Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Tuesday, April 15, 2025

Hopefully your taxes are done, filed, and maybe even bringing a refund your way.

Before we dive into the data, a quick personal update...

I’ve been hitting the trails again lately, training for a half marathon later this month and a 50K trail race (5K x 10) in early May. I ran the same 50K last year without quite enough training… and while I did finish, it wasn’t exactly the finish I had in mind. This time, I’m hoping a bit more preparation will make it feel less like a survival exercise and maybe even a little fun. (Maybe.)

Wish me luck, and let me know if you want to join me on a trail run!

This Month’s Giveaway: Brunch on Me?

Each month I like to say thanks to my readers with a local giveaway. This time around, I’m giving away a $50 gift card to Clementine - a downtown Harrisonburg favorite with an excellent weekend brunch lineup.

Hungry yet? Click here to enter to win your chance at brunch at Clementine.

Each month I like to say thanks to my readers with a local giveaway. This time around, I’m giving away a $50 gift card to Clementine - a downtown Harrisonburg favorite with an excellent weekend brunch lineup.

Hungry yet? Click here to enter to win your chance at brunch at Clementine.

Back To The Numbers

Now, let’s shift from numbers you have to deal with (pesky income taxes) to numbers you might actually enjoy! I promise this month's local housing market update will be more exciting than the tax code - though I admit, that’s not necessarily saying much.

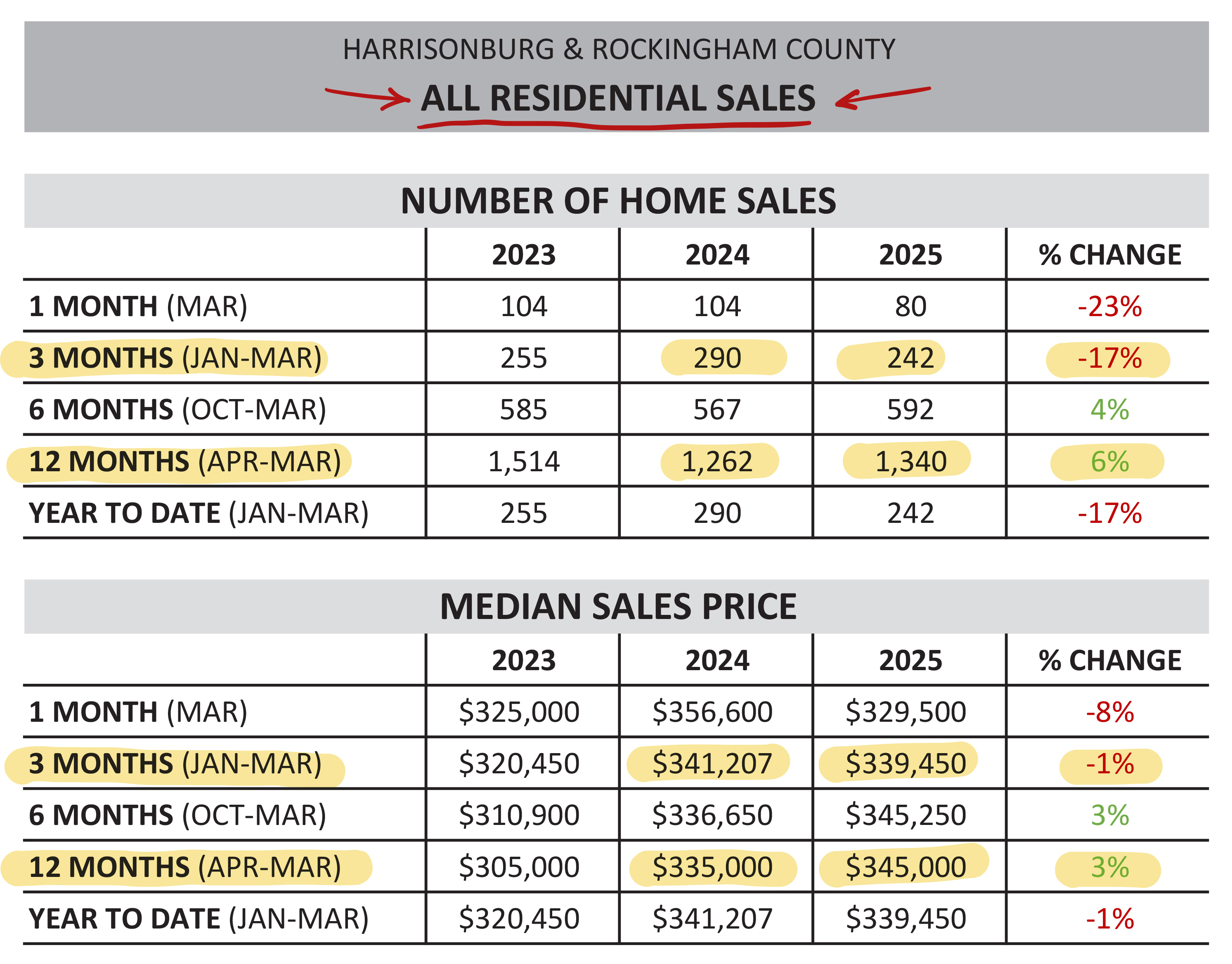

First up, the overall market through three months...

First, the pace of home sales is off to a slower start this year. From January through March, we saw a 17% drop in the number of homes sold compared to the same time last year.

But zooming out tells a different story. When we compare the most recent 12 months to the 12 months before that, we’re actually seeing more homes selling overall. So yes, things have started slowly in 2025 - but the broader trend suggests the market is gaining momentum.

And what about prices?

The days of double-digit annual increases in the median sales price seem to be behind us. So far this year, prices are down just slightly - about 1% compared to the first three months of last year.

But again, looking at the bigger picture, the median sales price over the past 12 months is still 3% higher than the previous 12 months.

In short: prices are still inching upward, just at a much more modest pace than we’ve gotten used to over the past five years.

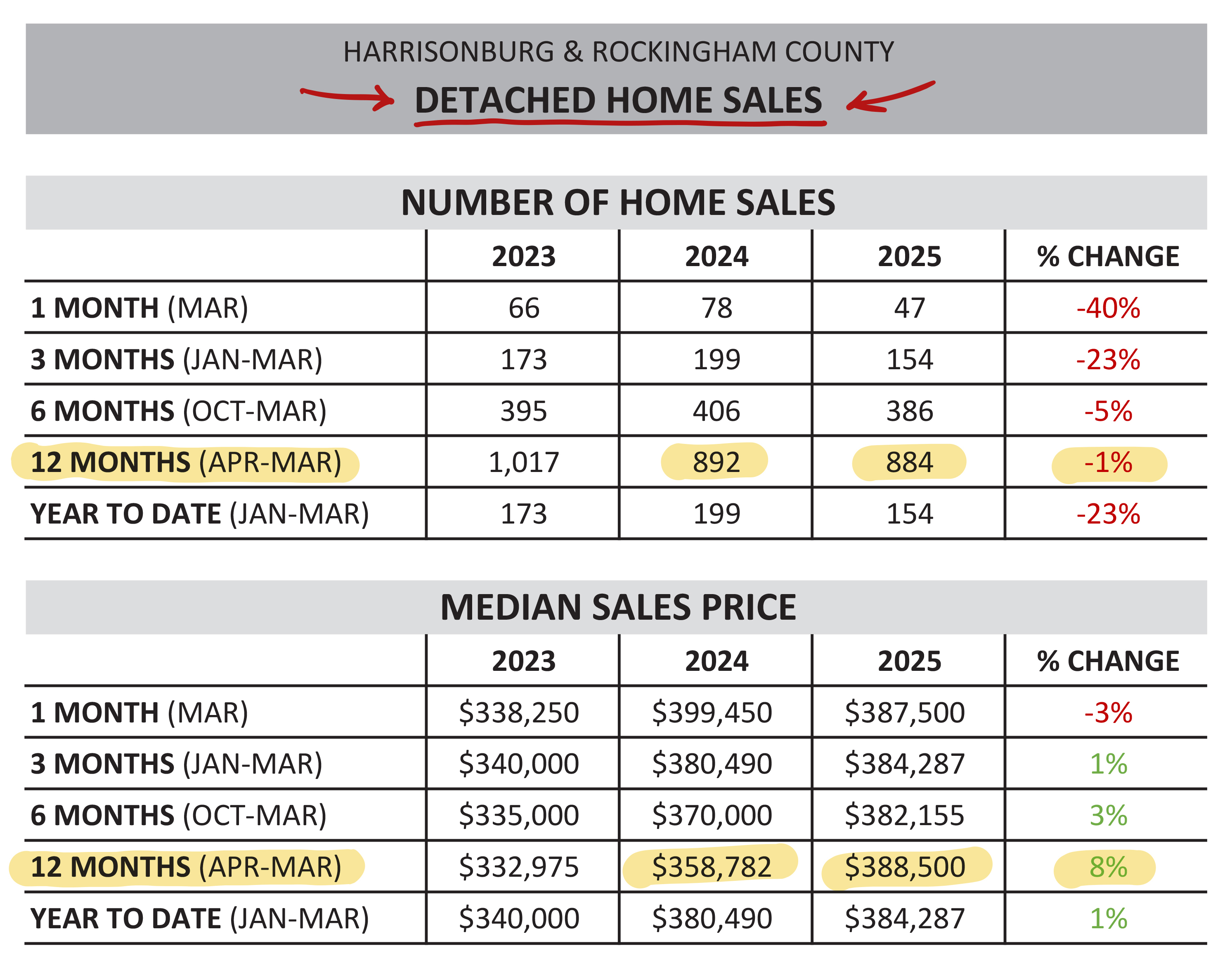

Now, let's look just at detached homes...

Even though the overall market has seen a 6% increase in home sales, sales of detached homes are actually down 1% over the past 12 months compared to the previous year. This slight dip likely isn’t due to a lack of buyer interest- it's more likely a result of fewer homeowners choosing to sell.

On the pricing side, detached homes are telling a different story. While the market as a whole has seen a 3% increase in the median sales price, detached homes are up 8% over the past year.

So, with fewer detached homes hitting the market, it's not too surprising to see prices rising more quickly in that segment. Fewer sellers + steady demand = upward pressure on prices.

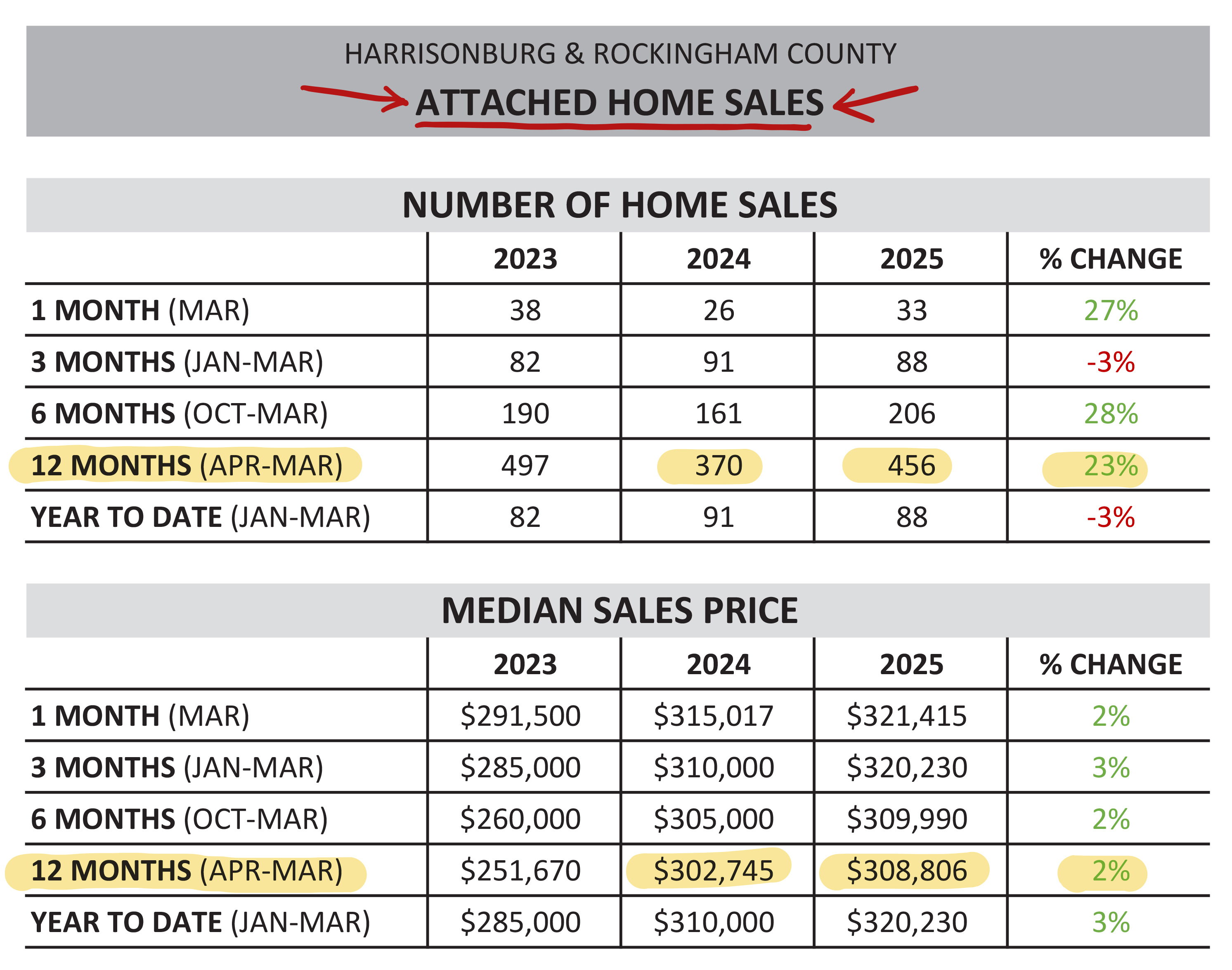

Now how about those attached homes?

Over the past 12 months, attached home sales are up 23% compared to the year before. That tells us there are plenty of buyers in the market - and plenty of sellers, too.

With inventory a bit more available in this segment, prices haven't climbed as quickly. The median sales price of attached homes is up just 2% over the past year - compared to an 8% jump for detached homes.

So, in short: it's somewhat easier to find an attached homes to buy, and price growth has been more modest thanks to a better balance between supply and demand.

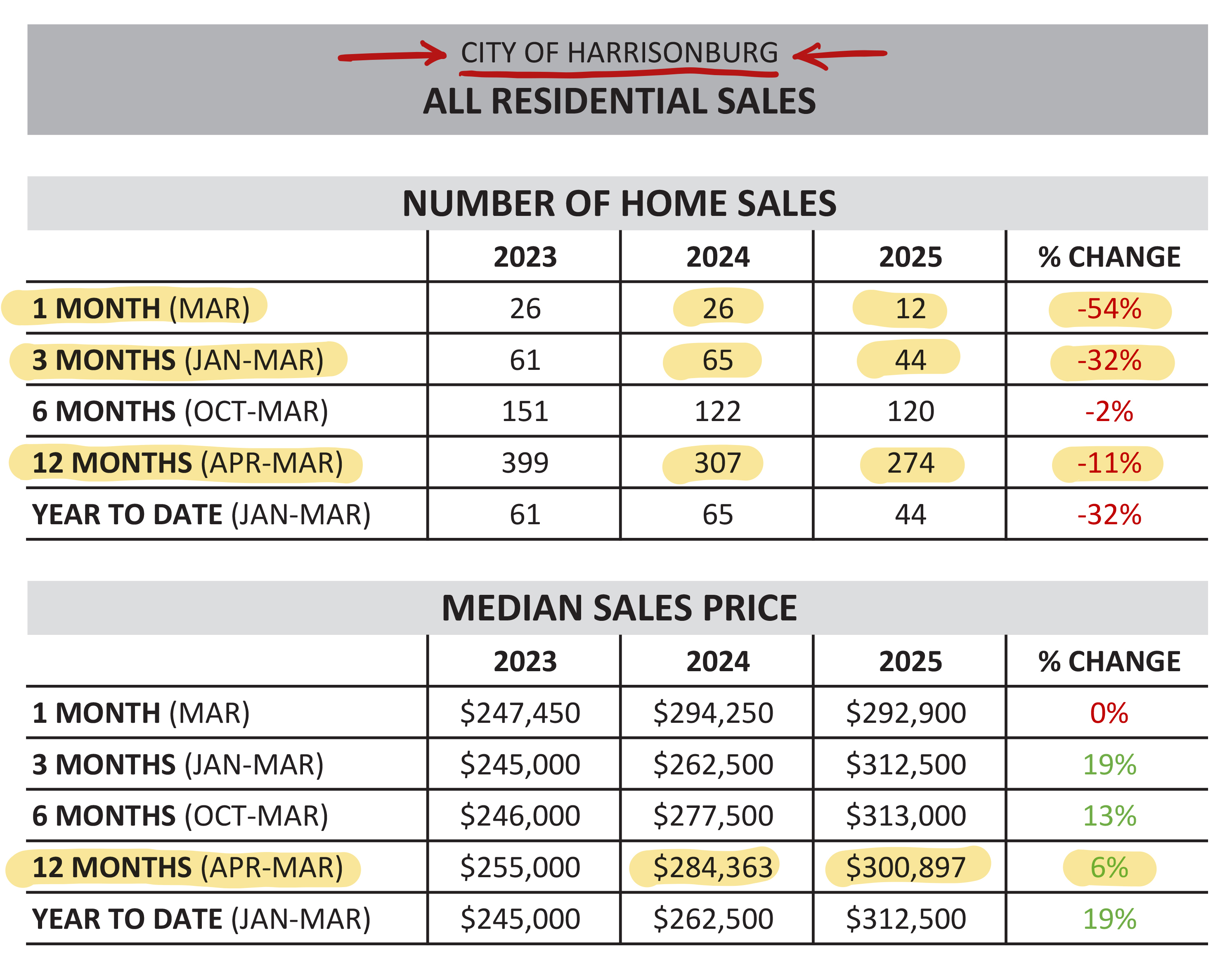

When we zoom in on just the City of Harrisonburg, things get wacky...

Read it, and read it again. Only 12 homes sold in the City in March!?! This is a sharp 54% drop compared to last March. A one-month fluke? Maybe not.

Looking at the first quarter of the year, City sales are down 32%, and over the past 12 months, they’re down 11%. So yes - fewer homes are selling in the City of Harrisonburg.

But with fewer homeowners choosing to sell, or perhaps because of fewer homeowners choosing to sell, prices are on the rise. The median sales price in the City is up 6% over the past year, outpacing the 3% market-wide increase.

Less inventory, steady demand, higher prices - it's a familiar formula.

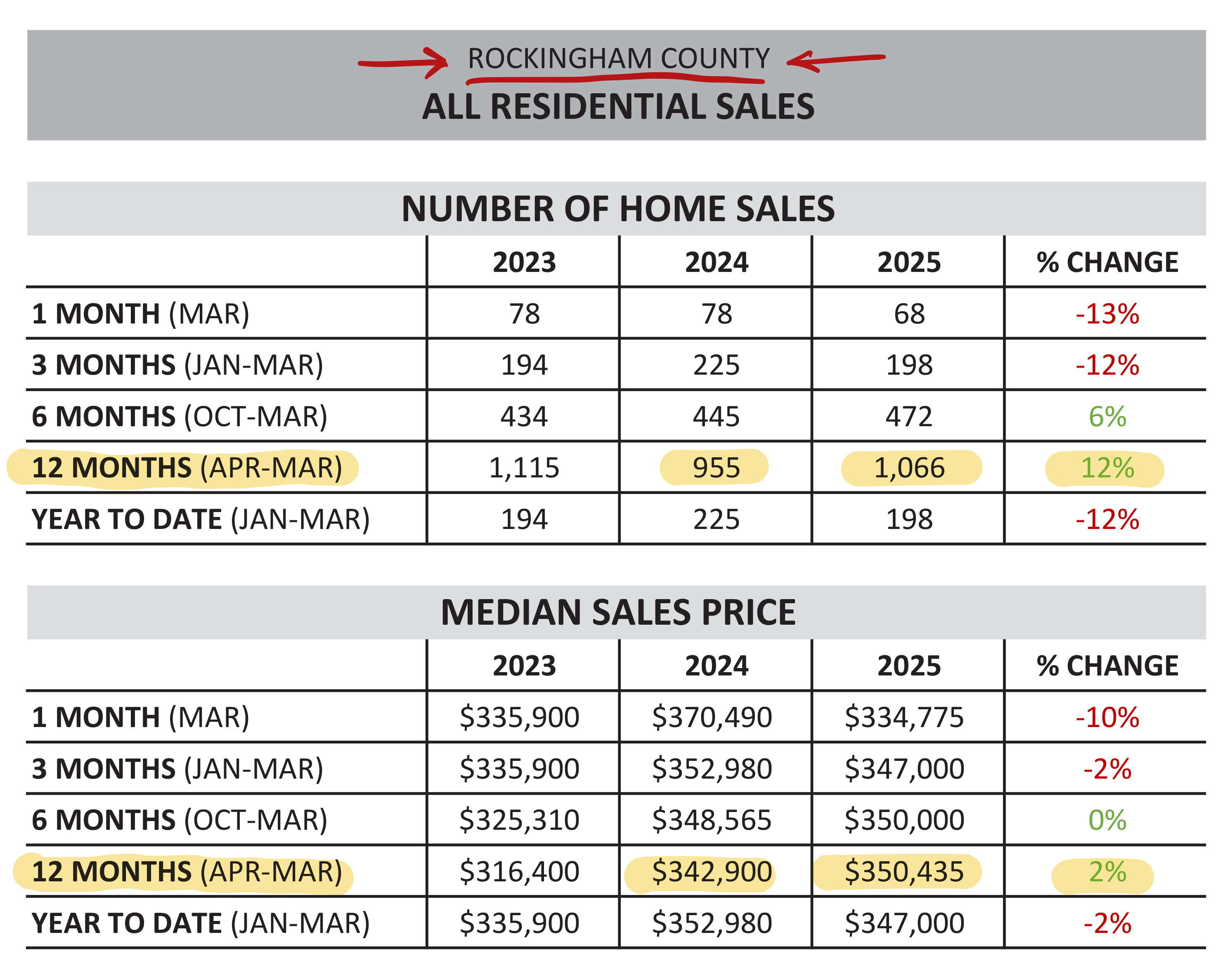

Meanwhile, in Rockingham County...

But with that increase in activity comes a bit of a tradeoff. Inventory has been more readily available, which means prices haven’t climbed as quickly - the median sales price is up just 2% over the past year.

More homes to buy = more sales = more modest price growth. It all comes back to supply and demand, as usual.

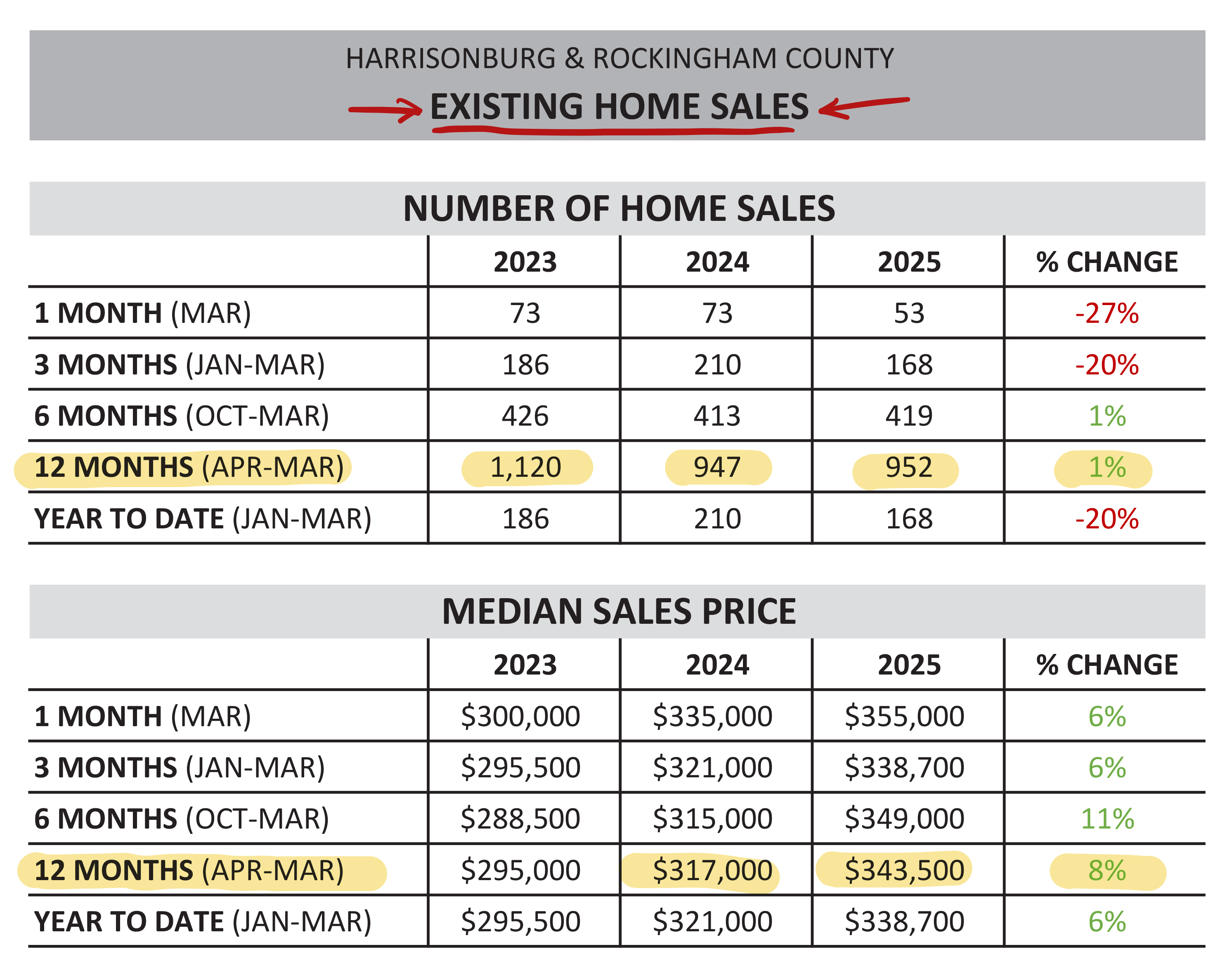

One more chart (existing home sales) before we get to the pretty graphs... hang in there...

We’re finally seeing a slight (slight!) uptick, with 1% more existing homes selling over the past 12 months compared to the year before. But before we start celebrating, let’s keep it in perspective... existing home sales were down 20% in the first three months of this year, and down 27% in March alone.

One likely reason? There just aren't enough existing homes hitting the market. And that continued low supply is still putting upward pressure on prices. The median sales price of existing homes is up 8% year-over-year - a stronger increase than we're seeing in the market overall.

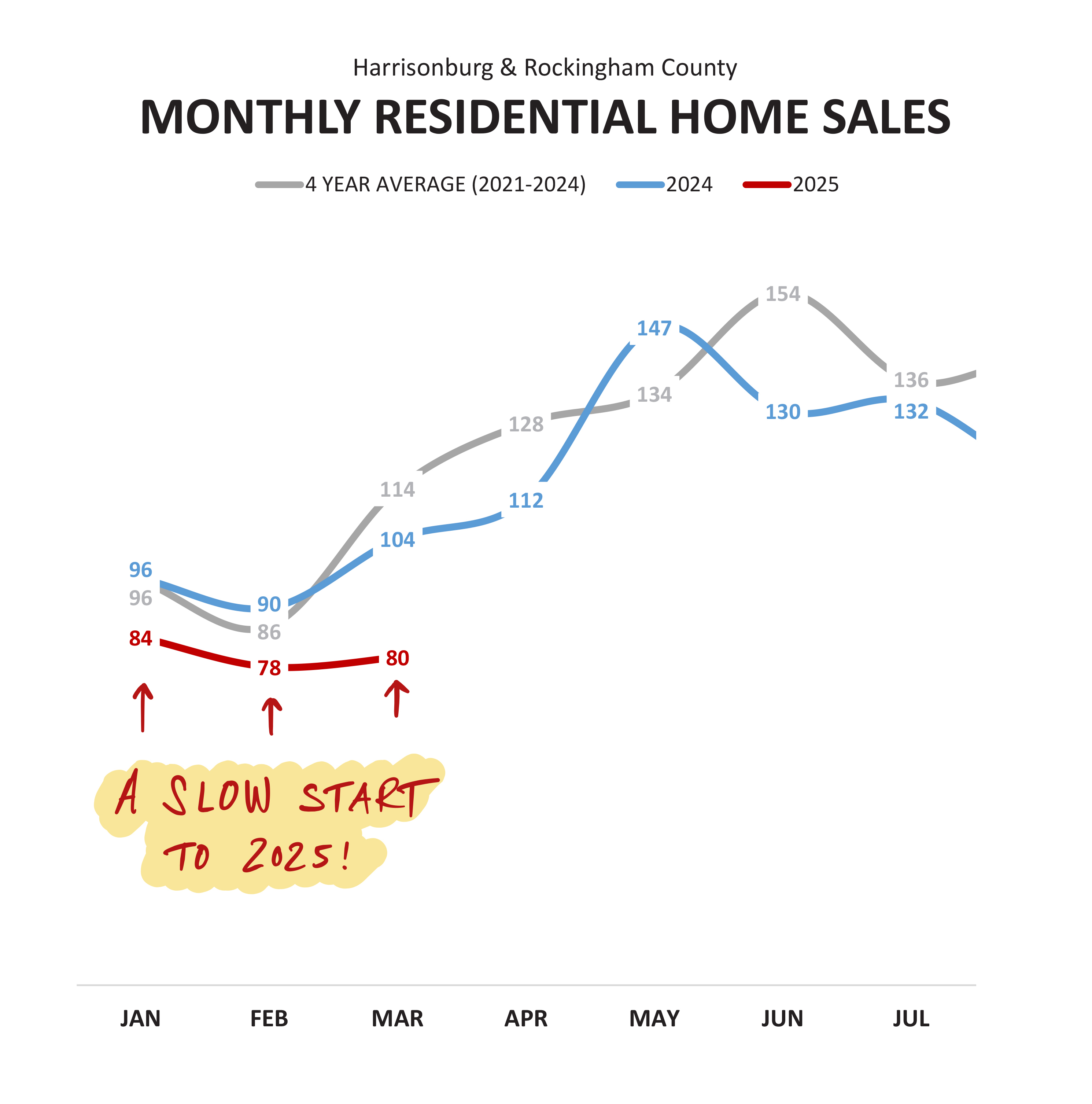

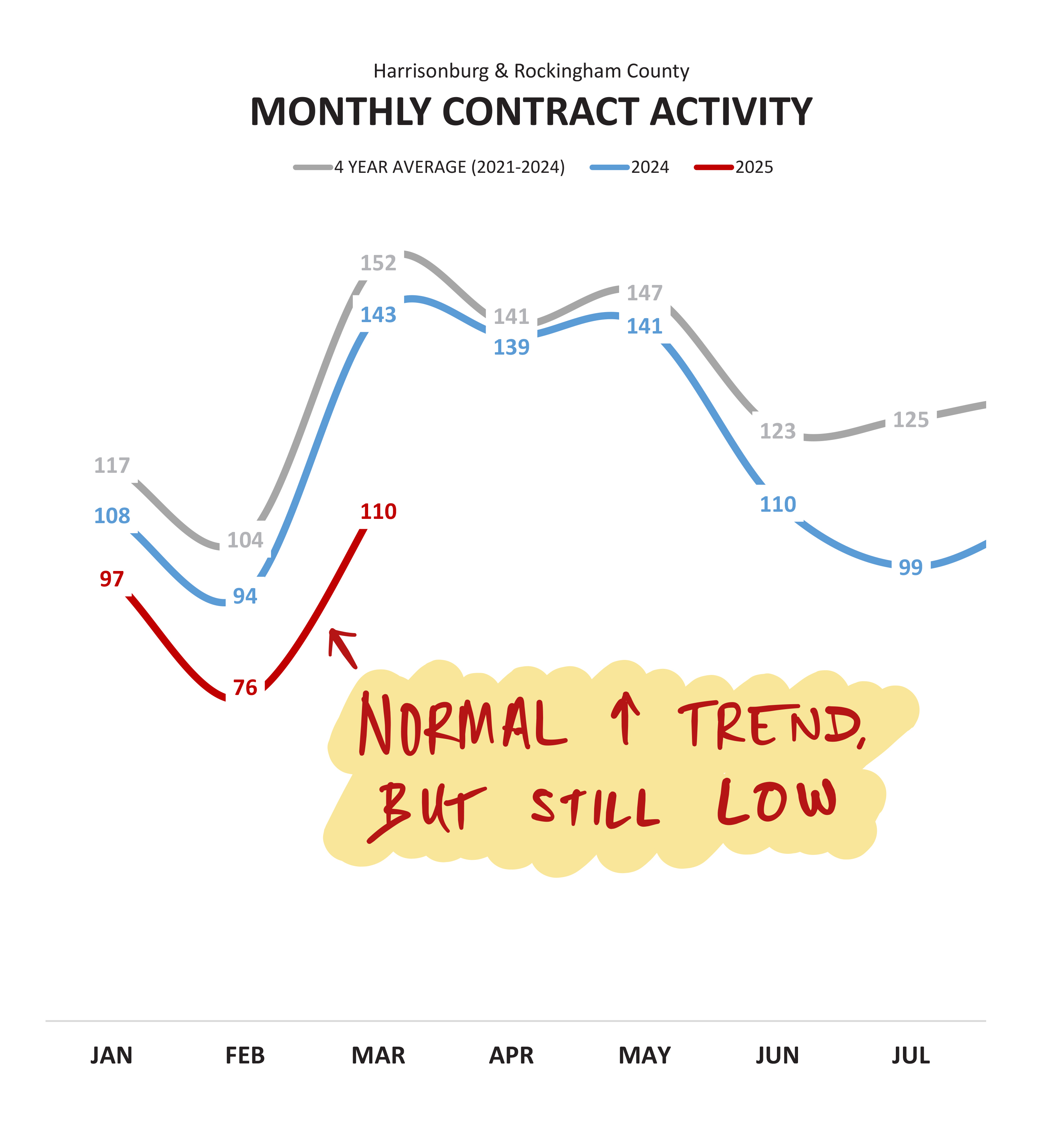

Now, a visual of the slow start of 2025...

And that red line, trailing well below the others? Yep, that's the slow, slow, sloooow start to 2025.

Fewer homes sold in January than the year before - and the same story played out in February and March. Will things pick up in April and May? That's going to depend on one big question: Will enough homeowners decide it's time to sell?

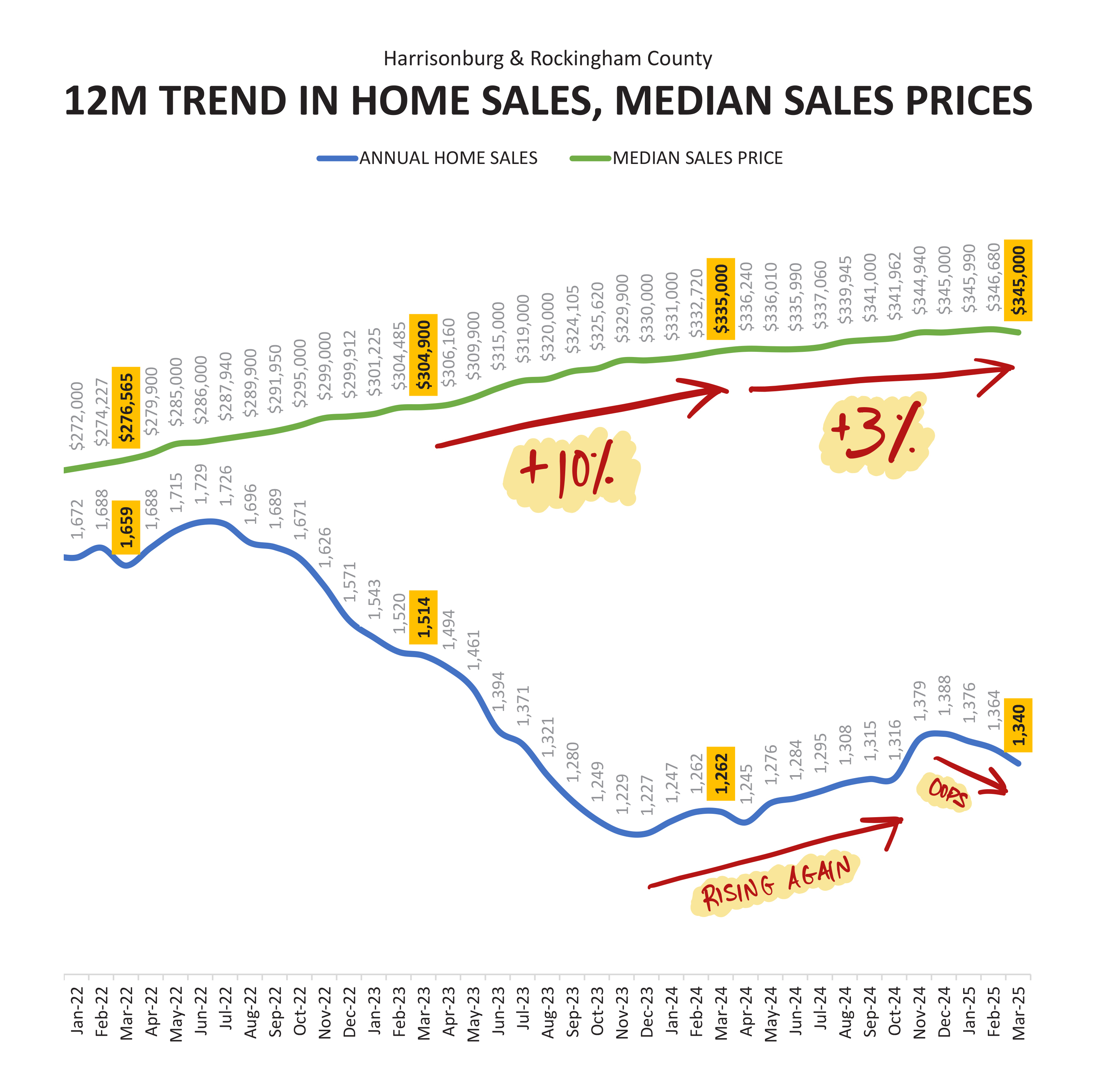

Next, here's a smoothed out version of our local market trends...

First, after a steady climb in the pace of home sales through most of 2024, things have been heading in the other direction so far in 2025. New year, new trend? Unfortunately, not the kind that excites would-be buyers.

As for prices - after several years of double-digit increases, prices aren't rising quite as quickly. The median sales price is up just 3% over the past year.

Will we see sales pick back up later this year? Will that 3% price growth hold steady? Stay tuned - 2025 still has plenty of story left to tell.

And now, the best predictor of future sales... recent contracts...

So, what's ahead for April and May? Say it with me now... it all depends on whether more homeowners are willing to sell.

The buyers? They're ready.

The sellers? Not quite as eager. And that's what continues to shape the market as we roll through 2025.

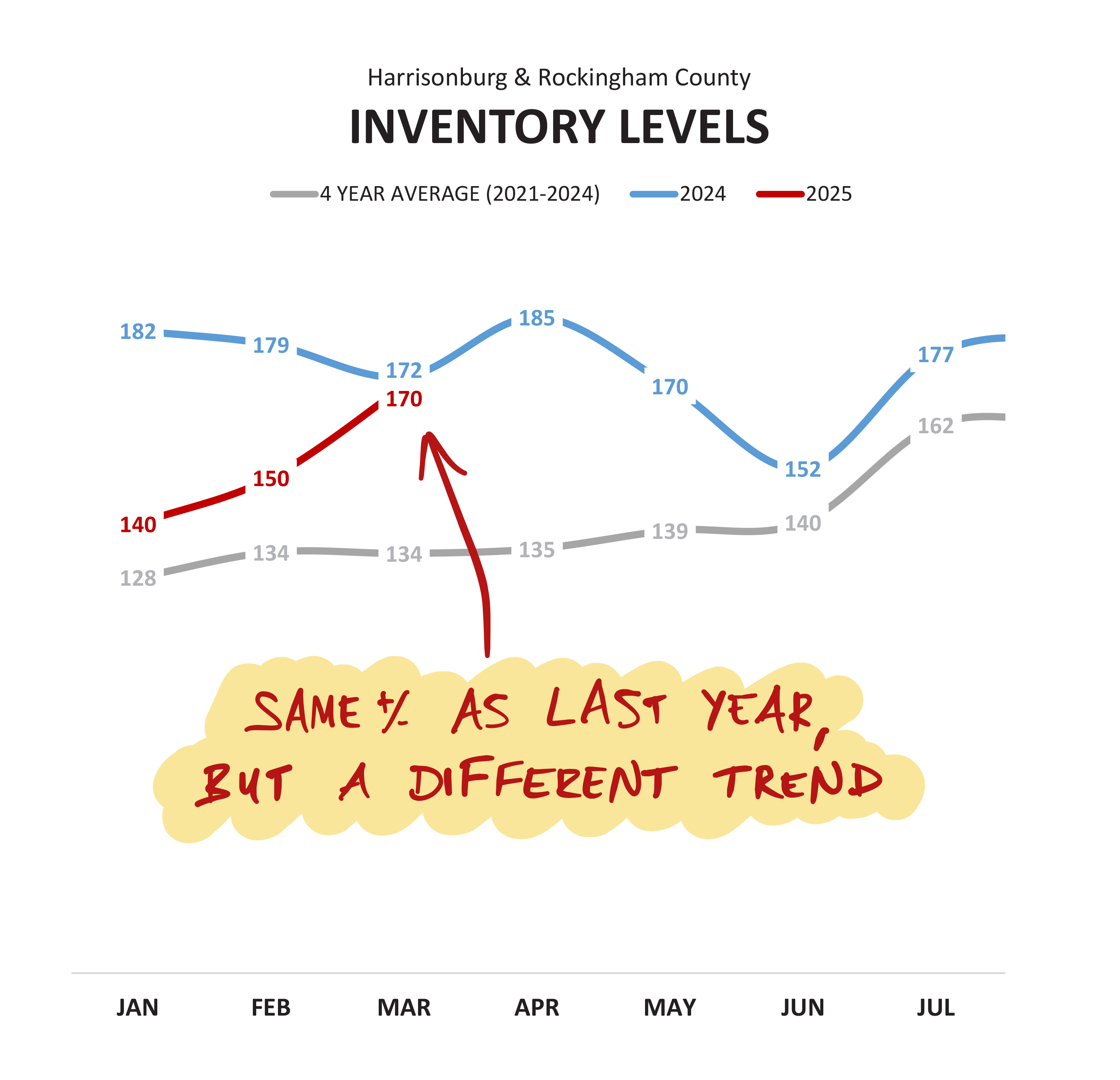

We've been picking on homeowners not selling... let's look at the inventory numbers...

Will inventory climb higher in April and May? That would certainly be noteworthy... but I'm not expecting that we'll see that happen. Buyers are still quick to pounce on new listings, keeping overall inventory levels in check.

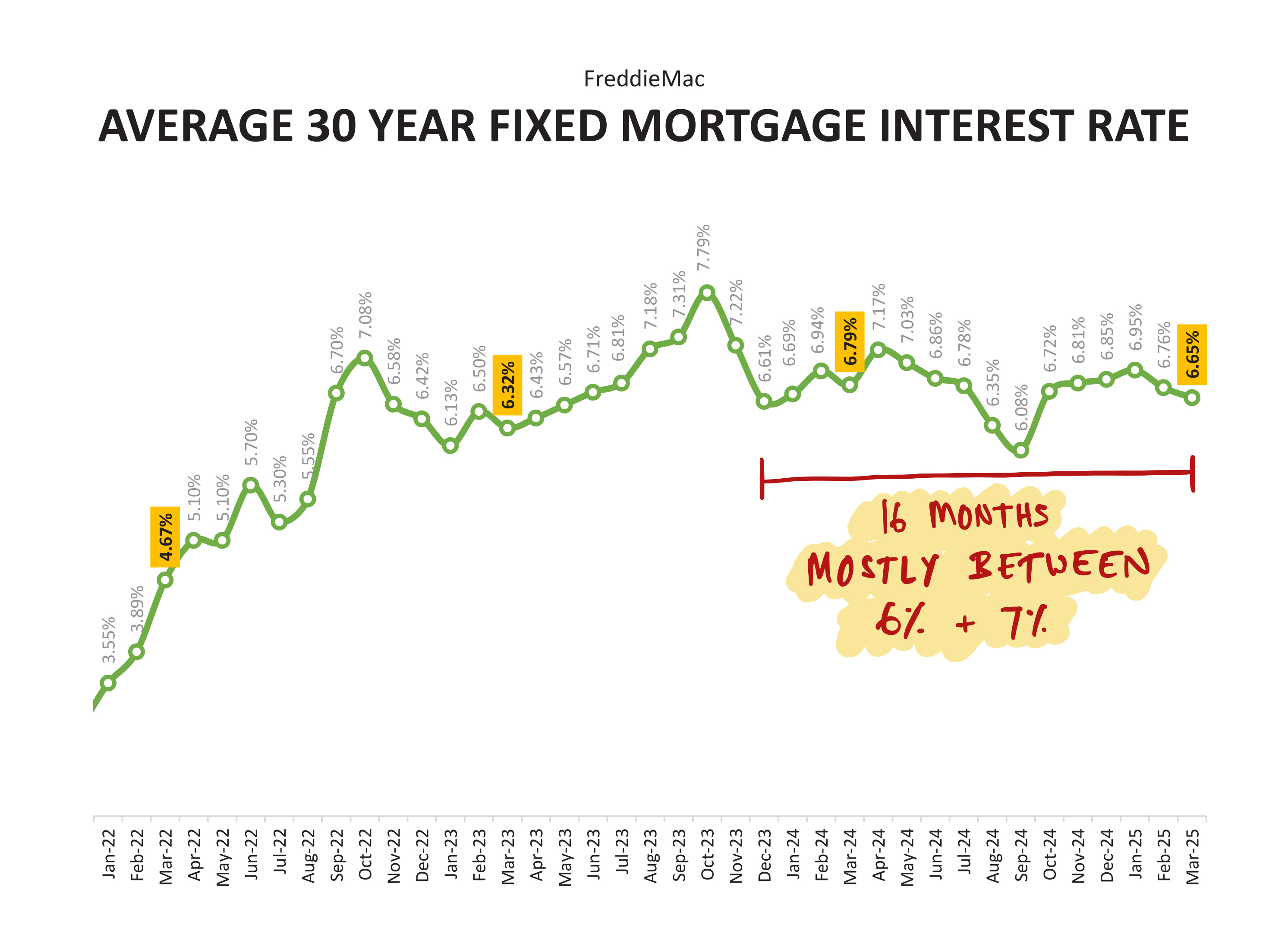

Finally, let's look at mortgage interest rates...

I'd love to say we're heading back to sub-6% rates later in 2025... but at the moment, that doesn't seem likely.

Now, having absorbed all of those numbers and charts, here's what you need to know...

Tips for Buyers

1. Be Ready to Act Quickly

Inventory remains low - especially for detached and existing homes - so when the right property comes along, hesitation can mean missing out. Get pre-approved, know what you’re looking for, and be ready to make a move.

2. Have Reasonable Expectations About Pricing

2. Have Reasonable Expectations About Pricing

Prices aren't skyrocketing like they were a few years ago, but they're still inching upward. Detached homes and existing homes, in particular, are seeing stronger price growth. Budget accordingly.

3. Will You Broaden Your Search?

3. Will You Broaden Your Search?

Attached homes - and new homes - are seeing more availability and slower price growth. If you're feeling priced out of the detached or resale home market, consider exploring this segment for more options and slightly less competition.

Tips for Sellers

1. The Buyers Are Still Out There

While overall sales have slowed, buyer demand is still strong - especially when a home is well-presented and priced appropriately. Many homes are going under contract quickly, especially if they're move-in ready.

2. Price Strategically Based on Your Market Segment

2. Price Strategically Based on Your Market Segment

Detached homes have seen stronger price growth than attached homes. In the City, prices are rising faster than in the County. Let's work together to understand where your home fits in and price it accordingly.

3. The Perfect Time Is Now (said all the buyers)

3. The Perfect Time Is Now (said all the buyers)

Inventory is still tight, and buyers are active. They would love for you to sell your home! If you think 2025 is your year, let's talk through your timing, goals and where you'll land next to see if selling now will work well for you.

That's all, folks!

If you found this month's market update helpful - wonderful! And if you're left with questions (big or small) about what all of this means for your home, your plans, or your potential move, I'm always happy to chat.

You can reach me anytime by phone or text at 540-578-0102, or send me an email here.

Whether you're buying, selling, or just keeping an eye on the market - I'm here to help however I can.

You can reach me anytime by phone or text at 540-578-0102, or send me an email here.

Whether you're buying, selling, or just keeping an eye on the market - I'm here to help however I can.