| Newer Posts | Older Posts |

A Full Price Offer Does Not Always Win Negotiations |

|

I don't play poker regularly - though I have played it a few times lately with my kids. When I do play, I can become caught up in my excitement to see a strong hand. Wow! This pot is mine! I am bound to win this time! And often, that might happen with a strong hand in poker -- but not always. Sometimes, another player will have an even stronger hand, and I'll lose despite my strong hand. Here are the rating of poker hands, in increasing strength...

And here are some generic types of offers that might exist on a house, in increasing strength, generally speaking...

That order isn't actually always 100% accurate - it can depend on the property, the seller, etc. But the point should be clear... Even if you make a full price offer, with what would be considered to be normal contingencies (financing, appraisal, inspection) you could still lose in negotiations in several different ways. So -- play your strongest hand, but always know that there could be a stronger hand out there! | |

How Much Are Sellers Negotiating On Price These Days? |

|

If you're looking to buy a home under $250K, should you only consider homes priced at or below $250K? Probably not - some sellers of homes priced above $250K will negotiate down to $250K. Should you look at homes priced above $500K? Probably not - most sellers of homes priced above $500K probably will not negotiate down to $250K. Both of those are probably obvious to most home buyers, but how do we understand the negotiability dynamics between those two mostly obvious statements? The data above is a first look at that puzzle - with some constraints. Basically, I looked at one year of City/County home sales, but limited it to homes with 1500+ square feet, 3+ bedrooms, 2+ bathrooms, on less than an acre, between $200K and $400K. So, not a canvas of the entire market -- but a pretty reasonable chunk of the middle of our market not likely to be thrown off by lots of investors (lower priced or attached properties) or high end buyers (high priced properties). And - after that intro - here's (some of) what we find...

So - hopefully that provides some guidance as to what you might expect as a buyer. If you see a home listed for 11% above your budget -- there is likely only a 1% chance that the seller will sell at a price that works for you -- or, put another way, you might have to find 99 such properties (where the seller won't come down 10%) before you find the 100th where they will. | |

Responding Well (or not) To A LOW Offer On Your House |

|

Sellers are sometimes quite shocked, dismayed or disheartened to receive a low offer on their house, for example, an offer of $325K on a $375K listing. But it is important to remember that even that low offer really is a compliment!

If you have not yet had an offer on your house (that is listed at $375K) and you receive an offer of $325K, that doesn't necessarily mean your house is only worth $325K, nor does it necessarily mean that you should accept $325K or something close to it. It does, however, mean something quite exciting --- somebody wants to buy your house!!! Of course, negotiations won't always work out with low offers -- but recognize a low offer for what it is -- a buyer who wants to buy your house, and perhaps the first buyer who has declared as much through a written offer! If there is any way to put a deal together with those buyers, you ought to pursue it, as it's hard to know when the next buyer will work up the courage to tell you that they want to buy your house! | |

Home Buyers and Sellers Often Have Very Different Perspectives When Negotiating Repairs After A Home Inspection |

|

While not always the case, a general rule of thumb is that... On home inspection repairs...

Inspector: Several roof shingles are missing, and the roof is past its life expectancy. Seller: Replace the shingles. Buyer: Replace the roof. Inspector: The air handler coils are dirty and the heat pump is reeaaallly old. Seller: Clean and service the heat pump and air handler. Buyer: Replace them both! These are a few extreme examples to start to show the differences in perspectives on repairs. Again, the important thing here is to recognize that a buyer and seller look at home inspection reports differently. A seller typically wants to minimize their repair costs while keeping the home sale on track. A buyer wants to make sure that any previously unknown property condition issues are addressed in a manner that is likely to prevent further near term maintenance needs in those areas. So, what is a buyer to do? A few thoughts....

| |

Think Twice Before Rounding Up Your List Price |

|

Sometimes it is tempting for a seller to want to round up their list price. The seller says (or thinks)... "We think the house is worth $240K? And you're saying we should list it for $245K or $249K? I'm optimistic -- I think someone is going to be willing to pay $250K, so let's list it for $260K! A buyer can always make an offer!" That's all well and fine and good -- and somewhat logical -- unless every buyer that comes to see the house in the first three weeks really thinks it is worth $240K. Then, when leaving the house priced at $260K, if they are willing to pay $240K, they are likely thinking they'd need to offer $220K in order to negotiate you down to the value of $240K. And they almost certainly won't make the offer. If a house priced at $260K has been on the market for a few days, most buyers aren't going to make an offer of $220K. They might think it is a waste of their time. They might not want to insult the seller. Regardless of the reason, you are not likely to have $220K offers on a $260K listing within the first few weeks. Thus, the buyer who excitedly came to see your $260K house, and then concluded that it is probably worth $240K (where we started this conversation) is likely to conclude that they should just wait a month or so and see if you eventually reduce the price to $250K -- and then they might consider an offer. But by the time you reduce the price to $250K, you are bound to get significantly less buyer/market attention with that price reduction since it is no longer a new listing. And some of the originally interested buyers will have found something else to buy. And there will be much less urgency for any buyer to make a decision about an offer. So -- beware of rounding up on your list price too far above what we have concluded is your home's value in the current market. It's easy to talk yourself into it -- and it's likely you'll regret it later. | |

Be Careful of Asking For Little Repairs When Also Asking for Big Repairs |

|

After a home inspection, a buyer knows more about the house than when they agreed to pay $X to purchase the house. In order for them to still want to pay $X for the house, they may ask the seller to address some of the deficiencies found during the home inspection. Imagine a hypothetical scenario where the following deficiencies are found:

So - which items should the buyer ask the seller to repair? Some could say ALL of them - the buyer didn't agree to pay $X for the house with all of these large and small issues. But I'd advise most buyers to only request that the seller address a subset of those issues:

All of the other items (3-7) are minor issues that won't cost too much (in time or money) to repair after you buy the house. But why not ask the seller to repair these items?

This is not a one-size-fits-all strategy, but I do urge you to carefully weight whether to ask for a home seller to make minor repairs if there are some major repairs that need to be addressed. | |

A Strong Hand (Offer) Does Not Always Win |

|

I don't play poker regularly - though I have played a few times over the years. Whenever I do, I can become caught up in my excitement to see a straight, a flush, or full house in my hand. Wow! This pot is mine! I am bound to win this time! And often, that might happen with a strong hand in poker -- but not always. Sometimes, another player will have an even stronger hand, and I'll lose despite my strong hand. Here are the rating of poker hands, in increasing strength...

And here are some generic types of offers that might exist on a house, in increasing strength, generally speaking...

That order isn't actually always 100% accurate - it can depend on the property, the seller, etc. But the point should be clear... Even if you make a full price offer, with what would be considered to be normal contingencies (financing, appraisal, inspection) you could still lose in negotiations in several different ways. So -- play your strongest hand, but always know that there could be a stronger hand out there! | |

Needing vs Wanting A Home Sale Contingency |

|

If you're looking to buy a house this Spring or Summer -- but -- you own your current home -- this morning's ramblings are for you... Selling (for some houses, in some price ranges, in some locations) can seem like a breeze these days -- inventory is low, buyer interest is high, homes are going under contract quickly -- all good news for sellers. And buying (for some houses, in some price ranges, in some locations) can be quite difficult these days -- inventory is low, interest from competing buyers is high, homes you might want to buy are going under contract quickly -- all less than exciting news for buyers. And when you wrap those two realities together -- buying and selling in the current market -- things can get tricky. Because it can be hard to find something to buy, many would-be seller-buyers aren't listing their home yet despite their desire to make a move. After all, they don't want to find someone to buy their home when they don't have somewhere to go. But then, the perfect house comes on the market! So, now what!? Do we quickly (quickly!!) list your home for sale and try to secure a buyer in time to make an offer on your dream house that is contingent on the settlement on the sale of your current home that is under contract? Hoping some other eager buyer has not already secured a contract on your dream house by the time we have your current house under contract? OR -- do we make an offer on your dream home, contingent on the sale of your current home, even though your current home is either not yet on the market or not yet under contract? (Hint, hint - the seller of your dream home probably won't be be interested in this proposal.) OR -- do we make an offer on your dream home WITHOUT a home sale contingency. That was a lot of build up to get here -- but this is the central item you may want to think about as you consider a sale and purchase this Spring or Summer. First - Do you NEED a home sale contingency... This can be pretty quickly determined in a conversation with a lender. Let me know if you need some recommendations of who to call for your next mortgage. They will essentially be asking you questions about your income, recurring monthly debt (house, car, student loans, etc.), and assets (cash) on hand. They'll be trying to determine whether your income (and offsetting expenses) qualify you to get a mortgage to purchase the new home while still owning the current home. Again - this is rather cut and dry from a lender's perspective, so if you're thinking (even a little bit) about whether you could / should / would buy without having first sold, then start with a conversation with your lender. If they can qualify you for a mortgage to purchase your dream home without having first sold your existing home, you will then move on to the next question... Second - Do you WANT a home sale contingency... Perhaps you own a $250K house and you're thinking about buying a $350K house. And perhaps your lender says it is no problem at all - they'll give you a mortgage to buy the $350K house even if you still own the $250K house. And perhaps you are quite certain we'll be able to speedily sell the $250K house. But yet, still, you might decide that you don't WANT a home sale contingency. Maybe you don't want the risk associated with having to pay both mortgage payments until the $250K house sells. Perhaps you don't like the loan terms that will be required on the $350K purchase without having freed up some equity from the $250K sale. Whatever the reason, there may in fact be a reason why you WANT a home sale contingency. Alright - the ramblings will stop for now. As you may have figured out if you made it this far -- selling and buying at the same-ish time can be relatively complex -- and we can't always figure it all out by thinking through a formula or checklist. As such -- if you're thinking about selling and buying this summer, let me know if you'd like to chat more about all of these topics, in person, as it relates to your own particular scenario. | |

If Only We Had Two Or Three Of These Houses! |

|

Sometimes, these days, sellers are seeing more than one offer coming in at the same time on their home. Not always, mind you, just sometimes. All people in Harrisonburg are nice. OK, well, maybe not all, but most of them seem to be. As such, sometimes two super nice, awesome, wonderful people make offers on the same house -- and sadly, only one of them can buy it! Sometimes a buyer tries to set their offer apart (above?) other offers by including a personal, heartfelt letter about why they LOVE the seller's home and how they will live happily ever after in it. These are often meaningful, helpful, touching and effective. But shoot - sometimes there are two awesome buyers who wrote these emotion evoking letters, and again, only one of them gets the house. It stinks to be that second (or third) buyer - as it's often quite the letdown for the contemplated home purchase to not have worked out. It's a bit easier as a seller -- you're selling your house to buyer #1, even if buyer #2 is crying in the corner -- but it's still not ideal. Sometimes a seller even knows buyer #2 or buyer #3 and feels terrible about not being able to sell them the house as well, but... Anyhow -- it's a good problem for a seller to have -- multiple buyers vying to buy their house. But it's just simply no fun at all for buyers. I feel for them - whether I'm working with them as my clients, or if I am representing the seller who effectively had to reject them. Stay strong, buyers! Hopefully some new, exciting listings will be on the market soon to ease the pain of missing out on the house you had been convinced you would be buying! | |

How Much Price Negotiation Should Home Buyers Expect? |

|

If you're looking to buy a home under $250K, should you only consider homes priced at or below $250K? Probably not - some sellers of homes priced above $250K will negotiate down to $250K. Should you look at homes priced above $500K? Probably not - most sellers of homes priced above $500K probably will not negotiate down to $250K. Both of those are probably obvious to most home buyers, but how do we understand the negotiability dynamics between those two mostly obvious statements? The data above is a first look at that puzzle - with some guide rails. Basically, I looked at one year of City/County home sales, but limited it to homes with 1500+ square feet, 3+ bedrooms, 2+ bathrooms, on less than an acre, between $200K and $400K. So, not a canvas of the entire market -- but a pretty reasonable chunk of the middle of our market not likely to be thrown off by lots of investors (lower priced or attached properties) or high end buyers (high priced properties). And - after that intro - here's (some of) what we find...

So - hopefully that provides some guidance as to what you might expect as a buyer. If you see a home listed for 11% above your budget -- there is likely only a 2% chance that the seller will sell at a price that works for you -- or, put another way, you might have to find 98 such properties (where the seller won't come down 10%) before you find the 99th and 100th where they will. Happy home shopping -- and negotiating! | |

Do Not Be Insulted By A Low Offer On Your Home |

|

Sellers are sometimes quite shocked, dismayed or disheartened to receive a low offer on their house, for example, an offer of $225K on a $275K listing. But it is important to remember that even that low offer really is a compliment!

If you have not yet had an offer on your house (that is listed at $275K) and you receive an offer of $225K, that doesn't necessarily mean your house is only worth $225K, nor does it necessarily mean that you should accept $225K or something close to it. It does, however, mean something quite exciting --- somebody wants to buy your house!!! Of course, negotiations won't always work out with low offers -- but recognize a low offer for what it is -- a buyer who wants to buy your house, and perhaps the first buyer who has declared as much through a written offer! If there is any way to put a deal together with those buyers, you ought to pursue it, as it's hard to know when the next buyer will work up the courage to tell you that they want to buy your house! | |

When To Make An Offer To Buy If You Still Need to Sell Your Home |

|

Here's a good opportunity to practice patience... If your dream home is on the market -- either as a new listing, a newly reduced listing, or an old and stale listing -- it might be tempting to go ahead and make an offer to buy the house, even if you still need to sell your house. I'll recommend, in almost all instances, that we wait to make the offer until we have secured a contract on your house. And here's why... NOTHING GAINED - In almost all instances, the seller of your dream house will counter back (to our contingent offer) with a "kick out clause" allowing them to continue to market their house for sale to other buyers, and to allow them to move on to an alternative buyer who does not have to sell their home after giving you 48 or 72 hours to remove your home sale contingency after the new offer comes in. As such, unless you can buy without selling, having a contingent contract with a kickout clause is pretty similar to not having a contract at all. If another buyer comes along to buy your dream house, the only reason why you'd have an upper hand (over that new buyer) in already having a contingent contract in place is if you can somehow pull together a contract on your current house within that 48 or 72 hours period after that new buyers hows up. So -- having the contingent contract (with kick out clause) doesn't do a whole lot to defend your spot in line to buy your dream home. NEGOTIATION - We are likely to do better in negotiating a deal for you to buy your dream home if we already have your current house under contract. The seller of your dream home is not likely to be willing to negotiate as much if you still don't have your house under contract (or if you haven't even listed your house for sale) as your purchase of their house will seem significantly less certain. LEVERAGE - Any savvy seller (or seller's agent) will use your (contingent) offer against you. It's not personal of course, they're just trying to do their best to sell their home. If there have been other recent showings of your dream home, the moment your contingent offer is received, they are likely to notify all of those other buyers that they have received an offer -- and will try to use the existence of your (contingent) offer to generate enough interest and urgency for another buyer to also make an offer, which they would hope would not have a home sale contingency. Now, even if we make an offer once your current house is under contract, the seller will likely still try to generate additional offers to compete with us -- but at that point we can compete much better, already having your house under contract. Why allow the seller to use your contingent offer (with your house not yet under contract) to drum up other actionable interest from other buyers? So -- as hard as it may be for you to do -- I will almost always recommend that we **wait** to make an offer on your dream house until we have your current house under contract. | |

Do Not Fear the LOW Offer On Your Home |

|

Sellers are usually quite shocked, dismayed or disheartened to receive a low offer on their house, for example, an offer of $225K on a $275K listing. But it is important to remember that even that low offer really is a compliment!  If you have not yet had an offer on your house (that is listed at $275K) and you receive an offer of $225K, that doesn't necessarily mean your house is only worth $225K, nor does it necessarily mean that you should accept $225K or something close to it. It does, however, mean something quite exciting --- somebody wants to buy your house!!! Of course, negotiations won't always work out with low offers -- but recognize a low offer for what it is -- a buyer who wants to buy your house, and perhaps the first buyer who has declared as much through a written offer! If there is any way to put a deal together with those buyers, you ought to pursue it, as it's hard to know when the next buyer will work up the courage to tell you that they want to buy your house! | |

How do home inspection negotiations usually proceed? |

|

How do home inspection negotiations usually proceed? The short (and vague) answer is -- well, it depends on the terms of your contract. But, overall, here is how the inspection process typically flows....  As you can see above, after a buyer requests repairs (based on the home inspection) the seller can choose to make some, all or none of the requested repairs. The transaction (and negotiations) can then go in a few different directions based on that response. Learn more about the home buying process at....  | |

Should you accept a home sale contingency? |

|

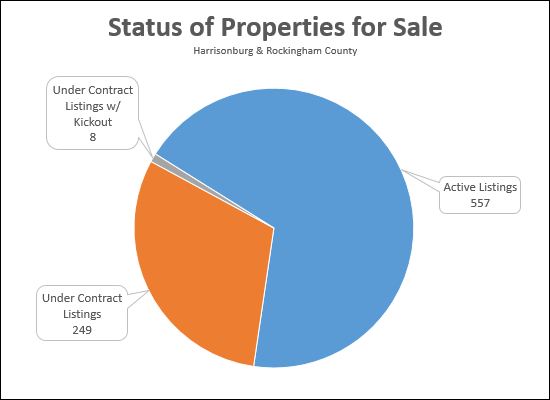

Based on the analysis above, it would seem that sellers are not (in almost all cases) accepting home sale contingencies. Here's the logic....

I must say, I was quite surprised to find this to be the case --- I thought perhaps 10% - 20% of contracts might have kickout clauses (and thus home sale contingencies) because plenty of buyers have to sell before buying. It would seem that most buyers are likely waiting to make offers until they have their own properties under contract (thus eliminating the need for the kickout clause) AND/OR most sellers are not accepting offers with home sale contingencies unless the buyers' houses are already under contract (thus eliminating the need for the kickout clause). If you are a buyer, I would certainly suggest the strategy outlined above (and the only one that is apparently working with sellers right now) --- get a contract on your house and THEN make an offer on the property you would like to purchase! | |

When making a low offer, accentuate your other offer terms |

|

If you are making a low offer, you can increase the appeal of your offer by strengthening your other offering terms.... DEPOSITS Make the largest deposit you are comfortable with so the seller knows you have money "on the line" and that you won't risk losing that money by attempting to walk away from the deal. CLOSING COST ASSISTANCE Sellers don't just look at the contract price --- they calculate their net proceeds based on the offer price and any credits or closing cost assistance. Only ask for assistance if you truly need it. FINANCING Provide as much detail as possible about your financing intentions, and always include a pre-approval letter. Sellers who believe you are capable of financing the purchase will be less hesitant as they consider other terms of your offer. And yes -- offer cash, a large pile of it, if you are able. :) PERSONAL PROPERTY Don't automatically ask for everything the seller intends to convey --- if you don't need them all, leave them out of the offer. Allowing the seller to keep their washer/dryer (for example) may make them more flexible in other areas. INSPECTIONS Having a professional inspect the property you are purchasing is usually a good idea; however if you only intend to do it for informational purposes, consider leaving it out of the contract negotiations and conducting it post-settlement. SETTLEMENT & POSSESSION If possible, cater your settlement date and the details of transferring possession of the property to the needs or wants of the seller. This can go a long way towards gaining seller flexibility on other contract terms. Finally, research the seller's context for selling. That information can be invaluable in negotiating a successful contract. | |

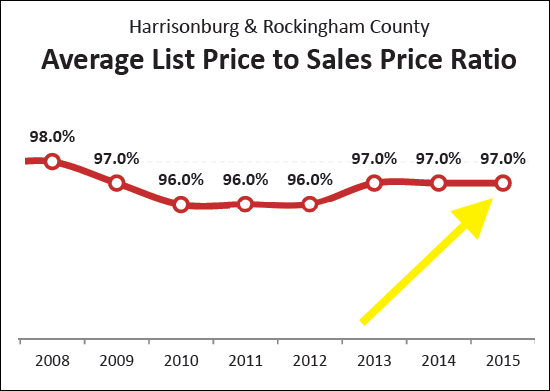

Sellers are only negotiating an average of 3 percent off of their list price these days |

|

Sellers, on average, are willing to take 3% off of their list price -- based on a historical analysis of how much sellers have negotiated in recent years. That being said.... 1) This ratio (homes sell for 97% of their list price) is a comparison of the sales price to the LAST list price. Sometimes it takes a price reduction or two until a list price is seen to be at a reasonable place by buyers to elicit an offer that then gets negotiated to that average of 97% of the final list price. 2) On a related note, a seller can't price their home wherever they'd like and then expect it will sell for 97% of that list price. A home with a market value of $300K will not sell for $388K if you list at $400K. 3) Buyers should not necessarily expect to be able to negotiate 10% off of a list price. Sometimes it happens -- a seller is extra motivated, a list price is way too high, etc. -- but it is not a common occurrence. 4) Sellers should not expect to sell for 100% of their list price. If you lower your list price from $315K to $300K, buyers will certainly take note of the recent price reduction, but they won't necessarily be ready to pay you 100% of your new list price -- unless you have lowered the list price to the point where it is right at, or just below market value. If you're getting ready to put your house on the market this Fall, let's start talking now about pricing strategies to best prepare you for what a buyer might offer you for your house in the current market. | |

Maximize strength of other offer terms when making a low offer |

|

If you are making a low offer, you can increase the appeal of your offer by strengthening your other offering terms.... DEPOSITS Make the largest deposit you are comfortable with so the seller knows you have money "on the line" and that you won't risk losing that money by attempting to walk away from the deal. CLOSING COST ASSISTANCE Sellers don't just look at the contract price --- they calculate their net proceeds based on the offer price and any credits or closing cost assistance. Only ask for assistance if you truly need it. FINANCING Provide as much detail as possible about your financing intentions, and always include a pre-approval letter. Sellers who believe you are capable of financing the purchase will be less hesitant as they consider other terms of your offer. And yes -- offer cash, a large pile of it, if you are able. :) PERSONAL PROPERTY Don't automatically ask for everything the seller intends to convey --- if you don't need them all, leave them out of the offer. Allowing the seller to keep their washer/dryer (for example) may make them more flexible in other areas. INSPECTIONS Having a professional inspect the property you are purchasing is usually a good idea; however if you only intend to do it for informational purposes, consider leaving it out of the contract negotiations and conducting it post-settlement. SETTLEMENT & POSSESSION If possible, cater your settlement date and the details of transferring possession of the property to the needs or wants of the seller. This can go a long way towards gaining seller flexibility on other contract terms. Finally, research the seller's context for selling. That information can be invaluable in negotiating a successful contract. | |

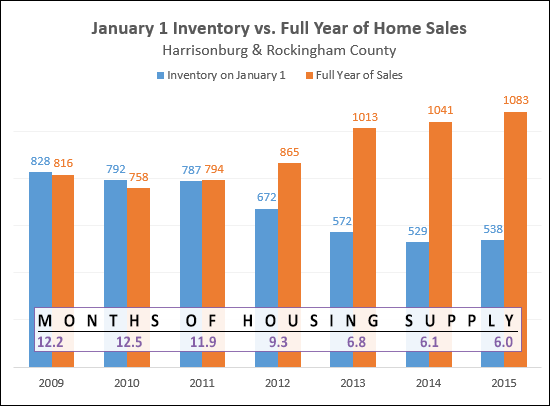

We are again starting the year with a six month supply of homes for sale, a sign of a balanced market |

|

For the second year in a row we are starting out in January with a six month supply of homes for sale, which is traditionally seen as a sign of a balanced housing market. A few years ago (2009-2011) we were consistently starting the year with enough homes on the market for every buyer that would buy in that year. That equates to 12 months of housing supply, and those were years of having a significantly oversupplied market -- which caused sales prices to decline and gave buyers the upper hand in negotiations. In 2015, we should expect that buyers and sellers will have relatively equal amounts of negotiating power, depending on the other factors affecting the sale. Important Notes: 1. The 2015 sales (1083) is an estimate of the number of sales we will see this year. Read more here. 2. The number of months of housing supply available varies by price range. See my full market report for further details. | |

That low offer is really a compliment! |

|

Sellers are usually quite disheartened to receive a low offer on their house, for example, an offer of $250K on a $300K listing. But it is important to remember that even that low offer really is a complement!  If you have not yet had an offer on your house (that is listed at $300K) and you receive an offer of $250K, that doesn't necessarily mean your house is only worth $250K, nor does it necessarily mean that you should accept $250K or something close to it. It does, however, mean something quite exciting --- somebody wants to buy your house!!! Of course, negotiations won't always work out with low offers -- but recognize a low offer for what it is -- a buyer who wants to buy your house, and perhaps the first buyer who has declared as much through a written offer! If there is any way to put a deal together with those buyers, you ought to pursue it, as it's hard to know when the next buyer will work up the courage to tell you that they want to buy your house! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings