| Newer Posts | Older Posts |

Building A Budget When Buying A Home |

|

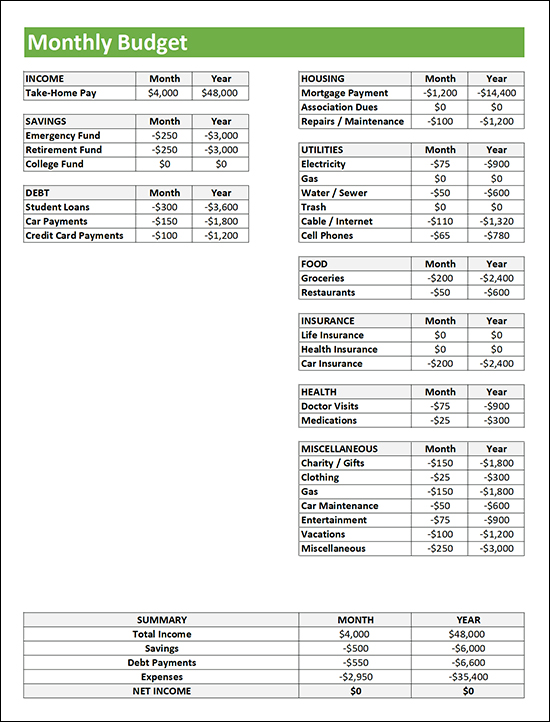

Several buyers have recently asked me about how to determine how much they can and should spend on a home purchase. Those are actually answered differently... CAN -- How much you *can* spend will best be determined through a conversation with a mortgage lender. They will evaluate your income, existing required recurring debt payments, credit score, etc., to tell you the maximum that you can spend on a home. SHOULD -- How much you *should* spend is best determined by calculating what portion of your income you are comfortable spending on housing while still having enough left over for all of your other life expenses. In other words, a budget! I created the budget spreadsheet shown above (download it here) as a starting point for thinking this through. Let me know if you have questions about how to use this spreadsheet. And let me know if you'd like a recommendation on a local mortgage lender. | |

Summer Is Fading Away. Home Sales Are Not. |

|

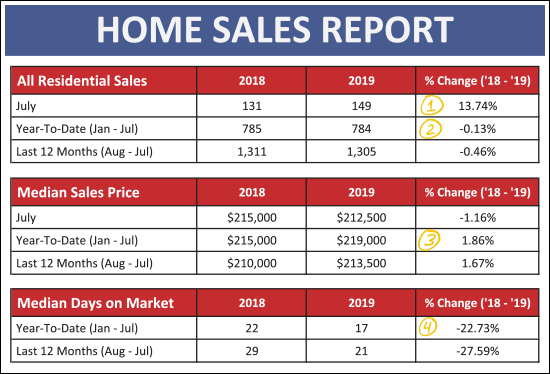

Summer is here! Oh wait, summer is gone!? Once that first week of August hits, it seems it's almost time for school to start again. Where did the summer go!?! While I ponder how another summer flew by so fast, let's take a few minutes to reflect on the state of our local housing market. But first - the beautiful home pictured above is this month's featured home - a spacious upscale home in Barrington with a finished basement, guest house and private courtyard! Check out the details at 2860BarringtonDrive.com. Now, onto the data! Download the full 28-page market report as a PDF, or read on...  As shown above, July was a strong month for home sales...

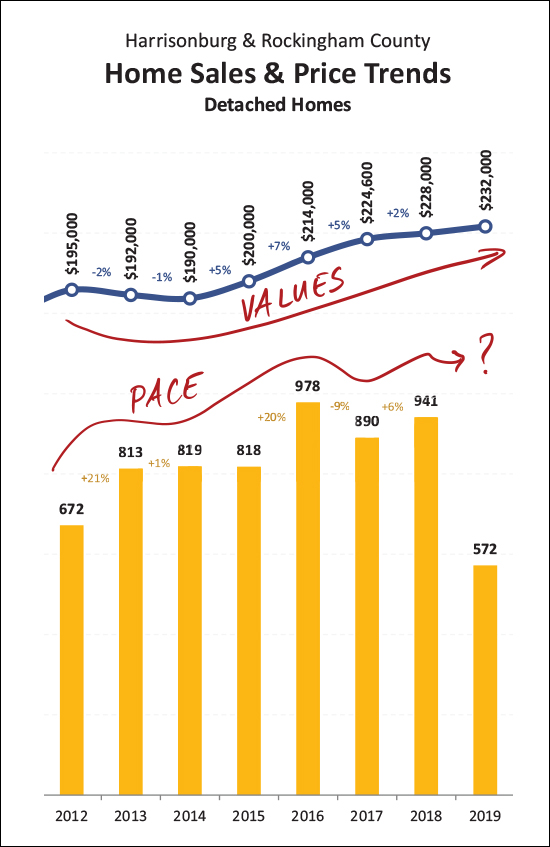

Diving slightly deeper, let's see how detached homes compared to attached homes. An "attached home" is a duplex, townhouse or condo...  As shown above, there are some differences in these two broad segments of our local market...

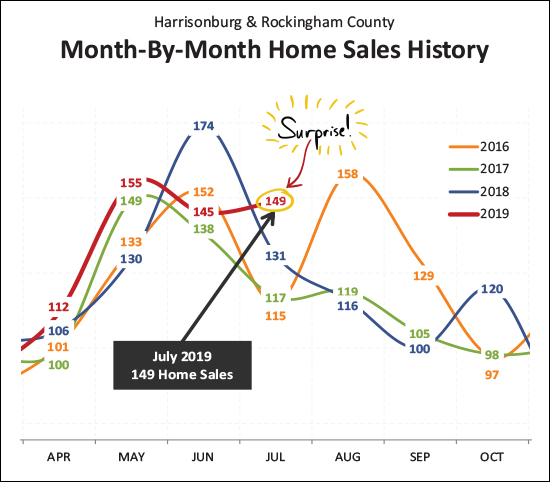

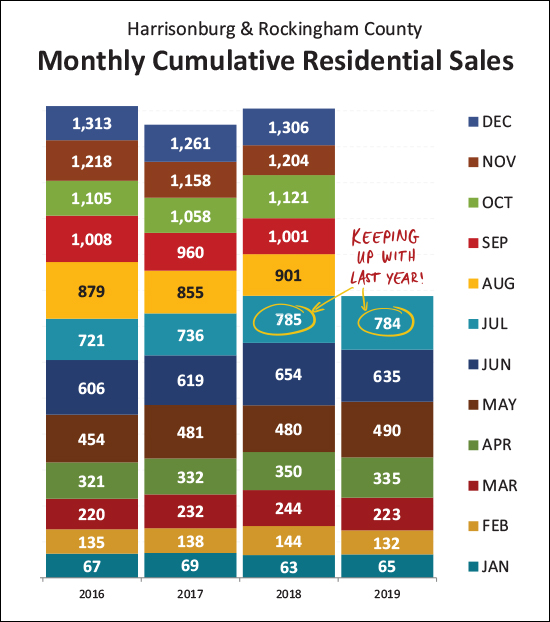

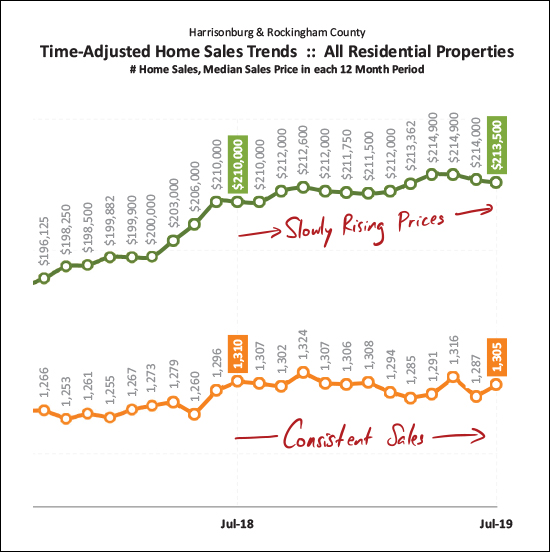

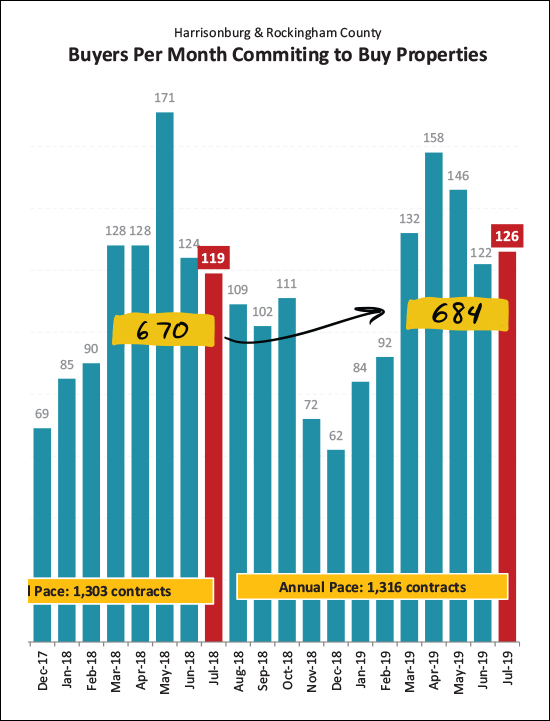

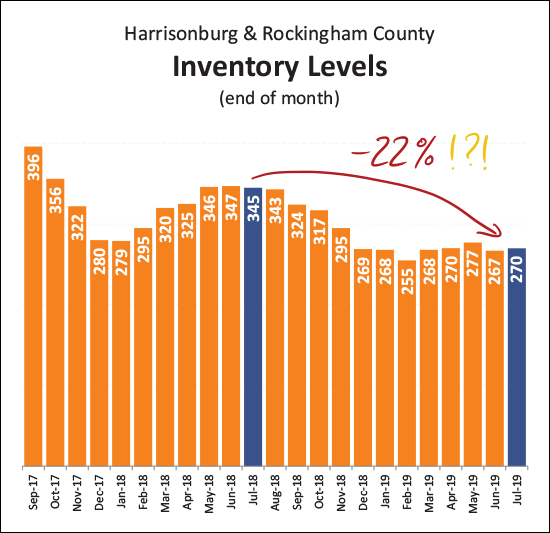

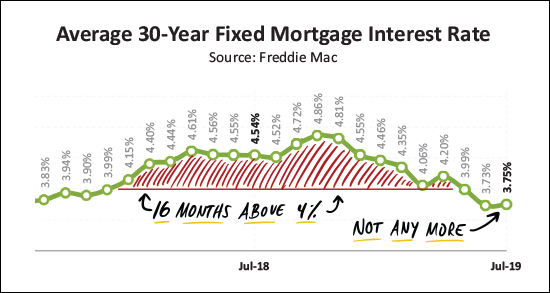

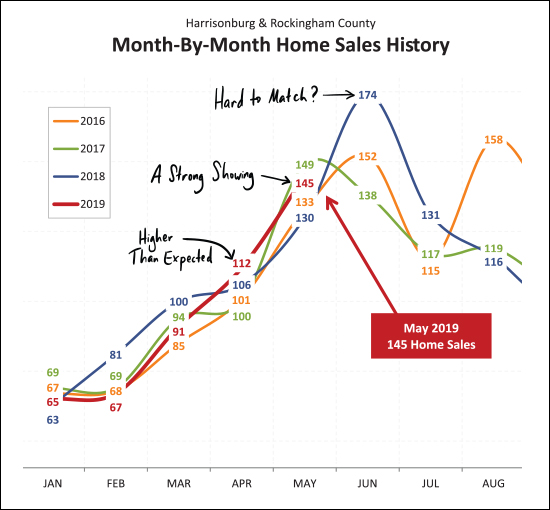

And just how did this past July compare to some other months of July?  This was a bit of a surprise to me! June home sales were rather slow compared to previous months of June. I didn't anticipate that a slower June would so quickly translate into a faster paced July - but wow! Looking back at the past three years we have seen 115, 117 and 131 homes sales during July. This year it was 149 home sales! An impressive showing for buyers in the local marketplace! And here's how that strong month of July contributed to the overall year...  If we were a bit behind as of the end of last month (635 vs. 654) we just about (just about!) caught back up in July -- as there have now been 784 home sales thus far in 2019 compared to 785 last year. it would seem we'll probably make it back to around 1300 home sales this year. And now, let's step back a bit...  This is the slooooooooowest moving graph ever - it looks at a rolling twelve months of sales data. Here, though, we see that the general trend is a consistent-ish pace of home sales -- and slowly rising prices. And when we look for some overall indicators just for detached homes...  This is where we see (above) that despite some year to year turbulence as to the pace of home sales, we're seeing overall increases in sales prices all the way back to 2014. Some years (2015, 2016, 2017) have been larger increases than others (2018, 2019) but it has followed the same general trend. So, what's next?  Well -- it would seem we are likely to see another strong month of home sales in August. After all, we saw an uptick (from 119 to 126) in July contracts, and over the past five months there have been 684 contracts signed, as compared to only 670 during the same months last year. How, though, will those contracts come together with such limited inventory?  That is, of course, an excellent question! Inventory levels have fallen 22% over the past year. This means today's buyers are finding fewer and fewer options when looking for a home to buy at any given time. That said - a relatively consistent number of homes are selling - so a buyer might just have to be a bit more patient, and then be ready to jump quickly when the right house comes on the market. And one last note about mortgages and financing...  In case you missed it, today's buyers are locking in below 4% on 30 year fixed rate mortgages! We went through 16 months with rates above 4%, and we have now been back below 4% over the past few months. Anyone who locked in at 4.25%, 4.5%, 4.75%, etc., still has a wonderful long-term fixed rate mortgage interest rate -- but 3.something? Wow! I'll wrap it up there for now, with a few closing thoughts...

Until next time, have wonderful remainder of your summer, and a great start to your school year if you or someone you know will be getting back to the classroom this month! | |

If You Are Not Able To Buy Quite Yet Should You Still Start Looking At Homes? |

|

Some buyers are close -- so close -- but not quite in a position to be able to make an offer yet on a house. It might be a matter of a few weeks -- or a month or two -- before you are able to actually sign a contract. This might be because you are waiting for a new job to start, or to finish paying off your car, or any number of other reasons. So -- if you're not able to make an offer on a house quite yet, should you still start looking at homes? Yes and no. YES - you should start looking at homes...

Understanding all of these things will help you be a better prepared buyer when you are actually ready to buy. NO - you should not start looking at homes...

So - for most buyers, I recommend "yes, up to a point". Let's start looking at homes that would be of interest if you were ready to sign a contract today. Let's build that context to allow you to understand your segment of the market. Let's get a sense of how often homes of interest will become available - and how quickly they go under contract. And then, after we have built somewhat of an understanding of the market, it will be your call as to whether to continue to look at homes that are not likely to actually be available for you to buy once you are able to do so. So, in conclusion - even if you are a few weeks or a few months out from being ready and able to sign a contract to buy a home, it is not necessarily too early to start going to see some houses. | |

Arranging the Timing and Logistics of Selling, Buying and Moving |

|

Moving from one house to another is tough work! Even tougher (sometimes) is arranging the timing and logistics to work well for all parties. If you're selling a house in order to buy a house, it's possible that...

The spot for you to be can be somewhat easier -- you could stay at a hotel or with a friend for a night if needed. It's decidedly harder to put all of your belongings in the hotel room or in your friend's house. The options, generally speaking, are...

If none of these are possibilities -- I have even had some clients who had to put everything in storage, just for a few days -- and then move it out of storage into the new house. Again - even moving is tremendously hard - but arranging for it within the tight confines of closing timelines and when you do and do not have access to the old house and new house can make it even more difficult! | |

Sometimes Buyers Will Find It Difficult To Make Rational Decisions About Home Inspection Findings |

|

Buying a house can be an enormous decision - full of plenty of emotions - anxiety, apprehension, excitement and much more! Buy a house is likely to be one of the largest financial decisions you will ever make - AND you are making a decision (where you will live) that will affect countless other aspects of your life, likely for many years to come. So, are you good at making difficult decisions in a highly emotional state? Many people find that to be difficult! Let's imagine this scenario -- you're buying a $245,000 home and you are SO excited to buy it because if it's charm, character, location, and so much more! It is within walking distance of the downtown scene - and even though it is an older home, it seems to have been well maintained and updated. But then, you do the home inspection and you find out that the ___ will need to be replaced in the next few years. Technically, this could be any number of items -- heating system, roof, appliances, etc. What to do...what to do!? Perhaps it is going to cost another $5,000 to make this update - and the seller is not willing to adjust the contract terms based on your inspection findings because, after all, the ____ is still working properly now. So - do you throw the whole purchase out the window? You're going to have another $5,000 of costs within the next few years!? The seller should be willing to negotiate to cover some of that cost!? Is your "really good decision" now actually a "really bad decision"?!? This advise is not prescriptive to all situations, but I would encourage you to consider the big picture as rationally as possible. You are about to buy a home that is (in my fictional scenario) going to totally change your life. It's a home you can see yourself living in for 10 - 15 years. You look forward to the memories formed in the house, the places you can walk and experience based on its location, the opportunity to have a garden in the backyard, and so much more! A question that you could then ask yourself would be whether you'd pay $250K for this awesome, amazing, perfect, life changing house and opportunity, instead of the $245K you have contracted to pay. If so, and if you'll have cash available to make the needed upgrade to the ____ sometime in the next few years, then maybe it's not really a terrible idea to continue with the purchase despite the newfound information about the condition of the house and despite the seller's unwillingness to assist with it financially. Again - this is not generic advice of "don't worry about the issues that come up in the inspection" - but more of an encouragement to consider the big picture of what you are buying, why you are buying it, what it is worth to you, etc. | |

The Variable Value Of A Basement |

|

There are a lot of types of basements - and they have very different values to buyers and appraisers. Here are a few examples, to get you thinking...

You get the idea. :-) To say "this house has a basement!" can mean so many (so many!) different things. And, the value of that basement (to a buyer or an appraiser) will vary quite significantly. So when you see a house for sale with 2600 square feet -- but with 1200 of those finished square feet being in the basement -- you might just have to go see the house in person to understand which of the various basement types listed above best describe these 1200 square feet. | |

Home Buyers Have Had Fewer Choices Nearly All Year |

|

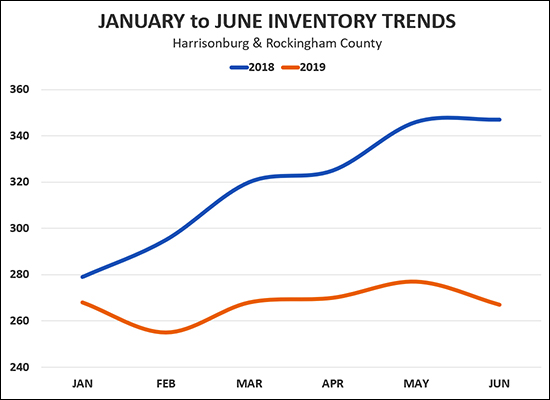

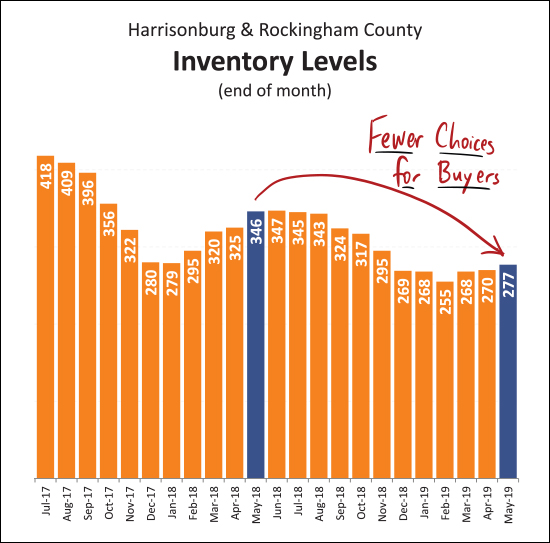

The blue line above shows the number of homes for sale at the end of the month for the first six months of last year, 2018. The orange line shows the same (homes for sale at the end of the month) for the first six months of 2019. Last year, inventory levels rose 24% between the end of January and the end of June. This year, inventory levels actually dropped negligibly (by one listing) between the end of January and the end of June. So - for all you would-be home buyers out there feeling like you don't have many options, or that the ones you do are going under contract quickly after having had multiple offers, the data backs up the pain you are feeling. What's next? How do we get out of this trend of fewer and fewer homes for sale? New construction is the likely anecdote, but there doesn't seem to be a whole lot on the horizon right now. | |

How Do I Make An Offer On A House? |

|

How, you might ask, do we go about getting from the point of wanting to make an offer --- to actually making the offer? Here's a brief overview....

When we get to step seven, above, we will be discussing and deciding on the terms of the offer. Below is a list of the main contract terms we will need to discuss in preparing to make an offer.

Before and after making an offer, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

Make Sure To Think About The Total (Near Term) Cost Of Purchasing A Home |

|

As one small example... A first time buyer looking to buy a detached home (not a townhouse or duplex) under $225K might find themselves considering mostly homes that are at least 50 years old. Said buyer might find the **perfect** home built in 1945 that is "move-in ready" with pretty paint on the walls, and beautiful furnishings, and a well-kept garden, and a quaint covered front porch, and on and on. This buyer is likely head-over-heels excited about the house at this point, as it is priced at $230K, just barely above their target maximum of $225K. But before the buyer signs that contract to make an offer on the house they should probably pause at least for a moment to ask some questions and to consider...

There are plenty of other items that might need updates or replacements in the next three years, but they are all either of a lower cost or elective - though these costs could also add up:

But circling back to the first two items - the roof and heating system - these are pretty much non-negotiable. If either quits working as it should, you'll need to replace it. And if you're maxing out your housing budget with a $225K-$230K home purchase, and then within a year or two you need to spend $8K - $15K on a roof and $8K - $15K on a heating system, that will likely create some financial stress for you. So - always be sure to think about the total cost of purchasing a home, especially when you are on a tight budget or when you are buying an older home. | |

All Square Footage Is Not Created Equally |

|

So -- if your neighbor's 2400 SF, circa 2000, 4 BR, 2 BA home just sold for $300K... Then it's probably reasonable to think that your 2400 SF, circa 2000, 4 BR, 2 BA home will also sell for $300K, right? After all, you have made the same updates (systems and cosmetic) over time -- and you're on the same street!

Well, maybe -- but maybe not! Consider the possibility that....

These two homes will not be seen as having an equivalent value -- not by potential purchasers and not by an appraiser. Above grade square footage has a higher value attached to it -- both specifically by appraisers, and generally by purchasers. Even if all of the other factors (condition, age, location, bedrooms, bathrooms) are the same between two houses, if one has a significant portion of the square footage in the basement then it will be seen as less valuable than the home that has all of its square footage above grade. | |

The Buyers Did Not Like The Layout Of Your Home |

|

If a buyer is buying over $400K, or even over $300K, the layout of the home becomes very important to them. That is not to say that it is unimportant for a $200K buyer -- but someone buying a more expensive home oftentimes plans to stay in it for a longer time frame. If not the #1 feedback, then perhaps the #2 feedback I receive from showings of homes priced over $400K is that the layout just didn't work for the buyers....

| |

Should I Be Worried If A House Is Being Sold In AS IS CONDITION? |

|

Sometimes a seller is stating this as soon as they list a property: All inspections are for informational purposes only. or This house is being sold in "as is" condition. Here are the top three innocent reasons why a seller would want a home inspection to be for informational purposes only....

| |

Summer Has Not Started, But For Real Estate, Summer Is Nearly Over |

|

Technically, summer has not even started yet -- the first day of summer is June 21, 2019 - this Friday. I suppose then, that was why we had such pleasant temperatures over the past week or two -- it was really late Spring, not yet Summer. :-) But for real estate, summer is almost over, at least as a home seller. Home buyers that want to close on their home purchase before next school year are likely aiming to close on their purchase by around August 15, 2019. Most contracts take around 45 days (sometimes 30, sometimes 60, sometimes in between or longer or shorter) to get from a brand new contract to the settlement table. If you wanted to close on a home by August 15, and it was going to take 45 days to do so, you'd need to be under contract by July 1. So -- that leaves buyers with only about two weeks to get a house under contract if they want to close on their purchase and have a chance to move in prior to next school year. So, buyers, get ready to amp up your game and get that new house under contract! And sellers, if you want to sell your house this summer, you need to get it on the market soon, now, yesterday! | |

Local Home Sales Stable, Prices Rising in First Five Months of 2019 |

|

We're nearly halfway through the year and 2019 is shaping up to be a strong year of home sales, very similar to last year. But before we dive into the data, here are a few quick links...

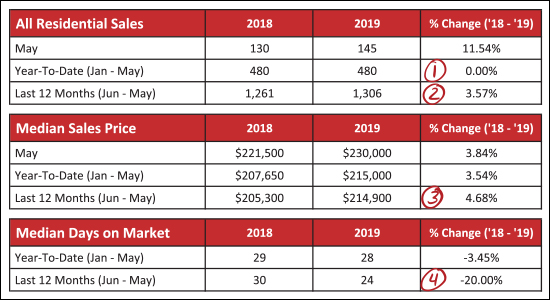

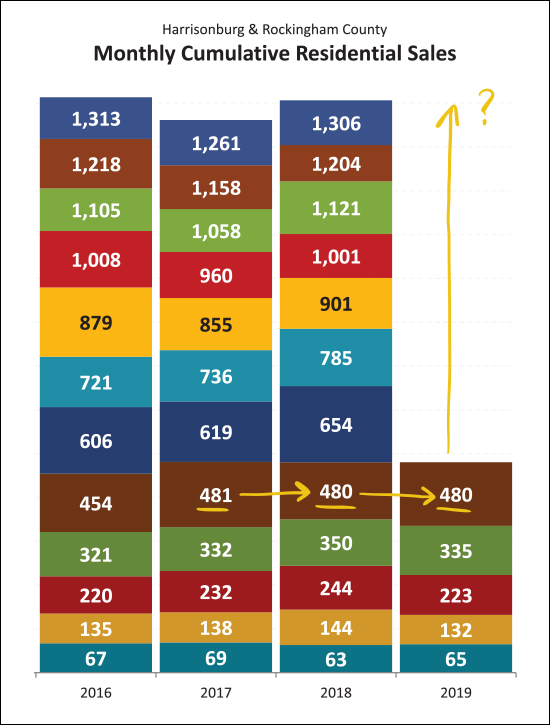

Now, let's see what the data is showing us this month...  As shown above, we have seen a solid start to the year, now five months in...

Breaking things down a bit further, as outlined above, we'll start with the green portions of the chart -- which are detached homes...

The orange section above represents attached homes -- including duplexes, townhouses and condominiums, where we find that...

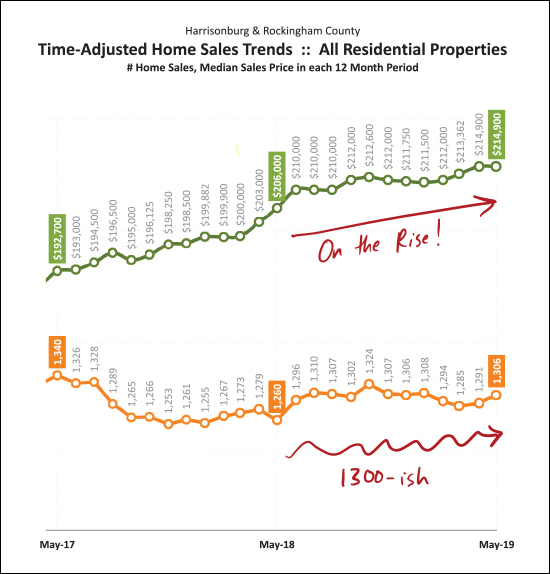

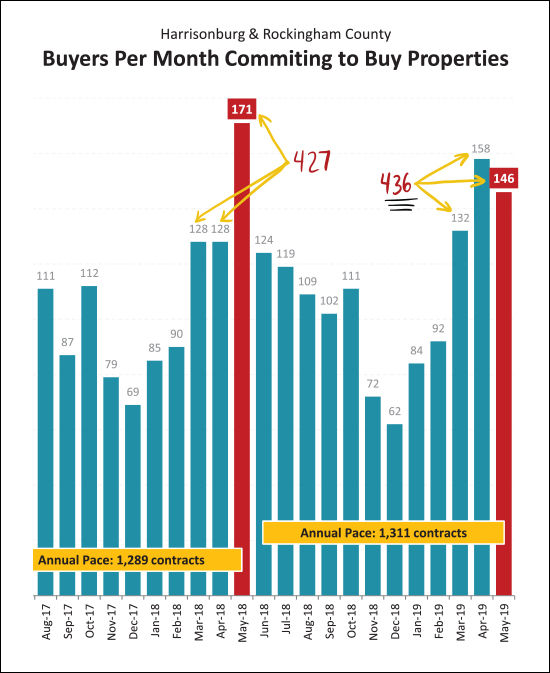

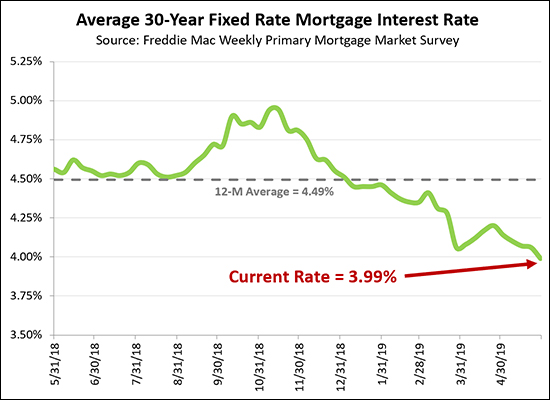

As you look at the graph above, find the dark red line and follow it from month to month from January through May to see how this year compares to previous years. What you'll find is that January, February and March were nothing special -- at all. They were slower or the slowest such months from the past few years. But once we hit April, things started to change -- we saw more home sales in April than any of the past three months of April -- and May home sales were also stronger than two of the past three months of May. So, as noted above -- April was surprisingly high, May was a pretty strong showing, but June, that might be where this year starts to slow down, comparatively. Last June we saw a surprising, historic, 174 home sales in a single month. It seems rather unlikely that we'd see that many home sales this June.  This tall, colorful, graph shows each month of home sales stacked on top of the prior month -- and you'll see that the first five months of this year have tracked pretty consistently with the first five months of each of the past two years. So, it seems reasonable to think we might end up somewhere around 1280 - 1300 home sales for the full year of 2019. Stay tuned as the year continues to develop.  This graph shows looooong term trends -- tracking a rolling twelve months of data when it comes to the quantity of home sales and the median price of those home sales. The highly technical 1300-ish red squiggle at the bottom of the graph represents the meandering annual pace of home sales as shown in orange. We've been somewhere around an annual pace of 1300 home sales for the past 12 months or so -- with the most recent (two month trend) heading us in a positive direction. The top, green, line is showing the long term trend for the median sales price of homes in Harrisonburg and Rockingham County. The median sales price keeps on climbing -- from $193K to $206K to $215K over the past two years.  Sometimes looking at a single month of data can throw us off -- getting us overly excited or overly depressed. Last May (2018) we could have been elated about the incredibly strong month of contracts -- though it followed two slower months in March and April. This year we saw strong months of contracts in both April and May -- even though neither reached the 171 contracts seen last May. But in the end, March-May contracts only added up to 427 contracts last year -- and 436 this year -- so, a net increase.  And so, as shown above, the sad story continues -- it is a tough time to be a buyer. Inventory levels might be rising and falling seasonally (rising, slightly, right now) but the overall trend over the past several years has been fewer and fewer homes for sale at any given time. This causes buyers to have fewer choices at any given moment -- and requires that they be able to act quickly and decisively when a house of interest comes on the market.  I'm not always convinced that month to month increases or decreases in mortgage interest rates can specifically spur on buyer activity (there has to be a house listed for sale that you actually want to buy) but the lower (and lower, and lower) mortgage interest rates of late certainly don't hurt! We haven't seen mortgage interest rates below 4% in over a year -- and right now many mortgage lenders are quoting rates of 3.875%, 3.95%, etc. An exciting time to lock in a fixed mortgage interest rate! Alright -- we'll wrap it up there for now, though keep in mind that there is a LOT more in my full market report, which you can download as a PDF here. And -- if you're getting ready to buy or sell -- here are some things to keep in mind... SELLERS -- even though it is a seller's market in just about every price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

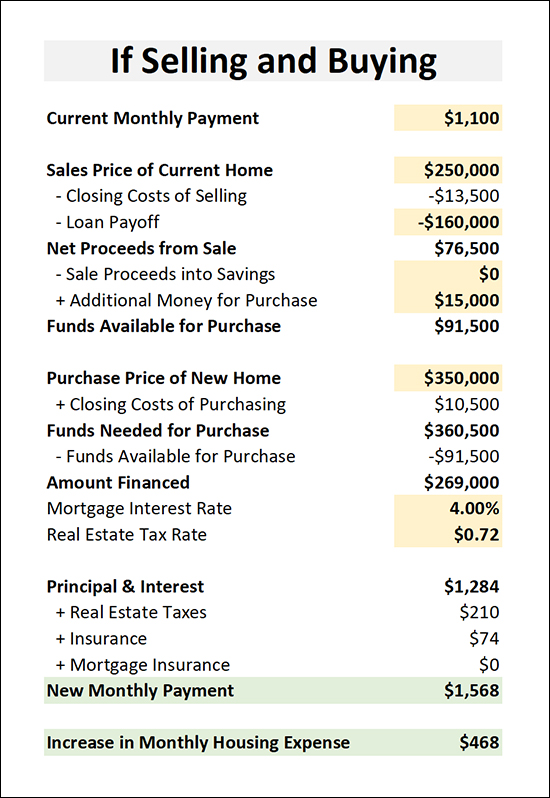

Crunching the Numbers on Both Selling AND Buying a House |

|

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

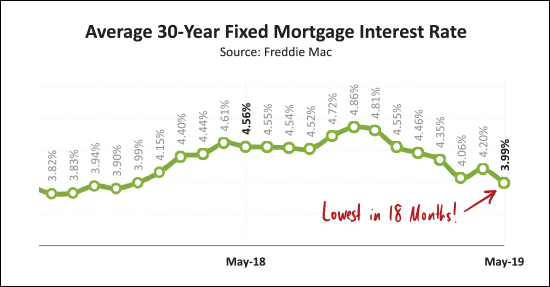

Summer Home Buyers Will Love These Low Mortgage Interest Rates |

|

Interest rates climbed nearly all the way to 5% this past Fall -- and over the past year have been at an average of 4.5%. But since the first of the year, mortgage interest rates have been falling, falling, falling, further and further! They are now, unbelievably at 3.99% for a 30 year mortgage. So - if you're contracting to buy a house in the near future you may want to lock your interest rate in sooner rather than later. It's hard to imagine we'll stay under 4% for long. | |

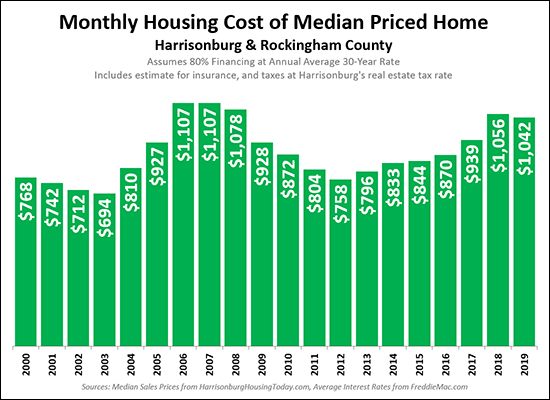

Monthly Housing Costs Actually Decline, A Bit |

|

The monthly cost of a mortgage on a median priced house has actually declined a bit this year! For this analysis, I am measuring "monthly housing cost" by determining the mortgage payment amount (principal, interest, taxes and insurance) for a median priced home in Harrisonburg and Rockingham County, if a buyer were financing 80% of the purchase price and paying Harrisonburg real estate taxes. Over the past year, the median sales price has only increased 1%, and the average mortgage rate has declined 6%, which results in a slight decline in the median housing cost -- if you are buying your home, and you have a 20% downpayment. So - monthly housing costs are still relatively high from a historical perspective, but we're not seeing a 12% increase in that monthly cost like we did between 2017 and 2018! | |

Be Careful of Asking For Little Repairs When Also Asking for Big Repairs |

|

After a home inspection, a buyer knows more about the house than when they agreed to pay $X to purchase the house. In order for them to still want to pay $X for the house, they may ask the seller to address some of the deficiencies found during the home inspection. Imagine a hypothetical scenario where the following deficiencies are found:

So - which items should the buyer ask the seller to repair? Some could say ALL of them - the buyer didn't agree to pay $X for the house with all of these large and small issues. But I'd advise most buyers to only request that the seller address a subset of those issues:

All of the other items (3-7) are minor issues that won't cost too much (in time or money) to repair after you buy the house. But why not ask the seller to repair these items?

This is not a one-size-fits-all strategy, but I do urge you to carefully weight whether to ask for a home seller to make minor repairs if there are some major repairs that need to be addressed. | |

Can Parents of JMU Students Buy Any House And Put Lots of Students In It? |

|

With great regularity, potential buyers (either investors or parents of JMU students) will ask if a single family home can be purchased and rented to a group of JMU students -- often an intended group of four or more students. I let them know that it will be no problem at all -- the adjoining property owners in the quaint neighborhood probably won't mind as long as the students aren't too bothersome -- and the City doesn't mind at all if their zoning ordinances are violated, so long as it's just "nice college kids".... WAIT! NOT REALLY! READ ON!!!! It seems that some buyers are really getting that feedback of "sure, it will be fine" -- though I'm not sure if they're getting it from their Realtor, or from someone else advising them in the transaction, or if they just aren't thinking about whether their planned use of a property is allowable. The REAL answer, and the feedback that I ACTUALLY provide to my clients is.... 1. We need to check to see how this property is zoned, and whether that zoning classification allows for that number of unrelated people to live in the property. 2. We need to check to see if there are recorded restrictive covenants for this neighborhood that restrict the number of unrelated people who live in the property. A few notes.... 1. Most single family homes in the City of Harrisonburg are zoned R-1 or R-2 and do NOT allow for three or more unrelated people (students or otherwise) to live in the property. 2. If a property has been used in a non-conforming manner (for example, four students living in it) since before the zoning ordinance was put in place, without a 24 month gap in the non-confirming us, it MIGHT be possible to continue to use the property in that non-conforming manner. And, if #2 above is starting to get confusing, then we arrive at my main reason for writing today.... CALL COMMUNITY DEVELOPMENT TO UNDERSTAND ALLOWED USE OF A PROPERTY! Yes, in fact, there are very helpful City staff in the Community Development department -- who can very quickly help you understand whether a property can be legally used as you intend to use it. And it is imperative that you make this call BEFORE you buy the property, and even BEFORE you make an offer on the property! | |

Most Home Sellers Do Not Seem To Accept Offers With Home Sale Contingencies Unless Those Houses Are Already Under Contract |

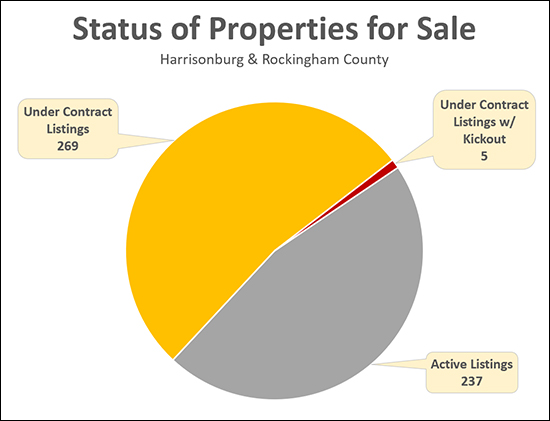

|

Based on the analysis above, it would seem that sellers are not (in almost all cases) accepting home sale contingencies unless the home that must be sold is already under contract. Here's the logic....

It would seem that most buyers are likely waiting to make offers until they have their own properties under contract (thus eliminating the need for the kickout clause) AND/OR most sellers are not accepting offers with home sale contingencies unless the buyer's house is already under contract (thus eliminating the need for the kickout clause). If you are a buyer, I would certainly suggest the strategy outlined above (and the only one that is apparently working with sellers right now) --- get a contract on your house and THEN make an offer on the property you would like to purchase! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings