Market

| Newer Posts | Older Posts |

Large Mixed Use Development With 728 Homes (Plus Commercial Space) Planned On 133 Acres Just Outside Harrisonburg |

|

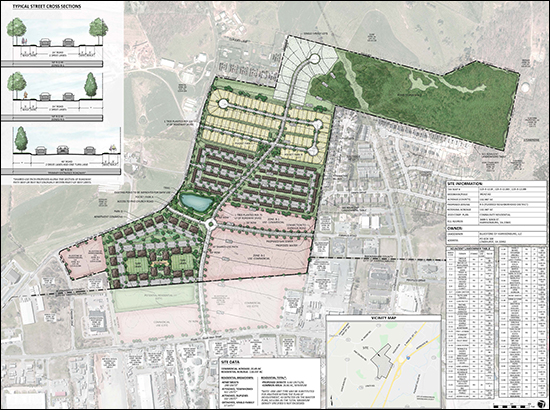

Download the master plan as a PDF here. A 133 acre mixed use development is in the planning / approval process in Rockingham County - just south of the City of Harrisonburg. This development would feature:

This planned development is located just south of the DMV, and backs up to Pikes Church Road. The land needs to be rezoned, slightly (from R-3C to R-5C) for the development as planned to move forward. County staff recommended approval last week and the Rockingham County Planning Commission unanimously recommended approval this week. The next step is for the rezoning request to go before the Board of Supervisors. The developer had previously rezoned the land, in 2009, for a 384 unit residential development. This updated rezoning, 11 years later, would increase the density to 728 units. The developer plans to have common areas for recreational spaces such as turf fields, a playground and walking trails. Download the full packet from the rezoning request here. As a random side note, the developer is seemingly planning to call the development "Bluestone Development" - which might cause a bit of market confusion given the existence of a large neighborhood in Harrisonburg called "Bluestone Hills". Maybe not. I guess if someone says they live in Bluestone, you'll have to ask if that's the City Bluestone or the County Bluestone. | |

Selling A Home In An Under Supplied Segment Of The Market |

|

Nobody needs to feel bad for a seller of a home in an under supplied segment of our local housing market. After all, they are likely to sell their house quickly, and for more than the list price. But...it's not all sunshine and roses... 2. These sellers practically ought to go on vacation for a few days as they are likely to be run out of their house from sun up to sun down with showings. 3. When the offers start pouring in, with touching introductory cover letters and heartfelt pleas from buyers to accept their offer, sellers will quickly realize that by saying "yes" to one buyer they will be saying "no" to quite a few others. On the bright side, though... 1. These types of homes are likely to go under contract quickly, ending the constant parade of buyers through the house. 2. The lucky winning buyer is likely to be gentle on any sort of repairs request as there will likely be multiple alternative buyers waiting in the wings if the primary buyers do not want to move forward based on the home inspection. 3. Homes in an under supplied segment of the market are likely to sell for more than the list price. So, it's not all good, but it is certainly NOT all bad to be selling in an under supplied segment of the local housing market! | |

Lots of Homes Selling (Going Under Contract) in September 2020 |

|

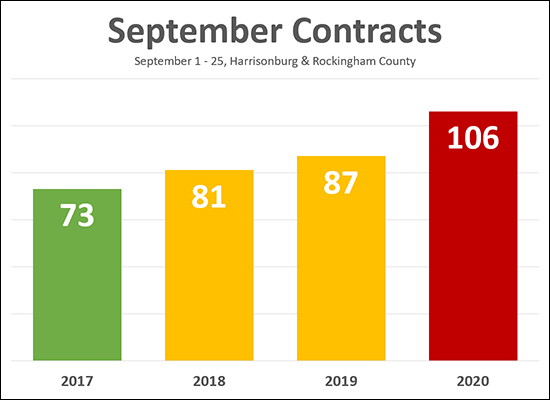

Buyer activity usually starts slowing down in September. After all -- spring is usually the busiest season for buying, followed by summer. But this September, buyer activity has been STRONG! As you can see, above, we have seen 73 to 87 contracts signed in the first 25 days of September during each of the past three Septembers. But this September -- there have been 106 contracts signed in the first 25 days of the month! Nothing has been normal this year, and September is proving to be no different. Home sales don't show any signs of slowing down yet this year! | |

Analyzing the Accuracy of Zillow Zestimates In Harrisonburg and Rockingham County |

|

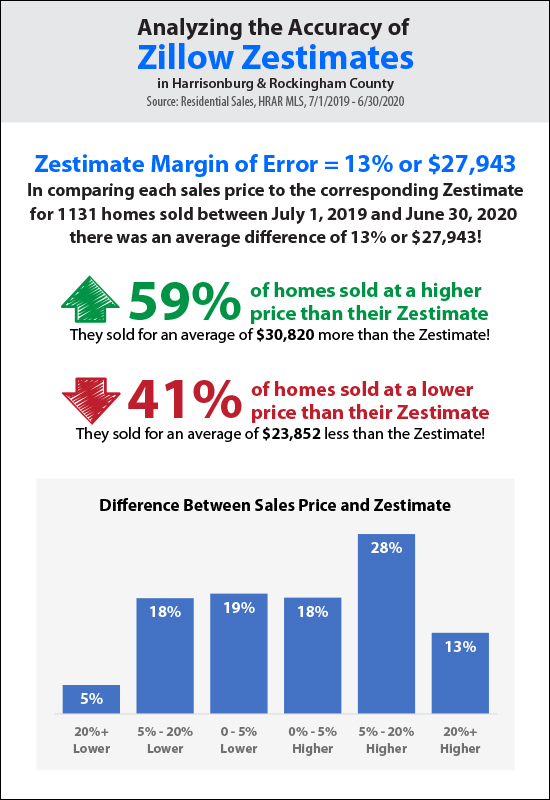

download the infographic above as a PDF Do homeowners enjoy checking out the Zillow Zestimate for their home? Yes Are Zestimates accurate indicators of market value of homes in some real estate markets? Yes, probably. Are Zillow Zestimates for properties in Harrisonburg and Rockingham County a good indicator of the price for which a home will sell? No, not at all. This used to just be a hunch, but now I can back it up with data. To answer this question...

As shown above...

So, as a homeowner thinking of selling your home... the Zestimate for your home might happen be accurate - but that would be the exception, not the rule. Only 37% of pre-listing Zestimates were within 5% of the final sales price of the houses. And as a home buyer thinking of buying a house... you shouldn't necessarily expect to only have to pay the Zestimate for a house, because those values are often too low... and yet you also shouldn't necessarily be willing to pay as much as the Zestimate for a house, because those values are often too high. In the end, just understand that the Zestimate for your home (in Harrisonburg and Rockingham County) is much more likely to be inaccurate than accurate. Presumably, you wouldn't want to make a decision about the asking price for your home with a value indicator that is on average 13% different than market value. That is an average of $27,943 -- and most sellers don't want to under-price or over-price their home by that much! | |

Spring and Summer Looked A Bit Different This Year In Our Local Housing Market |

|

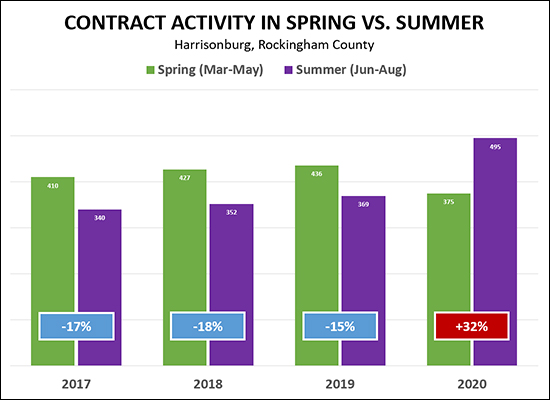

We always (I mean, always!) see more contract activity in the spring than the summer. More buyers contract to buy homes between March and May than between June and August. Always. For sure. Definitely. But not in 2020. Over the past three years we have seen a 15% - 18% decline in contract activity when comparing summer to spring - but this year contract activity INCREASED 32% when comparing summer to spring! This certainly had a lot to do with COVID-19. Plenty of buyers and sellers were feeling a bit uncertain this spring, which slowed down the pace of sales in our real estate market. But -- everything came roaring back this summer! Who knows what fall will look like this year in our local real estate market, but summer was certainly unusual! Yes, and I suppose spring was as well. :-) | |

Local Home Sales, Contracts, Prices Surge In Summer 2020 |

|

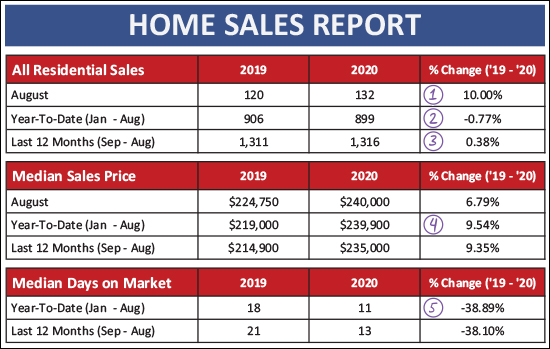

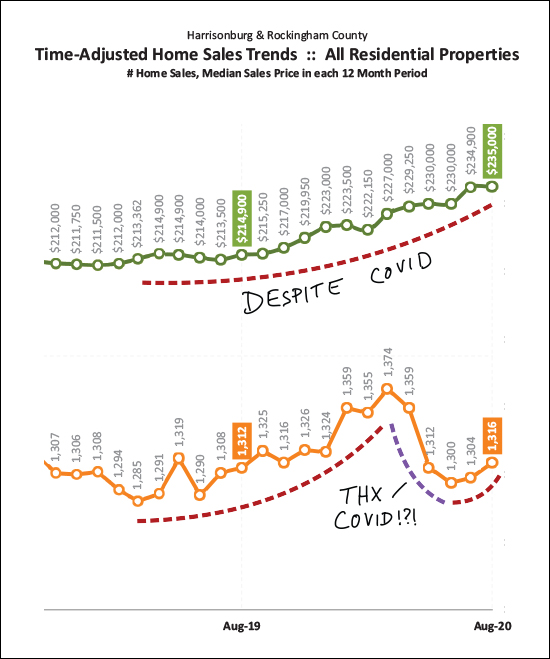

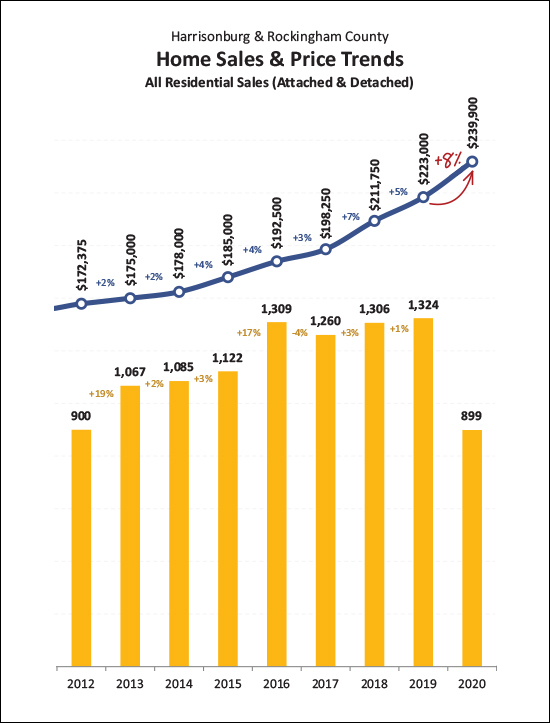

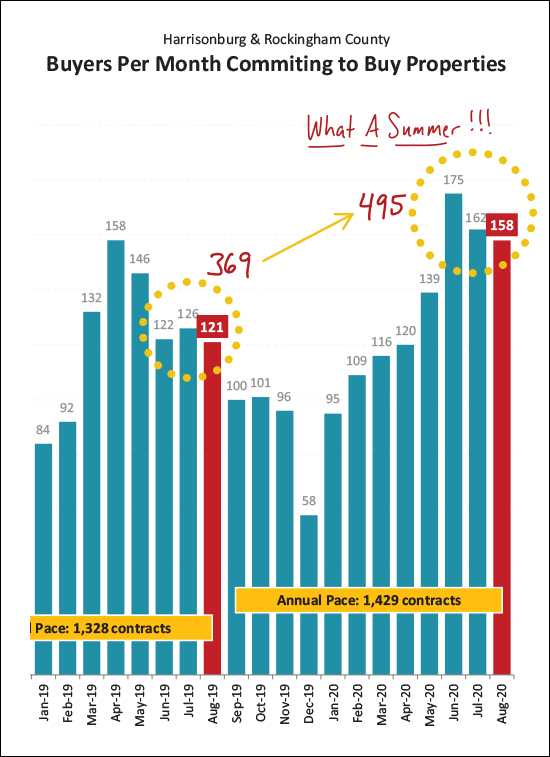

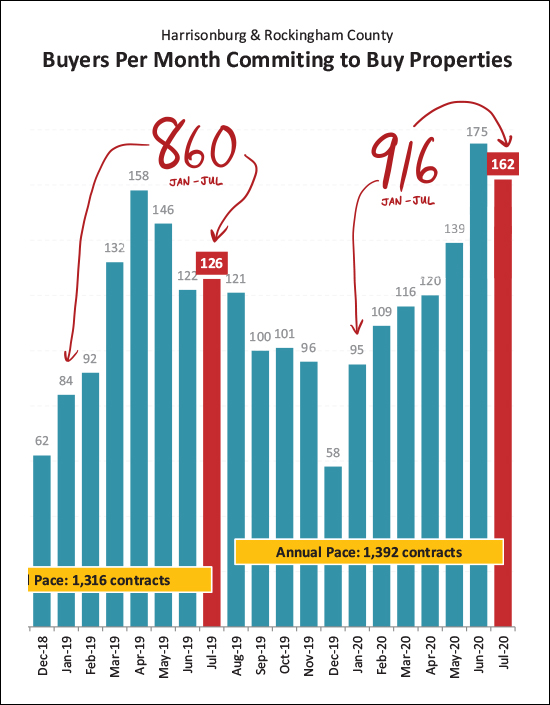

Happy Monday Morning! Temperatures are cooling, and fall will soon be upon us! It looks like the high temps will be in the 70's all week - except Friday when we're expected to have a high of only 67 degrees! I love fall and am looking forward to the slightly cooler weather. But even if the temperatures are cooling off, local home sales are not necessarily doing the same! Before we dig into the data this month, be sure to check out Congers Creek, the new townhouse neighborhood being built on Boyers Road near Sentara RMH Medical Center by visiting CongersCreek.com. Now, feel free to download a PDF of my entire report, or read on for highlights...  Quite a few items to note above...

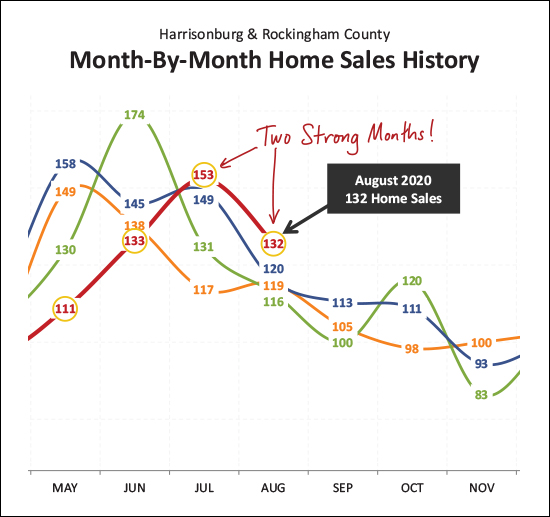

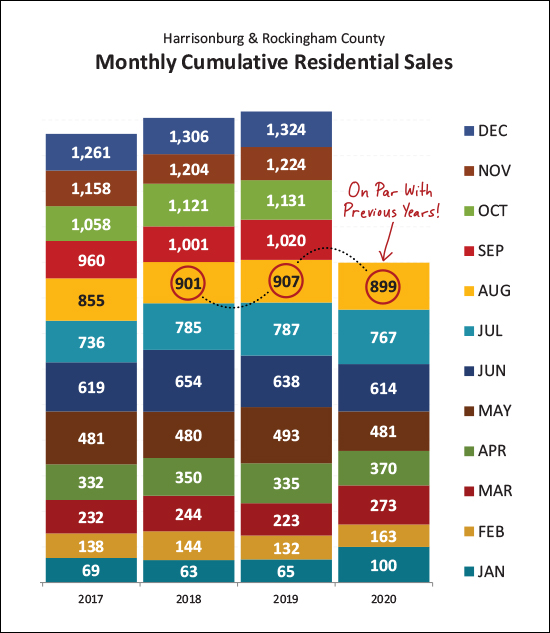

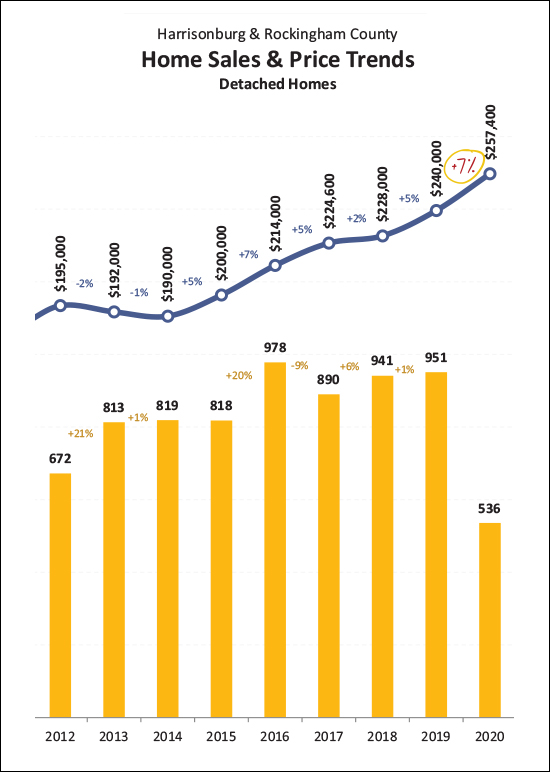

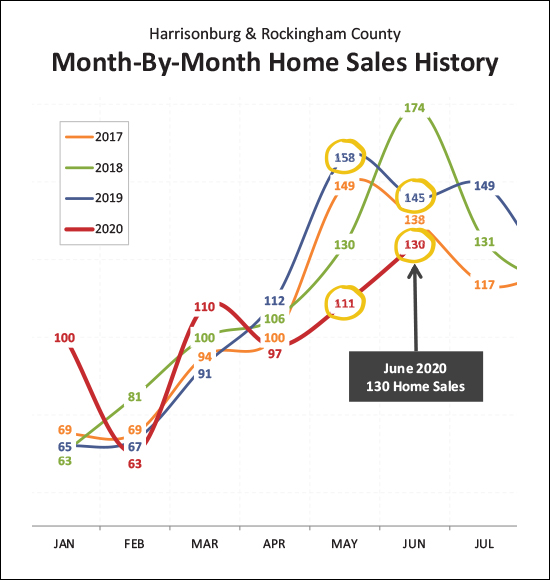

Now, let's take a look at how the past few months have fallen into the context of previous years...  As you can see above, May and June were remarkably SLOW months for home sales - well below the normal pace for those months. But then, July and August came storming in -- with higher numbers of home sales than we would have or could have expected. So it seems that home sales may have just shifted this year to be later in the year than most years. Who could even guess what might happen in September and October at this point!?! And here is how the year is stacking up with the past two years thus far in 2020...  For all the things one might say about 2020, it seems we won't be able to say that home sales stunk. A busy late-summer has caused this year to catch right back up (almost) to where we have been for the past two years -- and based on contract activity (keep reading) I think we might surpass last year's sales trajectory as we close out 2020. That's not to say, of course, that home sales didn't take a temporary dip as a result of COVID...  Indeed, the annual pace of home sales took a nose dive in the spring -- OK, that might be an exaggeration, but they did slow down. Despite that temporary slow down, though, home prices kept right on climbing!?! That disconnect likely means the slow down was largely a result of sellers not wanting to sell -- not a result of buyers not wanting to buy. Now about those rising prices - how fast are they actual increasing?  Faster than anytime recently - though barely. We've seen an 8% increase in the median sales price between 2019 and 2020. To try to put that in context...

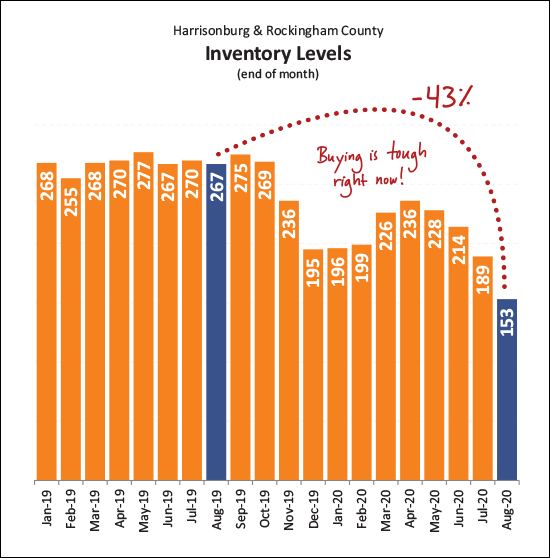

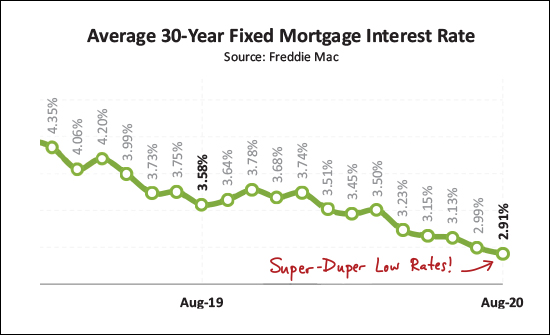

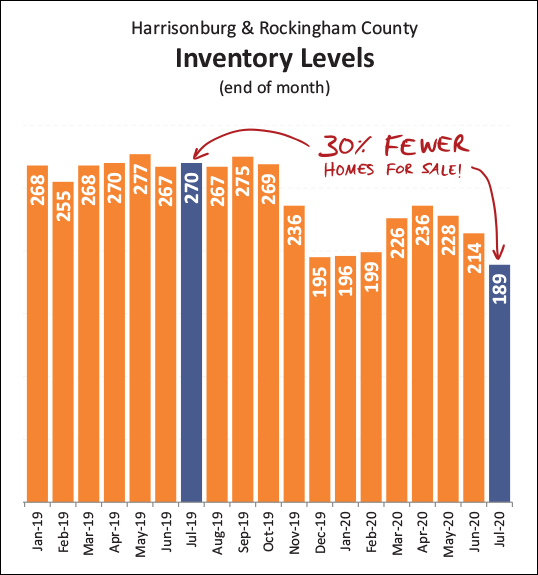

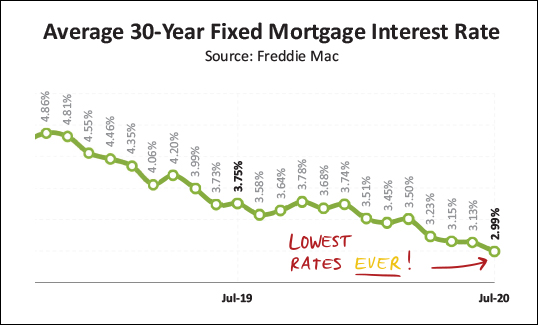

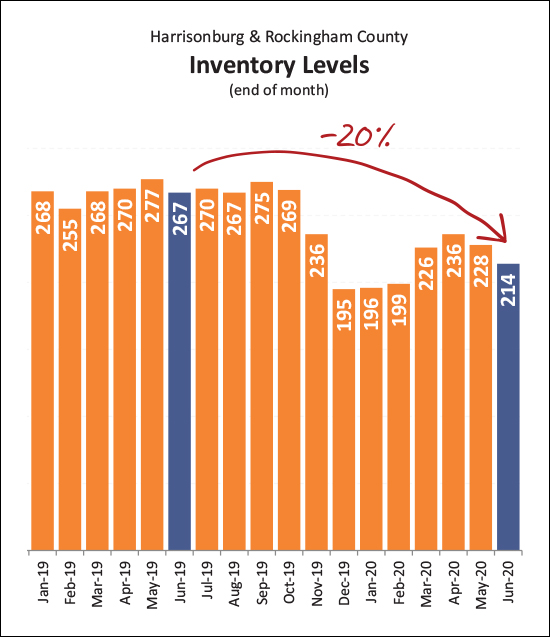

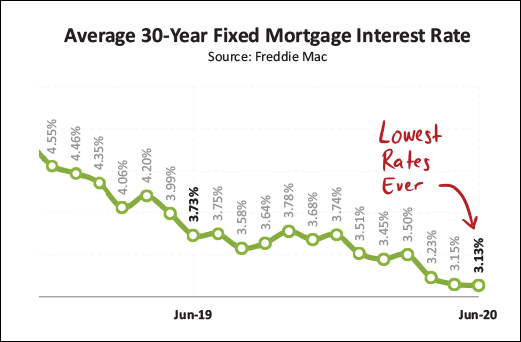

So - I guess prices are rising somewhat faster than in recent years, but not absurdly faster. Now, let's look back in order to look forward...  The graph above is showing us contract activity -- when buyers (and sellers) are signing contracts, not when they are closing on their purchase/sale. As you can see, this was a blockbuster of a summer for contract activity! Only 369 contracts were signed last June through August, and that increased to 495 contracts this June through August. That's a 34% increase in summer contracts! This all means we are likely to see a high number of home sales continue take place as we move into the fall. I expect that we'll see an abnormally high number of home sales in both September and October. Perhaps it is no surprise that all of these buyers signing contracts is keeping/driving inventory levels low, so very, very low...  There have been fewer, and fewer, and fewer homes on the market at any given time as we have moved through this year. It is a tough time to be a buyer as there are not many choices for you at any given time, and you will likely have competition from other buyers if you are pursuing a new listing. Those buyers who are able to secure a contract on a house are financing their purchases at some rather extraordinary rates...  The mortgage interest rates they just keep on falling The average rate fell to 2.91% by the end of August, and I have seen my clients locking in as low as 2.85% and even 2.75% on a 30 year fixed rate mortgage! OK - that brings our monthly jaunt through the local homes sales data to a close, for now. You can read more about our local real estate market on my blog, and of course you can email me (scott@hhtdy.com) with any questions about the market or about your particular situation. Some key take aways... BUYERS

SELLERS

OK, that's all folks! I hope that you have a wonderful balance of September, and that you and your family are healthy and well and are finding ways to manage the many changing dynamics in our daily lives! Reach out anytime (540-578-0102 or scott@hhtdy.com) if I can be of any help to you! | |

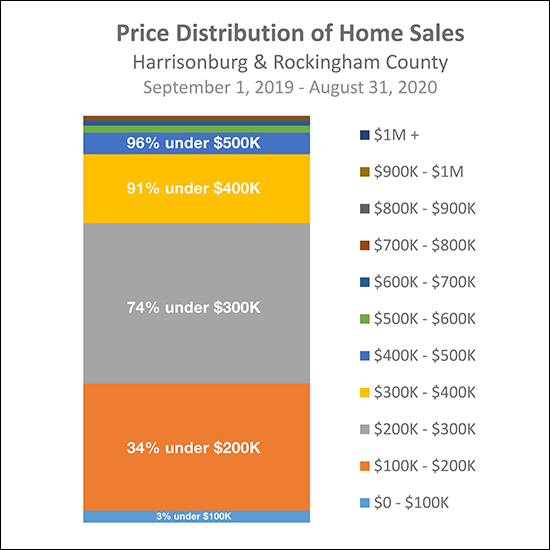

Only 1 in 10 Home Buyers Spends More Than $400K |

|

Lots to observe / conclude here...

| |

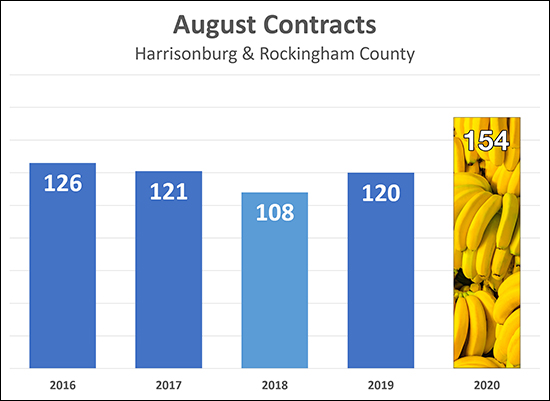

Home Buyers Went Bananas In August 2020 |

|

A little later this month I'll take a thorough look at all of the home buying (and selling) activity in Harrisonburg and Rockingham County. But before we get there - I thought I'd take a quick peek at how many buyers (and thus, sellers) signed contracts in August 2020. I was surprised to see a BIG increase in August contract activity as compared to the month of August in each of the past four years! Buyers still seem to be out in full force, ready to pursue houses as they hit the market for sale. It seems this fall might be busier than usual in our local housing market! | |

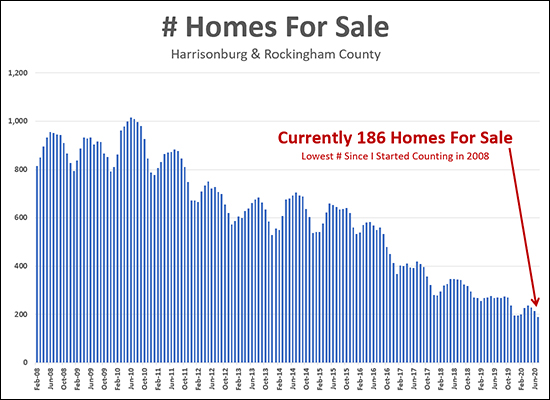

So You Are Saying You Are Having A Hard Time Finding A Home To Buy? |

|

So - there are only 186 homes for sale in all of Harrisonburg and Rockingham County. Which, as you can see above, is much lower than the number of homes for sale for most of the past 12 years. Breaking it down a bit further by location...

...and by property type...

...and by price...

Regardless of how you break it down, there are fewer options for buyers today than there have ever been at any other point in the past 12 (plus) years. One important caveat is that the lack of inventory at any given point does not mean that there aren't as many houses selling. There have been 1300-ish home sales per year for the past few years, despite continually declining inventory levels. So, basically, homes are coming on the market - but they are going under contract VERY QUICKLY - so inventory levels have been staying low or getting lower! What does this mean for buyers?

It's not necessarily a totally fun time to buy a home right now because of these low (low!!!) inventory levels -- but it is possible to buy a home. Let me know if you'd like to chat about inventory levels in your particular segment of the local housing market. | |

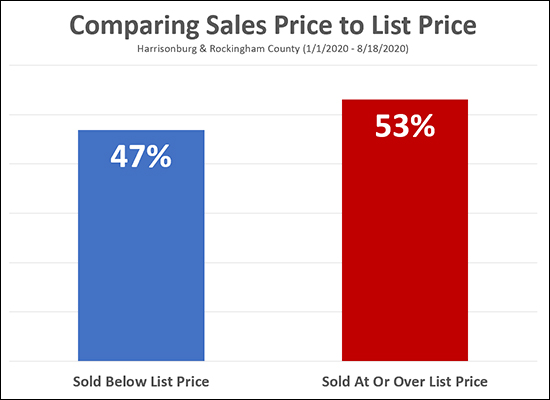

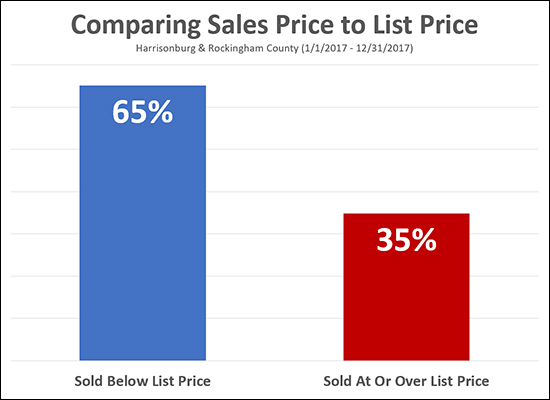

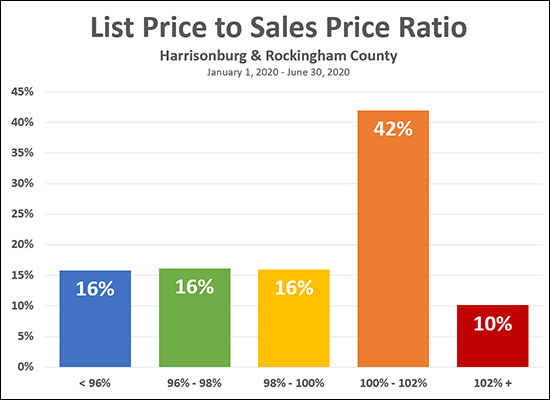

Should You Be Surprised If Your Home Sells At Or Above List Price? |

|

No. You should not be surprised if your home sells at or above the list price. As shown above, 53% of homes that have sold thus far in 2020 have sold at or over their list price. It's a sign of the times, I suppose. There are LOTS of buyers fighting over very few homes for sale and this often leads to...

Just to put this in context, let's see how things looked three short years ago...  Things were quite a bit different in 2017, it seems! Way back in 2017 only about a third of homes sold at or above their list price! As with many other recent market indicators, this is great news for sellers and rather unexciting news for buyers. | |

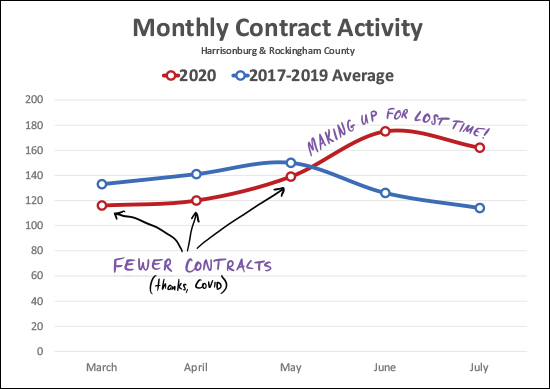

Home Buyers And Sellers Made Up For Lost Time In June, July |

|

Well - hello June and July! The red line above shows the number of contracts signed for each of the past five months. The blue line shows the average number of contract signed in that same month during 2017, 2018 and 2019. Basically, comparing the monthly pace and pattern of 2020's contract activity to the three most recent years to see if this is what we should have expected. It's not what we should have expected. Typically, contract activity peaks in May and then slowly declines in June and July. But not this year. During 2020, contract activity was lower than would have been expected in March, April and May -- but then -- wow! Thinks really started to move in June and July. All in all, I think this is the impact of COVID. It slowed the local housing market down for a few months, but things are speeding right back up to likely eventually catch up to where we were last year. Stay tuned to see what happens come August... | |

Local Home Sales Slow Slightly But Prices Are Up 10% in 2020! |

|

Happy Tuesday Morning! Summer is winding down, and it's been a bit of an unusual one...

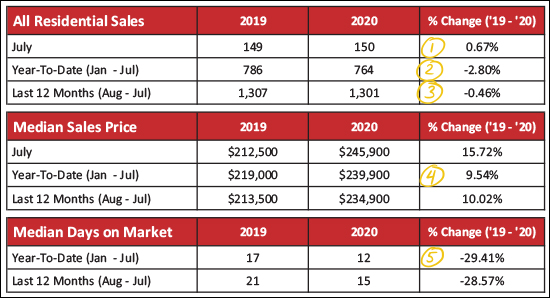

As your summer comes to a close, I hope you have found some ways to relax and take a break, despite everything going on right now. Go for a run! Head out on a bike ride! Plan a day hike! In the latest adventures of the Rogers family, I took Emily zip lining and Luke water skiing this past weekend. :-) Whatever your version of fun and relaxation, I hope you can find some of it in these last weeks of summer. And now, if you have been looking for a distraction from the craziness in your everyday life, read on for some crazy news about our local housing market. :-) But first -- check out this beautiful home (shown above) in Chatham Square by visiting 2378AlstonCircle.com. Also, feel free to download a full PDF of my market report here. OK, OK, now, on to the data...  Quite a bit to note above...

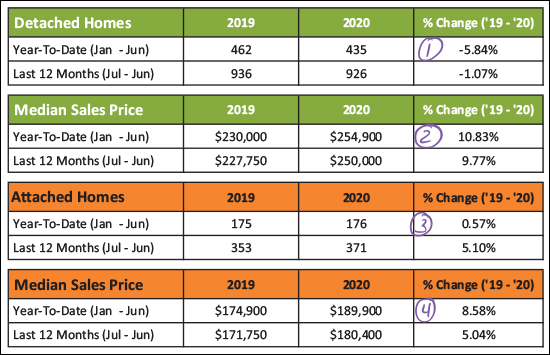

To pick up on a few nuances, let's break things down by detached homes (single family homes - shown in green below) as compared to attached homes (townhomes, duplexes, condos - shown in orange below)...  We start to see some differences when breaking things down by property type...

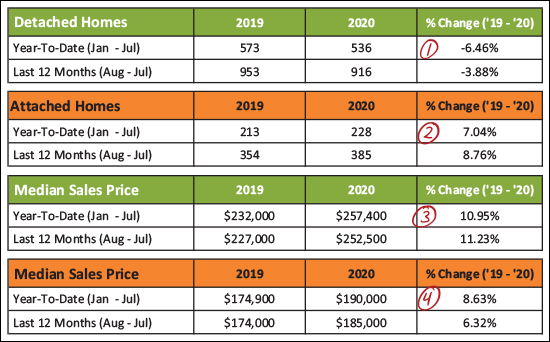

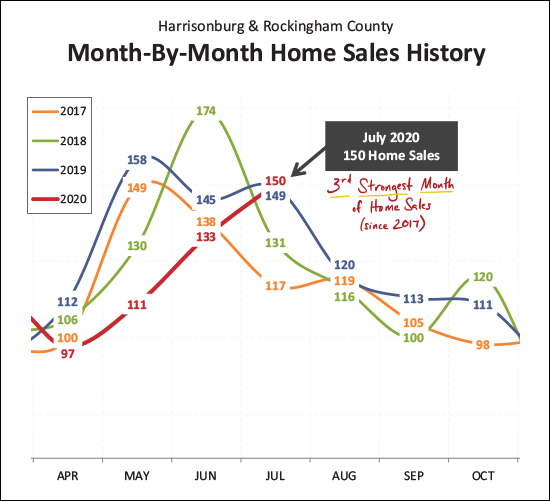

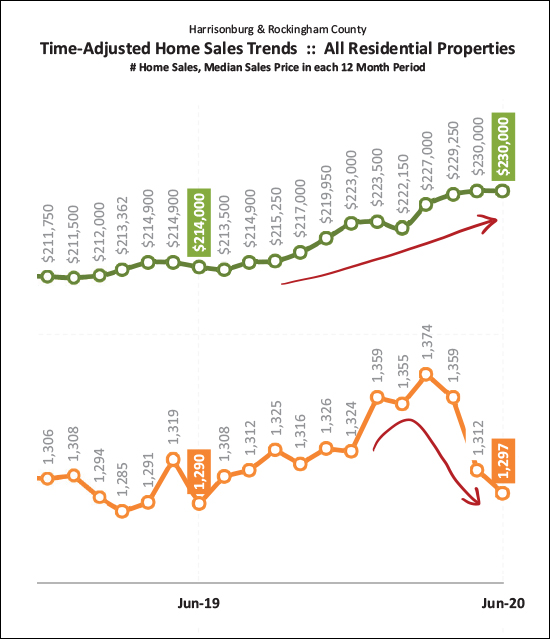

Now, let's contextualize those 150 home sales we saw in July...  As shown above, home sales often or usually peak in May or June with sales then slowing down as we roll into July. But not this year! Home sales seem to be accelerating month by month as we have seen steady increases between April, May, June and July. In fact, the 150 home sales see in July was the third strongest month of home sales we have seen since at least 2017! This next graph might be a bit confusing, but let's see if we can make sense of it...  OK - starting with the orange line at the bottom of the graph... The annual pace of home sales had risen all the way up to 1,374 home sales per year by the end of March 2020. This was a slow and steady increase over several years -- but that all started to shift downward once we started incorporating April and May data into the mix. Home sales did decidedly slow down for several months, causing the annual pace of home sales to slide. It seems we may now be seeing that trend line stabilize in July as the annual pace of sales is no longer declining. But yet -- as noted next to the green line -- home prices have continued to go up, up, up. Back in March and April I wondered whether we'd see a slow down in sales and whether we would see a slight downward shift in home prices. It seems I was half right. Sales slowed, but prices have continued to rise! These two contradictory trends may best be understood by realizing that sellers drive trends during a seller's market. Fewer sellers wanted to list their homes for sale during the "time of COVID" and thus fewer sales happened in April and May (if the houses aren't listed for sale, they surely won't sell) but there were seemingly just as many (or more) buyers ready to buy. An unusual (and temporary) decline in sellers combined with just as many (or more) buyers caused home prices to continue to climb, perhaps even higher and faster than they would have otherwise! OK - thanks for sticking with me on that one. Now, let's predict the future by looking at contract activity...  First, the big, red, handwritten numbers will quickly show you that the pace of contract signing this year (916 between Jan and Jul) is quite a bit higher than last year (860 between Jan and Jul), but there's more! Last year in June and July we saw 247 buyers (and sellers) sign contracts to buy and sell homes. This year there were 337 contracts signed during that same timeframe! It is almost as if buyers (and sellers) are trying to make up for lost time -- as contract activity has been ramping up for the past few months after a slower than expected spring market. OK, I told you I'd circle back to it...  OK - so - about those home prices. As shown above, you'll note that the median sales price of detached homes (not townhouses, duplexes or condos) has increased 7% between 2019 and 2020. That's more than the 4.8% average over the past five years -- though we did also see a 7% increase between 2015 and 2016. So, should we be concerned about prices increasing this much? After all, didn't prices skyrocket back in 2004 and 2005 leading to eventual declines in housing prices? Why yes, you are correct - we did see significant increases in the median sales price in 2004 (+16%) and 2005 (+24%) and those increases were unsustainable -- prices eventually came back down, slowly, between 2006 and 2011. But this time, perhaps it's different? It's hard to say for sure whether the price increases we are seeing are "too fast" or "too much" to be sustainable. We'll only really know a year or two from now, looking backward. I suppose it is important to note that while a 7% increase is much higher than any long term average, it is also not as crazy as we were seeing back in 2004 and 2005. One of the things that is driving these prices up is the vast number of would-be buyers competing over an ever-shrinking number of homes for sale...  Yes -- you're reading that correctly -- there are currently 30% fewer homes for sale now as compared to a year ago. Further -- the current inventory level (189 homes for sale) is actually lower than this past winter, which is rather unusual for July/August! There are many things causing so many buyers to want to buy, and buy now, which is driving down the inventory levels, but one of those motivators for buyers is...  ...super low interest rates! Mortgage interest rates have been below 3% for the past few weeks -- yes, the 30 year fixed mortgage interest rate -- below 3%! I have had a few clients lock in at 2.65% and 2.75% which is rather hard to fathom. So, not to encourage you to jump on the bandwagon if you're not ready to do so, but if you're thinking about buying soon, these interest rates sure do make it compelling to try to buy sooner rather than later. OK - that wraps it up for now. A few closing notes... SELLERS - Even though it is a seller's market, it is still essential that we prepare, price and market your home well! Read more about that here and shoot me an email if you want to meet to start talking about getting your house on the market in the coming weeks or months. BUYERS - Be prepared to be patient, as you'll likely be competing with plenty of other buyers. Make sure to talk to a lender ASAP (ask me if you need a recommendation) so that we have a pre-qualification letter in hand when making an offer. HOMEOWNERS - Yes, certainly the vast majority of those who receive this market report won't be buying or selling next month. So, for the rest of you, enjoy the fact that your home's value has likely increased over the past year! If that makes you want to think about selling - let's chat. Otherwise, just enjoy knowing that your home's value has likely increased. :-) That's all for now, folks. If there is any way that I can help you or your family with real estate, or otherwise, let me know. Otherwise, enjoy the balance of August and I'll be back to crunch the numbers all over again in mid-September. | |

Will COVID Cause Local Home Prices To Decline? |

|

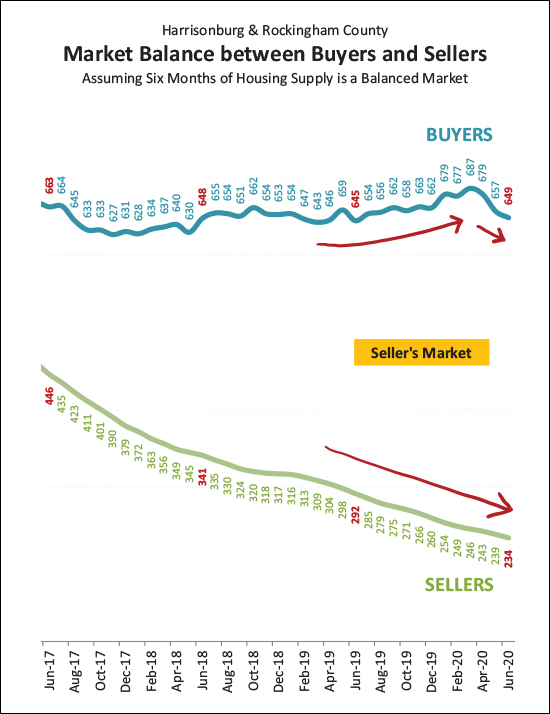

I still get this question from time to time and my general thought, at this point, is that it is quite unlikely that COVID will cause home prices to decline locally. Home prices are typically most directly affected by supply and demand. If supply is high (lots of sellers want or need to sell) and demand is low (fewer buyers want to buy) then home prices are likely to decline. This is called a buyer's market. If supply is low (fewer sellers want or need to sell) and demand is high (more buyers want to buy) then home prices are likely to increase. This is called a seller's market. Anyone want to guess which market we're experiencing these days? We're definitely in a seller's market! Over the past five years, there have been fewer and fewer (and fewer) homes on the market for sale at any given point. During those same five years, buyer demand has increased -- not by as much as seller supply has decreased -- but buyer demand has increased nonetheless. So, back to the original question - will COVID cause local home prices to decline. I still say that it is unlikely, because that would almost certainly require both...

I'm not seeing either trend (increase in sellers, decrease of buyers) on the horizon at this point. That said, here are two important caveats...

So, for now, it does not seem at all likely that COVID will cause local home prices to decline - but stay tuned to see how new construction and employment/unemployment could play into that in the months to come. | |

Housing Inventory Levels May Have Peaked For The Year |

|

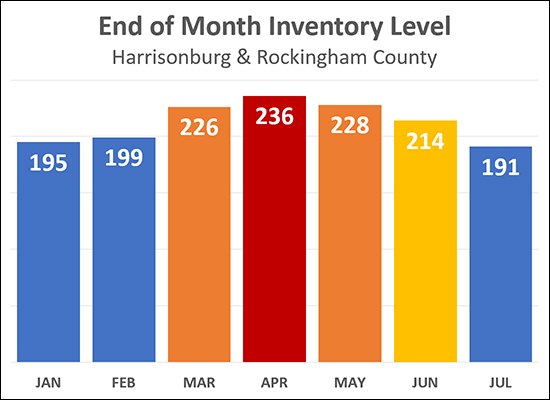

The number of options that you have today as a buyer (hint = not many) may be the most options you'll have at any given point between now and the end of the year. As shown above, inventory levels (the number of active listings in the MLS at the end-ish of each month) climbed through the first four months of the year, but seemed to peak in April and have been declining since that time. Surprisingly, the inventory level at the end of July was lower (!!??) than in January and February! Now, certainly, there will be some new listings over the next five months of this year -- so there will be some new inventory options -- but the total inventory available at any given point is not likely to increase again until next Spring. | |

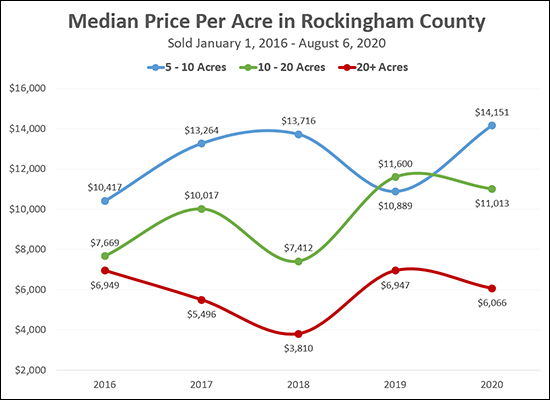

Price Per Acre of Land Sold in Rockingham County |

|

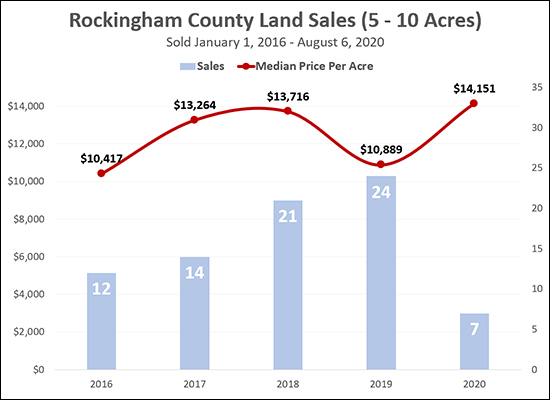

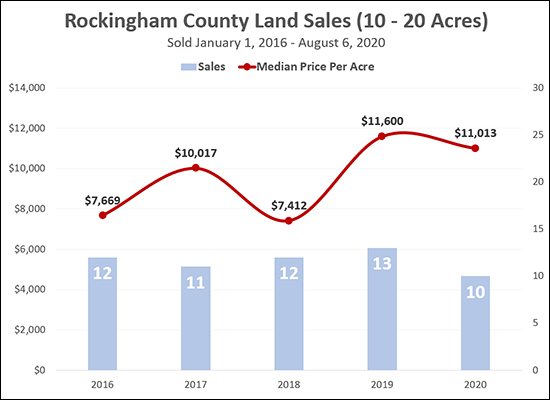

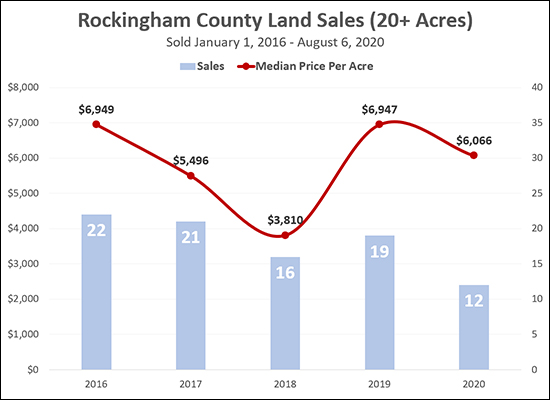

As shown above, the price per acre of 5 - 10 acre tracts has mostly stayed between $13K and $14K over the past four years, with the exception of last year (2019) when it dipped down to $11K. We have seen a steady increase in the number of 5 to 10 acre land sales over the past several years.  The number of 10 to 20 acre tracts selling per year has stayed much more consistent over the past four years (2016 - 2019) with 11, 12 or 13 parcels selling -- though there have already been 10 such sales in the first 7-ish months of 2020. The median price per acre has been generally trending up for this size of parcel, and seems poised to remain around $11K per acre this year.  The median price per dipped down rather low ($4K/acre) in 2018 for parcels of 20+ acre but then rose quite significantly in 2019 to $7K per acre. We have seen around 15 to 20 such sales per year for the past several years but it seems we might surpass that in 2020.  Finally, this (above) is a compilation of the price per acre for each parcel size. As you might expect, the larger the parcel, the lower the price per acre. | |

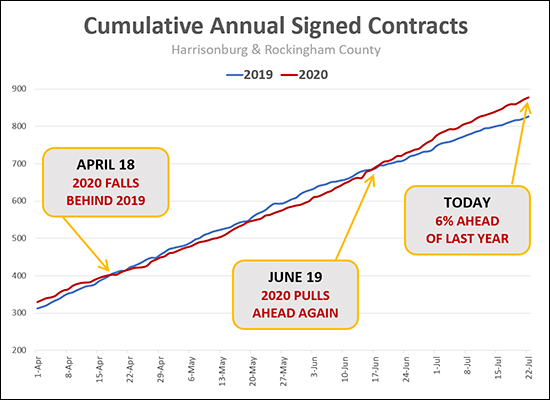

Cumulative Contract Activity Pulls Ahead In 2020 |

|

How did COVID-19 affect our local housing market? So far, this is what we're seeing...

Now, there have been 6% more contracts signed in 2020 than in 2019! There are still plenty of ways that COVID-19 could affect our local housing market, but we're not seeing any significantly harmful impacts to date. | |

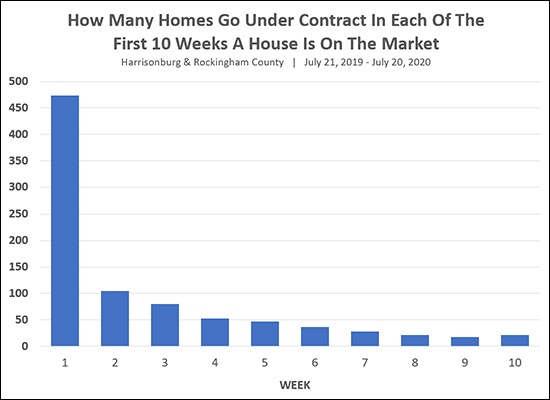

Most Homes That Sell In The First Ten Weeks On The Market... Sell In The First Week |

|

We know that homes are selling quickly. 62% of homes that sold in the past year were under contract within 30 days. 75% of homes that sold in the past year were under contract within 60 days. But was market activity spread out evenly over those first 4, 8 or 10 weeks? Not at all! As shown above, when we look at homes that went under contract within the first 10 weeks of being on the market -- a lot of them (most of them!) were under contract the very first week they were listed for sale! Perhaps this is also why we're seeing more than half of homes selling for more than their list price. | |

More Than Half Of Homes Are Selling For More Than Their List Price |

|

This might surprise you. It surprised me! More than half (52%) of homes that sold in the first half of 2020 sold for MORE than their list price! It is certainly true that we have seen buyers being able to negotiate less and less over the past few years as the market has become tighter in many price ranges and locations -- and this is some specific evidence that now many buyers aren't able to negotiate at all! Plenty of caveats, of course...

Anyhow, regardless of how you slice the data, the market is hot in many price ranges and buyers are often finding themselves needing to be prepared to pay the full list price or even a bit higher to secure a contract on a home! | |

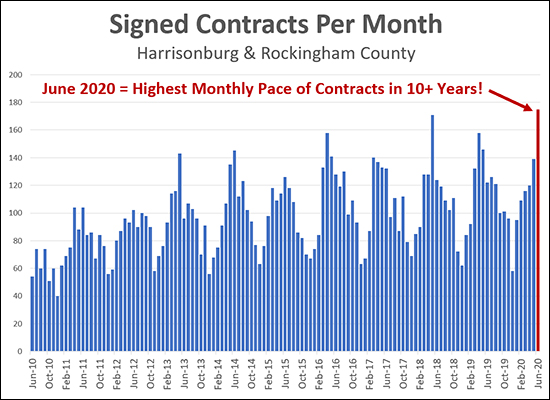

Highest Monthly Pace of Contracts in Over 10 Years |

|

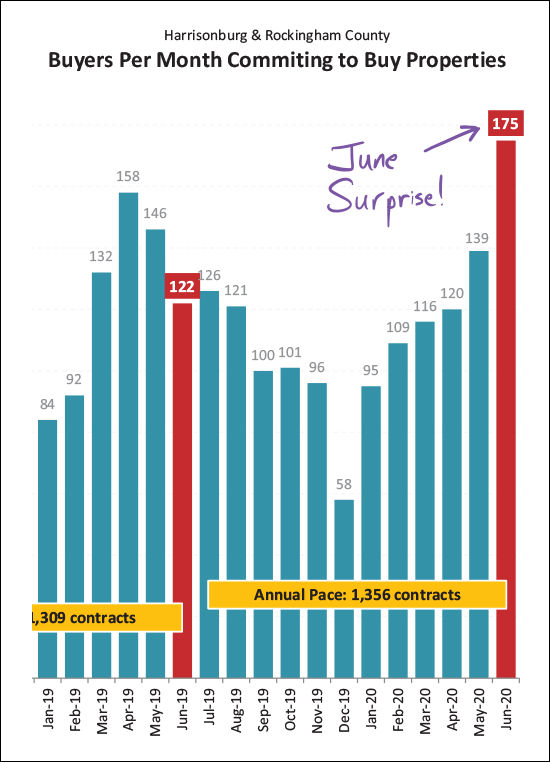

To say June 2020 was a busy month of contract activity is a bit of an understatement. A total of 175 properties went under contract in June, which was more than any other month in the past 10 years! Some of the previous high months were...

Read more about our local real estate market in my most recent monthly market report. | |

Harrisonburg Area Home Prices Up Nearly 7% in First Half of 2020 |

|

Happy Tax Day! Yes, that's right, today is the extended deadline for filing and paying income taxes. But the day is still young, so read on for an update on our local housing market before you go submit your tax filing. ;-) But first -- check out this recent listing (shown above) in Highland Park priced at $365K by visiting 4065LucyLongDrive.com. Two other notes before we get started...

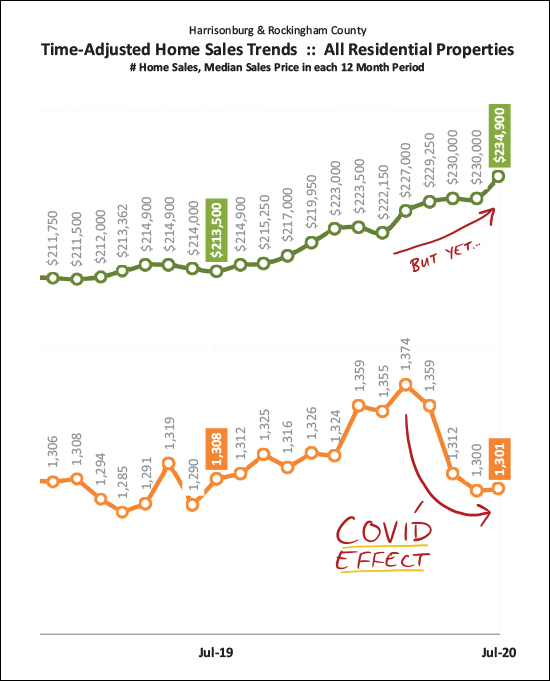

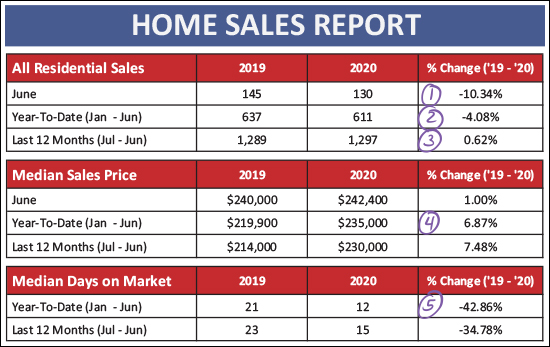

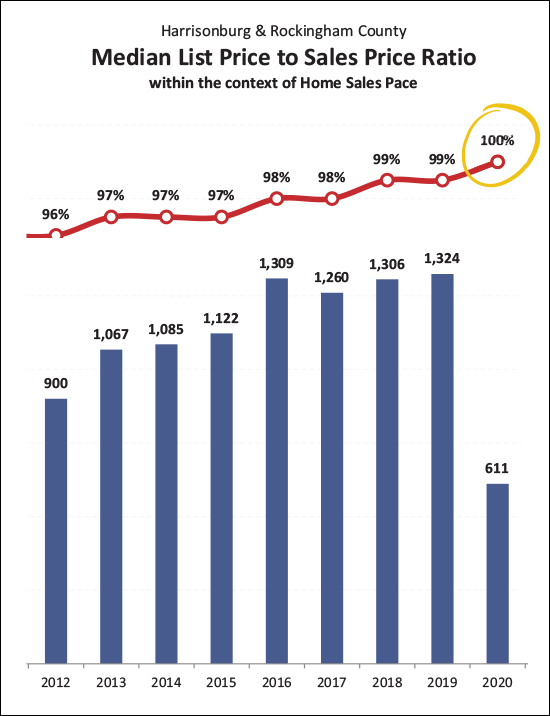

OK, now, on to the data...  We're now officially halfway through the year when looking at year-to-date sales figures and there is plenty of interesting trends to note above...

Now, let's take a brief look at detached homes compared to attached homes. Attached homes includes duplexes, townhomes and condos.  As shown above...

So, prices have risen quite a bit between 2019 and 2020 even without much of an increase (actually a slight decrease) in the number of homes that are selling. But perhaps the trend in the pace of home sales is shifting...  If you look at the four numbers I circled in gold above, you'll see that May 2020 home sales were drastically lower than May 2019 -- but the gap between June 2020 and June 2019 was not as severe. Perhaps we are starting to see home sales pick back up again? At least some of the (slight) decline in home sales in 2020 seemed to be a result of fewer would-be home sellers listing their homes for sale which gave would-be home buyers fewer options for buying. Now, looking at some longer term trends...  The data above looks at a moving 12-month set of data, and we're seeing divergent trends now. The median sales price (green line) keeps on steadily rising -- while the annual pace of home sales (orange line) has been drifting downward over the past three months. As noted above, fewer sales seems likely to be a result of fewer sellers being willing to sell and not fewer buyers being willing to buy -- which would at least partially explain why prices keep on rising. All of this means that is definitely still a STRONG seller's market...  As shown above, the number of buyers buying in the market has stayed rather steady over the past few years (though it has dropped off a bit over the past few months) while the number of sellers selling (inventory at any given time) continues to decline. This makes it an absolutely wonderful time to be a seller -- and probably a not very fun time at all to be a buyer. And, well, if you need to do both (sell and buy) you'll be both ecstatic and depressed! This next stat might surprise you...  I did not see this one coming! I'll dive a bit deeper into this in the coming days, but it seems that the median "list price to sales price ratio" has risen to 100% in 2020! That means that half of sellers are selling below their list price and half of sellers are selling ABOVE their list price!? I knew sellers were having to negotiate less and less on price -- but this statistic is still rather shocking. Again, I'll dive deeper into the data in coming days to see what else I can uncover here. And set your coffee cup back down, because here's another surprise for you...  Contract activity in the first five months of the year was lagging behind this year (-5%) as compared to last year. But when we factor in June contracts, not such much! Now there have been 3% more contracts in 2020 than in the same timeframe in 2019, mostly because of the astonishingly high 175 contracts signed in June 2020! Wow! Again, I'll break this down further over the next few days to try to better understand this spike in contract activity. And as is likely NO surprise, inventory levels keep on dropping...  There are currently only 214 homes for sale in Harrisonburg and Rockingham County -- which is 20% lower than where we were a year ago. I was hopeful that we'd see inventory levels pick up a bit during the spring -- which didn't really happen. Maybe we'll see some late summer, early fall increases?? Finally, on to this super low, historically low, ridiculously low interest rates...  Buyers financing their home purchases over the past few months have enjoyed some absurdly low mortgage interest rates. The current average is 3.13%, which is the lowest EVER and I've even had some buyer clients pay a point or so to get under 3% -- on a 30 year fixed rate mortgage! Wow! OK - that about wraps up my monthly run down of what is happening in our local real estate market. Stay tuned over the next few days for some deeper analysis of some of the trends as mentioned above. If you have questions about what I have discussed, or about other market trends you are observing, shoot me an email. Otherwise, until next time...

Finally... if you're thinking about buying soon, or selling soon, and are looking for a Realtor to assist you with that process - I'd be happy to connect with you at your convenience. You can reach me most easily at scott@HarrisonburgHousingToday.com or by calling/texting me at 540-578-0102. Have a great second half of the first month of the second half of the year! :-) | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings