| Newer Posts | Older Posts |

Review Restrictive Covenants Before Buying A Home |

|

Some property owners associations and neighborhoods are more (or less) strict about the enforcement of their restrictive covenants than others. Click here to read a story from yesterday's Daily News Record about townhouse owners in Harrisonburg that are being asked to remove a Marine Corp garden flag from in front of their home because of their restrictive covenants. You can find Restrictive Covenants for most of Harrisonburg's townhouse communities on HarrisonburgTownhouses.com.

| |

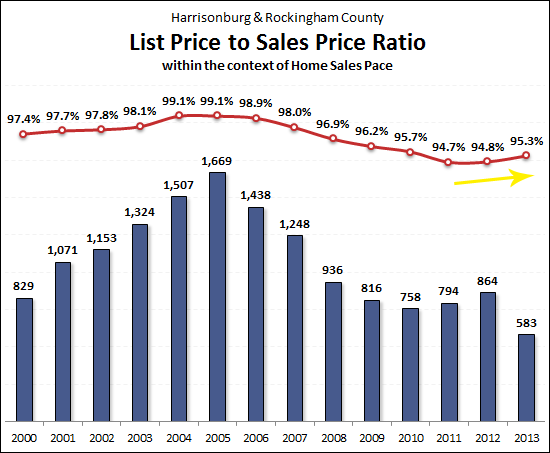

Home prices less negotiable |

|

A few snippets buyers should be aware of....

| |

Strong Home Sales (+21%), Improving Prices (+3%) in Harrisonburg, Rockingham County |

|

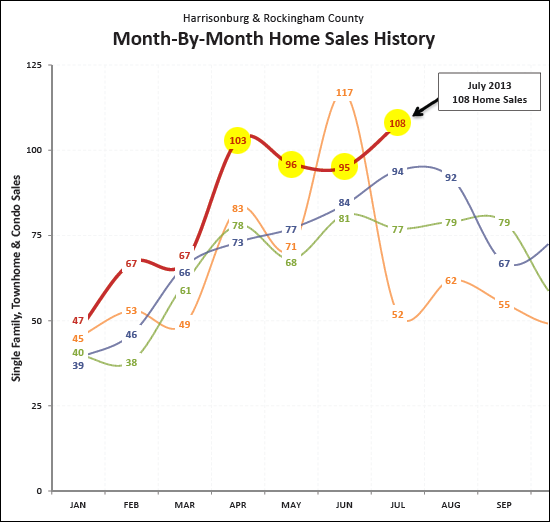

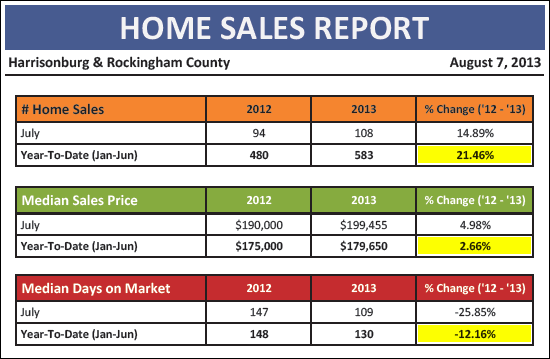

I have just released my August 2013 monthly market report covering the Harrisonburg and Rockingham County housing market. Click here to download the full report as a PDF, read on for some highlights, or click here to view more details on the cover home, 1032 James Place.  The big picture indicators in our local market are all positive when we look at January through July home sales in Harrisonburg and Rockingham County....  As shown above:

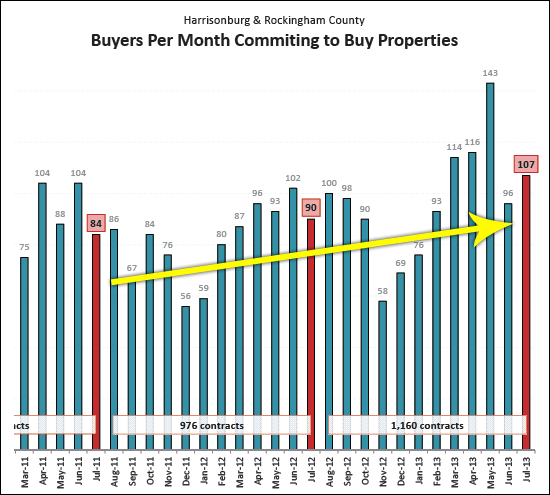

Assuming you are hoping for a strengthening local housing market, these are all great news for our local area. Below you can see the reason why the year-to-date home sales figures are so strong....

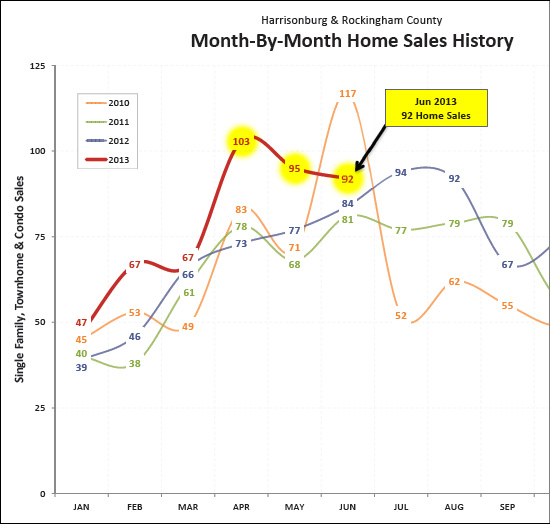

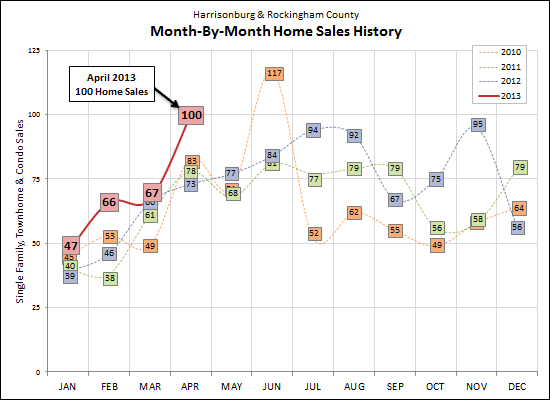

As you can see, above, the past four months of home sales (Apr, May, Jun, Jul) have been much stronger than any of the previous three years --- with the one exception of June 2010 when the federal home buyer tax credit expired. What, you might ask, should we expect for the next few months?

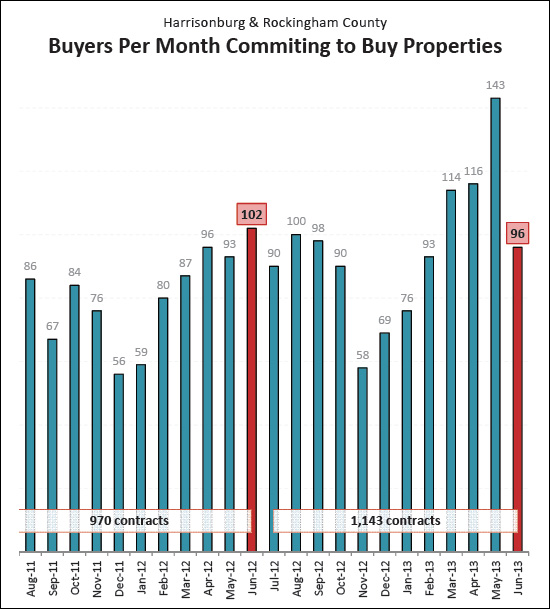

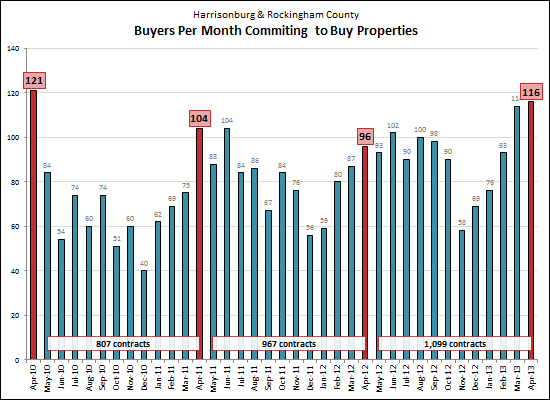

Based on the trend in signed contracts, shown above, I believe we will continue to see strong home sales over the next several months. It is also important to note that it's not just the short term indicators that are positive in our local housing market....

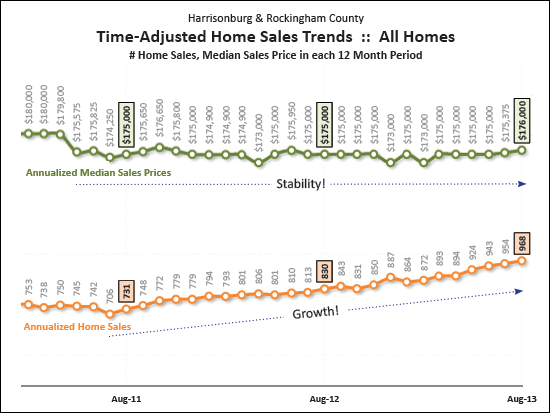

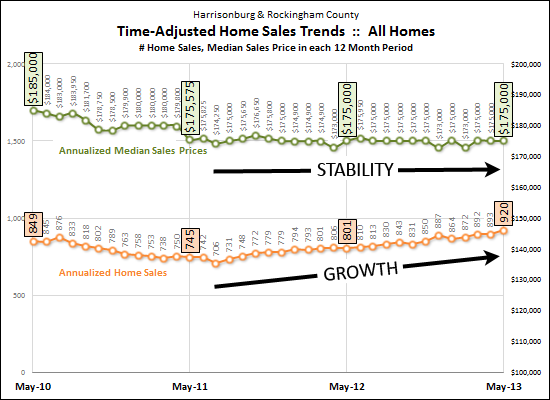

Each of the data points on the graph shown above takes 12 months of data into account --- thus these trends take a long time to show any substantial change, but they are excellent indicators of the overall shifts in a housing market. As can be seen, above, we are seeing steady growth in the pace of home sales, and stability in home values. There is a LOT more in my full report, including....

| |

What did home buyers buy in July 2013? |

|

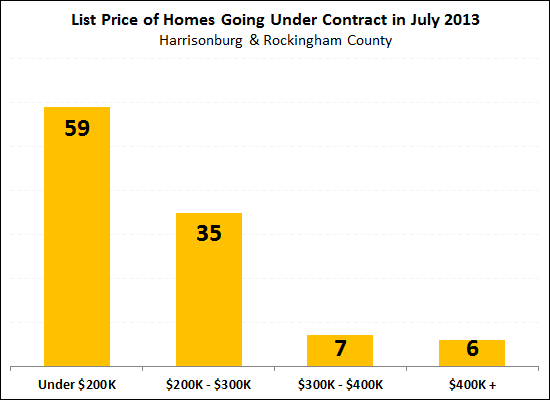

107 properties in Harrisonburg and Rockingham County went under contract in July 2013, ranging from a low list price of $39,900 to a high of $549,900. Click here to see which properties went under contract in July 2013. | |

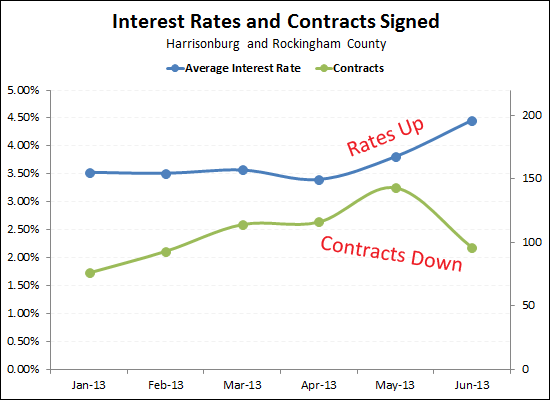

Are rising interest rates slowing down buyer activity? |

|

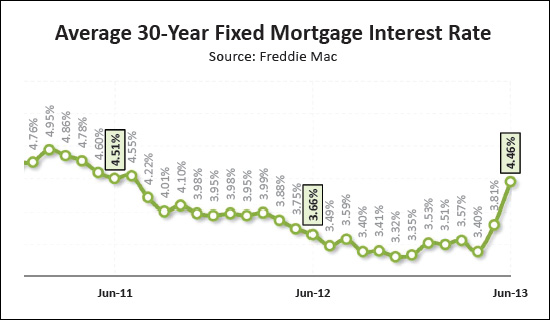

It seems quite possible --- see above. But remember folks, these are still ridiculously low interest rates from a historical perspective. | |

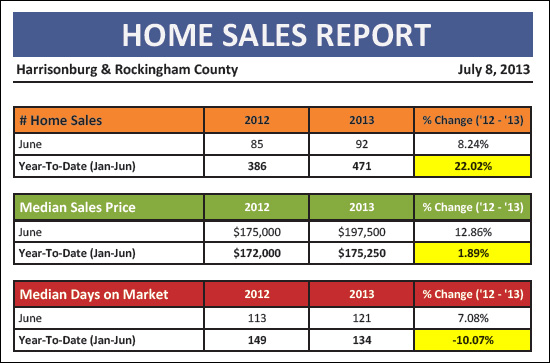

Local Home Sales Up 22% Year To Date |

|

I have just released my July 2013 monthly market report covering the Harrisonburg and Rockingham County housing market. Click here to download the full report as a PDF, read on for some highlights, or click here to view more details on the cover home, 3100 Brookshire Drive.  As can be seen below, we finally saw all three overall market trends head in a positive direction --- sales are up, median prices are up, and days on market are down!  June marked another exciting month of home sales in Harrisonburg and Rockingham County. As shown below, this is the third month in a row where we have seen a significant increase in home sales over the same month last year.  Interest rates are starting to creep up, even if they are still at historically low levels....  The rising interest rates may have cooled buyer activity a bit. After record setting months (April, May, June) buyer activity slowed in June.  There is a LOT more in my full report, including....

| |

Can I wait to start the financing process until after the home inspection contingency has been resolved? |

|

In short, no. Virginia's standard Residential Contract of Purchase states the following in the FINANCING section.... Purchaser agrees to make written application for such financing or assumption (including the payment of any required application, credit, or appraisal fees) within five (5) business days of the date of acceptance of this Contract and to diligently pursue obtaining the Commitment.Later on in the FINANCING section, we find this.... The occurrence of any of the following shall constitute a default by Purchaser under this Contract [...] (i) Purchaser fails to make timely application for any financing provided for hereunder, or to diligently pursue obtaining such financing;Now, I can understand why a buyer would want to wait to apply for their loan until they knew that the home inspection contingency had been resolved, but that would likely delay the entire transaction. A home inspection is often not completed until 7 - 10 days after the contract is ratified, and then it might be another few days until the repairs negotiations are completed. That would then put you 10 - 13 days into the transaction before you had applied for financing. Not only would this be a default per the terms of the contract, this would also make you less likely to be able to obtain loan commitment by the deadline, which is often 30 days after the ratification of the contract. | |

What did buyers buy in June 2013? |

|

89 properties in Harrisonburg and Rockingham County went under contract in June 2013, ranging from a low list price of $42,900 to a high of $895,000. Click here to see which properties went under contract in June 2013. | |

Home sales soar in April 2013 to highest level since June 2010 |

|

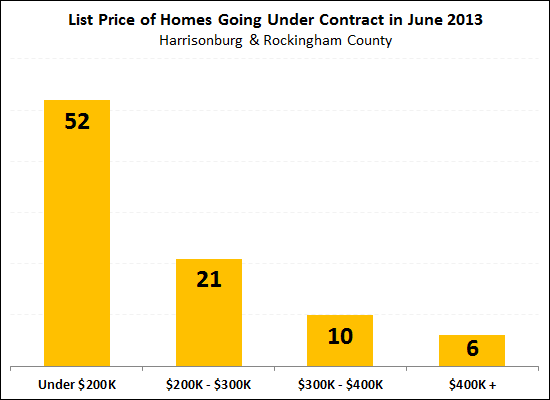

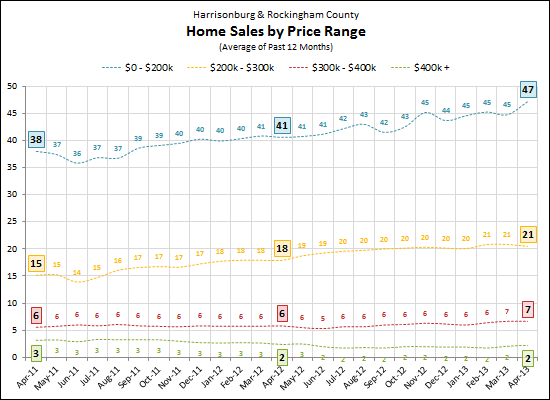

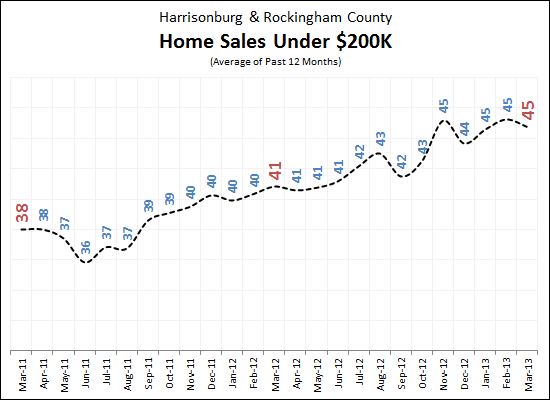

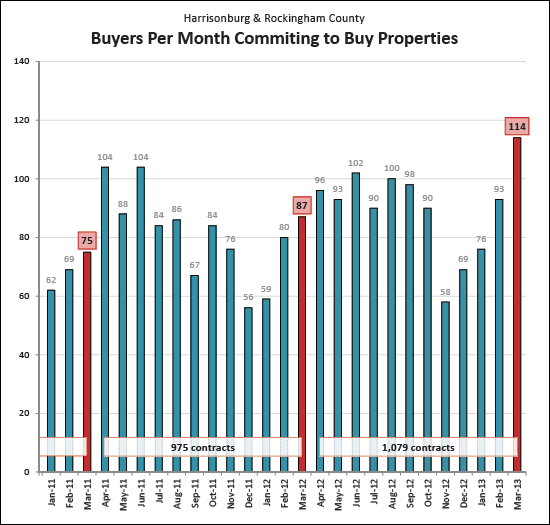

I just published my monthly market report on the local housing market and there is plenty of good news in many segments of the market. Click the cover of the report below to download the entire report as a PDF or read on below for some highlights.  Cover Home: 3291 Barrington Drive, Harrisonburg, VA After a relatively mild month of home sales in March, there were an astonishing 100 home sales in April 2013 (see below) -- bringing us to the highest level since June 2010 when buyers had their last chance to cash in on the federal home buyer tax credit.  Beyond the single month of market exuberance shown above, it is also important to examine long term trends. Below you will note that for the past two years we have seen stable prices and an ever increasing rate of annualized home sales.  The future looks positive as well, with another strong month of contracts in April (116) piling on top of March's 114 contracts.  It should be noted that the market improvements described above vary based on price range, property type and location. As shown below, the lower price ranges have seen a greater improvement in sales than the higher price ranges.  There is plenty more inside the full report, including....

Click here to download the full May 2013 Harrisonburg and Rockingham County Real Estate Market Report. And as always, if you're interested in talking to me about buying a home in Harrisonburg or Rockingham County.....or if you are interested in selling your current home.....just drop me a line by email (scott@HarrisonburgHousingToday.com) or call me at 540-578-0102. | |

April Home Sales Looking Strong |

|

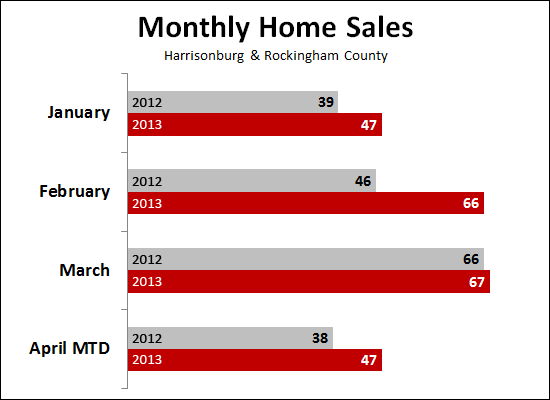

The first few months of the year showed exciting signs for our local housing market:

But then there was March, which left some wondering what was going on:

Don't worry too much, yet, because April month-to-date sales are looking good:

Stay tuned, but our local housing market seems to be continuing to perform well during 2013! | |

Low Home Prices + Really Low Mortgage Interest Rates = Fantastic Monthly Payments |

|

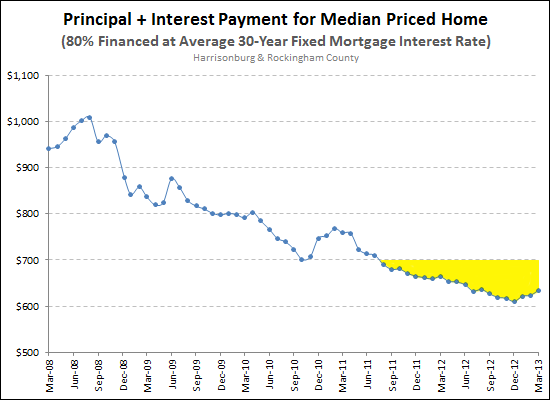

March 2008 Annualized Median Sales Price = $197,000 March 2013 Annualized Median Sales Price = $175,000 March 2008 Average 30-Year Fixed Mortgage Interest Rate = 5.97% March 2013 Average 30-Year Fixed Mortgage Interest Rate = 3.57% The graph above shows the impact of combining low home prices and ultra low mortgage interest rates by analyzing the monthly payment (principal + interest) assuming 80% financing of the median sales price at the average mortgage interest rate. As you can see, this monthly payment would have been $942 back in March 2008, and is only $634 today. Today's low housing prices and historically low mortgage interest rates provide unique opportunities for home buyers! | |

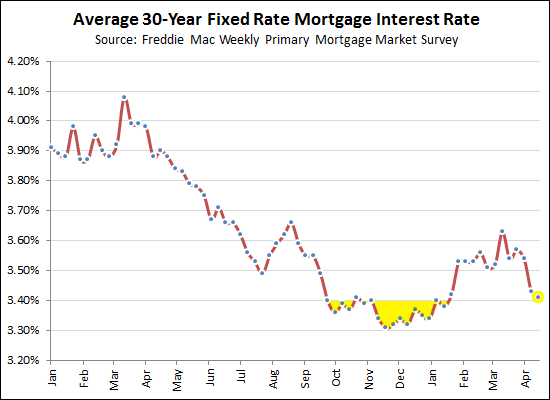

30 Year Fixed Mortgage Interest Rates Drop....Again! |

|

Today's rates are not the lowest ever (see Oct 2012 - Jan 2013, in yellow) but they are still amazing rates --- at an average of 3.41% per Freddie Mac's weekly survey. Just one month ago, the average rate was 3.63%, and we're now back down to an average rate of 3.43%. If you're buying, this week would be a great time to lock in your mortgage interest rate! | |

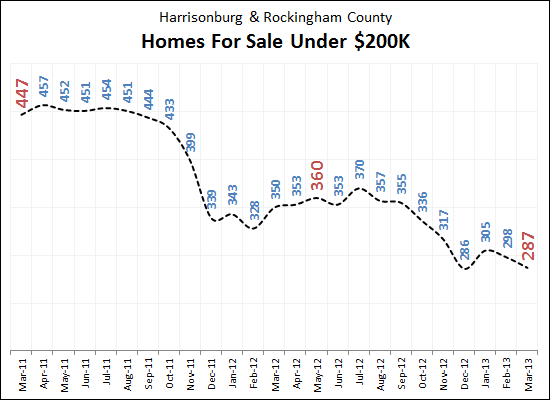

36% fewer homes for sale under $200K, 18% more sales! |

|

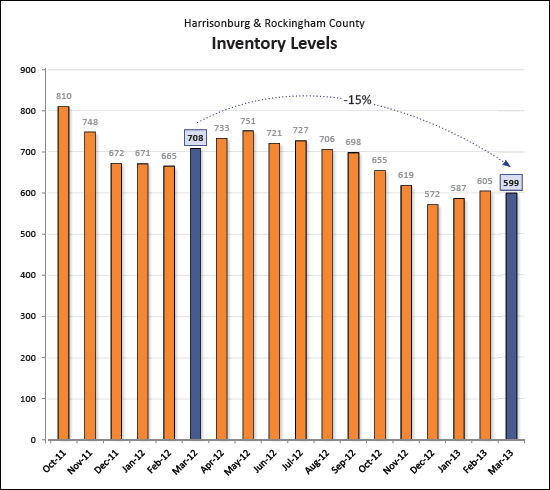

There are fewer and fewer homes for sale under $200K (shown above) but there are more and more buyers (see below).  These crossing trends (fewer sellers, more buyers) helps to balance the under-$200K segment of our local market, and since many of those sellers will move up to $200K-$300K sales, it can slowly, positively impact the remainder of our market as well. | |

Harrisonburg Home Sales Up 19% YTD, Median Prices Up 6% |

|

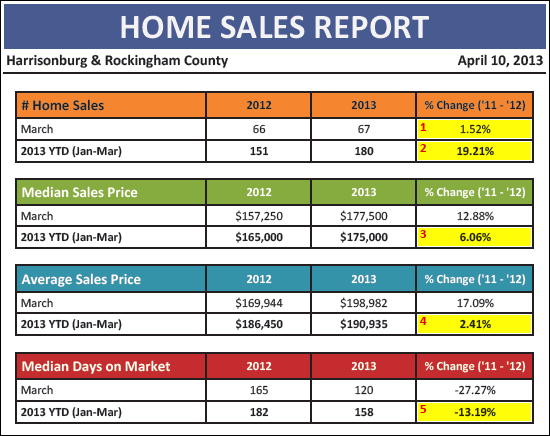

I just published my monthly housing market report for Harrisonburg and Rockingham County (download here) and good news abounds in many/most segments of our local housing market.  (Beautiful Cover Property: 1920 Marigold Circle, Harrisonburg, VA)  As shown above, there are many positive trends in the local housing market....

Even if March was a bit slower with home sales (+1.5%) the pace of contracts skyrocketed to 114 contracts during March 2013. This marks an astonishing 31% increase over last March, and is the highest pace of monthly contracts since April 2010 which was nearly the last opportunity for a buyer to take advantage of the home buyer tax credit.  As shown above, despite this being the spring selling season, inventory levels have dropped again --- with only 599 homes currently listed for sale. This marks a 15% decline in inventory level over the past 12 months. Here are a few other tidbits to entice you to download the full report....

Also, here are a few other articles of note from the past month....

As always, if you're interested in talking to me about buying a home in Harrisonburg or Rockingham County.....or if you are interested in selling your current home.....just drop me a line by email (scott@HarrisonburgHousingToday.com) or call me at 540-578-0102. | |

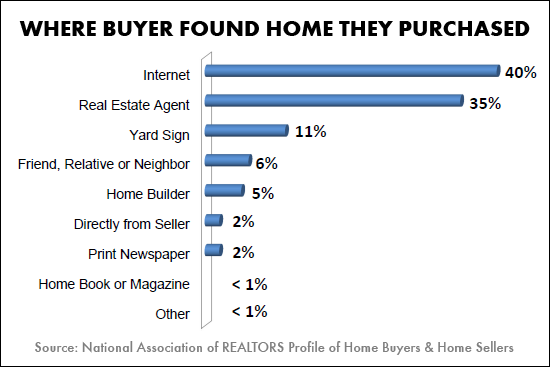

Where Do Buyers Find The Home They Buy? |

|

This certainly has some implications as to where we should and should not be focusing our marketing efforts! | |

Don’t Be a Bashful Buyer |

|

My article below was published in the Shenandoah Valley Business Journal yesterday. Apparently, it was somewhat controversial, as I received some very passionate responses from a few people telling me that they disagreed with my perspective. I welcome your perspective as well, in the comment section below, or by email at scott@HarrisonburgHousingToday.com. Sometimes home buyers in the Shenandoah Valley are too polite for their good. Don't get me wrong, I am grateful that we have such a congenial local culture where most people show others decency, respect and kindness. But when it comes to purchasing a home, buyers need to be willing to be bold with their offering price or they may find themselves sitting on the sidelines, missing the best opportunities. Ask yourself this, would you be willing to make a $175,000 offer on a house that is listed for $200,000? Most buyers in this area would not be willing to make such an offer. Last year, homes in Harrisonburg and Rockingham County sold for an average of 5.2% below their last list price. This means that a home last listed for $200,000 would have sold for $189,600. As you think of what offer you might make as a potential buyer of this home, you should quickly realize that if you hope to be an average negotiator and get to that $189,600 price, you likely need to start with an offering price lower than where you hope to end up. Perhaps that means an initial offer of $180,000 in order to aim towards a final price of $189,600. One other perspective that buyers often forget about is that if a buyer doesn't come along soon, the seller of any given home may very well adjust their list price downward to attract a new set of buyers. Thus, if someone does not buy this $200,000 house soon, it might then be reduced to $195,000 or $190,000. Combining these two ideas above, we should quickly realize that if the seller might soon reduce the price to $190,000 at which time an offer of $175,000 would be reasonable, then you might as well go ahead and make that lower offer now. In explaining these concepts to first time home buyers earlier this month they asked why most buyers don't make these low offers, even just to find out whether they can buy a home for a particular price. One reason, it seems, is that some buyers do not want to become emotionally invested in hoping to buy a particular house if it is likely that the negotiations will not work out. Some buyers also hesitate to make low offers because they don't want to insult the sellers and miss out on the opportunity to buy the house at all. Finally, some buyers don't want to deal with the process of determining offer terms, reviewing an offer, and dealing with all of the paperwork required for making an offer. Whatever their reasons, many buyers won't make a low offer that they don't believe a seller will accept. All of this general counsel aside, it is important to recognize that a seller's willingness to negotiate will likely vary based on if their current list price is realistic and/or based on how much they owe on their mortgage and/or how motivated they are to not own their home any longer. But regardless of how much a seller is willing to negotiate, nearly all sellers would rather have more offers rather than fewer, even if some are quite low. And as one final word of encouragement for you to make an offer as a buyer, even if it is low --- let the seller make their own decision about how much they are willing to negotiate, don't assume that you can accurately guess how they are going to respond to your low offer. | |

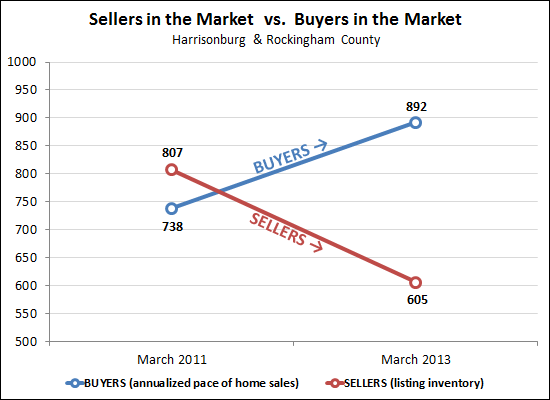

Major shift seen in local real estate market over past two years |

|

Comparing today to where we were two years ago in Harrisonburg and Rockingham County....

| |

Working with a Realtor when pursuing a "For Sale By Owner" property in Harrisonburg, Rockingham County |

|

Some times, when I am working with a buyer, they or I will become aware of a "for sale by owner" property of interest to them. They almost always have the same question --- how would it work if we wanted to pursue that property? Here's how I see it . . . Some times, when I am working with a buyer, they or I will become aware of a "for sale by owner" property of interest to them. They almost always have the same question --- how would it work if we wanted to pursue that property? Here's how I see it . . .In Virginia (and in most places) when a homeowner decides to sell, and work with a Realtor in doing so, they typically negotiate a percentage of the purchase price that will be paid as a "brokerage fee" at closing. This brokerage fee (call it 20% of the sales price, for the sake of absurdity, and because there is not a standard brokerage fee) is almost always split between the Realtor (and his/her company) representing the seller, and the Realtor (and his/her company) representing the buyer. So, in my absurd example, 10% to the seller's Realtor and realty company, and 10% to the buyer's Realtor and realty company. An interesting byproduct of this typical business practice is that a buyer isn't counting on "paying their Realtor." As a buyer works with their Realtor to identify, view, evaluate, negotiate and close on a property --- they aren't necessarily thinking "and in addition to buying the house, I'll be paying my Realtor 10% of the sales price." Here, some people would interject to point out that the buyer pays both Realtors, as they are the ones bringing the money to the transaction --- the seller just brings the house. And thus, the questions begin when a buyer client becomes interested in a "for sale by owner" property. As a buyer looks at the sales prices of homes listed by Realtors (for example, $200k), they don't think about having to pay a brokerage fee on top of the price --- since the seller will pay it out of the sales price. But many "for sale by owner" sellers don't plan on paying a brokerage fee to any Realtors, and thus the sales price they would negotiate doesn't accommodate for the buyer's Realtor being paid. So . . . if I have been assisting someone in looking for a home, and they decide they want to buy a "for sale by owner" property, here are the options I make available:

On a related note, a Buyer Brokerage Agreement helps clear up these options and facilitate these discussions to determine how a buyer would want to proceed. | |

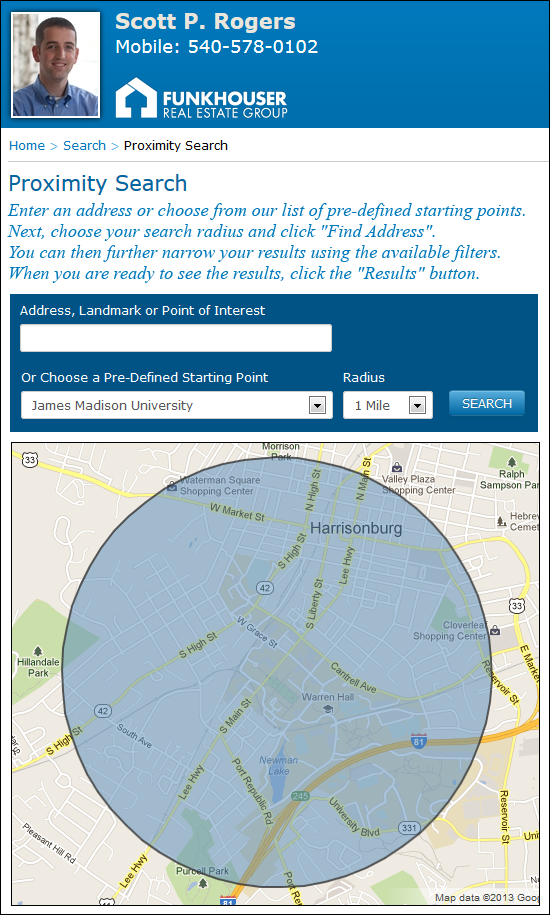

Use this Proximity Search tool to find a home close to any address or point of interest |

|

Use the Proximity Search tool on my web site to search for homes within a certain distance of your employer, favorite restaurant, etc. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings