Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Monday, October 16, 2023

Happy October, Friends!

October is one of my favorite months of the year... for quite a few reasons...

1. Cool mornings, warm afternoons and then cool evenings again.

2. Beautiful changing colors of fall leaves.

3. Pumpkin pie!

4. My birthday. ;-)

5. Coaching middle school volleyball.

6. Apple cider.

7. Watching JMU football games. Goodness, there have been some stressful ones this season, though not this past weekend!

Is October a favorite month for you as well? What would be on your list?

While you're building your own list of all the reasons why October is amazing, let me mention my monthly giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included Taste of Thai, Merge Coffee and Jimmy Madison's.

This month I am giving away a $50 gift certificate to Hank's Grille, located in McGaheysville. I enjoyed a delicious meal this weekend of pork BBQ with baked beans and macaroni and cheese on the side, rounded out with some pecan pie. If you haven't been to Hank's Grille, you should go check it out... whether you win the gift certificate or not! Click here to enter to win a $50 gift certificate!

And now... on to the data, and charts and graphs...

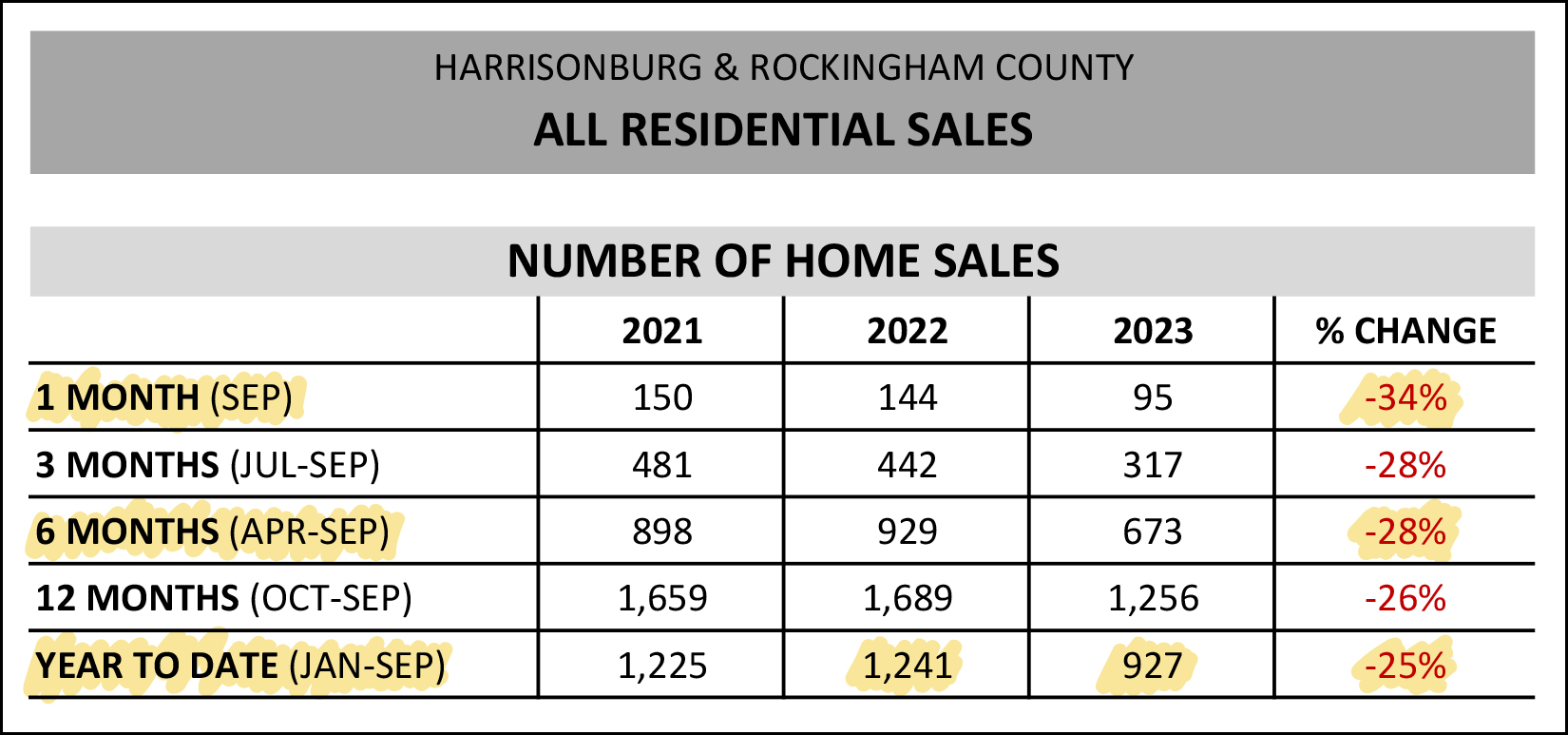

OK, my highlighting on the chart above requires a bit of explanation. Let's work our way from the bottom of the chart upwards...

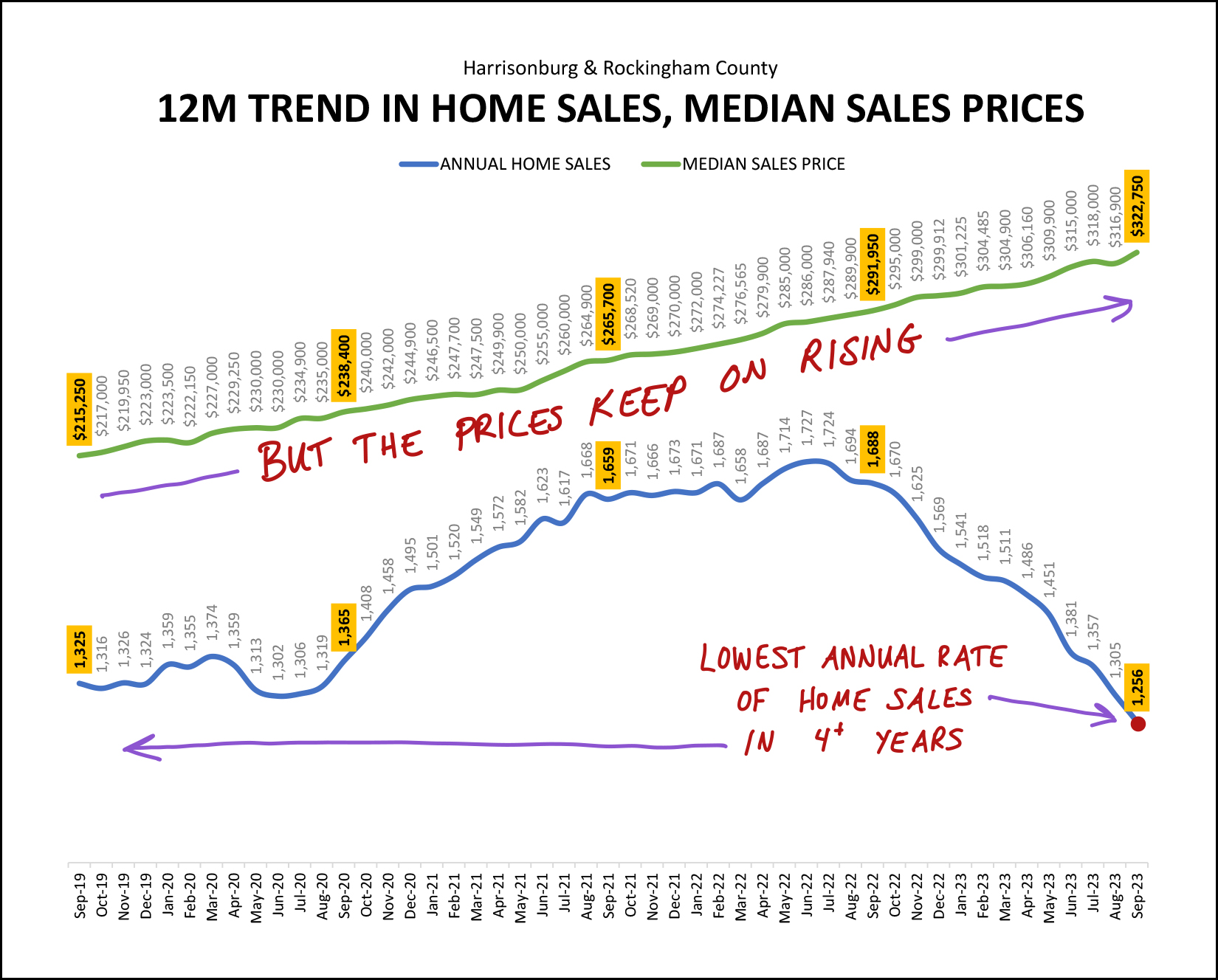

[1] Year to date we have seen 927 home sales, which is 25% fewer than the 1,241 home sales we saw in the first nine months of last year.

[2] When we look just at the past six months (April through September) we have seen a slightly larger 28% decline in the number of homes selling in Harrisonburg and Rockingham County.

[3] When we look just at September (while keeping in mind that a small data set can lead us to erroneous conclusions) we'll see a 34% decline in the number of homes that are selling.

So, far fewer homes (at least 25% fewer) are selling in Harrisonburg and Rockingham County this year as compared to last.

But what about the prices of those homes that are selling?

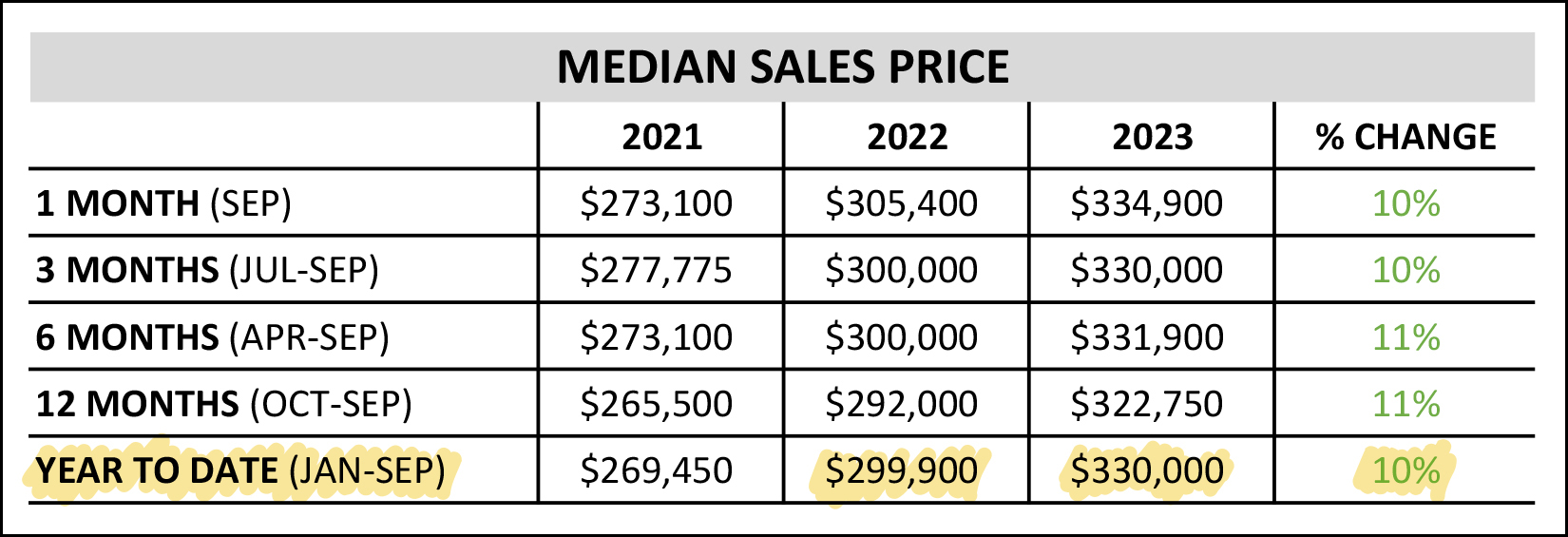

The prices, it seems, keep on rising, no matter how we slice and dice the data from a timeframe perspective. As shown above, the median sales price has increased 10% this year to date as compared to last year to date. When we look at a shorter timeframe (six months, three months, one month) we still see a double digit (10% - 11%) increase in the median sales price.

All that said, later in this report I'll take a look at only detached home sales where we are starting to see a slightly different trend in median sales prices. I know... quite the build up... but don't skip ahead... keep reading. :-)

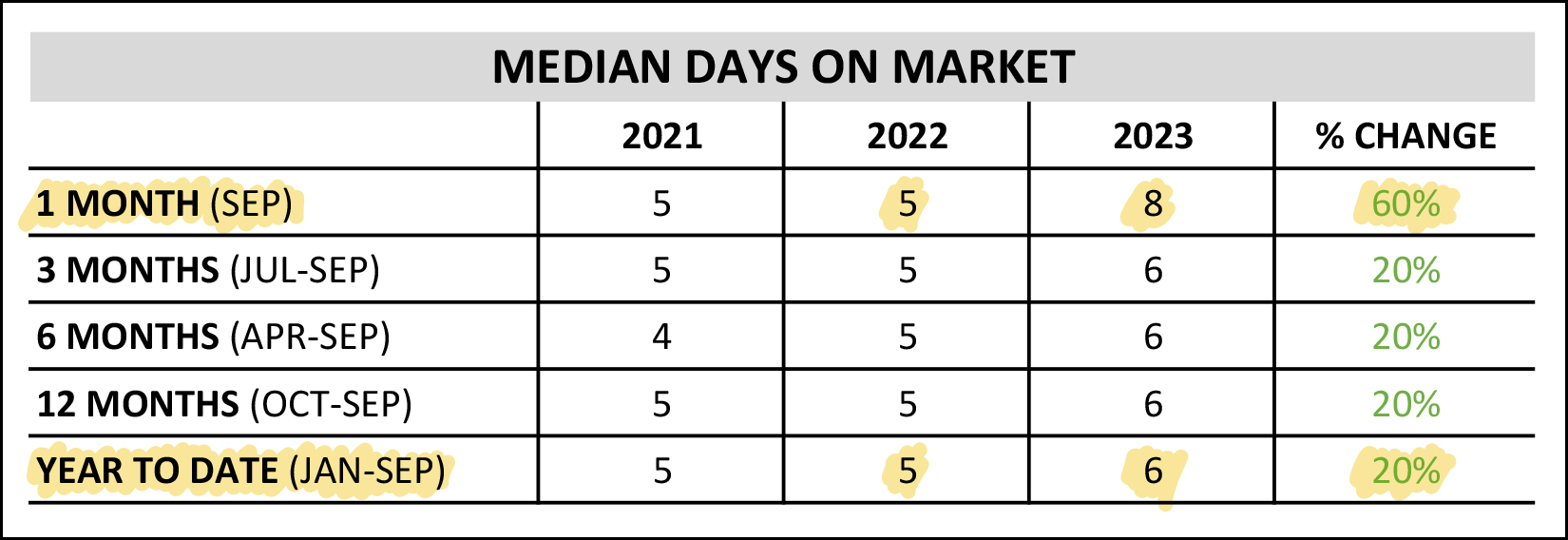

These next numbers can be quite easily taken out of context...

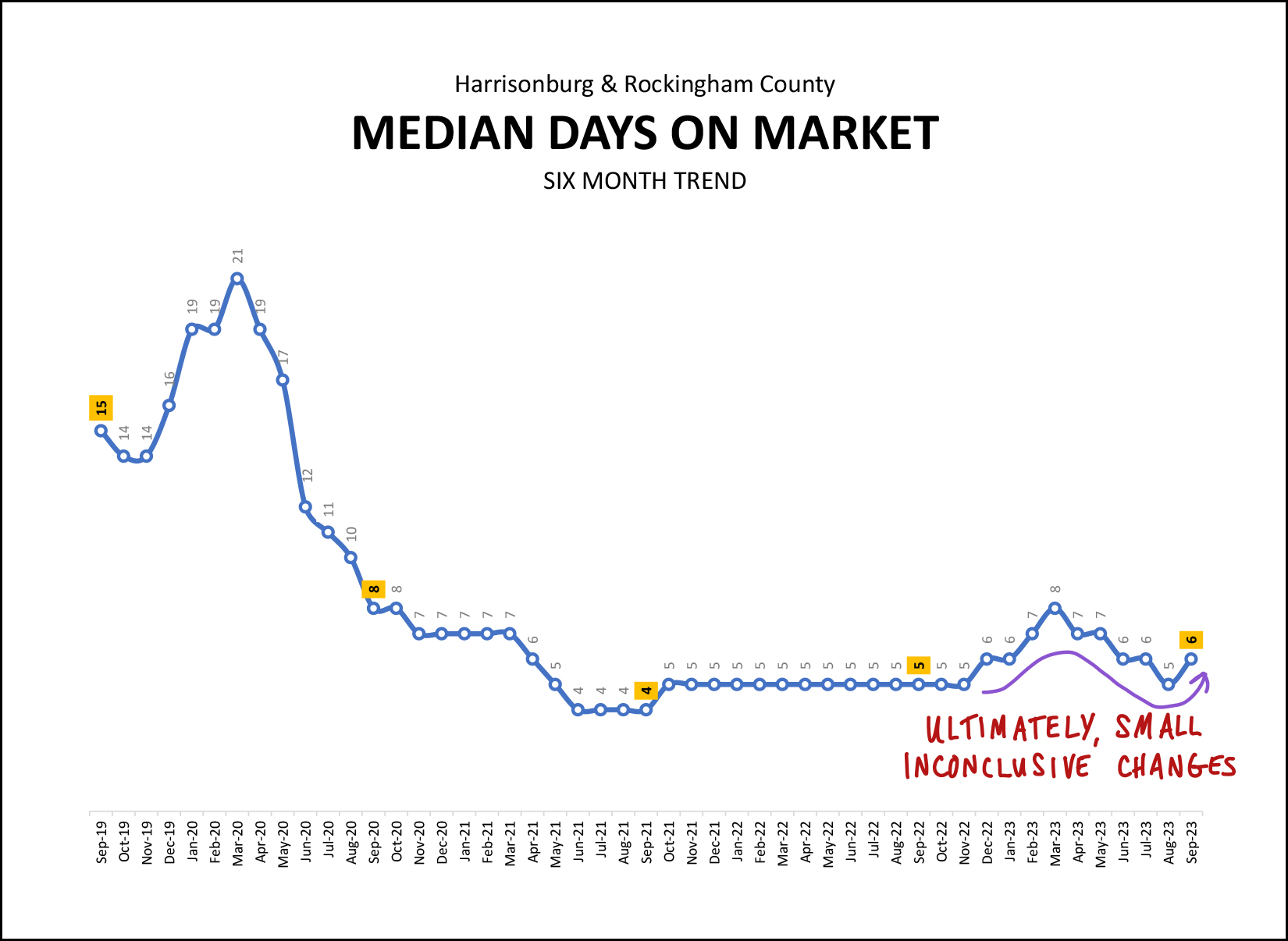

The median time that it takes for a home to go under contract (days on market) increased 60% in September 2023! Gasp! ;-)

It's actually not as much of a story as you might think. Median days on market was five days last September and is eight days this September. Yes, that is a 60% increase... but eight days is still quite low and doesn't mark too much of a shift in how quickly homes are going under contract. Most sellers are just as delighted to have their home under contract in eight days even if it isn't under contract in five days.

Also, above, you'll see that year to date the median days on market has only increased from five days to six days. Another graph below will put these numbers in a larger (longer) context. More suspense, I know.

Now, on to some graphs for the visual learners amongst us...

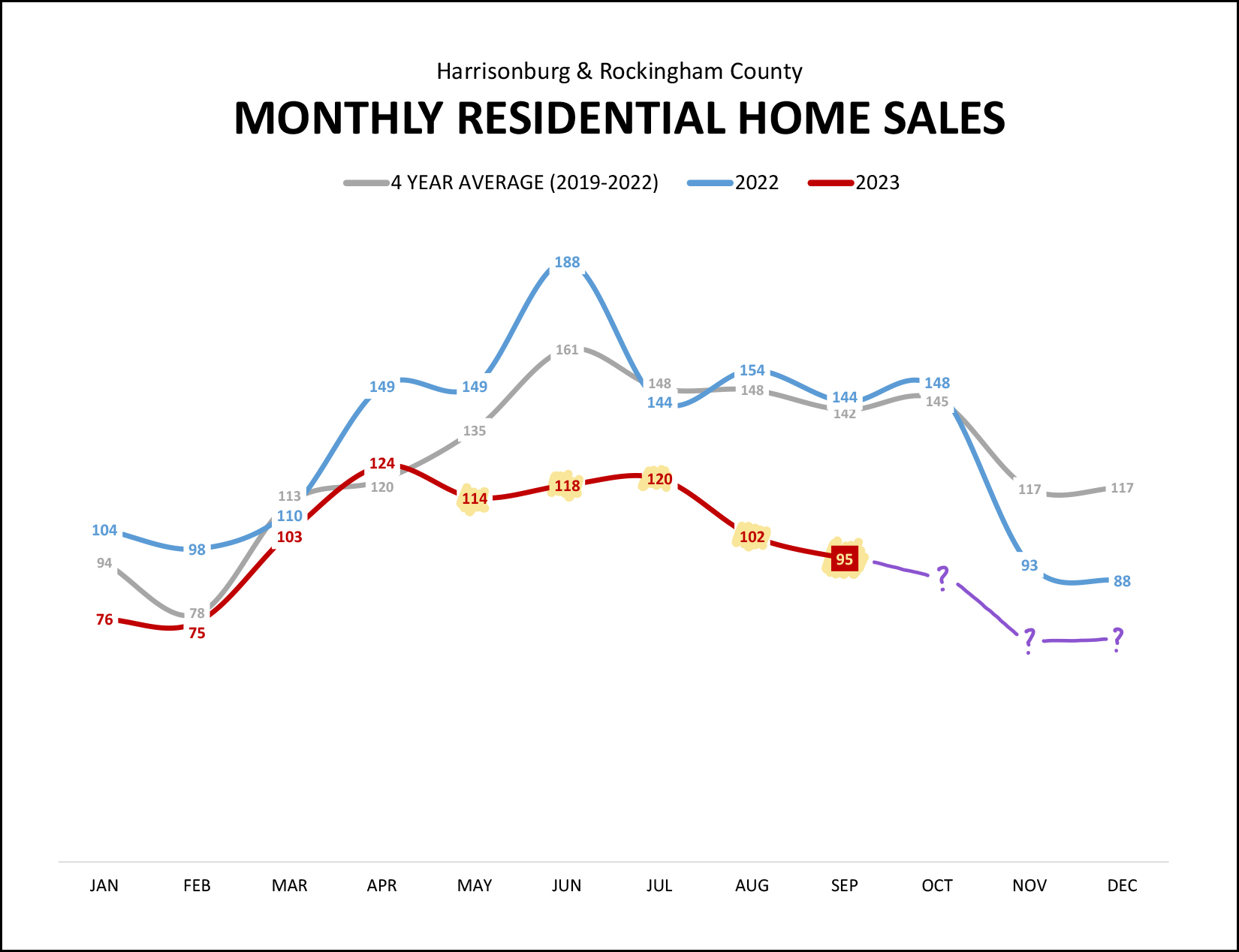

After a normal-ish January through April, we have been seeing far fewer home sales each month thereafter. May through September makes five months in a row where we saw significantly fewer home sales as compared to the same month last year (blue line) and as compared to the average of the past four years (grey line).

Looking ahead, on the graph above, I think it is reasonable to assume we will continue to see slower months of home sales in October, November and December as compared to recent years.

As I have pointed out in the past, this slow down in home sales seems to be a result in changes on both the supply and demand side of the housing market...

SUPPLY - We are seeing fewer sellers willing to sell their homes as they don't want to give up their likely low mortgage interest rate in the 3% to 4% range.

DEMAND - We are seeing fewer buyers willing or able to buy homes given the current higher mortgage interest rates in the 7% to 8% range.

Now, then, for even more context... let's see how home sales have fallen...

The blue line above shows the number of home sales in a year's time. That annual rate of home sales was hovering in the 1,300's pre-Covid and then surged up to a high of 1,727 in summer 2022. Now, however, we have seen the annual rate of home sales decline all the way below 1,300 home sales a year which is the lowest annual rate in over four years!

But yet -- enter the green line -- the median sales price of those homes keeps on rising! However, maybe we are starting to see a slight change in the trajectory of the median sales price? See below...

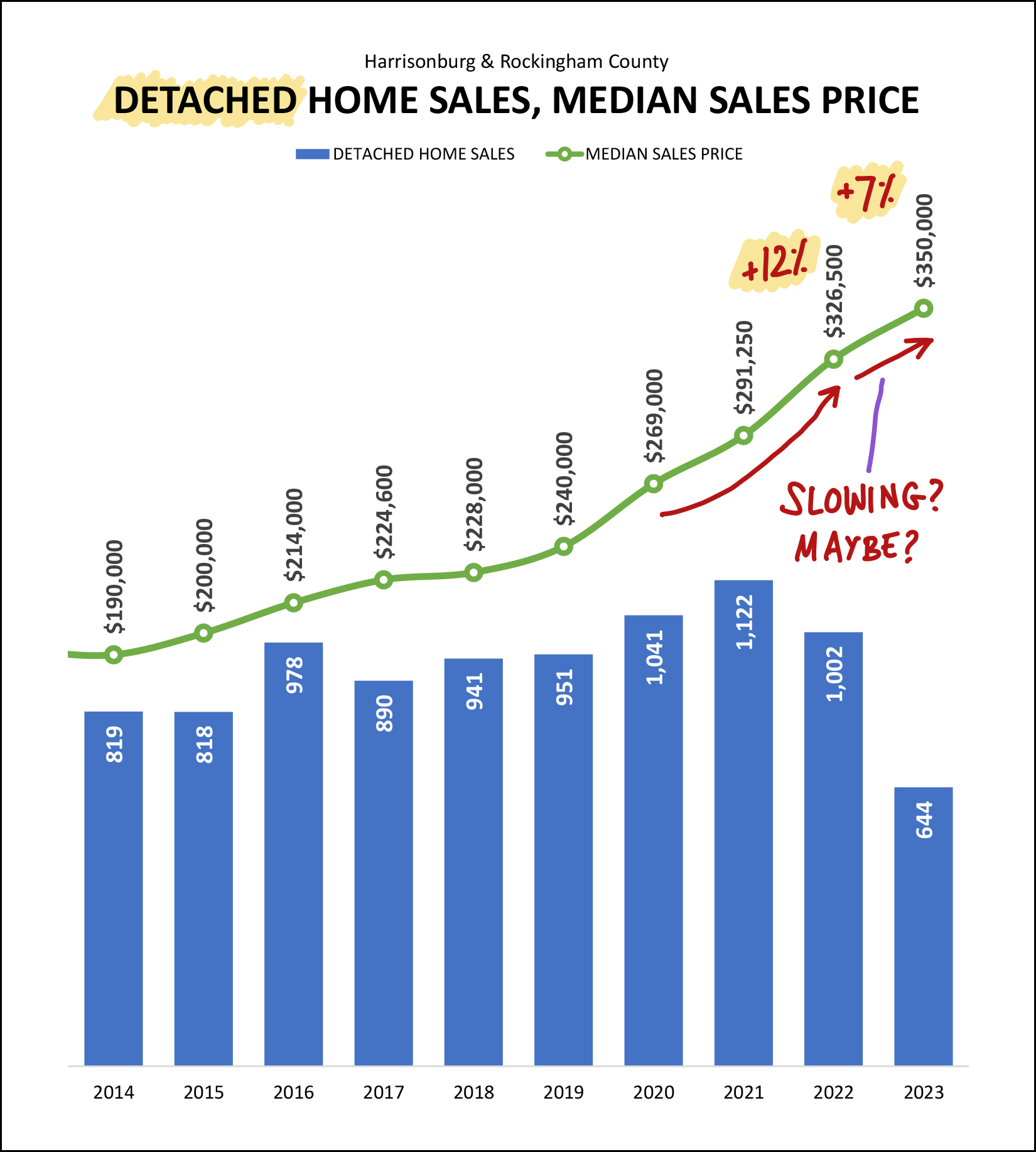

The graph above segments out only DETACHED home sales, also known as "single family homes" and excludes duplexes, townhouses and condos. Sometimes looking just at detached homes can be a more helpful or accurate view of changes in median sales prices as it removes one variable from the mix.

When we're looking at market-wide changes in the median sales price the numbers can be affected by how many detached homes are selling (generally at higher prices) compared to how many attached homes are selling (usually at lower prices). Thus, I'm looking here just at the detached home sales.

With all of that as context, you'll see that we saw a 12% increase in the median sales price of detached homes in Harrisonburg and Rockingham County in 2022... but thus far in 2023 we have only seen a 7% increase in the median sales price.

Please note that I tried to choose my words very carefully in the latter part of my headline this month...

"... Possible Slowing In Sales Price Gains"

It is possible -- not certain -- that we are seeing a slowing of sales price GAINS. Sales prices are not declining, or even staying level. Prices are still rising, but they might be rising a bit more slowly now (7%) than they were last year (12%).

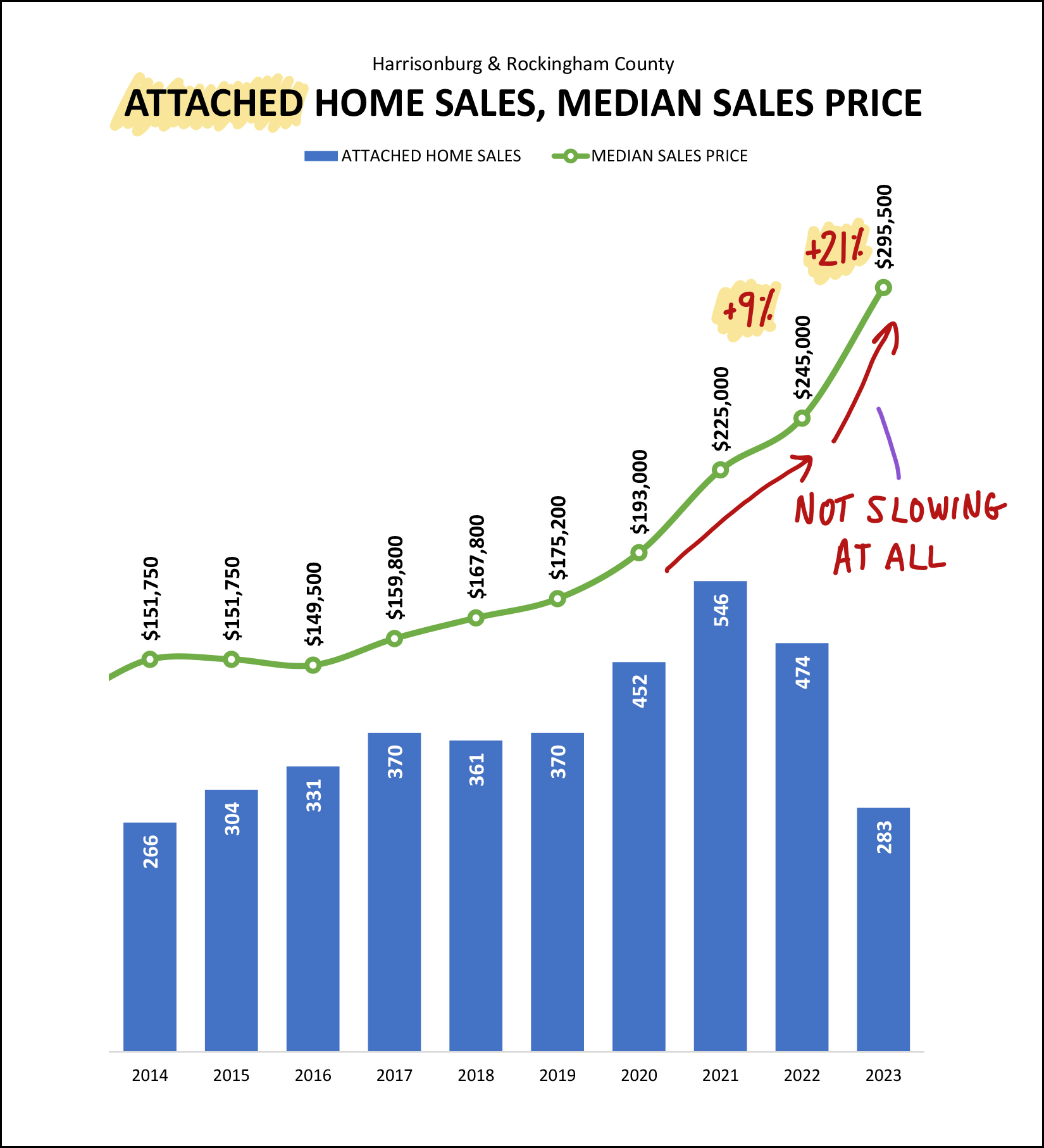

But, yes, that's just for detached homes... because look at attached homes!?!

As shown above, the median sales price of attached homes is shooting upwards, quickly! After a 9% increase in the median sales price of attached homes in 2022, we are now seeing a 21% increase in 2023!?!

My only theory here (thus far) is that this may be a result of more new construction (higher priced) attached homes selling this year, which might be driving the median sales price of attached homes up this quickly. I'll look into that further in the coming days. But yes, the median price of an attached home... is rising very quickly right now.

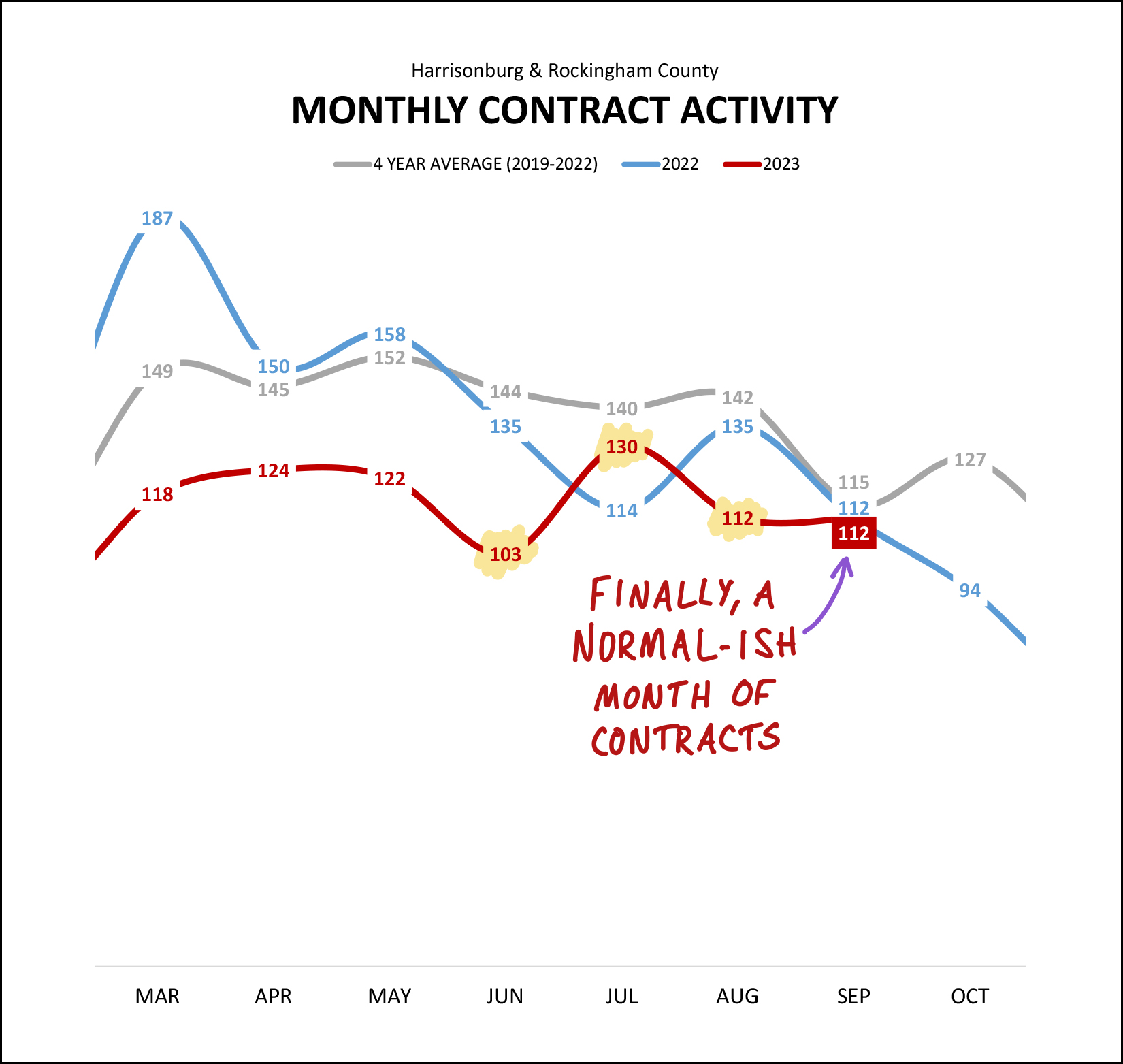

Now, on to the contracts that were signed in September that might predict the home sales we'll see in October and/or November...

As shown above (highlighted in yellow) the rate of contracts being signed in June, July and August was a bit unpredictable. June was slower than last June. July was faster than last July. August was slower than last August. But September, it was just what we might have expected... we saw 112 contracts signed this September and 112 contracts signed last September.

Now, then, the only thing I'll say looking ahead is that I expect we'll see fewer than 112 contracts signed this October and quite possibly fewer than the 94 that were signed last October.

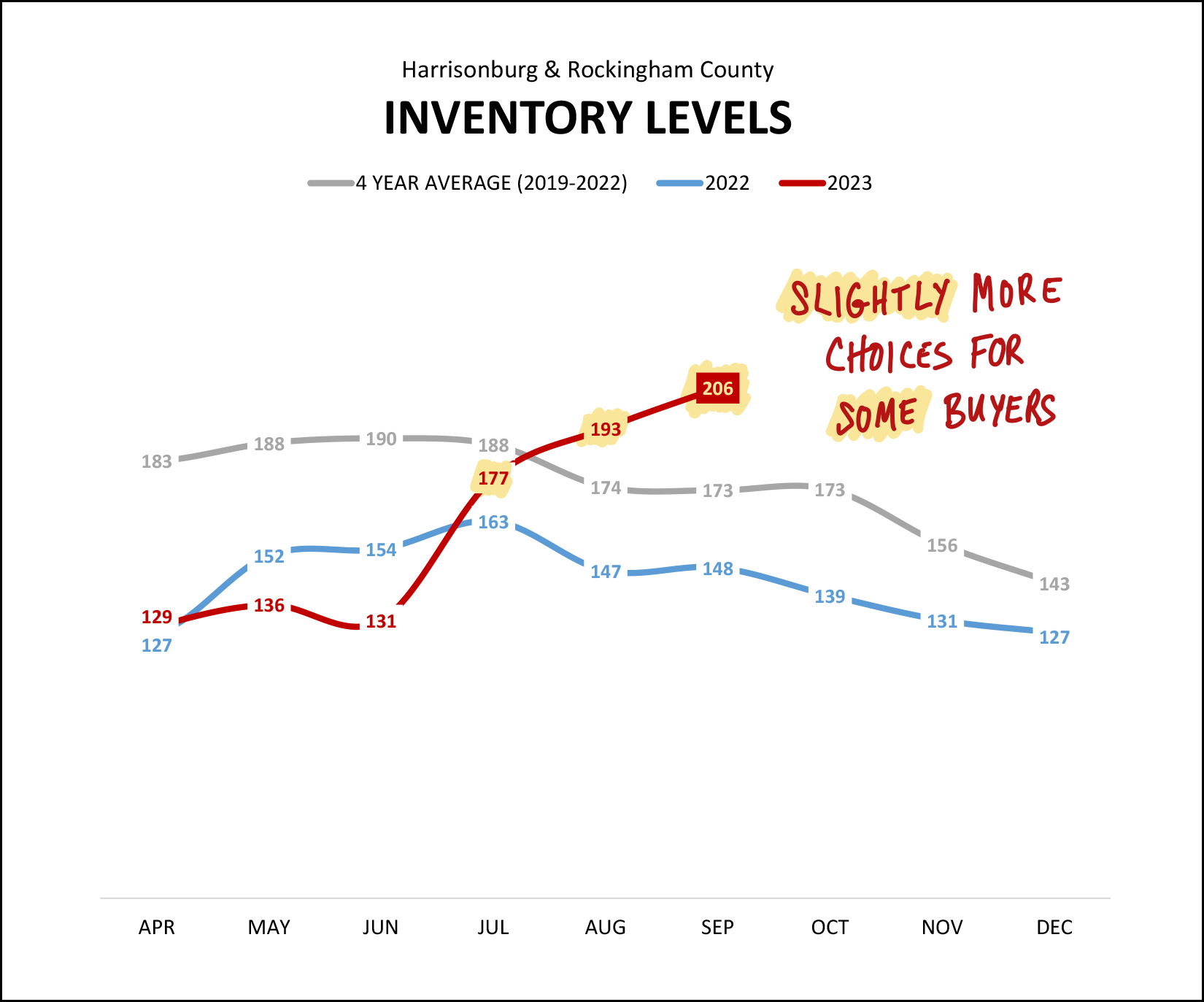

Next up, inventory levels, and as you know from the headline, they are rising...

Over the past three months we have seen inventory levels rise from almost the lowest level in the past two years (131 in June 2023) to definitely and absolutely the highest level in the past two years (206 in September 2023).

A few nuances to add here, though, as highlighted above...

SLIGHTLY - This increase in inventory levels does put us above where we have been for the past few years (during/after Covid) but inventory levels are still well below where they were for much of the past decade. This increase in inventory levels provides slightly more choices for buyers -- not abundantly more choices for buyers.

SOME - The increased inventory levels are not equally distributed across all price ranges, property types and locations. Some segments of our local market are still quite undersupplied and some are more oversupplied than others. So, some buyers have slightly more choices... but all buyers do not have slightly more choices.

Now, to add a bit longer context to the recent rise in median days on market...

We have started to see the median days on market figure bounce around a bit in 2023... but it has remained between five days and eight days for the past year. These very small increases still keep it well below where it was in 2020 and prior. Also of note here is that while the median days on market figure is staying within that five to eight day range there are plenty of homes that are selling in fewer than five days and plenty that are selling in more (or much more) than eight days.

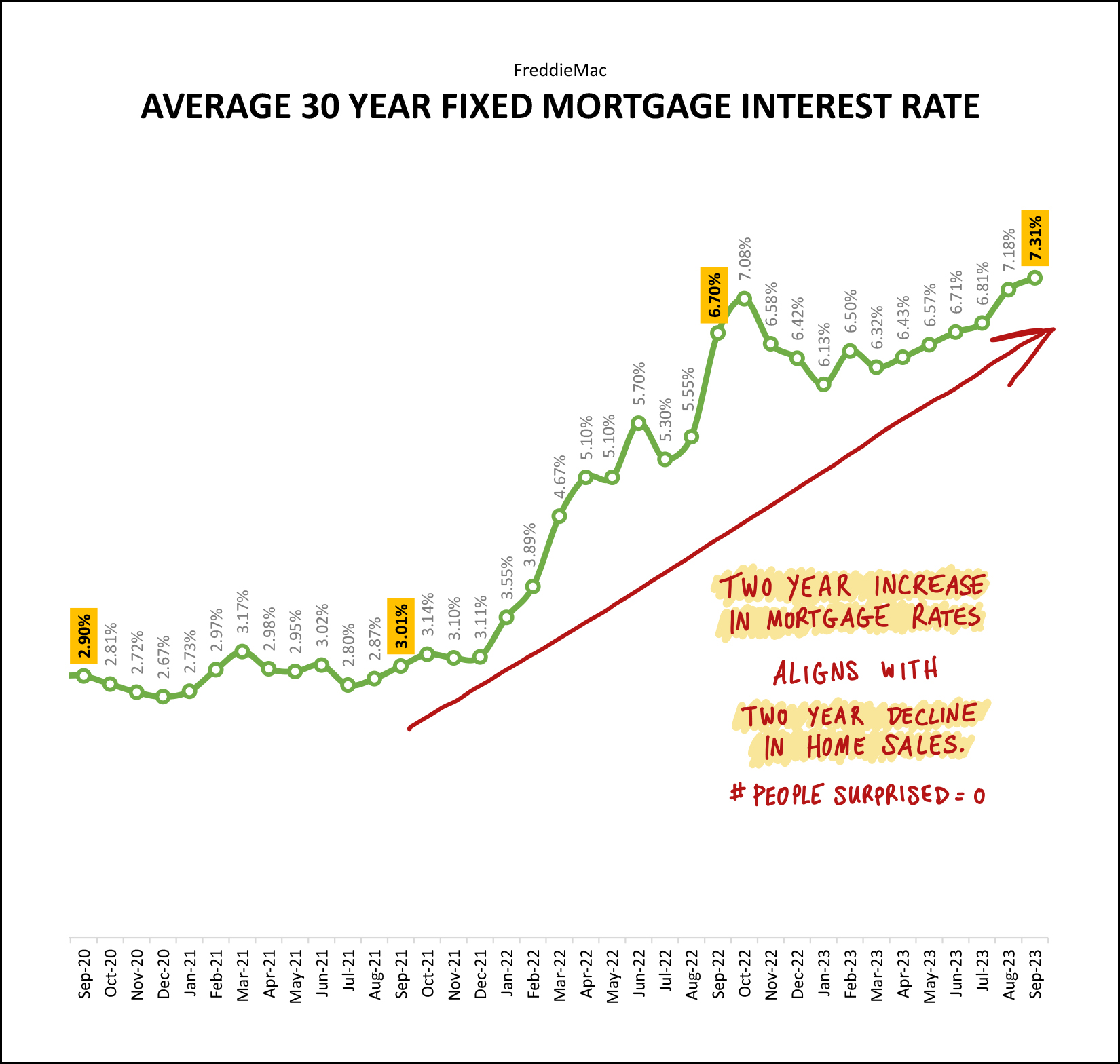

And finally, it's time to play the blame game! :-) Why are we seeing fewer home sales right now? Why are we seeing rising inventory levels? Why might price increase gains be slowing? It's all, arguably, because of those darn mortgage interest rates...

Over the past two years we have seen steadily increasing mortgage interest rates.

Over the past two years we have seen steady declines in the annual rate of home sales.

Coincidence? Probably not.

Higher mortgage interest rates have...

[1] Caused some would-be sellers to decide not to sell as they do not want to give up their low mortgage interest rate.

[2] Caused some would-be buyers to decide not to buy as they can't afford (or don't want to pay) the monthly payment associated with the house they would like to buy.

Where, then, will we likely see the market headed through the remainder of 2023 and into 2024? I believe we'll see...

[1] Continued high mortgage interest rates, at or above 6.5%.

[2] Continued declines in the annual rate of home sales, though I suspect the declines will slow.

[3] Continued increases in the median sales price, though I suspect the increases will slow.

[4] Sustained higher inventory levels that might continue to creep upward.

So... if you plan to engage in this current real estate market as a home buyer or a home seller...

BUYERS - You might see a few more choices of homes to purchase at any given time over the next few months. Your monthly housing costs will likely still be high given continued high interest rates. Waiting a year probably won't result in a lower monthly payment as rates likely won't drop considerably and prices don't seem likely to drop.

SELLERS - Prices are still high, and rising, but those prices convert into an ever higher monthly housing cost for buyers. As such, you'll likely have fewer showings on your house and fewer offers. Prepare your house well, price it appropriately, market it thoroughly, and bear in mind that you might have to negotiate on price and terms with a buyer depending on your home's price range, property type, location, etc.

If you're thinking about buying or thinking about selling but don't know what to think... feel free to reach out. I'm always happy to talk things through with you to try to help you clarify your goals and priorities and to figure out if now is the right time to make a move. You can reach me most easily at 540-578-0102 (call/text) or by email here.