Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Wednesday, May 15, 2024

Will mortgage interest rate fluctuations impact market activity in the local housing market?

Yes and no.

For context, first...

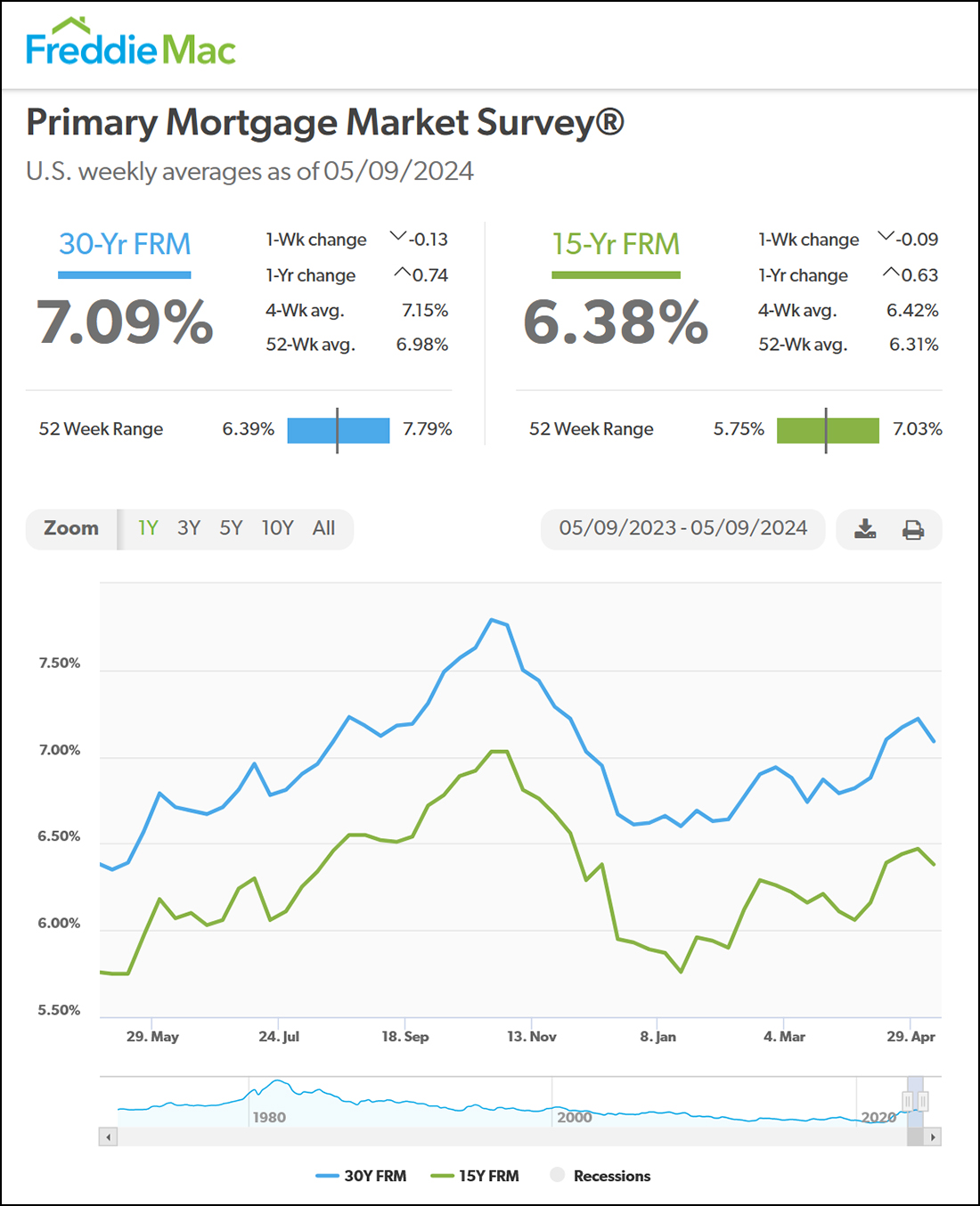

Over the past year, rates have fluctuated between 5.75% and 7.75%. That's a pretty broad swing over just a single year.

The current average rate of 7.09% is lower than the 7.5% rate we saw six months ago.

Rates have been mostly rising over the past four months from 6.6% to 7.1%.

So, will rates impact market activity?

Yes... if/as rates get back below 7% or closer to 6.5%, more buyers are likely to more seriously consider more offers on more properties. Likewise, if/as rates rise further and if they approach 7.5%, fewer buyers are likely to consider offers.

But, no... rate swings between 6% and 7% (for the most part) seem unlikely to drastically change the number of buyers who will choose to buy a home this year.

So, if you will be selling a home, you likely don't need to try to time your listing with when mortgage interest rates are lowest.

And if you will be buying a home, it will be convenient if the home you like the most hits the market when mortgage interest rates are the lowest... but you'll probably still pursue it if rates are a bit higher when that perfect house hits the market.