Investing

| Older Posts |

If You Can Buy A House Before Selling Your Current House, Consider Keeping Your Current House As A Rental Property |

|

This isn't universally applicable advice for all homeowners who are selling and buying, but it's worth considering if you find yourself in this situation... If You Can Buy A House Before Selling Your Current House, Consider Keeping Your Current House As A Rental Property Here's what I mean and why... You might already be a homeowner... but find yourself ready to buy a new home. You might be considering selling the current home and buying a new one for a variety of reasons -- to get to a larger house, or a smaller one, or one with different rooms in different places, or to move to a new school district, and on and on. If you are in this situation... of getting ready to sell and then buy... you'll likely want to explore whether you have the financial capability to buy before you sell. After all, your offer to buy a house will look much more compelling to a seller if you do not have a home sale contingency in that offer. And thus, if you talk to your lender and find out that you can buy before you sell, it is often then reasonable to stop and consider whether you could buy... and then not sell at all! If you buy a new home and then do NOT sell your current home... 1. You can rent your current home, often for more or much more than your current mortgage payment. 2. You can put your excess rental income towards your new mortgage payment, while also putting some aside for maintenance costs on the house you are keeping. 3. The rental rate on the house you keep will likely continue to increase over time. 4. Your tenants will be paying down your mortgage on the home you kept instead of selling. 5. Over the long term, you will own two houses that are appreciating in value, rather than just one. There are plenty of reasons why you might not keep the house you are selling... because you don't want to be a landlord, or you don't like the larger financial risk, or you are moving out of the area... but if you can buy before selling, let's talk the "keeping the house" idea through before you commit to selling your current house. | |

Some Townhomes Owned By Investors Are Being Offered For Sale. Will They Be Purchased By Owner Occupants Or Other Investors? |

|

Lots and lots of townhouses in and near Harrisonburg are owned by investors. I know, that's a very exact and precise figure. ;-) Anecdotally, I've seen some of those townhouses hitting the market for sale over the past two months. Not an overwhelming number... more than five but fewer than ten. My curiosity is in whether these investor owned townhouses will remain investor owned -- if another investor will buy them -- or if an owner occupant will purchase them. I work with plenty of investor clients, and so in some sense I'm rooting for them, if any of them want to buy another investment property. But... I think I'm rooting for the would-be owner occupants just a smidge more than the investors. Buying a home, moving in, investing in that home and in a neighborhood, having a sense of stability and permanence are all things that help build the Harrisonburg community that we know and love. If or as folks decide that they would like Harrisonburg to be their home for the long term, I'd be delighted for them to be able to *buy* a home and not just have to *rent* a home -- IF their financial situation points to that being a wise and sustainable decision. Anyhoo... only time will tell whether these (few) recent investor owned townhouses will be purchased by other investors or by owner occupants... but I'm a big fan of homeownership, so here's hoping that at least some of them will be purchased by those who plan to live in them and make Harrisonburg their home for years to come. | |

Are You Ready To Sell Your Rental Property? |

|

If you own a rental property, you might wonder from time to time whether you should keep or sell that property. I generally advise my clients to keep their rental properties, and not to sell them unless there is a good reason to do so. Here are some of those good reasons... VALUE - If the value of your rental property is currently high, and there is a reasonable chance that it won't be quite as high in the coming years, then now could be a good time to sell the rental property. INVENTORY - If there are very few competing properties for sale right now (which would lead to a speedy sale) but there will be many, many new properties built in the near future (which could result in a slow sale) then it might make sense to sell the rental property now vs. later. EQUITY - If you have owned the property for a decent period of time you may have a good bit of equity tied up in the property - and perhaps you'd like to do something else with that money. Maybe you'll use the sale proceeds for another investment (real estate or otherwise) or to pay off some debt, make a large purchase, go on a trip, who knows, but sometimes selling a rental property is a key part of freeing up some cash to make some other financial moves. HASSLE - Maybe you are tired of dealing with owning a rental property. Regardless of whether you manage the property yourself, or have a professional property manager, there can still be some annoying details to attend to with property maintenance, uncooperative tenants, etc. MAINTENANCE - Perhaps your rental property is 20 years old and you're pretty sure that if you keep it for another 3 - 5 years you'll have to pay for a new roof, new heating system and new water heater. If so, it might make sense to sell the property now to avoid those major capital expenses. TENANTS - If most of the prospective buyers for your rental property will be owner occupants, then the time between tenants might be the perfect time to sell your rental property. PARTNERS - If you purchased the rental property with a friend or family member, and they would like to move their investment dollars elsewhere, then it might be a good time to sell the property. RENTAL RATES - If rental rates are starting to decline, changing the performance of your investment, it might make sense to go ahead and sell, unless you see a turn around happening in the near future. IMPROVEMENTS - Perhaps your most recent tenant absolutely trashed the property, and you have just completely renovated it, such that the property has never looked better. This could be an ideal time to sell before the condition starts to deteriorate again. | |

Thinking About Investment Properties Like Trees |

|

A (not very well sourced) proverb goes something like this... "The best time to plant a tree was 30 years ago, and the second best time to plant a tree is now." And so it goes with purchasing investment properties. The best time to purchase an investment property was (certainly!) 30 years ago... or 20 years ago... or even 10 years ago! (or in this crazy market, even five years ago) The second best time to purchase an investment property is now. A bit of explanation and plenty of caveats are necessary here... I've had a variety of conversations with real estate investors over the past few months as they have considered various properties that have come on the market for sale. We have lamented (together) that prices have risen so much that it's harder to justify some investment property purchases with today's prices and today's interest rates. On multiple occasions, my clients have said commented that they wish they had bought an investment property (or two... or five) about 5 to 10 years ago. But, as we have reflected further, we have realized that there is not likely going to be a future time when conditions will be more favorable for an investment property purchase. Prices do not seem likely to decline significantly (if at all) and while interest rates may decline some over the next year or two they seem unlikely to decline significantly. As such, if you didn't buy an investment property (or properties) 10 or 20 years ago... but you want to own one in 10 or 20 years, perhaps today is the best time to do so. OK, OK, plenty of caveats... [1] Investment property values do not always increase over all periods of time. I'm not trying to tell you that they do. Investing (in real estate or otherwise) includes risk. [2] You still need to make sure the numbers work from a monthly cash flow perspective, etc. [3] I do recognize that if you buy a property as an investment property it might keep an owner occupant buyer out of the market for buying that same property. This observation is not me telling you that you should not buy the investment property - but just an acknowledgement that any purchasing decision has other follow on consequences. If you're hoping to buy an investment property in the next few years (or this year!) let's chat sooner rather than later to make sure you understand what numbers to expect -- from a purchase price perspective and from a rental income perspective. And then... let's go find you a tree to plant... I mean... an investment property to purchase! | |

Now Could Be An Ideal Time To Sell A Residential Rental Property! |

|

If you own a rental property in the City of Harrisonburg or in Rockingham County, perhaps a townhouse or duplex or small single-family home, this could be an ideal time to sell the property. If you would like to explore the possibility of selling a property that you have been renting out for the past few years, let’s talk about timing and logistics. You will likely be selling the property at a very favorable price with very favorable contract terms and as an added bonus you will be helping out what seems to be a continued backlog of owner occupied buyers who are still trying to buy a home and settle down in the Harrisonburg area. | |

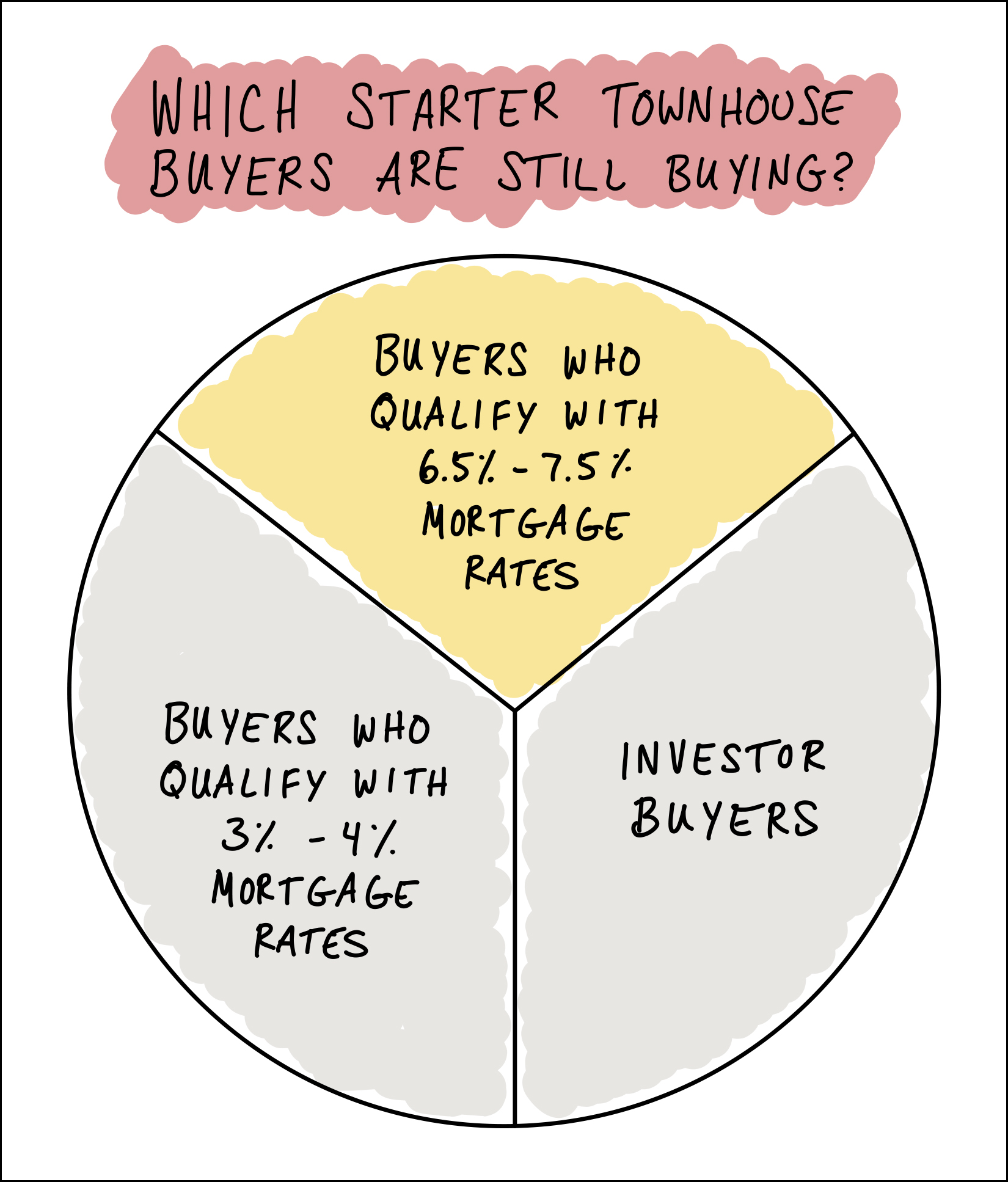

The Buyer Pool For Starter Townhouses May Be Smaller For Now |

|

Starter townhouses (think two story, 15 - 25 year old) in the City of Harrisonburg used to sell for $150K-ish but have increased in price over the past five years to a range of somewhere between $200K and $240K. Why have prices escalated so quickly? Similar to much of the market, it's largely related to low interest rates... [1] With mortgage interest rates of 3% to 4%, the pool of potential home buyers expanded considerably... lots and lots of potential first time buyers were delighted to find that they qualified to purchase a townhouse. [2] Real estate investors were also happy to scoop up these types of townhouses as they were able to finance those purchases with exceptionally low mortgage interest rates as well. Certainly, the interest rate would be higher for an investment purchase than for an owner occupant, but an interest rate that is higher than "very very low" is perhaps "very low" so plenty of investors were purchasing these properties as well. But now, mortgage interest rates are a bit higher... OK... twice as high. The current average 30 year fixed mortgage interest rate is 6.95%. As such, and as shown on the "not at all based on real numbers or data" graph above... [1] Would be home buyers who could only qualify to buy with a mortgage interest rate of 3% - 4% clearly do not quality any longer and thus are not buying. [2] Investor buyers who were delighted to buy when interest rates were quite low are also likely not buying right now. That just leaves owner occupant home buyers who still qualify with 6.5% to 7.5% mortgage interest rates. What does this actually mean for this segment of our local housing market? [1] There will likely be fewer buyers coming to see your townhouse if you are selling a starter townhouse in the City of Harrisonburg. [2] There will likely be fewer offers on said townhouse, and less competition from other buyers if you are trying to buy such a townhouse. [3] We might see these townhouses take a bit longer to sell. Maybe? [4] Maybe the price of these townhouses won't climb quite as quickly over the next year or two. Maybe? These are my observations about this segment of our local housing market, very unscientifically graphed above. Let me know if you have other observations, thoughts or questions about the market for this type of property moving forward into 2023. | |

Do You Own A Rental Property? Perhaps You Should Sell It? Pretty Please!? |

|

If you own a rental property in the City of Harrisonburg or in Rockingham County, perhaps a townhouse or duplex or small single-family home, are you potentially interested in selling it? "Please! Pretty Please!" -- said every owner occupant buyer in the market I understand, there are plenty of reasons why you would not want to do so. Your long-term strategy may be to continue to rent out that property for many years to come, and perhaps you would not want to tax liability that might arise from selling the property, but maybe you have been thinking about selling the property for the past few years.

But... if you have had any thought at all about perhaps selling such a property, now is an excellent time to do so. There is an extreme shortage of available lower-priced homes in the City and County and owner occupant buyers are pursuing such properties quickly and making very competitive offers when they do come on the market. If you would like to explore the possibility of selling a property that you have been renting out for the past few years, let’s talk about timing and logistics. You will likely be selling the property at a very favorable price with very favorable contract terms and you will be helping out the backlog of owner occupied buyers who are desperate to buy a home and settle down in the Harrisonburg area. | |

It Can Be Difficult For An Owner Occupant Buyer To Compete With An Aggressive, Motivated, Investor Buyer With Cash |

|

Some properties that hit the market these days -- particularly townhouses -- appeal to two different pools of buyers... Owner Occupants - often first time buyers, hoping to buy the townhouse to move in, put down roots, establish some equity, and more. Investor Buyers - hoping to buy the townhouse to then rent it out to tenants to provide a return on their investment. Sometimes, owner occupants and investor buyers are on relatively equal footing when it comes to negotiations. They might offer similar prices... they might both be financing a part of the purchase price... they might both have inspection or appraisal contingencies, or they might not have either of those contingencies. But sometimes... ...sometimes aggressive, motivated investors with cash, make it *very* difficult for an owner occupant buyer to have a chance at all. Even if an owner occupant's offer price is identical to this aggressive investor' offer price... an investor who is paying cash removes the loan approval as a variable... and more importantly (especially in this market) they remove the appraisal as a variable. Let's say that townhouses in this particular neighborhood have been selling for $200K... but both the owner occupant buyer and cash investor buyer are willing to pay $225K. That $225K offer (times two) is great news for the seller... but... the owner occupant buyer who is financing their purchase will likely need the property to appraise for $225K (in many cases) and thus the investor buyer, paying cash, which will not require an appraisal, becomes a MUCH more compelling offer. And who can blame the seller of the townhouse... even if they would much rather sell their townhouse to an owner occupant buyer, it's hard for such a townhouse seller to choose a path that is objectively much more likely to have issues related to the appraisal. So... if you are a would-be owner occupant buyer making an offer on a townhouse... you better just hope you aren't competing against an aggressive, motivated investor buyer with cash! | |

Timing The Sale Of Your Rental Property |

|

Do you own a property in Harrisonburg occupied by a tenant? When you are ready to sell it, how will you go about that process? In the past, many landlords would try to secure a buyer for the home before their tenant moved out -- because they did not want a potential gap of several months without rental income while they waited to see if the rental property would sell. These days, if you'd like to sell your rental property, I'd suggest... 1. Give your tenant a notice of the non-renewal of the lease. 2. Once the tenant moves out, do any necessary minor cleaning or repairs and consider whether it would make sense to paint the interior of the property and/or replace any flooring. 3. List your property for sale. 4. Get overwhelmed by an incredibly high number of showings and likely a multitude of offers. 5. Gleefully select the offer with the most favorable terms and the fewest contingencies. 6. Proceed quickly and smoothly to closing. It won't always go this way -- of course -- but the market is starved (!) for new listings right now, especially in the price range where many tenant occupied properties fall. If you have a rental property that you would consider selling in 2022, let's talk! | |

Demand Is HIGH For Income Generating Properties |

|

Everybody wants to buy a rental property. OK, well, not everybody... but seemingly, lots of people do! Two quads (four unit apartment buildings) in the vicinity of Eastern Mennonite University recently came on the market for $450K each. Both were under contract within a week with multiple offers, some with escalation clauses. One such recent multi-family listing had nine offers... the second had ten offers! So, yes, there seem to be plenty of investors seeking out income generating properties in the Harrisonburg area. Let me know if you are interested in considering the purchase of a rental property in the Harrisonburg area. As should be evident, you'll have LOTS of competition, but I'm happy to help you explore the opportunities if you are interested. | |

Now Can Be A Great Time To Sell An Investment Property |

|

Do you own a residential rental property? Or two? Or five? Or 10? Would you consider selling one or all of them? There are plenty of reasons why you might NOT do so...

But... if you are open to selling your residential rental property... it might be a GREAT time to do so, because...

If you own a rental property and the end of the lease is coming up, let's take a few minutes to chat about your options and whether it might make sense to sell that property instead of finding a new tenant. | |

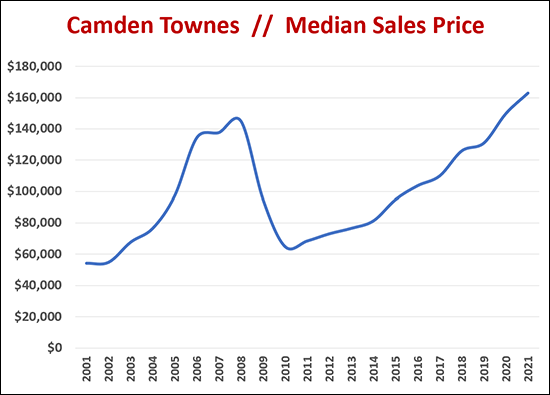

Prices Are Skyrocketing At Camden Townes |

|

Camden Townes is a rental community on Port Republic Road within walking distance to the JMU campus. This community has historically been a student housing community and my understanding is that it is still primarily, but not entirely, students living in these properties. As shown above, the values at Camden Townes have been skyrocketing over the past several years. A few benchmarks...

I suspect many factors likely affect the values in this mostly-student housing community...

As to what values will be in Camden Townes in 2022 or 2023 or 2024 -- it's hard to say based on the turbulent past of values in this community. I suppose a counter-narrative to the "who knows" perspective would be that values have mostly always gone up except during the 2006-2010 housing boom and bust? | |

Should You Sell Your Rental Property Now? |

|

This is not an uncommon train of thought of late...

So, how then should you think about whether to sell your rental property? It is, after all, a very strong sellers market. Some thoughts to consider...

Clearly, these are just some of the factors to consider when evaluating whether to sell your rental property. I'm happy to talk through your particular scenario with you, and we may also want to connect with your financial planner or accountant as well. Feel free to touch base if I can be of help to you as you think through these decisions. | |

Maybe Some Townhouse Developments Have Fewer Homeowners (Living In Those Townhouses) Than I Thought |

|

Before I look at any given set of real estate data, I usually have some sort of an idea in my head of what the data is likely going to indicate. I'm not always exactly right in my guess as to what I'll find when digging into the data - but I'm usually not overly surprised. A fellow agent asked me a few weeks ago about how many townhouses in Taylor Spring I thought were owner occupied vs. tenant occupied. I think I guessed that 80% or more were owner occupied. That was just my general feel for the neighborhood. It seems to mostly be homeowners. I was wrong. Pretty significantly wrong. I pulled the property records for all townhouses in Taylor Spring and then determined which were owner occupied based on whether the tax bills are sent to the actual property (likely owner occupied) or sent to a different address (likely not owner occupied) and this is what I found... Total Townhouses = 185 Owner Occupied = 94 Percent Owner Occupied = 51% So, it seems that about half of the townhouses in Taylor Spring are rentals. I was surprised, though mainly just because of my general assumption about what I was going to find. Are you surprised? | |

Are You The Parent Of A JMU Student Looking To Buy A House For Your Son Or Daughter To Live In With Friends? |

|

With some regularity, I'll hear from parents of JMU students who are interested in buying a house in Harrisonburg, near the JMU campus, with the intent of having their son or daughter live in the house with friends. Not a bad idea, right? Instead of paying rent for several years, you (and the friends of your son or daughter) can be paying off the mortgage on your newly acquired house! But before you sign a contract to purchase a house, keep this in mind... Most (but not all) single family homes (as opposed to duplexes or townhomes) in Harrisonburg are zoned R-1 or R-2. This limits occupancy of the property to no more than to unrelated people - with one exception which I will mention below. So -- before you go buy a five bedroom house with the idea that Johnny and his four best buds can live there -- you should definitely check the zoning of the property. If the house is zoned R-1 or R-2, it will just be able to be Johnny and his best friend living at the house. But wait -- what if you put Johnny on the deed to the house, making him one of the owners of the house -- would this change anything? Why, yes, it would! While Johnny would not then be able to invite all four of his friends back into the fold, he would be able to have his two best friends living there at the house instead of just one friend. Stated more simply... An R-1 or R-2 property can only be occupied by two unrelated people if the owner is not living there, but it can be occupied by the owner plus two unrelated people if the owner is living there! You'll find all the details here. If you're a JMU parent, looking to buy a house off campus, I'm happy to help with the process -- but don't let Johnny get too many friends excited about the idea until you have reviewed the information above. A few final notes... 1. There are some properties in Harrisonburg that have been in non-conforming use (many unrelated people living in them) since before these current zoning regulations were put in place. Those properties are "grandfathered in" and can be continued to be rented in that (non-conforming) manner until/unless there is a 24 month interruption in the non-conforming use. So, technically, you could buy a house for Johnny and his four friends -- but we'd have to find a property that is grandfathered into that non-conforming use and those properties don't come on the market very often. 2. There are likely some property owners out there, now, who are renting their properties to more unrelated people than are legally allowed to live there. Before you jump to "well if they can do it, then I should also be able to do it" I will encourage you to only consider making an investment purchase that allows you to rent the house in a manner that is legal according to local zoning ordinances. It's not worth the risk to try to skirt the zoning regulations. | |

Different Strategies for Buying A Rental Property For Your College Student |

|

Option 1 -- A property in a traditional student housing neighborhood. These will allow the most students to live in the property and will maximize the rental income per dollar spent on the purchase. However, it will also expose you to a more turbulent segment of the market, as rental rates and sales prices of these properties can vary quite a bit over time as the supply of competing student housing ebbs and flows based on large complexes being built by student housing developers. You can find purchase options in this category here. Option 2 -- A townhouse in a community that has many owner occupants, some non-student renters and some student renters. Many of these will not allow as many unrelated students to live in the property (per zoning regulation or restrictive covenant) and will not provide quite as much rental income per dollar spent on the purchase price. However, they will be in segment of the real estate market that is much more predictable and less volatile from a rental rate and/or sales price perspective. You can find purchase options in this category here and here. I work with parents of JMU students each year who go down each path outlined above, each for different reasons. Most of the time, though, it boils down to their tolerance for risk or their desire for reward. It can also be related to their intended time horizon for owning the property. If you are interested in buying a rental property for your son or daughter to live in while they are at student at JMU, let me know. Oh, and you might also want to read up here... | |

When Buying A House To Rent To Students, Call Community Development First! |

|

With great regularity, potential buyers (either investors or parents of JMU students) will ask if a single family home can be purchased and rented to a group of JMU students -- often an intended group of four or more students. I let them know that it will be no problem at all -- the adjoining property owners in the quaint neighborhood probably won't mind as long as the students aren't too bothersome -- and the City doesn't mind at all if their zoning ordinances are violated, so long as it's just "nice college kids".... WAIT! NOT REALLY! READ ON!!!! It seems that some buyers are really getting that feedback of "sure, it will be fine" -- though I'm not sure if they're getting it from their Realtor, or from someone else advising them in the transaction, or if they just aren't thinking about whether their planned use of a property is allowable. The REAL answer, and the feedback that I ACTUALLY provide to my clients is.... 1. We need to check to see how this property is zoned, and whether that zoning classification allows for that number of unrelated people to live in the property. 2. We need to check to see if there are recorded restrictive covenants for this neighborhood that restrict the number of unrelated people who live in the property. A few notes.... 1. Most single family homes in the City of Harrisonburg are zoned R-1 or R-2 and do NOT allow for three or more unrelated people (students or otherwise) to live in the property. 2. If a property has been used in a non-conforming manner (for example, four students living in it) since before the zoning ordinance was put in place, without a 24 month gap in the non-confirming us, it MIGHT be possible to continue to use the property in that non-conforming manner. And, if #2 above is starting to get confusing, then we arrive at my main reason for writing today.... CALL COMMUNITY DEVELOPMENT TO UNDERSTAND ALLOWED USE OF A PROPERTY! Yes, in fact, there are very helpful City staff in the Community Development department -- who can very quickly help you understand whether a property can be legally used as you intend to use it. And it is imperative that you make this call BEFORE you buy the property, and even BEFORE you make an offer on the property! | |

Flirting With Selling A Rental Property |

|

Depending on your short and long term financial goals - you may want to list your rental property for sale for one month between tenants... In a recent conversation with the owner of a rental property, they were reflecting on the fact that after a tenant recently vacated their rental property (a townhouse) they were making quite a few updates and improvements to the townhouse based on some aging components and finishes in the property. They realized that the townhouse would be in better shape than it had been for years -- and that the condition would likely start to deteriorate (even if just a bit) as soon as they moved tenants back in. So, they wondered whether they should go ahead and just sell the townhouse instead of renting it again -- since it would be in great shape. But they lamented the fact that they'd need to keep it off the rental market for several months to see if it would sell at a price that would suit their financial goals - in other words, a sales price whereby it would make more sense for them to sell it than to continue to rent it. Here are a few thoughts I shared with this owner of an investment property...

So - here's an idea, if you own an investment property and you are about to have a tenant move out and you are about to make some improvements to the townhouse... Move the tenant out. Make the improvements. List the townhouse for sale for one month at a price for which you'd be happy to sell instead of continuing to rent the property -- so long as that value is generally in line with recent sales prices for similar townhouses. With this concept you don't have to commit to listing the property for six months, missing out on rental income, etc. -- but you can quickly determine if you could sell the townhouse while it is at its peak (from a condition perspective) at a price that would make it worthwhile for you to do so. OK - that was a lot. I'd be happy to talk it all through with you as well - in person, by email, by phone, etc. If you own a rental property and *might* want to sell it soon - be in touch (scott@hhtdy.com or 540-578-0102) and let's talk strategy... | |

Why Investors Eventually Sell Their Rental Properties |

|

If you own a rental property, you might wonder from time to time whether you should keep or sell that property. I generally advise my clients to keep their rental properties, and not to sell them unless there is a good reason to do so. Here are some of those good reasons... VALUE - If the value of your rental property is currently high, and there is a reasonable chance that it won't be quite as high in the coming years, then now could be a good time to sell the rental property. INVENTORY - If there are very few competing properties for sale right now (which would lead to a speedy sale) but there will be many, many new properties built in the near future (which could result in a slow sale) then it might make sense to sell the rental property now vs. later. EQUITY - If you have owned the property for a decent period of time you may have a good bit of equity tied up in the property - and perhaps you'd like to do something else with that money. Maybe you'll use the sale proceeds for another investment (real estate or otherwise) or to pay off some debt, make a large purchase, go on a trip, who knows, but sometimes selling a rental property is a key part of freeing up some cash to make some other financial moves. HASSLE - Maybe you are tired of dealing with owning a rental property. Regardless of whether you manage the property yourself, or have a professional property manager, there can still be some annoying details to attend to with property maintenance, uncooperative tenants, etc. MAINTENANCE - Perhaps your rental property is 20 years old and you're pretty sure that if you keep it for another 3 - 5 years you'll have to pay for a new roof, new heating system and new water heater. If so, it might make sense to sell the property now to avoid those major capital expenses. TENANTS - If most of the prospective buyers for your rental property will be owner occupants, then the time between tenants might be the perfect time to sell your rental property. PARTNERS - If you purchased the rental property with a friend or family member, and they would like to move their investment dollars elsewhere, then it might be a good time to sell the property. RENTAL RATES - If rental rates are starting to decline, changing the performance of your investment, it might make sense to go ahead and sell, unless you see a turn around happening in the near future. IMPROVEMENTS - Perhaps your most recent tenant absolutely trashed the property, and you have just completely renovated it, such that the property has never looked better. This could be an ideal time to sell before the condition starts to deteriorate again. All of these potential reasons to sell are quite general - so feel free to touch base if you want to chat more specifically about your rental property and whether it would make sense to sell it now, or keep it for the next few years. | |

Potential Challenges of Selling A Rental Property in Harrisonburg |

|

Do you own a property in Harrisonburg occupied by a tenant? When you are ready to sell it, how will you go about that process? Will you list the property for sale while the tenant is still living in the property?

Will you list the property for sale after the tenant has moved out?

OK -- admittedly, I'm spelling out the worst case scenario of both sides of this issue -- hopefully making it clear(er) that there is no sure-fire easier, faster, better way to sell an investment property. There can be challenges in listing the property for sale while the tenant is still occupying the property, and likewise, if you list the property for sale after they move out. We'll need to work together to determine the best game plan for your property, perhaps considering...

It doesn't have to be difficult to sell a property occupied by a tenant, but we'll want to approach the process thoughtfully. Let me know if you're planning to sell an investment property in 2020. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings