| Newer Posts | Older Posts |

Harrisonburg Multi-Family Cap Rates |

|

Multi-family properties often provide different cap rates than single properties. Let's take a look at some recent multi-family sales in Harrisonburg . . . 1710 Park Road, Harrisonburg = 5.1% 1986 Brick quad Sold for $400,000 in February 2008 ( ($2030 per month x 12 months) - ( $1023 insurance + $2002 taxes + $1,000 repairs ) ) / $400,000 sale price 325 Colicello Street, Harrisonburg = 10.6% 1919 triplex Sold for $184,500 in April 2008 ( ($21600 per year) - ( $658 insurance + $678 taxes + $750 repairs ) ) / $184,500 000 sale price 331 Grace Street, Harrisonburg = 3.4% Duplex Sold for $282,000 in September 2007 ( ($1040 per month x 12 months) - ( $720 insurance + $1538 taxes + $500 repairs ) ) / $282,500 sale price As you can see, in multi-family properties, the cap rate is not as predictable as in singe family rental property. Related Posts: Harrisonburg Single-Property Cap Rates What Is A Cap Rate? | |

What Is A "Cap Rate"? |

|

The "cap rate" or capitalization rate of a property is what I call an an "investment measure." It is a value that compares the income generated with the acquisition cost of an investment.

| |

New Harrisonburg Townhomes -- Quite The Upgrades! |

|

For the past seven years, Coldwell Banker Funkhouser Realtors (the company where I work) has represented the builder/developer of Beacon Hill Townes. Up until the most recent six months, the townhouses that have been built have been of high quality, with several exciting standard features such as hardwood floors on the main level.  Now, everything has changed! All of a sudden, the builder has decided to throw in even more upgraded features as standard components to the townhouses currently being built. Now, everything has changed! All of a sudden, the builder has decided to throw in even more upgraded features as standard components to the townhouses currently being built. Gone are the standard "builder's brass" light fixtures, door knobs, etc. Now, you'll find exciting (and contemporary) features such as decorative lighting and plumbing fixtures, upgraded cabinetry, decorative door hardware, and more. Why, you might ask? Was the change made to try to eek a little bit more profit out of each townhouse sale? Actually --- the prices have remained some of the most competitive (low) prices of all new construction townhome subdivisions in Harrisonburg. One reason for the upgrades is to finish out the last section of Beacon Hill with the most exciting units yet, to keep the excitiment for the subdivision high all the way to the end. Whatever the reason --- the new townhouses being built are quite stylish, and give a wonderful impression to buyers who have been shopping around and looking at other new construction townhomes. I'm curious to see how long it will be until other new townhomes in Harrisonburg start to include some of these stylish upgrades. Soon, I hope --- as it certainly benefits Harrisonburg townhome buyers! | |

Are CMA's Just For Sellers? |

|

Not at all! They are for buyers as well! Not at all! They are for buyers as well!First, a CMA is a comparative (or "competitive", depending on who you ask) market analysis --- or, an analysis that compares one property (the "subject property") to other similar properties that have either recently sold, or are on the market. As I explain to my clients, my CMA's attempt to account for all significant aspects and characteristics of a home including square footage, functional space,age, style, condition, and more. Why would a buyer want a CMA? When making a purchase offer, sometimes buyers determine price based on what they think the seller will accept, or what would be a reasonable offer given the asking price. Ignore the asking price! That's not to say that all offers should be low offers trying to "make a deal", but consider these two examples:

| |

"I'm ready to buy a home -- I'll call you when I find it!" |

|

Wait a minute! Let's examine that . . . Wait a minute! Let's examine that . . .A friend recently made this comment at the end of an unrelated conversation. His plan was to start looking on the web, going to open houses, going to see houses for sale with the listing agent for each of those houses, and then when he found the one he wanted --- he'd call me to help him buy it. I told my friend that if he plans to enlist my services to assist him in buying a home, that we ought to approach the task in a slightly different manner: 1. We discuss his needs/wants in a home. 2. We review (online) the currently available properties, and we go view (in person) the current options. 3. We both monitor new listings (and price changes) and go to view (in person) new options as they become available. 4. When we find "the house" --- we make the offer, negotiate, coordinate closing details, and close on the house. In my conversation with my friend, I didn't go into all of the details below, but I did touch on a few of these reasons why I suggested this alternative course of action: 1. Knowing about all of the options -- many of my clients are highly adept at searching for homes online (or in other mediums), but when I also set up the search criteria within the local MLS (with e-mail alerts of new matches to myself and my client) we always find a few other good options to consider. 2. Leveraging my wider familiarity with similar properties -- many of my clients are real estate junkies (and are very familiar with currently available homes), but often they focus their search on homes that meet a specific set of criteria. As I begin to view homes with a buyer, I begin to understand what they like and dislike, and what they want and need. I am often able to recommend options my clients had not considered (because the property didn't quite meet their given search criteria), because I show many buyers many homes, and have a wider familiarity of similar properties. 3. Avoiding wasted time for other Realtors -- if I am going to represent someone in their purchase of a home, it's best for that buyer to have me view the property with them, as opposed to the listing agent. In the past, I have worked with buyer clients who didn't want to bother me with viewing lots of homes -- and thus they decided to call the Realtor representing the seller of each home in which they were interested. There's nothing fundamentally wrong with this, as it is in the best interests of the seller for their Realtor to show the prospective buyer the home (as opposed to refusing to show the buyer the home). However, if I will be representing the buyer (and getting paid to do so), it is best to utilize my time for the viewings, not the time of each listing agent. 4. Conserve your time -- the buyers referenced above, who were so gracious as to not take up my time, expended a LOT of their own time in order to do so. When the buyer wanted to see three houses, they would call three Realtors (possibly have to wait to hear from them) and set up three appointments to see the properties. Instead, my clients could have called or e-mailed me with the addresses or MLS numbers of the three properties, and I would have coordinated the three showings for them. 5. Know my role -- I have had clients in the past who saw my job as a "sales job" and thus thought I would be trying to "sell them" on a house. That's not how I see my role when I represent a buyer. I'm not working to sell a house to a buyer, I am working to help a buyer identify and purchase the house that is right for them. This is a big distinction --- again, I never try to convince a buyer client to buy a particular home, instead I endeavor to understand their goals, needs and desires, and assist them in finding (and negotiating on, and closing on) the home that is most appropriate for their situation. In summary --- if you plan to have me represent you (and your interests) in a purchase, let's start working together earlier rather than later. Doing so will allow me to better assist you in your home search! | |

Should High Gas Costs Drive Buyer Behavior? |

|

This was an interesting question posed by a friend a few weeks ago, and we took some time to do some rough analysis, which seemed to indicate NO. Here's the logic: This was an interesting question posed by a friend a few weeks ago, and we took some time to do some rough analysis, which seemed to indicate NO. Here's the logic:Historically, some people who work in Harrisonburg have chosen to live outside of Harrisonburg where housing is somewhat more affordable. Two classic examples of this are Weyers Cave (14.4 miles away) and Broadway (12.9 miles away). Both Weyers Cave and Broadway have offered home buyers housing at somewhat lower prices, within a reasonable commute to Harrisonburg. But with gas costs going higher and higher, could (or should) this buyer behavior change? The distances above (14.4m, 12.9m) were city-center to town-center. We'll round up, and say the one-way commute for a fictitious commuter is 15 miles. We'll assume a somewhat gas-hungry vehicle that will drive 20 miles per gallon of gas. With current (4/29/2008) gas costs around $3.60, the one-way commute has a gas cost of $2.70. Driving both ways to and from work, 5 days a week, 50 weeks a year, equates to an annual cost of $1,350. If someone lived in Harrisonburg instead (and still worked in Harrisonburg), their commute might be 3 miles, which would equate to an annual cost of $270. Thus, the cost savings in gas consumption (relative to the work commute) of living in Harrisonburg instead of Broadway or Weyers Cave is approximately $1,080 per year. That $1,080 per year, or $90 per month, if used to allow the home owner to afford a larger mortgage payment, would allow for a home purchase of $13,500 greater. That is to say that a $200,000 home ($40k down, 6% rate) would have an $1,100 monthly payment, and a $213,500 home ($40k down, 6% rate) would have an $1,190 monthly payment. So, the question then becomes, does a $200,000 home in Broadway or Weyers Cave cost $213,500 in Harrisonburg, or more, or less? Broadway: 4 bedrooms, 2.5 bathrooms, 1517 SF, circa 2007, garage, $199,900 http://60755.scottprogers.com Weyers Cave: 4 bedrooms, 2 bathrooms, 1584 SF, circa 2003, $199,000 http://64154.scottprogers.com Harrisonburg: 3 bedrooms, 2.5 bathrooms, 1360 SF, circa 2002, garage, $214,900 http://62949.scottprogers.com Though the data in my example is limited, it seems that even accounting for the commuting cost of living in Broadway or Weyers Cave, you can still buy a (somewhat) larger, (somewhat) newer house in those communities as opposed to Harrisonburg. | |

Looking Back at Virginia's First Quarter Home Sales |

|

The Virginia Association of Realtors recently released their First Quarter 2008 housing market report, entitled "The Virginia Housing Market in Uncertain Times." The Virginia Association of Realtors recently released their First Quarter 2008 housing market report, entitled "The Virginia Housing Market in Uncertain Times."Their opening paragraph provides a good summary: The word "uncertainty" sums up the current housing market. A national recession, foreclosures on the rise, tight credit markets, potential federal legislation—all of these factors make it difficult to predict where the market is going. In Virginia, the housing market is performing better than in some other states, although certain local markets within the state are in for a rocky 2008. The report, provided by George Mason University's Office of Housing Policy Research, is based in part on reported sales from around the state of Virginia. The methodology is slightly different than my recent April report, but the numbers are very close. Essentially, sales are down, but prices are up. In the Harrisonburg-Rockingham area, the number of sales was down 21%, but the median price was up 5%, and the average price was up 14%. For even more insight into the first quarter of home sales around Virginia, listen to this media conference call where Realtors from around Virginia (myself included), and staff from George Mason University provide commentary to the media on this recent report. | |

Getting Ready To Buy -- Loan Pre-qualification |

|

In almost all circumstances, buyers should pre-qualify for a mortgage before starting to look for a home. In almost all circumstances, buyers should pre-qualify for a mortgage before starting to look for a home.What is pre-qualification? In short, it means providing basic financial information to a lender so they can give you a preliminary indication of how much money they are willing to lend you for the purchase of a home. What is a lender? A lender can be either a bank, a mortgage company, or a mortgage broker. A bank offers banking services and accounts as well as offering loans. A mortgage company is just in the business of making loans. A mortgage broker contacts multiple "funding sources" on behalf of a home buyer to find the best loan. How hard is it to get "pre-qualified"? It is not difficult at all --- in fact, it can be done over the phone in about 30 minutes. Alternatively, you can set up an appointment with a lender to get "pre-qualified." What is the lender doing when they pre-qualify me? They will be inquiring as to your income, expenses, assets and liabilities. How much do you make per month from your job, and any other income sources? What monthly payments do you already have, such as a car loan, or credit card payments? What other assets do you own, such as a car, boat, additional residence, etc? What other debt do you have, such as another mortgage, personal loans, etc? After having collected this information, they will look at your credit score, and your "debt ratios". What is a "debt ratio"? This is a comparison of your potential monthly housing costs and your monthly income. Some programs, for example, don't like to see more than 28% of your gross monthly income going towards housing expenses. What is the difference between "pre-qualified" and "pre-approved"? This varies from lender to lender, but my general understanding of the distinction is that a pre-approval involves submitting all of your information to an "automated underwriting program" to be able to give you a Fannie Mae or Freddie Mac pre-approval. Why should I pre-qualify first? Having been pre-qualified for a mortgage gives you a realistic idea of how much of a mortgage you can obtain, or want to obtain. This will guide us as we set your home search criteria, so that we are not considering homes that would not be possible for you to purchase. There might be a difference between what I can get, and what I want to get? Absolutely! I have frequently run into situations where a lender will tell my client that they can borrow an amount that would lead to a monthly payment that the borrower is not at all comfortable making. Sometimes the limit is set by the limit from the lender, and sometimes the limit is set by the comfort level of the borrower. How many lenders should I talk to? To start, just talk to one lender to get a general idea of how much money you can borrow for your home purchase. Then, when we have found a home for you to purchase, you can check with multiple lenders to make sure you are getting the best loan terms (interest rate, closing costs, etc). There are likely tens or hundreds of other questions that I could have addressed here. Feel free to ask other questions in the comments of this post, or by e-mailing me at scott@cbfunkhouser.com. I am not a lender myself, but I have become quite familiar with the lending process through assisting many real estate clients in analyzing mortgage options over the years. | |

Now May Be The Best Time To Sell |

|

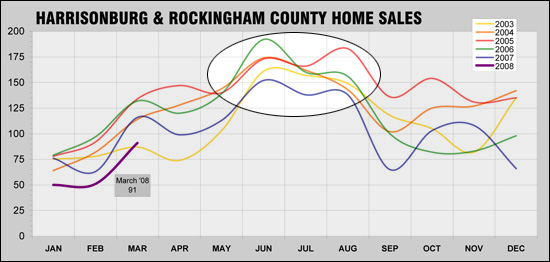

That doesn't mean that it is particularly easy or fast to sell your home right now -- but compared to the last six months, and the coming twelve months, now may be the most likely time that your home will sell. Here's why . . .  Despite lower sales in 2008 than in 2007, and lower sales in 2007 than 2006, sales in Harrisonburg and Rockingham County have continued (in large part) to follow normal month-to-month trends. October-November of 2007 was a bit of an abnormality, but otherwise, you'll see that month-to-month, buyers are coming into and out of the market at the same (proportional) rate as in previous years. This means, that in June, July and August, we will likely have the largest number of closings for the year -- which shouldn't come as any surprise to you. I mention this, however, because some people hear the national news (sales down, prices down), or the local news (sales down by 20%, prices up by 5%), and assume that the month-to-month sales are rather flat, and that it is always a terrible time to sell. Not so. Your home is much more likely to be purchased in the next few months (contract in April, May or June with a closing in June, July or August) than any other time of the year. I'm certainly willing to be proven wrong -- sales during the next few months could defy prior years' month-to-month trends -- but I doubt that will occur. | |

Change Is Here . . . We Must Adapt! |

|

Slower Home Sales . . . Fewer Mortgage Options . . . Appreciation Remains, But . . . | |

Buyers, Sellers Must Understand Perspectives |

|

From my March article in the Shenandoah Valley Business Journal . . . Cycles exist in every real estate market across the country, and the Shenandoah Valley is no different. Thus, it is essential that buyers and sellers have a firm understanding of their segment of our local market. To better understand our current market, here is a look at several different perspectives: How Many Buyers Feel . . . Even if buyers want or need to purchase, many are still hesitant to move forward with an offer and a purchase, and here are a few reasons why:

What Buyers Should Realize . . . Some buyers have started to realize that now can be a good time to buy because:

How Many Sellers Feel . . . Depending on the price range, and location of a seller's house, and their timetable, a seller may be thinking:

What Sellers Should Realize . . . Some sellers would like to believe it is always a good time to sell, but I would purport that:

Some Conclusions . . . Here is some time-proven buying and selling advice buyers and sellers should consider:

| |

Do Buyer Incentives Encourage A Sale? |

|

Many sellers think so.....but I rarely meet buyers who think so. Many sellers think so.....but I rarely meet buyers who think so.You have likely heard of incentives that sellers offer buyers, such as:

But wait --- all such logic goes out the window given the negotiation process! For instance, it is quite possible that when presented with an offer, the seller of the house without free trash service might come off of their price by $8,000, while the seller of the house with free trash service might not negotiate at all. As becomes clear --- the existence of a buyer incentive does not at all guarantee a better opportunity for the buyer --- and buyers know this! Additionally, buyers can ask for and attempt to negotiate any term they so desire in a contract. If you want free trash service from a seller who isn't offering it --- ask! If you want closing costs from a seller who isn't offering them --- ask! I rarely find a buyer who is bashful to include such concessions in an offer, even if it is not being advertised by the seller as being possible. Thus, the non-existence of a buyer incentive doesn't mean that the concession won't happen --- and buyers know this! A few final notes . . .

| |

Rent To Own --- Balancing the Risks and Benefits . . . |

|

Housing supply in Harrisonburg and Rockingham County is high in many price ranges, and has been for many months now. As a result, some sellers are anxious to sell their homes, and some buyers are hesitant to commit to buying. It has become a standoff of sorts! Housing supply in Harrisonburg and Rockingham County is high in many price ranges, and has been for many months now. As a result, some sellers are anxious to sell their homes, and some buyers are hesitant to commit to buying. It has become a standoff of sorts!Additionally, some buyers are having difficulty obtaining financing, as many loan programs have disappeared, or become more restrictive (100% financing, for example). These factors have prompted some buyers to pursue a rent-to-own opportunity, where they would rent a property for a period of time before they purchase it. Sellers aren't always thrilled about the possibility, but some are willing to explore it. Let's take a look at it from a few perspectives: Buyers are typically most excited about obtaining new housing without closing costs, a mortgage, or a long-term commitment. A buyer can, at some point in the future buy the home in which they have been living, without physically moving, and often at a sales price determined at the start of the rental relationship. Aside from the missed opportunity of tax savings, paying down mortgage principal, and appreciation --- a rent-to-own opportunity generally works well for a buyer. Sellers are often very lackluster about the opportunity to lease their property to a buyer and then (possibly) sell it to them at some point in the future, for good reason. Often, the future purchase price is fixed, which eliminates the seller benefit of increases in property values. A buyer typically is not required to buy the property, and thus the seller may be back in the same situation of needing to sell, when the buyer's lease term or option period comes to an end. They only positive aspect of a rent-to-own scenario for a seller is the fact that someone starts providing incremental income immediately. Cash flow can sometimes drive a seller to commit to a rent-to-own relationship. If both the buyer(tenant) and seller are willing to explore a rent to own agreement, here are some of the main questions to consider:

| |

One Year Builder's Warranty on New Construction |

|

As you consider buying a newly constructed home, it is important to be aware of what is often referred to as a one-year builder warranty. As you consider buying a newly constructed home, it is important to be aware of what is often referred to as a one-year builder warranty. Technically, what we are referring to are "Implied warranties on new homes" per Virginia statute 55-70.1. What is covered by the warranty? The builder warrants that the "dwelling with all its fixtures is, to the best of the actual knowledge of the vendor or his agents, sufficiently (i) free from structural defects, so as to pass without objection in the trade, and (ii) constructed in a workmanlike manner, so as to pass without objection in the trade." Essentially, no structural defects, and workmanlike construction. When does the one year start? The earlier of when the title is transferred, or when the buyer takes possession of the property. I bought a house three months ago and have discovered structural defects. The builder is telling me a warranty doesn't exist, because "as is" was written into the contract. Is this possible? It is possible to modify or exclude the Virginia statute based implied warranty. However --- it is likely that the builder did not follow the statute when selling the property to you as is. To sell a new property "as is" and exclude the implied home warranty, the fact that the house is being sold "as is" must be written on the face of the contract, in capital letters, in a font size at least two points larger than the other type in the contract. This doesn't happen too often. I have a structural issue, what do I do? The statute specifies that you have a cause of action against the builder, but that you must first notify the builder of the defect and allow them a reasonable period of time (no longer than six months) to cure the defect. What about the foundation? The foundation is warrantied for five years (instead of just one) --- though if a foundation issue exists, it must be reported to the builder within two years of when it is discovered. The Virginia statute keeps referring to a "structural defect" --- what is that? Per the code, "a defect or defects that reduce the stability or safety of the structure below accepted standards or that restrict the normal use thereof." Yes, that is about as vague as you can get. My builder is asking me to sign a warranty document at closing --- why? And should I sign it? First, take time to read the document. In most cases, such a document includes verbiage that limits the (vague) rights you would have had under the broad Virginia statute. Builders ask buyers to sign these documents to narrow the scope of buyer's possible warranty requests --- and this desire often comes from past buyers who have been unreasonable in asking the builder to address cosmetic (or other non-structural) issues within the first year. If the document only includes language that restricts or eliminates your rights under the broad Virginia statute, kindly refuse to sign the document. Unless all parties agreed in the sales contract that a warranty document would be signed at closing, the builder can not require you to sign the document --- it is imposing a new contract term on the buyer, when that was not included in the original negotiations. One caveat --- sometimes the document serves both the builder and the buyer --- it can do so by specifically stating items that the builder will indeed repair that might otherwise be in a gray area given the vague nature of the Virginia statute. | |

The Best of Lenders, The Worst of Lenders |

|

After (just about) five years in real estate, and many transactions with many lenders, I have finally discovered that with the best of lenders, and with the worst of lenders, the experience for my clients can still be fantastic, or terrible! After (just about) five years in real estate, and many transactions with many lenders, I have finally discovered that with the best of lenders, and with the worst of lenders, the experience for my clients can still be fantastic, or terrible!The root of the problem is the many variables involved with a loan, for example:

Scenario #1 --- $300k (+/-) purchase, 80% financing, loan application to closing in approximately 14 days, absolutely no issues in the entire process. Amazing! Scenario #2 --- $100k (+/-) purchase, 100% financing, down payment assistance program, loan application to closing in approximately 35 days (even though 21 was promised), an absolute nightmare with more and more, and more documentation and paperwork requested from the loan underwriter and loan closer up until the closing day. Many of my buyer clients ask for recommendations on which lender they should select in order to make it a smooth and successful purchase. I do indeed have lenders that I recommend. However --- even with one of the stellar lenders I recommend, a buyer can have a terrible financing process, as a result of the underwriter, closer, appraiser, program requirements, etc. And . . . even if you don't select one of the lenders that I recommend, you can absolutely have a fantastic financing process. | |

100% Financing (and then some) From A Local Lender |

|

A few weeks ago I was lamenting the fact that 100% finance seemed to be sailing out to sea --- never to be available again for first-time buyers (or otherwise).  However, just this past week, Debbie Huntley at SunTrust Mortgage informed me of quite a few 100% (plus) financing programs that are indeed still available . . . Lender Paid Mortgage Insurance --- 100% Financing

VHDA/FHA/PLUS --- 102.75% Financing

80/15/5 COMBO Loan

So, fear not --- even if you don't have a down payment (or even closing costs), if you have good credit and steady income, you are likely to be able to obtain 100% financing after all! | |

Buy Now, Save Big (sometimes) |

|

In two out of my most recent three closings, my buyer clients bought at a fantastic price --- below appraised value. In two out of my most recent three closings, my buyer clients bought at a fantastic price --- below appraised value. Scenario #1 --- buyers offered a quick closing, with no home sale contingency, and paid $13,000 under the appraised value. Scenario #2 --- buyers bought from a relocation company, and paid $10,000 under the appraised value. Why is it happening? In both cases, the buyers made aggressive offers --- instead of opting not to make an offer based on a higher than reasonable asking price. As I noted a few weeks ago, buyers currently seem to be hesitating to make offers, and sellers are hesitating to lower their prices. For the buyer who is willing to negotiate, this means there are opportunities to buy at great prices! | |

Harrisonburg / Rockingham Home Sales Report (3/7/2008) |

|

See below the report for commentary . . .  Some interesting trends this month include:

| |

Foreclosure: Mt. Hope Lane, Keezletown |

|||||||||||||||||||

| |||||||||||||||||||

Foreclosure: 730 Virginia Avenue, Harrisonburg |

|||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings

There are quite a few local and national changes occurring right now that greatly affect buyers and sellers. Let's contemplate how we must prepare and adjust.

There are quite a few local and national changes occurring right now that greatly affect buyers and sellers. Let's contemplate how we must prepare and adjust.