Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Monday, June 26, 2023

Over the past three years...

[1] The median sales price has increased by about 10% each year.

[2] The average mortgage interest rate has doubled.

[3] The City real estate tax rate has increased by 12%.

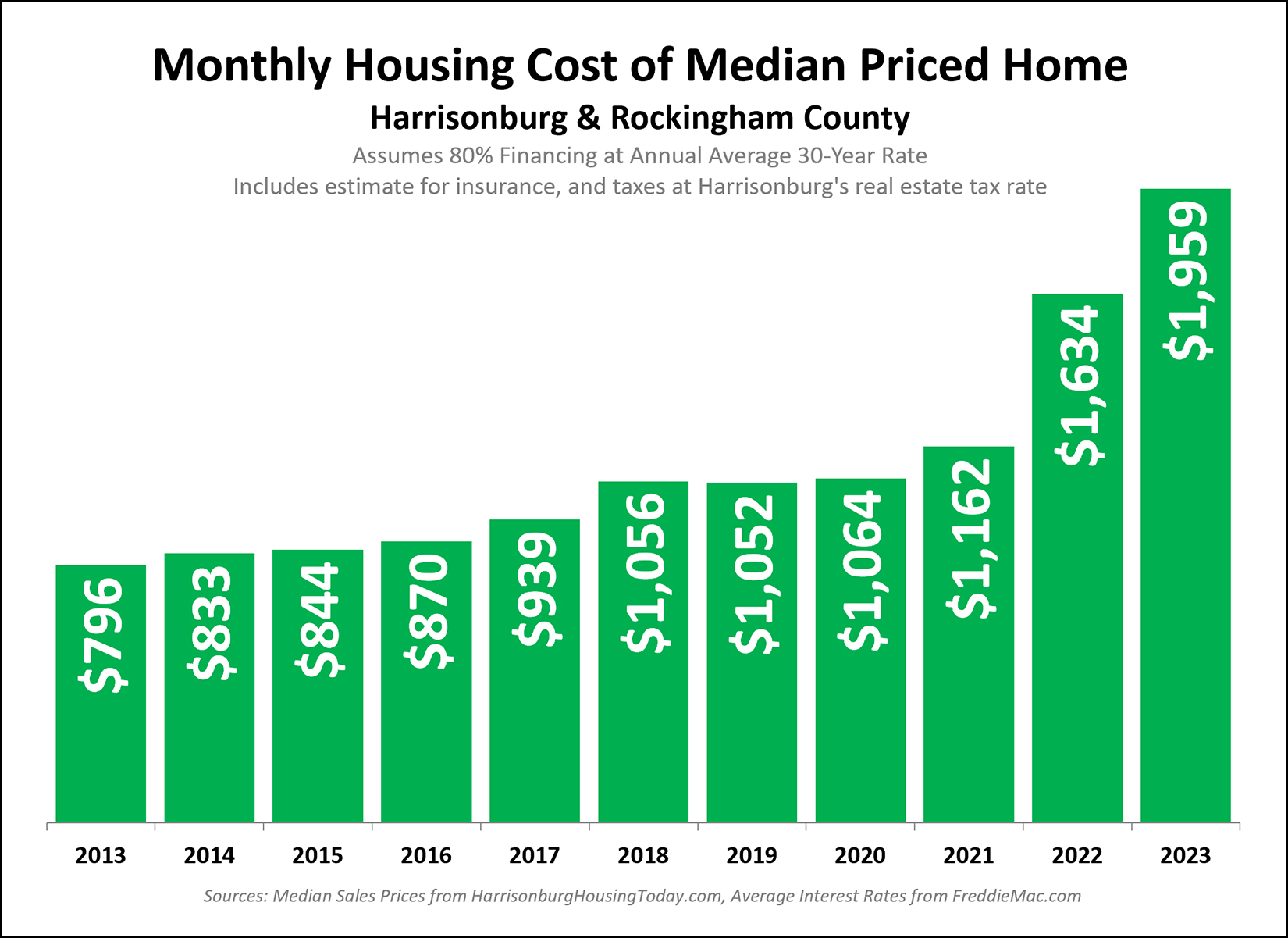

Given these three changes, and how each plays into housing costs, it shouldn't be much of a surprise that monthly housing costs have increased significantly over the past three years.

Three years ago, if a home buyer financed 80% of their purchase of a median priced home, they would be paying about $1,064 per month.

Now, if a home buyer finances 80% of their purchase of a median priced home, they will be paying $1,959 per month.

Beyond the "wow, that's a crazy increase" here are a few of my other thoughts and observations...

[1] Perhaps this is a statement of the obvious... but this "increase in monthly housing cost" only affects those who are buying homes now. Anyone who already owns a home is not seeing this type of an increase in their housing costs. They might have a minor increase in their monthly housing costs due to rising assessed values, rising real estate tax rates and/or rising homeowners insurance rates, but those will amount to a relatively small increase in their monthly housing costs compared to what is described above.

[2] Yes, this is a big increase... but it's partially because monthly housing costs were abnormally low for quite a few years as a result of super low mortgage interest rates. We have now exited a prolonged period of tremendously low mortgage interest rates. This kept housing costs very low for anyone buying a home (or refinancing their mortgage) during that unique time of low mortgage interest rates. Thus, the increase in monthly housing costs seems huge -- but it's only partially because of how high mortgage rates are now, but also very much about how low those mortgage rates were very recently.

[3] Just a note on methodology. The housing cost numbers above are calculated using the median sales price of homes sold in Harrisonburg and Rockingham County per the HRAR MLS, combined with the average mortgage interest rate for the duration of the year, combined with the real estate tax rate for the City of Harrisonburg, and assumes a 20% downpayment.

Bottom line -- it is quite a bit more expensive for someone to buy a home now compared to just a few years ago.