| Newer Posts | Older Posts |

Savvy Home Buyers Are Content To Wait For The Right House To Hit The Market |

|

Three years, home buyers starting the year by looking for a home to buy in Harrisonburg and Rockingham County would have been choosing from about 270 homes actively for sale. Two years ago, home buyers would have been choosing from about 200 homes for sale. One year ago, home buyers would have been choosing from about 130 homes for sale. Today, buyers are choosing from about 100 homes for sale. So, yes, home buyers today have far fewer choices... at any given moment in time. That's the important part, folks. If we look at the full span of a year, we find that... Three years ago buyers bought about 1,300 homes through the year. Two years ago buyers bought about 1,500 homes through the year. Last year buyers bought about 1,665 homes through the year. So, if you are getting ready to buy a home in early 2022 - or in 2022 at all - two things are true... #1 - You will likely have fewer options at any given moment in time as compared to the past few years. #2 - You will likely have more options over time as compared to the past few years. Thus, home buyers this year should get prequalified with a local lender... and then be content to wait for the right house to hit the market for sale! | |

With So Few Homes For Sale, You Should Expand Your Search Parameters A Bit |

|

If you're looking for a four bedroom home, it might be worthwhile to look at a few homes with three bedrooms. If you plan to buy a home under $300K, it might be worthwhile to look at a few homes priced between $300K and $325K. If you prefer homes built in the past 20 years, it might be worthwhile to view some homes that are 21 - 30 years old. If you know you need 2400 SF, it might be worthwhile to walk through some homes that are 2200 - 2399 SF. If you only want to live 10 minutes from where you work, it might be worthwhile to look at a few homes that are 15 minutes from your job. Sometimes buyers draw firm lines around what will and won't work for them. This is fine, but there is definitely value in walking through some homes that are close to but not within those parameters. Here's why...

So -- loosen up your parameters a bit and look at some houses that are close to what you're looking for but not quite right on the money. | |

If Your Lease Ends This Summer, Start Looking For A Home To Buy Now! |

|

If you have a lease ending this summer and you are thinking about buying a home instead of renewing that lease, you might think you have PLENTY of time before you need to start looking for a home to purchase. You might actually want to start looking for that new home sooner than you think. Let's imagine that your lease ends June 30th. Here's one potential timeline...

A few details worth mentioning...

Finally, one thing that is not noted above is how this might all play out related to your monthly housing payments...

As you can see, above, in this scenario (closing on home purchase on May 31, lease ends June 30) you would not have any months where you would need to both make a rent payment and a mortgage payment. | |

Buying A Home Today Might Feel Like Mostly Waiting Around |

|

In days gone by, when you decided to buy a home, you would talk to a lender to get pre-qualified and then you would start going to view homes that were currently on the market to see if there was a house available that you wanted to buy - or whether you would decide to wait for some other houses to be listed for sale in the following weeks or months. Now days, that initial phase of looking at homes -- going to view homes that are currently on the market to see if there is a house available that you want to buy-- often does not exist. Many folks who decide to buy a home talk to lender to get pre-qualified and then find there are no homes on the market at that moment that they want to go to see. Now, to clarify, there may very well be homes "on the market" that are of interest -- but they'll all be under contract. And such is the fate of many home buyers these days -- get pre-qualified -- and then wait. Wait for the next new listing that is of interest and then hurry out to see it within the first few days to see if you want to make an offer. Interestingly, there are likely to be just as many (or more) choices of homes for a buyer to buy now as compared the "days gone by" described above -- it's just that now days those homes don't linger on the market, so there are very few available at any given time -- though there will certainly be more options hitting the market soon. So, if you plan to buy a home in 2022 - get pre-qualified - and then get ready to wait. :-) | |

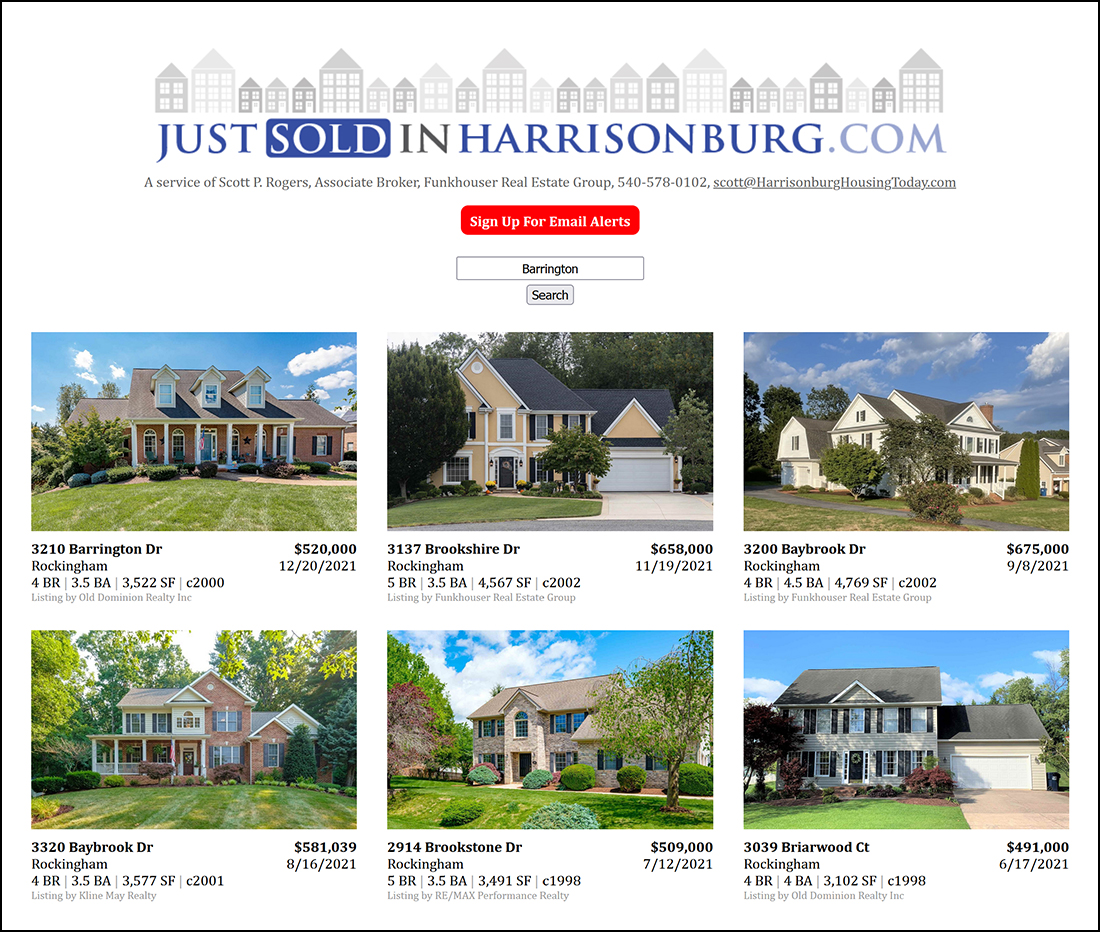

Thinking About Home Buying By Examining Past Sales |

|

You might be thinking about home buying by zeroing in on a neighborhood that you find interesting... -- I really think I'd like to live in ____ neighborhood. I love the style of homes in that neighborhood, and the location is ideal. So, let's go see some of the homes that are on the market in that neighborhood. Wait, what? There aren't any homes for sale in that neighborhood?? -- But, yes, this is a typical phenomenon... no homes for sale in a given neighborhood. So, what then are you to do if you want to better understand what options you might have for buying in the ____ neighborhood? Often, the best predictor of the future can be gleaned by looking into the past. It's certainly not an exact science, but the next five homes to come on the market for sale in ____ neighborhood are at least somewhat likely to be similar to the last five homes to sell in that same neighborhood. Certainly, this will be truer in neighborhoods with less variation in homes (age, size, style) and less true in neighborhoods with greater variation in homes -- but you get the idea. So, as you gaze out into the very, very small number of homes that are available for sale right now, perhaps will be more helpful to look backwards at past home sales to give you an idea of what types of houses at what types of prices might become available in the future. Here's one way to do this research... 1. Visit JustSoldInHarrisonburg.com 2. Click on the blue "Search by Street or Neighborhood" button 3. Type in the name of a street or neighborhood and click "Search" Happy researching... and let me know if you have questions or if you'd like help in fine tuning your research of past sales trends. | |

There Is Currently Only ONE Townhouse For Sale in the City of Harrisonburg!? |

|

Yes, it can be done... ...you can buy a townhouse in the City of Harrisonburg... ...but it's much more difficult now than it was in the past! Townhouses Sales in 2021 in the City of Harrisonburg = 195 Townhouses Under Contract Today in the City of Harrisonburg = 16 Townhouses Currently Available For Sale in the City of Harrisonburg = 1 I should also point out that the median sales price of townhouses in the City of Harrisonburg in 2021 was $194,900 -- up from $185,000 in 2020 -- and up from $166,000 in 2019. So, yes, you can buy a townhouse in the City of Harrisonburg, but you'll need to be ready to act quickly when one hits the market as they don't stick around long. The median "days on market" for the 195 townhomes sold in 2021 was only four days! | |

Moving to Harrisonburg, From Out of Town, and Buying A House Can Be.... |

|

Many people move to Harrisonburg, Virginia (or the surrounding area) each year and in 2021 many of those individuals and families have found it challenging to find a home to purchase. Why, you might ask? It's an "inventory at any given time" sort of problem. As I have mentioned quite a few times lately, more homes have sold this year than last... Jan - Nov 2020 = 1,385 home sales Jan - Nov 2021 = 1,525 home sales (12% more than in 2020) But most homes are under under contract less than a week after having hit the market for sale. The median "days on market" of homes sold in 2021 is a mere five days! So, most out of town buyers can identify plenty of homes that they'd would like to view -- and possibly buy -- in an extended timeframe of a month (for example) but if they are in Harrisonburg for a weekend for a home buying visit they are likely to see very, very few options of homes that they can tour and consider purchasing. So, what then, is the out of town (but moving into town) buyer to do? Idea #1 - Move first, buy later. Perhaps you can put most of your belongings into storage temporarily, and live with a friend or family member in Harrisonburg for a few months while you house hunt, viewing new listings in person shortly after they are listed for sale, and potentially making an offer on such a new listing and purchasing a home. Idea #2 - A Local Home Buying Ambassador Perhaps you have a family member living in Harrisonburg, or a long time friend, who can go see new listings on your behalf as soon as they hit the market to help you decide whether you want to make an offer on such a new listing even without having seen it in person. Idea #3 - Rent For A Year This is a variant of the first idea, but some would be home buyers relocating to this area resign themselves to renting a property for a year to get into the area and start viewing new listings in person so that they can take their time to find the right home to purchase in the Harrisonburg area. Idea #4 - FaceTime or Zoom If you don't have a local home buying ambassador to send along in your stead to view new listings, I am happy to walk you through new listings virtually, via FaceTime or Zoom. It's certainly not the same as seeing a house in person, but it can provide much more context for you as you consider a home purchase from afar. If you are moving to Harrisonburg in 2022, from out of town (or out of state), start giving some thought to how you will approach the remote home buying experience. I'd love to tell you that you'll be successful in just scheduling a weekend to come see a bunch of homes and make a decision -- but it seems unlikely that we are going to see inventory levels meaningfully rise in 2022, so you will likely need to consider one or several of the ideas above. | |

Will Mortgage Interest Rates Really Rise In 2022? |

|

Will mortgage interest rates really rise in 2022? Yes, he said, knowing he has said "yes" for years and has been wrong over and over. ;-) To be fair, I guess interest rates did rise between 2012 and 2014 and again between 2016 and 2018. But, they've been below 5% for over a decade now -- and have been below 4% for eight of the past ten years. So, again, will interest rates really rise in 2022? After steadily declining since 2018, yes, it seems likely that interest rates will start rising again in 2022. But, it seems quite likely that I could be wrong, again. :-) | |

The New Flow Of Home Buying Decisions |

|

Inventory levels are so low right now -- it must be hard for a home buyer, because they have so few choices, right? Not exactly... 1,213 homes sold in the first ten months of last year 1,384 homes sold in the first ten months of this year So, buyers have actually had MORE options this year than last. But... those options of what to buy have come on the market and often/usually gone under contract VERY quickly... thus, keeping inventory levels at any given time quite low! As such, the flow of home buying decisions looks quite different now as compared to -- for example -- three years ago. Three (or so) years ago... Once you decided to buy a home you might have ten or so houses you could go see that would generally fit your home buying criteria. You could compare and contrast each of them, prioritize them, decide which one you might want to buy, make an offer, and if it didn't work out, pursue one of the other houses. Today... Once you decide to buy a home you likely won't find any houses on the market that will work for you. We'll wait for a new listing to hit the market, go see it within a day or two and you'll need to make a decision very quickly about whether you want to make an offer on the house. If not, someone else will buy it, and we'll be waiting on the next new listing of interest to hit the market, and we'll repeat the process again. The difference... Before, you could view 10 houses and compare them and pick your favorite and pursue that house. Now, you can consider 10 houses, but you only get to consider them one at a time... and if you don't decide to buy house #2 because you didn't realize how unexciting houses #3 through #10 were going to be, you can't go back and buy house #2 because it will already be under contract. So, you are likely to have just as many options to buy houses right now -- but the flow of decision making is much different than it used to be! | |

Home Inspection Contingency Modifications |

|

In this competitive real estate market -- when buyers are often finding themselves competing with multiple other buyers for their perfect home -- some buyers find themselves considering whether to make an offer without a home inspection contingency. Certainly, an offer without a home inspection contingency is likely to be seen by the seller as a stronger than an identical offer with an inspection contingency. Of late, I have seen some buyers (or their agents) trying to find space between having a home inspection contingency and not having one. Here are three modifications of home inspection contingencies I have seen lately that don't seem to be all that helpful... Repairs Will Only Be Requested If Total Repair Cost Exceeds $1,000 - I suppose this is intended to communicate that a buyer won't ask the seller to make small or minor repairs, but most sellers still see this as being almost identical to a regular old home inspection contingency. After all, just about every inspection report has enough needed small repairs that they would have a total cost of over $1,000. So, this ends up being some "feel good language" that doesn't actually make an insightful seller feel any better than a contingency without the language. Inspection For Informational Purposes Only - This is usually accompanied by language that allows a buyer to terminate the contract if they do not like what they find during the home inspection, so this modification really just seems to be a promise to terminate the contract instead of asking for repairs if there are issues. This often isn't seen as much stronger than an offer with a regular old home inspection contingency. If There Are Issues, Buyer Will Request Repairs, Not Terminate - Again, I think this is often intended to try to make the seller feel better about the inspection contingency. The buyer is promising not to just give up and walk away -- they will at least request repairs and try to work things out. But, this one is also pretty subjective -- those repairs that are requested (instead of terminating the contract) can be requested in a manner that would make it almost impossible to come to an mutually acceptable resolution -- essentially working a buyer back towards being able to get out of the contract, technically by having required repairs instead of having terminated the contract. I have nothing against a buyer (or buyer's agent) trying to soften the impact of a home inspection contingency -- but most sellers look at things in a bit more of a black and white perspective -- is there an inspection contingency or not? So... instead of spending lots of time and energy trying to fine tune the language of a cleverly crafted modification of an inspection contingency... focus on deciding whether you want the opportunity to reconsider whether you will purchase the property after having gathered additional information during a home inspection. If you do want the chance to reconsider the purchase, then you're going to have an inspection contingency - and regardless of what additional language you add in to try to soften the impact of that contingency - a seller is almost certainly going to see it as being less favorable than an offer without an inspection contingency. | |

Demand Is HIGH For Income Generating Properties |

|

Everybody wants to buy a rental property. OK, well, not everybody... but seemingly, lots of people do! Two quads (four unit apartment buildings) in the vicinity of Eastern Mennonite University recently came on the market for $450K each. Both were under contract within a week with multiple offers, some with escalation clauses. One such recent multi-family listing had nine offers... the second had ten offers! So, yes, there seem to be plenty of investors seeking out income generating properties in the Harrisonburg area. Let me know if you are interested in considering the purchase of a rental property in the Harrisonburg area. As should be evident, you'll have LOTS of competition, but I'm happy to help you explore the opportunities if you are interested. | |

Townhomes Now Under Construction In Phase Two of The Townes at Congers Creek |

|

view larger photo here Have you driven by The Townes at Congers Creek lately? These newly built townhouses are located on Boyers Road just minutes from Sentara RMH Medical Center. (full disclosure - I represent the builder) The first phase of The Townes at Congers Creek is complete, with 26 townhomes plus a common area including a pavilion, patio, fire pit and basketball hoop. Construction is now beginning on townhomes in the second phase, and the first 20 townhomes are already under contract. Here's a view of the current site work under way on the second phase... view a larger photo here Learn more about this exciting townhouse community by viewing current availability, walking through the model home, viewing the standard features and upgrades. If you have questions, or if you'd like to schedule a time to view the model home in person, call/text me at 540-578-0102 or email me. | |

When The Absolutely Perfect House Hits The Market, Do Not Hesitate To Move Quickly |

|

Sometimes home buyers don't ever find that perfect house. Sometimes home buyers search for months and months (or years and years) before they find the absolutely perfect house. Sometimes the absolutely perfect house is the very first one you walk through. When you do find the absolutely perfect house do not hesitate to move quickly, confidently and boldly to make that house your home. I have now had three buyers clients this year that found their absolutely perfect house as the very first house we walked through. We just started looking -- how could we have found the absolutely perfect house first? Shouldn't I spend a few days, weeks or months looking at lots of houses to make sure this is the perfect house? My advice to you -- when you find that perfect house, whether on Day 1 or Day 30 or Day 365, be ready to pounce on it. Your absolutely perfect house may very well not come along again anytime soon! | |

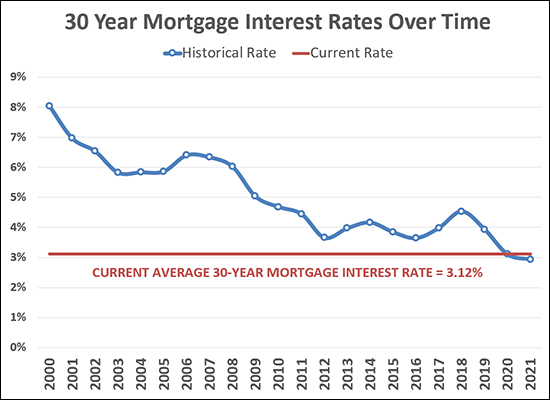

Mortgage Interest Rates Are Definitely Headed Up, For Sure, Oh Wait!? |

|

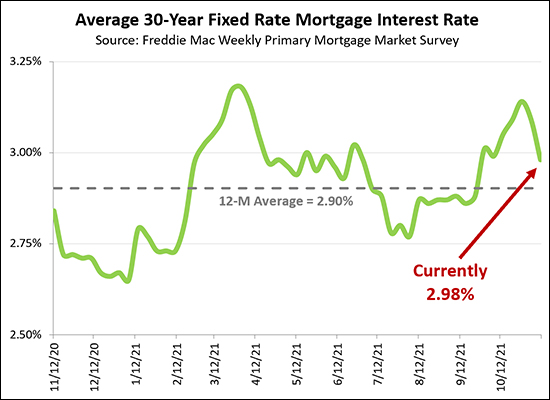

I can't even count how many times over the past five-ish years that I have said mortgage interest rates would certainly be rising again, soon, for sure. I have certainly been thinking that over the past few months, but... maybe they're not!? Consider these data points for the average 30 year fixed mortgage rate... One Year Ago = 2.84% April 2021 = 3.18% (a peak) August 2021 = 2.77% (a valley) October 28 = 3.14% (apparently, a peak) Today = 2.98% This is all show in the graph above, as well. After interest rates rather steadily rose between August and October, it seemed almost certain that they would continue to rise, staying above 3% for perhaps the indefinite future. But, then, for the past two weeks, mortgage interest rates have declined, now landing below 3%, again. So, yeah, mortgage interest rates are definitely going to go up now, soon, for sure. Just like I have been saying, inaccurately, for years now... | |

The Tax Assessment Of A Property Is Most Useful For... Calculating The Real Estate Tax Bill For The Property |

|

Oh, I see that house down the street is for sale! What's the list price? They are asking $400,000 for the house. What is the tax assessment of the property? Why? --- If you want to know the tax assessed value of the house to understand how much an owner of the property pays in real estate taxes - great! Let's go take a look at the tax assessment. --- If you want to know the tax assessed value of the house to evaluate whether the seller's asking price for their home is reasonable -- you likely aren't looking in the right places for indicators of market value. --- Tax assessed values are actually intended to be a good indicator of market value, as the City and County want to be taxing you on the basis of the actual market value of your property... but... oftentimes, the tax assessed value of properties in this area range from low to very low. Part of that is due to timing. Today's tax assessed values may be based on sales data from 12 to 18 to 24 months ago due to the time intensive process of analyzing property values and updating tax assessed values. The median sales price is currently increasing quickly, at a rate of 10% to 12% per year. Thus, when market values are quickly increasing and tax assessed values are based on 12 to 24 month old data, you are likely to see a more significant difference between tax assessments and market values. So, it's fine to look at the tax assessment of a property, but I wouldn't put too much confidence in thinking that it is an indicator of the present market value of the property. | |

Recent Similar Home Sales In The Same Neighborhood Are Often The Best Indicator Of Home Value |

|

What are the top three factors affecting home value? "Location, Location, Location" Or so the saying goes. But, really, the location of a property is key in understanding its value. A home with 1500 SF in one neighborhood in Harrisonburg will not necessarily sell for the same price as a home with 1500 SF in another neighborhood on the other side of town. A townhome built 20 years ago in one neighborhood will not necessarily sell for the same price as a townhome in another neighborhood that was built 20 years ago. As such... Don't be too hasty in drawing conclusions about the value of a house based on the sales price of houses in a completely different location or neighborhood. It is usually best to seek to understand the value of a home by first examining recent sales in the same neighborhood or location of the home in question. | |

How Much Will Your Housing Costs Increase When You Sell Your Home And Buy A New One? |

|

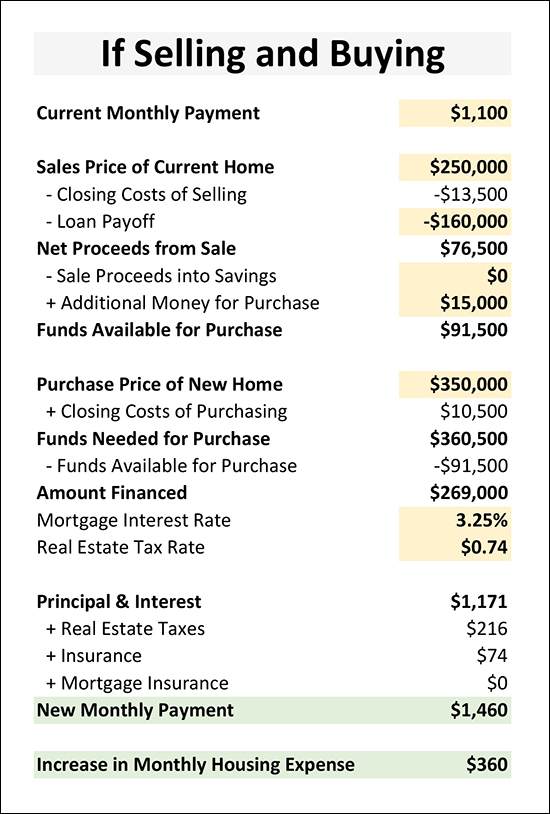

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

Yes, A Realtor Can Represent You As A Buyer |

|

Home buyers are well served to have a Realtor represent them in their home purchase. So, before you call the listing agent to see a home listed for sale, you should understand a bit more about buyer representation.

In representing you in your home purchase, your buyer's agent would be performing tasks such as:

So -- you can call the listing agent (who is contractually bound to represent the seller's best interests) -- or you can hire a Realtor to represent YOUR best interests as the buyer. Clearly, I recommend the second option. Beyond buyer representation, there is a lot more to know about and think about regarding the home purchasing process. Read more by visiting BuyingAHomeInHarrisonburg.com.  | |

How Much Are You Really Paying For That House? |

|

A first time buyer looking to buy a detached home (not a townhouse or duplex) under $275K might find themselves considering mostly homes that are at least 50 years old. Said buyer might find the **perfect** home built in 1945 that is "move-in ready" with pretty paint on the walls, and beautiful furnishings, and a well-kept garden, and a quaint covered front porch, and on and on. This buyer is likely head-over-heels excited about the house at this point, as it is priced at $280K, just barely above their target maximum of $275K. But before the buyer signs that contract to make an offer on the house they should probably pause at least for a moment to ask some questions and to consider...

There are plenty of other items that might need updates or replacements in the next three years, but they are all either of a lower cost or elective - though these costs could also add up:

But circling back to the first two items - the roof and heating system - these are pretty much non-negotiable. If either quits working as it should, you'll need to replace it. And if you're maxing out your housing budget with a $275K-$280K home purchase, and then within a year or two you need to spend $8K - $15K on a roof and $8K - $15K on a heating system, that will likely create some financial stress for you. | |

Only The Top 5% Of Home Buyers In Our Market Pay Over $550,000 |

|

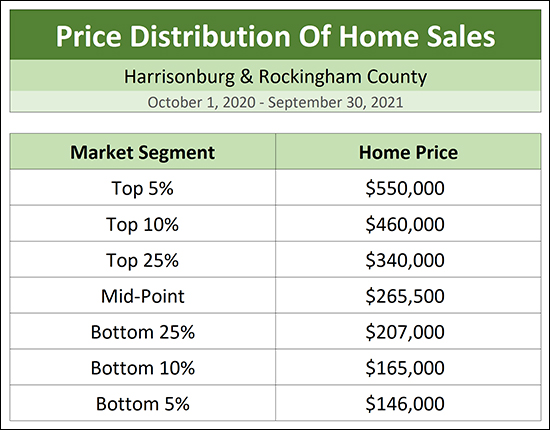

If you are selling a home over $550,000 -- you are only appealing to about 5% of the buying public as per the price distribution of the 1,654 home sales that were recorded in the HRAR MLS in Harrisonburg and Rockingham County over the past year. Looking to sell something over $460,000? That will appeal to about 10% of the buying public. You can slice and dice the data above however you'd like...

I think you get the point. :-) If you have ever wondered where your home falls into the overall distribution of home sales prices in this area -- now you know! Thanks, Tom, for the question that lead to this analysis! :-) | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings