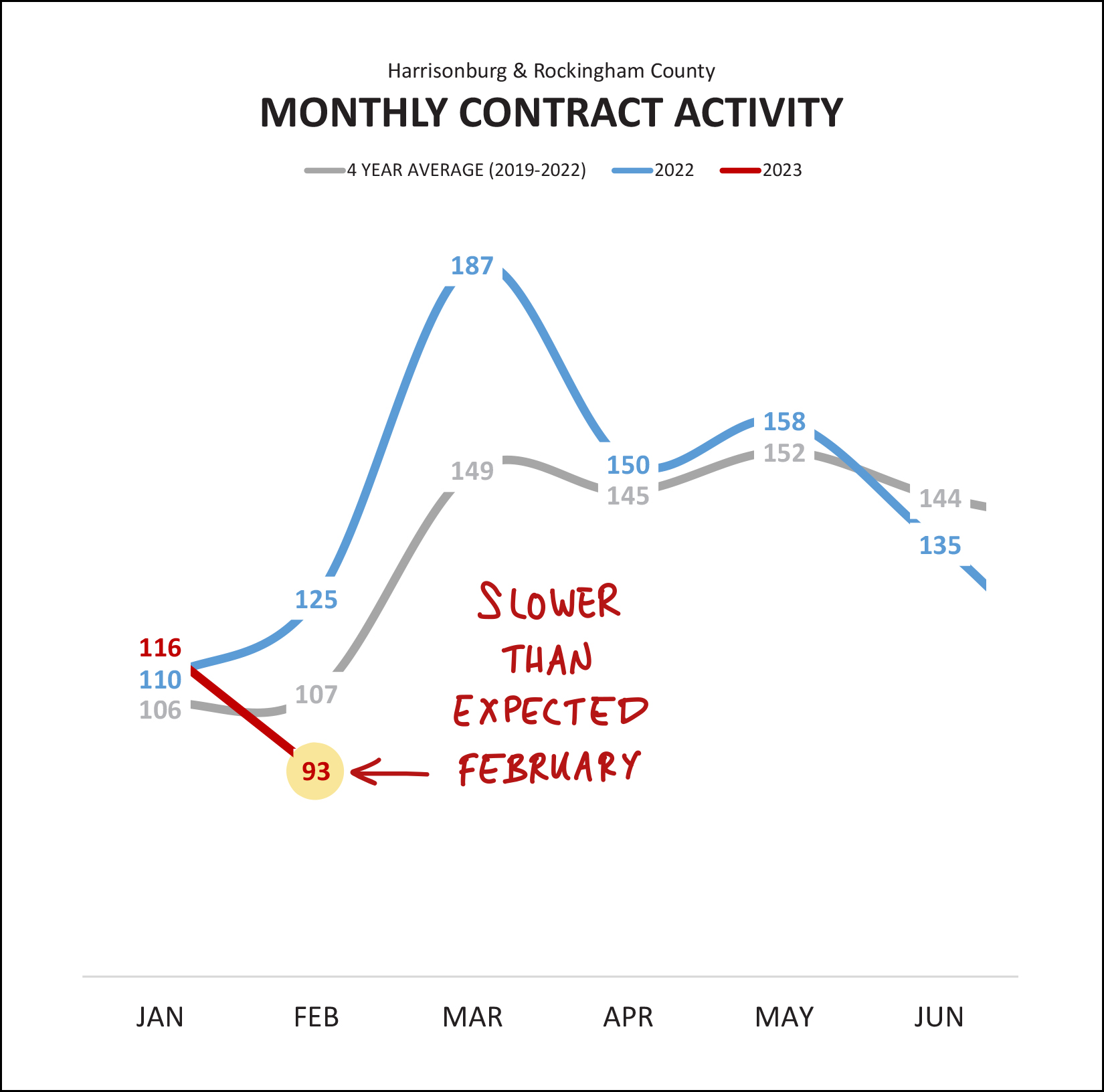

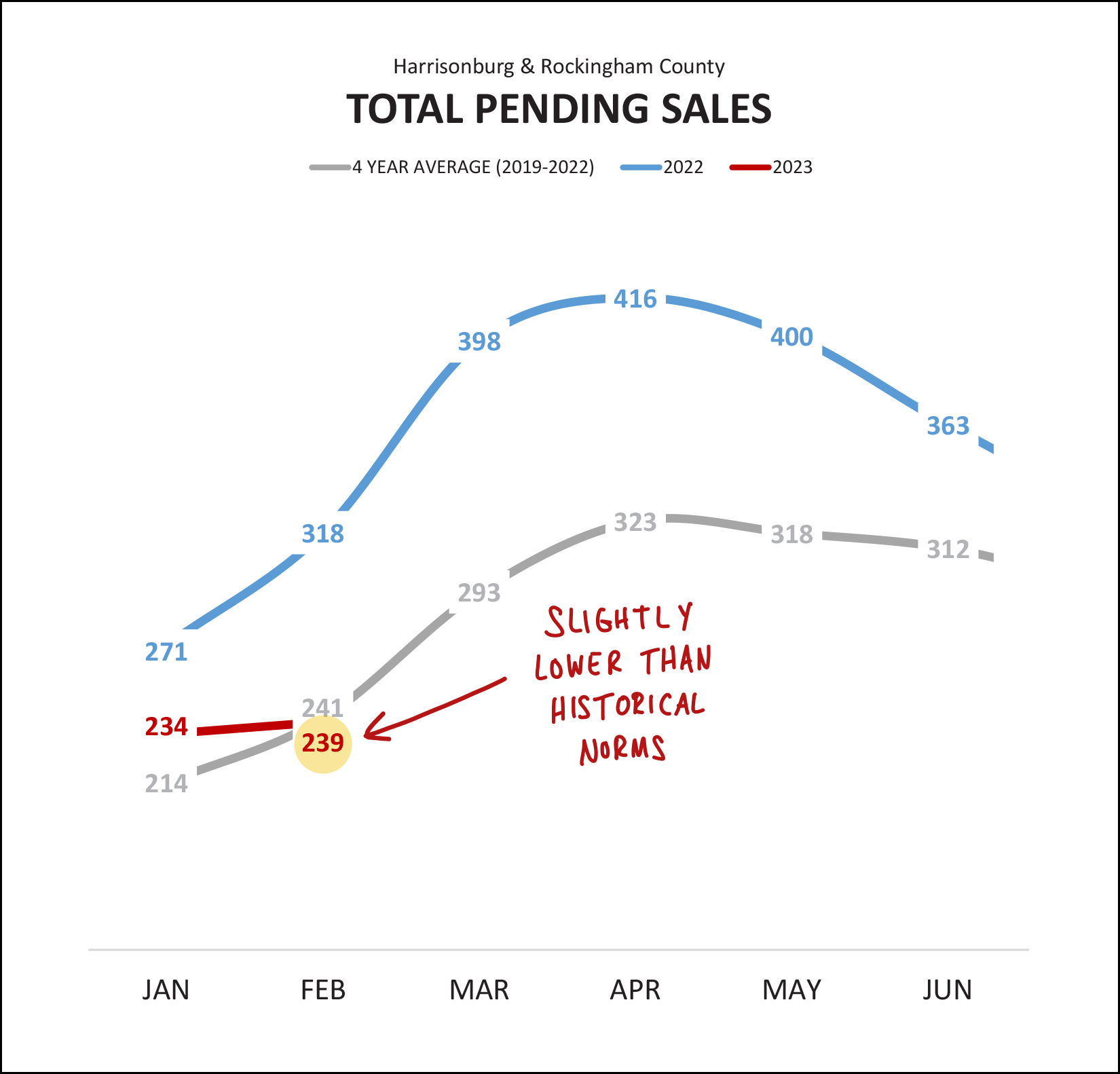

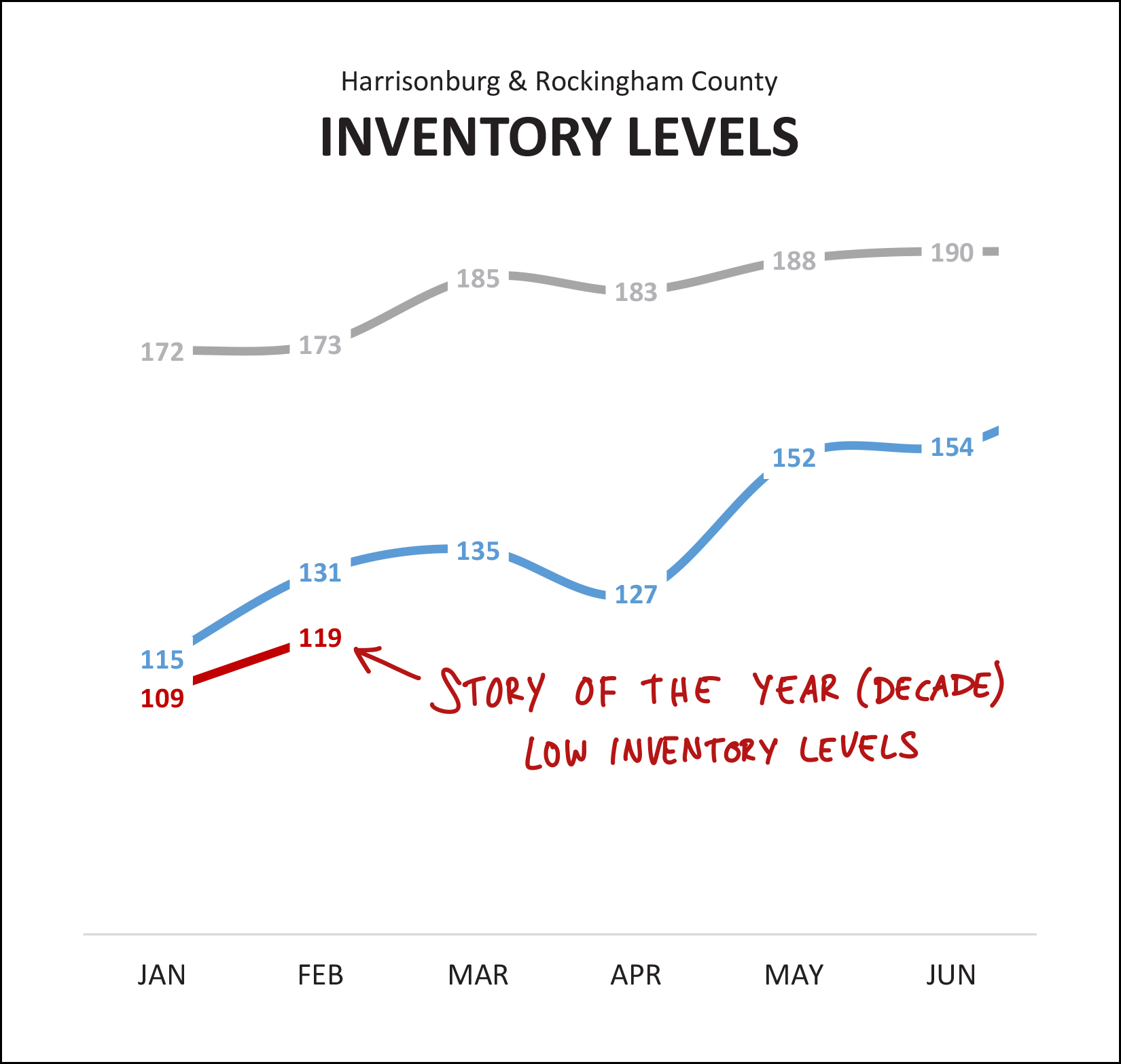

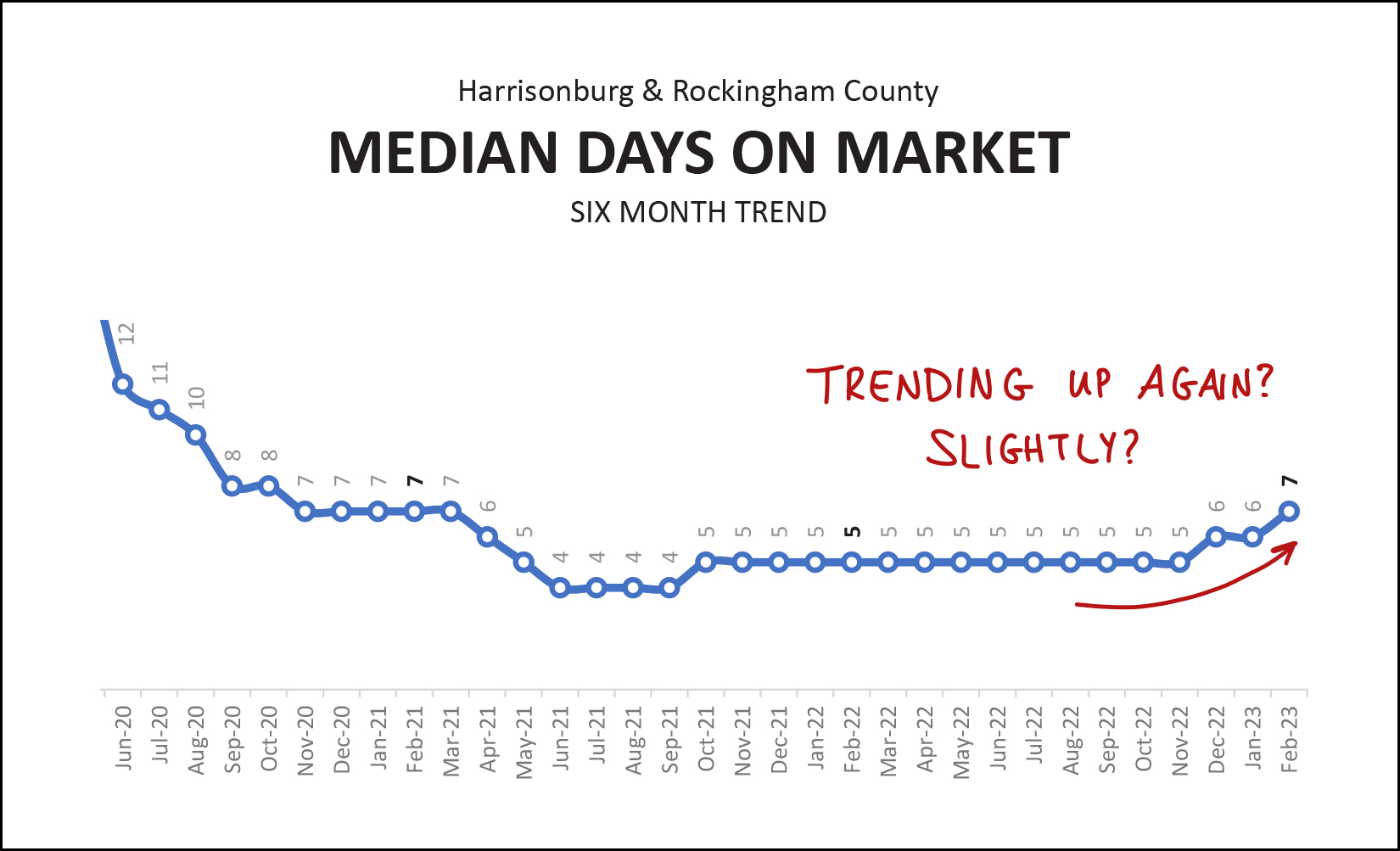

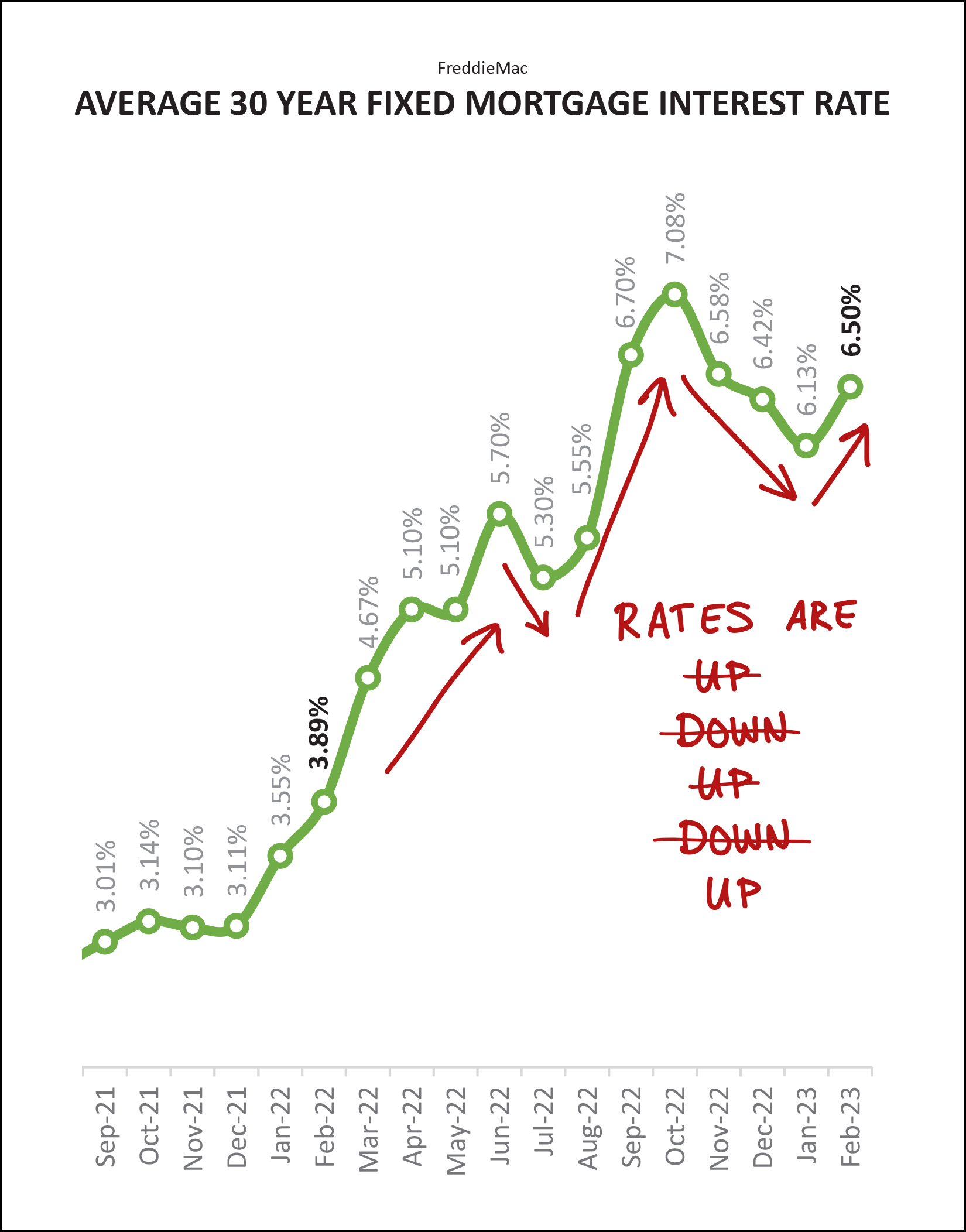

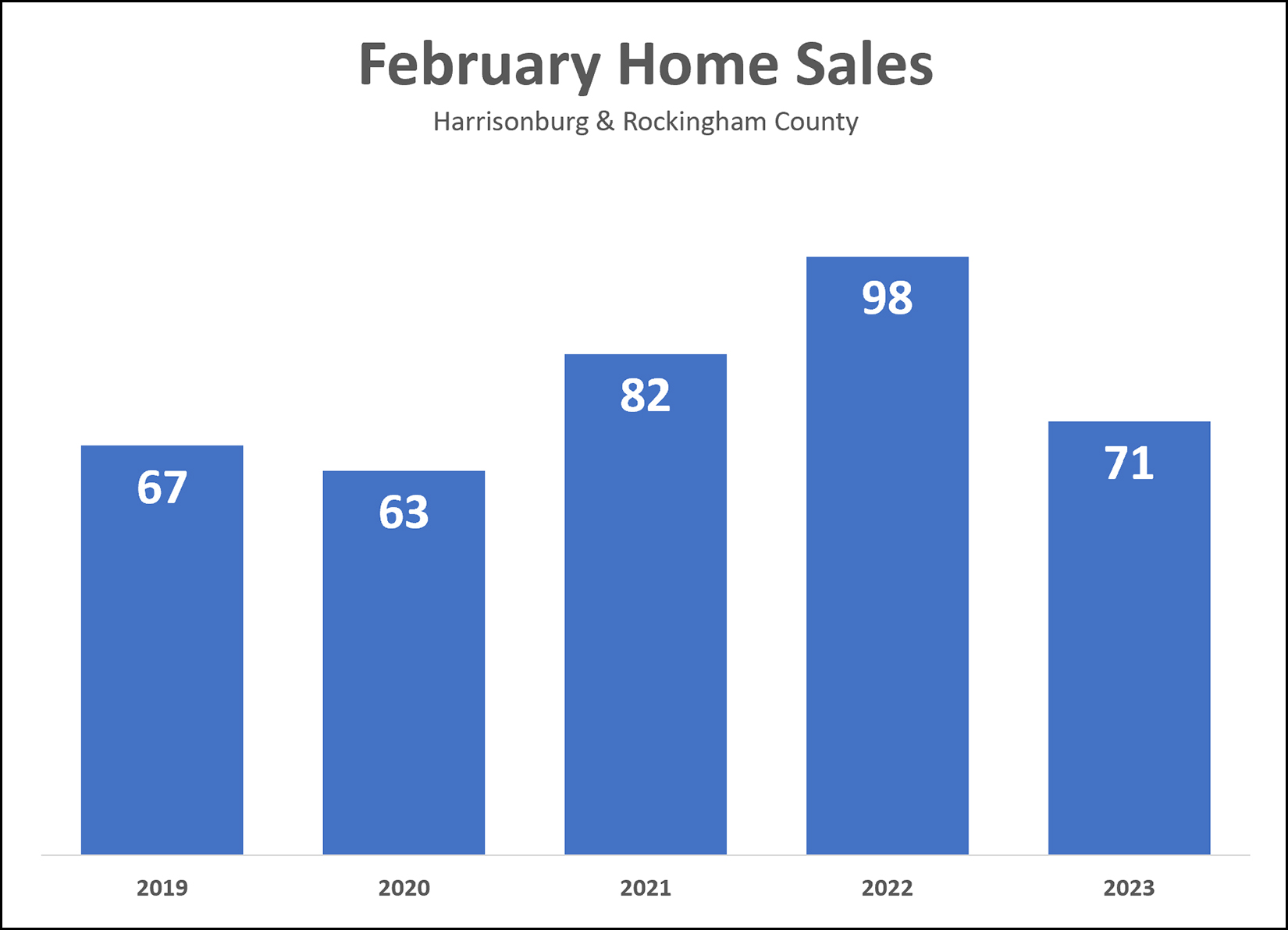

Happy Tuesday morning, friends! Indeed, February flew by quickly -- such a short month ;-) -- and now we're headed into what is typically a very busy spring in our local real estate market. Read on for an overview of everything happening right now in our local market... but first... a local highlight and an opportunity for you to be a winner! :-) Each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included A Bowl of Good, a Steel Wheels concert, and Grilled Cheese Mania. This month... I'm giving away a $50 gift card to another of my favorite local restaurants, Taste of India. My go to order is the Chicken Tikka Masala, but you will find an extensive menu of unique and flavorful dishes at Taste of India, located on University Blvd. Click here to enter for a chance to win the $50 gift card! And now, let's move on along to the most recent data on our local real estate market...  As per my headline, there are definitely fewer buyers buying homes right now, but I am fairly confident that it is a result of fewer sellers selling homes right now - as inventory levels are not rising. As shown above... [1] There were 28% fewer home sales this February (71) compared to last February (98) in Harrisonburg and Rockingham County. [2] Looking at the past three months (Dec, Jan, Feb) there was an even larger drop off in home sales... with a 34% decline from last year (346 home sales) to this year (230 home sales). [3] If we look back at an entire year of sales we will only find an 11% decline in home sales (from 1,687 sales to 1,509 sales) indicating that the majority of the slow down is in the more recent months. [4] Despite these decreases in the number of homes that are selling... home prices keep rising! The median sales price during the past three months (when the number of sales was 34% lower than last year) was $309,205... which is 8% higher than the median sales price one year ago of $285,750. [5] Looking back at the entire year again, the median sales price over the past 12 months was $304,485 which is 11% higher than in the 12 months before that when it was $274,000. [6] The number of days it takes for a home to go under contract is -- maybe, possibly -- on the rise. This (most recent) December through February homes went under contract with a median "days on market" of nine days... which is (50%) higher than the median of six days a year ago during those same three months. So, fewer homes are selling, slightly slower, but at ever higher prices!?! Now, let's look at the number of home sales January and February compared to past norms for these months...  The red line above is the current year -- 2023 -- and you can see that the number of home sales in January and February is quite a bit lower than... [1] The number of home sales last January and February -- shown in blue. [2] The average number of home sales in each month over the past four years -- shown in grey. So, there have been fewer home sales this January and February than in other recent years. Thus, what comes next? I expect we will continue to see lower number of home sales per month as we move through March, April and May 2023 as compared to last year and as compared to the average of the past four years. Let's put the declining number of home sales in a bit of a historical context...  The annual pace of home sales peaked at 1,374 home sales back in March 2020 after declines in monthly home sales in early 2020 due to the start of the COVID-19 pandemic. The annual pace of home sales slowed for a few months... but bottomed out at 1,302 home sales per year just three months later. Then, the annual pace of home sales started climbing, and climbing, and climbing. Two years ago, homes were selling at an annual pace of 1,520 home sales per year in Harrisonburg and Rockingham County. Then, annual home sales accelerated all the way up to 1,727 home sales per year in in June 2022 -- before they started declining again. Now, as we close out February 2023, the annual pace of home sales (1,509) has returned to the same approximate place that we were in two years ago. I expect that this annual pace of home sales will continue to decline over the next six months. But, yes, sales prices keep on rising, as shown with a green line above. The annualized median sales price seems intent on continuing to rise, month after month. It has now risen from $222,150 to $304,485 in just three years! But, perhaps the increase in the median sales price is... slowing?  If you stare intently at the green line above, you'll see the slope changing a bit, which perhaps is an indicator that the rate of price increases is slowing. Maybe. 2020 increase in median sales price = 9.8% 2021 increase in median sales price = 10.2% 2022 increase in median sales price = 11.1% 2023 increase in median sales price = 6% Don't read this too quickly... home prices are not declining... but the pace at which home prices are increasing... might be slowing. Or, then again, maybe not. We are only working with two months of data for 2023. Stay tuned over the next few months to see how the 2023 median sales price adjusts as we move further through the year. Now, to predict where home sales might go next, let's look at contract activity...  After a decent month of contract activity in January (116 this year compared to 110 last year) we saw a marked decline in contract activity in February. The 93 contracts that were signed in February 2023 was significantly lower than the 125 contracts signed last February, and also well below the four year average of 107 contracts in a typical February. Thus, it is unlikely that we'll start to see an increase in home sales in March, given the decline in contracts signed in February. Furthermore, the number of pending sales (homes under contract) also declined in February...  There are currently 239 homes under contract (pending) in Harrisonburg and Rockingham County which is quite a bit lower than a year ago (blue line) when there were 318 homes under contract... and is also lower than the four year average of 241 homes typically being under contract at this time of year. All of these different metrics are all showing the ways in which our market is cooling off -- as it pertains to the *number* of homes that are selling -- not as it relates to the value of homes in our area. Circling back to my headline this month... I think the cause of fewer home sales is mainly due to fewer sellers selling, which is resulting in fewer buyers buying, because...  Inventory levels are lower than ever. There are currently 119 homes for sale (not under contract) in Harrisonburg and Rockingham County which is even lower than the inventory levels a year ago at this time of the year (131 for sale) and significantly lower than the four year average of 173 homes for sale at this time of year. If fewer buyers were buying... and just as many sellers wanted to sell... we would start to see inventory levels increasing. Fewer home sales, combined with ever lower home sales, is a very good indicator that the decline in the number of home sales is a result of fewer sellers being willing to sell -- more so than a result of fewer buyers wanting to buy. All that said, there is one trend in our local market that runs at least a bit counter to all of the other trends...  The median "days on market" figure has started to trend upwards over the past few months. For over a year, the median number of days it took for a home to go under contract was only five days. That has now drifted slightly upward to seven days. This means something... but maybe not much. Homes are going under contract *slightly* more slowly now than they were over the past few years. It is now taking them (as per the median calculation) about seven days to go under contract, instead of only five days. I'll continue to monitor this over the coming months to see if this trend continues when we get into the thick of the spring market. And one last graph... that looks like it had one too many cups of coffee this morning with all of its jittering all over the place...  Mortgage interest rates have been all over the place over the past year. A year ago the average 30 year mortgage interest rate was 4%, and now it's 6.5%. But during the past year we have seen multiple months of increases and some decreases. It's hard to say what will happen next with mortgage interest rates. Perhaps the only reasonable prediction is that rates will go up and go down in the next six months. ;-) So... if you're looking to buy or sell a house in Harrisonburg or Rockingham County this spring, what should you conclude based on all of the data above? If you will be selling... [1] The market is still very favorable for home sellers. [2] Home prices have never been higher. [3] Half (or more) of homes that well are still going under contract in a week or less. [4] Diligent preparations, proper pricing and thorough marketing will likely still result in a speedy and favorable home sale for most sellers of most homes in most price ranges and locations. If you will be buying... [1] The market is still very competitive in most price ranges and for most property types. [2] It is still important to be pre-approved and to go see homes within the first day or two that they are on the market. [3] There will likely be fewer options for buying this year than last as fewer home sellers are seeming willing to sell. There's plenty more that we can discuss about your particular scenario if you are thinking of selling or buying, so feel free to reach out (call or text me at 540-578-0102 or email me here) if you'd like to chat or find a time to meet. If you're not quite ready to sell or buy yet, but have questions about the market or the process, I'd also be delighted to hear from you. Touch base anytime. That's all for today, folks. I hope that March treats you well and that you enjoy the suspense of not knowing whether we'll get that surprise March snowfall that we sometimes see in the Valley. ;-) Regardless of whether we get some snow or not, I hope you enjoy the changing of the seasons as we move through March. It is certainly a beautiful time in the Shenandoah Valley! P.S. If you want even more charts and graphs than I have included above, you'll find them here. | |

First Look At February 2023 Home Sales |

|

Perhaps unsurprisingly, February 2023 home sales don't quite match up to February 2021 or 2022. Of course, during 2021 and 2022 we were experiencing... [1] Surging buyer interest due to super low interest rates. [2] Many, many buyers trying to upgrade their living arrangements due to Covid induced life changes with working from home, etc. Interest rates are higher now, and there is a bit less urgency to upgrade ones living arrangements if you haven't already done so as we seem to be settling back into life after Covid. And what do you know... home sales in 2023 aren't quite as crazy high as they were in 2021 and 2022. I should also note that... [1] Home sales in February 2023 were (a bit) higher than in 2019 and 2020. [2] The decline in home sales is not (thus far) leading to an increase in housing inventory levels. Fewer buyers are buying... but fewer sellers are selling as well... so inventory levels are remaining low. I'll publish a full accounting of February housing market updates soon. | |

Valley View Village, To Include 420 Apartments, Proposed For Reservoir Street |

|

Back in 2019, a proposal was approved for 156 apartments on 5.3 acres on Reservoir Street... but the apartments have not been constructed. Now, a new proposal is being considered by Rockingham County (Planning Commission, Board of Supervisors) to include two unimproved parcels totaling 18.125 acres. The applicant is proposing to build approximately 420 apartments in 13 apartment buildings with a variety of amenities such as a pool, dog wash, tot lots and a walking trail. The original 5.3 acres is already zoned Planned Multi Family (PMF) and the applicant is seeking to rezone the second parcel from R2 to PMF. As you'll note below, the two parcels are mostly surrounded by apartments, a few duplexes, and some undeveloped land.  Per the applicant's representative at Blackwell Engineering, the apartment buildings will vary in size with anywhere from 28 apartments to 42 apartments per building. The apartments will be a mixture of 1, 2 and 3 bedroom units. This rezoning will go before the Planning Commission and then potentially the Board of Supervisors in the coming months. Download the entire information packet here. | |

Balancing Optimism, Pessimism And Realism When Thinking About An Almost Perfect House |

|

Yahoo! You have found an "almost perfect" house -- and you're thinking about making an offer. But... it's early spring (pre spring?) and there will be many more new listings coming on the market in the next few months, right? So... do you go ahead and make an offer on the almost perfect house now? Or do you wait to see what else hits the market that might be even more exciting!?? OPTIMISM tells us to wait for that perfect house. Don't compromise. There will be plenty of new options over the next 60 to 90 days. You won't want to miss out on the perfect house because you settled for an almost perfect house. PESSIMISM tells us that there probably won't be perfect houses, and if there are, there will be way too many buyers pursuing them, and your chances are low of winning a multiple offer scenario. REALISM tells us that (especially in the current fast moving, low inventory, real estate market) an almost perfect house is likely the perfect house to pursue. There are likely very few absolutely perfect houses, so if you have found one that is almost perfect, don't wait! It's tricky buying a home these days because you often can't compare one house to another, as the first will be under contract by the time the second house comes on the market. Thus, buyers often find themselves asking if "almost perfect" is perfect enough. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings