Negotiations

| Older Posts |

Is There A Price You WOULD Pay For This House? |

|

For quite a while now, we've been operating in a market where nearly everything sells at or over the asking price, sometimes with multiple offers. Thus, many buyers assume a seller will only sell for the asking price and it isn't worth making an offer below the asking price. Sometimes this is, indeed, the case -- especially in the first few weeks that a house is on the market. At this stage, home sellers are typically still rather confident and/or hopeful that their asking price is appropriate for the market. But after a house has been on the market for a few weeks, what's the downside of a buyer making an offer below the asking price? When a buyer views a house that has been on the market for a few weeks, and they don't like it enough to pay the list price... they often just move on and decide not to make an offer. I think many buyers should, instead, consider what price they WOULD pay for the house. If you like a house, but just not at the current offering price -- make an offer of the price you would be willing to pay for the house. Who knows, the seller might surprise you, and might be willing to negotiate to a price that would work for them and for you! | |

Is It Reasonable For A Home Buyer To Ask A Seller To Fix Every Item Mentioned In A Home Inspection Report On A Resale Home? |

|

From a local home inspector... "The purpose of a home inspection is to provide the consumer with comprehensive information to help them make a confident and informed decision when buying a home. As we complete your home inspection we have two main goals. Our first goal is to inform you about the status of the structure and systems of the home. The second goal is to explain the unique future maintenance needs of the home." You will learn more about the home you are purchasing through the home inspection process -- and you will learn about deficiencies that might exist in the home -- and you will learn about upgrades you might make in the home. So, is it reasonable for a buyer of a resale home to ask a seller to fix or address every item mentioned in a home inspection report? Usually, no, that is not reasonable. In addition to deficiencies found in a home, a home inspector is likely also going to be referencing... 1. Upgrades you might make to the home later. 2. Ways to make your home more energy efficient. 3. Parts of the home that were to code at the time it was built but that would be done differently now. So, if you're buying a home, don't plan to ask a seller to address every little thing in an inspection report. Focus, instead, on the most significant deficiencies in the home that would be the most costly or cumbersome for you to address after settlement. | |

Will Your Offer Terms Cause The Seller To Say YES Or To Seek Other Offers? |

|

Clearly, if you are making an offer on a house, it's because you want to buy that house... so, you probably hope that the seller will accept your offer, rather than hold onto your offer for a day or two hoping to receive other more favorable offers. Thus, choose your offer terms wisely... Let's consider a house listed for $475K and the following two offers you might make...

These offers might seem very similar to you -- but they will likely seem very different to the seller. The first offer will likely cause the seller to seek other offers that might have better terms. The second offer may cause the seller to just go ahead and accept your offer. The offer you make on a home you want to purchase will elicit a reaction from the seller -- what do you want that reaction to be? Do you want them to be excited to work with you, or hoping to find another interested buyer? | |

Sometimes An Offer Is So Strong A Seller Will Not Wait For Other Imminent Offers |

|

Wahoo! An exciting new listing just hit the market. You are excited to go see it and will definitely consider making an offer. You know it will likely be a popular listing, with the potential for multiple offers, but you have already been pre-approved for your mortgage, you are going to see the house on the first day it is on the market, and you will likely make an offer on the second day that it is on the market. That should be enough, right? Well, maybe. Sometimes, an offer shows up that is strong enough to cause a seller to adjust how they were otherwise planning to receive and consider offers. If an offer comes in on the fictional house above on the afternoon of the first day that it is on the market... that is above asking price, cash, without an inspection, with a closing to take place in 20 days, with the seller able to rent back for free for up to three months... 1. Who could blame the seller for going ahead and accepting this very (very!) strong offer. 2. Who could blame buyers if they are disappointed when they find out on the second morning that the house is on the market that they are too late to submit an offer. So... 1. Buyers - Be willing to make a strong offer, quickly, if you want to try to get the seller to respond before considering other offers. 2. Also, Buyers - Know that an early offer from a motivated buyer might very quickly eliminate your opportunity to compete to buy a house that you really like - so, make an offer just as quickly as you are ready to do so. | |

Sometimes It Makes Sense To Just Adopt The Timetable The Seller Prefers |

|

In a seller's market, which we are in... Sometimes It Makes Sense (for a buyer) To Just Adopt The Timetable The Seller Prefers Conversely, in a buyer's market, which we are not in... Sometimes It Makes Sense (for a seller) To Just Adopt The Timetable The Buyer Prefers Let's get into why... If you are about to make an offer on a house... and the seller prefers to close in 90 days, and you could, but you would prefer not to wait to long to close... sometimes it may make sense to just go with the timetable the seller prefers. After all, it is a seller's market, and if you don't go along with their desired timetable, they may choose to work with a buyer who will. Similarly... If you are about to make an offer on a house... and the seller prefers to close within 30 days, and you could, but you would prefer not to close quite so quickly... sometimes it may make sense to just go with the timetable the seller prefers. After all, it is a seller's market, and if you don't go along with their desired timetable, they may choose to work with a buyer who will. There may very well be costs to you (dollars, logistical headaches, stress) of going along with the seller's timetable -- but if you actually get to buy the house that you want to buy, maybe it will be worthwhile. P.S. Did you enjoy the AI generated image of a "man looking at a wall calendar"? ;-) | |

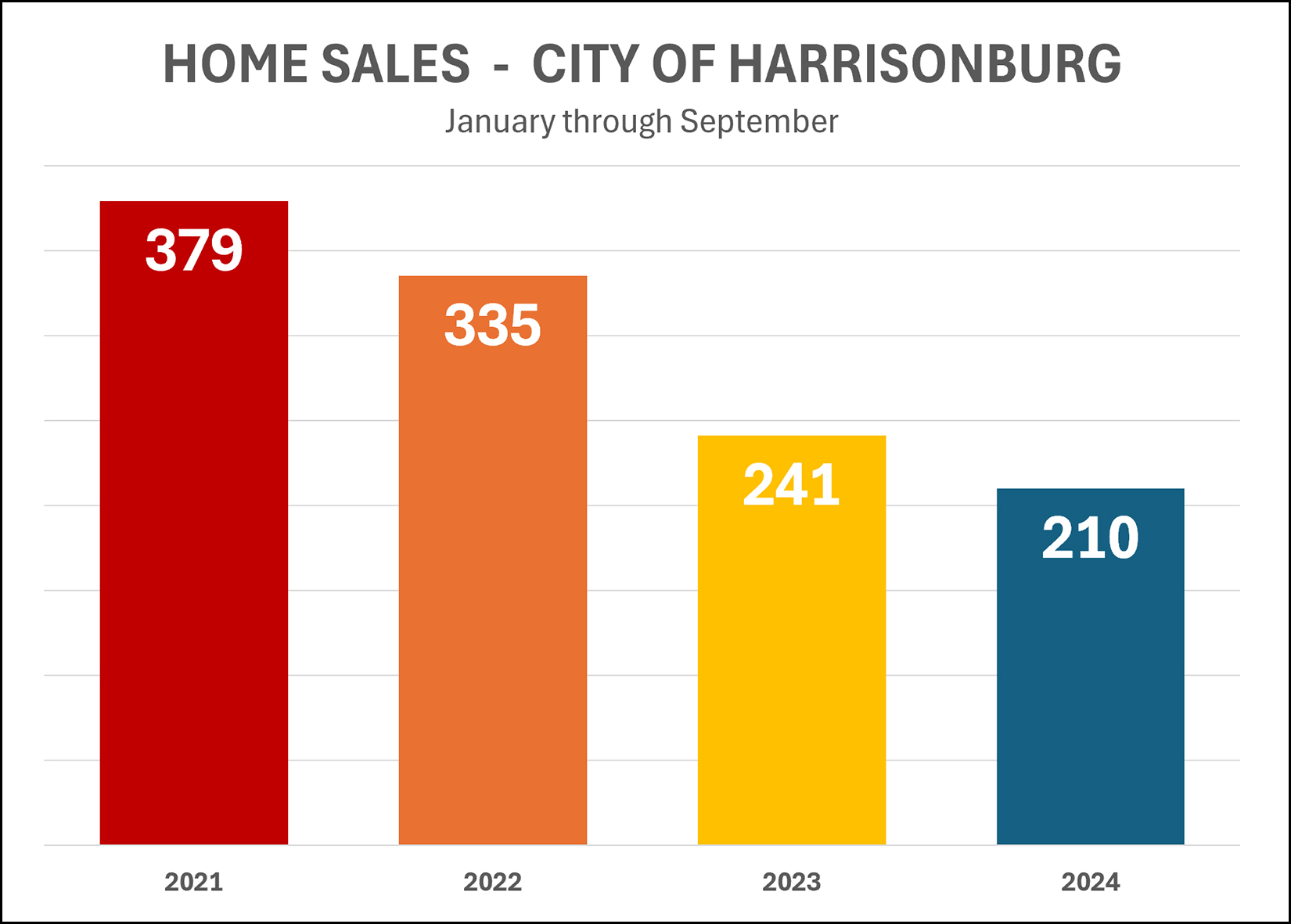

Competition Is Often Fierce For City Homes! |

|

We have seen fewer, and fewer, and fewer home sales in the City of Harrisonburg over the past few years. But this is almost entirely an issue of not enough sellers being willing to sell -- not an issue of not enough buyers wanting to buy. The result is that in the current market, when a City home is listed for sale... there is often a LOT of interest in said home. This is great for home sellers in the City of Harrisonburg...

This is not quite as great for home buyers in the City of Harrisonburg...

But alas, the City of Harrisonburg remains a popular place to live. Until and unless we start to see some new construction (for sale) housing in the City of Harrisonburg, we will likely still see lots of competition for City homes when they are offered for sale. | |

Will You Remove Contingencies From Your Offer In A Multiple Offer Scenario Regardless Of Whether The Competing Offers Have Those Very Same Contingencies? |

|

A house comes on the market, and you like it, and it is priced reasonably. You make a full price offer on the house with a home inspection contingency. Then, you get notified that another offer has been received on the house. Since the time that you made the offer, you have decided that you don't just like the house you LOVE it. You don't want to miss out on this one. So, do you remove the home inspection contingency? You don't know whether the other competing offer has an inspection contingency. You also don't know what other contingencies exist in that other offer. You could leave the inspection contingency in place if you are not comfortable buying this home (or any home) without conducting a home inspection. You could remove the inspection contingency to try to make your offer as competitive as possible - though if the other offer also had an inspection contingency, maybe you didn't need to remove it? Or, trying to hit the middle ground in some ways... perhaps you add language to your home inspection contingency to only keep the contingency in place if the competing offer does not have an inspection contingency. Side note on this last strategy... If you offer $400K with an inspection contingency -- and your inspection contingency includes language to only keep it in place if the competing offer does not have an inspection contingency... And if the competing offer was $402K with an inspection contingency... Then you might lose out on the house - because both offers had an inspection contingency and your offer was at a slightly lower price - whereas your offer might have been selected if you had removed your inspection contingency from your offer that was at a slightly lower price than the competing offer. A single best way to navigate this issue - when to include or remove contingencies - does not exist. But, it is important to keep in mind the myriad of contingencies that competing offers may or may not have when you start to modify your offer terms based on a competing offer with unknown terms. | |

Sometimes Buyer And Seller Price Expectations Conflict On New Listings |

|

Some home sellers decide they ought to round up their list price a bit because surely buyers will expect them to negotiate. This might result in a house worth $400K being listed for $410K. Some home buyers expect all listings to go under contract quickly at or above the list price. This might result in them assuming that house listed for $410K will really sell for $420K or $425K. In such an instance -- a home buyer deciding whether they are willing to pay $420K or $425K for a house they believe is worth $400K -- likely results in the buyer not making an offer at all. So... Sellers - Price your homes reasonably - don't round up too much, or any at all, above the market value of the house. Buyers - Consider the list price as the list price - don't assume every house will sell for $10K or $15K or $25K more than the list price. Some will, but not all, and probably not most. | |

With Home Inspections Back In Play Again, Do Not Assume Your Contract Price Will Definitely Be Your Sales Price |

|

Plenty of buyers are making offers that include home inspection contingencies these days - and reasonably so. A home purchase is a large purchase and a major decision and it makes sense to engage a professional to help you understand the condition of the house. As such, home sellers should not assume that their contract price will definitely be their sales price, because... 1. Your home inspection might reveal property condition issues that you did not know existed, resulting in negotiations on repairs or pricing. 2. The buyer for your home might be more concerned about some known needed repair items than you might expect, resulting in negotiations on repairs or pricing. So, when your home goes under contract, great! But wait until you get past the home inspection contingency to consider your contract price to (likely) be your sales price. All that said, as with most things, how true the above will be for you and your home will vary based on the price range of the home, it's condition, the age of the major systems, and based on how much other buyer interest existed when your current buyer made their offer. | |

Two Versions Of Paying Slightly More For A House Than You Had Hoped |

|

Sometimes a buyer loves a new listing but thinks it is priced a smidge higher than it should be - and they aren't sure what to do. Here are two versions of how such a scenario might play out... Scenario 1 - A house is listed for sale for $545,000. You love the house, but think it should only be priced at $535,000. You ask if there have been many showings - there have been. You ask if other buyers seem to be considering offers - they are. You offer $545,000 for the house and secure a contract to buy it. You're happy but in the back of your mind wonder whether you should have only offered $535,000. Scenario 2 - A house is listed for sale for $545,000. You love the house, but think it should only be priced at $535,000. You ask if there have been many showings - there have been. You ask if other buyers seem to be considering offers - they are. You offer $535,000 and the seller waits for a day to respond. You are then notified that they have received two other offers. You add an escalation clause to your offer to confirm your willingness to increase your offer as high as $550,000. Your escalation clause goes into effect and you end up paying $547,000 for the house. Or the not quite as exciting outcome... Scenario 3 - A house is listed for sale for $545,000. You love the house, but think it should only be priced at $535,000. You ask if there have been many showings - there have been. You ask if other buyers seem to be considering offers - they are. You offer $535,000 and the seller waits for a day to respond. The seller informs you that they accepted another buyer's offer and when it goes to closing you see that the other buyer paid $545,000 for the house. If you love a house, and it's a new listing, and it's only priced a smidge higher than you think it should -- there can be merit in just going ahead and making that full price offer to try to secure a contract to buy the house that you love. | |

If You Are The First Or Only Buyer To Make An Offer, Go Ahead And Include Those Contingencies |

|

Egads! The market is crazy right now -- would be home buyers have to include escalation clauses and they certainly couldn't include an inspection contingency or an appraisal contingency!?! Right? Well... yes... often... but not always. Sometimes you might be looking at a home that has been on the market for 3, 7 or 10 days -- without an offer on it as of yet. Should you offer full price, waive an inspection and opt out of an appraisal contingency? Not necessarily. As funny as it might be to say this... If a house has been on the market for a few days and does not have any offers, go ahead and go crazy... include that inspection contingency, and the radon test contingency, and the appraisal contingency, and... wait for it... maybe even try to negotiate a bit on price!?! Certainly, your offer might spur on another offer, and then you might be in a competitive offer situation where you are revising your offer and removing your contingencies... but you might just find success in buying a home with a few of those used-to-be-normal contingencies. ** results may vary based on property type, price range and location ** ;-) | |

No Need To Get Overly Competitive As A Home Buyer... Unless You Have Competition |

|

Many sellers of homes newly listed for sale are still receiving multiple offers from eager buyers within the first few days on the market... but that is not universally happening on all new listings. As such... if you're the first one to the party... the first buyer to make an offer, you likely do not need to... [1] included an escalation clause [2] waive a home inspection [3] offer to pay your offered price regardless of the appraised value But... if you submit an offer without an escalation clause, with a home inspection contingency and with an appraisal contingency... and then receive notice that another offer has been received... you might pause to reconsider your offer terms. If you are competing against another buyer, you may very well want to... [1] included an escalation clause and/or [2] waive a home inspection and/or [3] offer to pay your offered price regardless of the appraised value The competition that you do or do not have when making an offer should guide and direct your offer terms. | |

Many (Or Most?) Home Sellers Prioritize Certainty Over Price |

|

When a seller signs a contract with a buyer, they want to be as certain as possible that the contract will proceed to settlement. The king of all offers, providing the most certainty to a seller would be a cash offer with no contingencies whatsoever. As each of the contingencies below are added to a contract, the seller's certainty decreases...

It is important, as a buyer, to remember that most sellers are thinking about certainty alongside price. Which of these offers is likely to succeed?

When presented with these three offers I think many or most sellers would choose offer #1 even though it is $1K or $5K lower than the other two offers in hand. Give careful thought to the contingencies you do and do not include in your offer and understand how they affect the seller's view of the certainty that your contract will make it to settlement. | |

Another Buyer May Be Able Or Willing To Pay More Than You |

|

Many homes in many price ranges are still receiving multiple offers. Thus, a variety of questions may run through your mind if you are making an offer on a popular new listing... [1] How much is this home worth? [2] How much am I willing to pay for this house? [3] Will I win the bidding war? The challenge in answering #3 above is often not in the answer to #1 but in other buyer's answer to #2. It's note quite this black and white, but let's pretend that you and the three other buyers who are making an offer all conclude that the home is worth $350K. You love the house but your budget is capped at $360K. You offer to pay up to $360K. The second buyer won't pay a dime over market value, so they offer $350K. The third buyer has a budget that goes up to $500K, so they are willing to pay up to $370K for the house. Depending on the other terms of the offer, the third buyer is likely to secure the contract on the house. As another example... Let's again pretend that the home in question is worth $350K, but it needs some updates. You love the house, but given the need for some updates you are not comfortable paying more than $350K. The second buyer offers $340K because of the need for updates. The third buyer is super handy and will make all of the updates themselves and has plenty of cash to spare for supplies, etc., so they offer to pay up to $360K. Again, depending on the other terms of the offer, the third buyer is likely to secure the contract on the house. In any given multiple offer scenario, you must remember (as a buyer) that other buyers might be able or willing to pay more than you. | |

The Differential Value In Your Escalation Clause Should Likely Vary Based On The Other Terms Of Your Offer |

|

We're still in a housing market where many new listings will have multiple offers within a few days -- not all new listings, and maybe not most -- but many. As such, if you are hoping to buy a home this spring or summer you may find yourself competing against another buyer (or buyers) when you make an offer. If you are making an offer, and competing against one or more other offers, you may find yourself including an escalation clause in your contract. How does an escalation clause work, you might ask? An escalation clause allows you to make an offer at one price but include offer terms that will automatically increase that offer if another offer is at a higher price point. For example... offering $325K... but automatically increasing your offer up to $340K if there is another higher offer. One missing element of the description above is the differential value in your escalation clause. Here are two different versions of the escalation clause above, with differential values... [1] Offer of $325K, automatically increasing to be $1K above other offers, up to a maximum of $340K. [2] Offer of $325K, automatically increasing to be $5K above other offers, up to a maximum of $340K. Let's say, for illustrative purposes, that you are (unbeknownst to you) competing with an offer of $330K. The first escalation clause above [1] would cause your offer to be $331K. The second escalation clause above [2] would cause your offer to be $335K. Why would you include a differential of $1K vs. $5K vs. something even higher? Oftentimes, it depends on the other terms of your offer. If you are making a very clean offer with an 80% financing contingency, no home inspection, no home sale contingency and a speedy proposed settlement... you might just include a $1K differential in your escalation clause. The thought or hope in this instance is that your offer terms (other than price) will be equal to or better than the competing offer, and that your offer being $1K higher is enough of a difference to hopefully cause the seller to accept your offer. If you are making an offer with a smaller downpayment (95% financing), and with an inspection contingency... and if you suspect you are competing against buyers with larger downpayments or without inspection contingencies... you might include a larger differential in your escalation clause. The thought here is that if your offer with an inspection contingency is only $1K higher than a competing offer without an an inspection contingency, the seller will likely accept the other offer... but if you are offering (via the differential in your escalation clause) a price that is $3K (or $5K) higher than the competition, maybe that differential will be enough to cause the seller to still consider your offer despite the inspection contingency. And so on and so on. If you are proposing a delayed settlement date, increase the differential. If you have a home sale contingency as well, increase the differential. You can't know the details of the terms of the offer with which you are competing... but you can be strategic about how you craft the terms of your escalation clause based on the other terms of your offer. | |

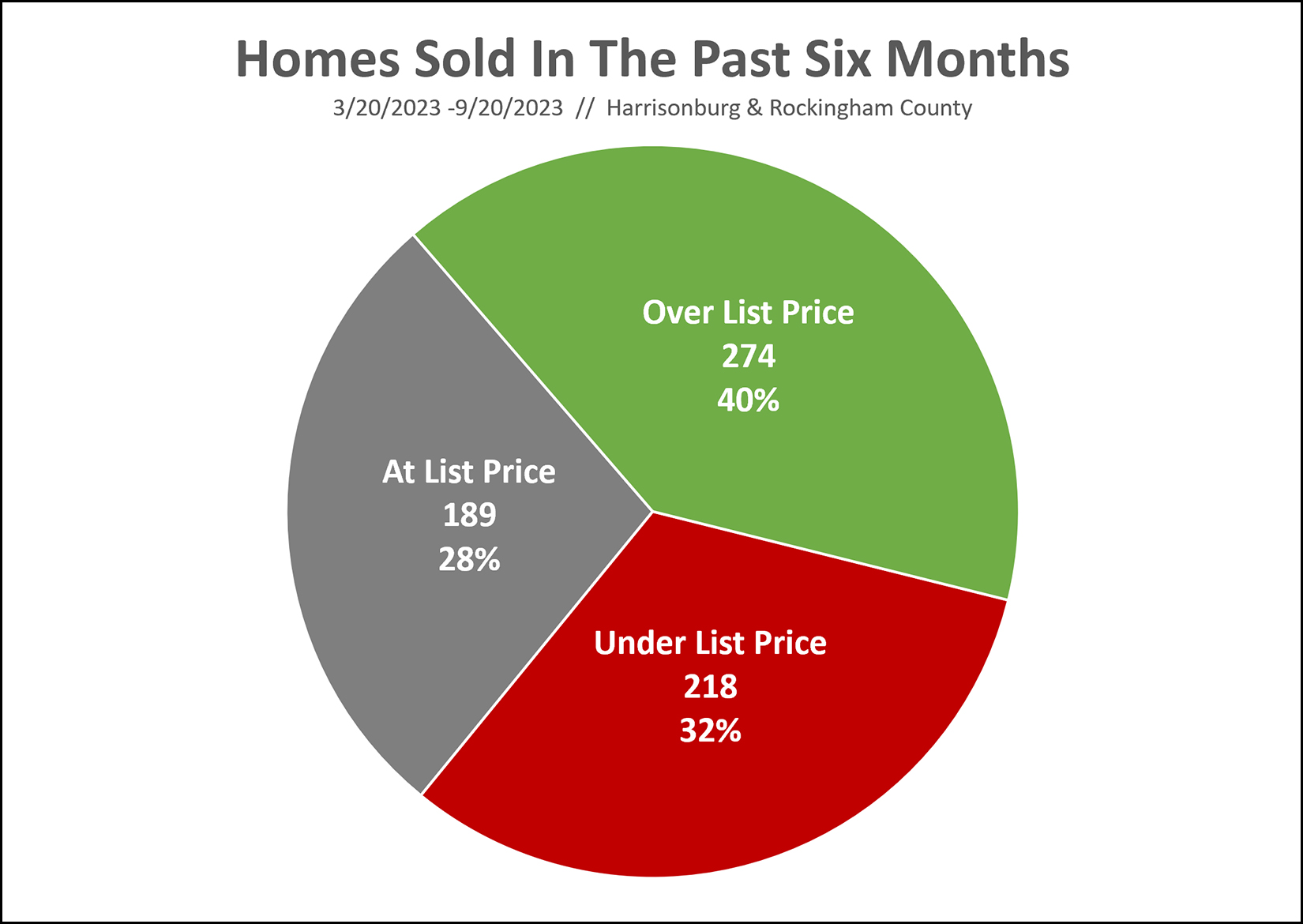

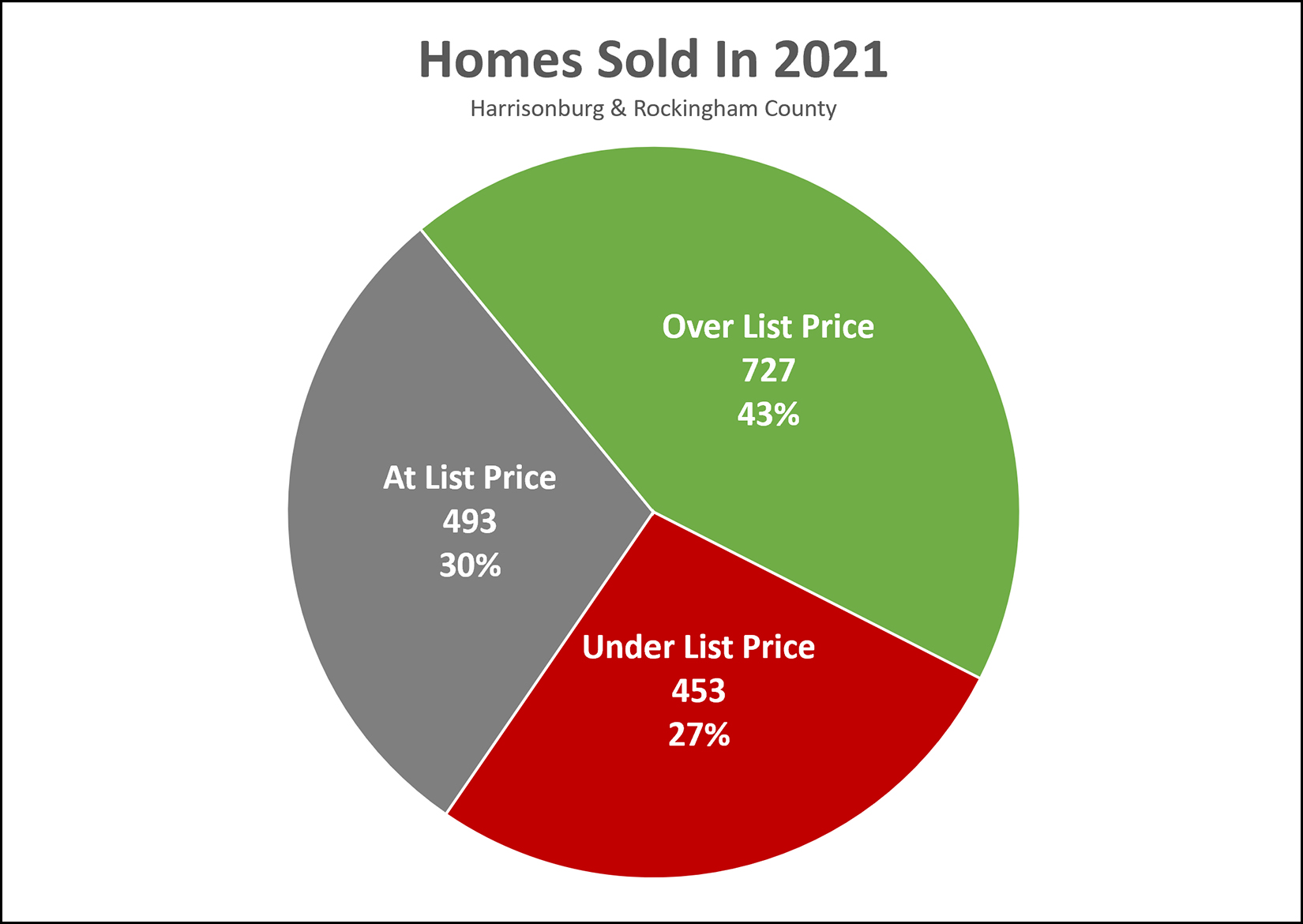

How Many Homes Are Selling For Less Than The List Price? |

|

If we look at homes that have sold in the past six months... [1] 68% have sold for the list price or higher. [2] 32% have sold for less than the list price. [3] 40% have sold for over list price. Maybe several of these stats surprise you. Maybe none of them do. I think the most surprising to me is that 32% of homes sold for less than the list price. If often feels like buyers are barely ever able to negotiate on price -- and sellers are barely ever willing to negotiate on price. Interestingly, let's look back a year and a half (ish) to 2021 when mortgage interest rates were in the 3.something range...  The numbers here are certainly different, though not quite as different as you might imagine. For all the homes that sold in 2021... [1] 73% sold for the list price or higher. [2] 27% sold for less than the list price. [3] 43% sold for over list price. So... is every home selling over asking price? Nope. Back in the crazy times of 2021, was every home selling over asking price? Nope. | |

If Your Offer Is Competing With Other Offers, You Should Max Out Your Preapproval Letter |

|

A few (4+) years ago, most offers were made without having to compete with another offer. In such as a circumstance, it often made sense to tailor your preapproval letter to match the price you were offering. For example... $275,000 = List Price $350,000 = Your Max Preapproval Amount $265,000 = Your Offer $265,000 = The Preapproval Letter You Include After all, why let the seller know that you could pay $350K when you're trying to negotiate them down from $275K to $265K. :-) These days, however, things work a bit differently. You should consider maximizing the amount of your preapproval letter to show your financial strength. $350,000 = List Price $475,000 = Your Max Preapproval Amount $375,000 = Your Offer (after escalating) $475,000 = The Preapproval Letter You Include Yes, you could certainly include a preapproval letter from your lender showing you are qualified to pay $375K for the house -- but the strength of your finances will be much more evident to the sellers if you include the maximum preapproval letter of $475,000. So... in a competitive offer scenario, don't hide the top price you can afford, as it might sway the seller in your favor as they are considering multiple offers. Most sellers, if presented with these three offers would choose the third offer... [1] Offer of $375,000 with pre-approval letter of $375K [2] Offer of $375,000 with pre-approval letter of $395K [3] Offer of $375,000 with pre-approval letter of $475K As a side note -- even if you don't want to spend $475K, and you won't spend $475K, if you qualify for $475K it can still be helpful to have that letter from your lender for the reasons outlined above. | |

The First Buyer To Make An Offer Will Likely Not Include An Escalation Clause, At Least Not At First |

|

Yes indeed, we're still in a market where we often see multiple offers on new listings... and when there are multiple offers, we are likely to see some escalation clauses. If you are selling one of these popular new listings, should you expect that the first offer you receive will have an escalation clause? Probably not. Here's why... An offer only needs an escalation clause if it is in competition with another offer... and thus, if a buyer is making the first offer, the escalation clause is not needed. For example, if a house is listed for $325K, an interested buyer might offer $325K - but they are unlikely to offer $325K with an escalation clause going up to $350K. Why not include the escalation clause up front? If the first offer a seller receives includes an escalation clause, they are almost certainly going to be motivated to... wait for other offers. If your home is listed for $325K, and you have eight showings lined up, and the first buyer to see the house makes an offer of $325K that escalates to $350K -- you'll want to wait to see if you have any other offers, hopefully above $325K, that would cause that escalation clause to kick in. Now, certainly, that first buyer will want the opportunity to consider adding an escalation clause if or when there is a second offer with which they are competing. Thus, they may ask to be notified if any other offers are received -- and it would make sense for a seller to give them a heads up if or when a second offer is received. So... BUYERS: You likely don't need to have an escalation clause in your offer if you are the first buyer to make an offer -- but you should be ready to adjust your offer (to add one) very quickly if/when you hear that there is a second offer. SELLERS: Don't be surprised if the first offer you receive does not include an escalation clause. Likewise, don't be surprised if those buyers add an escalation clause once a second offer exists. | |

In A Multiple Offer Scenario, Consider Making The Strongest Offer You Are Comfortable Making |

|

It seems we might still be finding ourselves in plenty of multiple offer scenarios this coming spring in the Harrisonburg and Rockingham County real estate market. And sometimes... a buyer discovers that the house they have just walked into is one that works very, very well, for their needs. What sort of an offer should that interest translate into? I recommend that buyers make the strongest offer that they are comfortable making. PRICE - If the house we just viewed is listed for $400K, and we believe it is worth $400K, perhaps we offer $400K. Or, perhaps we include an escalation clause to demonstrate a willingness to pay as much as $410K, or $425K, given that this property fits your needs (and wants) very, very well, like no other house has to date. INSPECTION - If you are comfortable making an offer without a home inspection, based on your level of risk tolerance, and the condition and age of the property, and your available resources for making improvements, then perhaps we make an offer without an inspection contingency. Or, perhaps you are not comfortable making an offer without an inspection contingency. RADON - If you are comfortable testing for radon after you purchase the home, and installing a radon mitigation system at that time if needed, then perhaps we make an offer without a radon test contingency. APPRAISAL - If, based on the size of your downpayment, a slightly low appraised value would not affect your financing, and if you are comfortable paying the offering price regardless of what value the appraiser determines through their appraisal process, then perhaps we make an offer without a specific appraisal contingency. As you can see here, if we are going to be competing with other buyers and offers, we need to make a strong offer, but only as strong as you are comfortable making given your financial picture, the particular property, how well the property suits you, your tolerance for risk, etc. | |

An Appraisal Contingency Should Not Worry Most Home Sellers |

|

For a few years now, in a highly competitive seller's market, buyers were waiving contingencies left and right... No Home Inspection Contingency! No Radon Test Contingency! No Appraisal Contingency! No Home Sale or Home Settlement Contingency! Now, though, with much higher interest rates, and somewhat lower levels of buyer interest, we are sometimes seeing some of these contingencies sneaking their way back into offers. One of my general rules of thumb these days is that if you are making the only offer on a property, it is probably reasonable to include some of these contingencies that you might have waived if you had bought in 2020/2021... but if you are competing against multiple other offers, you may want to consider waiving some of these contingencies. As such... some sellers are now receiving offers with... my topic of the day... appraisal contingencies! Should a seller be concerned about an appraisal contingency? Should they counter back and propose not having an appraisal contingency? Generally speaking, I don't think an appraisal contingency should worry most home sellers. Appraisers are not personal crusaders with a mission of lowering market values by strategically coming up with low appraised value to wreak havoc on real estate transactions and to course correct the real estate market because they think homes are overvalued. ;-) Appraisers work to provide a detailed and objective estimate of the value of a house to the lender who is using that house as collateral for a mortgage. So, as a home seller, if your contract price is in line with recent sales prices of similar homes, you likely don't need to get too worried about an appraisal contingency. Certainly, it's another hoop to jump through, or another hurdle to clear, between contract and closing... but the existence of the contingency in an offer should not cause you undue stress or anxiety. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings