Analysis

| Newer Posts | Older Posts |

What Home Sales Could Have Been in Harrisonburg and Rockingham County |

|

In an interesting e-mail dialogue about the current real estate market, I was offered this terrific insight... "It seems to me that houses bought and sold in a "normal" market should have some average per capita value ... the factors which affect whether people buy or sell houses should be relatively similar from year to year (people moving in for new jobs, divorces, retirements, etc.) in non bubble years." I couldn't agree more --- so let's run with that theory for a moment and see what we can learn.  The graph above shows the population for Harrisonburg and Rockingham County (source) compared to home sales per the HRAR MLS. You can see that while population has steadily increased over the past decade, home sales rose dramatically, and then fell dramatically. So....what if we took the per capita theory, and extrapolated from the year 2000....  This graph supposes that the number of home sales in 2000 compared to the total population in 2000 (0.77%) was the norm -- and then suggests what home sales would have been for each subsequent year -- still assuming they would be 0.77% of the population. You can see that home sales would have slowly increased just as the population did.  The graph above shows actual home sales (blue) compared to the theoretical 0.77% home sales --- what a difference in the peak years of 2004 through 2006! Per this theory, we're "behind" as of 2009 --- there should have been more home sales, given the population figure, and assuming that home sales will usually be 0.77% of the population.  To push the envelope a bit further, let's assume home sales should be 0.87% of the population. You see, in 2000 the per capita figure was 0.77%, but in 2001 it was 0.97%. If we split the difference, we have the graph above -- showing that last year the home sales were significantly below the norm. What does this mean for the future? If we buy into the per capita theory, then last year's home sales are not the pattern the future. We won't always have about 800-ish home sales per year, and see a steady increase from that number. Instead, we are likely going to see a return (over the next year or two) to a sales level closer to around 1,000 home sales per year, which will then steadily increase as the population grows. That is, of course, unless we see another market boom at some point in the future! | |

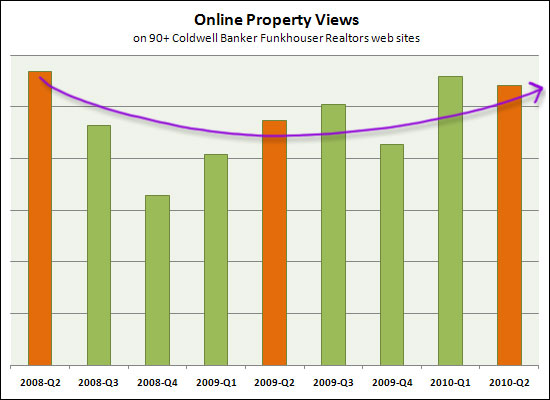

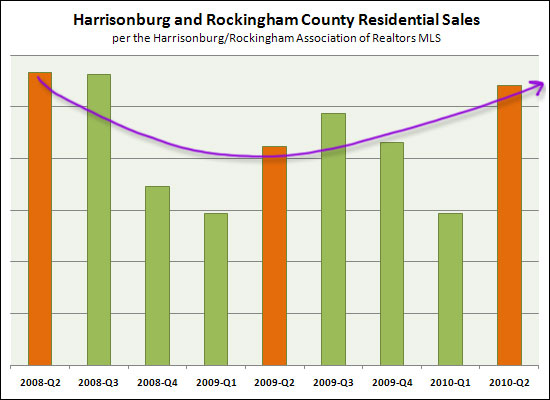

Online Property Views and Residential Property Sales Appear To Be Heading Up! |

|

A lot of you might view properties online today --- only a few of you might close on a home sale today. That said, there often seems to be a correlation between the number of people viewing properties online, and the number of people closing on properties. It makes sense --- if more people are going to buy a home, there will likely be more people looking at said homes online. Take a look at the interesting two year trends below. Not only do they mimic each other, but they are both headed up!   Now, I don't wear the rose colored glasses 24x7 --- I know we're not out of the woods yet. We still have super-high inventory levels, we haven't decidedly seen a turn of the tide in sales volume, and it will probably be another year or more before we see prices starting to stabilize. However, there are more and more indicators of late that we may be seeing a gradual change towards more positive times in the Harrisonburg and Rockingham County housing market. | |

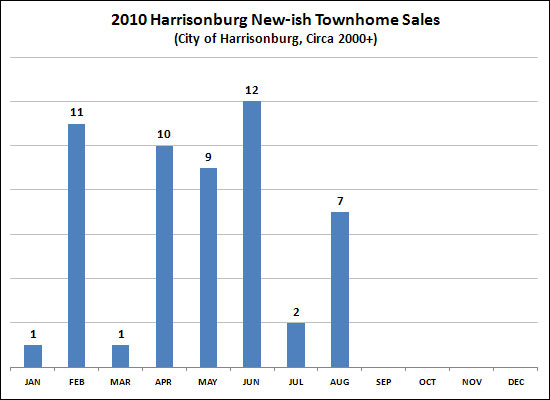

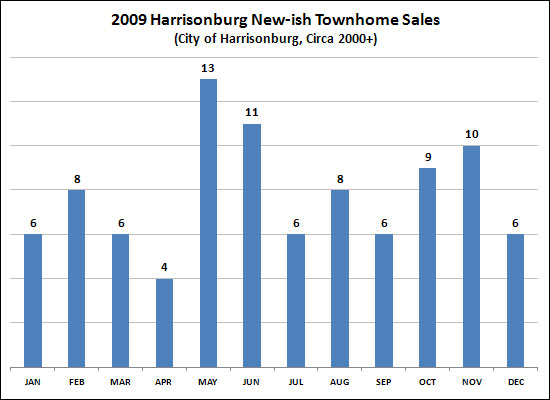

The Yo-Yo Effect of Harrisonburg Townhome Sales |

|

The one thing I try to tell all of my seller clients is that the market is very unpredictable. It's impossible to know if a given house will sell in three months, six months, a year, or even longer. Most of this uncertainty is related to the vast number of homes for sale relative to the number of buyers in the market. It's hard to predict which houses buyers will actually choose. But here is another unpredictable and turbulent market trend --- the sale of new-ish (circa 2000-2010) townhomes in the City of Harrisonburg.  What a roller coaster this year has been! Only a single sale in January and March, and only two in July!?!?! The dip in July is likely because of the original June 30th tax credit expiration --- but why were January and March so terribly low, with a strong February between them? Maybe there is always this much turbulence in the townhouse market? Let's take a look at last year....  Here you see some variation, but not the extreme ups and downs that the townhome market has experienced this year. If you own a townhome and are trying to sell it, I suppose this coming month could be wonderful, or it could be terrible. Townhome buyers are coming in small bursts these days, and then disappearing again. | |

Could September be showing signs of an improved real estate market in Harrisonburg and Rockingham County? |

|

Last year, 816 homes sold in Harrisonburg and Rockingham County. Per my most recent market report, it seems probably that we'll be at the same pace in home sales for 2010. But follow me for a minute....

One last exciting statistic for your Monday --- last September, only 52 homes went under contract in the entire month. In the first half (less than half, really) of this September, 36 homes have already gone under contract! Thanks Kemper, for pointing out last week's astounding buying pace! | |

Remember 2003? "With home values increasing so much, let's buy as big of a house as we can!" |

|

As home values escalated between 2003 and 2006 in Harrisonburg and Rockingham County, buyers bought larger and larger homes!  The graph above shows the average size of single family homes sales per the Harrisonburg Rockingham Assocation of Realtors MLS. As can be seen, the average size of a single family home increased quite steadily between 2002 (1,698 square feet) through 2007 (2,162 square feet). That is a 27% increase in the average sized home! Over the past few years, however, the size of the average home has decreased, all back down to 1,971 square feet thus far in 2010. This is not a trend only taking place in the Shenandoah Valley. Read about it nationally at MSN: At annual builders' show, small is in. | |

Local Home Sales Slow in August, Still Strong YTD |

|

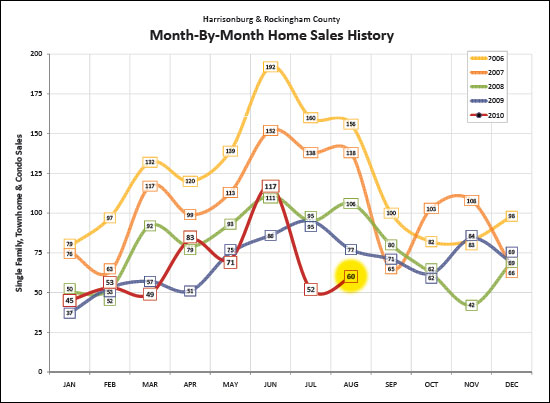

Below are several highlights from the September 2010 Harrisonburg & Rockingham County Real Estate Market Report. Read on, or click here to download a PDF of the entire report. Home sales in Harrisonburg and Rockingham County... Are they up? Down? Stable?  In fact, they are up, down AND stable! A mix of indicators this month:

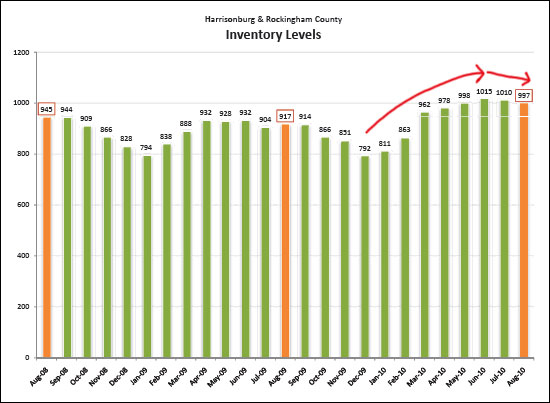

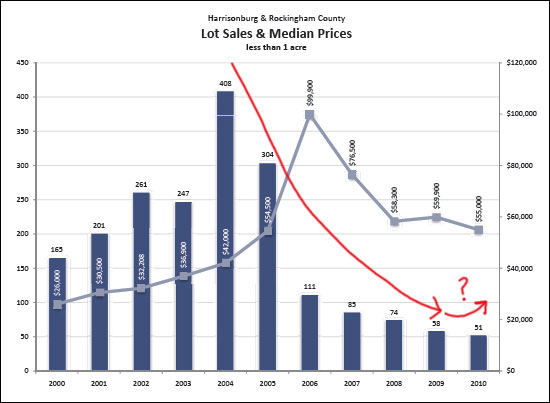

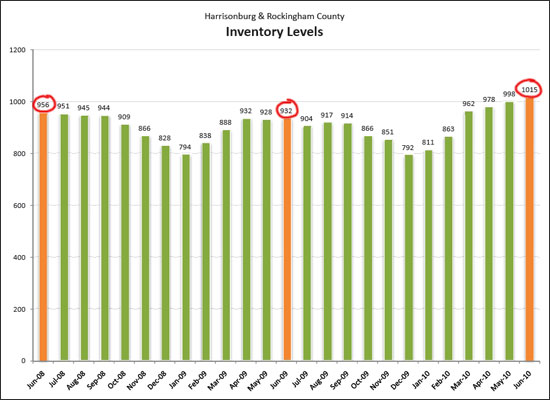

Another good indicator, as shown above, is that the local housing inventory has peaked --- at least for now. A few months ago the number of homes for sale in Harrisonburg and Rockingham County broke 1,000 for the first time -- but it has now started to decline again, as is typical for this season of the year.  Lot sales (less than an acre) have been very, very slow over the past several years, falling from a peak in 2004 of 408 lot sales to only 58 lot sales last year. As shown above, lot sales might actually rebound this year! There is even more in the 19-page September 2010 Harrisonburg & Rockingham County Real Estate Market Report. Download the entire report by clicking on the image below.  Thanks for reading, and if you have any questions, or if I can assist you with buying or selling real estate in Harrisonburg or Rockingham County, please contact me at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

If I haven't listed my home yet, should I wait until Spring? |

|

First of all, I should point out that there are LOTS of homes on the market right now, so this blog post is not intended to broadly encourage anyone and everyone to put their house on the market. However....I have been asked several times in the past two weeks about whether it's really too late at this point to try to sell a house this fall. It seems that this assumption is based on:

On the second point, I haven't given up on 2010 yet. If the rest of the year is going to be quite slow, we should see it in the number of contracts being ratified. Here are the past four Augusts....

My full market report will be coming out in about a week after additional data is available. Stay tuned! | |

Local Home Sales Versus National Home Sales |

|

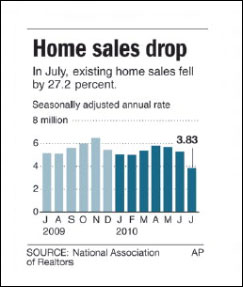

You may haven noticed the depressing news in the Daily News Record today -- on the front page -- home sales dropped 27% in July! You may haven noticed the depressing news in the Daily News Record today -- on the front page -- home sales dropped 27% in July! But wait -- those are national numbers, and may not have much to do with what's going on in Harrisonburg and Rockingham County. The chart to the right is from the DNR, showing the 27% decline in July. The chart below shows essentially the same data for Harrisonburg and Rockingham County. The only difference is that the national figures only include existing home sales (it excludes new homes) and the local numbers are both new and existing homes. Here is the local data:  Despite a 27% decline nationally, local home sales only showed a 5% annualized decline! | |

Is My House Overpriced? |

|

This is a question that many home sellers are wondering these days in and around Harrisonburg -- and perhaps all across the nation. Let's see why.... A real estate market is considered to be balanced (between buyers and sellers) if there are six months of supply available. Depending on the price range, there is quite a bit of excess supply in the Harrisonburg and Rockingham County housing market:

It was said by some, at one point, that if your house hadn't sold in 60 days, lower the price, and repeat. Thus, if you started at $300k, and you hadn't sold it within 60 days, you might lower it to $290k, and wait another 60 days and lower it again, etc. Eventually, you'd reach the point where the market (buyers) would respond to your price, and you'd sell the house. That logic might work in a balanced market, but when the market is so flooded with sellers, and so void of buyers, the logic doesn't work as well. Homes now sometimes sit on the market for months priced well below comparable homes, and don't sell. Will they sell if the price is lowered? Maybe, but maybe not! Time on the market is quite unpredictable at this point, and price is no longer the trump card. In many markets, if a price was lowered to a certain place, a house would definitely sell. If it appraised at $300k, and you lowered it to $280k, it would more than likely sell. Now, you could lower it to $260k, and it might sell, but it might not. You could then lower it to $240k, and it might sell, but it might not. Thus, as you can hopefully see, the answer to the aforementioned question (Is My House Overpriced?) is very difficult to answer. I suppose the answer is that if it has been properly marketed, and it hasn't sold, then it is probably overpriced, but even if the price is lowered, it still may not sell. One last illustration to explore this dilemma... Three comparable houses on your street sell for $245k, $250k and $255k. You assume your house is worth $250k, and put it on the market for $245k to be aggressive. It doesn't sell after four months, so we assume it is overpriced -- even though recent sales would not suggest that. After another four months at $235k, it still hasn't sold. Is it overpriced? I suppose the market would say yes, even though recent comparable sales still do not agree. If, after another four months at $215k it has still not sold, do we STILL say it is overpriced??? | |

What Do You Mean I Did Well? I Brought Thousands Of Dollars To Closing! |

|

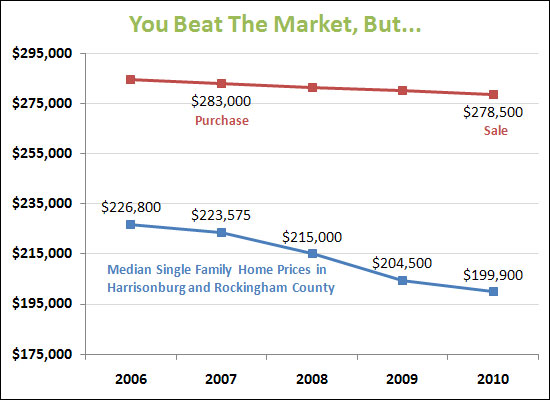

In these crazy times, it's possible to "beat the market" and yet still be hurting financially...  The blue line above shows the trend in single family home prices over the past five years in Harrisonburg and Rockingham County. As you can see, prices have declined, though only a total of 12% over the past five years. The red line shows the purchase and sale of a single home in Harrisonburg, as experienced by some of my clients. You'll note that while the red line declines, it's not by anywhere near as much as the blue line. Thus, my client's home outperformed the market --- they beat the market, and experienced a smaller decline that perhaps they should have. How exciting, right?? But no, actually, it wasn't too exciting. The heroic act of selling the house at a higher price than the market suggested would be possible was still painful. My clients had financed most of their home purchase in 2007, so they actually had to bring thousands of dollars to closing in 2010 in order for the sale to proceed. You see, it's not as simple as the purchase price minus the sales price --- you also have to factor in the closing costs on the buying side (2007) and the closing costs on the selling side (2010). So....when the market is declining, even if it is declining slowly, it can be difficult to purchase and then sell within a short time period. Thus, buyers and sellers should note that:

| |

Harrisonburg and Rockingham County Home Sales Fall Dramatically In July 2010, But The Future Still Looks Bright (Really!) |

|

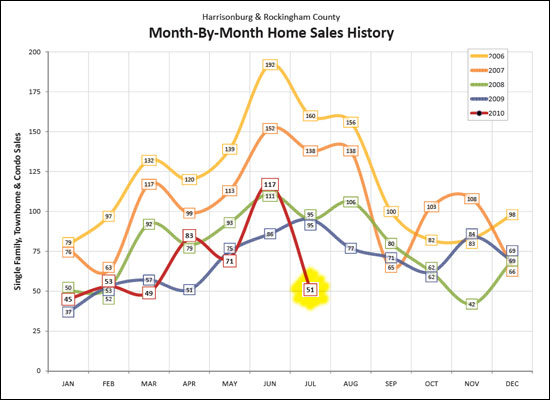

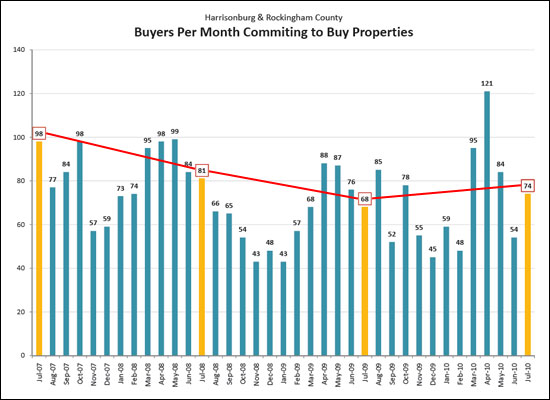

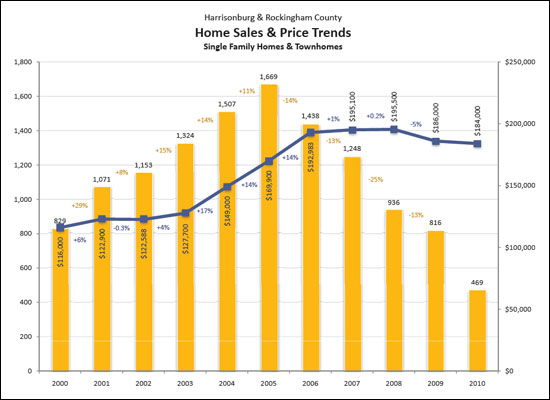

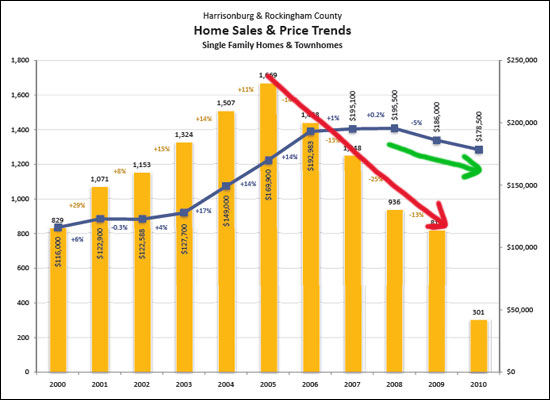

Click here for the full August 2010 Harrisonburg & Rockingham County Real Estate Market Report. If we only looked at July 2010 home sales (and ignored several other key indicators, and the bigger picture) we might get a little worried about our local housing market.  As can be seen above, there were very few home sales in July 2010. This is likely because of the original June 30th deadline for closing under the home buyer tax credit (the deadline has now been extended to September 30th). But after a very slow July, we'll probably start to see things pick back up, since contracts looked healthy in July 2010.  As can be seen above, there weren't too many buyers committing to buy properties last month, but there was a return to the contract-signing-table in July 2010. This month's buyer commitments actually exceeded last July's data, showing a reversal of the downward trend of the last several years. For another reversal, read on.  The yellow bars above show the number of home sales over the past ten years -- it is very likely that after four years of declining home sales, we might finally see an increase in 2010. Year to date, 2010 shows a 3% improvement over 2009 to date. The blue line above shows the change in median sales price over the past ten years. The median sales price declined by 5% between 2008 and 2009, but the decline appears to be much smaller this year. Learn even more about what's going on in the Harrisonburg and Rockingham County real estate market by reading the full report.  Do you have questions about this report, or about the Harrisonburg and Rockingham County real estate market? Or about your house? Or about a house you might buy? Be in touch . . . Scott Rogers | 540-578-0102 | scott@HarrisonburgHousingToday.com | |

The Five Best Deals In The Last Ten Days |

|

Over the past few weeks I have received (on behalf of my seller clients) quite a few offers that I considered to be quite low:

First, do note that of the 27 homes sold in Harrisonburg and Rockingham County over the last 10 days, on average, 5.4% was negotiated off of the list price. Now, for the houses where the buyers negotiated the highest percentage off of the list price....  4377 Hilltop Road (Massanetta Spring) - sold for 22% less than the list price  160 Wildwood Drive (Bridgewater) - sold for 15% less than the list price  253 S Sunset Drive (Broadeway) - sold for 11% less than the list price  2965 Pin Oak Drive (Belmont Estates) - sold for 10% less than the list price  545 Tabb Court (Preston Heights) - sold for 10% less than the list price So, with average negotiations of 5.4%, what do you think? Where the four offers of 10%, 15%, 16% and 20% below asking price reasonable? Perhaps negotiations have to start somewhere! | |

Investing in Harrisonburg Real Estate |

|

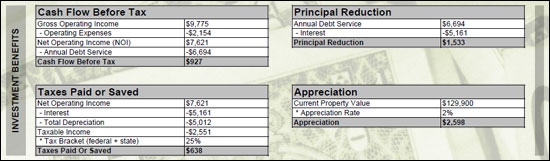

Investing in real estate isn't for everyone --- and it isn't without its risks. But if you have some money to put into an investment as a down payment, and if you have financial reserves with which to cover maintenance costs and months without rental income, you might be interested in learning more. The easiest case study of real estate investing in Harrisonburg is to consider the purchase of a two-story townhome built in the last ten years. There are quite a few neighborhoods where these townhomes can be purchased, somewhere between $130k and $160k: These two-story townhouses in these neighborhoods will likely rent for between $850 to $950 depending on the age and condition. View them on a map here. Next, let's assume a great deal on the purchase (we'll shop until we find that deal) with a purchase price of $129,900. However, we'll make lots of conservative assumptions as we continue. For the time being, assume:

This might not seem like much, but when combined with a few other investment benefits, it starts to add up, even in the first year. Year 1 Investment Benefits

There are plenty of variables to consider when buying an investment property, but the basics of the cash flow are the first to thoroughly understand. For a head start on everything else you need to learn, review this detailed investment analysis. | |

Housing Market Enjoys Boomlet But Area's Sales Surge Likely To Be Short-Lived |

|

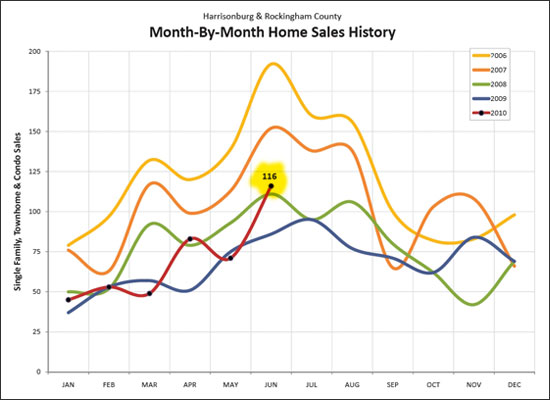

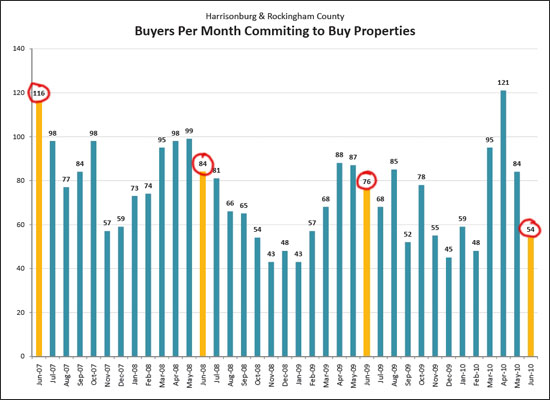

It's always good to get a different take on the data and situation in our market. Feel free to share your own comments on the state of our market in the comment section below.  [From the Daily News Record, July 16, 2010] Housing Market Enjoys Boomlet But Area's Sales Surge Likely To Be Short-Lived By Doug Manners HARRISONBURG - Buoyed by the expected expiration of federal tax credits, home sales in Harrisonburg and Rockingham County climbed in June to the highest monthly total in nearly three years. However, sales are likely to drop during the second half of the year, due in part to the expiration of the tax credit program. According to a report released by Scott Rogers, associate broker at Coldwell Banker Funkhouser Realtors, 116 homes were sold last month, the most since August 2007, when 138 homes sold. It also marks a 35 percent increase over sales from June 2009. To be eligible for the credits - up to $8,000 for first-time homebuyers and $6,500 for existing homeowners - buyers originally had until June 30 to close sales, but Congress extended the deadline to Sept. 30. Buyers still must have entered into a binding contract by April 30 to qualify. ‘Buffer' Needed Local sales in 2010 are 16 percent higher than those from the first six months of last year, and Rogers said he believes that the area will reverse a four-year downturn in annual home sales. "I think the 16 percent is enough of a buffer" to beat last year's numbers, Rogers said. That buffer is key because sales are now expected to fall, with most tax-credit seekers having already made their home purchases (Congress didn't approve the extension until late June). Furthermore, Rogers wrote in his report, "for most of the past four years, there is a steady decline in sales between June and December, so we will likewise probably see a decline month after month." Contracts Plummet In April, 121 properties went under contract, the most since March 2007. After the April 30 deadline expired, that number dropped to 84 in May and plummeted to 54 in June. "This June's buyer commitment rate is notably lower than any of the past three Junes," Rogers wrote, "which is not a good indicator for July and August sales figures." Rogers said it's too soon to say conclusively whether the tax credits provided a real boost to the housing market or simply shifted sales toward the first half of the year. "Perhaps it's a wash other than the timing," Rogers said, "except that timing might have helped create some momentum in getting people feeling more positive and hopeful about the economy." Values Continue To Drop Despite the increased market activity, home values continue to decline, according to Rogers' report. The average median sales price is $186,450, down 8 percent from a year earlier. Rogers said median prices are not likely to start increasing until the year-over-year sales pace rises. The average time a home stays on the market is holding steady at about six months. Contact Doug Manners at 574-6293 or dmanners@dnronline.com | |

An Explanation Of The July 2010 Harrisonburg & Rockingham County Real Estate Market Report |

|

Can you spare 5 minutes? Press play below, and I'll walk you through most of the graphs in my monthly report to provide some commentary on what we're seeing this month. Have further questions? Leave them in the comments below, or e-mail me at scott@HarrisonburgHousingToday.com. | |

Home Sales (and Inventory) Soar in June 2010, Contracts Decline |

|

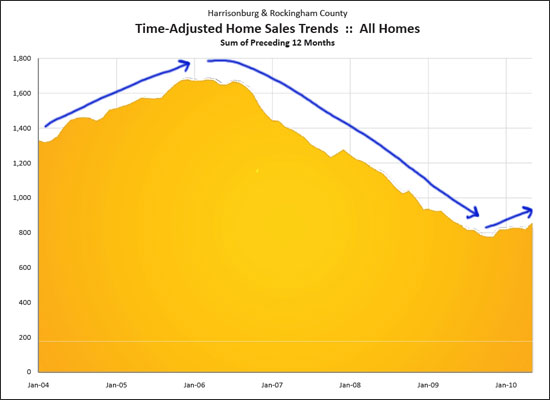

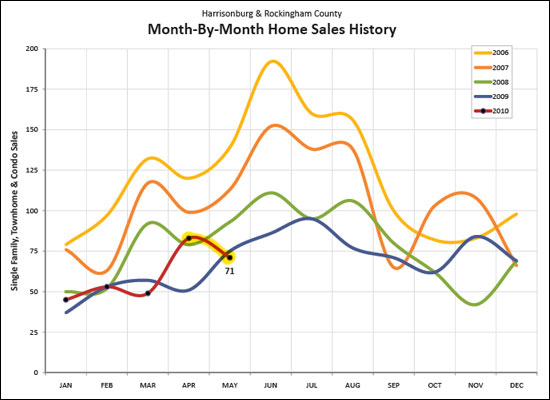

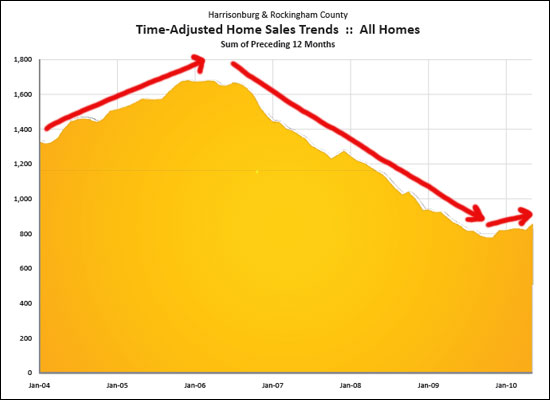

Click here for the full July 2010 Harrisonburg & Rockingham County Real Estate Market Report. We're not out of the woods yet, but several indicators are quite positive in the Harrisonburg and Rockingham County housing market.  As can be seen above, June 2010 home sales soared up to 116 transactions -- the highest number of monthly sales we have seen in almost three years. Many of these home sales were likely a result of the home buyer tax credit deadline, so we may see a decline in July home sales.  Above, you will note that long term indicators continue to trend very positively. This graph shows a rolling 12-month sum of home sales to remove the seasonal variation in sales. After several years of a declining market (in number of home sales), we have now seen a stabilization and increase for over six months.  Despite good signs as far as closed home sales go, the number of buyers committing to buy during June 2010 (contracts signed) declined, both compared to the last several months, as well as compared to the past three months of June (2007, 2008, 2009). This will likely result in lower levels of home sales in July and August.  In addition to home sales, inventory levels also soared in June 2010 -- cresting above 1,000 homes for sale for the first time in recent past (and maybe the first time ever). We should see a decline in inventory over the next six months based on historical seasonal trends. Learn even more about our local housing market: click here for the full July 2010 Harrisonburg & Rockingham County Real Estate Market Report.  Do you have questions about this report, or about the Harrisonburg and Rockingham County real estate market? Or about your house? Or about a house you might buy? Be in touch . . . Scott Rogers | 540-578-0102 | scott@HarrisonburgHousingToday.com | |

How Much Of An Effect Did The First Time Buyer Tax Credit Really Have in Harrisonburg and Rockingham County? |

|

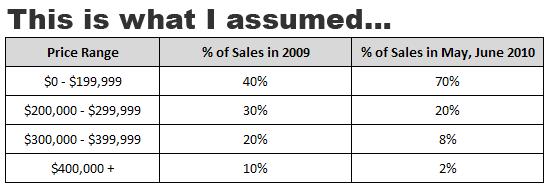

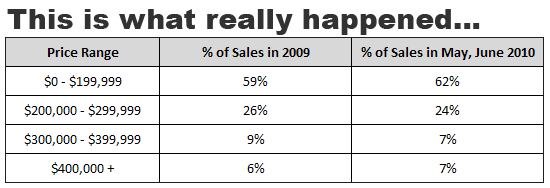

Many people have asked me how much of an affect on our market the first time buyer tax credit has had over the past year. It's a challenging question to answer --- some first time buyers who bought this year may have bought because of the tax credit, but some (or most?) may have bought even if the tax credit didn't exist. One way that we should be able to tell if the tax credit had a big impact is to see if there are more first time buyers in the market now as compared to last year. Thus, I decided to examine the breakdown of sales prices during May and June 2010 (it should be a lot of first time buyers) as compared to all of last year (2009).  As you can see, above, I assumed that I would probably find a pretty big increase in the proportional number of lower priced homes selling this May and June as compared to last year.  Above, however, you'll note that there wasn't actually much of a change at all. About 60% of the homes sold in the last two months were priced below $200k and the same percentage of the sales from last year were below $200k. I welcome your suggestions for other ways to slice and dice the data to get at whether the tax credit had an impact on the market. For now, we'll say the jury is still out... | |

Home Sales versus Foreclosures |

|

Data Sources: Harrisonburg/Rockingham Association of Realtors MLS, Rockingham County Circuit Court Clerk's Office (Thanks Chaz & April!) Many have asked me how foreclosures are affecting our local real estate market. Absent hard data on the number of foreclosures in Harrisonburg and Rockingham County, I have always mentioned that there aren't an overwhelming number of foreclosures --- and certainly not enough to make a huge difference in home values. Now, I have the data, thanks Chaz & April at the Clerk's Office . . .  What can be seen here is that the percentage of the home sales that are foreclosures has certainly been on the rise over the past several years. However, despite this being based on hard data, there is still a bit of fuzzy math.... The "Sales" includes all home sales as recorded in the HRAR MLS. This includes most foreclosures, because most such properties end up being bank owned properties that are then listed (and sold) by Realtors via the MLS. However, if only 127 of the 177 foreclosures ended up in the MLS as sales, then the true number of total sales for 2009 would have been 866 sales, making foreclosures 20.4% of the market as opposed to 21.7% of the market. This year (2010) and next year will be important to watch as we see how many home sales we'll have, and how many foreclosures will exist in the market. I predict that home sales will level off this year (and thus, stop declining), but that foreclosures will increase over last year. | |

The first-time buyer tax credit is (mostly) over, now what? |

|

June has been a busy month in the local real estate market --- or at least on my end --- as a LOT of buyers close on their purchases of homes in and around Harrisonburg. Quite a few of these buyers are first time buyers, who will receive an $8,000 tax credit when they file their taxes early next year. But the opportunity for this $8,000 tax credit has passed now --- the deadline to have a house under contract was April 30th, and the closing deadline is June 30th (though it may be extended). So....what now? The big question that remains is whether this was either:

I've had this conversation with many people lately --- now that this whole tax credit has come and gone, can the real estate market stand on its own? Will things slow back down again? The big picture is this -- fewer and fewer homes have been selling for quite a few years now:

I have made lots of predictions about the real estate market over the past five years, and most of them have been wrong. I did not think we would continue to see the number of home sales fall as much as they have. In 2008, I thought for sure we'd see 2007 volume. In 2009, I thought for sure we'd see 2008 volume. So.....here I go again: I predict that we will see 800 home sales in 2010. That would show only a 2% decline since 2009 --- and would be a turn in right direction from the multiple years of double digit declines in sales volume. But, as the image above alludes to, there is somewhat of an awkward pause now, as we see what the second half of 2010 has to hold. I am thankful that the tax credit brought buyers into the market --- it helped to sell properties for many homeowners that really needed (or really wanted) to sell. I am now hopeful as we move forward, that our local real estate market will continue to recover and strengthen through the balance of 2010. | |

Local Home Sales Up 10% in 2010, Prices Down 4% |

|

Click here to view my full June 2010 Harrisonburg & Rockingham County Real Estate Market Report. Exciting Fact #1 --- May 2010 home sales declined 5% as compared to May 2009, but year-to-date sales (January through May) are up 10% over last January through May.  Exciting Fact #2 --- After three and a half years of steadily declining home sales (quantity, not prices), we have now seen stabilization or increases in home sales for over six months.  Not-So-Exciting Fact #3 --- Sales volume has declined sharply for four years now (red line), and median home values have declined gradually for two years (green line). Despite early positive indicators for the past several months, we're not out of the woods yet.  Other tidbits that you'll discover in my June 2010 Harrisonburg & Rockingham County Real Estate Market Report include:

| |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings